Centre Testing International Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centre Testing International Group Bundle

Unlock the strategic potential of Centre Testing International Group with a comprehensive BCG Matrix analysis. Understand precisely where their products fall – are they the high-growth Stars, the stable Cash Cows, the underperforming Dogs, or the promising Question Marks? Purchase the full report for an in-depth breakdown and actionable insights to guide your investment and growth strategies.

Stars

Digital Transformation & AI-Powered Services represents a significant star for Centre Testing International (CTI). The market for AI-driven inspection tools and digital compliance platforms is experiencing rapid expansion, with global spending on AI expected to reach $500 billion in 2024, according to IDC. CTI's focus on these high-growth areas, including AI-powered inspection systems and digital verification platforms, positions it to capture substantial market share.

Sustainability and ESG Certification is a star performer for Centre Testing International Group (CTI). The increasing global focus on environmental, social, and governance (ESG) matters means companies desperately need to prove their green credentials. CTI's expertise in ESG auditing and certification directly addresses this urgent need, positioning them for substantial market share gains.

Companies are facing mounting pressure to accurately report emissions, ensure ethical supply chains, and certify their commitment to sustainable operations. This is where CTI's services become indispensable. In 2024, for instance, the global ESG investing market was projected to reach over $33.9 trillion, highlighting the immense demand for reliable verification services.

CTI has strategically embedded ESG governance into its fundamental business approach. They provide comprehensive assurance solutions that validate sustainability claims, a critical factor for businesses navigating investor scrutiny and regulatory requirements in the current financial landscape.

The automotive and aviation testing sectors are booming, driven by the electric vehicle revolution and ever-changing material regulations. This surge means a greater need for thorough testing and certification, a space where Centre Testing International (CTI) is well-positioned. CTI's expertise, including their power bank testing and involvement in automotive material projects, aligns perfectly with this growing demand.

The broader Testing, Inspection, and Certification (TIC) market is seeing significant growth, with the automotive industry being a major contributor. For instance, the global automotive testing market was valued at approximately $25.4 billion in 2023 and is projected to reach $39.2 billion by 2029, showcasing the robust demand CTI can capitalize on.

Pharmaceutical and Clinical Testing

The pharmaceutical and clinical testing sectors represent a significant growth opportunity for Centre Testing International (CTI). This is driven by the increasing pace of innovative drug approvals and breakthroughs in areas like cell and gene therapy. CTI's expertise in these specialized testing services, including support for clinical trials, positions it well within this dynamic market.

The demand for pharmaceutical and clinical testing is robust, fueled by ongoing research and development in the life sciences. This segment is characterized by stringent regulatory requirements and a continuous need for advanced testing methodologies. CTI's established capabilities are crucial for navigating this complex landscape.

- Market Growth: The global pharmaceutical testing market was valued at approximately USD 15.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, according to industry reports.

- Innovation Driver: Advancements in biotechnology, particularly cell and gene therapies, are creating new avenues for specialized testing, demanding sophisticated analytical techniques.

- Regulatory Landscape: The increasing complexity of drug development and regulatory approvals worldwide necessitates comprehensive and reliable testing services, a core offering of CTI.

- CTI's Position: CTI's investment in advanced laboratory infrastructure and skilled personnel for pharmaceutical and clinical testing underscores its commitment to capturing market share in this high-potential area.

International Expansion and Acquisitions

Centre Testing International Group (CTI) is actively pursuing international expansion and acquisitions as a core component of its growth strategy. This is evident in its planned acquisition of Safety SA in South Africa and Emicert in Greece, moves designed to significantly increase market share in these new territories.

These strategic moves underscore CTI's dedication to broadening its global footprint and establishing leadership positions across various international markets. For instance, by acquiring Safety SA, CTI aims to tap into South Africa's growing industrial testing and inspection sector, which is projected to see continued expansion in the coming years.

- Strategic Acquisitions: CTI's planned acquisitions of Safety SA (South Africa) and Emicert (Greece) highlight a proactive approach to international market penetration.

