CTI Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

Navigate the complex external forces impacting CTI Logistics with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are shaping the logistics landscape. This in-depth report provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

Government policies significantly shape CTI Logistics' operating environment. For instance, Australia's commitment to infrastructure development, such as the AUD 110 billion National Reconstruction Fund announced in 2022, aims to boost domestic manufacturing and supply chains, potentially creating new opportunities for logistics providers like CTI. Conversely, changes in road transport regulations, like increased emissions standards or driver hour limits, could raise operational costs.

Trade agreements and tariffs also play a crucial role. Australia's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can streamline cross-border trade, benefiting CTI's freight forwarding services. However, any imposition of new import/export tariffs or trade disputes could negatively impact freight volumes and profitability by increasing the cost of moving goods.

Global geopolitical tensions and evolving trade agreements directly impact CTI Logistics' operations. For instance, ongoing trade disputes between major economies can lead to increased tariffs and altered shipping patterns, affecting demand for international freight. The International Monetary Fund (IMF) projected in April 2024 that global growth would remain subdued, partly due to these geopolitical uncertainties, highlighting the challenging environment for logistics providers.

Government initiatives like fuel subsidies or tax breaks for green logistics investments can significantly impact operational costs and competitiveness. For instance, in 2024, many nations continued to explore incentives for adopting electric vehicles in freight transport, potentially lowering CTI Logistics' fuel and maintenance expenses.

Furthermore, specific incentives for technology adoption, such as those promoting digital tracking systems or automated warehousing, can enhance efficiency and service quality. These programs are designed to modernize the logistics sector, offering a competitive edge to companies like CTI Logistics that can leverage them effectively.

Political Stability and Corruption Levels

CTI Logistics' operations are significantly influenced by the political stability of the countries it serves. For instance, in Australia, where CTI has a substantial presence, the country consistently ranks high on global stability indices, fostering a predictable business environment. In contrast, some Asian markets may present greater volatility, impacting transit times and security.

Corruption remains a critical concern. Transparency International's 2023 Corruption Perception Index (CPI) ranked Australia at 18 out of 180 countries with a score of 77, indicating relatively low corruption. However, in other regions where CTI might operate or source services, higher corruption levels, as suggested by CPI scores below 50, can inflate operational costs through bribes or illicit payments. This directly affects CTI's ability to provide reliable and cost-effective logistics solutions.

- Political Stability: Australia's stable political climate supports CTI's operational predictability and security.

- Corruption Impact: High corruption in certain operating regions can increase costs and cause delays for CTI Logistics.

- Transparency International 2023 CPI: Australia's score of 77 highlights a low corruption environment, a positive factor for CTI.

- Operational Inefficiencies: Corruption can lead to increased costs and reduced reliability in CTI's supply chain services.

Lobbying and Industry Influence

The logistics sector, including companies like CTI Logistics, is significantly impacted by lobbying efforts. Industry associations actively engage with policymakers to shape regulations concerning labor, such as minimum wage laws and working conditions, and environmental standards, like emissions targets for transport fleets. For instance, in Australia, the Australian Trucking Association (ATA) regularly advocates for policy changes that affect trucking operators. In 2024, the ATA continued its focus on issues such as fuel tax reform and driver shortages, aiming to influence government decisions that directly bear on operational costs and efficiency for logistics firms.

CTI Logistics must remain attuned to these industry influences to proactively adapt to evolving regulatory landscapes. The ability of major logistics players and their representative bodies to sway policy can create a more favorable or challenging operating environment. Understanding these dynamics is crucial for strategic planning and risk management, ensuring the company can navigate potential shifts in compliance requirements or market access driven by successful lobbying campaigns.

- Industry Associations Advocate for Favorable Policies: Groups like the ATA actively lobby governments on issues impacting logistics, such as fuel costs and driver regulations.

- Impact on Operating Costs: Policy decisions influenced by lobbying can directly affect CTI Logistics' expenses related to labor, fuel, and compliance.

- Navigating Regulatory Change: Awareness of lobbying activities allows CTI Logistics to anticipate and prepare for upcoming regulatory shifts.

Government policies and trade agreements significantly influence CTI Logistics' operations. For example, Australia's AUD 110 billion National Reconstruction Fund, announced in 2022, aims to bolster domestic supply chains, potentially creating new opportunities. Conversely, stricter emissions standards for road transport could increase operational costs.

Geopolitical tensions and trade disputes impact freight volumes and profitability. The IMF's April 2024 projection of subdued global growth, partly due to these uncertainties, highlights a challenging environment for logistics providers like CTI.

