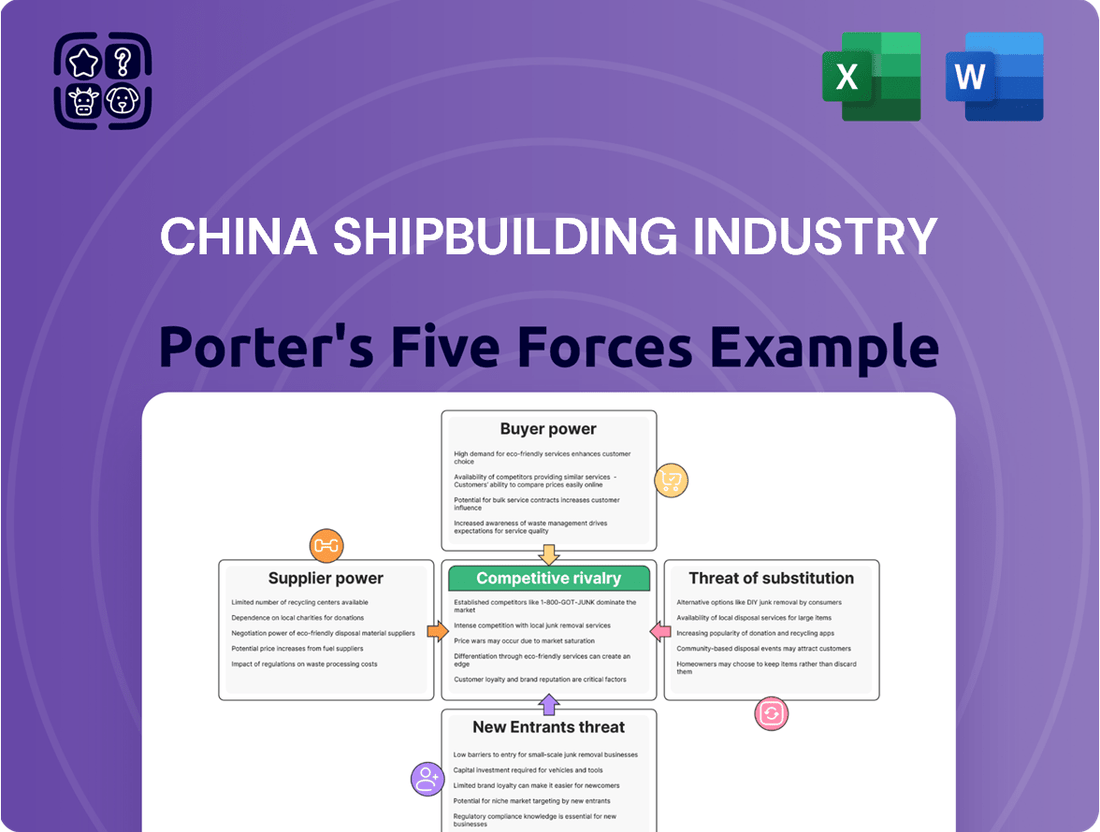

China Shipbuilding Industry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Shipbuilding Industry Bundle

The China Shipbuilding Industry faces intense competition, with significant bargaining power held by both buyers and suppliers. The threat of new entrants is moderate, yet the industry is constantly influenced by technological advancements and the availability of substitutes.

Ready to move beyond the basics? Get a full strategic breakdown of China Shipbuilding Industry’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The shipbuilding sector, including giants like China Shipbuilding Industry (CSSC), heavily depends on specialized inputs such as marine engines, sophisticated electronics, and particular steel grades. A market structure where only a handful of suppliers provide these essential materials grants them considerable leverage. This concentration allows these suppliers to potentially influence pricing and contractual conditions for CSSC.

For example, the global demand for shipbuilding steel is anticipated to see a rise in 2025. This increasing demand could strengthen the bargaining position of steel producers, enabling them to negotiate more favorable terms with shipbuilders, including CSSC.

