CTI Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

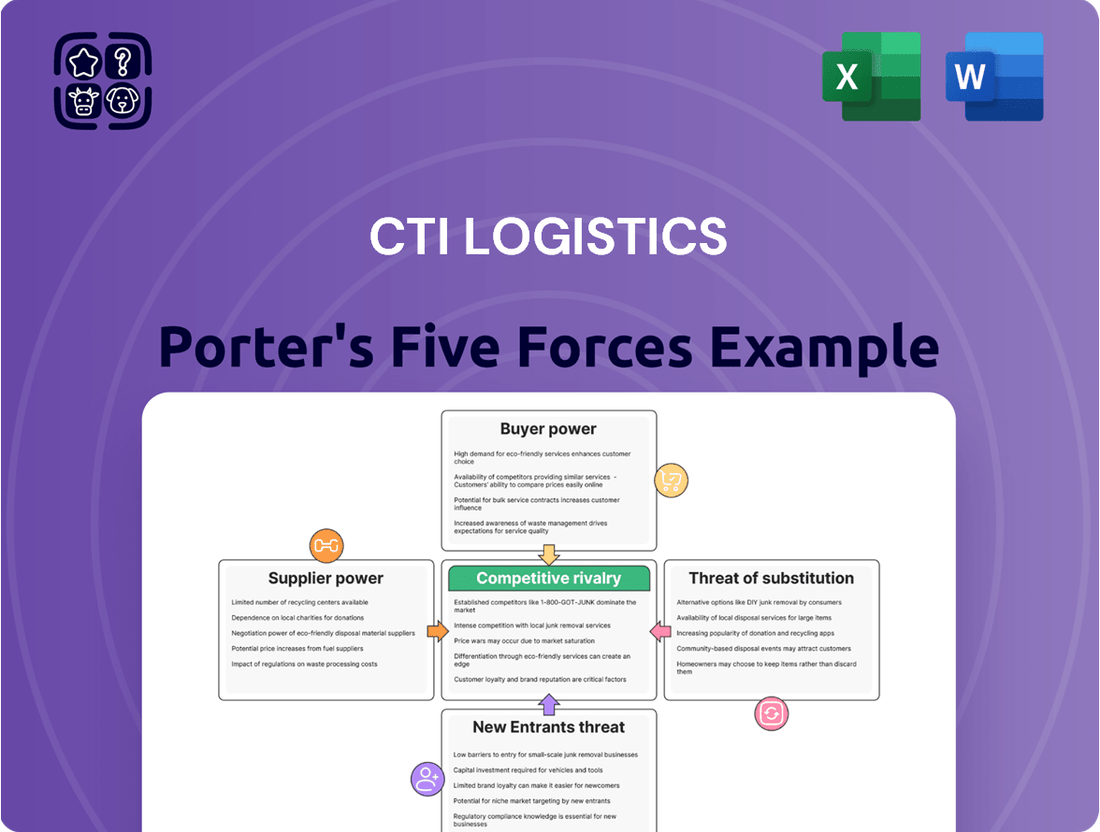

CTI Logistics faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers shaping its market landscape. Understanding these forces is crucial for navigating the logistics industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CTI Logistics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The price of fuel, a critical input for CTI Logistics, directly impacts supplier power. Global oil price volatility can significantly increase operating expenses, and fuel suppliers often wield considerable influence due to the commodity's essential nature in transportation. For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a level that directly translates to higher fuel costs for CTI.

Suppliers of vehicles, trailers, and specialized logistics equipment wield significant influence, particularly over CTI Logistics' specialized resources division. The substantial upfront investment, stringent technical specifications, and ongoing maintenance demands often create a dependency on a limited number of manufacturers, thereby reducing CTI's bargaining power concerning purchase terms and after-sales service.

The availability and cost of skilled labor, especially drivers and warehouse staff, significantly influence supplier power for CTI Logistics. For instance, in 2024, the Australian trucking industry continued to face a shortage of qualified drivers, with some reports indicating a deficit of thousands of drivers, which naturally puts upward pressure on wages.