Political stability and corruption levels are critical. Australia's high ranking on global stability indices and low corruption (Transparency International 2023 CPI score of 77) provide a predictable environment, unlike potentially more volatile Asian markets.

Industry lobbying, such as that by the Australian Trucking Association (ATA) on issues like fuel tax reform and driver shortages in 2024, can shape regulations impacting operational costs and efficiency for CTI Logistics.

What is included in the product

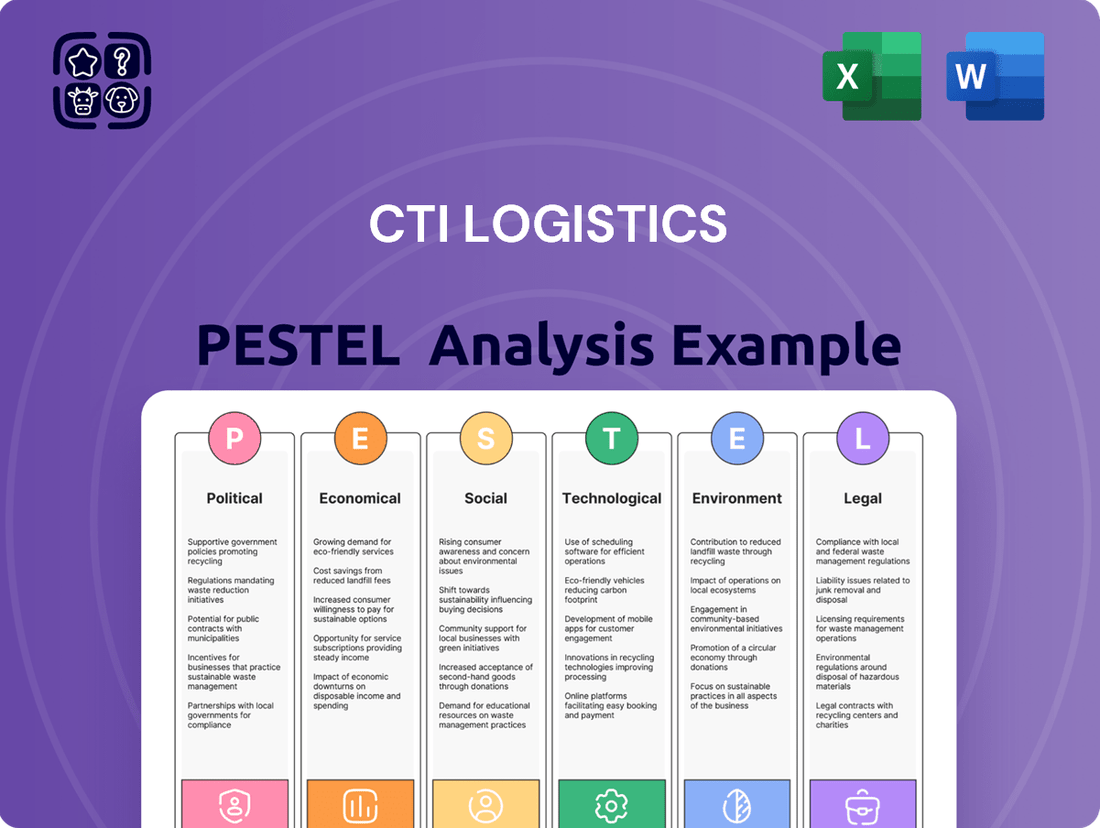

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CTI Logistics, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within the logistics industry.

A concise, actionable summary of CTI Logistics' PESTLE analysis, highlighting key external factors to proactively address challenges and capitalize on opportunities.

Economic factors

Overall economic growth significantly influences the demand for logistics services. As economies expand, businesses ramp up production, and consumers increase their spending, directly boosting freight volumes and the need for warehousing and distribution, which benefits companies like CTI Logistics.

For instance, Australia's Gross Domestic Product (GDP) growth was projected to be around 1.5% in 2024, a moderate but positive expansion. This suggests a steady, albeit not explosive, demand for logistics services, supporting CTI Logistics' core business operations.

Consumer spending in Australia also plays a crucial role. In the first quarter of 2024, Australian retail sales saw a modest increase, indicating continued consumer confidence and a healthy appetite for goods that require transportation and delivery.

Fuel is a massive operating expense for CTI Logistics, a transport company. Fluctuations in global oil prices directly impact their profitability. For instance, Brent crude oil prices averaged around $82 per barrel in early 2024, a significant factor for companies like CTI.

Managing energy costs is vital for CTI Logistics' financial health. This involves strategies like optimizing delivery routes, investing in more fuel-efficient vehicles, and potentially using hedging techniques to lock in fuel prices. These measures help stabilize their bottom line against volatile energy markets.

