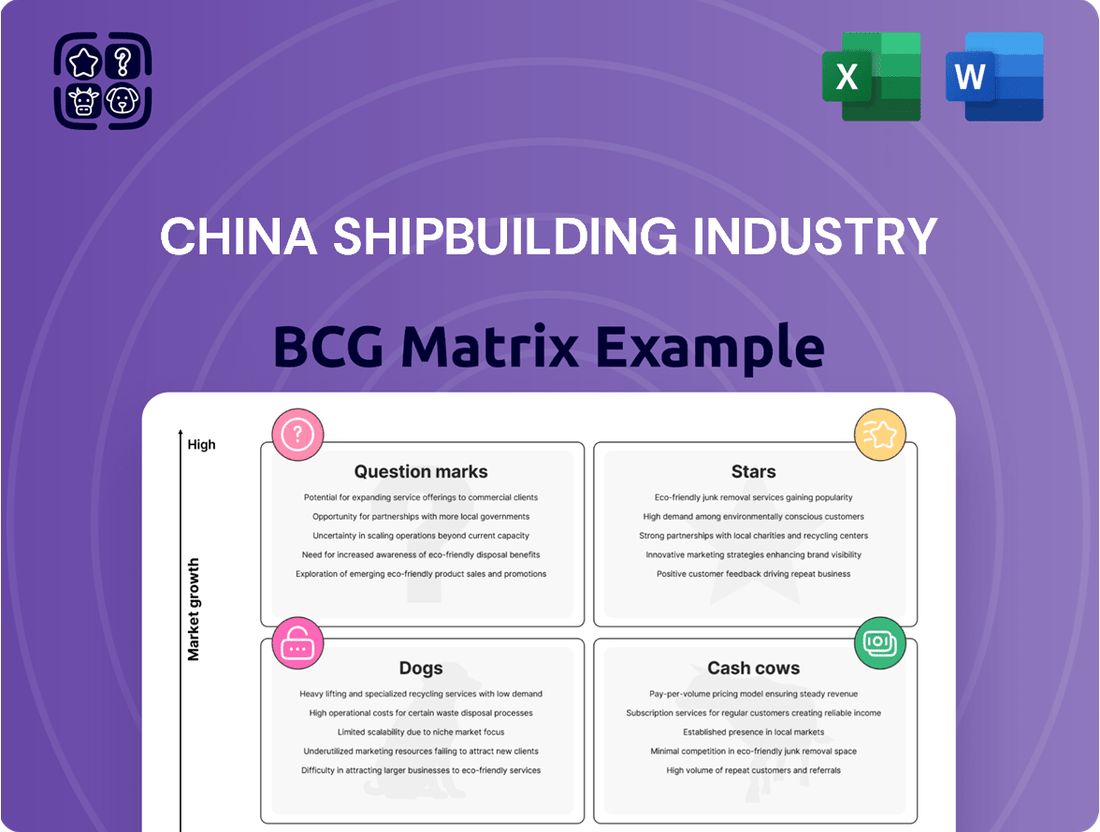

China Shipbuilding Industry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Shipbuilding Industry Bundle

Curious about the China Shipbuilding Industry's strategic positioning? This glimpse into its BCG Matrix reveals key product categories, but the full report unlocks the complete picture. Understand which segments are booming "Stars," which are reliable "Cash Cows," and which require careful consideration as "Dogs" or "Question Marks."

Don't miss out on the critical insights needed to navigate this dynamic sector. Purchase the full BCG Matrix for a detailed quadrant-by-quadrant breakdown, data-driven recommendations, and a clear roadmap for optimizing your investments and product portfolio within China's shipbuilding powerhouse.

Stars

Naval Ship Construction, spearheaded by China State Shipbuilding Corporation (CSSC), is a prominent 'Star' in China's shipbuilding landscape. CSSC is a key player in fulfilling the nation's strategic naval expansion goals, a sector seeing substantial investment and development.

In 2024, CSSC's commercial shipbuilding output surpassed the total tonnage constructed by the entire US shipbuilding industry since World War II. This impressive commercial capacity, combined with its significant naval production, allows for the cross-subsidization of military research and development, reinforcing CSSC's dominant position in naval vessel manufacturing.

