Centre Testing International Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centre Testing International Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Centre Testing International Group's trajectory. Our meticulously researched PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and identify strategic opportunities. Gain a competitive advantage by understanding the forces at play. Download the full PESTLE analysis now for actionable insights.

Political factors

Government regulations and standards are a major driver for Centre Testing International Group (CTI). As national and international rules become more stringent, CTI's core business of ensuring compliance is directly boosted. This means that when governments focus more on environmental protection, worker safety, or product quality, CTI's services become even more essential.

For instance, the testing, inspection, and certification (TIC) market in China, a key region for CTI, is heavily influenced by a growing emphasis on strict regulatory standards and certifications. This trend is expected to continue, with projections indicating significant growth in the demand for TIC services as China aligns its regulations with international best practices.

Global trade policies, including tariffs and trade barriers, directly impact the volume and complexity of cross-border commerce, influencing the demand for Centre Testing International Group's (CTI) inspection and certification services. For instance, the US tariff rate on certain Chinese goods, which saw fluctuations in 2024, necessitates rigorous compliance checks for affected products.

International trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) which came into full effect in 2023, streamline trade but also introduce specific compliance requirements. Navigating these varying international standards and ensuring supply chain integrity significantly boosts the demand for comprehensive Testing, Inspection, and Certification (TIC) services like those offered by CTI.

Centre Testing International Group's (CTI) operations are significantly influenced by political stability in its key markets. For instance, in 2024, regions experiencing heightened political instability often see reduced foreign investment and slower economic growth, which can dampen demand for CTI's testing and certification services. Maintaining business continuity and pursuing expansion strategies requires a careful assessment of these political landscapes.

Geopolitical tensions, a growing concern in the current macroeconomic climate, directly impact the Testing, Inspection, and Certification (TIC) industry. These tensions can lead to supply chain disruptions, as seen with trade disputes affecting the movement of goods and materials in late 2023 and early 2024. Such disruptions can create uncertainty for businesses, potentially slowing down their need for compliance and quality assurance services from CTI.

The global trade dynamics are being reshaped by these geopolitical shifts, creating both challenges and opportunities for CTI. For example, the push for regionalized supply chains in response to geopolitical risks may increase the demand for localized testing and certification. CTI's ability to navigate these evolving trade patterns, particularly in light of ongoing international relations in 2024, will be key to its market positioning.

Government Investment in Infrastructure and Manufacturing

Government initiatives to boost infrastructure and manufacturing are a significant driver for the Testing, Inspection, and Certification (TIC) sector. Investments in areas like transportation networks, renewable energy projects, and advanced manufacturing facilities directly translate into increased demand for TIC services. These services are crucial for ensuring the quality, safety, and compliance of materials, components, and finished products throughout the project lifecycle.

For example, in China, substantial government spending on infrastructure projects, including high-speed rail and urban development, is fueling the growth of its TIC market. This trend is expected to continue through 2024 and 2025, as the nation prioritizes modernization and technological advancement. The need for rigorous testing and certification to meet international standards and domestic regulations underpins this demand.

- Increased Demand for TIC Services: Government infrastructure spending directly correlates with a higher need for testing, inspection, and certification across various industries.

- China's TIC Market Growth: The Chinese TIC market is anticipated to experience robust expansion, largely driven by significant government investments in infrastructure and manufacturing sectors.

- Focus on Quality and Safety: These investments necessitate stringent quality assurance and safety inspections, creating opportunities for TIC providers to ensure compliance.

- Sectoral Impact: Key sectors benefiting include construction, energy (especially renewables), transportation, and advanced manufacturing, all requiring extensive TIC support.

Focus on Domestic vs. Export-Oriented Manufacturing

A government's strategic pivot from promoting export-led growth to fostering domestic consumption significantly reshapes the demand for testing and certification services. This shift means that the emphasis moves from meeting stringent international product regulations, crucial for global market access, to complying with national standards and ensuring domestic consumer safety and quality. For a company like Centre Testing International Group, this could mean a recalibration of service offerings and expertise.

China's economic trajectory has historically been heavily reliant on manufacturing geared towards exports. For instance, in 2023, China's exports of goods reached approximately $3.38 trillion USD, underscoring the importance of international compliance. However, as domestic markets mature and consumption power grows, there's an increasing focus on internal quality assurance and adherence to China's own robust national standards, such as GB standards.

This evolving landscape presents both challenges and opportunities for Centre Testing International Group:

- Shift in Regulatory Focus: A move towards domestic consumption necessitates a deeper understanding and adaptation to China's national testing and certification requirements, potentially differing from international mandates.

- Market Diversification: While export markets remain vital, a growing domestic market offers a new avenue for service expansion, requiring tailored testing solutions for consumer goods, electronics, and automotive sectors within China.

- Increased Demand for Consumer Safety Testing: As domestic consumption rises, so does consumer awareness and demand for product safety, leading to a greater need for rigorous testing and certification services aligned with national consumer protection laws.

- Opportunity for Specialization: Centre Testing International Group can leverage its expertise to become a key player in ensuring compliance with China's evolving domestic standards, potentially offering specialized services for emerging domestic industries and consumer products.

Government policies and regulatory frameworks significantly shape Centre Testing International Group's (CTI) operational landscape. Stricter national and international standards for product safety, environmental protection, and quality assurance directly increase the demand for CTI's testing, inspection, and certification (TIC) services. For example, the ongoing push for enhanced cybersecurity standards across various industries in 2024 necessitates specialized testing protocols that CTI can provide.

