CTI Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

CTI Logistics boasts a strong market presence and efficient operational network, but faces increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating the logistics industry.

Want the full story behind CTI Logistics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CTI Logistics' integrated supply chain solutions are a significant strength, encompassing warehousing, distribution, general transport, and specialized logistics. This end-to-end capability allows them to manage the entire flow of goods for clients, simplifying operations and building deeper partnerships. For instance, in the fiscal year ending June 30, 2023, CTI reported a 12% increase in revenue from its integrated services segment, demonstrating strong client adoption and the effectiveness of this comprehensive offering.

CTI Logistics has showcased impressive financial resilience and growth. In fiscal year 2024, the company achieved a record revenue of $321.2 million, marking a significant 6.3% increase. This robust performance is further underscored by a 4.7% rise in EBITDA, reaching $55.9 million for the same period.

CTI Logistics boasts a significant owned property portfolio, a key strength that underpins its operational resilience. As of August 2024, this portfolio is valued at an impressive $136 million.

This substantial asset base provides CTI Logistics with considerable financial stability, insulating it from the rising costs and uncertainties associated with leasing commercial space. Owning its facilities also grants the company greater strategic flexibility, enabling easier adaptation for future expansion or operational adjustments without the constraints of lease agreements.

Diversified Revenue Streams and Geographic Footprint

CTI Logistics benefits from a robust, geographically diversified revenue model. With operations spanning over 30 strategic locations across Australia, the company effectively mitigates risks tied to localized economic fluctuations. This broad operational footprint, particularly its significant presence in Western Australia, which contributed 58% of its revenue, and the East Coast, accounting for 42%, solidifies its national market standing and provides a stable revenue base.

Strategic Investments in Infrastructure and Technology

CTI Logistics is making significant capital expenditures to bolster its operational capabilities. For the fiscal year ending June 30, 2024, the company reported a substantial increase in its investment in property, plant, and equipment, reaching approximately AUD 45 million. This investment is directed towards modernizing its fleet, upgrading warehouse infrastructure, and implementing cutting-edge technology systems.

These strategic investments are designed to directly improve CTI Logistics' service delivery and cost-effectiveness. By owning and developing key sites, acquiring new vehicles and equipment, and deploying advanced warehouse and transport management systems, the company is enhancing its capacity and efficiency. This proactive approach is crucial for meeting evolving customer demands and securing a competitive edge in the logistics sector.

- Enhanced Operational Efficiency: Investments in new vehicles and advanced management systems streamline operations.

- Improved Service Quality: Upgraded infrastructure and technology lead to more reliable and faster delivery.

- Foundation for Growth: Strategic site development and system implementation support future expansion.

- Capital Expenditure: Approximately AUD 45 million invested in property, plant, and equipment for FY24.

CTI Logistics' integrated supply chain solutions are a significant strength, encompassing warehousing, distribution, general transport, and specialized logistics. This end-to-end capability allows them to manage the entire flow of goods for clients, simplifying operations and building deeper partnerships. For instance, in the fiscal year ending June 30, 2023, CTI reported a 12% increase in revenue from its integrated services segment, demonstrating strong client adoption and the effectiveness of this comprehensive offering.

CTI Logistics has showcased impressive financial resilience and growth. In fiscal year 2024, the company achieved a record revenue of $321.2 million, marking a significant 6.3% increase. This robust performance is further underscored by a 4.7% rise in EBITDA, reaching $55.9 million for the same period.

CTI Logistics boasts a significant owned property portfolio, a key strength that underpins its operational resilience. As of August 2024, this portfolio is valued at an impressive $136 million. This substantial asset base provides considerable financial stability, insulating it from rising leasing costs and offering greater strategic flexibility for expansion or operational adjustments.

CTI Logistics benefits from a robust, geographically diversified revenue model. With operations spanning over 30 strategic locations across Australia, the company effectively mitigates risks tied to localized economic fluctuations. This broad operational footprint, particularly its significant presence in Western Australia, which contributed 58% of its revenue, and the East Coast, accounting for 42%, solidifies its national market standing and provides a stable revenue base.