For China State Shipbuilding Corporation (CSSC), switching suppliers in the complex shipbuilding industry is a significant undertaking. The process often necessitates costly re-engineering of vessel designs to accommodate new components, rigorous re-certification processes for those parts, and the establishment of entirely new logistical networks for procurement and delivery. These substantial hurdles translate into high switching costs for CSSC.

This elevated cost of changing vendors directly amplifies the bargaining power of CSSC's existing suppliers. For instance, specialized engine manufacturers or advanced navigation system providers, knowing the difficulty CSSC faces in finding and integrating alternatives, can leverage this situation to negotiate more favorable terms, potentially impacting CSSC's profitability and operational flexibility. As of 2024, the global shipbuilding market continues to see consolidation, which can further strengthen the position of key component suppliers.

The bargaining power of suppliers for China State Shipbuilding Corporation (CSSC) is significantly influenced by their role in ensuring product quality. If a supplier provides critical components that are essential for CSSC's reputation for reliability and adherence to stringent international maritime regulations, such as the International Maritime Organization's emission standards, that supplier possesses considerable leverage.

For instance, specialized engine manufacturers or advanced navigation system providers whose technology directly impacts a vessel's performance and compliance can command higher prices or more favorable terms. In 2023, the global shipbuilding industry saw continued demand for eco-friendly technologies, meaning suppliers of advanced propulsion systems and emissions control equipment held strong positions.

Forward Integration Threat from Suppliers

The threat of suppliers integrating forward into shipbuilding operations for China Shipbuilding Industry (CSSC) represents a potential, albeit less common, challenge. If a key supplier possesses the technological prowess or strategic ambition to start constructing vessels, it could directly compete with CSSC.

This scenario would not only diminish CSSC's bargaining power by creating a new competitor but also potentially disrupt established supply chains. For instance, a major engine manufacturer with advanced manufacturing capabilities could theoretically enter the shipbuilding market, leveraging its existing expertise.

- Forward Integration Threat: Suppliers might leverage their expertise to build ships, becoming direct competitors to CSSC.

- Reduced Reliance, Increased Competition: While this could reduce CSSC's dependence on certain suppliers, it introduces a new, potentially formidable rival.

- Industry Example: A hypothetical scenario involves a leading marine equipment supplier with advanced composite material production capabilities deciding to enter the shipbuilding sector.

Limited Availability of Substitute Inputs

For highly specialized components crucial to shipbuilding, such as advanced propulsion systems or sophisticated navigation equipment, the availability of substitute inputs is often scarce. This scarcity grants existing suppliers significant leverage, as shipbuilders may have few alternatives when sourcing these critical parts. For instance, a particular type of high-efficiency marine engine might only be produced by a handful of manufacturers globally.

While the industry has historically relied on established suppliers for specialized equipment, a notable trend is the increasing adoption of alternative fuels and green technologies. This shift is actively fostering the emergence of new, specialized suppliers who can provide innovative solutions for emissions reduction and energy efficiency. For example, by 2024, the demand for methanol-fueled engines and related infrastructure is projected to grow substantially, creating opportunities for new entrants in this specialized segment.

- Limited Substitutes for Specialized Components: Highly technical parts like advanced navigation systems or specific engine types often have few direct replacements, strengthening supplier bargaining power.

- Emergence of New Suppliers in Green Tech: The push for sustainability is creating a market for new suppliers specializing in alternative fuels and eco-friendly technologies, potentially diversifying the supply base.

- Impact of Green Technologies on Supplier Power: As green technologies mature, they may introduce new suppliers with unique capabilities, potentially shifting the balance of power away from traditional component providers.

The bargaining power of suppliers to China Shipbuilding Industry (CSSC) is substantial due to the industry's reliance on specialized, high-value components. Factors like high switching costs for CSSC, the limited availability of substitutes for critical parts, and the quality implications of these components all contribute to suppliers' leverage.