Trade policies and geopolitical stability also play a crucial role. Fluctuations in tariffs and trade agreements, like those impacting global supply chains in late 2023 and early 2024, directly influence the volume and complexity of cross-border commerce, thereby affecting the demand for CTI's compliance services. Political stability in key markets, such as China, is vital for consistent business operations and expansion, with instability potentially dampening investment and service demand.

Government investment in infrastructure and manufacturing, particularly in regions like China, acts as a substantial growth driver for the TIC sector. For instance, China's continued significant spending on infrastructure projects through 2024 and 2025 fuels the need for rigorous testing and certification to meet both domestic and international standards, benefiting companies like CTI.

The strategic direction of governments, such as a pivot from export-led growth to fostering domestic consumption, alters the focus of testing and certification. A greater emphasis on national standards and consumer safety within a country, like China's growing domestic market, requires CTI to adapt its services to meet these evolving internal compliance requirements, presenting new market opportunities.

What is included in the product

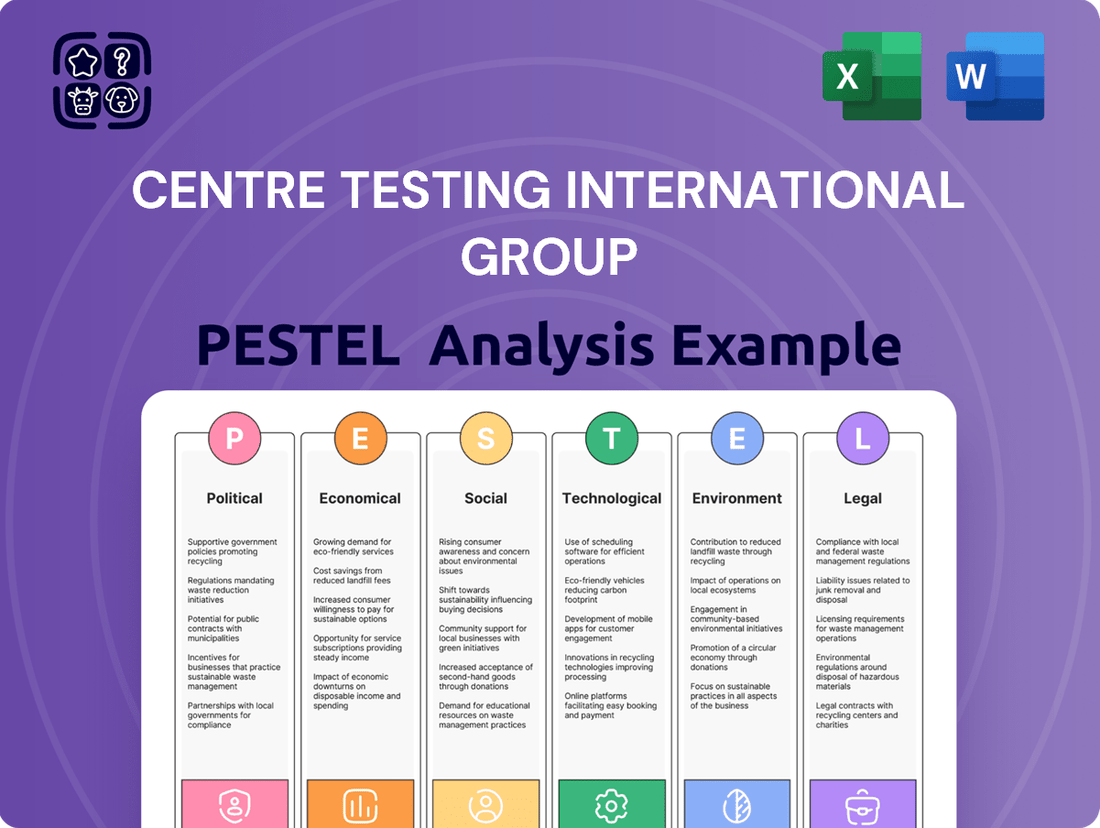

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Centre Testing International Group, covering Political, Economic, Social, Technological, Environmental, and Legal considerations.

A concise PESTLE analysis for Centre Testing International Group, presented in an easily digestible format, alleviates the pain of sifting through extensive data, enabling rapid strategic decision-making.

Economic factors

Global economic growth is a key driver for Centre Testing International Group (CTI). A robust global economy typically translates to higher industrial production and increased consumer spending, both of which boost demand for CTI's testing, inspection, and certification (TIC) services. For instance, projections from the International Monetary Fund (IMF) in April 2024 indicated a global growth forecast of 3.2% for both 2024 and 2025, suggesting a stable, albeit moderate, environment for CTI's operations.

However, persistent inflation and higher interest rates present challenges. These economic conditions can dampen business investment and consumer confidence, potentially slowing the growth in sectors that rely heavily on TIC services. For example, the World Bank's January 2024 Global Economic Prospects report noted that elevated interest rates in advanced economies could continue to weigh on investment and trade, requiring CTI to be agile in adapting its service portfolio and operational strategies to navigate this uncertain landscape.

Centre Testing International Group's (CTI) revenue is closely tied to the growth experienced by the diverse industries it serves. Sectors like consumer goods, automotive, food, and environmental testing are key drivers for CTI's business. A robust expansion in these areas directly translates to increased demand for CTI's testing, inspection, and certification services.

The broader Testing, Inspection, and Certification (TIC) market itself is showing strong upward momentum. Projections indicate the global TIC market will approach USD 400 billion by 2034. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.6% between 2025 and 2034, suggesting a favorable environment for companies like CTI.