CTI Logistics is making significant capital expenditures to bolster its operational capabilities. For the fiscal year ending June 30, 2024, the company reported approximately AUD 45 million invested in property, plant, and equipment. These strategic investments are directed towards modernizing its fleet, upgrading warehouse infrastructure, and implementing cutting-edge technology systems to improve service delivery and cost-effectiveness.

| Financial Metric | FY2023 | FY2024 | Change |

|---|---|---|---|

| Revenue | $302.1 million | $321.2 million | +6.3% |

| EBITDA | $53.4 million | $55.9 million | +4.7% |

| Property Portfolio Value (Aug 2024) | N/A | $136 million | N/A |

| Capital Expenditure (FY24) | N/A | AUD 45 million | N/A |

What is included in the product

Delivers a strategic overview of CTI Logistics’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats impacting its market position and future growth.

Offers a clear, actionable roadmap by highlighting CTI Logistics' core strengths and mitigating weaknesses.

Weaknesses

CTI Logistics' strategic investments, while crucial for future expansion, have led to a noticeable dip in short-term profitability. For the fiscal year 2024, the company reported a decrease in profit before tax, a trend expected to continue into the half-year ending December 2024.

This temporary decline in earnings is a direct trade-off for the substantial capital expenditure undertaken to bolster long-term growth initiatives, impacting immediate financial performance metrics.

A significant weakness for CTI Logistics lies in its susceptibility to economic downturns, particularly concerning consumer spending. With Australia's economic growth forecast to moderate to 1.2% in FY2025, coupled with persistent cost-of-living pressures, consumers are likely to curtail non-essential purchases. This directly translates to reduced demand for logistics services, potentially hindering CTI Logistics' expansion in segments reliant on discretionary consumer behavior.

CTI Logistics grapples with significant operating costs, a common hurdle in the logistics sector. Rising labor expenses, particularly for drivers and warehouse staff, directly impact the bottom line. For instance, in the 2023 financial year, CTI Logistics reported an increase in employee benefits expenses, reflecting these pressures.

Ongoing global supply chain disruptions continue to exacerbate these high operating costs. These disruptions can lead to increased fuel prices and longer transit times, further squeezing already thin profit margins, especially within the competitive road freight forwarding segment.

Potential for Labor Shortages

The logistics sector, including CTI Logistics, faces ongoing challenges with a scarcity of skilled workers, especially truck drivers and warehouse personnel. This persistent labor shortage is a significant weakness, potentially driving up labor costs through wage increases and creating operational bottlenecks that could hinder the company's capacity to fulfill customer orders effectively.

The impact of these labor shortages can be substantial:

- Increased Wage Pressure: To attract and retain staff, CTI Logistics may need to offer higher wages, directly impacting its operating expenses and profit margins. For instance, industry reports from late 2024 indicated a 7% average increase in driver wages across the sector.

- Operational Disruptions: A lack of available drivers or warehouse staff can lead to delayed deliveries, reduced transport capacity, and an inability to scale operations during peak demand periods. This can damage customer relationships and lead to lost business.

- Higher Recruitment and Training Costs: The constant need to recruit and train new employees to fill these roles further strains resources. The cost to onboard a new driver can range from $5,000 to $10,000, a significant expense when turnover is high.

Intense Market Competition

The Australian logistics landscape is characterized by its fragmentation, with a multitude of companies competing for business. This high level of competition means CTI Logistics constantly faces pressure to keep its pricing competitive, which can impact profitability.

To navigate this intense market, CTI Logistics must focus on operational efficiency and innovation. The Australian road freight industry, for instance, saw a 3.5% increase in operating costs in 2023 according to the National Transport Commission, highlighting the need for cost management in a price-sensitive environment.

- Fragmented Market: Numerous small and large players compete for market share in Australia.

- Price Pressure: Intense competition often leads to downward pressure on freight rates.

- Margin Squeeze: Maintaining healthy profit margins requires constant operational optimization.

- Innovation Imperative: Continuous investment in technology and service improvement is crucial for differentiation.

CTI Logistics faces a significant weakness in its susceptibility to economic downturns, particularly impacting consumer discretionary spending. With Australia's economic growth moderating and cost-of-living pressures persisting, reduced consumer demand directly affects the logistics sector.

High operating costs, including rising labor expenses for drivers and warehouse staff, alongside ongoing global supply chain disruptions, continue to squeeze profit margins. The scarcity of skilled workers, especially truck drivers, exacerbates these cost pressures and can lead to operational disruptions.