Increasing wage demands or robust unionization within the transport sector directly translate to higher operational costs for CTI Logistics. This can impact profitability if the company cannot pass these increased labor expenses onto its customers effectively.

CTI Logistics' capacity to attract and retain qualified personnel is crucial for mitigating the bargaining power of labor suppliers. Competitive compensation packages, training programs, and a positive work environment are key strategies to ensure a stable and skilled workforce, thereby reducing reliance on costly or scarce labor.

Technology and Software Providers

CTI Logistics, as an integrated supply chain solution provider, depends heavily on technology and software for its operations. This includes systems for warehousing, distribution, freight forwarding, and managing its supply base. The bargaining power of these technology and software providers can be substantial, particularly those offering specialized or proprietary systems. For instance, in 2024, the global logistics software market was valued at approximately $22.5 billion, indicating a significant investment in these technologies.

The ability of these suppliers to exert power is often linked to the switching costs associated with their solutions. When CTI invests in complex, integrated software platforms, the expense and effort required to transition to an alternative vendor can be considerable. This high switching cost strengthens the leverage of existing technology suppliers, potentially leading to increased pricing or less favorable contract terms for CTI.

- High Switching Costs: Implementing and integrating new logistics software can take months, involving significant IT resources and training, making it costly for CTI to change providers.

- Specialized Solutions: Vendors providing highly tailored or niche software for specific logistics functions, like advanced route optimization or cold chain management, often face less competition and can command higher prices.

- Proprietary Technology: Software built on unique or proprietary architectures can lock customers in, as alternative systems may not offer the same level of integration or functionality.

- Dependence on Innovation: CTI's need to stay competitive means relying on suppliers who continuously innovate, which can give those suppliers more influence over contract renewals and feature development.

Real Estate and Warehouse Lessors

The bargaining power of real estate and warehouse lessors is a significant factor for CTI Logistics. Their ability to secure and maintain suitable warehousing and distribution facilities directly impacts operational efficiency and cost. In 2024, the demand for prime industrial and logistics space remained robust, particularly in key economic hubs, which can empower landlords.

Lessors of strategically located warehouse spaces, especially those offering specialized features or proximity to major transportation networks, can exert considerable influence. This is particularly true in markets where suitable alternatives are scarce, allowing landlords to dictate terms and potentially increase rental rates. For instance, reports from early 2024 indicated vacancy rates for industrial properties in major Australian cities were often below 2%, a tight market that favors lessors.

- Strategic Location Advantage: Lessors controlling properties in prime industrial zones or near key transport infrastructure hold a stronger negotiating position due to the inherent value of accessibility for logistics operations.

- Limited Availability of Alternatives: In markets with low vacancy rates for specialized logistics facilities, the scarcity of comparable spaces grants lessors increased leverage in lease negotiations. As of Q2 2024, the average industrial vacancy rate across Australia was around 1.5%, highlighting this limited availability.

- Lease Term and Specialization: Long-term lease agreements and properties with specific configurations required by CTI can further solidify the lessor's power, as switching costs for CTI can be substantial.

Suppliers of essential inputs like fuel and vehicles hold significant sway over CTI Logistics due to the critical nature of these resources. The cost and availability of skilled labor, particularly drivers, also empower labor suppliers, as evidenced by ongoing shortages in the Australian trucking sector in 2024. Furthermore, providers of specialized logistics technology and software can exert considerable bargaining power, especially when switching costs are high.

| Supplier Type | Key Influence Factors | Impact on CTI Logistics | 2024 Data Point |

|---|---|---|---|

| Fuel Suppliers | Global oil price volatility, essential commodity | Increased operating expenses | Brent crude oil ~ $80/barrel (early 2024) |

| Vehicle/Equipment Manufacturers | High upfront investment, specialized needs, limited vendors | Reduced negotiation power on purchase terms | N/A (Industry specific) |

| Skilled Labor (Drivers) | Labor shortages, wage demands, unionization | Higher operational costs, potential profitability squeeze | Thousands of drivers short in Australian trucking (2024) |

| Technology/Software Providers | High switching costs, specialized/proprietary systems | Potential for increased pricing, less favorable terms | Global logistics software market ~$22.5 billion (2024) |

What is included in the product

This analysis dissects the competitive forces impacting CTI Logistics, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the logistics industry.