Businesses are increasingly handing over their testing, inspection, and certification (TIC) tasks to specialized companies like Centre Testing International Group (CTI). This shift is mainly because it can save money and access skills that companies might not have in-house. This growing outsourcing trend directly influences CTI's position and potential for expansion in the market.

The part of the TIC market focused on outsourcing is really taking off. Experts predict it will grow at a solid pace, around 6% annually, between 2024 and 2029. This expansion highlights a significant opportunity for CTI as more companies look to external partners for these critical services.

Exchange Rate Fluctuations

Centre Testing International Group (CTI), as a global entity, is exposed to the risks and opportunities presented by exchange rate fluctuations. When CTI conducts business in various currencies, the value of its revenues and expenses can shift significantly based on these movements. For instance, if CTI earns revenue in a depreciating currency, its reported profits in its home currency will be lower.

These fluctuations can directly impact CTI's profitability across different geographical markets. A strong home currency, for example, could make services provided in countries with weaker currencies less valuable when translated back. Conversely, a weaker home currency could boost the value of foreign earnings. For example, in 2023, the Euro experienced volatility against the US Dollar, which would have affected companies with significant cross-border transactions.

CTI's financial statements are therefore subject to translation adjustments. These adjustments arise from converting the financial results of foreign subsidiaries into the parent company's reporting currency. The magnitude of these adjustments depends on the volume of international transactions and the degree of currency volatility experienced during the reporting period.

- Impact on Revenue: A strengthening of CTI's reporting currency against currencies where it earns revenue can reduce reported income.

- Impact on Costs: Conversely, a weakening of the reporting currency can increase the cost of imported goods or services.

- Translation Exposure: Fluctuations can lead to gains or losses on the balance sheet when foreign assets and liabilities are translated.

- Competitive Positioning: Exchange rate shifts can alter the price competitiveness of CTI's services in international markets relative to local competitors.

Disposable Income and Consumer Awareness

Higher disposable incomes directly fuel demand for superior and safer goods, creating a ripple effect that necessitates robust testing and certification. As consumers become more informed about product safety and quality, their expectations rise, becoming a significant catalyst for the Testing, Inspection, and Certification (TIC) sector. For instance, in 2024, global consumer spending is projected to continue its upward trend, with many developed economies seeing disposable income levels rebound post-pandemic, directly benefiting industries reliant on consumer confidence in product integrity.

This heightened consumer awareness translates into a stronger market for services like those provided by Centre Testing International Group. Consumers are increasingly scrutinizing product origins, ethical sourcing, and environmental impact, pushing manufacturers to adhere to stricter standards. This trend is particularly evident in sectors such as electronics and apparel, where transparency and verifiable safety claims are paramount. Data from 2024 indicates a significant increase in online searches for product certifications and safety ratings, demonstrating this growing consumer vigilance.

- Increased Demand: Rising disposable incomes in 2024 are expected to boost consumer spending on premium and safety-assured products.

- Consumer Vigilance: Growing awareness of product safety and ethical production is a key driver for the TIC market.

- Market Opportunities: Manufacturers are compelled to invest more in testing and certification to meet consumer expectations.

- Sectoral Impact: Industries like electronics and food are experiencing heightened demand for rigorous quality and safety checks.

Global economic growth is a key driver for Centre Testing International Group (CTI). A robust global economy typically translates to higher industrial production and increased consumer spending, both of which boost demand for CTI's testing, inspection, and certification (TIC) services. For instance, projections from the International Monetary Fund (IMF) in April 2024 indicated a global growth forecast of 3.2% for both 2024 and 2025, suggesting a stable, albeit moderate, environment for CTI's operations.

However, persistent inflation and higher interest rates present challenges. These economic conditions can dampen business investment and consumer confidence, potentially slowing the growth in sectors that rely heavily on TIC services. For example, the World Bank's January 2024 Global Economic Prospects report noted that elevated interest rates in advanced economies could continue to weigh on investment and trade, requiring CTI to be agile in adapting its service portfolio and operational strategies to navigate this uncertain landscape.

The broader Testing, Inspection, and Certification (TIC) market itself is showing strong upward momentum. Projections indicate the global TIC market will approach USD 400 billion by 2034. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.6% between 2025 and 2034, suggesting a favorable environment for companies like CTI.

Higher disposable incomes directly fuel demand for superior and safer goods, creating a ripple effect that necessitates robust testing and certification. As consumers become more informed about product safety and quality, their expectations rise, becoming a significant catalyst for the Testing, Inspection, and Certification (TIC) sector. For instance, in 2024, global consumer spending is projected to continue its upward trend, with many developed economies seeing disposable income levels rebound post-pandemic, directly benefiting industries reliant on consumer confidence in product integrity.

| Economic Factor | 2024/2025 Outlook | Impact on CTI |

|---|---|---|

| Global GDP Growth | Projected at 3.2% for 2024 & 2025 (IMF) | Positive correlation with demand for TIC services. |

| Inflation & Interest Rates | Persistently high in advanced economies | Potential dampening of business investment and consumer spending. |

| Global TIC Market Growth | Projected CAGR of 4.6% (2025-2034) | Favorable market conditions for expansion. |

| Consumer Spending | Projected upward trend in 2024 | Increased demand for safety and quality assurance in goods. |

What You See Is What You Get

Centre Testing International Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Centre Testing International Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a clear overview of the strategic landscape.

Sociological factors

Consumers are increasingly prioritizing safety and quality in their purchases, a trend that directly fuels demand for Centre Testing International Group's (CTI) services. This heightened awareness across diverse product categories means more businesses need rigorous testing and certification to meet customer expectations.

