CSX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

CSX's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the threat of new entrants disrupting the rail industry. Understanding these dynamics is crucial for navigating the complex transportation sector.

The complete report reveals the real forces shaping CSX’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CSX, like other Class I railroads, depends on a select group of suppliers for essential equipment and technology. This limited supplier base, particularly for specialized items like locomotives or advanced signaling systems, grants these suppliers considerable bargaining power. For instance, in 2024, the market for new high-horsepower locomotives is dominated by a few major manufacturers, making it difficult for railroads to find alternative sources or negotiate significantly lower prices.

CSX faces significant supplier bargaining power due to high switching costs for essential equipment like specialized railcars and advanced signaling systems. These costs can run into millions, making it financially prohibitive to change providers frequently.

The complexity of integrating new systems with existing infrastructure further solidifies this dependency. For instance, a new signaling system might require extensive track modifications and retraining of personnel, adding layers of expense and time, thereby diminishing CSX's leverage.

Labor unions represent a significant supplier force for CSX, wielding considerable bargaining power. Recent negotiations, including agreements reached in 2024 and those anticipated for 2025, highlight how union demands on wages, benefits, and working conditions directly influence operational costs and employment terms throughout the railroad sector.

Specialized Inputs and Services

Suppliers offering highly specialized maintenance, repair, and overhaul (MRO) services or unique technological solutions vital for rail operations wield significant bargaining power. Their specialized knowledge and the critical nature of their contributions mean CSX faces challenges in finding viable alternatives, enabling these suppliers to negotiate more favorable terms and pricing.

For instance, consider the market for advanced locomotive diagnostic systems. Companies providing proprietary software and hardware for predictive maintenance can command higher prices due to the scarcity of comparable solutions. This reliance on specialized expertise limits CSX's ability to switch suppliers easily, thereby strengthening the suppliers' position.

- Specialized MRO Providers: Suppliers offering unique repair techniques or parts for specific locomotive models have considerable leverage.

- Proprietary Technology: Companies with patented rail signaling or track maintenance technology can dictate terms.

- High Switching Costs: CSX incurs substantial costs and operational disruptions when changing providers for critical, specialized services.

- Limited Supplier Pool: The number of qualified suppliers for certain niche rail components or expertise is often small.

Regulatory and Safety Requirements

Suppliers to the rail industry, including CSX, must navigate a complex web of federal and state regulations. These often pertain to safety, environmental impact, and operational standards. For instance, the Federal Railroad Administration (FRA) sets rigorous safety rules for equipment and operations. Adherence to these mandates, such as those concerning track integrity or locomotive emissions, requires significant investment in compliance and quality control from suppliers. This can inflate their costs, which may then be passed on to CSX.

These stringent requirements act as a significant barrier to entry for potential new suppliers. Companies without established compliance protocols or the capital to invest in meeting these standards find it difficult to enter the market. This dynamic benefits existing, compliant suppliers by reducing competitive pressure, thereby strengthening their bargaining power. For example, a supplier of specialized railcar components must demonstrate compliance with FRA Part 215, which dictates specific safety standards for railcars, a costly process for any new entrant.

The need for specialized knowledge and certifications to meet these regulatory demands further limits CSX's sourcing options. Suppliers who have successfully integrated these requirements into their operations possess a competitive advantage. This can lead to a situation where CSX has fewer viable alternatives for certain critical components or services, giving those established suppliers more leverage in price negotiations and contract terms.

- Regulatory Compliance Costs: Suppliers face increased operational expenses to meet safety and environmental standards, such as those set by the FRA.

- Barriers to Entry: Stringent regulations deter new suppliers, consolidating the market and empowering existing vendors.

- Limited Sourcing Options: Specialized compliance requirements reduce the pool of qualified suppliers, enhancing the bargaining power of established players.

