China Shipbuilding Industry PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Shipbuilding Industry Bundle

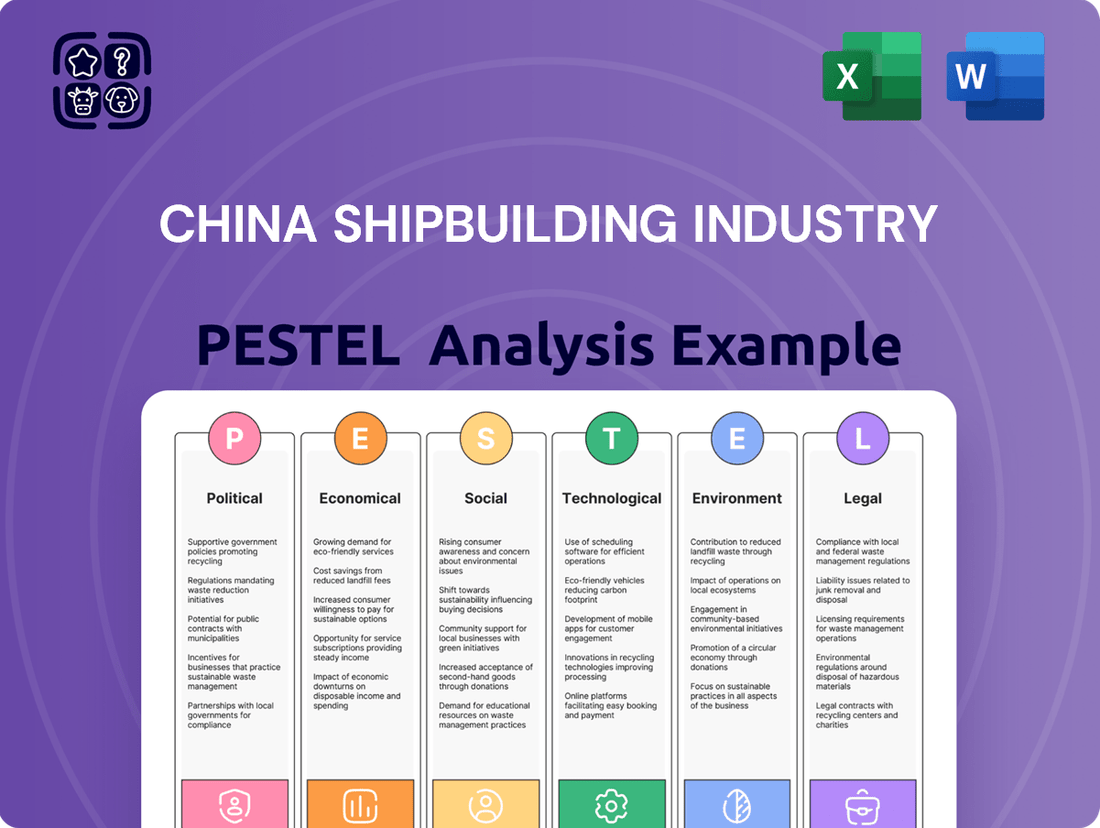

Navigate the complex landscape of China's shipbuilding industry with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its future. Equip yourself with the knowledge to make informed strategic decisions and gain a competitive advantage.

Unlock actionable insights into the forces driving change in China's shipbuilding sector. Our expert-crafted PESTLE analysis provides a deep dive into regulatory shifts, economic trends, and technological advancements. Download the full report now to gain a strategic edge.

Political factors

The Chinese government's robust support for its shipbuilding sector, including entities like CSSC, is a cornerstone of its industrial policy. This backing manifests through substantial subsidies, strategic planning, and preferential financial arrangements, all designed to elevate China's global maritime standing and strengthen its defense infrastructure.

In 2023, China's shipbuilding output reached 43.4 million gross tons, accounting for over 50% of the global market share, underscoring the effectiveness of these state-driven initiatives. Government incentives, such as tax rebates and access to low-interest loans, continue to fuel this growth, enabling companies to invest heavily in technological advancements and capacity expansion.

China State Shipbuilding Corporation (CSSC) is central to the People's Liberation Army Navy's (PLAN) modernization efforts, serving as its principal shipbuilding partner. The PLAN's ambitious expansion, aiming for a blue-water navy, directly fuels substantial orders for advanced warships and support vessels for CSSC. This strategic alignment guarantees consistent demand for CSSC's capabilities in constructing everything from aircraft carriers to submarines, underpinning its financial stability and technological advancement.

Rising geopolitical tensions, particularly between China and Western nations, alongside ongoing disputes in the South China Sea, present significant challenges for China Shipbuilding Industry (CSSC). These tensions can disrupt CSSC's international operations and complicate its global supply chains, impacting the procurement of essential materials and technologies. For instance, the ongoing trade friction between the US and China, which saw tariffs imposed on various goods, could potentially extend to shipbuilding components, affecting costs and availability.