In China, for instance, rising living standards have amplified consumer focus on the safety and quality of everyday items, particularly food and consumer goods. This shift is a significant driver for the Testing, Inspection, and Certification (TIC) market, with CTI well-positioned to benefit from this growing emphasis on product integrity.

Growing public awareness regarding environmental protection and sustainable practices is a significant sociological factor influencing companies like Centre Testing International Group (CTI). This heightened concern directly translates into increased demand for CTI's services, including environmental testing, green product certification, and Environmental, Social, and Governance (ESG) consulting.

For instance, a 2024 survey indicated that 78% of consumers consider a company's environmental impact when making purchasing decisions, a figure that has steadily risen over recent years. This trend underscores the market's growing preference for businesses that demonstrate a commitment to sustainability, thereby boosting the relevance and revenue potential for CTI's specialized offerings.

Furthermore, the emphasis on ESG principles is not just an external market driver but also an internal operational focus for many corporations, including those in logistics sectors where CTI might operate. Companies are increasingly investing in staff well-being, implementing robust safety initiatives, and actively working to reduce their carbon emissions, aligning with the very services CTI provides and validating the market need for such expertise.

Changes in workforce demographics, such as an aging workforce or shifts in generational preferences, can create significant challenges for Centre Testing International Group (CTI) in specialized testing and certification fields. For instance, a report by the Bureau of Labor Statistics in 2024 indicated a growing demand for skilled technicians in areas like cybersecurity and environmental testing, fields crucial to CTI's operations. This demographic shift, coupled with a projected retirement wave of experienced professionals in these niche sectors, could lead to a notable skill shortage.

These workforce shortages are not just a future concern; they are already impacting the Testing, Inspection, and Certification (TIC) market. Industry analyses from 2024 highlight that a lack of qualified personnel is a key barrier to market entry and expansion for many companies, including those in CTI's operational sphere. This scarcity directly affects CTI's ability to scale its services and recruit the highly specialized talent needed to maintain its competitive edge and meet evolving client demands.

Social Responsibility and Ethical Sourcing

Societal expectations are heavily influencing business operations, with a growing emphasis on social responsibility and ethical sourcing. Consumers and stakeholders are increasingly scrutinizing supply chains for fair labor practices, environmental impact, and responsible manufacturing. This trend directly benefits Centre Testing International Group (CTI) by boosting demand for its audit and certification services in these critical areas. For instance, the global ethical fashion market, a key sector for CTI's services, was valued at approximately $7.5 billion in 2023 and is projected to grow significantly in the coming years. CTI's commitment to transparently disclosing its environmental, social, and corporate governance (ESG) concepts, management, and actions further aligns with these evolving societal demands.

CTI's strategic focus on ESG principles is a direct response to this heightened societal awareness. The company actively works to provide assurance on ethical labor practices and responsible production, which are becoming non-negotiable for many brands.

- Growing consumer demand for ethically produced goods.

- Increased regulatory scrutiny on supply chain transparency and labor standards.

- CTI's ESG reporting enhances its appeal to socially conscious businesses.

- The global market for ethical sourcing audits is expanding rapidly.

Health and Safety Consciousness

Societal emphasis on health and safety is a significant driver for testing, inspection, and certification (TIC) services, especially in sectors like food, pharmaceuticals, and manufacturing. This heightened awareness necessitates rigorous compliance checks to mitigate risks and ensure product integrity. The global TIC market is projected to reach USD 286.6 billion by 2028, growing at a CAGR of 4.9% from 2023, according to Mordor Intelligence.

The healthcare sector, in particular, is seeing robust growth within the TIC market. This surge is fueled by an intensified focus on patient safety and the implementation of increasingly stringent regulatory frameworks. For instance, the demand for medical device testing and certification is rising as regulatory bodies like the FDA and EMA enhance their oversight.

- Increased Demand for Safety Assurance: Consumers and regulators alike are demanding higher standards for product safety, directly benefiting TIC providers.

- Growth in Healthcare TIC: The healthcare application segment is expected to lead market growth, driven by patient safety concerns and evolving regulations.

- Regulatory Compliance as a Key Factor: Stringent testing and certification are essential for businesses to meet legal requirements and avoid costly penalties.

- Risk Mitigation for Businesses: Investing in TIC services helps companies minimize product recalls, reputational damage, and liability issues.

Societal shifts towards valuing ethical production and supply chain transparency are increasingly important. Consumers and stakeholders are scrutinizing businesses for fair labor practices and responsible sourcing, directly boosting demand for Centre Testing International Group's (CTI) audit and certification services. For example, the global ethical fashion market, a sector CTI serves, was valued at approximately $7.5 billion in 2023 and is expected to see substantial growth.

CTI's focus on Environmental, Social, and Governance (ESG) principles directly addresses this growing societal demand. The company provides assurance on ethical labor and responsible manufacturing, which are becoming essential for many brands seeking to align with consumer expectations.

The increasing societal emphasis on health and safety is a major driver for testing, inspection, and certification (TIC) services. This is particularly evident in sectors like food, pharmaceuticals, and manufacturing, where rigorous compliance checks are crucial. The global TIC market is projected to reach USD 286.6 billion by 2028, growing at a CAGR of 4.9% from 2023.