- Market Share Growth: These expansions are key to CTI's objective of capturing substantial market share in new, high-potential regions.

- Global Network Expansion: The company is deepening its global layout, aiming for leadership in diverse testing and inspection markets worldwide.

- Industry Trends: CTI's strategy aligns with the broader trend of consolidation within the testing, inspection, and certification (TIC) industry, driven by globalization and increasing regulatory demands.

Digital Transformation & AI-Powered Services, Sustainability and ESG Certification, and Pharmaceutical & Clinical Testing are key stars for Centre Testing International Group (CTI). These areas benefit from robust market growth and CTI's strategic investments. The global AI market is projected to reach $500 billion in 2024, while ESG investing is valued in the trillions, and pharmaceutical testing is expected to grow at over 7% CAGR. CTI's expertise in these high-demand sectors positions it for significant market share capture and revenue growth.

| Business Area | Market Driver | CTI's Advantage | 2024 Market Insight |

|---|---|---|---|

| Digital Transformation & AI | AI adoption across industries | AI-powered inspection, digital compliance | Global AI spending expected to hit $500 billion |

| Sustainability & ESG | Increasing regulatory and investor scrutiny | ESG auditing and certification | ESG investing market valued over $33.9 trillion |

| Pharma & Clinical Testing | Drug innovation and regulatory complexity | Clinical trial support, advanced analytical techniques | Pharma testing market projected to grow over 7% CAGR |