Trade disputes and the threat of sanctions could restrict CSSC's access to critical foreign-sourced components, such as advanced marine engines or specialized electronic systems, and also limit its ability to export certain high-value vessels to key international markets. This situation is compounded by the fact that China's shipbuilding sector relies on a globalized supply chain for specialized equipment. In 2023, China's total export value of shipbuilding products reached approximately $40 billion, a figure that could be vulnerable to trade restrictions.

Conversely, these geopolitical pressures may also serve as a catalyst for accelerated domestic innovation and a drive towards greater self-reliance within China's shipbuilding industry. The push for technological independence could lead to increased investment in research and development for indigenous component manufacturing, potentially strengthening CSSC's long-term competitive position by reducing reliance on foreign suppliers.

Belt and Road Initiative (BRI)

The Belt and Road Initiative (BRI) significantly boosts demand for maritime transport and port infrastructure, creating substantial opportunities for China Shipbuilding Industry Corporation (CSSC). As a central element of China's maritime ambitions, CSSC is well-positioned to capitalize on BRI-driven development, potentially securing new commercial shipbuilding contracts and expanding its international presence. This global infrastructure push inherently encourages greater international cooperation in maritime logistics, benefiting large-scale shipbuilding enterprises.

CSSC's role in BRI projects is expected to grow, aligning with China's strategic vision for global connectivity. The initiative's focus on developing trade routes and infrastructure across Asia, Africa, and Europe translates directly into increased needs for vessels and port equipment. For instance, the ongoing expansion of ports under BRI, such as the development of the Gwadar Port in Pakistan and the Hambantota Port in Sri Lanka, underscores the demand for maritime infrastructure and the vessels that service it.

- Increased Demand: BRI is projected to stimulate a significant increase in global trade volumes, directly impacting the need for new and larger cargo vessels.

- Global Footprint Expansion: CSSC can leverage BRI projects to establish stronger relationships with participating nations, leading to future shipbuilding orders and service contracts.

- Maritime Logistics Enhancement: The initiative's focus on improving port efficiency and connectivity necessitates advanced shipbuilding capabilities for container ships, bulk carriers, and specialized vessels.

International Regulations and Diplomatic Relations

Compliance with international maritime conventions, such as those set by the International Maritime Organization (IMO), is crucial for China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (CSSC) to operate globally. For instance, the IMO's 2023 Greenhouse Gas Strategy aims to achieve net-zero GHG emissions from international shipping by or around 2050, requiring significant technological advancements and investments from shipbuilders. The state of diplomatic relations directly impacts CSIC's and CSSC's ability to secure international contracts and access foreign markets.

Changes in global shipping regulations, like stricter environmental standards or safety protocols, can create barriers to market access or necessitate costly upgrades for Chinese shipyards. Conversely, favorable diplomatic relations can unlock new markets and foster strategic partnerships, as seen with China's Belt and Road Initiative, which has spurred demand for maritime infrastructure and vessel construction.

- IMO 2023 GHG Strategy: Mandates significant emissions reductions, impacting vessel design and fuel choices for global shipyards, including those in China.

- Trade Agreements: Favorable trade agreements can boost export opportunities for Chinese-built vessels and components, enhancing market access.

- Geopolitical Tensions: Strained diplomatic ties can lead to sanctions or trade restrictions, potentially impacting supply chains and contract awards for major shipbuilding entities like CSSC.

- International Collaboration: Diplomatic efforts can facilitate joint ventures and technology transfer, strengthening China's position in the global shipbuilding market.

The Chinese government's strategic direction heavily influences the shipbuilding industry, with policies prioritizing national defense and economic growth. State-owned enterprises like CSSC receive substantial backing, including subsidies and preferential financing, to bolster their capabilities and global market share. In 2023, China solidified its dominance, capturing over 50% of the global shipbuilding market, a testament to these state-driven initiatives.

Geopolitical tensions, particularly with Western nations, pose challenges by potentially disrupting supply chains and limiting access to critical technologies. However, these pressures also encourage domestic innovation and self-reliance, as seen in the drive for indigenous component manufacturing. The Belt and Road Initiative further stimulates demand for maritime transport, offering CSSC opportunities for international expansion and new commercial contracts.