Instantly visualize the competitive landscape of CTI Logistics with a dynamic Porter's Five Forces analysis, simplifying complex market pressures for actionable insights.

Customers Bargaining Power

CTI Logistics' diverse client portfolio, spanning various sectors, helps dilute the bargaining power of any single customer. However, major corporate clients, representing substantial business volumes, naturally wield greater influence, often seeking competitive pricing, customized solutions, and advantageous contract terms.

For instance, in 2024, CTI Logistics' top 10 clients accounted for approximately 35% of their total revenue, indicating that while diversification exists, a significant portion of business still relies on larger accounts, thereby granting these clients considerable bargaining leverage.

Customer switching costs are a significant factor in CTI Logistics' competitive landscape. When CTI's services are deeply embedded within a customer's supply chain, particularly with specialized logistics or supply base management, the effort and expense required to transition to a competitor become substantial. This integration can involve complex process reconfigurations and system re-engineering, making a switch a costly undertaking.

For instance, if a client relies on CTI for end-to-end supply chain visibility and management, switching providers necessitates rebuilding those intricate connections and workflows. This contrasts with simpler, transactional services where the barriers to switching are inherently lower, allowing customers more leverage.

Customers in the logistics sector, particularly for standard freight services, often exhibit high price sensitivity. This means they are very likely to switch providers based on cost alone. For instance, a significant portion of freight spending can be driven by per-mile rates, making it a primary comparison point.

The rise of digital platforms has dramatically increased price transparency. Online marketplaces and comparison tools allow customers to easily view and compare quotes from multiple logistics providers. This easy access to information empowers buyers, leading to greater negotiation leverage and potentially squeezing margins for companies like CTI Logistics.

CTI Logistics can mitigate this intense price sensitivity by focusing on differentiation. By offering superior service quality, reliable delivery times, and value-added services such as supply chain optimization or specialized handling, CTI can build loyalty and command a premium. For example, clients valuing speed and reduced damage claims might be less swayed by minor price differences.

Threat of Backward Integration by Customers

Large customers, especially those with substantial shipping volumes, possess the inherent capability to bring their logistics operations in-house. This potential for backward integration acts as a significant pressure point for CTI Logistics, compelling them to consistently offer competitive pricing and superior service to maintain client loyalty.

The feasibility of a customer managing their own logistics hinges on their operational scale and whether logistics aligns with their core business strategy. For instance, a major retailer with a vast distribution network might find it more cost-effective to develop its own fleet and warehousing compared to a smaller business.

- Customer Scale: The threat is amplified for customers who handle a high volume of goods, making the investment in their own logistics infrastructure more justifiable.

- Cost-Benefit Analysis: Customers will weigh the costs of building and managing an in-house logistics operation against the current service fees from providers like CTI Logistics.

- Strategic Alignment: If logistics is a critical differentiator or a core competency for the customer, they are more likely to consider backward integration.

Availability of Alternative Logistics Providers

The logistics sector is notably fragmented, featuring a wide array of providers from large international corporations to specialized local operators. This sheer volume of choices significantly enhances customer bargaining power, as they can easily switch to a competitor if CTI Logistics doesn't meet their demands.

CTI Logistics faces a dynamic market where customers, particularly larger enterprises, can leverage the availability of numerous alternative logistics providers. For instance, in 2024, the global third-party logistics (3PL) market was projected to reach over $1.3 trillion, indicating a highly competitive landscape with ample options for shippers.

- Fragmented Market: The logistics industry's diversity in providers, from global giants to local specialists, gives customers numerous alternatives.

- Customer Leverage: This abundance of choice empowers customers to negotiate better terms or switch providers, increasing their bargaining power.