The global demand for Liquefied Natural Gas (LNG) carriers is experiencing a significant upswing, driven by worldwide energy transition efforts. This surge positions the LNG carrier market as a high-growth sector. CSSC, through its subsidiary Hudong-Zhonghua Shipbuilding, stands as a prominent global player in this domain, evidenced by substantial orders like the 18 super-large LNG carriers secured from QatarEnergy in 2024.

These high-value vessels are instrumental in bolstering CSSC's financial performance and solidifying its market dominance within this crucial and expanding industry segment.

Green and Low-Carbon Vessels represent a significant growth area for China Shipbuilding Industry (CSSC), driven by global decarbonization efforts. International Maritime Organization (IMO) targets for 2030 are pushing demand for vessels powered by ammonia, methanol, and LNG.

CSSC has responded by prioritizing these eco-friendly, high-margin vessels. As of March 2025, over 40% of their orderbook consists of IMO-compliant ships, demonstrating a clear strategic shift.

The company is actively securing new contracts and delivering advanced green vessel designs, capitalizing on the booming market for sustainable shipping solutions. This segment is key to CSSC's future revenue and market positioning.

Large Commercial Vessels (Bulk Carriers, Tankers)

Large Commercial Vessels, encompassing bulk carriers and tankers, represent a cornerstone of China's shipbuilding dominance. China, as a nation, leads the global market, and within this, China State Shipbuilding Corporation (CSSC) stands as the largest player.

CSSC's formidable presence is underscored by its significant share of newbuilding orders. In 2024 alone, the company secured orders for 154 civil vessels, a testament to its strong market position in the vital seaborne trade sector. This robust order book, extending through 2029 for civilian ships, highlights CSSC's sustained high market share in this expanding segment.

- Market Dominance: China is the undisputed leader in global commercial shipbuilding.

- CSSC's Scale: CSSC is the largest shipbuilding entity in China, holding a substantial portion of newbuilding orders.

- 2024 Performance: CSSC received orders for 154 civil vessels in 2024, reflecting strong demand.

- Future Outlook: The company's order backlog extends to 2029, indicating continued high market share.

Offshore Wind Turbine Installation Vessels & Components

The offshore wind sector is booming, and China is a major player. This surge in demand means more need for specialized ships and huge turbine parts. CSSC Offshore & Marine Engineering is right in the middle of this, building components for the newest, biggest wind turbines, those with capacities of 20 to 25 megawatts.

This strategic focus places CSSC directly in a fast-growing renewable energy market. They are becoming a crucial supplier for this expanding industry.

- Market Growth: Global offshore wind capacity is projected to reach 300 GW by 2030, with China expected to contribute significantly to this expansion.

- Component Demand: The development of larger turbines (15MW+) necessitates specialized installation vessels and robust component manufacturing capabilities.

- CSSC's Role: CSSC's involvement in 20-25MW turbine components positions them to capture a substantial share of this high-value market segment.

- Investment: Significant global investment is flowing into offshore wind, with China leading in new project announcements and installations.

Naval Ship Construction, spearheaded by China State Shipbuilding Corporation (CSSC), is a prominent 'Star' in China's shipbuilding landscape, fulfilling the nation's strategic naval expansion goals with substantial investment.

In 2024, CSSC's commercial shipbuilding output surpassed the total tonnage constructed by the entire US shipbuilding industry since World War II, enabling cross-subsidization of military R&D and reinforcing its dominant position in naval vessel manufacturing.

The LNG carrier market is a high-growth sector, driven by global energy transition efforts, with CSSC, through Hudong-Zhonghua Shipbuilding, securing substantial orders like 18 super-large LNG carriers from QatarEnergy in 2024, bolstering financial performance.

Green and Low-Carbon Vessels represent a significant growth area for CSSC, with over 40% of its orderbook consisting of IMO-compliant ships as of March 2025, capitalizing on the booming market for sustainable shipping solutions.