International maritime regulations, such as the IMO's 2023 Greenhouse Gas Strategy targeting net-zero emissions by 2050, necessitate significant investment in new technologies and vessel designs. Diplomatic relations directly impact market access and the potential for strategic partnerships, influencing CSSC's ability to secure global contracts and navigate trade agreements.

| Factor | Impact on China Shipbuilding Industry | Key Data/Trend (2023-2025) |

| Government Support & Industrial Policy | Drives capacity expansion, technological advancement, and global market share. | China's shipbuilding output exceeded 50% of global market share in 2023. |

| Geopolitical Tensions & Trade Disputes | Risks supply chain disruption and restricted access to foreign components; spurs domestic innovation. | Potential tariffs on shipbuilding components could impact costs and availability. |

| Belt and Road Initiative (BRI) | Increases demand for vessels and port infrastructure, fostering international expansion. | Ongoing port development under BRI creates demand for maritime logistics and vessels. |

| International Regulations (e.g., IMO GHG Strategy) | Requires investment in greener technologies and new vessel designs. | IMO's 2023 GHG Strategy mandates net-zero emissions by circa 2050. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors shaping the China Shipbuilding Industry, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by highlighting key trends, potential challenges, and emerging opportunities within this dynamic sector.

A concise PESTLE analysis of China's shipbuilding industry offers a clear roadmap to navigate complex external forces, transforming potential challenges into strategic opportunities for growth and resilience.

Economic factors

Global demand for new ships, a key driver for shipbuilding giants like CSSC, is closely tied to international trade volumes, commodity prices, and the natural aging of existing fleets. For instance, in 2023, the global maritime trade volume saw a slight increase, signaling a steady, albeit cautious, demand for shipping capacity, which directly benefits order books.

Worldwide economic growth rates significantly shape the need for different vessel types. A strong global economy in 2024 and projected into 2025 typically boosts demand for bulk carriers transporting raw materials and container ships carrying manufactured goods, leading to increased newbuild orders for shipyards.

The cost of key inputs like steel, a primary material for shipbuilding, directly impacts China State Shipbuilding Corporation (CSSC)'s bottom line. For instance, global steel prices experienced fluctuations throughout 2023 and into early 2024, with benchmarks like the TSI China Steel Price Index showing periods of upward pressure due to demand and supply dynamics.

Similarly, the price of marine equipment and advanced components, whether sourced from domestic suppliers or international markets, adds another layer of cost variability. Disruptions in global supply chains, as seen in recent years, can further exacerbate these costs, making consistent pricing a challenge for CSSC.

Effective management of these raw material and component expenses is therefore paramount for CSSC to maintain competitive pricing in the global shipbuilding market and ensure sustained profitability.

Exchange rate fluctuations significantly impact China Shipbuilding Industry Corporation (CSIC), a major exporter. For instance, in late 2023 and early 2024, the Chinese Yuan experienced some volatility against the US Dollar. A stronger Yuan, as seen at times in 2024, can increase the cost of Chinese vessels for international clients, potentially impacting CSIC's order book and competitiveness in the global market.

Conversely, a weaker Yuan, which has also occurred, can make CSIC's shipbuilding services more attractive and cost-effective for overseas buyers. This can lead to increased export orders and improved profitability for the company, especially considering that a substantial portion of CSIC's revenue is denominated in foreign currencies.

Labor Costs and Productivity

Rising labor costs in China present a challenge for the shipbuilding industry, potentially affecting the competitive edge of major players like CSSC against shipyards in nations with lower wage structures. For instance, average manufacturing wages in China have seen consistent growth, impacting overall operational expenses.

However, significant investments in automation and advanced manufacturing technologies are being made to enhance labor productivity. These technological upgrades aim to streamline production processes and improve efficiency, thereby mitigating the impact of increased labor expenses. By integrating robotics and AI, shipyards can achieve higher output with fewer resources.

The availability of a skilled workforce remains a critical factor in maintaining operational efficiency and ensuring high-quality output. China's focus on vocational training and education in shipbuilding disciplines is crucial for meeting the demand for specialized skills.

- Wage Growth: Average manufacturing wages in China continued their upward trend through 2024, although the pace of growth may moderate.

- Automation Investment: Leading Chinese shipyards are significantly increasing capital expenditure on automated welding, painting, and assembly lines.

- Productivity Gains: Industry reports suggest that adoption of advanced manufacturing techniques can lead to productivity improvements of 10-15% in specific production stages.

- Skills Gap: While overall labor availability is high, a persistent need exists for highly specialized engineers and technicians in advanced shipbuilding sectors.

Access to Financing and Subsidies

The China State Shipbuilding Corporation (CSSC) relies heavily on robust access to financing and government subsidies to fuel its ambitious large-scale projects. State-owned banks play a pivotal role in providing the substantial capital required for these endeavors, often with favorable terms. For instance, in 2023, China's shipbuilding sector received significant financial backing, with policy banks and commercial lenders extending considerable credit lines to support shipbuilding enterprises and their order books.

Government subsidies are equally crucial, acting as a vital mechanism to mitigate the immense financial burden and inherent risks associated with massive capital expenditures in shipbuilding. These subsidies can directly reduce project costs or offer incentives for innovation and green technology adoption, thereby enhancing the competitiveness of Chinese shipyards on the global stage. The Chinese government has consistently prioritized the shipbuilding industry, evidenced by ongoing financial support programs aimed at maintaining its leading position.

