CSX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

Curious about CSX's strategic product portfolio? This glimpse into their BCG Matrix reveals the foundational insights into their market performance. Understand which of their offerings are driving growth and which may require a strategic rethink.

Unlock the full potential of this analysis by purchasing the complete CSX BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategies to optimize their business.

Stars

CSX's intermodal segment showed solid performance in 2024, with volumes increasing by 5%. This growth highlights its strong market position in an expanding sector, as intermodal shipping gains traction for its efficiency and environmental benefits.

The ongoing infrastructure enhancements, such as the Howard Street Tunnel project slated for completion by 2026, are projected to unlock significant revenue potential, estimated between 15% and 20% through expanded double-stack capacity.

This strategic investment solidifies intermodal's role as a primary growth engine for CSX, with the potential to evolve into a substantial cash generator in the coming years.

CSX's strategic infrastructure investments, such as the planned $2.5 billion capital expenditure for 2025, position it to capitalize on future growth. Projects like the Howard Street Tunnel expansion and the Blue Ridge subdivision rebuild are key to this strategy.

These substantial investments are designed to boost operational efficiency and expand network capacity. This focus on infrastructure upgrades is crucial for supporting profitable growth and securing a larger market share in the long term.

Upon completion, these projects are anticipated to significantly increase capacity, allowing for double-stack intermodal services. This enhancement will unlock new markets and create valuable incremental growth opportunities for CSX.

CSX's dedication to technological innovation, including yard inspection drones and wayside car health monitoring, directly translates to enhanced operational efficiency. This focus on advanced tech and strict operational discipline has demonstrably improved fuel efficiency and significantly reduced derailment incidents, showcasing a strong market position in operational excellence within the rail sector.

These technological investments and operational discipline contribute to tangible cost savings and margin expansion for CSX. The company's commitment to service excellence, reflected in improved train velocity and reduced dwell times observed in Q2 2025, further reinforces its leadership in network fluidity and efficiency.

Diversified Merchandise Freight

Diversified Merchandise Freight is a key component of CSX's business, projected to be its largest revenue generator in FY2025. This segment is expected to contribute 64% of total revenues, amounting to approximately $9.1 billion. Its strength lies in the wide array of commodities it handles, including chemicals, agricultural products, and automotive parts, demonstrating robust growth and a significant market presence across multiple industrial sectors.

The diversified nature of this freight segment is a strategic advantage for CSX. By handling a broad spectrum of goods, the company can better manage risks that might arise from downturns in any single commodity market. This broad base ensures more stable and consistent revenue streams, supporting its position as a star performer within the CSX portfolio.

- Projected FY2025 Revenue: $9.1 billion

- Contribution to Total Revenue: 64%

- Key Commodities Handled: Chemicals, agricultural products, automotive components

- Strategic Advantage: Diversification mitigates market-specific risks

New Customer Facilities and Industrial Development

CSX's strategic focus on expanding customer facilities is yielding significant results. In the first half of 2025, the company successfully added 49 new customer facilities, demonstrating robust demand for its services. An additional 30 facilities are projected to come online by the close of fiscal year 2025, further solidifying its market position.

These new developments are not concentrated in a single sector but are spread across a diverse range of industries. This diversification creates a stable and resilient flow of new business volume for CSX. It also underscores the company's capability to broaden its market reach and attract a wider customer base.

The continuous pipeline of industrial development acts as a primary driver for CSX's long-term market share expansion. This ongoing investment in new facilities and customer relationships is crucial for sustained growth and competitive advantage in the transportation sector.

- New Facilities Added (H1 2025): 49

- Projected New Facilities (FY 2025): 30

- Impact: Diversified industry adoption, resilient new volume

- Strategic Importance: Catalyst for long-term market share gains

CSX's Diversified Merchandise Freight segment is a clear star in its portfolio. Projected to generate $9.1 billion in FY2025, it accounts for a significant 64% of total revenues. This segment's strength comes from handling a wide variety of commodities like chemicals and agricultural products, providing a stable revenue base.