For instance, the global market for marine engines is dominated by a few key players, giving them considerable pricing power. As of early 2024, the ongoing demand for new vessels and the stringent requirements for emissions compliance mean that suppliers of advanced, eco-friendly propulsion systems are in a strong position to negotiate favorable terms.

The potential for forward integration by suppliers, while less common, poses a strategic threat. If a major component manufacturer were to enter the shipbuilding market, it could disrupt existing relationships and intensify competition.

The increasing global emphasis on sustainability and alternative fuels, such as methanol and ammonia, is also shaping supplier power. Suppliers who can provide innovative solutions in these areas, like advanced fuel injection systems or specialized tank designs, are gaining significant influence. For example, the market for methanol-ready large containerships is expected to grow significantly through 2025, benefiting suppliers in this niche.

| Factor | Impact on CSSC | Example (2024/2025 Outlook) |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited global manufacturers for advanced marine engines |

| Switching Costs | High costs to change suppliers | Re-engineering, recertification of specialized components |

| Component Criticality & Quality | Suppliers with critical tech have power | Providers of emissions control systems for IMO regulations |

| Availability of Substitutes | Scarcity of substitutes strengthens suppliers | Few alternatives for specific high-efficiency engine types |

| Forward Integration Threat | Potential for new competitors | Major equipment supplier entering shipbuilding |

What is included in the product

This analysis delves into the competitive landscape of the China Shipbuilding Industry by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Navigate the intense competition and government influence in China's shipbuilding sector with a clear, actionable framework that pinpoints key threats and opportunities.

Customers Bargaining Power

China Shipbuilding Industry Corporation (CSIC), now part of China State Shipbuilding Corporation (CSSC), caters to a wide array of clients, including global navies, major international shipping conglomerates operating bulk carriers, container ships, and LNG carriers, as well as offshore energy sector players. This diversity, however, doesn't negate the significant leverage held by certain customer segments.

Specific sectors, such as the world's largest shipping lines or key national defense ministries, represent highly concentrated customer bases. For instance, a single major shipping company might account for a substantial portion of a shipyard's order book for a particular vessel type. This consolidation translates directly into enhanced bargaining power, allowing these large clients to negotiate more favorable terms, pricing, and delivery schedules from shipbuilding giants like CSSC.

Customers in the commercial shipbuilding sector, especially major fleet operators, are frequently very sensitive to price because of the fierce competition in the worldwide shipping business. For example, in 2023, the average price per TEU for new container ships saw fluctuations driven by demand and material costs, but the underlying pressure for cost-effectiveness remained high.

This intense price pressure compels shipbuilders, such as those within the China State Shipbuilding Corporation (CSSC) group, to maintain competitive pricing strategies. This can directly affect their profitability, as they must balance the need to secure orders with the imperative to cover their production costs and generate a healthy margin.

While China Shipbuilding Industry (CSSC) is a global leader, customers aren't entirely reliant on them. They can turn to other major shipbuilding nations like South Korea, which remains a strong competitor, especially in areas like LNG carriers. For highly specialized or niche vessels, European shipyards also offer viable alternatives, providing customers with a broader selection.

This availability of choice significantly limits CSSC's bargaining power. Customers can leverage options from South Korea and Europe to negotiate better terms, pricing, and delivery schedules, preventing CSSC from dictating unfavorable conditions. For instance, in 2023, South Korea's shipbuilding sector secured a substantial portion of the global orders for high-value vessels, demonstrating their continued competitive strength.

Customer's Ability to Delay or Cancel Orders

In a fluctuating global trade environment, customers' ability to delay or cancel orders significantly impacts the shipbuilding industry. If market conditions turn unfavorable, buyers might postpone or scrap their shipbuilding plans. This leverage is particularly potent for large, long-term contracts, granting customers considerable bargaining power.