The availability and specific terms of this financing and subsidy landscape are therefore critical determinants for CSSC's ability to initiate new shipbuilding projects and effectively manage its ongoing cash flow. Fluctuations in these support structures can directly impact project timelines and overall financial health.

- State-backed financing: CSSC's major projects are often financed through loans from major Chinese state-owned banks, ensuring capital availability for large-scale construction.

- Government subsidies: Direct financial support from the Chinese government helps offset the high costs of research, development, and production in the shipbuilding sector.

- Impact on cash flow: The accessibility and conditions of financing directly influence CSSC's ability to manage its liquidity and undertake new contracts.

- Risk mitigation: Subsidies and preferential financing reduce the financial risk for CSSC, enabling it to pursue more complex and capital-intensive projects.

Global economic growth directly influences the demand for shipping services, which in turn drives new shipbuilding orders. In 2023, global GDP growth was around 3%, and projections for 2024 suggest a similar or slightly lower rate, impacting the volume of goods transported and the need for new vessels.

Fluctuations in commodity prices, particularly for steel, significantly affect shipbuilding costs. For example, the average price of steel plates for shipbuilding in China saw a notable increase in late 2023 and early 2024, impacting the profitability of new contracts.

Exchange rate volatility, especially between the Chinese Yuan and the US Dollar, influences the cost competitiveness of Chinese shipbuilders for international clients. A stronger Yuan in 2024 made Chinese vessels more expensive for overseas buyers.

| Economic Factor | 2023 Data Point | 2024 Projection/Trend | Impact on Shipbuilding |

|---|---|---|---|

| Global GDP Growth | ~3.0% | Slightly lower or similar to 2023 | Influences demand for shipping capacity |

| Steel Plate Prices (China) | Increased in late 2023 | Volatile, with upward pressure | Directly impacts construction costs |

| USD/CNY Exchange Rate | Fluctuating | Yuan strengthened at times in 2024 | Affects export competitiveness |

Full Version Awaits

China Shipbuilding Industry PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the China Shipbuilding Industry delves into Political, Economic, Social, Technological, Legal, and Environmental factors shaping its landscape. You'll gain insights into government policies, market trends, labor dynamics, innovation, regulatory frameworks, and sustainability initiatives impacting this vital sector.

Sociological factors

The availability of a skilled workforce, encompassing engineers, designers, and experienced shipyard workers, is crucial for China State Shipbuilding Corporation (CSSC)'s operational efficiency and its capacity for innovation. China's demographic shifts, including an aging population, present a potential challenge in attracting and retaining the necessary talent for this specialized industry.

To counter these demographic trends and maintain a competitive edge, CSSC must invest in continuous training and development programs. This ensures existing expertise is kept current and new generations of workers acquire the advanced skills needed for shipbuilding advancements, especially as the average age of China's workforce continues to rise, projected to be around 40 years old by 2025.

China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (CSSC) are increasingly prioritizing stringent health and safety standards. This focus is vital not only for the well-being of their workforce but also to maintain operational efficiency and a positive corporate image. A strong safety record directly impacts productivity and can prevent costly disruptions.

Failure to meet these standards can result in significant penalties, including substantial regulatory fines and potential labor disputes, which can severely damage a company's reputation. For instance, in 2023, China's Ministry of Emergency Management reported a reduction in workplace accidents across various heavy industries, reflecting a broader governmental push for improved safety compliance.

CSSC, in particular, must rigorously adhere to both national safety regulations, such as those set by the Ministry of Transport, and international maritime safety protocols to effectively manage and mitigate operational risks inherent in shipbuilding.

Growing global awareness of Corporate Social Responsibility (CSR) means that stakeholders, including customers, investors, and the public, increasingly expect companies like China Shipbuilding Industry Corporation (CSIC) to operate ethically and sustainably. This encompasses fair labor practices, community engagement, and transparent governance, all of which are becoming critical decision-making factors for socially conscious investors. For instance, in 2024, ESG (Environmental, Social, and Governance) funds saw significant inflows, indicating a strong market preference for companies demonstrating robust CSR commitments.

A strong CSR profile can significantly enhance brand reputation and attract socially conscious investors. CSIC's efforts in environmental protection, such as reducing emissions in its shipbuilding processes, and its contributions to local communities through job creation and social programs, are increasingly scrutinized. Companies that fail to meet these evolving expectations risk reputational damage and potential divestment from portfolios prioritizing sustainability, as evidenced by the growing number of shareholder resolutions focused on ESG performance in the maritime sector.

Consumer and Industry Preferences for Shipping

Consumer and industry preferences are significantly reshaping the shipbuilding landscape, particularly for giants like China State Shipbuilding Corporation (CSSC). There's a clear shift towards vessels that are not only efficient but also environmentally friendly and equipped with advanced digital technologies. This evolving demand directly impacts CSSC's product development strategies.