The healthcare sector is a significant growth area within the TIC market, driven by heightened patient safety concerns and evolving regulatory frameworks. Demand for medical device testing and certification is rising as regulatory bodies strengthen their oversight.

| Sociological Factor | Impact on CTI | Supporting Data/Trend |

|---|---|---|

| Ethical Sourcing & Supply Chain Transparency | Increased demand for audit and certification services. | Global ethical fashion market valued at $7.5 billion in 2023, with strong projected growth. |

| Health & Safety Emphasis | Higher demand for rigorous testing and compliance in key sectors. | Global TIC market projected to reach $286.6 billion by 2028 (4.9% CAGR from 2023). |

| ESG Awareness | Enhanced appeal to socially conscious businesses; drives demand for ESG reporting assurance. | Growing consumer consideration of environmental impact in purchasing decisions. |

| Workforce Demographics & Skills Shortage | Potential challenges in recruiting specialized talent for testing and certification. | Projected demand for skilled technicians in cybersecurity and environmental testing (2024 BLS data). |

Technological factors

Rapid advancements in testing methodologies, equipment, and analytical techniques are significantly enhancing Centre Testing International Group's (CTI) capabilities. These innovations allow for more precise, efficient, and comprehensive testing services, directly impacting CTI's service quality and market competitiveness.

Innovations like generative AI are creating new avenues for automated testing and data analysis, potentially streamlining CTI's operations and expanding its service offerings. For instance, AI-powered diagnostic tools can accelerate failure analysis in electronics, a key sector for CTI.

Enhanced cybersecurity measures are also paramount, given the increasing sophistication of cyber threats. CTI's ability to maintain robust data security for its clients' sensitive product information is crucial, especially as digital transformation accelerates across industries.

Centre Testing International Group (CTI) is significantly impacted by the accelerating adoption of digital transformation and automation within the Testing, Inspection, and Certification (TIC) sector. These advancements streamline operations, enhance data accuracy, and unlock new service avenues such as remote inspections and digital credentials.

Looking ahead, AI-powered automated testing, digital certification processes, and robotics in inspections are poised to become foundational elements of the TIC industry between 2025 and 2035. For instance, the global AI in testing market is projected to reach $1.5 billion by 2027, indicating a substantial shift towards automated solutions.

Centre Testing International Group's operations are deeply intertwined with handling sensitive client data and digital certifications, making robust cybersecurity and data integrity absolutely critical. The growing dependence on digital platforms necessitates stringent security protocols to safeguard against evolving cyber threats.

In 2024, the global cybersecurity market was valued at an estimated $271.7 billion, highlighting the significant investment and focus in this area. This trend is expected to continue, with projections indicating growth to over $400 billion by 2028, underscoring the increasing risk and need for advanced protection measures for companies like CTI.

The adoption of blockchain-based traceability solutions presents a powerful technological advancement for CTI, offering enhanced protection for data integrity and simplifying compliance validation. This technology can provide an immutable record of data, significantly reducing the risk of tampering and ensuring the trustworthiness of certifications.

Development of New Materials and Products

The relentless pace of innovation, particularly in areas like advanced materials and intricate product designs, directly translates into a growing need for sophisticated testing methodologies. Centre Testing International Group (CTI) is positioned to capitalize on this by developing specialized expertise in these evolving fields. For instance, the burgeoning electric vehicle (EV) market alone is projected to reach over $1.5 trillion globally by 2030, according to recent market forecasts, underscoring the significant demand for testing services related to battery technology, charging infrastructure, and vehicle safety.

Emerging sectors are a key driver for niche Testing, Inspection, and Certification (TIC) services. The renewable energy industry, a critical component of global decarbonization efforts, requires rigorous testing for solar panels, wind turbines, and energy storage systems. CTI's ability to adapt and offer these specialized services is crucial for its growth. In 2024, investments in renewable energy are expected to surpass $2 trillion worldwide, highlighting the substantial market opportunities for TIC providers who can support these rapidly expanding industries.

The development of new materials and complex products creates a direct demand for new testing protocols and specialized expertise. This evolution presents significant service opportunities for companies like CTI. Consider the semiconductor industry, where the complexity of microchips continues to increase. The global semiconductor market was valued at approximately $600 billion in 2024, with ongoing research into new materials like graphene and advanced packaging techniques requiring highly specialized testing capabilities.

- Electric Vehicle Market Growth: Global EV market projected to exceed $1.5 trillion by 2030, creating demand for EV component testing.

- Renewable Energy Investment: Over $2 trillion expected to be invested in renewable energy globally in 2024, driving demand for testing of solar and wind technologies.

- Semiconductor Industry Complexity: The $600 billion semiconductor market is continuously evolving with new materials and designs, necessitating advanced testing protocols.

- New Material Adoption: The integration of advanced materials like composites and nanomaterials in various industries requires specialized validation and certification processes.

Integration of AI and Machine Learning

The integration of AI and machine learning is revolutionizing testing and inspection. For Centre Testing International Group (CTI), this means predictive analysis for potential failures, improved anomaly detection in complex datasets, and more efficient quality control measures. This technological advancement provides CTI a significant competitive edge in the market. For instance, AI-powered visual inspection systems can identify defects with greater accuracy and speed than human inspectors, potentially reducing error rates by up to 40% in certain applications.

AI and cloud technologies are critical for navigating today's rapidly changing market conditions. They enable companies like CTI to scale their operations effectively, manage vast amounts of data securely, and adapt quickly to new demands. The global AI market was valued at over $200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards AI adoption across industries. By leveraging these technologies, CTI can enhance its service offerings and operational agility.

Key benefits for CTI include:

- Enhanced Efficiency: AI algorithms can automate repetitive tasks, speeding up testing cycles and reducing operational costs.

- Improved Accuracy: Machine learning models can identify subtle patterns and anomalies that might be missed by traditional methods, leading to higher quality assurance.

