Currys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Currys Bundle

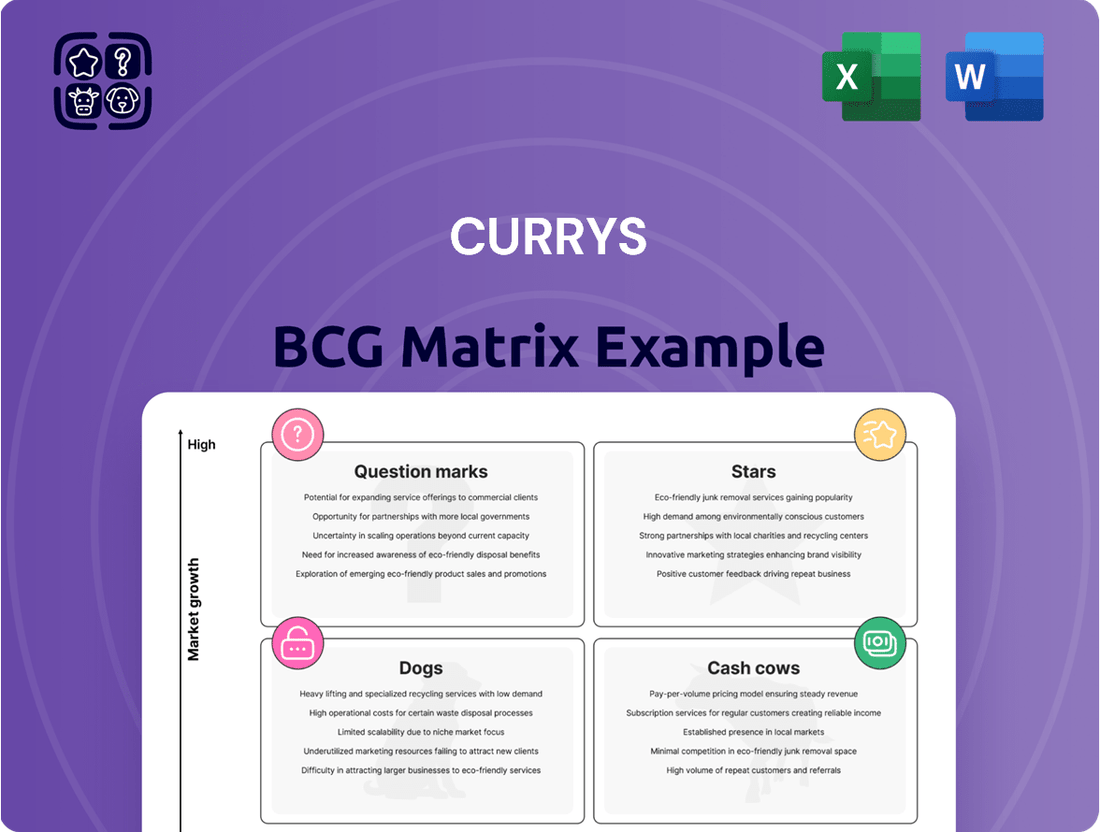

Curry's BCG Matrix reveals a dynamic portfolio, showcasing their market leadership in certain categories while highlighting areas needing strategic attention. Understanding these positions is crucial for optimizing resource allocation and driving future growth.

This preview offers a glimpse into Curry's product landscape, but for a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to unlock actionable strategies, purchase the full BCG Matrix report. Gain the clarity needed to make informed decisions and secure a competitive edge.

Stars

AI-enabled computing represents a significant growth area for Currys, evidenced by their commanding 75% market share in the UK for Windows AI-compatible PCs. This strong position is bolstered by an anticipated upgrade cycle, largely due to the impending end of support for Windows 10, which is expected to drive demand for newer, AI-capable devices throughout 2024 and beyond.

iD Mobile, Currys' own mobile virtual network, is a shining example of a star product within the company's portfolio. In the fiscal year 2024/25, it saw a substantial 26% surge in subscribers, reaching 2.2 million. This impressive growth, coupled with a target of 2.5 million by the close of 2025, underscores its position as a key driver for Currys.

The integration of iD Mobile into Currys' wider retail ecosystem not only boosts customer loyalty but also secures a consistent, recurring revenue stream. This dual benefit of increased customer engagement and predictable income solidifies its status as a star, contributing significantly to the overall business performance.