CSX's reliance on a concentrated supplier base for critical components like locomotives and advanced signaling systems grants these suppliers significant bargaining power. For instance, in 2024, the limited number of high-horsepower locomotive manufacturers means CSX has fewer options for procurement, leading to less favorable pricing. Similarly, the high switching costs associated with specialized equipment, often running into millions, make it financially challenging for CSX to change providers, further solidifying supplier leverage.

Labor unions also represent a substantial supplier force for CSX. Agreements reached in 2024, and ongoing negotiations for 2025, demonstrate the significant impact union demands on wages and benefits have on CSX's operational costs and employment terms.

Suppliers of specialized maintenance, repair, and overhaul (MRO) services, along with those providing proprietary technology such as locomotive diagnostic systems, wield considerable influence. Their unique expertise and the critical nature of their offerings limit CSX's ability to find alternatives, enabling them to negotiate higher prices and more advantageous contract terms.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on CSX | Example (2024 Data) |

| Locomotive Manufacturers | Limited number of producers, high R&D costs | Higher equipment acquisition costs | Dominance of a few major manufacturers in the high-horsepower locomotive market |

| Specialized MRO Providers | Proprietary repair techniques, unique parts | Increased maintenance expenses, potential operational delays if services are unavailable | Providers of specific engine overhauls for older locomotive fleets |

| Technology Providers (e.g., Signaling) | High switching costs, integration complexity, proprietary technology | Significant upfront investment for system changes, ongoing reliance on specific vendors | Companies offering advanced positive train control (PTC) systems |

| Labor Unions | Collective bargaining, essential workforce | Increased labor costs, impact on operational flexibility | Negotiations impacting wages and benefits for engineers and conductors |