Large Commercial Vessels, led by CSSC, form a cornerstone of China's shipbuilding dominance, with the company securing orders for 154 civil vessels in 2024, highlighting sustained high market share through 2029.

The offshore wind sector is booming, with CSSC Offshore & Marine Engineering building components for 20 to 25 megawatt wind turbines, positioning them as a crucial supplier in this fast-growing renewable energy market.

| Segment | CSSC's Position | Key 2024/2025 Data | Growth Driver | Outlook |

|---|---|---|---|---|

| Naval Ship Construction | Dominant Star | Commercial output exceeded US WWII total tonnage (2024) | National strategic goals, R&D investment | Continued expansion |

| LNG Carriers | Global Leader | 18 super-large LNG carriers ordered from QatarEnergy (2024) | Global energy transition | High-value growth |

| Green Vessels | Key Player | Over 40% of orderbook IMO-compliant (March 2025) | Decarbonization efforts, IMO targets | Strong future revenue |

| Large Commercial Vessels | Market Leader | 154 civil vessel orders secured (2024) | Global seaborne trade | Sustained high market share through 2029 |

| Offshore Wind Components | Emerging Star | Manufacturing 20-25MW turbine components | Renewable energy expansion | Capturing high-value market |

What is included in the product

This BCG Matrix analysis categorizes China's shipbuilding sectors by market share and growth, guiding investment decisions.

The China Shipbuilding Industry BCG Matrix offers a clear, distraction-free view for C-level executives, simplifying complex portfolio decisions.

This matrix provides an export-ready design, allowing for quick drag-and-drop into PowerPoint for efficient strategic communication.

Cash Cows

Standard merchant vessel production, including bulk carriers, oil tankers, and container ships, represents a significant Cash Cow for China Shipbuilding Industry Corporation (CSIC). CSIC commands a substantial portion of this mature global market, ensuring consistent demand and predictable revenue streams.

In 2023, global shipbuilding orders saw a notable increase, with China leading the charge. CSIC's established capacity in producing these conventional vessels allowed it to capitalize on this demand, generating robust cash flow. This segment benefits from lower R&D costs compared to innovative ship designs, contributing to healthy profit margins.

CSSC's ship repair and maintenance services represent a classic Cash Cow within its portfolio. This segment generates stable, predictable revenue from a mature market, serving both CSSC's internal fleet and a broad base of external customers.

In 2024, the company secured orders for 296 ship repairs, translating to a value of roughly US$288 million. This performance underscores the ongoing demand for essential vessel upkeep, a critical factor for maintaining operational efficiency and consistent cash flow generation.

While this sector exhibits lower growth potential compared to other industries, its high operational efficiency and the perpetual need for ship maintenance make it a reliable source of strong, consistent cash flow for CSSC.

Legacy Marine Equipment Manufacturing, a segment within China Shipbuilding Industry (CSSC), operates as a Cash Cow. Its core business involves producing established marine equipment and components vital for building and maintaining ships. This mature market ensures consistent demand, meaning CSSC doesn't need to pour significant funds into new research and development for these products.

CSSC's vast supply chain and manufacturing prowess allow it to maintain a substantial market share in this segment. This translates into reliable and steady profits from these foundational offerings. For instance, in 2023, the global marine equipment market was valued at approximately $70 billion, with established components forming a significant portion of this value.

Long-term Government and State-Owned Enterprise Contracts

China Shipbuilding Industry Corporation (CSIC), now part of China State Shipbuilding Corporation (CSSC), benefits significantly from long-term contracts with the Chinese government and state-owned enterprises. These agreements provide a stable revenue stream, particularly for shipbuilding segments that may not be at the forefront of technological innovation, such as naval support vessels or commercial ships for state-owned fleets. This predictable demand and high market share within China's secure domestic market solidify these contracts as cash cows.

The consistent cash flow generated from these traditional orders is crucial for funding CSSC's investments in more dynamic and potentially higher-growth areas of the shipbuilding industry. For instance, in 2023, the global shipbuilding market saw continued strength, with China maintaining its leading position. While specific figures for CSSC's "cash cow" segments are not publicly itemized separately from its overall performance, the sheer volume of state-backed orders contributes substantially to the company's financial stability. The predictable nature of these contracts, often spanning multiple years, ensures a reliable income source, allowing the company to weather market fluctuations in other sectors.