This dynamic was evident in 2023, where global new shipbuilding orders saw a notable slowdown in certain segments compared to the surge in 2022. For instance, while overall order volumes remained robust, the cancellation rates for some vessel types, particularly those sensitive to freight rate volatility, saw an uptick. This underscores the customer's ability to adjust their commitments based on evolving economic outlooks, directly influencing shipbuilders' order books and production schedules.

- Order Cancellation Risk: Customers can leverage market uncertainty to delay or cancel shipbuilding contracts, especially for large or long-term commitments.

- Market Volatility Impact: Fluctuations in global trade and freight rates directly influence customer decisions, giving them more power to renegotiate or withdraw from orders.

- 2023 Trends: Reports from maritime analytics firms indicated a rise in cancellation rates for certain vessel types in 2023, reflecting this customer bargaining power.

Customers' Threat of Backward Integration

The threat of backward integration by customers, while generally low for the China Shipbuilding Industry Corporation (CSSC), can still influence negotiations. A very large shipping or logistics conglomerate, possessing immense scale and capital, could theoretically explore building its own vessels. This hypothetical capability, even if not actively pursued, acts as a bargaining chip, allowing these major clients to exert pressure on CSSC during price and contract discussions.

Consider the global shipping industry's dynamics. In 2024, major players like Maersk or COSCO Shipping are massive entities. While establishing a full-fledged shipbuilding operation is incredibly complex and capital-intensive, the sheer financial muscle of such companies means the *possibility* of internal shipbuilding cannot be entirely dismissed. This theoretical leverage is a constant factor in their dealings with shipbuilders.

- Customer Scale: Major shipping lines operate fleets numbering in the hundreds, representing significant potential order volumes.

- Capital Intensity: Building a shipyard requires billions in investment, a barrier that deters most, but not all, very large customers.

- Negotiating Leverage: The *idea* of backward integration, even if not a practical reality, empowers large customers in their discussions with shipbuilders.

The bargaining power of customers within the China Shipbuilding Industry (CSSC) is considerable, particularly from large, concentrated clients like major shipping conglomerates and defense ministries. These entities can negotiate more favorable pricing and terms due to the sheer volume of business they represent. For example, in 2023, the competitive nature of the global shipping market meant that price sensitivity remained a key factor for large fleet operators, influencing their demands on shipbuilders.

Customers also benefit from the availability of alternatives. While CSSC is a global leader, shipyards in South Korea and Europe offer strong competition, especially for specialized vessels like LNG carriers. This choice allows customers to leverage offers from different regions to secure better deals, as evidenced by South Korea's significant share of high-value vessel orders in 2023.

Furthermore, market volatility empowers customers to delay or even cancel orders, a risk particularly relevant for large, long-term contracts. This was observed in 2023, with some reports indicating an uptick in cancellation rates for certain vessel types amidst fluctuating freight rates, demonstrating the customer's ability to adapt commitments based on economic outlooks.

What You See Is What You Get

China Shipbuilding Industry Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis of the China Shipbuilding Industry, detailing the competitive landscape and strategic implications. You'll receive this exact, professionally formatted document immediately after purchase, offering a comprehensive understanding of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry within this dynamic sector.

Rivalry Among Competitors

The global shipbuilding arena is a tight-knit club, with China, South Korea, and to a lesser extent, Japan and Europe, holding the reins. This high industry concentration means that a few giants dictate the market's direction.

China State Shipbuilding Corporation (CSSC), a colossal entity in China's maritime sector, finds itself in a fierce battleground. It locks horns with formidable international rivals such as Hyundai Heavy Industries, Samsung Heavy Industries, and Daewoo Shipbuilding & Marine Engineering, all vying for market share and technological supremacy.

While certain niches like Liquefied Natural Gas (LNG) carriers and environmentally friendly ships are seeing robust demand, the broader shipbuilding industry can face periods of sluggish expansion or excess capacity. This dynamic intensifies the battle among shipyards for available contracts. For instance, while the global shipbuilding market is expected to see growth, projections indicate that some specific vessel segments might actually shrink in the coming years, further concentrating competition.