CSX's strategic expansion of customer facilities is also a star performer. Having added 49 new facilities in the first half of 2025 and projecting another 30 by year-end, this growth is spread across diverse industries. This continuous pipeline of industrial development is a key driver for market share expansion.

| Segment | FY2025 Revenue Projection | % of Total Revenue | Key Growth Drivers |

|---|---|---|---|

| Diversified Merchandise Freight | $9.1 billion | 64% | Broad commodity mix, stable demand |

| Intermodal | N/A (Growth Engine) | N/A | Infrastructure upgrades (Howard St Tunnel), efficiency gains |

| Customer Facilities Expansion | N/A (Volume Driver) | N/A | 49 new facilities (H1 2025), 30 projected (FY2025) |

What is included in the product

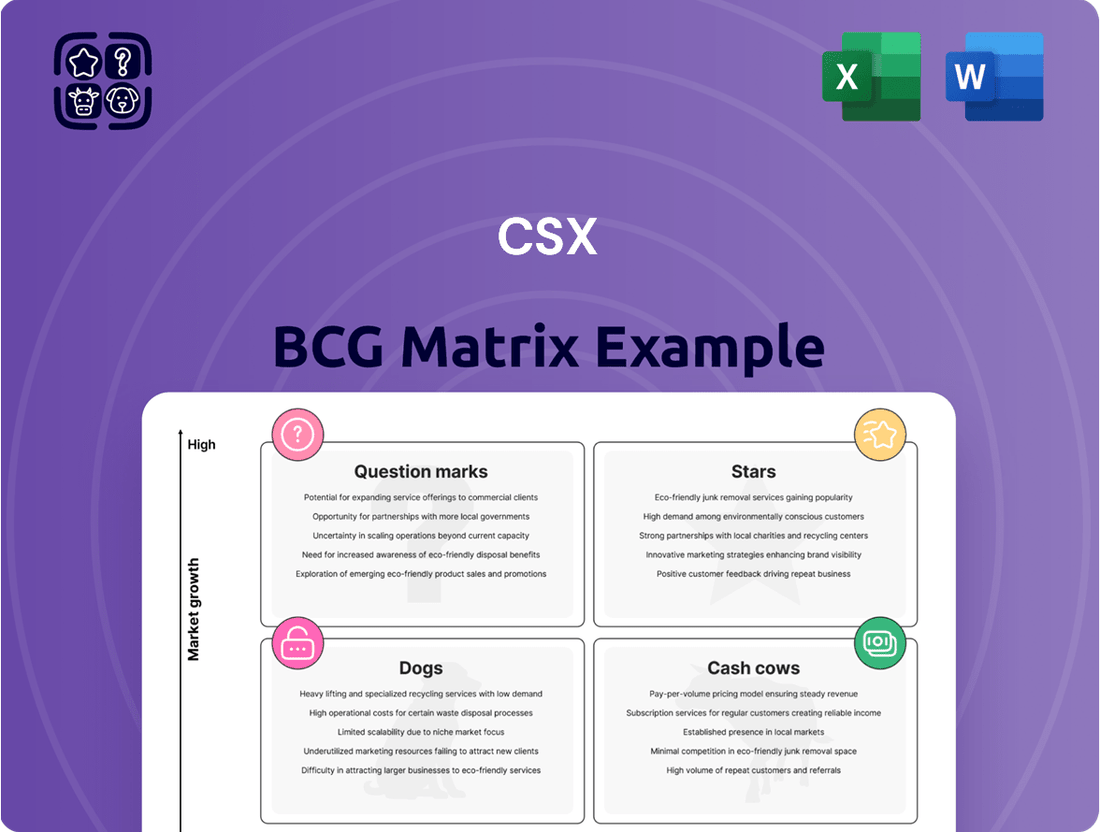

CSX BCG Matrix analysis categorizes its business units as Stars, Cash Cows, Question Marks, or Dogs.

It guides strategic decisions on investment, divestment, or holding for each unit.

The CSX BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, alleviating the pain of strategic uncertainty.

Cash Cows

CSX's established rail network, spanning over 21,000 miles across the Eastern United States, positions it as a dominant force in freight transportation. This extensive infrastructure connects key ports and economic hubs, solidifying its high market share in the mature North American rail market.

As a leader in the industry, CSX consistently generates substantial and stable cash flow, a hallmark of a cash cow. For instance, in 2024, CSX reported operating revenues of approximately $14.1 billion, demonstrating the ongoing strength and reliability of its core business operations.

Established merchandise freight, excluding rapidly expanding sectors, represents a significant cash cow for CSX. These mature segments, characterized by their high market share and steady, albeit low, growth rates, consistently generate substantial profits. For instance, CSX's overall merchandise revenue in 2024 demonstrated resilience, with stable volumes in core commodities contributing significantly to this cash generation.