- Stable Revenue: Long-term government and state-owned enterprise contracts provide predictable and consistent income for CSSC.

- High Market Share: These contracts secure a dominant position within the domestic Chinese market for specific vessel types.

- Cash Generation: The low-growth but high-volume nature of these orders generates substantial cash flow.

- Funding for Growth: The generated cash is vital for investing in research, development, and expansion into more advanced shipbuilding sectors.

Proven Offshore Production Units (e.g., older FPSO models)

While cutting-edge offshore projects might be considered Stars, China State Shipbuilding Corporation (CSSC) also benefits from its established Floating Production Storage and Offloading (FPSO) units. These are essentially Cash Cows for the company. Their continued operation and maintenance generate a steady, reliable income stream.

These mature offshore production units are in a stable operational phase. They consistently produce cash flow with minimal need for significant new investment. CSSC's proven track record in delivering and managing these types of assets solidifies its strong position in this dependable market segment.

- Mature FPSO units contribute consistent revenue.

- Low reinvestment needs characterize these assets.

- CSSC's expertise ensures continued profitability in this segment.

Standard merchant vessel production, including bulk carriers, oil tankers, and container ships, represents a significant Cash Cow for China Shipbuilding Industry Corporation (CSIC). CSIC commands a substantial portion of this mature global market, ensuring consistent demand and predictable revenue streams.

In 2023, global shipbuilding orders saw a notable increase, with China leading the charge. CSIC's established capacity in producing these conventional vessels allowed it to capitalize on this demand, generating robust cash flow. This segment benefits from lower R&D costs compared to innovative ship designs, contributing to healthy profit margins.

CSSC's ship repair and maintenance services represent a classic Cash Cow within its portfolio. This segment generates stable, predictable revenue from a mature market, serving both CSSC's internal fleet and a broad base of external customers.

In 2024, the company secured orders for 296 ship repairs, translating to a value of roughly US$288 million. This performance underscores the ongoing demand for essential vessel upkeep, a critical factor for maintaining operational efficiency and consistent cash flow generation.

| Segment | Description | Cash Flow Generation | Market Maturity | 2024 Data Point |

| Merchant Vessel Production | Bulk carriers, oil tankers, container ships | High, consistent | Mature | China led global shipbuilding orders in 2023, benefiting CSIC. |

| Ship Repair & Maintenance | Essential vessel upkeep | Stable, predictable | Mature | US$288 million in orders for 296 repairs in 2024. |

Delivered as Shown

China Shipbuilding Industry BCG Matrix

The preview you're currently viewing is the definitive China Shipbuilding Industry BCG Matrix report you will receive upon purchase. This comprehensive analysis, meticulously crafted with industry data, will be delivered in its entirety, free from any watermarks or placeholder content, ensuring immediate professional utility.

Rest assured, the China Shipbuilding Industry BCG Matrix you are examining is the exact document you will download after completing your purchase. It represents a complete, market-validated strategic framework, ready for immediate integration into your business planning without any need for further editing or revision.

What you see here is the actual, fully unlocked China Shipbuilding Industry BCG Matrix file you’ll receive once your purchase is confirmed. This professionally designed report is instantly downloadable, empowering you to begin strategic analysis, client presentations, or internal team discussions without delay.

This detailed China Shipbuilding Industry BCG Matrix report is precisely what will be delivered to you after your purchase. Developed by seasoned industry analysts and formatted for maximum clarity, it's engineered to be directly applicable to your strategic decision-making processes.

Dogs

Certain older ship repair facilities within China Shipbuilding Industry Corporation (CSIC) might be categorized as Dogs. These yards, often characterized by less advanced technology and lower operational efficiency, likely face a mature or declining market with limited growth potential and a small market share.

These facilities may struggle to compete with more modern shipyards, potentially requiring substantial capital investment for upgrades. The return on such investments can be uncertain, making them prime candidates for divestment or consolidation to free up resources for more promising ventures. For instance, in 2023, the global shipbuilding market saw significant demand, yet older facilities may not have been equipped to capitalize on this trend, instead becoming cash drains.