The shipbuilding industry is characterized by exceptionally high fixed costs due to the need for vast shipyards, specialized machinery, and a skilled workforce. For instance, establishing a new large-scale shipyard can easily run into billions of dollars. These substantial upfront investments create significant barriers to entry and, crucially, to exit.

Consequently, companies in this sector face immense pressure to maintain high capacity utilization. Even when demand falters, as seen in periods of global economic slowdown, shipbuilders are often compelled to compete fiercely for available orders. This can lead to price wars and reduced profit margins as firms strive to cover their considerable fixed expenses, rather than shutting down operations.

Product Differentiation and Specialization

Competitive rivalry within China's shipbuilding sector is intensifying, particularly as companies move beyond standardized vessel production. While basic cargo ships remain a significant segment, there's a clear trend towards differentiation in high-value, technologically advanced, and environmentally conscious vessels. This includes specialized ships like Liquefied Natural Gas (LNG) carriers, sophisticated cruise ships, and advanced naval vessels, where innovation and specific capabilities command premium pricing and market share.

China State Shipbuilding Corporation (CSSC), a dominant player, leverages its broad product portfolio, encompassing these advanced and green shipbuilding segments, as a crucial competitive advantage. This strategic focus allows CSSC to cater to diverse and evolving global maritime demands, from energy transport to luxury cruising and defense, thereby solidifying its position against rivals who may specialize in fewer segments. For instance, in 2023, CSSC reported significant orders for LNG carriers, a testament to its specialization in this high-demand, technologically complex area.

- Increasing Demand for Eco-Friendly Vessels: Global regulations and market preferences are driving demand for greener ships, such as those powered by LNG or equipped with emissions reduction technologies.

- Technological Sophistication: The shipbuilding industry is seeing a rise in demand for complex vessels like ultra-large container ships with advanced automation, specialized offshore vessels, and advanced naval platforms, requiring significant R&D investment.

- CSSC's Market Position: CSSC's extensive capabilities across various vessel types, including a strong push into new energy and smart ship technologies, positions it favorably against competitors, particularly in securing contracts for high-margin, specialized builds.

- Global Order Book Trends: As of early 2024, major shipyards globally, including those in China, are experiencing robust order books, with a notable proportion dedicated to LNG carriers and other specialized, high-value vessels.

Government Support and Geopolitical Factors

China's shipbuilding sector, spearheaded by giants like China State Shipbuilding Corporation (CSSC), thrives on substantial government support. This includes direct subsidies and strategic industrial policies, which can create a competitive advantage, potentially disadvantaging international rivals. For instance, in 2023, China's shipbuilding output reached a record 43.4 million gross tons, a significant portion of which benefited from state initiatives.

Geopolitical tensions and trade disputes add another layer to the competitive landscape. Proposed measures, such as potential US port fees on Chinese-built vessels, could increase costs for Chinese shipbuilders and impact their global competitiveness. These factors highlight the intricate interplay between national industrial strategy and international trade relations.

- Government Subsidies: China's shipbuilding industry has historically received significant state funding, bolstering its capacity and technological advancement.

- Industrial Policies: Strategic plans aimed at dominating global shipbuilding markets influence investment and production decisions within the sector.

- Trade Disputes: International trade friction, including potential tariffs or fees on Chinese vessels, can alter cost structures and market access for Chinese shipbuilders.

- Geopolitical Influence: Global political relationships and trade agreements directly impact the operational environment and competitive positioning of China's shipbuilding industry.