- Predictive Capabilities: AI can forecast potential issues or failures based on historical data, allowing for proactive maintenance and risk mitigation.

- Scalability: Cloud infrastructure, combined with AI, allows CTI to easily scale its testing services up or down to meet fluctuating client demands.

Technological advancements are reshaping the Testing, Inspection, and Certification (TIC) landscape, directly impacting Centre Testing International Group (CTI). The integration of Artificial Intelligence (AI) and machine learning is a significant driver, enabling predictive analysis and enhanced quality control. For example, AI-powered visual inspection can reduce defect detection errors by up to 40% in certain applications.

The burgeoning demand for testing in rapidly expanding sectors like electric vehicles (EVs) and renewable energy presents substantial opportunities. The global EV market is projected to exceed $1.5 trillion by 2030, while renewable energy investments are expected to surpass $2 trillion in 2024, necessitating specialized testing services.

Furthermore, the increasing complexity of products, particularly in the semiconductor industry valued at approximately $600 billion in 2024, requires CTI to develop advanced testing methodologies for new materials and intricate designs. Cybersecurity is also paramount, with the global market valued at over $271.7 billion in 2024, growing to over $400 billion by 2028, underscoring the need for robust data protection.

| Technology Area | Impact on CTI | Market Data/Projections |

|---|---|---|

| AI & Machine Learning | Enhanced efficiency, predictive analysis, improved accuracy in testing. | AI in testing market projected to reach $1.5 billion by 2027. AI visual inspection can reduce errors by up to 40%. |

| Digital Transformation & Automation | Streamlined operations, remote inspections, digital credentials. | Global AI market over $200 billion in 2023, with substantial growth. |

| Cybersecurity | Crucial for protecting sensitive client data and digital certifications. | Global cybersecurity market valued at $271.7 billion in 2024, projected to exceed $400 billion by 2028. |

| Emerging Sectors (EVs, Renewables) | Demand for specialized testing services for new technologies. | EV market > $1.5 trillion by 2030. Renewable energy investments > $2 trillion in 2024. |

| Advanced Materials & Product Complexity | Need for sophisticated testing methodologies and specialized expertise. | Semiconductor market approx. $600 billion in 2024, driven by increasing complexity. |

Legal factors

Centre Testing International Group (CTI) must strictly adhere to standards from organizations like ISO, ASTM, and various national regulatory bodies. For instance, ISO 17025, a key standard for testing and calibration laboratories, directly dictates CTI's operational methodologies and quality assurance processes. Failure to comply can result in loss of accreditation, impacting their ability to provide essential certification services.

Changes in these standards, such as updates to safety regulations for electronics or new environmental testing requirements, necessitate immediate adjustments to CTI's testing protocols and equipment. This constant evolution ensures CTI remains relevant and competitive in a market where adherence to evolving global norms is paramount for product safety and market access.

Stringent product liability laws across major markets, including the European Union and the United States, directly fuel the need for comprehensive testing and certification. These regulations hold manufacturers accountable for product safety and performance, creating a significant demand for independent verification services like those offered by Centre Testing International Group (CTI). For instance, the EU's General Product Safety Regulation (GPSR) requires businesses to ensure their products are safe, driving investment in quality assurance.

As global supply chains become more complex, companies are increasingly outsourcing their compliance needs to specialized third-party Testing, Inspection, and Certification (TIC) providers. This reliance on external expertise helps businesses mitigate legal risks and avoid costly recalls or lawsuits stemming from non-compliance with international standards. The global TIC market was valued at approximately $230 billion in 2023 and is projected to grow, with product safety and regulatory compliance being key drivers.

Centre Testing International Group (CTI) must navigate a complex landscape of data privacy regulations, such as the General Data Protection Regulation (GDPR) and similar frameworks enacted globally. These laws mandate stringent requirements for collecting, processing, and storing personal data, directly impacting CTI's operational procedures and IT investments. Failure to comply can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The increasing digitalization of CTI's testing and certification services means a greater volume of sensitive client and consumer data is handled. This necessitates robust data management practices and potentially significant upgrades to IT infrastructure to ensure secure data handling and breach prevention. In 2024, cybersecurity spending by global organizations was projected to reach over $200 billion, highlighting the critical importance and cost associated with data protection.

Demonstrating effective data protection is no longer just a legal obligation but a significant competitive differentiator for CTI. By prioritizing the security and privacy of client information, CTI can foster greater customer trust and loyalty, which is crucial in an industry where reputation and reliability are paramount.

Accreditation and Licensing Requirements

Centre Testing International Group (CTI) must consistently uphold a range of accreditations and licenses to legally operate and offer its services across diverse sectors and international markets. This commitment ensures their operations and certifications are both recognized and trusted by clients and regulatory bodies alike. For instance, CTI Group holds accreditation for its services in certifying Social Accountability Management Systems, a testament to their adherence to specific operational standards and quality assurance protocols, often involving rigorous ongoing audits.

Maintaining these credentials involves continuous compliance with evolving regulatory frameworks and industry-specific criteria. Failure to meet these legal and accreditation requirements can result in operational disruptions, loss of market access, and damage to CTI's reputation. The group's ability to secure and retain accreditations from bodies like the International Accreditation Forum (IAF) members is crucial for its global business operations.

- Accreditation for Social Accountability: CTI Group is accredited to provide certification for Social Accountability Management Systems, demonstrating compliance with international labor and ethical standards.

- Regulatory Adherence: The company must continuously monitor and comply with changing legal and regulatory landscapes in all operating jurisdictions, impacting everything from data privacy to service delivery standards.