- CTI's Challenge: CTI Logistics must consistently prove its value proposition through superior service, reliability, and comprehensive offerings to retain clients in this competitive environment.

- Market Data: The global 3PL market's substantial size in 2024 highlights the intense competition and the availability of alternatives for businesses seeking logistics solutions.

The bargaining power of customers for CTI Logistics is influenced by several factors, including customer scale, price sensitivity, and the availability of alternatives. Large clients, especially those with significant shipping volumes, can exert considerable pressure due to their potential to bring logistics in-house or switch to competitors. For example, in 2024, the global third-party logistics market was valued at over $1.3 trillion, underscoring the intense competition and the numerous options available to customers.

| Factor | Impact on CTI Logistics | Mitigation Strategies for CTI Logistics |

| Customer Scale & Backward Integration | Large clients can threaten to insource logistics, increasing negotiation leverage. | Offer competitive pricing, superior service, and value-added solutions to retain loyalty. |

| Price Sensitivity & Transparency | Customers are highly sensitive to costs, especially for standard services, and digital platforms increase price transparency. | Differentiate through service quality, reliability, and specialized offerings to justify premium pricing. |

| Fragmented Market & Alternatives | A wide array of logistics providers gives customers numerous choices, enhancing their power. | Focus on building strong customer relationships and demonstrating unique value propositions. |

Preview Before You Purchase

CTI Logistics Porter's Five Forces Analysis

This preview showcases the comprehensive CTI Logistics Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, ensuring you receive the exact, professionally formatted analysis for your strategic planning needs.

Rivalry Among Competitors

The logistics sector, especially for general transport and warehousing, is a crowded space with many different types of companies. You'll find massive global players with vast reach alongside smaller, niche businesses focusing on specific local needs. This wide variety of competitors means the fight for customers is really tough.

In 2024, the Australian logistics market, where CTI Logistics operates, saw continued consolidation but still maintained a significant number of participants. While major players like Toll Group and Linfox dominate certain segments, a substantial number of mid-tier and smaller operators actively compete, particularly in regional and specialized freight services. This diverse competitive landscape means pricing pressures are a constant factor.

The logistics industry, while generally experiencing steady growth, can see intensified competitive rivalry during periods of slower expansion. When the market pie isn't growing as quickly, companies like CTI Logistics often engage in more aggressive competition for market share. For instance, in 2023, global logistics market growth was estimated to be around 4.5%, a solid figure but one that still requires companies to actively differentiate themselves.

Conversely, strong industry growth can ease competitive pressures. When demand outstrips supply, there's often enough business for all participants, potentially reducing the need for intense price wars. This environment allows CTI Logistics to focus on expanding its services and operational footprint without the same level of direct competition for every new contract. The International Monetary Fund projected global GDP growth of 3.2% for 2024, which typically translates to healthy demand for logistics services.

The degree to which logistics services can be made unique is a major factor in how intense the competition is. When services are seen as very similar, like basic transportation, companies often end up competing mainly on price, which can squeeze profit margins.

CTI Logistics actively works to stand out by offering what it calls integrated supply chain solutions. This means they go beyond just moving goods; they manage the entire process. For example, in 2024, CTI reported a significant portion of its revenue coming from these value-added services, indicating a successful move away from pure freight forwarding.

The company also emphasizes specialized resources logistics, which caters to niche markets requiring specific handling or equipment. This specialization allows CTI to command premium pricing and build stronger customer loyalty, as clients in these sectors value expertise and reliability over the lowest bid.

High Fixed Costs and Exit Barriers

The logistics sector, including companies like CTI Logistics, is characterized by significant upfront investments. Think about the cost of a fleet of trucks, large warehouse facilities, and the sophisticated IT systems needed for tracking and management. These aren't small expenses; they represent substantial fixed costs that must be paid regardless of how much business is actually being done.

These high fixed costs, combined with assets that are often specialized for logistics operations, create formidable exit barriers. It's not easy for a company to simply shut down and sell off its assets without incurring substantial losses. This means that even when market conditions are tough and profitability is low, businesses are often forced to continue operating to avoid the crippling costs associated with exiting the industry.