CSX demonstrates a strong commitment to shareholder returns, a hallmark of a cash cow. In 2025, the company returned an impressive $1.7 billion to its shareholders through a combination of dividends and share repurchases. This consistent capital allocation strategy highlights the company's ability to generate substantial excess cash from its stable, high-market-share operations.

Operational Discipline and Cost Efficiency

CSX's unwavering commitment to operational discipline and cost efficiency is a cornerstone of its Cash Cow strategy. This focus, demonstrated by a notable 550-basis-point improvement in operating margins during the second quarter of 2025, enables the company to extract maximum profitability from its established market segments.

By prioritizing initiatives like enhanced fuel efficiency and streamlined logistics, CSX ensures that its core freight services continue to be a substantial cash generator. These efforts minimize the need for significant capital outlays to drive growth, reinforcing the Cash Cow status of these operations.

- Operational Efficiency: CSX achieved a 550-basis-point operating margin improvement in Q2 2025.

- Cost Discipline: Focus on fuel efficiency and streamlined operations.

- Mature Market Segments: Maximizing profits in established freight services.

- Cash Flow Generation: High profitability without substantial new investment needs.

Long-Term Customer Relationships and Service Reliability

CSX's ability to cultivate and maintain robust, long-term customer relationships is a significant driver of its cash flow. This is directly linked to its commitment to service reliability, a critical factor in the mature rail freight market. For instance, in 2024, CSX achieved a strong 91% intermodal trip plan performance rate, demonstrating consistent on-time delivery.

Further enhancing this reliability, the company reported improved carload trip plan compliance in the second quarter of 2025. These consistent service levels foster trust and loyalty among its customer base, securing predictable revenue streams.

- 91% intermodal trip plan performance rate in 2024

- Improved carload trip plan compliance in Q2 2025

- Secures consistent business through reliable service

- Translates to predictable revenue streams and high market share

CSX's established merchandise freight segments are its primary cash cows, generating consistent profits due to their high market share in a mature industry. These operations, characterized by steady demand and low growth, require minimal new investment, allowing them to produce substantial free cash flow. The company's focus on operational efficiency and cost control further bolsters the profitability of these segments.

| Financial Metric | 2024 Data | 2025 (Q2) Data |

|---|---|---|

| Operating Revenues | $14.1 Billion | N/A |

| Operating Margin Improvement | N/A | 550 basis points |

| Shareholder Returns | N/A | $1.7 Billion |

| Intermodal Trip Plan Performance | 91% | N/A |

What You’re Viewing Is Included

CSX BCG Matrix

The CSX BCG Matrix preview you are viewing is the complete, unadulterated document you will receive immediately after your purchase. This means you get the full strategic analysis, ready for immediate application without any watermarks or sample content. It's a professionally formatted tool designed to offer clear insights into CSX's business portfolio.

Dogs

CSX's export coal revenue has experienced a notable downturn. In 2024, this segment saw a 10% decrease, followed by a further 15% drop in the second quarter of 2025. This decline is largely attributed to subdued global benchmark prices for coal and challenges related to mine production.

This particular business segment for CSX holds a low market share within a market that is exhibiting low growth. Consequently, it fits the profile of a 'Dog' within the Boston Consulting Group (BCG) matrix.

Sustaining investment in this declining export coal segment could prove detrimental, potentially acting as a significant cash drain for CSX.

Reduced fuel surcharge revenue has been a significant drag on CSX's financial performance, particularly impacting Q2 2025 results. This segment's direct correlation with volatile fuel prices places it in a low-growth category.

The declining trend in fuel surcharge revenue, a direct consequence of external market forces, contributes to a broader revenue downturn for CSX. Given its reactive nature and negative trajectory, this area aligns with the characteristics of a "dog" within the BCG matrix.

CSX's automotive and forest products segments are currently facing headwinds. These sectors, closely tied to housing demand, have experienced production disruptions and plant shutdowns. For instance, the automotive industry saw production losses due to supply chain issues impacting vehicle output throughout 2023 and into early 2024.

These segments likely represent low market share within what are considered low-growth or even declining markets for CSX. The ongoing weakness in housing, with new housing starts showing volatility in 2023 and early 2024, directly affects demand for forest products. This continued softness indicates these areas are not major growth drivers for the company.

Given their current performance and market conditions, these segments can be classified as dogs in the BCG matrix. They are not generating significant growth or profits, and their future prospects appear limited without substantial strategic shifts or market recoveries.