Shippers and cargo owners are increasingly factoring in environmental performance and smart capabilities when placing new vessel orders. For instance, the International Maritime Organization's (IMO) 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, pushing shipbuilders to innovate in areas like alternative fuels and energy-saving designs. This trend means CSSC must prioritize green and smart ship technologies.

- Growing demand for eco-friendly vessels: Driven by regulations and corporate sustainability goals, the market is favoring ships powered by cleaner fuels like LNG, methanol, and ammonia.

- Emphasis on digitalization and automation: Smart ship technologies, including advanced navigation systems, predictive maintenance, and remote monitoring, are becoming key selling points.

- Efficiency as a core requirement: Fuel efficiency remains paramount, with owners seeking designs that minimize operational costs and carbon footprints.

Urbanization and Infrastructure Development

China's rapid urbanization, with over 65% of its population now living in cities as of 2023, fuels significant demand for enhanced marine infrastructure. This surge necessitates the construction of new ports and the expansion of existing ones, directly boosting the need for specialized vessels like dredgers and tugboats, areas where CSSC holds considerable expertise. For instance, the ongoing development of the Guangdong-Hong Kong-Macao Greater Bay Area involves massive port upgrades, creating substantial opportunities for shipbuilding companies.

However, this relentless urban expansion also presents challenges for the shipbuilding industry. The competition for land and resources intensifies, potentially impacting the availability and cost of space for shipyard operations and expansion. By 2024, coastal land acquisition for industrial development, including shipyards, faces increasing scrutiny and higher costs due to environmental regulations and competing urban land-use needs.

- Urbanization Drives Demand: Over 65% of China's population resides in urban areas as of 2023, increasing the need for port infrastructure and associated vessels.

- Infrastructure Projects: Major initiatives like the Greater Bay Area development create direct demand for dredgers, tugboats, and other support vessels.

- Resource Competition: Urban expansion intensifies competition for land and resources, potentially increasing operational costs for shipyards.

- Regulatory Impact: Stricter land-use and environmental regulations in 2024 add complexity to shipyard site selection and expansion.

China's demographic shifts, including an aging workforce, necessitate investment in training to maintain a skilled talent pool for shipbuilding, especially as the average age nears 40 by 2025. Growing expectations for Corporate Social Responsibility (CSR) mean companies must prioritize ethical labor and environmental practices, with ESG funds seeing significant inflows in 2024, highlighting market preference for sustainable operations.

Technological factors

China's shipbuilding sector is heavily embracing automation and smart manufacturing to boost efficiency and cut costs. By integrating robotics and advanced production techniques, shipyards are seeing significant improvements in build times and quality. For instance, China State Shipbuilding Corporation (CSSC) is a major player in this transition, investing billions in technologies like automated welding and assembly to construct increasingly sophisticated vessels.

China's shipbuilding sector is increasingly embracing digitalization and big data analytics to sharpen its competitive edge. By leveraging these technologies, companies can significantly optimize ship design processes, streamline production planning, and enhance the efficiency of operational maintenance. This strategic shift is crucial for maintaining global leadership in a rapidly evolving industry.

The integration of digital twins, predictive maintenance algorithms, and unified data platforms is revolutionizing decision-making within Chinese shipyards. These advancements lead to a notable reduction in operational downtime, directly boosting productivity and profitability. For instance, the adoption of AI in quality control can identify potential defects earlier, saving considerable resources in the long run.

This technological transformation positions China's shipbuilding industry as a pioneer in data-driven operations, moving beyond traditional manufacturing methods. In 2024, China's shipbuilding output continued its strong performance, accounting for a significant portion of global market share, with technological advancements being a key driver of this success.

China Shipbuilding Industry Corporation (CSIC), a major player, is heavily invested in green propulsion. The company is actively developing vessels that can utilize cleaner fuels like Liquefied Natural Gas (LNG), methanol, ammonia, hydrogen, and electric/hybrid systems. This focus is driven by increasingly stringent environmental regulations worldwide, pushing the industry towards sustainability.

CSIC's commitment to these alternative propulsion technologies is crucial for its future competitiveness. For instance, the International Maritime Organization (IMO) has set ambitious targets for reducing greenhouse gas emissions from shipping, with a goal of net-zero emissions by or around 2050. Vessels powered by these cleaner fuels are essential for meeting these targets, and CSIC's research and development in this area positions it as a leader in sustainable maritime solutions.

Autonomous and Smart Ship Technologies

China's shipbuilding industry, particularly through entities like China State Shipbuilding Corporation (CSSC), is heavily invested in autonomous and smart ship technologies. Research and development are accelerating in areas like advanced autonomous navigation systems, sophisticated remote control capabilities, and integrated smart ship features. This push aims to deliver vessels that are not only more efficient but also significantly safer, with the potential for crew-less operations in the coming years.