Currys' after-sales services, encompassing installation, repairs, and technical support, represent a significant growth driver. In the UK and Ireland, recurring services revenue saw a robust 12% increase, highlighting the increasing demand for these offerings.

The company's commitment to service is evident in its impressive scale, undertaking 1.6 million repairs annually. This high volume not only contributes to revenue but also strengthens customer loyalty and promotes sustainability through a circular economy approach.

Omnichannel Model in UK & Ireland

Currys' integrated omnichannel strategy in the UK and Ireland, seamlessly blending physical store experiences with robust online platforms, has proven to be a significant driver of its success. This approach allows the company to meet customers wherever they prefer to shop, fostering convenience and brand loyalty.

The effectiveness of this model is clearly illustrated by the company's financial performance. In the fiscal year 2024/25, Currys reported a healthy 4% increase in like-for-like revenue for its UK and Ireland operations. This growth highlights the model's ability to capture market share effectively within a competitive retail landscape.

- Integrated Omnichannel Presence: Currys combines a strong physical store network with a sophisticated online presence, offering customers flexibility in their shopping journey.

- FY2024/25 Performance: The UK & Ireland division experienced a 4% rise in like-for-like revenue, underscoring the success of its integrated retail strategy.

- Market Share Capture: This model enables Currys to effectively gain and retain market share by leveraging its established brand and customer trust.

- Sales and Profitability: The synergy between online and offline channels contributes directly to driving both sales volume and overall profitability for the business.

Premium & Gaming Computing

Premium and gaming computing have been standout performers for Currys, driving significant sales growth, especially during key shopping seasons. For instance, the gaming hardware market saw substantial uplift in 2024, with sales of high-end graphics cards and consoles continuing to surge as new titles and technologies emerged.

These segments typically offer higher profit margins due to their advanced features and premium pricing, reflecting strong consumer appetite for cutting-edge technology. The demand for powerful processors and immersive gaming experiences remains robust, making this a lucrative area for Currys.

- Strong Sales Growth: Premium and gaming computing contributed positively to overall sales, particularly in Q4 2024.

- Higher Margins: These categories often feature higher price points, leading to better profitability.

- Consumer Demand: Continued interest in high-performance computing and gaming fuels sustained market demand.

- Strategic Positioning: Currys' focus on these areas supports ongoing growth and market share.

Currys' AI-enabled computing, with a 75% UK market share in Windows AI PCs, is a clear star, driven by an expected upgrade cycle from Windows 10 end-of-support. iD Mobile is also a star, having grown its subscriber base by 26% to 2.2 million in FY2024/25 and aiming for 2.5 million by the end of 2025. The company's after-sales services, including 1.6 million annual repairs, are a star performer, with UK and Ireland recurring services revenue up 12%.

| Product/Service | Market Share/Growth | FY2024/25 Performance | Key Driver |

| AI-enabled Computing | 75% UK Market Share (Windows AI PCs) | Strong demand expected due to Windows 10 EOL | Upgrade cycle, AI capabilities |

| iD Mobile | 26% Subscriber Growth (to 2.2M) | Targeting 2.5M subscribers by end of 2025 | Integration into retail ecosystem, recurring revenue |

| After-Sales Services | 12% Revenue Growth (UK & Ireland) | 1.6M repairs annually | Customer loyalty, sustainability focus |

What is included in the product

Currys BCG Matrix analyzes product portfolio for growth and market share.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

Currys BCG Matrix: A clear, one-page overview of each business unit's strategic position, relieving the pain of uncertainty.

Cash Cows

Currys commands a substantial slice of the major domestic appliances market, a sector characterized by its maturity and steady, albeit moderate, growth. This segment, encompassing everyday essentials like refrigerators and washing machines, is a reliable generator of significant cash flow for the company, with annual growth hovering around 3%.

The consistent demand for these core household items, coupled with Currys' robust competitive positioning and efficient supply chain, translates into healthy profit margins. This stability makes major domestic appliances a clear cash cow within the Currys portfolio.

While the broader market for traditional consumer electronics like standard TVs might be experiencing slower growth compared to newer technologies, Currys holds a robust market share in this fundamental segment. This strong position means these products, even in a mature market, continue to be a significant revenue driver for the company.