Rising interest rates, such as the Bank of England's base rate holding at 5.25% as of early 2024, directly impact CTI Logistics by increasing the cost of financing new vehicles or technology upgrades. This makes capital-intensive expansion more expensive.

Inflationary pressures, with UK CPI at 3.4% in February 2024, raise CTI Logistics' operational costs. Expenses for fuel, vehicle parts, and wages are likely to climb, potentially squeezing profit margins if these costs cannot be passed on to customers.

Labor Costs and Availability

The cost and availability of skilled labor, especially for drivers, warehouse personnel, and logistics specialists, are paramount economic considerations for CTI Logistics. Rising wage expectations, persistent labor shortages, or shifts in employment regulations can directly affect the company's ability to operate efficiently and maintain profitability.

For instance, in Australia, the average weekly wage for truck drivers saw an increase, reflecting broader inflationary pressures and demand for these essential roles. Data from industry bodies in early 2024 indicated ongoing challenges in recruiting qualified drivers, leading to higher recruitment costs and potential delays in service delivery. This directly impacts operational capacity.

- Wage Pressures: Ongoing inflation in Australia has contributed to increased wage demands across the logistics sector, impacting CTI's labor expenditure.

- Labor Shortages: Persistent shortages of skilled drivers and warehouse staff, a trend observed throughout 2024, necessitate higher recruitment costs and can limit operational expansion.

- Employment Law Changes: Potential future changes to employment laws, such as those affecting gig economy workers or minimum wage stipulations, could introduce new cost structures for CTI.

- Skill Gaps: The availability of specialized logistics professionals, such as those with expertise in supply chain technology, remains a critical factor influencing CTI's ability to innovate and adapt.

Exchange Rates and Global Trade Volume

Fluctuations in exchange rates directly affect CTI Logistics' profitability and pricing for international freight forwarding. For instance, a stronger Australian Dollar (AUD) in 2024 could make Australian exports more expensive, potentially dampening demand for inbound shipping services, while a weaker AUD might boost export volumes but increase the cost of overseas operational expenses.

The overall volume of global trade is a critical driver for CTI Logistics. Projections for 2024 and 2025 suggest a moderate recovery in global trade growth after a period of slowdown. For example, the World Trade Organization (WTO) forecast a 3.3% increase in global merchandise trade volume for 2024, a slight improvement from the 0.9% in 2023.

- Exchange Rate Impact: A strengthening AUD can increase the cost of CTI Logistics' international operations and potentially reduce the price competitiveness of its services in foreign markets.

- Trade Volume Sensitivity: CTI Logistics' demand for freight forwarding and logistics services is directly correlated with global trade volumes.

- 2024/2025 Outlook: The WTO's forecast of 3.3% global merchandise trade volume growth for 2024 indicates a positive, albeit modest, environment for international logistics providers like CTI.

- Currency Volatility: Ongoing currency volatility, particularly between major trading partners, necessitates robust hedging strategies and flexible pricing models for CTI Logistics.

Economic conditions like GDP growth and consumer spending directly impact logistics demand. Australia's projected 1.5% GDP growth for 2024 and modest retail sales increases in early 2024 signal a steady, positive environment for CTI Logistics.

Fuel costs remain a significant expense for CTI, with Brent crude averaging around $82 per barrel in early 2024, directly influencing profitability and requiring efficient cost management strategies.

Rising interest rates, like the UK's 5.25% base rate in early 2024, increase financing costs for fleet upgrades, while inflation, evidenced by the UK's 3.4% CPI in February 2024, drives up operational expenses like wages and parts.

Labor availability and wages are critical; Australia's trucking sector saw wage increases and driver shortages in early 2024, impacting CTI's operational capacity and recruitment costs.

Exchange rate fluctuations, particularly for the AUD, affect CTI's international operations and pricing, while global trade growth, forecast at 3.3% for merchandise volume in 2024 by the WTO, offers a moderate positive outlook for freight services.

| Economic Factor | 2024 Data/Projection | Impact on CTI Logistics |

|---|---|---|

| Australian GDP Growth | ~1.5% | Steady demand for logistics services. |

| Australian Retail Sales (Q1 2024) | Modest Increase | Supports freight volume for consumer goods. |

| Brent Crude Oil Price (Early 2024) | ~$82/barrel | Directly impacts operating costs and profitability. |

| UK Base Interest Rate (Early 2024) | 5.25% | Increases cost of capital for expansion. |

| UK CPI Inflation (Feb 2024) | 3.4% | Raises operational costs (fuel, wages, parts). |

| Australian Truck Driver Wages | Increased | Higher labor expenditure, potential recruitment challenges. |

| Global Merchandise Trade Volume Growth (2024) | 3.3% (WTO Forecast) | Positive outlook for international freight forwarding. |

Preview the Actual Deliverable

CTI Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CTI Logistics PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping CTI Logistics' strategic landscape.