What is included in the product

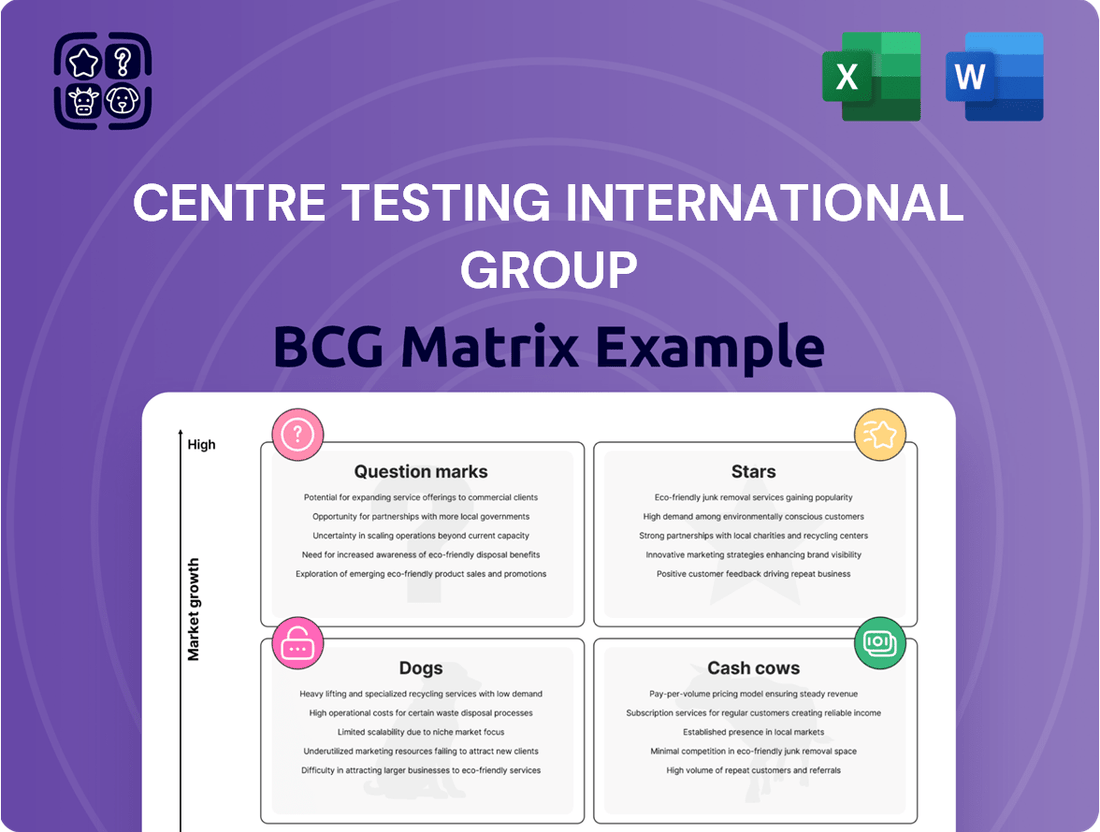

This BCG Matrix offers clear descriptions and strategic insights for Centre Testing International Group's Stars, Cash Cows, Question Marks, and Dogs.

The Centre Testing International Group BCG Matrix offers a clear, visual representation of business unit performance, alleviating the pain of complex portfolio analysis.

Cash Cows

Centre Testing International Group's (CTI) traditional consumer product testing, covering textiles, toys, and electronics, is a prime example of a Cash Cow. These services are well-established, indicating a high market share for CTI in a mature, stable demand sector.

These core capabilities are essential for ensuring product quality and safety compliance, consistently generating reliable cash flow for CTI. For instance, the global toy testing market alone was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of 4.5% through 2030, showcasing the enduring demand for such services.

Food and Environmental Testing represents a significant Cash Cow for Centre Testing International Group (CTI). These sectors are mature, heavily regulated, and demand constant vigilance regarding safety and compliance, allowing CTI to leverage its expertise in testing, inspection, and certification for stable, high-margin revenue streams.

In 2024, the global food testing market was valued at approximately $25.7 billion, with projections indicating continued steady growth driven by increasing consumer awareness and stringent regulatory frameworks. Similarly, the environmental testing market, valued at over $30 billion in 2024, benefits from a persistent need for monitoring pollution and ensuring sustainable practices, both areas where CTI offers critical services.

Calibration services, a cornerstone of quality assurance, typically reside in a stable, mature market characterized by consistent, recurring demand. Centre Testing International Group's (CTI) involvement in this sector likely generates a predictable and dependable cash flow, driven by the perpetual requirement for equipment accuracy and regulatory compliance.

For instance, in 2024, the global calibration services market was valued at approximately $7.5 billion, with projections indicating steady growth. CTI's calibration offerings are a foundational element of their comprehensive, one-stop solution for clients, solidifying their position as a reliable revenue generator within the group.

Industrial Product Inspection and Certification

Centre Testing International Group's (CTI) industrial product inspection and certification services operate within a mature market, acting as a stable Cash Cow. These services are crucial for ensuring manufacturing and industrial equipment, including building materials, meet stringent industry standards and regulatory requirements.

This segment generates consistent revenue due to the essential nature of compliance for ongoing operational safety and market access. For instance, in 2024, the global industrial inspection market was valued at approximately $20 billion, with a projected CAGR of 6.5% through 2030, highlighting its maturity and steady demand.

CTI's offerings in this area are vital for businesses across various sectors:

- Ensuring product safety and quality for industrial machinery.

- Verifying compliance with national and international standards for building materials.

- Providing certification that facilitates market entry and maintains operational integrity.

- Contributing a predictable and substantial revenue stream to CTI's overall portfolio.

Audit and Training Services

Centre Testing International Group's (CTI) Audit and Training Services, while perhaps not the largest segment, act as valuable cash cows within its BCG matrix. These offerings, particularly in established markets, generate consistent, albeit slower, revenue growth. Their contribution to overall profitability is significant, often reinforcing existing client partnerships by addressing compliance and quality management needs.

These services typically require minimal ongoing investment in marketing once their reputation is built. This allows them to deliver steady, predictable income streams. For example, in 2024, CTI's audit and training divisions likely continued to benefit from the ongoing demand for regulatory adherence and skill development across various industries.

- Steady Revenue: Audit and training services provide a reliable income source, contributing to CTI's financial stability.

- Client Retention: These offerings strengthen relationships with existing clients by meeting ongoing compliance and development needs.