This situation directly fuels competitive rivalry. When companies are reluctant to leave the market due to these high exit barriers, they tend to compete more aggressively to maintain market share and cover their fixed expenses. This can lead to price wars and a general intensification of competition, impacting profit margins across the board.

- High Capital Expenditure: The Australian trucking industry, for example, sees significant capital tied up in vehicles. A new prime mover can cost upwards of $300,000, with a trailer adding another $100,000-$200,000.

- Specialized Assets: Warehousing often requires specialized racking, climate control, and material handling equipment, making them difficult to repurpose or sell quickly.

- Operational Necessity: Companies in 2024 continue to face pressure to maintain fleet utilization rates above 70% simply to break even on depreciating assets and operational overheads.

- Industry Persistence: The reluctance to exit due to sunk costs means that even smaller, less profitable players may remain active, adding to the competitive intensity for established firms like CTI Logistics.

Strategic Stakes and Aggressiveness of Competitors

The logistics industry is characterized by fierce competition, with many players possessing high strategic stakes. This often translates into aggressive pricing, rapid service expansion, and significant investments in new technologies. CTI Logistics encounters rivals who are not only vying for market share but are also actively broadening their service portfolios to offer more integrated solutions.

For CTI, this means a constant need to innovate and adapt to stay ahead. Competitors are pushing boundaries, whether through enhanced tracking capabilities, last-mile delivery optimization, or sustainable logistics practices. For instance, in 2024, the global logistics market saw continued investment in automation and AI, with companies like DHL and FedEx announcing substantial capital expenditures aimed at improving efficiency and customer experience, directly impacting the competitive landscape CTI operates within.

- Aggressive Pricing: Competitors frequently engage in price wars to capture market share, pressuring profit margins across the sector.

- Service Expansion: Rivals are broadening their offerings, moving beyond core transportation to include warehousing, customs brokerage, and supply chain consulting.

- Technological Investment: Significant capital is being deployed into areas like AI-powered route optimization, IoT for real-time tracking, and autonomous vehicles, raising the bar for operational efficiency.

- Market Presence: Competitors are actively pursuing mergers and acquisitions and organic growth strategies to expand their geographical reach and customer base.

Competitive rivalry within the logistics sector, particularly in Australia where CTI Logistics operates, remains intense. The market is populated by a diverse range of players, from global giants to specialized local firms, all vying for business. This crowded field means companies like CTI must continually differentiate themselves to avoid competing solely on price, a common outcome when services are perceived as similar.

In 2024, the Australian logistics market continued to see a mix of large established companies and numerous smaller operators, especially in regional and niche freight. This dynamic ensures ongoing pressure on pricing and service levels. For instance, while major players like Toll and Linfox hold significant market share, the presence of many mid-tier and smaller competitors means that opportunities for differentiation through specialized services are crucial for CTI Logistics.

The intensity of competition is further amplified by high exit barriers due to substantial capital investments in fleets and warehousing, as well as specialized assets that are difficult to repurpose. This forces companies to remain active even in challenging market conditions, leading to persistent rivalry. For example, the cost of a new prime mover in Australia can exceed $300,000, contributing to these high fixed costs and the reluctance to exit.

CTI Logistics counters this by focusing on integrated supply chain solutions and specialized logistics, aiming to move beyond basic freight forwarding. In 2024, a notable portion of CTI's revenue was attributed to these value-added services, demonstrating a strategy to capture higher margins and build customer loyalty in a competitive environment. Competitors are also investing heavily in technology, such as AI for route optimization, to gain an edge.

| Competitor Type | Market Presence | Strategic Focus |

|---|---|---|

| Global Logistics Providers | Extensive international networks | End-to-end supply chain solutions, technology integration |

| Major Australian Players (e.g., Toll, Linfox) | Significant domestic infrastructure and fleet | Market share dominance, service diversification |

| Mid-tier & Niche Operators | Regional focus, specialized services | Agility, customer-specific solutions, competitive pricing |

| CTI Logistics | Australian operations, growing integrated services | Specialized resources logistics, value-added supply chain management |

SSubstitutes Threaten

Customers developing their own in-house logistics capabilities represent a significant threat. For instance, major retailers with substantial shipping volumes, like Amazon or Walmart, often invest heavily in their own fleets and distribution networks to gain greater control and potentially reduce costs. This trend is fueled by the desire for end-to-end supply chain visibility and customization, which can be challenging for third-party logistics providers to match without demonstrating exceptional value.