Competitive rivalry in China's shipbuilding sector is intense, driven by a few dominant players like China State Shipbuilding Corporation (CSSC) competing against each other and global giants. This rivalry is escalating as companies focus on higher-value, technologically advanced, and eco-friendly vessels, moving beyond basic cargo ships. For example, in 2023, China's shipbuilding output reached 43.4 million gross tons, with a significant portion of this growth fueled by demand for specialized vessels.

| Key Competitors (Global) | China's Top Player | Key Differentiators | Market Trends Benefiting Competition | 2023 Data Point |

|---|---|---|---|---|

| Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering | China State Shipbuilding Corporation (CSSC) | Technological advancement, eco-friendly designs, diverse vessel types (LNG carriers, cruise ships, naval vessels) | Increasing demand for LNG carriers and green shipping technologies | CSSC secured significant LNG carrier orders in 2023 |

SSubstitutes Threaten

For the vast majority of international trade, particularly for bulk commodities and large volumes, seaborne transport stands out as the most cost-effective and efficient method. This dominance is underscored by the sheer scale of goods moved by sea; in 2023, global maritime trade volume reached an estimated 11.9 billion tonnes, highlighting its indispensable role.

There are simply no direct substitutes that can match the capacity and economic viability of shipping for long-distance, heavy cargo transport. While air freight offers speed, its cost is prohibitive for bulk goods, and land-based transport is limited by infrastructure and capacity for transcontinental movements of the same magnitude.

While ships are the dominant force for bulk and containerized cargo, certain niches see competition from other transport modes. For high-value, time-sensitive goods, air freight offers speed, though at a significantly higher cost per unit. In 2024, air cargo rates for expedited services can be ten times that of ocean freight for similar volumes.

Rail and road transport can also serve as substitutes for shorter domestic or regional routes, particularly for manufactured goods or specific raw materials where intermodal transfer is efficient. However, their capacity and cost-effectiveness for long-haul, large-volume shipments remain far below that of maritime shipping. For instance, a single large container ship can carry the equivalent of thousands of truckloads, making it indispensable for global trade volumes.

The threat of substitutes for China's shipbuilding industry, particularly concerning regional trade, is evolving. Improvements in land-based logistics, such as enhanced rail and road networks across continents, could decrease the demand for short-sea shipping services. For instance, in 2024, significant investments continue in infrastructure projects like the Belt and Road Initiative, which aims to bolster overland trade routes, potentially diverting some cargo from maritime transport, especially for intra-continental movements.

Technological Advancements in Logistics and Supply Chain Management

Technological advancements in logistics and supply chain management pose a significant threat of substitution for new shipbuilding. Innovations in areas like real-time tracking, predictive analytics for demand forecasting, and optimized route planning can dramatically improve the efficiency of existing shipping fleets. For example, advancements in AI-driven route optimization could reduce the number of voyages needed, thereby decreasing the demand for new vessel construction. In 2023, the global logistics market was valued at approximately $9.6 trillion, with technology adoption being a key growth driver, suggesting a substantial impact on shipbuilding if efficiency gains are realized.

These improvements in supply chain efficiency, warehousing, and inventory management can lead to better utilization of existing ships. By minimizing idle time and optimizing cargo loads, companies may find they can meet their shipping needs without commissioning as many new vessels. This increased efficiency effectively acts as a substitute for new shipbuilding orders, as it lowers the overall requirement for shipping capacity. The International Monetary Fund (IMF) projected global trade growth to be around 3.3% in 2024, and how much of this growth translates into new ship orders will be influenced by these efficiency gains.

- Optimized Fleet Utilization: Advanced logistics software can reduce the need for additional ships by maximizing the use of current vessels.

- Reduced Idle Time: Better port management and intermodal connectivity decrease the time ships spend waiting, increasing their effective capacity.

- Inventory Management: Just-in-time inventory systems and improved demand forecasting reduce the buffer stock of goods, potentially lowering overall shipping volumes.

On-shore Manufacturing and Local Sourcing

A significant threat arises from the global trend towards onshoring manufacturing and increased local sourcing. This shift directly impacts the demand for shipping services, a core driver for shipbuilding orders. As more production happens domestically, the need for long-haul maritime transport diminishes, consequently reducing the impetus for building new vessels.