- Low Investment: Once established, these services generally require less promotional expenditure, enhancing their profitability.

- Market Maturity: Their success is often linked to the maturity of the markets they serve, where compliance and quality are paramount.

Centre Testing International Group's (CTI) established consumer product testing, food and environmental testing, calibration services, industrial product inspection, and audit and training services all function as significant Cash Cows. These segments operate in mature markets with consistent demand, allowing CTI to leverage its expertise for stable, high-margin revenue. The consistent cash flow generated by these services is crucial for funding other areas of the business.

| CTI Service Segment | Market Maturity | Revenue Stability | Example 2024 Market Data |

|---|---|---|---|

| Consumer Product Testing (Textiles, Toys, Electronics) | Mature | High | Global Toy Testing Market: ~USD 1.5 billion (2023) |

| Food & Environmental Testing | Mature | High | Global Food Testing Market: ~$25.7 billion (2024) |

| Calibration Services | Mature | High | Global Calibration Services Market: ~$7.5 billion (2024) |

| Industrial Product Inspection & Certification | Mature | High | Global Industrial Inspection Market: ~$20 billion (2024) |

| Audit & Training Services | Mature | High | Ongoing demand for regulatory adherence and skill development |

What You’re Viewing Is Included

Centre Testing International Group BCG Matrix

The Centre Testing International Group BCG Matrix preview you are viewing is precisely the document you will receive upon purchase. This means you're seeing the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning.

Dogs

Legacy manual testing processes at Centre Testing International Group (CTI) would likely fall into the Dogs quadrant of the BCG Matrix. These are the areas where CTI might still be relying on older, non-digitized methods that are becoming increasingly irrelevant in the fast-evolving tech landscape.

These manual processes, by their nature, have low growth potential because the market is rapidly moving towards AI and IoT-driven testing solutions. Think about the efficiency gains and accuracy improvements that automation brings; manual methods simply can't keep pace.

Consequently, these legacy areas would also have low market share. As CTI and its competitors embrace advanced technologies, the demand for purely manual testing services will naturally shrink. Resources invested here yield minimal returns, making them a drain rather than a growth driver.

Centre Testing International Group (CTI) might classify certain niche testing or certification services within industries facing long-term stagnation or decline into the 'Dogs' quadrant of the BCG Matrix. These specialized services, while potentially serving a small, dedicated customer base, operate in markets with limited growth prospects and would likely contribute minimally to CTI's overall market share. For instance, testing for older, less prevalent electronic components or certifications for outdated manufacturing processes could fit this description.

Such offerings typically generate low profits and can consume valuable resources, including specialized personnel and equipment, that could be more effectively deployed in higher-growth areas of CTI's portfolio. In 2024, CTI's focus on emerging technologies like AI and electric vehicles highlights a strategic shift away from such mature or declining sectors, suggesting that resources tied to 'Dog' services are actively being evaluated for reallocation to more promising ventures.

Centre Testing International Group's operations in geographically limited, low-growth regions often fall into the Dogs category of the BCG Matrix. These might be laboratories situated in areas with consistently sluggish economic expansion, where CTI holds a minimal market share.

For example, if CTI has a lab in a region where GDP growth has averaged below 1% annually for the past five years, and its market share there is less than 5%, it would likely be a Dog. Such locations demand considerable resources for modest revenue generation, making them inefficient investments.

Services with High Operational Costs and Low Differentiation

Services with high operational costs and low differentiation, often found in the Dogs quadrant of the BCG Matrix, are characterized by substantial investment requirements coupled with minimal unique selling propositions. This combination typically leads to slim profit margins and difficulty in gaining significant market share.

These types of services, like basic data entry or generic call center support, face intense competition where price often becomes the primary differentiator. For instance, in 2024, many outsourced customer service providers struggled with profitability due to the commoditized nature of their offerings, with average profit margins hovering around 3-5% for highly competitive segments.

- High Capital Expenditure: These services often necessitate significant upfront investment in technology, infrastructure, and personnel training.

