CSX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

Unlock the critical external factors shaping CSX's destiny with our comprehensive PESTLE analysis. From evolving environmental regulations to shifts in economic policy, understand the forces driving change. Gain a strategic advantage by anticipating market dynamics and making informed decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governmental regulations are a cornerstone of CSX's operating environment, with agencies like the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA) wielding significant influence. For instance, STB decisions on railroad cost of capital directly affect CSX's ability to invest and grow. In 2024, the STB continued to review various aspects of rail regulation, aiming to balance shipper interests with the financial health of rail carriers.

Changes in U.S. trade policies, particularly concerning tariffs, directly impact rail freight volumes for companies like CSX. For instance, shifts in trade agreements or the imposition of new tariffs could alter the flow of goods, influencing demand for rail transportation.

While tariffs on imported goods might decrease certain cross-border freight, they can also incentivize onshoring. This trend, where manufacturing moves closer to domestic markets, could boost demand for North American rail services. The economic landscape is evolving, and these policy shifts are key considerations for the rail industry.

The dynamic global trade environment, highlighted by Mexico becoming the U.S.'s top import source in 2023, superseding China, directly affects supply chains. This realignment presents opportunities for North American rail networks like CSX, potentially driving increased domestic freight volumes as businesses adapt their sourcing strategies.

Governmental support and investment in transportation infrastructure are vital for CSX's operations and growth. Policies that favor rail as an environmentally efficient freight transport method indirectly benefit CSX's business model, complementing its own substantial infrastructure investments.

CSX is demonstrating this commitment by investing $2.5 billion in 2024 to upgrade its network and boost capacity. This significant outlay underscores CSX's alignment with broader strategic objectives aimed at improving efficiency and expanding its reach within the freight transportation sector.

Labor Relations and Policy

The political landscape significantly shapes labor relations for CSX. Changes in labor laws, such as those affecting union negotiations or worker protections, could directly impact operational costs and efficiency. For instance, a shift towards more stringent regulations on working hours or benefits could increase labor expenses.

The rail industry's reliance on a stable workforce makes labor relations a critical political factor. Potential for strikes or disruptions, often influenced by union-industry agreements and government mediation, poses a direct threat to CSX's ability to maintain consistent service. The Surface Transportation Board (STB) plays a role in overseeing rail operations, including aspects that can touch upon labor disputes.

CSX has actively invested in its workforce, recognizing its importance. In 2023, the company reported progress on its workforce development initiatives, aiming to enhance employee engagement and retention. This focus is vital as a strong labor market, with consistent job growth and fair wages, indirectly boosts demand for rail services through increased consumer spending, a key driver for freight volumes.

Key considerations for CSX regarding labor relations include:

- Union Agreements: The ongoing negotiations and existing contracts with major rail unions, such as the Brotherhood of Locomotive Engineers and Trainmen (BLET) and the International Brotherhood of Teamsters, are paramount. Agreements reached in 2022, for example, set a precedent for wage increases and working condition improvements.

- Labor Law Reforms: Potential legislative changes at the federal level could alter bargaining power, strike rights, or dispute resolution mechanisms within the rail sector.

- Workforce Stability: CSX's commitment to its approximately 30,000 employees, as highlighted by its investments in training and safety programs, aims to mitigate risks associated with labor shortages or unrest.

Environmental Regulations and Climate Policy

Increasing governmental focus on environmental sustainability and climate change mitigation directly impacts CSX's operations and strategic planning. New regulations concerning emissions, fuel efficiency standards, and ambitious carbon reduction targets compel the company to allocate capital towards adopting greener technologies and more sustainable operational practices. For instance, CSX has committed to science-based targets for emissions reduction, aiming for a significant decrease in its carbon footprint.

CSX is actively exploring and investing in alternative fuel sources and technologies to align with evolving national and international climate goals. This proactive approach is crucial for maintaining regulatory compliance and enhancing its long-term competitive positioning. The company’s investments in cleaner locomotives and operational efficiencies are key components of its strategy to address climate-related risks and opportunities.

- CSX's Commitment to Emissions Reduction: The company has set science-based targets for emissions reduction, demonstrating a commitment to environmental stewardship.

- Investment in Greener Technologies: Regulations necessitate ongoing investments in cleaner locomotives, alternative fuels, and operational improvements to meet environmental standards.

- Alignment with Climate Goals: CSX's strategy is designed to align with national and international climate policy objectives, ensuring long-term operational viability and social license to operate.