What is included in the product

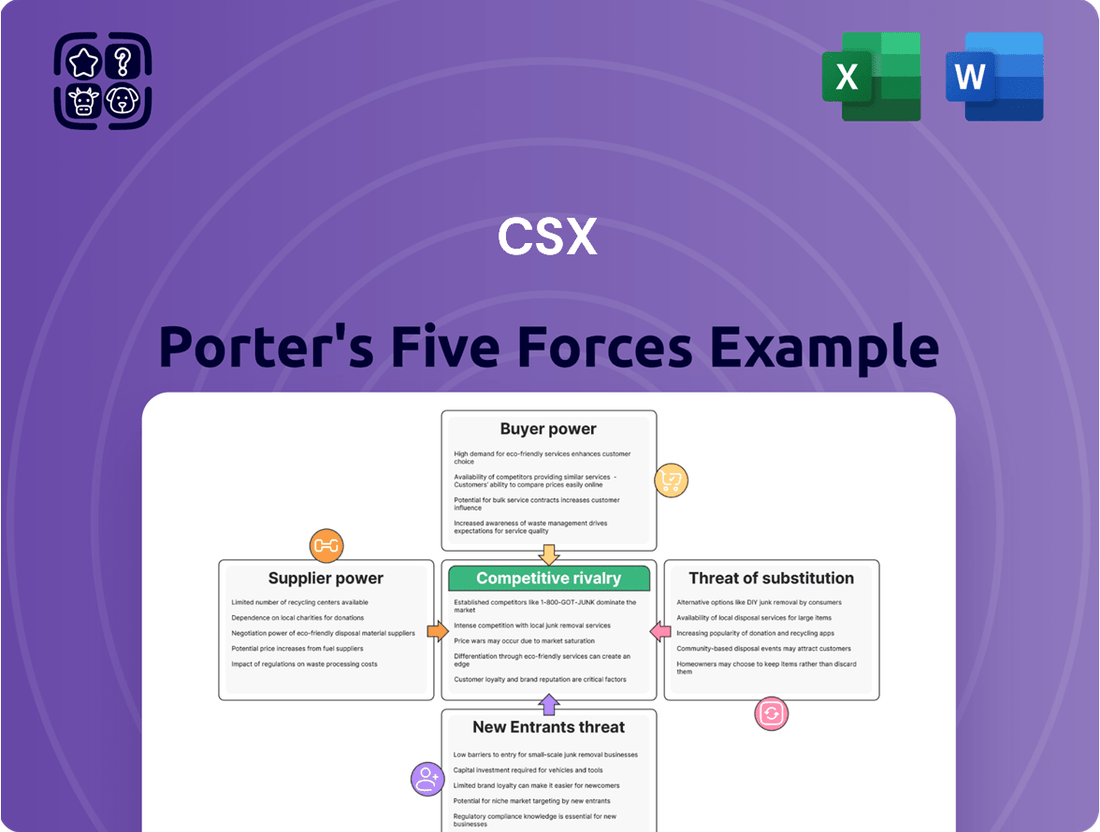

This analysis dissects the competitive forces impacting CSX, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the railroad industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

CSX's diverse customer base, spanning industries like coal, agriculture, chemicals, automotive, and intermodal, significantly moderates customer bargaining power. This broad reach means no single customer segment holds substantial sway over CSX's pricing or service terms, as revenue is not heavily reliant on any one sector. For instance, in 2023, while coal remained a key commodity, agricultural products and chemicals also represented significant portions of CSX's freight volume, preventing any one group from dictating terms.

For many bulk commodities and long-haul freight, switching from rail to another transport mode, like trucking or intermodal, presents substantial hurdles. These include the need for new infrastructure such as specialized loading docks or storage facilities, and often result in increased overall transportation expenses, making rail a sticky choice for many shippers.

For instance, the cost to build a new rail spur or adapt existing facilities for truck loading can run into hundreds of thousands or even millions of dollars, a significant barrier to switching carriers or modes. This investment discourages customers from easily moving their business, thereby reducing their bargaining power.

Customer demand for CSX's services is closely tied to the health of the broader economy and industrial production. When the economy slows, freight volumes tend to decrease, giving customers more leverage to negotiate pricing and contract terms.

For instance, in 2024, a slowdown in manufacturing and a continued decline in coal shipments, a key commodity for CSX, directly impacted freight volumes. This reduced demand inherently strengthens the bargaining power of customers, as they have alternative transportation options or can simply reduce their shipping needs.

Presence of Large Shippers and Intermodal Operators

The presence of large shippers and intermodal operators significantly influences CSX's bargaining power with its customers. Large shippers, especially those with substantial freight volumes or unique logistical requirements, can exert considerable pressure to secure more favorable pricing and service terms.

Intermodal operators, by consolidating freight from numerous smaller shippers, amplify their collective negotiating strength. This aggregated volume allows them to demand better rates and operational efficiencies from railroads like CSX. For instance, in 2024, major CPG companies continued to leverage their scale, often negotiating multi-year contracts with volume commitments that cap price increases.

This dynamic means CSX must remain competitive and responsive to the needs of these powerful customer segments.

- Large shippers can negotiate volume discounts, impacting CSX's revenue per ton.

- Intermodal operators' consolidated demand can lead to lower per-unit shipping costs.

- These powerful customers often have alternative transportation options, increasing their leverage.

- CSX's ability to offer integrated solutions and reliable service is crucial to retaining these clients.

Service Quality and Reliability as a Differentiator

While cost is certainly a consideration, the reliability and quality of service are paramount for CSX's customers. When network disruptions occur, such as those experienced in early 2024 impacting freight movement, customers feel the pinch. This can lead them to demand concessions or explore other transport providers, even if switching costs are significant.

For instance, in the first quarter of 2024, CSX reported a decrease in operating income compared to the previous year, partly due to increased operating expenses and lower volumes, highlighting the impact of operational challenges on financial performance. These service interruptions directly empower customers to negotiate better terms, as their supply chains are directly affected.

- Service Disruptions: Network issues, like those seen in Q1 2024, directly impact customer operations.

- Negotiating Power: Reliability is a key factor; poor service increases customer leverage for concessions.

- Alternative Options: Even with switching costs, persistent service failures can drive customers to competitors.