These established products act as reliable cash generators for Currys. They require less aggressive marketing investment to maintain their sales volume, allowing them to contribute steadily to the company's overall financial health and supporting other, more growth-oriented business areas.

Currys' substantial UK & Ireland retail footprint, comprising 296 stores, signifies a dominant position in the physical electronics market. This extensive network is a core cash cow, as a significant portion of customers, approximately two-thirds, still leverage these stores for purchases, including the popular order and collect service and in-person expert advice.

The ongoing investment in store modernizations underscores Currys' commitment to preserving this strong physical presence. These updates are designed to enhance the customer experience, ensuring the stores remain a primary driver of revenue and a key contributor to the company's cash generation, even amidst the growing e-commerce trend.

Core Online Sales Platform

Currys' core online sales platform is a prime example of a Cash Cow within the BCG Matrix. Its established presence and significant market share in consumer electronics, bolstered by its physical stores, generate consistent and substantial revenue. This digital channel is highly efficient, reaching a vast customer base and contributing significantly to the company's profitability.

The online platform leverages a mature market position, benefiting from a large, loyal customer base. This translates into a reliable and predictable stream of income for Currys, underpinning its financial stability.

- High Market Share: Currys maintains a strong position in the UK consumer electronics market, with its online sales playing a crucial role in this dominance.

- Profitability Driver: The online platform's efficiency in sales and broad reach contribute directly to the company's bottom line, acting as a key profit generator.

- Mature Revenue Stream: As a well-established channel, online sales represent a dependable and significant source of income, supporting ongoing operations and investments.

- Customer Base: The platform has cultivated a substantial and established customer base, ensuring consistent demand and repeat business.

Credit Sales & Financing Solutions

Currys' credit sales and financing solutions have become a significant cash cow, demonstrating a strong market position in offering flexible payment options for technology purchases. These offerings saw a notable increase, reaching £1.1 billion in FY2024/25.

This segment generates substantial recurring revenue and boasts higher profit margins, solidifying its status as a stable income generator for the company. By enabling customers to make larger purchases and increasing overall customer adoption, these financing solutions contribute significantly to Currys' financial stability.

- Credit sales reached £1.1 billion in FY2024/25.

- High market share in technology financing.

- Generates significant recurring revenue and higher margins.

- Facilitates larger customer purchases and increases uptake.

Currys' established online sales platform is a prime example of a Cash Cow. Its significant market share in consumer electronics, supported by its physical stores, generates consistent and substantial revenue, contributing directly to the company's profitability.

This digital channel is highly efficient, reaching a vast customer base and benefiting from a large, loyal following. This translates into a reliable and predictable stream of income, underpinning Currys' financial stability and supporting other business areas.

The company's credit sales and financing solutions have also emerged as a significant cash cow, reaching £1.1 billion in FY2024/25. This segment generates substantial recurring revenue with higher profit margins, solidifying its role as a stable income generator.

These financial offerings enable larger customer purchases and increase overall adoption, contributing significantly to Currys' financial health and demonstrating a strong market position in technology financing.

| Business Segment | BCG Matrix Category | Key Characteristics | FY2024/25 Data |

|---|---|---|---|

| Major Domestic Appliances | Cash Cow | Mature market, steady growth, robust market share, efficient supply chain | Annual growth ~3% |

| Consumer Electronics (Standard) | Cash Cow | Mature market, strong market share, consistent revenue driver | Significant revenue driver |

| UK & Ireland Retail Stores | Cash Cow | Dominant physical presence, high customer utilization, investment in modernization | 296 stores, ~2/3 customers use stores |

| Online Sales Platform | Cash Cow | Established presence, significant market share, efficient sales, large customer base | Crucial role in market dominance |

| Credit Sales & Financing | Cash Cow | High market share in tech financing, recurring revenue, higher margins | £1.1 billion in credit sales |

Delivered as Shown

Currys BCG Matrix

The preview you see is the complete and final Currys BCG Matrix report you will receive immediately after your purchase. This means the analysis, formatting, and insights are exactly as presented, ready for your strategic decision-making without any alterations or watermarks. You can confidently use this exact document for your business planning, presentations, or competitive reviews.