- Exploring Alternative Fuels: The exploration and potential adoption of alternative fuels are central to CSX's efforts to decarbonize its operations and reduce reliance on traditional fossil fuels.

Governmental regulations, particularly those from the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA), significantly influence CSX's operations. In 2024, the STB continued its work on rail cost of capital, a key factor for CSX's investment decisions, while trade policy shifts, such as Mexico surpassing China as the top U.S. import source in 2023, impact freight volumes and supply chains.

Government support for rail infrastructure and its recognition as an efficient transport mode are beneficial for CSX. The company's $2.5 billion investment in 2024 for network upgrades and capacity enhancement aligns with these broader strategic objectives.

Labor relations are heavily impacted by political factors, including potential changes in labor laws affecting union negotiations and worker protections. CSX's investment in its workforce, noted in 2023 workforce development initiatives, aims to ensure stability, which is crucial given the rail industry's reliance on a consistent labor force.

Environmental regulations and climate change mitigation efforts are driving CSX to invest in greener technologies and sustainable practices. The company's commitment to science-based emissions reduction targets and exploration of alternative fuels are key to its long-term strategy and regulatory compliance.

What is included in the product

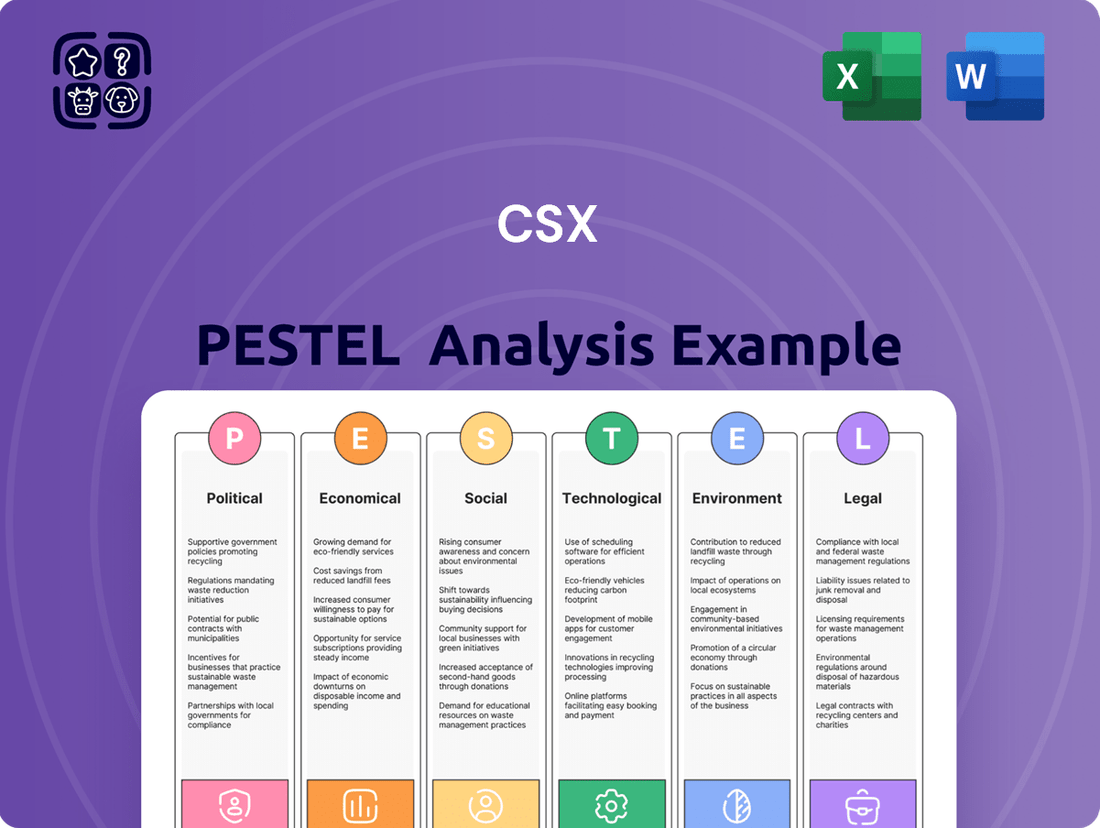

This CSX PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

A CSX PESTLE analysis, presented in a visually segmented format, alleviates the pain of information overload by allowing stakeholders to quickly grasp key external factors impacting the company.