The fragmented Australian logistics market intensifies competition, forcing CTI Logistics to maintain competitive pricing, which can further impact profitability and necessitates continuous operational optimization.

| Weakness | Impact | Supporting Data/Observation |

|---|---|---|

| Economic Sensitivity | Reduced demand for logistics services | Australia FY2025 economic growth forecast at 1.2%; persistent cost-of-living pressures |

| High Operating Costs | Squeezed profit margins | Increased employee benefits expenses (FY2023); rising fuel prices and transit times due to supply chain disruptions |

| Labor Shortages | Increased wage pressure, operational bottlenecks | Industry reports of ~7% average driver wage increase (late 2024); high recruitment/training costs ($5k-$10k per driver) |

| Market Fragmentation | Price pressure, margin squeeze | Intense competition in Australian road freight; ~3.5% increase in operating costs (2023) |

What You See Is What You Get

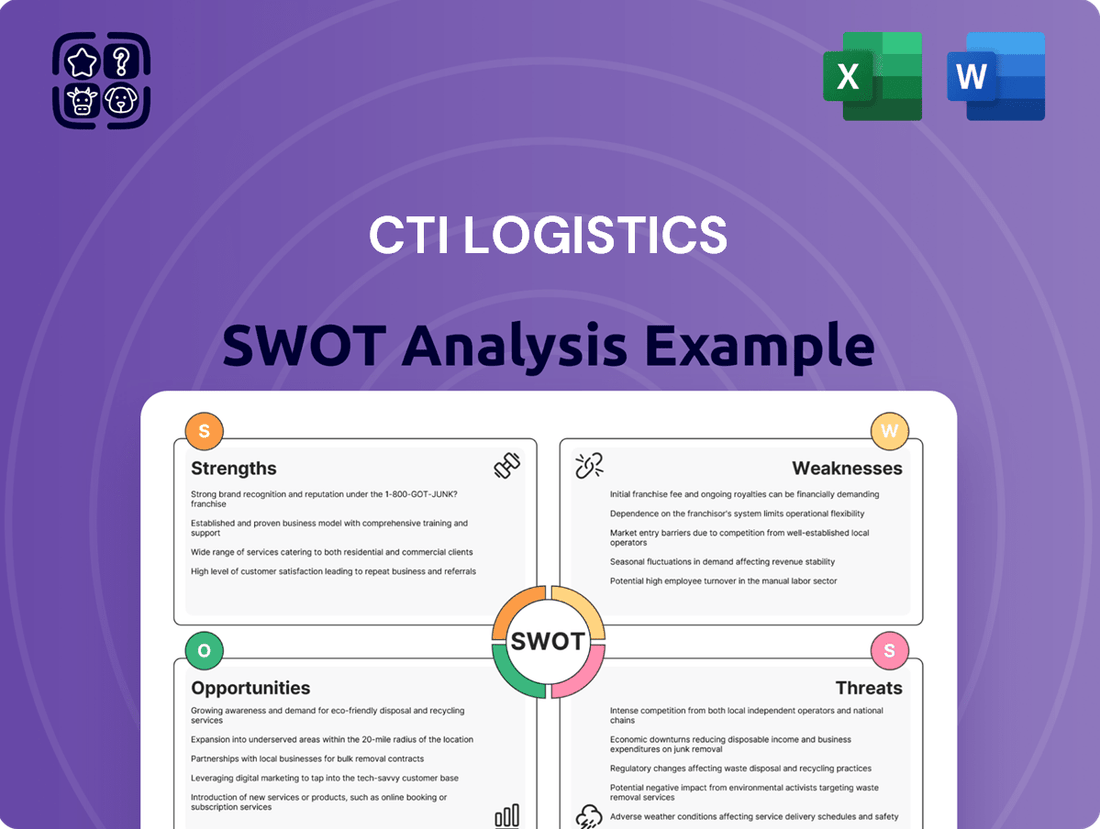

CTI Logistics SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual CTI Logistics SWOT analysis, providing a clear overview of its Strengths, Weaknesses, Opportunities, and Threats. The complete, detailed report is unlocked immediately upon purchase.

Opportunities

The Australian e-commerce market is a significant growth engine, with projections indicating it will generate substantial revenue by 2025. This expansion directly translates into a heightened demand for sophisticated and efficient last-mile delivery solutions, creating a prime opportunity for CTI Logistics.

CTI Logistics is well-positioned to leverage this burgeoning e-commerce trend. By further optimizing its existing delivery networks and strategically investing in advanced technologies and infrastructure, the company can effectively cater to the escalating customer expectations for faster, more reliable, and convenient delivery services, thereby capturing a larger market share.