Customers have readily available alternatives to integrated logistics providers like CTI Logistics. They can opt for direct engagement with specific transport modes such as rail, air cargo, or ocean freight, depending on their cargo's urgency, cost sensitivity, and nature. For instance, in 2024, the global air cargo market was projected to handle over 65 million tons of freight, demonstrating a significant standalone option for time-critical shipments.

The emergence of digital logistics platforms, like Uber Freight or Convoy, acts as a significant substitute threat. These platforms directly connect shippers with carriers, bypassing traditional intermediaries and offering a more streamlined, often cheaper, service. For instance, in 2023, digital freight matching platforms facilitated billions of dollars in freight transactions, demonstrating their growing market share and ability to disrupt established players.

Technological Advancements Impacting Logistics Needs

Innovations like additive manufacturing, commonly known as 3D printing, are beginning to reshape supply chains. For instance, a 2024 report indicated that the global 3D printing market was projected to reach over $30 billion, highlighting its growing adoption. This technology allows for the production of goods closer to the point of consumption, potentially reducing the reliance on extensive transportation networks.

While 3D printing is not yet a universal substitute for traditional manufacturing and logistics across all sectors, its impact is undeniable in specific niches. For example, in aerospace and medical device manufacturing, where complex, low-volume parts are common, on-site printing is already displacing some traditional shipping needs. CTI Logistics must actively track the expansion of these capabilities and their implications for freight volume.

The long-term threat lies in the potential for widespread adoption of localized manufacturing enabled by advanced technologies. As 3D printing becomes more cost-effective and versatile, it could significantly diminish the demand for transporting finished goods, impacting the core business of logistics providers like CTI. Monitoring the growth of industries heavily investing in additive manufacturing, such as automotive and consumer electronics, is crucial for anticipating future shifts.

- 3D Printing Market Growth: Global market projected to exceed $30 billion in 2024, indicating significant technological advancement and adoption.

- On-Site Production: Additive manufacturing enables localized production, directly reducing the need for long-haul transportation of certain goods.

- Niche Impact: Already influencing sectors like aerospace and medical devices by enabling on-demand, localized part creation.

- Future Implications: Continued technological progress could lead to a substantial decrease in demand for traditional logistics services for specific product categories.

Direct-to-Consumer (D2C) Models and Local Sourcing

The rise of direct-to-consumer (D2C) models by manufacturers presents a threat to traditional logistics providers like CTI Logistics. As more companies bypass intermediaries and sell directly to end customers, they may also seek to manage their own distribution, potentially reducing their need for third-party logistics (3PL) services, especially for last-mile delivery. For instance, e-commerce growth in Australia, projected to reach over AUD 70 billion by 2025, fuels this D2C trend, as brands invest in their own fulfillment capabilities.

Increased local sourcing also poses a challenge. When businesses source more goods domestically, the need for extensive, long-haul transportation, a core service for many 3PLs, may diminish. This shift can lead clients to explore more localized, agile logistics solutions, potentially impacting CTI's established distribution networks and revenue streams.

- D2C Growth Impact: Manufacturers adopting D2C models may internalize logistics, reducing demand for 3PLs.

- Local Sourcing Shift: Greater reliance on domestic suppliers can decrease the necessity for long-haul freight services.

- E-commerce Influence: Australia's e-commerce market expansion highlights the trend towards direct sales and potentially self-managed logistics.

- Client Preference Change: CTI must adapt to clients potentially favoring specialized, localized logistics solutions over comprehensive 3PL offerings.