Sociological factors

The relentless growth of e-commerce, projected to reach over $8.1 trillion globally by 2024, directly fuels consumer demand for speed and flexibility in deliveries. This surge means CTI Logistics must constantly refine its last-mile operations to keep pace with expectations for same-day or next-day delivery, a trend amplified by major online retailers.

Consumers now expect real-time tracking and transparent communication throughout the delivery process, a shift driven by the digital native generation. CTI Logistics' ability to provide these features will be crucial for customer retention and competitive advantage in the evolving logistics landscape of 2024-2025.

Aging populations in key operating regions, such as Australia, are contributing to a shrinking pool of experienced workers. This demographic shift, coupled with a persistent shortage of skilled drivers and logistics professionals, creates significant recruitment and retention hurdles for CTI Logistics. For instance, the Australian Trucking Association reported a shortage of approximately 40,000 drivers in 2023, a figure expected to grow.

To counter these challenges, CTI Logistics must proactively adapt by investing in robust training programs to upskill existing staff and attract new talent. Offering competitive compensation packages and demonstrably improving working conditions, including better work-life balance and safety protocols, will be crucial for retaining valuable employees in this tight labor market.

Societal expectations for robust health and safety are escalating, directly influencing CTI Logistics' operational frameworks and compliance burdens. This heightened focus necessitates rigorous training and adherence to stringent protocols for all personnel, impacting everything from vehicle maintenance to warehouse management.

Maintaining exemplary safety standards is not merely a regulatory requirement but a crucial element for CTI Logistics to safeguard its workforce and uphold its reputation. For instance, in 2024, the Australian logistics sector, where CTI operates, saw a continued emphasis on reducing workplace incidents, with industry bodies advocating for a 5% year-on-year reduction in serious injury frequency rates.

Corporate Social Responsibility and Ethics

Public scrutiny of corporate behavior is intensifying, with a growing demand for ethical operations across all business facets, including logistics partners. CTI Logistics is therefore under pressure to showcase its commitment to social responsibility through fair treatment of its workforce, environmentally conscious operations, and active participation in community initiatives.

This societal expectation translates into tangible business considerations. For instance, in 2024, a significant percentage of consumers, estimated around 70%, indicated they would switch brands if they discovered unethical practices. This highlights the direct financial impact of ethical lapses.

- Fair Labor Practices: Ensuring equitable wages and safe working conditions for all employees and contractors is paramount.

- Sustainable Operations: Implementing eco-friendly logistics, such as optimizing routes and exploring alternative fuel sources, reduces environmental impact.

- Community Engagement: Supporting local communities through various programs or charitable contributions demonstrates corporate citizenship.

- Supply Chain Transparency: Verifying ethical standards among all partners, from warehousing to last-mile delivery, is increasingly expected by stakeholders.

Urbanization and Traffic Congestion

The ongoing shift of populations into urban centers significantly exacerbates traffic congestion, directly impacting the efficiency of CTI Logistics' urban delivery operations. By 2025, it's projected that 68% of the world's population will live in cities, a trend that intensifies the challenge of making timely deliveries.

CTI Logistics needs to proactively implement sophisticated urban logistics strategies. This includes leveraging advanced routing algorithms and establishing strategically located consolidation centers to streamline last-mile deliveries amidst growing urban density.

- Urban populations are expected to reach 68% globally by 2025, increasing delivery complexities.

- Traffic congestion in major cities can add 30-50% to delivery times during peak hours.

- Innovative solutions like micro-depots and electric vehicle fleets are becoming crucial for efficient urban logistics.

Societal attitudes towards work-life balance are evolving, influencing CTI Logistics' ability to attract and retain talent, particularly drivers. Companies offering flexible scheduling and better work-life integration are becoming more attractive in the 2024-2025 job market.

The increasing demand for convenience and speed in deliveries, driven by e-commerce growth, places direct pressure on CTI Logistics to optimize its operations. Meeting consumer expectations for rapid fulfillment requires continuous investment in technology and efficient supply chain management.

Heightened public awareness of environmental sustainability is pushing logistics companies like CTI to adopt greener practices. This includes exploring electric vehicles and optimizing delivery routes to reduce carbon footprints, a trend that gained significant traction throughout 2024.