- Financial Impact: Operational challenges can lead to reduced revenues and profitability, as evidenced in early 2024 financial reports.

CSX customers possess moderate bargaining power, influenced by the diversity of its freight base and the high costs associated with switching transportation modes. While large shippers and intermodal operators can leverage their volume for better terms, most customers face significant hurdles in shifting away from rail, limiting their ability to dictate pricing.

The bargaining power of CSX's customers is a key factor in its operational strategy. While the company benefits from the stickiness of rail transport due to high switching costs, the economic environment and service reliability directly influence customer leverage. For example, in 2024, a slowdown in industrial output meant that reduced freight volumes gave customers more room to negotiate pricing and service level agreements.

Large customers, such as major automotive manufacturers or energy companies, can exert considerable influence due to their substantial shipping volumes. These entities often negotiate long-term contracts with specific volume commitments, which can cap price increases and demand tailored logistical solutions. This is particularly evident in sectors where freight represents a significant portion of a company's cost structure.

| Customer Segment | Bargaining Power Factor | Impact on CSX |

|---|---|---|

| Large Shippers (e.g., Automotive, Energy) | High Volume, Long-Term Contracts | Negotiate volume discounts, service customization; potential for price pressure. |

| Intermodal Operators | Consolidated Freight Demand | Amplify collective negotiating strength, seeking lower per-unit costs. |

| Commodity Shippers (e.g., Coal, Agriculture) | Economic Sensitivity, Mode Switching Costs | Moderate power; influenced by commodity prices and economic cycles, but rail is often the most cost-effective for bulk. |

| General Industrial Customers | Smaller Volumes, Standardized Services | Lower individual bargaining power, more reliant on CSX's standard offerings and network efficiency. |

Full Version Awaits

CSX Porter's Five Forces Analysis

This preview shows the exact CSX Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive assessment of the competitive landscape within the railroad industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use document.

Rivalry Among Competitors

The North American freight rail sector operates as an oligopoly, with a handful of Class I railroads, including CSX, Union Pacific, Norfolk Southern, and Canadian Pacific Kansas City, holding significant market sway. This concentrated structure fosters a competitive environment where these few giants vie intensely for market share across their operational regions.

While Class I railroads like CSX operate vast networks, their core business often concentrates geographically, for instance, in the Eastern United States. This segmentation means direct competition is most fierce in areas where these extensive networks intersect or where interline agreements are utilized.

Interline agreements, which allow freight to be transferred between railroads, create a dynamic where cooperation is essential, yet rivalry persists for traffic control and efficiency. In 2024, Class I railroads continued to navigate these complex relationships, balancing the need for seamless freight movement with the drive to capture market share on shared routes.

Railroad competition intensifies through pricing and service. Companies like CSX must offer attractive rates and dependable delivery to win and keep customers, particularly for crucial or time-sensitive freight. For instance, in 2024, the Class I railroads, including CSX, continued to focus on improving service metrics like train speed and dwell time to enhance customer satisfaction and compete with other transportation modes.

Competition with Other Transportation Modes

CSX contends with substantial competition from alternative transportation methods, most notably the trucking sector, but also including waterways and pipelines. While rail's inherent cost-effectiveness is a significant advantage, trucking provides superior flexibility and speed for specific types of cargo, creating pricing and market share pressures for CSX.

The trucking industry, in particular, represents a formidable competitor. In 2024, the U.S. trucking industry is projected to generate over $1 trillion in revenue, highlighting its vast scale and reach. This sector's ability to offer door-to-door service and faster transit times for less-than-truckload (LTL) shipments often makes it the preferred choice for time-sensitive or geographically dispersed deliveries, directly impacting CSX's potential freight volumes.

- Trucking's Dominance: The trucking industry remains the primary competitor, offering agility and speed that rail cannot always match, particularly for shorter hauls and last-mile delivery.

- Intermodal Competition: While CSX benefits from intermodal transport, it also competes with trucking companies that handle the first and last mile, potentially siphoning off business.