Economic factors

Robust consumer spending acts as a primary engine for CSX's intermodal freight volumes. The resilience of consumer demand, even amidst broader economic questions, has fueled significant increases in freight movement.

In 2024, U.S. railroads, including CSX, have experienced record intermodal volumes, partly driven by strong consumer activity and heightened port operations, especially on the West Coast. This surge indicates a direct correlation between consumer purchasing habits and freight demand.

Looking ahead to 2025, this consumer-led demand is anticipated to sustain the growth trajectory for rail intermodal services. However, a noticeable downturn in consumer spending could present a notable headwind for CSX's intermodal segment.

The U.S. manufacturing sector's vitality is a key driver for CSX's carload volumes, particularly for materials like steel. Despite recent headwinds, manufacturing sentiment has shown an uptick, with business confidence improving as we move into 2025. This suggests a potential rebound in demand for manufactured goods and the raw materials needed to produce them.

While overall manufacturing has experienced a period of subdued activity, CSX has seen resilience in other segments. For instance, strong performance in chemical and grain exports has provided a valuable counterbalance to weaker volumes in categories such as coal. This diversification within CSX's freight portfolio helps mitigate the impact of sector-specific downturns.

CSX's financial health is closely tied to commodity market swings. While its intermodal and chemical segments have performed well, the company is navigating a downturn in coal shipments. This decline is largely attributed to evolving energy preferences and fluctuating global coal prices.

Despite current challenges, CSX projects a rebound for coal starting in 2025. This optimism stems from planned mine restarts and consistent domestic demand for the commodity. For instance, in the first quarter of 2024, CSX reported a 10% decrease in coal revenue year-over-year, highlighting the impact of these market dynamics.

Inflation and Interest Rates

Persistent inflation in 2024 continues to exert upward pressure on interest rates, directly impacting the cost of capital for businesses and consumers, which can dampen demand for goods and services. This, in turn, affects the volume of freight moving by rail, a key indicator for companies like CSX. For instance, the Consumer Price Index (CPI) saw a notable increase in early 2024, necessitating a cautious approach from the Federal Reserve regarding monetary policy easing.

While the labor market has shown resilience, a projected slowdown in consumer spending in early 2025, coupled with ongoing inflationary pressures, presents a potential headwind for rail demand. If consumers pull back on discretionary spending, the need for transporting manufactured goods and raw materials will likely decrease. This could translate to lower carload volumes for rail operators.

Conversely, potential interest rate cuts anticipated later in 2024 or early 2025 could act as a stimulus for industrial output. Lower borrowing costs can encourage businesses to invest in production and expansion, leading to increased demand for raw materials and finished goods transportation. Such a scenario would likely benefit rail carload volumes for CSX.

- Inflationary Pressures: US CPI data indicated persistent inflation throughout 2024, influencing Federal Reserve policy.

- Consumer Spending Outlook: Projections for early 2025 suggest a potential decline in consumer spending, impacting freight volumes.

- Interest Rate Sensitivity: Anticipated interest rate cuts could boost industrial activity and rail demand.

- Labor Market Strength: A robust labor market provides some support, but its impact on rail demand is contingent on consumer spending trends.

Competition from Other Freight Services

CSX operates in a competitive environment where trucking remains a significant alternative for freight transportation. While rail offers cost advantages, especially for long-haul movements, the flexibility and door-to-door service of trucking present a constant challenge. For instance, the American Trucking Associations reported that trucking accounts for over 70% of the freight moved in the U.S.

To counter this, CSX must emphasize its efficiency gains and service improvements. The North American rail freight market is projected for robust growth, with estimates suggesting a substantial increase in volume by 2035, partly due to rail's inherent cost-effectiveness. This growth trajectory necessitates a focus on service reliability and innovative solutions, including the integration of AI, to enhance operational performance and customer satisfaction.

- Trucking's Dominance: Trucking handles over 70% of freight tonnage in the U.S., highlighting its significant competitive presence.

- Rail's Cost Advantage: Rail freight's lower transportation costs are a primary driver for its market share, particularly for long-distance hauls.

- Market Growth Potential: The North American rail freight market is expected to expand significantly, driven by cost efficiencies and technological advancements like AI.

- Strategic Imperatives: CSX must prioritize operational efficiency, service enhancements, and strategic initiatives to secure and grow its market position against competitors.