Ethical consumerism is on the rise, with a growing number of customers prioritizing businesses with strong corporate social responsibility. CTI Logistics must demonstrate fair labor practices and transparent operations to maintain brand loyalty and a positive public image.

| Sociological Factor | Impact on CTI Logistics | 2024-2025 Data/Trend |

|---|---|---|

| E-commerce Growth & Delivery Expectations | Increased demand for speed, flexibility, and real-time tracking. | Global e-commerce sales projected to exceed $8.1 trillion by 2024. |

| Demographic Shifts (Aging Population) | Shrinking labor pool, driver shortages. | Australian Trucking Association reported ~40,000 driver shortage in 2023. |

| Health & Safety Standards | Need for rigorous training and adherence to safety protocols. | Australian logistics sector focused on reducing serious injury frequency rates in 2024. |

| Ethical Consumerism | Pressure for fair labor, environmental consciousness, and community engagement. | ~70% of consumers may switch brands due to unethical practices (2024 estimate). |

| Urbanization | Increased traffic congestion impacting delivery times. | 68% of global population projected to live in cities by 2025. |

Technological factors

The increasing integration of automation and robotics in warehousing is a significant technological factor impacting logistics. These advancements promise to boost efficiency, enhance accuracy, and accelerate the speed of goods handling, directly affecting operational costs and service delivery times.

CTI Logistics can capitalize on these trends by implementing robotic solutions in its distribution centers. For instance, automated guided vehicles (AGVs) and robotic picking systems can streamline order fulfillment, reducing errors and the need for manual labor in repetitive tasks. The global warehouse automation market was valued at approximately $4.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating substantial growth and investment in this area.

Telematics and IoT integration is revolutionizing fleet management for companies like CTI Logistics. These technologies enable real-time vehicle tracking, allowing for precise monitoring of location and performance. This capability is crucial for optimizing delivery routes and ensuring timely service, which directly impacts customer satisfaction and operational efficiency.

Furthermore, telematics and IoT devices provide invaluable data on fuel consumption, driver behavior, and vehicle diagnostics. CTI Logistics can leverage this information to implement strategies that reduce fuel costs, a significant operating expense. For instance, by identifying inefficient driving patterns or potential mechanical issues early through predictive maintenance alerts, the company can avoid costly breakdowns and extend the lifespan of its fleet.

The adoption of these technologies is becoming a standard for competitive logistics operations. In 2024, the global fleet management market, heavily influenced by telematics and IoT, was valued at approximately $35 billion and is projected to grow significantly. This growth underscores the increasing reliance on data-driven insights to enhance safety, improve asset utilization, and ultimately boost profitability within the logistics sector.

Advanced data analytics and AI are transforming logistics by enabling sophisticated supply chain planning, more accurate demand forecasting, and optimized routing. CTI Logistics can leverage these powerful tools to unlock valuable insights from their extensive operational data, driving better-informed strategic decisions and enhancing overall service quality.

For instance, in 2024, companies that effectively integrated AI into their logistics operations reported an average reduction of 15% in fuel costs through improved route planning, and a 10% increase in delivery accuracy. By analyzing real-time traffic, weather, and delivery schedules, CTI Logistics can anticipate disruptions and proactively adjust its operations, leading to significant efficiency gains and improved customer satisfaction.

Digital Platforms and Cloud Computing

Digital platforms are revolutionizing freight operations. CTI Logistics can leverage these for streamlined booking, real-time tracking, and enhanced customer communication. For instance, many logistics providers saw a significant uptick in digital freight matching platforms in 2023, with some reporting a 20% increase in platform-based bookings.

Cloud computing is also a game-changer, enabling robust, scalable supply chain management systems. This fosters greater connectivity and transparency across the entire logistics network. By 2025, it's projected that over 70% of logistics companies will be utilizing cloud-based solutions for their core operations, up from approximately 45% in 2023.

Seamless digital integration through these platforms allows CTI Logistics to foster improved collaboration with both clients and partners. This digital-first approach can lead to faster decision-making and more agile responses to market demands.

- Digital Freight Platforms: Increased adoption by ~20% in 2023 for freight booking and tracking.

- Cloud Computing Adoption: Expected to reach over 70% of logistics firms by 2025.

- Enhanced Connectivity: Cloud systems improve visibility and communication across the supply chain.

- Collaboration Boost: Digital integration strengthens partnerships with clients and stakeholders.

Alternative Fuel Vehicles and Electrification

Developments in alternative fuel technologies, especially electric and hydrogen-powered vehicles, present a significant opportunity for CTI Logistics to lower its environmental impact and potentially reduce long-term operating expenses. The global electric vehicle market, for instance, was projected to reach over $800 billion by 2025, indicating substantial growth and infrastructure development.