China's shipbuilding sector, while a global leader, must contend with obsolete vessel types. Production lines for these older designs, such as certain types of bulk carriers or single-hull oil tankers, are increasingly becoming Dogs in the BCG Matrix. These segments represent low market share and minimal growth opportunities as newer, more efficient, and environmentally compliant vessel designs dominate the market.

The continued operation of these legacy production lines ties up valuable capital and skilled labor that could be redirected to more profitable and future-oriented shipbuilding segments. For instance, while the global order book for LNG carriers and container ships surged in 2023, the demand for older tanker designs has stagnated. Companies are likely to minimize or completely phase out these operations to improve overall financial performance and resource allocation.

China Shipbuilding Industry Corporation (CSSC), a colossal entity, often finds itself managing smaller, less effective subsidiaries. These units, while part of the larger conglomerate, struggle with low market penetration and operate within industries that show little to no growth. For instance, some of CSSC's legacy equipment manufacturing divisions in 2023 reported single-digit revenue growth, significantly lagging behind the group's overall expansion.

These underperforming segments drain valuable management focus and capital, diverting resources from more promising ventures. Their contribution to CSSC's profitability in 2024 has been minimal, with some divisions even posting net losses.

Consequently, these non-core, underperforming subsidiaries are prime candidates for strategic review, potentially leading to restructuring efforts or outright divestment to optimize CSSC's operational efficiency and financial health.

Standard Propulsion Systems (Non-Green, High-Emission)

Standard propulsion systems, characterized by high emissions, are increasingly becoming a "dog" in the China Shipbuilding Industry BCG Matrix. The global maritime industry's strong pivot towards decarbonization and environmental regulations means the demand for these traditional engines in new builds is shrinking. For instance, the International Maritime Organization (IMO) 2020 regulations have already tightened emission standards, pushing shipbuilders and owners towards more sustainable solutions.

While companies like CSSC, a major player in China's shipbuilding sector, may still produce these systems, their strategic focus is demonstrably shifting. The market share for new vessels equipped with solely high-emission propulsion is expected to continue its decline. Investing heavily in these older technologies without a clear roadmap for transitioning to greener alternatives risks becoming a significant cash drain, offering little to no future growth potential.

The financial implications are stark. Continued reliance on high-emission systems could lead to:

- Reduced competitiveness: As greener technologies become standard, vessels with traditional engines will face greater scrutiny and potentially higher operating costs due to stricter environmental compliance in many ports.

- Stranded assets: New builds equipped with outdated propulsion might quickly become obsolete, diminishing their resale value and operational lifespan.

- Missed market opportunities: The growth in the green shipping sector, driven by demand for LNG-powered vessels, methanol-fueled ships, and other low-emission technologies, represents a significant opportunity that is being forgone.

Limited-Demand Specialized Vessels

Certain highly specialized vessel types with very limited global or domestic demand, where China State Shipbuilding Corporation (CSSC) does not hold a significant competitive advantage, could be classified as Dogs within the BCG matrix. These niche vessels might be constructed on an infrequent, bespoke basis, but they do not contribute to scalable growth or substantial market share for CSSC. Consequently, they often yield low returns on investment, presenting a challenge for the company's overall portfolio performance.

This category stands in stark contrast to high-demand specialized vessels, such as Liquefied Natural Gas (LNG) carriers, where CSSC has actively pursued and secured a more dominant market position. For instance, while the global LNG carrier order book saw significant activity in 2024, with new orders placed for advanced propulsion systems, the market for the aforementioned specialized vessels remains considerably smaller and more fragmented. This limited demand restricts the potential for economies of scale and innovation, further solidifying their classification as Dogs.

- Limited Market Size: These vessels cater to extremely narrow segments of the maritime industry, restricting potential sales volumes.

- Lack of Competitive Edge: CSSC may not possess proprietary technology or significant market share in these specific vessel types.

- Low Profitability: The infrequent, custom nature of these builds often leads to lower profit margins and reduced return on investment.