This technological evolution is a major long-term trend within the global maritime sector. By 2024, the global market for autonomous ships was projected to reach billions of dollars, with significant growth anticipated through 2030. CSSC's strategic focus on these advancements positions them to capitalize on this expanding market, offering innovative solutions that redefine maritime operations.

- Autonomous Navigation Systems: Development of AI-powered systems for path planning and obstacle avoidance.

- Remote Operation Centers: Establishing infrastructure for real-time monitoring and control of vessels.

- Smart Ship Features: Integration of IoT sensors and data analytics for predictive maintenance and optimized performance.

- Market Growth: The autonomous shipping market is expected to see substantial year-over-year growth in the 2024-2025 period.

Cybersecurity in Maritime Operations

The increasing digitalization of maritime operations, from vessel navigation to shipyard management, elevates cybersecurity to a critical concern. As China State Shipbuilding Corporation (CSSC) and its counterparts integrate more networked systems, the risk of cyberattacks, data theft, and operational shutdowns grows significantly.

CSSC's commitment to robust cybersecurity is essential for protecting its valuable intellectual property, sensitive operational technology, and customer information. This focus is not unique to CSSC; the entire global maritime sector is grappling with these escalating digital threats.

The maritime industry experienced a notable increase in cyber incidents in recent years. For instance, reports from 2023 indicated a substantial rise in ransomware attacks targeting shipping companies, leading to significant financial losses and operational delays. This trend underscores the urgent need for advanced cybersecurity investments.

- Increased Connectivity: Vessels and port facilities are becoming more interconnected, creating a larger attack surface for cyber threats.

- Data Protection: Safeguarding sensitive data, including design blueprints, operational logs, and client information, is paramount for national security and commercial advantage.

- Operational Resilience: Preventing disruptions to critical maritime infrastructure and supply chains requires strong defenses against cyber sabotage.

- Industry-Wide Concern: The International Maritime Organization (IMO) has emphasized the growing cybersecurity risks, urging member states and companies to implement comprehensive security measures.

Technological advancements are fundamentally reshaping China's shipbuilding industry, driving efficiency and innovation. The adoption of smart manufacturing, digital twins, and AI in quality control are key trends, with major players like CSSC investing heavily in these areas. By 2024, China's shipbuilding output continued its global dominance, with technology being a primary catalyst for this success.

Legal factors

Compliance with International Maritime Organization (IMO) regulations is paramount for China Shipbuilding Industry. For instance, the IMO 2020 sulfur cap, implemented in January 2020, mandated a significant reduction in sulfur content in marine fuels, impacting engine design and fuel choices for new builds and existing fleets. Similarly, the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII), phased in from 2023, require continuous improvements in operational efficiency, directly influencing ship design to meet stricter environmental performance standards.

China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (CSSC) are deeply integrated within China's domestic legal landscape. This includes adherence to corporate law, labor regulations, and stringent environmental protection mandates. For instance, China's Environmental Protection Law, significantly revised in 2015 and further strengthened with updated enforcement mechanisms, directly impacts shipbuilding operations by dictating emissions standards and waste management protocols, potentially increasing compliance costs.

Shifts in these domestic laws, such as potential amendments to labor laws concerning worker rights or the introduction of new national security legislation impacting technology transfer, can directly influence operational expenses and necessitate adjustments to business strategies. Government oversight is a critical element, with regulatory bodies actively enforcing compliance, as seen in the ongoing efforts to meet international maritime organization standards, which are often mirrored and enforced through domestic Chinese regulations.

China's commitment to strengthening intellectual property rights (IPR) is a significant legal factor for shipbuilding giants like CSSC. The nation's evolving legal framework aims to better protect proprietary ship designs, advanced engineering processes, and critical technological innovations, bolstering CSSC's competitive edge. For instance, China's Supreme People's Court reported a 20% increase in IPR-related cases filed in 2023, signaling increased enforcement.

Navigating the complex landscape of international IPR laws is paramount for CSSC, as infringement risks exist both within China and in overseas markets. This legal diligence extends to managing technology licensing agreements with foreign partners, ensuring compliance and safeguarding valuable intellectual assets. The China National Intellectual Property Administration (CNIPA) continues to refine policies to align with global standards, impacting cross-border technology transfers.

Trade Agreements and Sanctions

China's shipbuilding industry, including major players like China State Shipbuilding Corporation (CSSC), navigates a complex web of international trade agreements and geopolitical sanctions. These legal frameworks directly influence export opportunities and the procurement of essential components. For instance, the ongoing trade tensions and specific sanctions targeting certain technologies or nations can restrict CSSC's access to global markets or suppliers, impacting its revenue streams and production capabilities.

Compliance with these evolving regulations is paramount. CSSC must meticulously adhere to export control regimes and sanctions lists to prevent severe legal penalties, including fines and the loss of market access. Navigating these international legal landscapes presents significant challenges for a global enterprise like CSSC, requiring robust compliance programs and strategic adaptation to maintain operational integrity and market presence.