By exploring these advancements, CTI Logistics can strategically modernize its fleet. This move not only aligns with increasing global sustainability mandates but also positions the company favorably for future regulatory changes and consumer preferences. For example, many countries are setting targets for phasing out internal combustion engine vehicles, making the transition to EVs a strategic imperative.

- Fleet Modernization: Investing in electric or hydrogen vehicles can reduce CTI Logistics' carbon footprint.

- Operating Cost Reduction: Lower fuel and maintenance costs associated with EVs can improve profitability.

- Sustainability Alignment: Adopting alternative fuels supports corporate social responsibility and environmental goals.

- Market Competitiveness: A greener fleet can enhance brand image and attract environmentally conscious clients.

Technological advancements are rapidly reshaping the logistics landscape, offering CTI Logistics opportunities for enhanced efficiency and cost savings. The increasing adoption of automation, telematics, AI, and digital platforms are key drivers of this transformation. Investing in these areas is crucial for maintaining a competitive edge.

| Technology Area | 2023/2024 Data Point | Projected Impact/Growth | CTI Logistics Opportunity |

|---|---|---|---|

| Warehouse Automation | Global market ~$4.5B (2023) | Projected to exceed $10B by 2028 | Streamline operations, reduce errors |

| Telematics & IoT | Global fleet management market ~$35B (2024) | Significant growth driven by data utilization | Optimize routes, reduce fuel costs, predictive maintenance |

| AI & Data Analytics | AI integration can reduce fuel costs by ~15% | Enhance demand forecasting, route optimization | Improve strategic planning, service quality |

| Digital Freight Platforms | ~20% increase in platform bookings (2023) | Facilitate seamless booking and communication | Streamline freight operations, enhance client collaboration |

| Cloud Computing | ~45% adoption in logistics (2023) | Projected 70%+ adoption by 2025 | Improve supply chain visibility and scalability |

| Alternative Fuels (EVs) | Global EV market projected >$800B by 2025 | Support sustainability mandates, reduce operating expenses | Modernize fleet, enhance brand image |

Legal factors

CTI Logistics navigates a dense regulatory landscape, encompassing national and international transport laws. This includes stringent licensing requirements, adherence to vehicle weight limits, and strict protocols for handling hazardous materials, all crucial for maintaining operational legality and avoiding costly penalties. For instance, in 2024, the Australian trucking industry faced ongoing discussions regarding the review of the Heavy Vehicle National Law, aiming to improve safety and efficiency, which directly impacts CTI's operational framework.

Labor laws, including minimum wage, overtime, and workplace safety standards, directly influence CTI Logistics' operational expenses and human resource strategies. For instance, in Australia, where CTI operates significantly, the Fair Work Act 2009 sets national employment standards. Changes in these regulations, such as potential increases to the national minimum wage, could impact CTI's labor costs for its drivers and warehouse staff in 2024 and 2025.

Occupational health and safety (OHS) regulations are paramount for a logistics company like CTI, affecting everything from vehicle maintenance to warehouse safety protocols. Compliance ensures a safe working environment and avoids costly penalties and disruptions. In 2023, the Australian transport and logistics industry reported a significant number of workplace injuries, underscoring the critical need for CTI to maintain robust OHS practices.

Unionization rights and collective bargaining agreements can shape CTI Logistics' employee relations and wage structures. The ability of CTI's workforce to organize and negotiate terms can lead to increased labor costs but also potentially higher employee retention and productivity. Monitoring union activity and labor relations trends in key operating regions will be important for CTI's financial planning through 2025.

Environmental Protection Laws are increasingly shaping the logistics landscape, directly impacting CTI Logistics. Stricter regulations on vehicle emissions, for instance, are becoming the norm. In 2024, many regions are implementing or tightening Euro 7 emission standards for new vehicles, pushing companies like CTI Logistics to invest in more fuel-efficient fleets or alternative fuels.

Compliance with these evolving environmental mandates necessitates significant capital expenditure. CTI Logistics may need to allocate funds towards upgrading its fleet with vehicles meeting lower emission thresholds, adopting electric or hydrogen-powered trucks, and improving waste management practices across its depots. These investments are crucial for avoiding penalties and maintaining operational licenses.

Contract Law and Liability

CTI Logistics navigates a complex web of contracts with clients, suppliers, and subcontractors, all subject to commercial and contract law. The company’s ability to effectively manage these contractual obligations, understand potential liabilities, and maintain appropriate insurance coverage is paramount. This careful management is key to safeguarding against significant financial losses and protecting its reputation.

The Australian contract law landscape, particularly concerning commercial agreements, demands rigorous attention to detail. For CTI Logistics, this means ensuring all agreements are clearly defined, specifying terms of service, payment schedules, and dispute resolution mechanisms. Failure to adhere to these legal stipulations can result in costly litigation and operational disruptions.