Customers developing their own in-house logistics capabilities, like major retailers, represent a significant threat. For instance, Amazon and Walmart invest heavily in their own fleets and distribution networks to gain control and reduce costs, driven by the desire for end-to-end supply chain visibility. This trend means CTI Logistics must demonstrate exceptional value to retain such clients.

Digital logistics platforms, such as Uber Freight, directly connect shippers with carriers, bypassing traditional intermediaries. These platforms offer streamlined and often cheaper services. In 2023, digital freight matching platforms facilitated billions of dollars in freight transactions, showcasing their growing market share and disruptive potential against established players like CTI Logistics.

Innovations like 3D printing are reshaping supply chains by enabling localized production closer to consumers. For example, the global 3D printing market was projected to exceed $30 billion in 2024. This technology can reduce reliance on extensive transportation networks, particularly in sectors like aerospace and medical devices, impacting traditional logistics volumes.

The rise of direct-to-consumer (D2C) models by manufacturers also poses a threat. As companies increasingly bypass intermediaries and manage their own distribution, their need for third-party logistics services may diminish. Australia's e-commerce market, projected to exceed AUD 70 billion by 2025, fuels this D2C trend and the potential for internalized logistics.

| Substitute Threat | Description | Impact on CTI Logistics | Supporting Data/Trend |

|---|---|---|---|

| In-house Logistics | Customers developing their own logistics capabilities. | Reduces demand for 3PL services, especially for large volume clients. | Major retailers like Amazon and Walmart invest in their own fleets. |

| Digital Freight Platforms | Online platforms connecting shippers directly with carriers. | Offers streamlined, potentially cheaper alternatives, disrupting traditional models. | Billions in transactions facilitated by platforms in 2023. |

| 3D Printing (Additive Manufacturing) | Enables localized production, reducing the need for long-haul transport. | Diminishes demand for transporting finished goods in specific niches. | Global market projected to exceed $30 billion in 2024. |

| Direct-to-Consumer (D2C) Models | Manufacturers selling directly to end customers and managing their own distribution. | Decreases reliance on third-party logistics providers for fulfillment. | Australian e-commerce market projected to exceed AUD 70 billion by 2025. |

Entrants Threaten

The logistics sector requires significant upfront capital for essential assets like a fleet of trucks, trailers, warehousing facilities, and sophisticated information technology systems. This substantial initial financial outlay creates a formidable barrier, deterring many prospective newcomers from entering the market.

CTI Logistics, having already made considerable investments in its asset base and continuously upgrading its infrastructure, is well-positioned to leverage this high capital requirement as a protective advantage against potential new competitors. For instance, in 2023, CTI Logistics reported capital expenditure of $25.8 million, primarily directed towards fleet expansion and technology upgrades, underscoring the ongoing investment needed to maintain a competitive edge.

Established players like CTI Logistics leverage significant economies of scale, which translate into lower per-unit costs for purchasing, warehousing, and transportation. For instance, in 2024, major logistics providers often operate fleets of thousands of vehicles, allowing them to negotiate bulk discounts on fuel and maintenance that smaller competitors cannot access. This cost advantage makes it challenging for new entrants to compete on price without achieving comparable operational volumes.

Network effects further solidify CTI Logistics' competitive position. A larger, more established network of depots and delivery routes means greater efficiency and faster service for customers, attracting more business and reinforcing the network's value. In 2024, the efficiency gains from optimized routing software and integrated tracking systems are substantial, and building a comparable network from scratch requires immense capital investment and time, creating a formidable barrier to entry.

The logistics and transport industry faces substantial regulatory burdens. These include stringent safety protocols, environmental standards, licensing requirements, and labor laws, all of which demand significant investment and ongoing attention from any player. For instance, in 2024, the implementation of stricter emissions standards for heavy-duty vehicles across many regions added to the compliance costs for all operators, including CTI Logistics.