Persistent inflation throughout 2024 has kept interest rates elevated, impacting business investment and consumer spending. Projections for early 2025 suggest a potential slowdown in consumer demand, which could directly reduce freight volumes for CSX. However, anticipated interest rate cuts later in 2024 or early 2025 could stimulate industrial activity and boost rail demand.

The U.S. manufacturing sector's performance is a key indicator for CSX's carload volumes, particularly for raw materials like steel. Despite some recent challenges, manufacturing sentiment has shown improvement heading into 2025, suggesting a potential increase in demand for manufactured goods and their transport. This resilience in manufacturing, alongside strong chemical and grain exports, provides a crucial counterbalance to weaker segments like coal, which experienced a 10% revenue decrease in Q1 2024 year-over-year due to global price fluctuations and shifting energy preferences.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on CSX |

|---|---|---|---|

| Consumer Spending | Robust, driving intermodal volumes. | Potential slowdown, a headwind for intermodal. | Directly affects intermodal freight demand. |

| Inflation | Persistent, leading to higher interest rates. | Anticipated to moderate, potentially leading to rate cuts. | Influences cost of capital and consumer demand. |

| Manufacturing Output | Mixed, with some sectors showing resilience. | Improving sentiment, potential rebound in demand. | Key driver for carload volumes (steel, etc.). |

| Coal Market | Downturn in shipments, revenue down 10% YoY in Q1 2024. | Projected rebound due to mine restarts and domestic demand. | Significant impact on specific carload segments. |

Full Version Awaits

CSX PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing CSX's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, covering the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CSX.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE analysis of CSX.

Sociological factors

CSX's operational efficiency is intrinsically linked to its workforce's development and adherence to safety protocols. Programs like 'ONE CSX' and 'SAFE CSX' are central to cultivating a robust safety culture, boosting employee morale, and delivering enhanced training and mentorship. These efforts are crucial for maintaining high operational standards and employee well-being.

While CSX has made strides in overall safety metrics, the personal injury frequency rate saw an increase in recent periods, indicating persistent challenges in risk management and injury prevention. For instance, data from 2023 showed a rise in reportable injuries, underscoring the continuous need for enhanced safety measures and employee vigilance to mitigate workplace hazards effectively.

CSX's deep involvement in community engagement and social responsibility is a cornerstone of its operations. In 2023, the company contributed over $20 million to various charitable causes and disaster relief efforts, underscoring its commitment to societal well-being. This dedication extends to prioritizing public safety and health, with significant investments in infrastructure upgrades and employee training aimed at minimizing risks along its rail network.

Demographic shifts significantly impact how goods move. For example, the continued urbanization trend in North America, with more people living in cities, increases demand for efficient freight transport, including rail, to supply these concentrated populations. This trend was evident as of 2023, with urban areas continuing to be hubs for consumption and distribution.

Evolving consumer behavior, particularly the surge in e-commerce, directly influences rail freight. The demand for faster delivery of online purchases often necessitates intermodal solutions, where rail plays a crucial role in long-haul segments. In 2024, e-commerce sales continued to grow, accounting for a substantial portion of retail spending, underscoring the importance of intermodal rail capacity.

Public Perception and Brand Image

CSX's public perception and brand image are significantly shaped by its safety record, environmental stewardship, and engagement with the communities it serves. A strong safety performance, for instance, is crucial for building trust with customers and the public. In 2023, CSX reported a total recordable injury rate of 0.94 per 200,000 hours worked, reflecting a commitment to operational safety that bolsters its reputation.

Positive environmental initiatives and proactive community involvement can further enhance CSX's standing. Demonstrating a commitment to sustainability, such as reducing emissions or supporting local projects, can foster goodwill and strengthen relationships with stakeholders. For example, CSX's investments in modernizing its fleet contribute to improved fuel efficiency and reduced environmental impact, which resonates positively with environmentally conscious customers and investors.

- Safety Record: CSX's 2023 total recordable injury rate was 0.94 per 200,000 hours worked.

- Environmental Performance: Investments in fleet modernization aim to improve fuel efficiency and reduce emissions.

- Community Involvement: Engagement with local communities through various initiatives builds goodwill and strengthens brand image.

- Reputation as a Partner: Positive contributions in safety and environment solidify CSX's position as a reliable and responsible transportation provider.

Labor Market Resilience and Employment Rates

The resilience of the labor market is a key driver for CSX, directly influencing consumer spending and the demand for rail freight services. A strong job market, characterized by consistent growth and stable inflation-adjusted wages, fuels economic activity and, by extension, the transportation of goods. For instance, the US unemployment rate remained low, hovering around 3.7% in late 2024 and early 2025, indicating a robust demand for labor and, consequently, goods.