- Waterways and Pipelines: For bulk commodities like coal, grain, and chemicals, barges and pipelines offer cost-competitive alternatives, especially for long-distance, high-volume movements.

- Pricing Pressures: The availability of these alternative modes compels CSX to maintain competitive pricing, potentially impacting its profit margins.

Merger and Acquisition Activity

Merger and acquisition (M&A) activity among Class I railroads, like the reported discussions between Union Pacific and Norfolk Southern in late 2023 and early 2024, highlights a fluid competitive environment. These potential consolidations could significantly alter market power dynamics.

Such M&A could either intensify competition by creating larger, more efficient entities or lead to greater market concentration, potentially impacting pricing and service levels across the industry.

The ongoing speculation surrounding potential mergers underscores the strategic importance of scale and network efficiency in the railroad sector.

- Potential Consolidation: Discussions between major players like Union Pacific and Norfolk Southern signal a willingness to explore significant structural changes.

- Market Power Shifts: Successful mergers could lead to a reshaping of competitive advantages and influence over market share.

- Impact on Competition: Increased concentration might reduce the number of direct competitors, potentially affecting service offerings and pricing strategies.

Competitive rivalry within the North American freight rail sector, where CSX operates, is intense due to the oligopolistic market structure dominated by a few Class I railroads. This rivalry is further amplified by robust competition from the trucking industry, which offers greater flexibility and speed for certain cargo types.

In 2024, the trucking sector's projected revenue exceeding $1 trillion underscores its significant market presence, directly challenging rail's market share. Additionally, waterways and pipelines provide cost-effective alternatives for bulk commodities, forcing CSX to maintain competitive pricing strategies to retain business.

| Competitor Type | Key Characteristics | Impact on CSX Rivalry |

|---|---|---|

| Class I Railroads | Oligopolistic structure, extensive networks, interline agreements | Intense competition for market share on shared routes, focus on service and pricing |

| Trucking Industry | Flexibility, speed, door-to-door service, vast scale | Significant pressure on pricing and market share, especially for time-sensitive or last-mile delivery |

| Waterways & Pipelines | Cost-effectiveness for bulk commodities, long-distance transport | Price competition for specific freight segments like coal and chemicals |

SSubstitutes Threaten

The trucking industry presents a substantial threat of substitutes to CSX's rail freight services. Trucks are particularly competitive for shorter distances and when speed is critical. In 2024, trucking's agility and direct delivery capabilities continue to capture market share from rail, especially for less-than-truckload (LTL) shipments and time-sensitive goods.

Waterway and pipeline transportation present a significant threat of substitution for CSX, particularly for bulk commodities. For instance, barges on inland waterways can move vast quantities of coal and chemicals at a lower cost per ton-mile than rail, especially for routes that are well-served by water. In 2024, the cost of barge transport for coal can be as low as $0.015 per ton-mile, compared to rail's $0.03 to $0.05 per ton-mile for similar bulk movements.

Pipelines also offer a compelling alternative for specific products like crude oil, refined petroleum products, and certain chemicals, providing a continuous, secure, and often more cost-efficient method of transport over long distances. The U.S. pipeline network, for example, moved approximately 15.2 billion barrels of liquids and gases in 2023, highlighting its substantial capacity and reach as a substitute for rail in these sectors.

Intermodal transportation, blending rail for long hauls with trucks for short-distance drayage, presents a hybrid approach that can function as both a complement to and a substitute for traditional single-mode transport. CSX's intermodal offerings face competition from other intermodal providers, and shippers can always opt for entirely truck-based solutions if CSX's service or pricing becomes less attractive.

Technological Advancements in Competing Modes

Technological advancements in trucking are a significant threat to rail. Innovations like autonomous driving and advanced logistics software are making road transport more efficient and cost-effective. For instance, the trucking industry is investing heavily in telematics and AI-powered route optimization, which can reduce transit times and fuel consumption. This increased efficiency makes trucking a more compelling alternative to rail for many types of freight.