- Contractual Compliance: CTI Logistics must ensure all agreements with clients, suppliers, and subcontractors comply with Australian Contract Law.

- Liability Mitigation: Proper contract management is crucial for limiting CTI Logistics' exposure to financial and legal liabilities.

- Insurance Requirements: Maintaining adequate insurance, as stipulated in contracts, is essential for covering potential damages or breaches.

- Dispute Resolution: Clear dispute resolution clauses within contracts help CTI Logistics manage and resolve disagreements efficiently.

Data Privacy and Cybersecurity Laws

The increasing digitalization of CTI Logistics' operations, from tracking shipments to managing customer information, brings data privacy and cybersecurity laws to the forefront. Regulations like the General Data Protection Regulation (GDPR) and similar local frameworks mandate strict data handling protocols, requiring CTI Logistics to ensure the secure processing and storage of sensitive client and operational data. Failure to comply can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher.

Cybersecurity laws are equally critical, as CTI Logistics' digital infrastructure is a prime target for cyber threats. Protecting against data breaches, ransomware attacks, and other malicious activities is paramount to maintaining operational continuity and client trust. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial and reputational risks associated with inadequate cybersecurity measures.

- Data Protection Compliance: CTI Logistics must adhere to evolving data privacy laws, such as GDPR, to safeguard customer and operational data.

- Cybersecurity Investment: Significant investment in robust cybersecurity defenses is necessary to protect against increasing digital threats.

- Reputational Risk: Data breaches can severely damage CTI Logistics' reputation and client confidence, impacting future business.

- Regulatory Fines: Non-compliance with data privacy and cybersecurity regulations can lead to substantial financial penalties.

CTI Logistics must stay abreast of evolving trade regulations and customs laws, which directly impact the efficiency and cost of international shipments. Compliance with import/export documentation, tariffs, and trade agreements is vital for seamless cross-border operations. For instance, ongoing global trade policy shifts in 2024 and 2025 could introduce new compliance burdens or opportunities for CTI.

Anti-corruption laws and regulations, such as the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, are critical for CTI Logistics' international business dealings. Ensuring ethical practices and transparent transactions is paramount to avoid severe legal repercussions and reputational damage. Maintaining robust internal controls and training programs is essential for compliance.

Legal compliance in the logistics sector also extends to intellectual property rights, particularly concerning software used for tracking and management systems. Protecting proprietary technology and respecting the IP of others is crucial. CTI Logistics needs to ensure its operational software is legally sound and that it doesn't infringe on existing patents or copyrights.

Environmental factors

The logistics sector, including companies like CTI Logistics, is under intense scrutiny for its substantial contribution to global carbon emissions. This pressure is mounting from governments implementing stricter environmental regulations, corporate clients demanding sustainable supply chains, and an increasingly environmentally conscious public. For instance, the International Energy Agency reported that transportation accounted for approximately 25% of global CO2 emissions in 2023, a significant portion of which is attributable to freight movement.

CTI Logistics must navigate these environmental headwinds by actively pursuing strategies to decarbonize its operations. This includes investing in more fuel-efficient vehicles, modernizing its fleet with lower-emission technologies, and integrating sustainable practices across its warehousing and transportation networks. The company is likely facing expectations to report on its carbon footprint and demonstrate tangible progress in reducing it, aligning with broader industry trends towards net-zero targets by 2050.

CTI Logistics faces significant environmental considerations regarding waste management and recycling. Operational waste generated from warehousing activities, packaging materials used in logistics, and byproducts from vehicle maintenance necessitate careful handling and compliance with evolving recycling regulations. For instance, in 2024, the Australian government continued to emphasize circular economy principles, impacting how companies like CTI manage their waste streams.

To mitigate its environmental footprint, CTI Logistics is compelled to implement and enhance robust waste reduction and recycling programs. This includes optimizing packaging to reduce material usage and exploring more sustainable disposal or recycling avenues for operational byproducts. The company's commitment to these practices directly influences its operational costs and its public environmental image.

Noise pollution from CTI Logistics' transport operations, especially in densely populated urban areas, is increasingly scrutinized by local authorities and residents. For instance, in 2024, several Australian cities, including Sydney and Melbourne where CTI operates, have seen an uptick in noise complaints related to freight movement, leading to stricter enforcement of existing bylaws.

CTI Logistics must proactively implement noise reduction strategies for its fleet and operational hubs to comply with these evolving regulations. This includes investing in quieter vehicle technologies and optimizing delivery schedules to minimize disruption during sensitive hours, such as late-night or early-morning operations, which are critical for efficient logistics but often coincide with peak community sensitivity to noise.