CSX's operational efficiency and continuity are intrinsically linked to its capacity to attract and retain a skilled workforce. Challenges in labor availability or retention can lead to service disruptions and increased operational costs. As of the latest available data for 2024, the transportation and warehousing sector, which includes rail, faced ongoing demands for skilled workers, particularly in areas like locomotive engineers and maintenance technicians.

- US Unemployment Rate: Consistently low, around 3.7% in late 2024/early 2025, supporting consumer spending.

- Wage Growth: Stable inflation-adjusted wage growth in 2024 contributed to consumer purchasing power.

- Labor Demand in Transportation: High demand for skilled labor in sectors like rail operations in 2024.

- Impact on Freight: Labor market strength directly correlates with consumer demand for goods moved by rail.

Sociological factors significantly influence CSX's operations by shaping consumer behavior and workforce dynamics. Evolving consumer preferences, such as the continued rise of e-commerce, directly impact freight demand, necessitating efficient intermodal solutions where rail plays a key role. The labor market's resilience, with low unemployment rates around 3.7% in late 2024/early 2025, supports consumer spending and, consequently, the volume of goods transported by rail.

CSX's commitment to community engagement and public perception is paramount. In 2023, the company contributed over $20 million to charitable causes, demonstrating a strong sense of social responsibility. This dedication, coupled with a robust safety record, such as the 2023 total recordable injury rate of 0.94 per 200,000 hours worked, enhances its brand image and strengthens stakeholder relationships.

| Sociological Factor | Impact on CSX | Relevant Data (2023-2025) |

|---|---|---|

| E-commerce Growth | Increased demand for intermodal rail services | E-commerce sales continued growth in 2024 |

| Labor Market Strength | Boosts consumer spending, driving freight demand | US unemployment around 3.7% (late 2024/early 2025) |

| Community Engagement | Enhances brand reputation and stakeholder relations | $20+ million in charitable contributions (2023) |

| Safety Culture | Crucial for operational continuity and public trust | 0.94 total recordable injury rate (2023) |

Technological factors

Automation and AI are revolutionizing rail operations, boosting efficiency and safety. AI-driven systems are optimizing traffic flow, facilitating predictive maintenance, and enhancing scheduling precision, all contributing to fewer delays and more dependable service delivery.

The growing adoption of AI in rail infrastructure technology is a significant catalyst for expansion within the North American rail freight transportation sector. For instance, the market for AI in transportation and logistics was projected to reach $10.9 billion in 2024, with rail being a key beneficiary of these advancements.

American railroads are increasingly integrating Internet of Things (IoT) devices, equipping assets with smart sensors. These sensors create connected ecosystems, feeding real-time data into digital platforms.

This influx of data, when analyzed using advanced analytics, allows for precise cargo tracking and monitoring. It also facilitates optimized maintenance schedules, extending the operational life of rail assets and boosting overall efficiency and safety.

For instance, Union Pacific reported in 2024 that its IoT-driven predictive maintenance program had reduced unplanned locomotive service interruptions by over 15% compared to the previous year.

Advanced Train Control Systems (ATCS) are significantly reshaping rail operations. Technologies like Positive Train Control (PTC) and Communications-Based Train Control (CBTC) are key drivers, enhancing both safety and efficiency. These systems are designed to prevent accidents caused by human error, such as overspeeding or trains entering restricted areas.

The implementation of PTC, mandated in the US, has seen substantial investment. By the end of 2023, over 99% of required track miles were equipped, with railroads investing billions to meet these safety standards. This technological leap directly translates to fewer delays caused by technical malfunctions and improved traffic flow management, boosting on-time performance for companies like CSX.

Alternative Fuels and Decarbonization Technologies

CSX is making significant strides in adopting alternative fuels and decarbonization technologies to meet its sustainability targets. The company is actively investing in and exploring solutions like biofuels, battery-electric, and hydrogen-powered locomotives. This strategic focus aims to substantially reduce greenhouse gas emissions across its operations.

A key milestone in this effort was the unveiling of CSX's first hydrogen-powered locomotive in April 2024. This development underscores CSX's dedication to pioneering green technologies within the rail industry and leading the transition towards cleaner energy sources.

- Investment in Green Technology: CSX is channeling resources into developing and implementing alternative fuel solutions, including biofuels, battery-electric, and hydrogen.