Navigating this intricate web of regulations and bearing the associated compliance costs acts as a powerful barrier to entry. New companies must dedicate considerable resources to understanding and adhering to these rules, which can be a daunting prospect. CTI Logistics, having operated for years, has developed robust internal processes and expertise to manage these regulatory demands efficiently, giving it a competitive edge.

Brand Reputation and Customer Relationships

In the logistics sector, particularly for comprehensive supply chain solutions, a strong brand reputation and deep-seated customer relationships are paramount. Reliability and trust are not just desirable; they are the bedrock upon which long-term contracts are built and maintained. CTI Logistics, leveraging its extensive operational history and a broad spectrum of services, has cultivated a brand image that presents a significant hurdle for any new competitor aiming to establish a similar level of client confidence. This trust is earned through years of consistent, high-quality service delivery, a factor that cannot be rapidly manufactured by emerging players.

The challenge for new entrants lies in overcoming the established loyalty and ingrained trust that incumbent firms like CTI Logistics enjoy. For instance, in 2024, the logistics industry continued to see a premium placed on proven track records, with many large corporations prioritizing long-term partnerships with providers demonstrating consistent performance and risk mitigation. Building this level of credibility and securing major accounts typically requires substantial time and a demonstrably flawless operational history, making it a formidable barrier to entry.

- Brand Loyalty: Established logistics providers often benefit from long-standing relationships, making it difficult for new entrants to poach key clients.

- Reputational Capital: A history of reliability and service excellence, as demonstrated by CTI Logistics, builds significant reputational capital that deters new competition.

- Customer Inertia: The cost and effort involved in switching logistics providers can be substantial, creating inertia that favors established players.

- Trust Factor: In an industry where supply chain disruptions can be costly, trust in a provider's ability to deliver consistently is a critical differentiator.

Access to Distribution Channels and Skilled Labor

New companies entering the logistics sector often struggle to build an effective distribution network. Securing access to essential routes, strategic hubs, and warehousing facilities presents a significant hurdle, especially when established players already control these critical assets.

The competition for skilled labor is intense. Attracting and retaining experienced drivers, warehouse staff, and logistics planners is a major challenge, driving up recruitment and training costs for new entrants. For instance, in 2024, the average annual wage for a truck driver in the US was around $60,000, with specialized roles commanding even higher salaries.

- Distribution Network: New entrants must invest heavily to replicate the extensive networks of incumbents.

- Skilled Labor: High demand for experienced logistics professionals increases recruitment costs.

- Route Access: Established players often have exclusive or preferential access to key transportation routes.

- Training Costs: Significant investment is required to train new staff to meet industry standards.

The threat of new entrants for CTI Logistics is moderate, primarily due to the substantial capital requirements and established infrastructure of existing players. Building a comparable fleet, warehousing, and IT systems demands significant upfront investment, a barrier that newcomers often find difficult to overcome.

Economies of scale and network effects enjoyed by incumbents like CTI Logistics further solidify their competitive advantage. For example, in 2024, major logistics firms leverage vast networks of depots and optimized routing, enabling cost efficiencies that are challenging for new entrants to match without considerable investment and time.

| Barrier to Entry | Impact on New Entrants | CTI Logistics' Advantage |

| Capital Investment | High upfront costs for fleet, facilities, IT | Established asset base and ongoing upgrades |

| Economies of Scale | Difficulty competing on price without volume | Bulk purchasing discounts on fuel, maintenance |

| Network Effects | Time and cost to build comparable reach and efficiency | Extensive, efficient network of depots and routes |

| Regulatory Compliance | Significant investment in safety, environmental, labor laws | Developed expertise and efficient internal processes |

| Brand Loyalty & Trust | Challenge in building credibility and securing clients | Long-standing relationships and proven track record |

Porter's Five Forces Analysis Data Sources

Our CTI Logistics Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. These include publicly available company financial reports, industry-specific market research from reputable firms like IBISWorld, and regulatory filings that offer insights into industry structure and compliance.

We also incorporate data from macroeconomic indicators and global trade association reports to understand broader economic influences and competitive pressures. This comprehensive approach ensures a robust and well-informed assessment of the competitive landscape.