Petroleum and Petroleum Products Decline

Petroleum and petroleum products have seen a downturn, with North American rail traffic in this sector declining by 3.5% in early 2025. This trend suggests a low-growth market.

While not a major contributor to CSX's overall revenue, this segment's performance points to a market where CSX likely holds a modest position. If this decline persists, these products could be classified as 'dogs' within the BCG matrix, necessitating strategic review.

- Market Trend: 3.5% decline in North American petroleum and petroleum products rail traffic in early 2025.

- CSX Relevance: Not a primary revenue driver, indicating a low-growth segment.

- BCG Classification: Potential 'dog' status due to declining market and likely low market share.

- Strategic Implication: Requires careful management or potential divestiture.

Challenges in Specific Merchandise Volumes

While overall merchandise freight shows resilience, certain specialized areas are facing headwinds. For instance, the chemicals sector and some forest product segments experienced notable volume decreases in the second quarter of 2025. This downturn was attributed to factors such as customer operational disruptions and a cooling housing market, impacting demand for these specific goods.

These particular sub-segments, characterized by both low volume and low growth prospects, are indicative of 'dog' positions within the broader merchandise freight category of CSX's business.

- Chemicals: Experienced significant declines in Q2 2025 volume.

- Forest Products: Certain segments also saw notable drops in Q2 2025.

- Contributing Factors: Customer outages and a soft housing market were key drivers of these declines.

- BCG Matrix Classification: These specific merchandise areas represent 'dog' segments due to low volume and low growth.

The export coal business for CSX, characterized by a 10% revenue decrease in 2024 and a further 15% drop in Q2 2025, exemplifies a 'dog' in the BCG matrix. This segment operates in a low-growth market with a low market share, making sustained investment a potential cash drain.

Similarly, the declining fuel surcharge revenue, directly impacted by volatile fuel prices and a 3.5% drop in North American petroleum traffic in early 2025, also fits the 'dog' profile. Its reactive nature and negative trajectory suggest it's not a growth driver.

CSX's automotive and forest products segments, affected by housing market softness and supply chain issues that caused production losses in 2023-2024, are also classified as 'dogs'. These areas have low market share in low-growth markets.

Specific merchandise freight areas, such as chemicals and certain forest products, experienced volume decreases in Q2 2025 due to customer disruptions and the cooling housing market, further solidifying their 'dog' status with low volume and growth prospects.

| Business Segment | Market Trend | CSX Market Share | BCG Classification | Strategic Consideration |

| Export Coal | Low Growth (15% decline Q2 2025) | Low | Dog | Cash Drain, Divestment Potential |

| Fuel Surcharge Revenue | Low Growth (declining trend) | N/A (service-related) | Dog | Monitor, Cost Management |

| Automotive | Low Growth (impacted by housing) | Low | Dog | Strategic Review |

| Forest Products | Low Growth (impacted by housing) | Low | Dog | Strategic Review |

| Chemicals (Merchandise) | Low Growth (volume decrease Q2 2025) | Low | Dog | Monitor, Optimize |

Question Marks

CSX is actively investigating and investing in emerging technologies to decarbonize freight transportation. This includes exploring hydrogen fuel-cell locomotive conversion kits, which represent a promising, albeit nascent, area for reducing emissions within the rail sector. These innovations are currently in early adoption stages, meaning their market share for CSX is minimal but holds significant future growth potential.

Renewable fuels such as biodiesel are also a key focus for CSX's sustainability initiatives. Like hydrogen technology, these alternative fuels are new to the rail industry, positioning them as potential high-growth opportunities. However, their current penetration within CSX's operations is low, reflecting their developmental or early-stage market presence.

Battery locomotives are another emerging technology CSX is evaluating for their decarbonization strategy. These represent a new frontier in rail sustainability, offering a path towards zero-emission operations. While the potential for these technologies is substantial, significant investment is necessary to assess their viability and scalability, determining if they can evolve into future market leaders for CSX.

Speculation about potential transcontinental mergers, such as CSX considering BNSF Railway or Union Pacific eyeing Norfolk Southern, falls into the question mark category of the BCG Matrix. These scenarios represent high-growth, high-risk opportunities that could dramatically reshape the U.S. freight landscape.