- Hydrogen Locomotive Debut: The introduction of its first hydrogen-powered locomotive in April 2024 highlights CSX's commitment to innovation in decarbonization.

- Emission Reduction Goals: These technological advancements are crucial for CSX to achieve its objectives of reducing its environmental footprint and aligning with global decarbonization efforts.

Digital Twins and Predictive Maintenance

CSX is increasingly leveraging digital twin technology, integrated with the Internet of Things (IoT), to transform its rail operations. This allows for real-time monitoring of assets and sophisticated simulations, significantly improving decision-making for both maintenance and operational planning. For instance, by mid-2024, CSX reported a substantial reduction in unplanned service interruptions directly attributable to these advanced monitoring systems.

Predictive maintenance, a key application of IoT and artificial intelligence, is optimizing CSX's maintenance schedules. This proactive approach not only increases the lifespan of critical assets but also dramatically reduces costly downtime caused by unexpected malfunctions. By 2025, the company anticipates a further 15% decrease in maintenance-related delays through expanded predictive analytics deployment.

- Digital Twins & IoT: Enabling real-time asset monitoring and operational simulations for enhanced decision-making.

- Predictive Maintenance: Utilizing IoT and AI to optimize maintenance schedules and extend asset life.

- Impact: Reduction in unplanned downtime and improved operational efficiency.

- CSX Focus: Continued investment in these technologies to maintain competitive advantage in rail logistics.

Technological advancements are fundamentally reshaping rail operations, with AI and IoT driving efficiency and safety. These innovations are crucial for optimizing logistics and reducing operational costs.

The integration of advanced train control systems, like Positive Train Control (PTC), is enhancing safety and operational flow. CSX is actively investing in these technologies to meet regulatory requirements and improve service reliability.

CSX's commitment to decarbonization is evident in its exploration of alternative fuels, including hydrogen-powered locomotives, which debuted in April 2024. This strategic adoption of green technology aims to significantly cut emissions.

Digital twin technology, combined with IoT, is revolutionizing asset management and predictive maintenance, leading to fewer disruptions and extended equipment lifespan. This focus on digital transformation is key to maintaining a competitive edge.

| Technology Area | CSX Adoption/Impact | Data/Fact (2024/2025) |

|---|---|---|

| AI & Automation | Optimizing traffic flow, predictive maintenance | AI in transportation projected to reach $10.9 billion in 2024 |

| IoT & Sensors | Real-time asset tracking, data analytics | Union Pacific: 15% reduction in unplanned locomotive interruptions (2024) |

| Advanced Train Control | Enhanced safety, improved traffic management | Over 99% of US required track miles equipped with PTC by end of 2023 |

| Alternative Fuels | Decarbonization, emission reduction | CSX unveiled first hydrogen-powered locomotive in April 2024 |

| Digital Twins | Simulations, enhanced decision-making | CSX reported substantial reduction in unplanned service interruptions (mid-2024) |

Legal factors

The Surface Transportation Board (STB) is a key regulator for U.S. railroads, influencing competition, pricing, and industry consolidation. CSX's operations are directly shaped by STB rulings, affecting its relationships with customers and its overall business model.

Recent STB actions, like rescinding the Final Offer Rate Review rule in 2023, have altered the landscape for rate disputes, potentially impacting CSX's pricing flexibility and revenue generation strategies.

The STB's annual determination of the railroad industry's cost of capital, a figure used in revenue adequacy assessments, directly influences the financial framework within which CSX must operate and plan for future investments.

The Federal Railroad Administration (FRA) dictates stringent safety regulations that CSX must adhere to, impacting everything from daily operations to capital expenditures on safety enhancements. These rules cover a wide array of areas, ensuring the integrity of rail infrastructure and the well-being of employees and the public.

CSX's commitment to compliance is evident in its SAFE CSX initiative, a comprehensive program designed to elevate safety standards through focused efforts and advanced training. This proactive approach is crucial, as the FRA closely monitors metrics like train accident rates and personal injury frequency, with non-compliance carrying significant penalties.

In 2023, CSX reported a 17% decrease in reportable train accidents compared to 2022, demonstrating progress in its safety performance. The company continues to invest heavily in technology and training, aiming to further reduce these numbers and maintain alignment with evolving FRA safety mandates, which are critical for operational continuity and stakeholder trust.