- Low Profitability: Intense competition and lack of unique features compress profit margins, making sustained profitability a challenge.

- Limited Market Growth: Mature markets with numerous undifferentiated players offer little room for expansion or increased market capture.

- Vulnerability to Price Wars: Without distinct value, businesses are forced to compete on price, eroding any potential for healthy returns.

Underperforming Recent Small Acquisitions

Underperforming recent small acquisitions by Centre Testing International Group (CTI) that haven't integrated well or gained market traction could quickly become dogs in the BCG Matrix. These acquisitions might drain resources without contributing to expected growth or market share, turning into cash traps rather than valuable strategic assets. For instance, if CTI acquired a small EdTech startup in 2023 for $5 million that has since shown minimal user adoption and generated less than $100,000 in revenue by mid-2024, it would fit this category.

These underperforming units require careful evaluation. Their continued investment needs to be weighed against their potential for turnaround or the benefits of divestiture. CTI's 2024 financial reports might highlight specific segments where such challenges are present, potentially impacting overall profitability if not addressed.

- Resource Drain: Acquisitions that fail to achieve expected revenue targets or market penetration consume management attention and capital without commensurate returns.

- Integration Challenges: Difficulties in merging operations, cultures, or technologies can hinder the performance of newly acquired entities.

- Market Re-evaluation: A reassessment of the market segment's potential and CTI's competitive positioning within it is crucial for these underperforming assets.

Dogs within Centre Testing International Group's (CTI) portfolio represent business units or services with low market share in low-growth industries. These are typically mature or declining offerings that consume resources without generating significant returns.

For example, CTI might have legacy testing services for outdated hardware or niche certifications in industries experiencing a long-term downturn. In 2024, the trend is for companies like CTI to divest or minimize investment in these 'Dog' segments to reallocate capital towards high-growth areas.

These 'Dogs' often suffer from low profitability due to intense competition and a lack of differentiation, forcing them into price wars. CTI's strategic focus in 2024 on areas like AI-driven testing and cybersecurity clearly indicates a move away from such resource-intensive, low-return activities.

Consider CTI's potential presence in a geographically isolated region with minimal economic growth and a small customer base for its services. If CTI's market share in such a region is below 5% and the region's GDP growth is consistently under 1%, it would exemplify a 'Dog' business unit.

Question Marks

New digital certification platforms by Centre Testing International Group (CTI) are likely positioned as Question Marks in the BCG Matrix. While the overall digital transformation market is a Star, these specific platforms, especially those that are newly launched or experimental, face a high-growth market driven by increasing industry digitalization. However, they currently possess a low market share as potential buyers are still in the process of discovering and adopting these newer solutions. For instance, the global digital credentialing market was valued at approximately $1.2 billion in 2023 and is projected to grow significantly, indicating the high-growth potential CTI is targeting.

Emerging technology testing, such as for quantum computing components, places Centre Testing International Group (CTI) in the 'Question Marks' category of the BCG matrix. These are areas with significant potential for future growth, but CTI's current market share is likely to be small because the market itself is still nascent and standards are still being developed.

The global quantum computing market, for instance, was valued at approximately $1.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 30% through 2030, indicating substantial future demand for specialized testing services. However, the early stage of development means CTI would be entering a market with evolving requirements and limited established players, thus a low initial market share.

Centre Testing International (CTI) Group's specialized cybersecurity certification services are positioned as Question Marks within the BCG Matrix. This segment operates in a high-growth market, driven by the escalating importance of cybersecurity across all industries.

While the market is expanding rapidly, CTI faces intense competition from established players. To gain significant market share, CTI will require substantial investment in areas like advanced training, credentialing infrastructure, and marketing to differentiate its offerings.

The global cybersecurity market was valued at approximately $214.14 billion in 2023 and is projected to reach $424.97 billion by 2029, growing at a CAGR of 12.06%. This robust growth underscores the potential, but also the challenge, for CTI's nascent services.