- International Recognition: Maintaining accreditations from recognized international bodies is vital for CTI to offer services and certifications that are accepted globally, facilitating cross-border trade and business.

Anti-Corruption and Bribery Laws

Operating internationally, Centre Testing International Group (CTI) must meticulously adhere to a complex web of anti-corruption and anti-bribery regulations. This commitment to ethical conduct extends across all its global operations and supply chains, ensuring integrity in every transaction. For instance, the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act are significant legal frameworks that CTI navigates. In 2023, the U.S. Department of Justice reported significant enforcement actions under the FCPA, highlighting the ongoing global focus on combating corruption.

CTI Logistics, a key part of the group, reinforces this commitment through its dedicated Anti-Bribery and Anti-Corruption Policy. This policy is integrated into the broader group-wide governance structure, underscoring the organization's zero-tolerance approach to unethical practices. Such policies are crucial as global regulatory scrutiny intensifies; for example, Transparency International's 2023 Corruption Perceptions Index indicates persistent challenges in many regions where businesses operate.

- Global Compliance: CTI must comply with diverse international anti-corruption laws like the FCPA and UK Bribery Act.

- Ethical Operations: Upholding ethical business practices is paramount across all CTI's worldwide activities.

- Group Policy: CTI Logistics features a specific Anti-Bribery and Anti-Corruption Policy as part of its group-wide framework.

- Regulatory Environment: Navigating stringent legal requirements is essential given the increasing global focus on anti-bribery enforcement.

Centre Testing International Group (CTI) operates within a robust legal framework that mandates adherence to numerous international and national standards, such as ISO 17025. These regulations directly influence CTI's testing methodologies and quality assurance, with non-compliance risking accreditation and market access. For instance, the EU's General Product Safety Regulation (GPSR) underscores the critical need for CTI's services in ensuring product safety and market entry.

The company must also navigate complex data privacy laws like GDPR, which impose strict rules on handling personal information, carrying significant penalties for breaches, potentially up to 4% of global annual revenue. Given the increasing digitalization of services, CTI's investment in cybersecurity, a market projected to exceed $200 billion in global spending for 2024, is crucial for maintaining client trust and competitive advantage.

CTI's global operations necessitate strict compliance with anti-corruption laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. The U.S. Department of Justice's continued enforcement actions in 2023 highlight the critical importance of these regulations. CTI Logistics, for example, maintains a dedicated Anti-Bribery and Anti-Corruption Policy, reflecting a zero-tolerance approach to unethical practices in line with global efforts to combat corruption, as indicated by Transparency International's findings.

| Legal Factor | Description | Impact on CTI | Example/Data Point |

|---|---|---|---|

| Standards Compliance | Adherence to international and national testing and accreditation standards. | Ensures operational validity, market access, and client trust. | ISO 17025 accreditation is vital for laboratory operations. |

| Product Liability & Safety Laws | Regulations holding manufacturers accountable for product safety and performance. | Drives demand for CTI's testing and certification services. | EU's GPSR mandates product safety, increasing reliance on TIC providers. |

| Data Privacy Regulations | Laws governing the collection, processing, and storage of personal data. | Requires robust IT infrastructure and data management practices; non-compliance incurs significant fines. | GDPR fines can reach up to 4% of global annual revenue. |

| Anti-Corruption Laws | Legislation prohibiting bribery and corrupt practices in international business. | Mandates ethical conduct across all global operations and supply chains. | FCPA and UK Bribery Act are key frameworks; global cybersecurity spending projected over $200 billion in 2024. |

Environmental factors

The growing global emphasis on environmental protection and sustainability is a significant driver for Centre Testing International Group (CTI). This trend directly fuels demand for CTI's expertise in areas like green product certification, carbon footprint verification, and eco-labeling. For instance, the global green building market was valued at approximately USD 10.4 trillion in 2023 and is projected to reach USD 30.7 trillion by 2030, indicating a substantial market for related testing and certification services.

Businesses are increasingly prioritizing sustainable IT practices and the adoption of green technologies to meet regulatory requirements and consumer expectations. This shift creates opportunities for CTI to offer specialized testing and consulting services that ensure compliance and promote environmental responsibility within the technology sector. The demand for sustainable solutions is not just a niche market; it's becoming a core business strategy for many organizations looking to enhance their brand reputation and operational efficiency.

Climate change and carbon emission regulations are increasingly shaping the operational landscape for businesses, directly boosting demand for Centre Testing International Group's (CTI) expertise. As governments worldwide implement stricter environmental mandates, companies across sectors are compelled to invest in robust environmental monitoring, precise emissions testing, and transparent sustainability reporting. This regulatory push, exemplified by initiatives targeting carbon footprints, directly translates into a growing market for CTI's specialized services.

Growing concerns about resource scarcity, particularly for critical minerals essential in electronics and renewable energy technologies, are intensifying the push towards circular economy models. For instance, the European Union's Critical Raw Materials Act, proposed in 2023 and expected to be in full effect by 2030, aims to diversify supply chains and promote recycling, directly impacting the demand for testing services related to material composition and recyclability. This trend is projected to boost the market for testing, inspection, and certification (TIC) services focused on sustainable resource management and waste valorization.

Pollution Control and Environmental Monitoring

Stricter environmental regulations globally are driving demand for pollution control and monitoring services, a key area for Centre Testing International Group (CTI). Governments are implementing more rigorous standards for air, water, and soil quality, directly benefiting companies like CTI that offer comprehensive testing and compliance solutions. For instance, the European Union’s Industrial Emissions Directive continues to push for reduced pollutant discharges, requiring extensive monitoring.