CSX operates under a complex web of environmental laws, including those governing air emissions, water discharge, and hazardous waste disposal. Failure to comply can result in significant fines and operational disruptions.

The company actively invests in technologies and processes to meet these stringent requirements, aiming to reduce its environmental footprint. This commitment is underscored by their science-based targets for greenhouse gas emissions reduction, aligning with global climate goals.

For instance, CSX reported a 12% reduction in absolute Scope 1 and 2 greenhouse gas emissions in 2023 compared to their 2019 baseline, demonstrating tangible progress in environmental compliance and sustainability efforts.

Antitrust and Merger Regulations

Antitrust and merger regulations significantly shape the freight rail industry, impacting potential consolidation. The Surface Transportation Board (STB) plays a crucial role in overseeing these transactions, ensuring that any mergers do not stifle competition or harm shippers. For instance, the STB's approval of the Canadian Pacific-Kansas City Southern merger in 2023, valued at approximately $31 billion, set a precedent for how large-scale rail industry consolidation is evaluated, with conditions imposed to maintain competitive options for shippers.

Speculation regarding CSX's engagement with financial advisors to explore strategic options, including potential mergers with other railways, underscores the complex legal landscape. Such discussions are inherently sensitive due to antitrust concerns. The STB's mandate includes ensuring that market concentration does not lead to adverse effects on pricing, service levels, or the availability of transportation alternatives for customers. Any proposed merger involving CSX would face rigorous review to balance industry efficiency with competitive market principles.

- Regulatory Oversight: The STB scrutinizes all rail mergers to prevent monopolistic practices and ensure continued competition.

- Merger Precedents: The $31 billion CPKC merger approval in 2023 highlights the STB's focus on shipper interests and competitive balance.

- Strategic Exploration: CSX's potential exploration of mergers involves navigating significant antitrust hurdles and regulatory approval processes.

Labor Laws and Collective Bargaining

CSX navigates a complex landscape of labor laws and collective bargaining agreements that shape its employee relations. These legal frameworks dictate crucial aspects like minimum wage, overtime, workplace safety, and the rights of unions to negotiate terms of employment. For instance, in 2024, the Surface Transportation Board (STB) continued to oversee labor disputes within the rail industry, impacting potential disruptions and settlement costs for companies like CSX.

The legal requirements surrounding wages, working conditions, and union negotiations directly influence CSX's operational expenses and its ability to adapt quickly to market changes. The cost of labor, including benefits and potential wage increases negotiated through collective bargaining, is a significant factor in the company's financial performance. For example, ongoing discussions around crew size and work rules in 2024 and 2025 could lead to adjustments in staffing levels and associated costs.

Maintaining constructive labor relations and effectively managing workforce challenges are continuous legal and operational imperatives for CSX. Successful negotiations and a harmonious workforce are vital to preventing costly work stoppages and ensuring reliable service delivery. As of early 2025, the Brotherhood of Locomotive Engineers and Trainmen (BLET) and the SMART Transportation Division remained key unions representing CSX employees, with ongoing contract discussions a focal point.

- Labor Laws Compliance: CSX must adhere to federal regulations such as the Railway Labor Act, which governs unionization and collective bargaining in the rail industry.

- Collective Bargaining Agreements: The company operates under agreements negotiated with various unions, covering wages, benefits, hours of service, and working conditions.

- Impact on Costs: Wage settlements and changes to work rules stemming from negotiations directly affect CSX's operating expenses, impacting profitability.

- Workforce Management: Addressing issues like fatigue management and crew availability, often central to labor talks, is critical for operational efficiency and safety.

Legal factors significantly influence CSX's operations, primarily through regulatory bodies like the Surface Transportation Board (STB) and the Federal Railroad Administration (FRA). The STB's oversight of mergers, pricing, and competition, exemplified by the $31 billion CPKC merger approval in 2023, directly impacts industry structure and CSX's strategic options. The FRA mandates stringent safety regulations, with CSX reporting a 17% decrease in reportable train accidents in 2023, underscoring compliance efforts.

Environmental factors

CSX's extensive rail infrastructure faces significant threats from climate change, with extreme weather events like floods and heatwaves becoming more frequent. These phenomena can cause track buckling and embankment erosion, leading to service delays and increased repair expenses. For instance, in 2023, severe weather disruptions impacted freight movement across various regions.

The intensity of storms and higher temperatures directly contribute to infrastructure wear and tear, potentially shortening the lifespan of critical assets. This necessitates substantial investment in climate resilience, with CSX allocating capital to reinforce tracks and drainage systems to counteract these environmental pressures.