For instance, in 2024, several major economies, including the United States and European nations, continued to implement policies encouraging domestic production and supply chain resilience. This has led to a measurable decrease in certain shipping routes, although the full impact on shipbuilding order books is still unfolding.

The potential for reduced international trade volumes due to reshoring presents a clear substitute for the traditional maritime transport model that fuels the shipbuilding industry. This could manifest in several ways:

- Reduced demand for bulk carriers: As raw materials and finished goods are sourced closer to home, the need for large vessels to transport them across oceans decreases.

- Shift in vessel types: If shorter, regional shipping routes become more prevalent, there might be a greater demand for smaller, specialized vessels rather than the large container ships and tankers currently dominating new builds.

- Impact on shipyard capacity: A sustained decline in international shipping demand could lead to overcapacity in existing shipyards, forcing consolidation or a reduction in new construction projects.

While maritime shipping remains the backbone of global trade, substitutes pose a growing threat to China's shipbuilding industry. Enhanced land-based logistics, particularly through initiatives like the Belt and Road, could divert cargo from sea routes, especially for continental movements. For example, in 2024, continued investment in these overland networks aims to increase their efficiency and capacity.

Technological advancements in logistics are also a key substitute, improving the efficiency of existing fleets. AI-driven route optimization and better inventory management can reduce the need for new vessel construction. The global logistics market's significant value, around $9.6 trillion in 2023, highlights the potential impact of these efficiency gains on shipbuilding demand.

Furthermore, the trend towards onshoring manufacturing reduces the reliance on long-haul international shipping. This shift directly impacts demand for bulk carriers and could lead to a greater need for smaller, regional vessels. Global trade growth in 2024, projected around 3.3% by the IMF, will be critical in determining how much of this translates into new shipbuilding orders versus being absorbed by efficiency improvements.

Entrants Threaten

The sheer cost of building and equipping a modern shipyard is a significant barrier. We're talking billions of dollars just for the initial setup, covering everything from dry docks and specialized cranes to advanced welding technology and skilled labor training. For instance, the expansion projects undertaken by major Chinese shipbuilders often involve investments in the tens of billions of dollars, making it incredibly difficult for newcomers to even enter the playing field.

Established giants in China's shipbuilding sector, such as China State Shipbuilding Corporation (CSSC), benefit immensely from economies of scale. Their vast production capacity allows them to spread fixed costs over a much larger output, leading to lower per-unit production costs. A new entrant would find it nearly impossible to match these cost efficiencies, putting them at a significant competitive disadvantage from day one.

The shipbuilding industry, particularly in China, demands a highly specialized and skilled workforce. This includes naval architects, marine engineers, welders, electricians, and other craftspeople with years of training and experience. Acquiring and retaining this talent pool is a significant hurdle for potential new entrants.

Established shipbuilders like China State Shipbuilding Corporation (CSSC) benefit immensely from strong brand reputations and deep-rooted customer relationships. These existing players have cultivated trust through consistent quality, reliable performance, and adherence to delivery schedules over many years. For instance, CSSC's order book in 2023 reached a significant value, underscoring the confidence of global clients.

New entrants face a considerable hurdle in replicating this level of credibility. Convincing major clients, often with complex and high-value projects, to switch from a trusted, established supplier to an unknown entity requires overcoming substantial skepticism. This loyalty to established brands significantly raises the barrier to entry for potential new competitors in the shipbuilding sector.

Government Regulations and Environmental Standards

Government regulations and stringent environmental standards significantly raise the barrier to entry in China's shipbuilding sector. New entrants must navigate complex international maritime organization (IMO) rules and national environmental protection laws, such as those concerning ballast water management and emissions. For instance, the IMO's 2020 sulfur cap on fuel oil necessitated substantial technological upgrades across the global fleet, requiring new shipyards to incorporate advanced emission control technologies from the outset, a costly undertaking.