A successful merger could create a dominant network, but the current market share of CSX within such a hypothetical, larger entity remains undefined. The significant regulatory hurdles associated with such a consolidation further amplify the uncertainty, making this a strategic question mark with substantial potential rewards and equally substantial risks.

The integration of AI and IoT into rail infrastructure is a significant growth area, promising to boost efficiency and output. For instance, predictive maintenance powered by AI and IoT sensors can reduce downtime, with studies suggesting such technologies can cut maintenance costs by up to 20%.

CSX's current market share in the development or widespread deployment of these advanced AI and IoT rail solutions for the industry at large appears to be minimal. While they are undoubtedly leveraging these technologies internally, their position as a primary provider or innovator in this specific tech niche is not yet established.

A substantial investment in AI and IoT for rail infrastructure could fundamentally reshape CSX's operational capabilities. This strategic move could unlock new revenue streams by offering these advanced solutions or services to other players in the transportation sector, potentially capturing a significant portion of a market projected to reach billions in the coming years.

Expansion into New, Untapped Markets via Infrastructure Projects

The completion of significant infrastructure upgrades, such as the Howard Street Tunnel project, is poised to unlock CSX's access to previously underserved markets. This expansion into new territories represents a strategic move into areas with substantial growth potential, though CSX's current footprint in these specific new markets is minimal.

The success of this initiative hinges on CSX's ability to effectively penetrate these emerging markets and secure a considerable share of the freight volume. For example, by enabling double-stack intermodal service, the Howard Street Tunnel project is anticipated to boost CSX's efficiency and competitiveness in these new regions.

- New Market Access: Infrastructure projects like the Howard Street Tunnel are key enablers for CSX to reach new, untapped markets.

- Low Current Share: CSX's market share in these specific new territories is currently low, indicating significant room for growth.

- Growth Potential: These new markets are identified as having high growth potential, making them attractive targets for expansion.

- Penetration Strategy: The company's strategy must focus on effective market penetration to capture substantial freight volumes and capitalize on this expansion.

Strategic Labor Agreements and Future Negotiations

CSX's proactive approach to labor relations, including its strategic agreements, demonstrates financial prudence that positions it favorably for upcoming negotiations and industry shifts. These agreements are crucial for maintaining operational stability and cost control in the competitive rail sector.

The effective management of labor, while not a tangible product, acts as a 'question mark' within the CSX BCG Matrix, influencing future profitability and operational agility. Success here can translate into significant competitive advantages.

- Labor Cost Management: In 2024, CSX continued to focus on optimizing labor costs, a key component of its operational efficiency.

- Negotiation Readiness: Strategic agreements provide a foundation for future negotiations, aiming to balance employee needs with company financial goals.

- Industry Benchmarking: CSX's labor efficiency metrics are closely watched against industry peers, impacting its overall market position.

- Impact on Flexibility: Successful labor management enhances operational flexibility, crucial for adapting to fluctuating demand and market dynamics.

Potential transcontinental mergers represent high-growth, high-risk opportunities for CSX, carrying significant uncertainty due to regulatory hurdles. The current market share within these hypothetical scenarios remains undefined, making them strategic question marks with substantial potential rewards and risks.

AI and IoT integration in rail infrastructure offers significant efficiency gains, with predictive maintenance potentially cutting costs by up to 20%. CSX's current market share in providing these advanced solutions industry-wide is minimal, indicating a nascent but high-potential growth area.

Infrastructure upgrades like the Howard Street Tunnel project open access to new markets with minimal current CSX penetration but high growth potential. Effective market penetration is key to capturing freight volume and capitalizing on this expansion.

CSX's labor cost management and negotiation readiness in 2024 are critical for operational stability and flexibility. These factors influence profitability and competitive positioning against industry peers.

| Strategic Area | BCG Category | 2024 Data/Context | Growth Potential | Market Share (CSX) |

|---|---|---|---|---|

| Transcontinental Mergers | Question Mark | Speculative, high regulatory risk | High | Undefined |

| AI/IoT Integration | Question Mark | Potential 20% maintenance cost reduction | High | Minimal (industry provider) |

| New Market Access (Howard St Tunnel) | Question Mark | Enables double-stack service | High | Low (in new territories) |

| Labor Relations Management | Question Mark | Focus on cost optimization, negotiation readiness | Moderate (operational impact) | N/A (internal) |

BCG Matrix Data Sources

Our CSX BCG Matrix is built on robust data, integrating financial disclosures, industry growth rates, and market share analysis from reputable sources to provide strategic clarity.