- Strategic Challenge: Their presence in the portfolio represents a drag on resources without offering significant growth prospects.

Certain older ship repair facilities and legacy production lines for obsolete vessel types within China's shipbuilding sector are prime examples of "Dogs" in the BCG Matrix. These segments are characterized by low market share and minimal growth potential, often struggling to compete with more modern operations and designs. For instance, production lines for older bulk carriers and single-hull tankers in 2023 faced declining demand compared to newer, more efficient vessel types.

These underperforming units can tie up capital and skilled labor, diverting resources from more profitable ventures. In 2024, some legacy equipment manufacturing divisions within major shipbuilding conglomerates reported very low revenue growth, highlighting their status as cash drains rather than contributors to overall expansion.

The continued operation of these "Dog" segments poses a strategic challenge, potentially leading to restructuring or divestment to optimize resource allocation and improve financial performance. Their contribution to profitability is minimal, and they risk becoming stranded assets as the industry pivots towards greener technologies and more advanced vessel designs.

| Segment Example | Market Share | Growth Potential | Strategic Implication |

|---|---|---|---|

| Older Ship Repair Facilities | Low | Declining | Divestment or Consolidation |

| Legacy Vessel Production Lines (e.g., older tankers) | Low | Minimal | Phased Out or Restructured |

| High-Emission Propulsion Systems | Shrinking | Negative | Transition to Greener Alternatives |

| Niche Specialized Vessels (low demand, no competitive edge) | Low | Limited | Strategic Review, Potential Divestment |

Question Marks

China State Shipbuilding Corporation's (CSSC) foray into constructing large cruise ships, exemplified by vessels like the Adora Magic City and Adora Flora City, targets a burgeoning segment within China's tourism industry. This move signifies a commitment to a high-growth potential market, reflecting significant national investment in developing this complex shipbuilding capability.

Despite the promising market, CSSC's position in the global large cruise ship construction market is nascent. Historically dominated by established European shipyards, CSSC currently holds a low global market share in this specialized area. This necessitates substantial capital and technological investment to bridge the gap and establish a competitive foothold.

Achieving success in this segment requires mastering intricate shipbuilding technologies and robust supply chain management, areas where European competitors have decades of experience. CSSC's ongoing efforts to enhance these capabilities are crucial for transforming this venture from a question mark into a future star within the BCG matrix, potentially capturing a larger share of the growing global cruise market.

China is aggressively investing in autonomous shipping and smart ship technologies, aiming for global leadership by 2025. This sector is poised for significant growth, driven by advancements in AI, IoT, and sensor technology.

While China State Shipbuilding Corporation (CSSC) is engaged in smart ship development, its current market penetration in fully autonomous commercial vessels is minimal. The company's focus is on building the foundational technologies and infrastructure for this emerging market.

The transition from research and development to widespread commercial adoption of autonomous shipping requires substantial capital outlay. The return on these investments remains uncertain, as regulatory frameworks and market acceptance are still evolving.

China Shipbuilding Industry Corporation (CSIC) is actively exploring advanced and novel marine propulsion systems, such as hydrogen fuel cells and small modular nuclear reactors, moving beyond current green technologies like LNG. These represent high-growth potential areas, though their market share is currently minimal due to early development stages and significant commercialization hurdles.

These futuristic propulsion systems are characterized by substantial capital investment and inherent technical risks, yet they offer immense long-term rewards. For instance, the global hydrogen fuel cell market for maritime applications is projected to grow significantly, with estimates suggesting a compound annual growth rate exceeding 20% in the coming years, indicating the strategic importance of CSIC's investments in this domain.

Specialized Offshore Platforms for Emerging Energy Sources

China State Shipbuilding Corporation (CSSC) is actively exploring specialized offshore platforms for emerging energy sources, a move that positions them within the question mark quadrant of the BCG matrix. While the company excels in traditional offshore engineering, these new markets, such as floating solar farms and advanced deep-sea mining vessels, represent high-growth potential. CSSC’s current market share in these emerging sub-segments is likely modest, necessitating substantial investment and innovation to achieve leadership.