Compliance with these regulations demands considerable capital investment in advanced manufacturing processes, pollution control equipment, and specialized workforce training. This financial burden, coupled with the need for ongoing adaptation to evolving standards, deters smaller or less-resourced potential competitors. By 2024, the global push for greener shipping, driven by initiatives like the EU's Fit for 55 package, further intensifies these requirements, making it harder for newcomers to establish a competitive foothold without substantial upfront investment.

- Stringent International Regulations: Compliance with IMO standards for safety, emissions (e.g., SOx, NOx), and energy efficiency requires significant upfront investment in technology and design.

- National Environmental Standards: China's own environmental protection laws, focusing on wastewater discharge, noise pollution, and hazardous materials handling, add to operational costs and complexity for new entrants.

- Capital Intensive Compliance: New shipyards must integrate advanced emission reduction systems and sustainable material sourcing from inception, increasing initial capital expenditure by an estimated 10-15% compared to older facilities.

- Evolving Regulatory Landscape: The continuous introduction of new environmental targets, such as those related to carbon intensity, necessitates ongoing R&D and adaptation, posing a sustained challenge to new market participants.

Access to Supply Chains and Distribution Channels

New entrants to China's shipbuilding industry face significant hurdles in securing access to critical supply chains and distribution channels. Establishing dependable relationships with a vast network of suppliers for essential components, specialized materials like high-grade steel, and securing efficient global distribution networks for finished vessels requires substantial investment and established credibility.

For instance, in 2023, China's shipbuilding output reached 39.7 million compensated gross tons (CGT), highlighting the sheer scale of raw material and component sourcing required. A new player would need to navigate complex procurement processes and build trust with suppliers already committed to major industry players, a process that can take years and considerable capital outlay.

- Supply Chain Complexity: Accessing a reliable and cost-effective supply of specialized shipbuilding components, from advanced engines to navigation systems, is challenging.

- Distribution Network Barriers: Establishing global logistics and sales channels to deliver massive vessels to international clients is a capital-intensive undertaking.

- Supplier Relationships: Existing shipyards have long-standing, often exclusive, relationships with key suppliers, making it difficult for new entrants to secure favorable terms or consistent supply.

The threat of new entrants into China's shipbuilding industry is considerably low due to immense capital requirements, the need for specialized labor, and established economies of scale enjoyed by existing giants like CSSC. New players must also overcome stringent regulatory compliance, particularly concerning environmental standards, which necessitate substantial upfront investment in advanced technologies. Furthermore, securing reliable supply chains and global distribution networks presents a significant hurdle, as established players already hold strong relationships with key suppliers and clients.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building and equipping a modern shipyard costs billions. Expansion projects for major Chinese shipbuilders often exceed tens of billions of dollars. | Extremely high initial investment makes entry prohibitive for most. |

| Economies of Scale | Established players like CSSC spread fixed costs over vast output, leading to lower per-unit costs. | New entrants cannot match cost efficiencies, facing a significant competitive disadvantage. |

| Skilled Labor | Requires specialized naval architects, engineers, and experienced craftspeople. | Acquiring and retaining this talent pool is a major challenge. |

| Brand Reputation & Customer Loyalty | Long-standing players have built trust and strong relationships. CSSC's order book in 2023 highlights client confidence. | Convincing clients to switch from trusted suppliers is difficult. |

| Government Regulations & Environmental Standards | Compliance with IMO and national environmental laws (e.g., IMO 2020 sulfur cap, EU's Fit for 55) demands costly technological upgrades. | Adds significant capital expenditure and ongoing adaptation costs. |

| Supply Chain & Distribution | Accessing raw materials and establishing global logistics for massive vessels is complex and capital-intensive. China's 2023 output of 39.7 million CGT shows the scale of sourcing. | Requires years and substantial capital to build dependable networks. |

Porter's Five Forces Analysis Data Sources

Our analysis of the China shipbuilding industry is built upon a foundation of diverse data sources, including official government reports from Chinese ministries, financial statements of major shipbuilding companies, and industry-specific market research from reputable firms like IHS Markit and Clarksons Research.