Expansion into Untapped Niche Markets (e.g., Space Industry Testing)

Expanding into untapped niche markets like space industry testing positions Centre Testing International Group (CTI) as a potential 'Question Mark' in the BCG matrix. These specialized sectors, such as testing components for satellites or advanced aerospace materials, offer substantial growth prospects but demand significant upfront investment in specialized equipment and highly skilled personnel. For instance, the global space industry market was valued at approximately $469 billion in 2023 and is projected to reach $747 billion by 2030, indicating a strong growth trajectory for related testing services.

CTI's strategic entry into these areas means building new capabilities and brand recognition from the ground up. This requires substantial R&D and capital expenditure, typical of Question Mark initiatives. The potential reward is high if CTI can successfully establish itself and capture market share in these high-value sectors.

- Niche Market Potential: Markets like space component testing offer high growth, with the global space economy projected to expand significantly.

- Investment Requirements: Significant capital is needed for specialized equipment and expertise to enter these advanced sectors.

- Strategic Positioning: CTI's move into these areas would place it in a Question Mark position, requiring careful management of investment versus potential return.

- Market Entry Challenges: Building credibility and market share in highly specialized fields like aerospace testing presents considerable hurdles.

Advanced Green Low Carbon Environmental and ESG Services (New Offerings)

While CTI's established ESG services are likely cash cows, their new advanced green low carbon environmental services represent a potential star. These specialized offerings cater to burgeoning regulatory demands and a rapidly expanding market, indicating significant growth potential. For instance, the global ESG investing market reached an estimated $37.8 trillion in 2023, with a notable surge in demand for carbon footprint analysis and reporting services.

These advanced services, focusing on areas like Scope 3 emissions verification and circular economy consulting, are positioned to capture a growing share of this market. Despite the overall strength of ESG, CTI's market penetration in these niche, cutting-edge segments may still be developing. The market for sustainability consulting services alone was projected to grow to over $15 billion globally by 2024.

- High Growth Potential: Specialized green and low-carbon services tap into a rapidly expanding market driven by new regulations and corporate sustainability goals.

- Emerging Market Share: While general ESG is established, CTI's position in these advanced sub-segments is likely still building, offering room for significant market share gains.

- Regulatory Tailwinds: The increasing complexity of environmental regulations globally creates a strong demand for expert services in carbon accounting, net-zero strategies, and supply chain sustainability.

- Competitive Landscape: The market for these advanced services is becoming more competitive, requiring CTI to innovate and differentiate its offerings to secure leadership.

Centre Testing International Group's (CTI) new digital certification platforms are positioned as Question Marks. They operate in a high-growth digital transformation market but currently hold a low market share as these solutions are still gaining traction. The global digital credentialing market, valued at around $1.2 billion in 2023, highlights the substantial growth CTI aims to capture.

Emerging technology testing, like for quantum computing, also places CTI in the Question Mark category. This sector offers high future growth, but CTI's current market share is small due to the market's nascent stage. The quantum computing market, projected to grow over 30% annually, demonstrates the significant demand for specialized testing.

CTI's specialized cybersecurity certification services are also Question Marks. They are in a high-growth market driven by increasing cybersecurity needs, with the global market valued at $214.14 billion in 2023. However, intense competition means CTI requires significant investment to build market share.

Expanding into niche markets like space industry testing positions CTI as a potential Question Mark. These sectors offer substantial growth, with the global space economy valued at $469 billion in 2023. However, entering these fields demands significant upfront investment in specialized equipment and expertise.

| Business Segment | BCG Category | Market Growth | Market Share | Key Considerations |

| Digital Certification Platforms | Question Mark | High | Low | New offerings, adoption phase, growing market |

| Emerging Tech Testing (Quantum) | Question Mark | High | Low | Nascent market, evolving standards, future potential |

| Cybersecurity Certification | Question Mark | High | Low to Medium | Intense competition, requires investment for share gain |

| Space Industry Testing | Question Mark | High | Low | Niche, high investment for specialized capabilities |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial reports, market share analysis, and industry growth rates, to accurately position each business unit.