Dogs

Older generation or obsolete tech products, like older model DVD players or specific legacy tech accessories, are firmly in the Dogs quadrant of the BCG matrix. These items have been largely superseded by rapid technological advancements, leading to a significant decline in demand. For instance, the global market for DVD players has been shrinking considerably, with sales dropping by over 10% year-on-year in recent periods, reflecting their obsolescence.

These products typically hold a low market share within a market that is experiencing very low or negative growth. Currys, like other retailers, would find that stocking such items ties up valuable capital with minimal prospect of returns. The continued presence of these products in inventory represents an inefficient use of resources, as consumer preference has shifted decisively towards newer, more advanced technologies.

Within Currys' extensive product range, certain niche categories might be classified as dogs if they consistently show weak sales and minimal customer engagement, with no obvious avenues for future growth. These would represent a small slice of a market that isn't expanding, thus holding little strategic importance for the company.

For instance, consider specialized audio equipment or older generation gaming consoles that might still be stocked but rarely sell. In 2024, such categories would likely contribute minimally to Currys' overall revenue, perhaps representing less than 1% of sales, and would be in markets with declining or flat year-on-year growth rates.

Certain low-margin, highly commoditized accessories within Currys' product lineup, such as generic charging cables or basic screen protectors, can be classified as Dogs in the BCG Matrix. These items face intense price competition, leading to very thin profit margins, and Currys finds it challenging to differentiate itself or capture substantial market share. For instance, in 2023, the average margin on basic mobile accessories across the UK retail sector hovered around 10-15%, a stark contrast to higher-margin electronics.

Physical Stores in Structurally Declining Locations

While Currys continues to invest in its physical store network, some individual locations might be classified as dogs. These are typically stores situated in areas experiencing a long-term decline in footfall or facing unfavorable demographic changes. Such stores consistently underperform, contributing minimally to the company's overall profitability.

These underperforming physical stores exhibit a low market share within their immediate geographical area and possess very limited growth potential. Despite Currys' broader efforts to modernize and optimize its store portfolio, these specific locations represent a drag on resources and capital.

- Underperforming Locations: Stores in areas with declining footfall and adverse demographic shifts.

- Low Market Share: Limited presence and customer base within their local catchment.

- Minimal Growth Potential: Unlikely to see significant improvement in sales or profitability.

- Resource Drain: Contribute little to overall profit and may require ongoing investment without commensurate returns.

Unsuccessful Pilot Programs or Niche Ventures

Unsuccessful pilot programs or niche ventures within Currys' portfolio would be classified as Dogs. These are initiatives, perhaps small-scale tests of new product categories or experimental retail formats, that haven't taken off. They often represent investments that failed to gain significant customer adoption or market penetration.

For instance, a pilot program for a highly specialized electronics repair service that saw very low customer sign-ups would fall into this category. Similarly, an experimental online marketplace for refurbished goods that struggled to attract sellers or buyers, despite marketing efforts, would also be considered a Dog. These ventures tie up capital and management attention without delivering the expected growth or profitability.

- Resource Drain: These ventures consume financial resources and management bandwidth without contributing meaningfully to overall company performance.

- Low Market Share: They typically operate in markets with limited demand or face intense competition, resulting in negligible market share.

- Limited Growth Potential: The underlying business model or market conditions prevent these initiatives from achieving substantial future growth.

Products in the Dogs quadrant, like older model DVD players or specific legacy tech, have a low market share in a low-growth market. These items tie up capital with minimal return prospects, as consumer preferences have shifted. For example, the global DVD player market has seen sales drop by over 10% year-on-year, highlighting their obsolescence.

Currys, like other retailers, must manage these products carefully. In 2024, categories like specialized audio equipment or older gaming consoles likely contributed less than 1% to overall revenue, operating in declining markets. Similarly, low-margin accessories such as basic charging cables, with average margins around 10-15% in 2023, face intense price competition.