Resource Depletion and Sustainable Sourcing

The increasing demand for fossil fuels and raw materials essential for vehicle manufacturing presents a significant challenge regarding sustainability for companies like CTI Logistics. This trend directly impacts operational costs and the long-term availability of critical components.

CTI Logistics can proactively address resource depletion by focusing on initiatives that enhance fuel efficiency and consider the broader environmental footprint of its fleet and operational equipment. For instance, in 2024, the global logistics industry faced continued pressure to reduce its carbon emissions, with many companies setting ambitious targets. The International Energy Agency reported that transportation accounts for approximately one-quarter of global energy-related carbon dioxide emissions, underscoring the urgency for efficiency gains.

- Fuel Efficiency: Implementing advanced telematics and driver training programs to optimize fuel consumption across the fleet.

- Fleet Modernization: Investing in newer, more fuel-efficient vehicles, including exploring alternative fuel options and electric vehicles where feasible.

- Lifecycle Assessment: Evaluating the environmental impact of vehicles and equipment from acquisition to disposal, promoting responsible sourcing and recycling.

- Supply Chain Collaboration: Working with suppliers to promote sustainable sourcing of materials used in fleet maintenance and operations.

Impact of Extreme Weather Events

Climate change is intensifying, leading to a documented increase in the frequency and severity of extreme weather events. This poses a significant risk to CTI Logistics by potentially disrupting crucial transport routes, causing costly delays, and damaging vital infrastructure. For instance, the Australian Bureau of Meteorology reported that 2023 was the warmest year on record for the country, with widespread heatwaves and bushfire risks impacting operations.

To counter these environmental challenges, CTI Logistics must proactively develop and implement resilient supply chain strategies. This includes creating robust contingency plans to mitigate the impact of weather-related disruptions. Such strategies could involve diversifying transport modes, securing alternative warehousing, and investing in weather-resilient infrastructure. The company’s ability to adapt will be critical for maintaining operational continuity and service reliability in an increasingly unpredictable climate.

- Increased frequency of extreme weather events globally, impacting supply chain reliability.

- Potential for significant financial losses due to transport delays and infrastructure damage.

- Necessity for CTI Logistics to invest in climate-resilient infrastructure and operational flexibility.

- Growing importance of robust contingency planning to ensure business continuity.

Environmental factors are increasingly shaping the logistics landscape, with a strong focus on reducing carbon emissions. CTI Logistics, like its peers, faces pressure from regulators and clients to adopt greener practices, such as investing in fuel-efficient fleets and optimizing routes to minimize environmental impact. The transportation sector's significant contribution to global emissions, estimated around 25% by the International Energy Agency in 2023, underscores the urgency for such changes.

Waste management and noise pollution are also critical environmental considerations. Stricter regulations around recycling and waste disposal, as seen with Australia's emphasis on circular economy principles in 2024, require companies like CTI Logistics to implement robust waste reduction programs. Similarly, noise complaints in urban areas are leading to tighter enforcement of bylaws, prompting investments in quieter vehicle technologies and optimized delivery schedules.

The company must also contend with resource depletion, particularly concerning fossil fuels and raw materials for vehicle manufacturing, which impacts operational costs and long-term availability. Proactive measures like enhancing fuel efficiency and exploring alternative fuels are essential. Furthermore, the escalating frequency of extreme weather events, with 2023 being Australia's warmest year on record according to the Bureau of Meteorology, necessitates investment in climate-resilient infrastructure and robust contingency planning to ensure business continuity.

| Environmental Factor | Impact on CTI Logistics | Mitigation Strategies | Relevant Data/Context |

|---|---|---|---|

| Carbon Emissions | Regulatory penalties, reputational damage, increased operational costs | Fleet modernization, fuel efficiency programs, alternative fuels | Transport accounts for ~25% of global CO2 emissions (IEA, 2023) |

| Waste Management | Compliance costs, potential fines, operational inefficiencies | Enhanced recycling programs, packaging optimization | Australia's focus on circular economy principles (2024) |

| Noise Pollution | Operational restrictions, community complaints, regulatory fines | Quieter vehicle technology, optimized delivery schedules | Increased noise complaints in Australian cities (2024) |

| Resource Depletion | Increased operational costs, supply chain disruptions | Fuel efficiency, lifecycle assessment of equipment | Global logistics industry pressure for emission reduction |

| Extreme Weather | Route disruptions, infrastructure damage, service delays | Climate-resilient infrastructure, contingency planning | 2023 warmest year on record in Australia (BoM) |

PESTLE Analysis Data Sources

Our CTI Logistics PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable industry associations, and leading economic forecasting agencies. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.