CTI Logistics can seize opportunities by integrating advanced logistics technologies like AI and automation. These innovations promise to boost operational efficiency, offering real-time supply chain visibility and predictive capabilities. For instance, the global warehouse automation market was projected to reach $30.6 billion in 2024, highlighting the significant potential for companies like CTI to streamline operations and optimize delivery routes.

The increasing global demand for environmentally friendly practices is a significant opportunity for CTI Logistics. Many consumers now actively seek out businesses with strong sustainability credentials, and regulatory bodies are implementing stricter environmental standards. For instance, by 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began impacting logistics companies, creating a clear incentive to adopt greener operations.

CTI Logistics can capitalize on this trend by investing in electric vehicle fleets and optimizing delivery routes to cut down on carbon emissions. This strategic shift not only meets growing market expectations but also positions CTI as a forward-thinking leader in the logistics sector. Companies that embrace sustainable logistics are likely to see enhanced brand reputation and potentially gain a competitive edge in securing contracts with environmentally conscious clients.

Expansion and Diversification of Supply Chain Networks

The Australian logistics sector is experiencing robust growth, fueled by expanding supply chain networks and significant infrastructure investments. CTI Logistics is well-positioned to capitalize on this by broadening its national presence and developing new operational sites. For instance, the Australian logistics market was valued at approximately AUD 120 billion in 2024, with projections indicating continued expansion.

This presents a clear opportunity for CTI Logistics to enhance its service portfolio and reach a wider customer base across diverse industries.

- Strategic expansion of national footprint to capture growing demand.

- Development of new, state-of-the-art facilities to support increased volumes.

- Diversification of service offerings to cater to a broader range of industry needs.

Strategic Partnerships and Acquisitions

CTI Logistics can leverage the fragmented nature of the Australian logistics sector by pursuing strategic partnerships or acquisitions. This approach could significantly bolster its market share and broaden its service offerings. For instance, acquiring smaller, specialized logistics providers could grant CTI access to new customer segments and geographic regions, as seen in other consolidating industries where market leaders have grown through M&A activity.

These collaborations offer a pathway to achieving synergistic benefits, such as cost efficiencies through shared infrastructure and technology, and revenue growth by cross-selling services. In 2024, the global logistics market was valued at approximately $11.3 trillion, indicating substantial room for consolidation and expansion for players like CTI.

Key opportunities include:

- Acquiring regional players: To gain immediate access to established customer bases and operational networks in underserved areas.

- Forming strategic alliances: With technology providers to enhance tracking, route optimization, and supply chain visibility.

- Expanding service portfolio: Through partnerships with companies specializing in niche logistics, such as cold chain or hazardous materials transport.

The Australian e-commerce boom presents a significant opportunity for CTI Logistics, with the market projected for continued substantial growth through 2025, driving demand for efficient last-mile delivery. By enhancing its networks and investing in technology, CTI can meet rising customer expectations for speed and reliability, thus increasing its market share.

Integrating advanced logistics technologies like AI and automation is another key opportunity, promising to boost efficiency and provide real-time supply chain visibility. The global warehouse automation market was expected to reach $30.6 billion in 2024, illustrating the potential for CTI to streamline operations and optimize routes.

CTI can also capitalize on the growing demand for sustainable logistics by investing in electric vehicle fleets and optimizing routes to reduce emissions. This aligns with increasing consumer preference for eco-friendly businesses and stricter environmental regulations, such as the EU's CBAM impacting logistics by 2024.

The expanding Australian logistics sector, valued around AUD 120 billion in 2024, offers CTI chances to grow its national presence and service offerings, catering to a wider range of industries. Strategic acquisitions of regional players or alliances with technology providers can further bolster its market share and service capabilities.

| Opportunity Area | Description | Supporting Data (2024/2025) |

|---|---|---|

| E-commerce Growth | Leveraging increased online sales for delivery services. | Australian e-commerce market projected for significant revenue by 2025. |

| Technology Adoption | Implementing AI and automation for efficiency. | Global warehouse automation market projected at $30.6 billion in 2024. |

| Sustainability | Adopting green practices and EV fleets. | Growing consumer demand for eco-friendly logistics; EU CBAM impact by 2024. |

| Market Consolidation | Strategic partnerships and acquisitions. | Australian logistics market valued at ~AUD 120 billion in 2024; global logistics market ~$11.3 trillion. |

Threats

Persistent economic uncertainty in Australia, with slower growth forecasts and ongoing inflation, presents a considerable threat. For instance, the Reserve Bank of Australia (RBA) has maintained its cash rate at 4.35% as of May 2024, signaling a cautious approach to managing inflation. This economic climate can dampen both business and consumer spending, directly affecting freight volumes and CTI Logistics' overall revenue streams.