Underperforming store locations in areas with declining footfall also fall into this category. These stores have a low market share locally and minimal growth potential, acting as a drain on resources. Unsuccessful pilot programs or niche ventures that failed to gain traction also represent dogs, consuming capital without delivering expected growth.

| Product Category | Market Share (Currys) | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Tech (e.g., DVD players) | Very Low | Declining | Low/Negative | Phase out |

| Niche Audio/Gaming Consoles | Low | Stagnant/Declining | Low | Reduce inventory/Consider discontinuation |

| Basic Mobile Accessories | Moderate (highly competitive) | Low | Very Low | Focus on differentiation or bundle strategies |

| Underperforming Stores | Low (local) | Low/Negative | Low/Negative | Evaluate for closure or significant restructuring |

| Failed Pilot Programs | Negligible | N/A | Negative | Terminate and reallocate resources |

Question Marks

Currys is strategically venturing into the health and beauty technology sector, a move that reflects evolving consumer preferences for tech-driven personal wellness. This burgeoning market is anticipated to see significant growth, with projections indicating a substantial increase in consumer spending on smart health and beauty devices. For instance, the global beauty tech market alone was valued at approximately $36.7 billion in 2023 and is expected to reach $111.1 billion by 2030, demonstrating a compound annual growth rate of 17.1%.

Given Currys' relatively recent entry into this segment, its current market share is likely to be low. This positions health and beauty technology as a classic question mark within the BCG matrix. While the growth potential is high, the company needs to invest heavily to build brand presence and capture a meaningful share of this competitive landscape.

Currys' introduction of pet technology products, like smart feeders and automated litter boxes, signifies their move into a burgeoning niche. This expansion taps into a market segment experiencing rapid growth, driven by increased pet ownership and a desire for convenience among owners.

While the pet tech market is expanding, Currys' current share within this specific category is likely small. This positions these products as question marks in the BCG matrix, requiring substantial investment to build brand recognition and market penetration against established players.

Currys is actively investing in portable power solutions, recognizing the surge in mobile device reliance and the growing popularity of outdoor activities. This strategic move positions them to capitalize on a market experiencing significant expansion.

While the portable power market is expanding, Currys' current market share within this specific segment is likely still in its nascent stages. This places portable power solutions firmly in the question mark category of the BCG matrix, indicating a need for focused investment to solidify its market position and growth trajectory.

Business-to-Business (B2B) Sales

Currys' B2B sales to small and medium-sized businesses are currently positioned as a question mark within its BCG matrix. The company has set an ambitious goal to double these sales within three years, signaling a belief in substantial market growth potential. This segment requires strategic investment and operational refinement to move towards a star status.

The UK B2B market for technology and services presents a compelling opportunity for Currys. In 2024, the SME sector in the UK continued to be a significant driver of economic activity, with many businesses actively seeking reliable technology partners. Currys aims to capture a larger share of this expanding market through tailored offerings and dedicated support.

- Market Growth: The UK B2B technology market is projected to see steady growth, driven by digital transformation initiatives across various industries.

- Strategic Focus: Currys' commitment to doubling B2B sales highlights a strategic pivot to capitalize on this growth.

- Investment Needs: Transitioning from a question mark to a star will necessitate targeted investments in sales infrastructure, product development, and customer relationship management.

- Competitive Landscape: The B2B sector is competitive, requiring Currys to differentiate itself through service quality, pricing, and specialized solutions for SMEs.

Smart Home Ecosystems & Advanced Connectivity

The smart home market is booming, with consumers increasingly seeking integrated solutions rather than just standalone gadgets. Currys' push into offering comprehensive systems, like whole-home automation or advanced security packages, taps into this high-growth potential. This strategic move positions them to capture a larger share of a market projected to reach over $200 billion globally by 2025, according to Statista.

- Market Growth: The global smart home market is experiencing robust expansion, driven by consumer demand for convenience and security.

- Integrated Solutions: Currys' focus on offering end-to-end smart home ecosystems, such as integrated security or automation, represents a key growth area.

- Developing Market Share: While Currys has a strong presence in individual smart devices, their market share in these more complex, integrated solutions is likely still in its formative stages, hence the question mark designation.

- Opportunity: This segment offers a significant opportunity for Currys to differentiate itself and capture a larger portion of the evolving smart home landscape.

Question marks represent business units or product lines with low market share in high-growth industries. Currys' ventures into health and beauty tech, pet technology, and portable power solutions all fit this description. These areas offer substantial future potential, but currently require significant investment to build brand awareness and gain market traction. Success hinges on strategic resource allocation and effective market penetration to convert these question marks into stars.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of public company filings, comprehensive market research reports, and proprietary sales data to accurately assess business unit performance and market share.