These improvements in trucking directly impact the attractiveness of rail as a transport mode. As trucking becomes faster and more reliable, it can capture market share previously dominated by rail, especially for time-sensitive or less-than-truckload shipments. By 2024, the global autonomous truck market is projected to see substantial growth, further intensifying this competitive pressure.

The threat is amplified by the ongoing development of intermodal solutions that seamlessly integrate trucking with other transport modes.

- Increased Trucking Efficiency: Autonomous vehicles and AI logistics software reduce transit times and operational costs for road freight.

- Competitive Pricing: Enhanced efficiency in trucking can lead to more competitive pricing, directly challenging rail rates.

- Intermodal Integration: Advancements facilitate smoother transitions between trucking and other transport methods, making road a more viable option for longer hauls.

Customer Preference for Specific Attributes

Customer preference for specific attributes significantly influences the threat of substitutes for CSX. Transportation buyers weigh factors like cost, transit time, and reliability. For instance, while CSX excels in cost-effective, bulk freight movement over long distances, customers needing rapid delivery or time-sensitive shipments might turn to air cargo or trucking.

The choice of transportation mode is often dictated by the specific needs of the cargo and the end-user. In 2024, the demand for expedited shipping continued to grow, putting pressure on traditional freight carriers like CSX to offer more flexible and faster solutions. This customer-driven demand for speed can make substitute services more attractive, even if they come at a higher price point for certain types of goods.

- Cost Sensitivity: While CSX offers competitive pricing for bulk, high-volume shipments, the total cost of using rail can be impacted by drayage fees and longer transit times compared to trucking for shorter hauls.

- Speed Requirements: Industries requiring just-in-time inventory management or time-critical deliveries often find air cargo or expedited trucking to be more suitable substitutes, despite higher per-unit costs.

- Reliability and Flexibility: While rail networks are generally reliable, disruptions can occur. Customers prioritizing absolute delivery certainty or needing highly flexible routing might consider alternative transport options.

- Environmental Concerns: Although rail is often more environmentally friendly than trucking, customers with strong sustainability mandates might still explore intermodal solutions that combine rail with other modes for specific legs of their journey.

The threat of substitutes for CSX is significant, with trucking, waterways, pipelines, and air cargo all offering viable alternatives depending on the freight type and distance. Trucking's agility for shorter hauls and time-sensitive goods, as well as waterway and pipeline transport for bulk commodities, directly compete with rail services. Technological advancements in trucking, such as autonomous vehicles, further enhance these substitutes' appeal by improving efficiency and reducing costs.

| Substitute Mode | Key Advantages | CSX's Competitive Area | 2024/2023 Data Point |

|---|---|---|---|

| Trucking | Flexibility, speed for short/medium hauls, door-to-door service | Long-haul bulk freight, intermodal | Trucking captured an estimated 80% of US freight spending in 2023. |

| Waterways (Barges) | Low cost per ton-mile for bulk commodities | Landlocked regions, non-time-sensitive bulk | Barge transport costs can be as low as $0.015/ton-mile for coal. |

| Pipelines | Continuous, secure, cost-effective for liquids/gases | Crude oil, refined products, chemicals | US pipelines moved ~15.2 billion barrels in 2023. |

| Air Cargo | Speed for high-value, time-sensitive goods | High-value electronics, pharmaceuticals, perishables | Air cargo rates can exceed rail by 10-20x for equivalent weight. |

Entrants Threaten

The freight rail industry, including major players like CSX, demands immense upfront capital for essential assets like tracks, locomotives, and rolling stock. This high capital intensity acts as a significant deterrent for new entrants. For instance, building even a short stretch of new track can cost millions, and acquiring a modern locomotive fleet easily runs into tens of millions of dollars.