The global offshore wind market, a key emerging energy sector, is projected to reach over $150 billion by 2030, indicating significant opportunities for specialized platform providers. Similarly, the nascent deep-sea mining industry, though facing regulatory hurdles, holds immense potential for resource extraction that will require unique offshore infrastructure. CSSC's strategic focus on these areas reflects a calculated effort to capture future market share.

- Emerging Energy Focus: CSSC is developing specialized platforms for floating solar and deep-sea mining, targeting high-growth sectors.

- Market Potential: The offshore wind sector alone is expected to exceed $150 billion by 2030, highlighting the vast revenue opportunities.

- Investment Needs: Securing a dominant position in these nascent markets requires significant capital expenditure and technological advancement.

- Strategic Positioning: This diversification aims to leverage existing shipbuilding expertise into future energy infrastructure development.

Digital and AI-driven Ship Management Solutions

The integration of digital and AI-driven solutions for ship management represents a significant growth frontier within the maritime sector. This includes leveraging AI, IoT, and advanced analytics for optimized operations, predictive maintenance, and enhanced safety. China Shipbuilding Industry Corporation (CSIC), while a major player in shipbuilding, may have a more nascent market presence in standalone digital management solutions compared to dedicated technology providers.

CSIC's strategic focus on intelligent manufacturing and green development is commendable, but its specific market penetration in offering comprehensive, independent digital ship management platforms could be limited. Capturing substantial market share in this high-growth area necessitates considerable investment in software development, robust data analytics capabilities, and building a strong ecosystem of digital services.

- Market Growth: The global maritime IoT market, a key enabler for digital ship management, was projected to reach approximately $2.5 billion in 2023 and is expected to grow at a CAGR of over 15% through 2028, driven by demand for efficiency and safety.

- CSIC's Position: While CSIC is a giant in shipbuilding, its direct competition in the specialized digital ship management software market might be less pronounced than firms like Wärtsilä or Kongsberg Maritime, which have dedicated digital service divisions.

- Investment Needs: To compete effectively, CSIC would need to significantly boost its R&D spending on AI algorithms, cloud infrastructure, and data science talent, aiming to develop proprietary platforms or acquire key technologies.

- Industry Trend: Major classification societies like DNV and Lloyd's Register are actively developing digital twin and AI-powered monitoring solutions, indicating the industry's strong push towards digitalization in vessel operations.

China's shipbuilding sector is actively exploring high-growth, but currently low-market-share areas, fitting the 'question mark' category in the BCG matrix. These ventures require significant investment and technological advancement to mature into future stars.

The development of large cruise ship construction, autonomous shipping technologies, advanced marine propulsion systems, specialized offshore platforms for emerging energy, and integrated digital ship management solutions all represent these question marks for China's shipbuilding industry.

While these sectors hold immense future potential, they currently demand substantial capital and face technological and market uncertainties, necessitating strategic investment and innovation to achieve competitive advantage.

| Area of Development | Current Market Share (Estimated) | Growth Potential | Key Challenges | Investment Required |

|---|---|---|---|---|

| Large Cruise Ship Construction | Low (Global) | High (Domestic Tourism Growth) | Technological Sophistication, Supply Chain Integration | High |

| Autonomous Shipping | Minimal (Commercial) | Very High (Efficiency, Safety) | Regulatory Frameworks, Market Acceptance, AI Development | Very High |

| Advanced Marine Propulsion (e.g., Hydrogen Fuel Cells) | Minimal | High (Green Shipping Mandates) | Cost, Infrastructure, Technical Maturity | High |

| Offshore Platforms for Emerging Energy (e.g., Floating Solar, Deep-Sea Mining) | Modest | High (Renewable Energy Transition, Resource Demand) | Specialized Engineering, Environmental Regulations | High |

| Digital Ship Management Solutions | Developing | High (Efficiency, Data-Driven Operations) | Software Development, Data Analytics, Cybersecurity | Medium to High |

BCG Matrix Data Sources

Our China Shipbuilding Industry BCG Matrix is built on verified market intelligence, combining financial data from publicly listed companies, industry research reports, and official government statistics to ensure reliable insights.