Fuel price volatility continues to pose a significant threat to CTI Logistics, directly impacting operational expenses and profitability. While global crude oil prices have seen fluctuations, the inherent unpredictability necessitates ongoing vigilance in cost management. For instance, in early 2024, Brent crude oil prices traded in a range of $75 to $85 per barrel, demonstrating this ongoing market instability.

The Australian logistics sector is intensely competitive and fragmented, placing constant pressure on CTI Logistics' pricing and profit margins. For instance, in the fiscal year ending June 30, 2023, the broader Australian transport and logistics industry saw average net profit margins hovering around 5-7%, a figure that CTI must contend with.

New market entrants or existing players employing aggressive pricing tactics pose a significant threat. If CTI Logistics cannot effectively manage its operational costs and clearly distinguish its service offerings, its profitability could be negatively impacted by such competitive pressures.

Supply Chain Disruptions and Geopolitical Instability

Global geopolitical tensions and the increasing frequency of natural disasters pose significant threats to CTI Logistics' operations. These events can disrupt shipping routes, increase fuel costs, and create unpredictable delays, impacting delivery times and overall efficiency. For instance, the ongoing Red Sea shipping crisis, which intensified in late 2023 and continued into 2024, forced many carriers to reroute vessels around the Cape of Good Hope, adding significant transit time and cost to shipments. This highlights the need for CTI Logistics to bolster its supply chain resilience.

CTI Logistics must proactively develop and implement robust strategies to navigate these external volatilities. This includes diversifying transportation partners and routes, investing in advanced tracking and visibility technologies, and potentially increasing inventory levels for critical goods to buffer against unforeseen disruptions. The company’s ability to adapt quickly to changing global conditions will be crucial for maintaining service reliability and competitive advantage.

- Geopolitical Instability: Ongoing conflicts and trade disputes can lead to sanctions, tariffs, and altered trade flows, directly impacting international logistics.

- Supply Chain Bottlenecks: Port congestion, labor shortages, and capacity constraints, exacerbated by global events, can cause significant delays and cost increases.

- Rising Operational Costs: Disruptions often translate to higher fuel prices, increased insurance premiums, and surcharges, squeezing profit margins.

- Demand Volatility: Geopolitical events can also trigger sudden shifts in consumer and business demand, making forecasting and resource allocation more challenging.

Rapid Technological Obsolescence and Investment Burden

The logistics industry is experiencing a swift technological evolution, demanding substantial and ongoing capital outlays for CTI Logistics to maintain its competitive edge. This includes investments in advanced tracking systems, automated warehousing solutions, and potentially autonomous vehicles. For instance, the global logistics technology market was valued at approximately $30 billion in 2023 and is projected to grow significantly, highlighting the competitive pressure to adopt these innovations.

Failure to adapt to these rapid technological shifts could result in CTI Logistics facing operational inefficiencies compared to rivals who have invested in newer, more advanced systems. This lag could manifest in slower delivery times, higher operating costs, and a diminished ability to meet evolving customer expectations for speed and transparency. Consequently, market share erosion is a tangible threat if the company cannot keep pace with the technological advancements driving the industry forward.

- Continuous Capital Outlay: The need for ongoing investment in cutting-edge logistics technology, such as AI-powered route optimization and robotic process automation, presents a significant financial challenge.

- Risk of Obsolescence: Technology in logistics can become outdated quickly, meaning investments made today may require further upgrades or replacements sooner than anticipated.

- Competitive Disadvantage: Companies that fail to invest in and implement the latest technologies risk falling behind competitors in terms of efficiency, cost-effectiveness, and service quality.

- Operational Inefficiencies: Outdated systems can lead to manual processes, increased error rates, and slower turnaround times, impacting overall service delivery and customer satisfaction.

The Australian logistics sector's intense competition and fragmentation exert constant pressure on CTI Logistics' pricing and profit margins. For the fiscal year ending June 30, 2023, the broader Australian transport and logistics industry reported average net profit margins of approximately 5-7%, a benchmark CTI must navigate. New market entrants or aggressive pricing by existing players could erode profitability if CTI cannot effectively manage its operational costs and differentiate its services.

SWOT Analysis Data Sources

This CTI Logistics SWOT analysis is built upon a foundation of verifiable data, including company financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a robust and accurate assessment of the company's strategic position.