The U.S. freight rail industry operates under a comprehensive regulatory umbrella, primarily overseen by the Surface Transportation Board (STB). This intricate web of rules covers everything from rates and service to safety and environmental standards.

For any potential new competitor, understanding and complying with these extensive regulations presents a formidable barrier. The process of securing operating rights and meeting stringent safety protocols requires significant investment in time, expertise, and capital, effectively deterring many new entrants.

The threat of new entrants for Class I railroads like CSX is significantly low due to the immense capital investment required to build a comparable network. CSX, for instance, operates over 21,000 route miles of track, a testament to centuries of development and acquisition. Establishing such extensive, proprietary rights-of-way is practically impossible for newcomers, creating a formidable barrier to entry.

Economies of Scale and Scope

Existing railroads, like CSX, enjoy substantial economies of scale and scope. This means they can move vast quantities of various goods much more cheaply because their infrastructure is already in place and highly utilized. For instance, in 2023, CSX reported total operating revenues of $14.0 billion, demonstrating the sheer scale of their operations.

New companies entering the rail industry would face immense difficulty matching these cost efficiencies. Building a comparable network and achieving the necessary volume to spread fixed costs thinly would require massive upfront investment, making it hard for newcomers to compete on price.

- Economies of Scale: Incumbent railroads leverage massive fixed assets, like extensive track networks and a large fleet of locomotives and railcars, to achieve lower per-unit transportation costs as volume increases.

- Economies of Scope: The ability to transport diverse commodity types (e.g., coal, intermodal, automotive, chemicals) over the same network allows for greater operational flexibility and cost-sharing across different business segments.

- Network Effects: A more extensive and interconnected rail network offers greater utility to customers, creating a barrier for new entrants who lack this comprehensive reach.

- Capital Intensity: The rail industry is highly capital-intensive, with significant ongoing investments required for track maintenance, upgrades, and rolling stock, presenting a substantial hurdle for new market participants.

Customer Relationships and Switching Costs

CSX benefits from deeply ingrained customer relationships, making it difficult for new entrants to gain traction. These long-standing partnerships often involve tailored services and integrated logistics solutions, creating a significant barrier.

Customers face considerable switching costs when considering alternatives to CSX. These costs can include the expense of reconfiguring supply chains, retraining personnel, and potential disruptions to operations. For example, in 2024, the average cost for a business to switch logistics providers can range from thousands to tens of thousands of dollars, depending on the complexity of their operations.

- Established Relationships: CSX's history with major industrial clients like those in automotive and agriculture fosters loyalty and trust.

- Switching Costs: The financial and operational hurdles for customers to move to a new rail provider are substantial, often involving new infrastructure investments or contract renegotiations.

- Value Proposition Hurdle: A new entrant must not only match CSX's service levels but also offer a demonstrably superior value proposition to justify the migration effort for customers.

The threat of new entrants in the freight rail sector, including for CSX, is exceptionally low. The industry's immense capital requirements, stringent regulatory environment, and the established economies of scale enjoyed by incumbents create substantial barriers. For instance, CSX's 2023 operating revenue of $14.0 billion highlights the scale that newcomers must contend with.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | Building and maintaining rail infrastructure (tracks, locomotives) requires billions in investment. | Prohibitively expensive for most potential entrants. |

| Regulation | Compliance with STB rules on rates, service, and safety is complex and costly. | Demands significant legal, operational, and financial resources. |

| Economies of Scale & Scope | Existing players like CSX (over 21,000 route miles) achieve lower per-unit costs through high volume and diverse freight types. | New entrants struggle to match cost efficiencies and service breadth. |

| Customer Switching Costs | Businesses face significant financial and operational hurdles to change rail providers. | Discourages customers from switching, locking in incumbents. |

Porter's Five Forces Analysis Data Sources

Our CSX Porter's Five Forces analysis is built upon a foundation of diverse data, including CSX's annual reports and investor presentations, alongside industry-specific publications and government transportation statistics. This blend ensures a comprehensive understanding of the competitive landscape.