CTI's expertise in identifying harmful substances and ensuring adherence to discharge limits positions it well in this evolving landscape. The increasing focus on sustainability and corporate social responsibility means businesses are actively seeking reliable partners for environmental assessments. In 2024, global spending on environmental consulting services, which includes monitoring and testing, was projected to reach over $50 billion, highlighting the significant market opportunity.

- Increased regulatory scrutiny globally on air, water, and soil pollution.

- Growing demand for environmental testing and monitoring services as a core business for CTI.

- Focus on compliance with discharge limits for various industries.

- Market growth in environmental consulting, exceeding $50 billion globally in 2024.

Increased Focus on ESG Reporting and Disclosure

Environmental, Social, and Governance (ESG) reporting is gaining significant traction, with companies worldwide facing increased scrutiny from investors, customers, and regulatory bodies demanding greater transparency. This trend is particularly pronounced as we look towards 2025, making robust ESG disclosures a critical compliance area.

Centre Testing International Group (CTI) is well-positioned to capitalize on this demand. The growing need for reliable ESG data verification and assurance services directly translates into increased opportunities for CTI's core competencies.

- Investor Pressure: A significant majority of investors, often cited as over 80% in recent surveys, consider ESG factors when making investment decisions, driving the need for credible reporting.

- Regulatory Push: Governments and financial regulators globally are implementing stricter disclosure requirements, with many expecting enhanced ESG reporting frameworks to be standard by 2025.

- Consumer Awareness: Consumers are increasingly favoring brands with strong sustainability credentials, pushing companies to communicate their ESG performance effectively.

- Market Growth: The global market for ESG consulting and assurance services is projected to see substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years.

The escalating global focus on environmental protection and sustainable practices directly benefits Centre Testing International Group (CTI). This trend amplifies the need for CTI's specialized services in areas such as green product certification, carbon footprint validation, and eco-labeling. For example, the global market for sustainable building materials was estimated to be worth over $250 billion in 2023, with significant growth anticipated due to increasing environmental regulations and consumer demand for eco-friendly construction.

Businesses are increasingly adopting sustainable IT practices and green technologies to meet regulatory mandates and consumer expectations. This shift creates avenues for CTI to offer specialized testing and consulting services, ensuring compliance and fostering environmental responsibility within the technology sector. The drive towards sustainability is no longer a niche concern but a fundamental business strategy for many organizations aiming to enhance their brand image and operational efficiency.

Climate change and carbon emission regulations are fundamentally reshaping the business environment, creating a strong demand for Centre Testing International Group's (CTI) expertise. As governments worldwide implement stricter environmental rules, companies are compelled to invest in advanced environmental monitoring, precise emissions testing, and transparent sustainability reporting. This regulatory impetus, particularly concerning carbon footprints, directly translates into a growing market for CTI's specialized services.

Growing concerns about resource scarcity, especially for critical minerals vital for electronics and renewable energy, are accelerating the adoption of circular economy models. Initiatives like the European Union's Critical Raw Materials Act, proposed in 2023, aim to diversify supply chains and boost recycling, directly influencing the demand for testing services related to material composition and recyclability. This trend is expected to drive growth in testing, inspection, and certification (TIC) services focused on sustainable resource management.

Stricter global environmental regulations are increasing the demand for pollution control and monitoring services, a key area for Centre Testing International Group (CTI). Governments are enforcing more rigorous standards for air, water, and soil quality, benefiting companies like CTI that provide comprehensive testing and compliance solutions. For instance, the European Union's continued emphasis on reducing industrial pollutant discharges necessitates extensive monitoring, a service CTI is well-equipped to provide.

CTI's proficiency in identifying hazardous substances and ensuring adherence to discharge limits positions it advantageously in this dynamic market. The heightened focus on sustainability and corporate social responsibility encourages businesses to seek reliable partners for environmental assessments. In 2024, global expenditure on environmental consulting services, encompassing monitoring and testing, was projected to exceed $50 billion, underscoring the substantial market opportunity.

Environmental, Social, and Governance (ESG) reporting is becoming increasingly critical, with companies facing heightened scrutiny from investors, customers, and regulators for greater transparency. This trend is particularly evident as we approach 2025, making robust ESG disclosures a key compliance requirement.

Centre Testing International Group (CTI) is strategically positioned to leverage this demand. The escalating need for dependable ESG data verification and assurance services directly translates into expanded opportunities for CTI's core competencies.

| Environmental Factor | Impact on CTI | Market Opportunity/Trend | Supporting Data (2023-2025) |

|---|---|---|---|

| Climate Change & Emissions | Increased demand for emissions testing, carbon footprint verification, and sustainability reporting services. | Governments implementing stricter regulations on carbon emissions. | Global carbon capture market projected to reach $10.2 billion by 2027 (from $4.3 billion in 2022). |

| Resource Scarcity & Circular Economy | Demand for testing related to material composition, recyclability, and sustainable sourcing. | Focus on circular economy models and critical raw material management. | EU Critical Raw Materials Act (proposed 2023) driving demand for material testing. |

| Pollution Control & Waste Management | Growth in demand for air, water, and soil quality testing and compliance services. | Stricter environmental standards for industrial discharges and waste handling. | Global environmental consulting market projected to exceed $50 billion in 2024. |

| ESG Reporting & Transparency | Opportunities in ESG data verification, assurance, and reporting services. | Investor and regulatory pressure for transparent ESG disclosures. | Over 80% of investors consider ESG factors; ESG consulting market CAGR projected over 15%. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Centre Testing International Group is built on a robust foundation of data from official government publications, international financial institutions, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.