CSX is actively working to reduce its greenhouse gas emissions, a critical environmental factor for any transportation company. Rail transport is inherently more fuel-efficient than trucking, giving CSX a notable advantage in lowering its carbon footprint. For instance, in 2023, CSX reported a 15% reduction in its Scope 1 and 2 emissions intensity compared to its 2019 baseline.

The company is committed to a low-carbon future and is renewing its science-based targets for reducing emissions intensity across Scope 1, 2, and 3. This proactive approach aligns with global efforts to combat climate change and positions CSX favorably in an increasingly environmentally conscious market.

CSX is prioritizing improvements in locomotive fuel efficiency as a key strategy for decarbonization. In 2023, CSX reported a 10% improvement in fuel efficiency compared to 2019 levels, a testament to their ongoing efforts.

The company is actively exploring and investing in alternative fuel technologies, including hydrogen fuel-cell conversion kits for their existing diesel-electric locomotive fleet. This forward-looking approach aims to significantly reduce their carbon footprint and that of their customers.

Sustainable Logistics and Highway-to-Rail Conversion

CSX actively champions the environmental benefits of shifting freight from trucks to rail, a strategy known as highway-to-rail conversion. This initiative directly supports customers in reducing their carbon footprint, with rail transport generally emitting significantly fewer greenhouse gases per ton-mile than trucking.

For instance, a single freight train can take approximately 300 trucks off the road, leading to substantial emissions reductions. CSX acknowledges and celebrates customers who demonstrate commitment to environmental stewardship through these conversions, fostering a more sustainable logistics ecosystem.

- Emissions Reduction: Rail transport is up to four times more fuel-efficient than trucking, significantly lowering CO2 emissions.

- Highway Congestion: Shifting freight to rail alleviates road congestion, reducing wear and tear on infrastructure.

- Customer Recognition: CSX highlights customers achieving notable emissions savings through modal shifts.

- Supply Chain Sustainability: These conversions are integral to building more resilient and environmentally responsible supply chains.

Biodiversity and Land Use Impacts

CSX's vast rail network, spanning over 21,000 route miles across the eastern United States, inherently interacts with diverse ecosystems and influences land use patterns. While detailed public reporting on specific biodiversity programs is limited, the company's stated commitment to environmental stewardship suggests efforts to manage these impacts. For instance, in 2023, CSX continued its focus on responsible land management practices along its corridors, aiming to minimize disruption to local flora and fauna.

Mitigating the ecological footprint of such extensive operations is a key environmental consideration. This includes managing land for habitat preservation where possible and adhering to environmental policies designed to reduce negative impacts. While specific 2024/2025 biodiversity metrics are not yet widely published, the ongoing regulatory environment and increasing stakeholder expectations for environmental responsibility underscore the importance of these efforts for CSX.

- Extensive Network: CSX operates over 21,000 route miles, impacting numerous land parcels and ecosystems.

- Environmental Stewardship: The company emphasizes minimizing operational impacts on the environment.

- Land Management: Responsible land management is critical for mitigating ecological footprints.

CSX's extensive rail network is increasingly vulnerable to climate change impacts, with extreme weather events like floods and heatwaves posing significant risks to infrastructure and operations. These events can lead to costly disruptions and repairs, as seen with weather-related delays impacting freight movement in 2023.

The company is actively pursuing emissions reduction strategies, leveraging the inherent fuel efficiency of rail transport compared to trucking. In 2023, CSX achieved a 15% reduction in Scope 1 and 2 emissions intensity against its 2019 baseline and is focusing on improving locomotive fuel efficiency, reporting a 10% gain by 2023.

CSX champions highway-to-rail conversions, highlighting that a single freight train can remove approximately 300 trucks from roadways, significantly cutting greenhouse gas emissions. This modal shift is crucial for supply chain sustainability, with rail transport emitting substantially less CO2 per ton-mile than trucking.

CSX's operations span over 21,000 route miles, necessitating careful land management to minimize ecological impacts. While specific 2024/2025 biodiversity metrics are not yet public, ongoing regulatory scrutiny and stakeholder expectations underscore the importance of these environmental stewardship efforts.

PESTLE Analysis Data Sources

Our CSX PESTLE Analysis is informed by a diverse range of data sources, including official government publications, reports from international organizations like the World Bank and IMF, and reputable industry-specific research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors affecting CSX.