- Trade Agreements Impact: China's participation in agreements like the Regional Comprehensive Economic Partnership (RCEP) can offer preferential access to certain markets, but global trade disputes, such as those involving the EU or US, can create barriers for Chinese-built vessels.

- Sanctions and Export Controls: Companies must monitor and comply with sanctions imposed by bodies like the United Nations and individual countries, which can affect the sourcing of advanced shipbuilding materials or the sale of vessels to specific end-users.

- Compliance Costs: Maintaining compliance with a multitude of international legal frameworks necessitates significant investment in legal expertise, monitoring systems, and due diligence processes for CSSC and its partners.

Contract Law and Dispute Resolution

China Shipbuilding Industry Corporation (CSIC), now part of China State Shipbuilding Corporation (CSSC), navigates a complex web of contracts with global entities. Adherence to international contract law and robust dispute resolution are paramount for managing commercial risks. For instance, in 2024, the shipbuilding sector saw ongoing arbitration cases related to contract breaches and delivery disputes, highlighting the need for strong legal frameworks.

Effective dispute resolution mechanisms are critical for CSSC, which operates across multiple legal jurisdictions. This involves understanding and complying with varying national contract enforcement laws. The company’s international dealings mean that navigating cross-border litigation and arbitration, particularly concerning intellectual property and payment terms, remains a key operational consideration.

- Contractual Complexity: CSSC's operations involve intricate agreements with suppliers and clients worldwide, necessitating meticulous legal oversight.

- Jurisdictional Challenges: Enforcement of contracts across different national legal systems presents ongoing legal hurdles.

- Dispute Management: Proactive strategies for arbitration and litigation are essential to mitigate financial and reputational risks in international trade.

China's evolving legal landscape significantly impacts its shipbuilding sector, emphasizing environmental protection and intellectual property rights. For instance, the nation's commitment to IP protection saw a reported 20% increase in IPR-related cases filed in 2023, signaling enhanced enforcement by bodies like the China National Intellectual Property Administration (CNIPA).

The industry must also navigate international trade agreements and sanctions, which can affect market access and component sourcing. Compliance with regimes like the UN sanctions list is critical to avoid penalties and maintain operational integrity, influencing global revenue streams and production capabilities.

Contractual adherence and dispute resolution are paramount for shipbuilding giants like CSSC, especially in international dealings. The sector experienced ongoing arbitration cases in 2024 related to contract breaches, underscoring the need for robust legal frameworks to manage commercial risks across jurisdictions.

Environmental factors

Global pressure to curb shipping emissions is intensifying, with the International Maritime Organization (IMO) aiming for net-zero GHG emissions by or around 2050. This translates to stricter regulations on sulfur oxides (SOx) and nitrogen oxides (NOx), alongside a growing focus on carbon intensity reduction. China, as a major shipbuilding nation, is aligning with these global targets, pushing its shipyards to innovate.

China State Shipbuilding Corporation (CSSC) is directly impacted by these environmental shifts. They are tasked with developing and constructing vessels that meet these evolving standards, necessitating a move towards lower-carbon designs and the exploration of alternative, zero-emission fuels like methanol and ammonia. This is crucial for maintaining competitiveness in a market increasingly prioritizing sustainability.

China's shipbuilding industry faces significant environmental pressures related to pollution control and waste management. Managing air emissions like sulfur oxides (SOx) and nitrogen oxides (NOx) from vessel operations and manufacturing processes, alongside wastewater discharge and hazardous waste from repairs, is a major hurdle. For instance, in 2024, China's Ministry of Ecology and Environment continued to tighten emission standards for industrial facilities, including shipyards, pushing for advanced abatement technologies.

CSSC, a leading player, must invest heavily in pollution control systems and sustainable waste management to meet these evolving regulations. This includes adopting cleaner fuels, improving wastewater treatment capabilities, and ensuring the proper disposal of materials like paints, oils, and metal scraps. The financial commitment to environmental compliance is substantial, with many shipyards allocating a growing percentage of their capital expenditure to green initiatives, reflecting the increasing importance of environmental stewardship.

China Shipbuilding Industry Corporation (CSIC), now integrated into CSSC, faces scrutiny over its coastal operations' impact on marine biodiversity. Shipbuilding yards, especially those expanding, can disrupt vital habitats like mangroves and coral reefs. For instance, the expansion of shipbuilding facilities in coastal regions of Shandong province has raised concerns among environmental groups regarding potential damage to local marine life, particularly shellfish populations which are crucial to the regional economy.

Mitigating these effects is paramount for CSSC's long-term sustainability and regulatory compliance. Implementing rigorous environmental impact assessments (EIAs) for new construction and expansion projects is a critical step. In 2023, China's Ministry of Ecology and Environment emphasized stricter EIA requirements for coastal industrial projects, with penalties for non-compliance, pushing companies like CSSC to invest in advanced pollution control and habitat restoration technologies.

Noise pollution from construction and vessel traffic also poses a threat to marine mammals and fish. CSSC is exploring quieter construction methods and operational protocols to reduce underwater noise. Furthermore, the risk of accidental spills, though infrequent, necessitates robust emergency response plans. CSSC's commitment to adopting best practices, such as those outlined in the International Maritime Organization's environmental conventions, is essential for protecting these sensitive ecosystems.

Resource Efficiency and Circular Economy

China's shipbuilding sector is increasingly focused on resource efficiency, driven by global sustainability trends. This push aligns with circular economy principles, aiming to minimize waste and maximize material reuse throughout a ship's lifecycle. For instance, the industry is exploring the integration of recycled steel, which can significantly reduce the carbon footprint compared to virgin steel production.

Companies like China State Shipbuilding Corporation (CSSC) are strategically positioned to leverage these trends. By optimizing material usage during construction and designing vessels for easier disassembly and recycling, CSSC can lessen its dependence on primary resources. This approach not only benefits the environment but also offers potential cost savings and enhances long-term competitiveness. For example, advancements in welding technologies in 2024 are enabling more precise material application, further reducing waste.

- Increased Use of Recycled Materials: By 2025, the global shipbuilding industry is projected to see a 15% increase in the use of recycled metals, including steel and aluminum, in new vessel construction.

- Optimized Material Utilization: Advanced digital design and manufacturing techniques in 2024 have led to an average 8% reduction in material waste during the shipbuilding process.

- Design for Disassembly: A growing number of new ship designs are incorporating modular components, facilitating easier repair, upgrade, and end-of-life recycling, with a target of 90% material recovery.

- Circular Economy Investments: CSSC has announced plans to invest over $500 million by 2026 in research and development focused on circular economy solutions for shipbuilding.

Climate Change Adaptation and Resilience

Climate change poses direct physical risks to China State Shipbuilding Corporation (CSSC) operations. Rising sea levels and increased frequency of extreme weather events, such as typhoons and floods, can disrupt shipyard activities and damage critical maritime infrastructure. For instance, coastal regions where many shipyards are located are particularly vulnerable to sea-level rise, potentially impacting dry docks and port facilities.

CSSC must integrate climate resilience into its long-term facility planning and design strategies. This involves fortifying existing infrastructure and ensuring new constructions can withstand more severe environmental conditions. By 2025, investments in climate-resilient infrastructure are becoming a standard expectation for major industrial players globally.

Furthermore, the impact extends to vessel design. CSSC is increasingly tasked with building ships engineered for future operating environments, which may include altered weather patterns, changing sea states, and potentially new regulatory requirements related to emissions and environmental performance. This necessitates innovation in hull design, propulsion systems, and onboard technologies to ensure vessels remain efficient and safe in a changing climate.

- Physical Risks: Coastal shipyards face threats from sea-level rise and extreme weather, potentially impacting operational continuity and asset integrity.

- Resilient Infrastructure: CSSC's facility planning must prioritize climate resilience to safeguard operations against environmental shifts.

- Vessel Design Evolution: Ship designs need to adapt to future operating conditions, including altered weather patterns and stricter environmental standards.

Global pressure for decarbonization is significantly reshaping the shipbuilding industry. By 2050, the International Maritime Organization aims for net-zero greenhouse gas emissions, driving demand for greener vessels. China's shipbuilding sector, a global leader, is responding by focusing on energy efficiency and alternative fuels like methanol and ammonia. This shift requires substantial investment in new technologies and manufacturing processes.

China's shipyards are also grappling with stricter environmental regulations on pollution control and waste management. For instance, in 2024, China continued to tighten emission standards for industrial facilities, compelling shipyards to adopt advanced abatement technologies. CSSC, a major player, must invest in cleaner production methods and robust waste management systems to ensure compliance and maintain its competitive edge in a sustainability-conscious market.

The industry faces scrutiny regarding its impact on marine ecosystems, particularly from coastal operations. Expansion projects can threaten habitats like mangroves and coral reefs, as seen with concerns raised about facilities in Shandong province affecting shellfish populations. Implementing rigorous environmental impact assessments and investing in pollution control and habitat restoration are critical for long-term sustainability and regulatory adherence.

Resource efficiency and circular economy principles are increasingly influencing shipbuilding. The industry is adopting practices like using recycled steel, aiming to reduce waste and reliance on primary resources. CSSC plans to invest over $500 million by 2026 in R&D for circular economy solutions, reflecting a commitment to environmental stewardship and operational cost savings through optimized material utilization.

PESTLE Analysis Data Sources

Our China Shipbuilding Industry PESTLE Analysis is built on a robust foundation of data from official Chinese government ministries, international maritime organizations, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.