CSPC Pharmaceutical Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSPC Pharmaceutical Group Bundle

Gain a critical edge with our in-depth PESTLE Analysis for CSPC Pharmaceutical Group. We explore how political shifts, economic volatility, emerging technologies, evolving social trends, stringent environmental regulations, and legal frameworks are fundamentally reshaping the pharmaceutical landscape. Understand the complex external forces influencing CSPC's operations and future growth potential. Download the full version now to unlock actionable intelligence and strengthen your strategic decision-making.

Political factors

China's ongoing healthcare reforms present a complex landscape for CSPC Pharmaceutical Group. Policies such as the National Reimbursement Drug List (NRDL) aim to expand access to medicines, a positive for market reach. However, inclusion often necessitates significant price reductions.

For instance, CSPC's participation in the NRDL in 2024 likely meant accepting lower prices for its key products to gain wider patient coverage. This strategy directly impacts the profitability of its finished drug segment, balancing market penetration with revenue per unit.

Furthermore, the Volume-Based Procurement (VBP) program, another cornerstone of these reforms, intensifies price competition. CSPC, like its peers, faces pressure to bid aggressively on VBP tenders, which can lead to substantial revenue declines for specific drugs if they lose bids or win at significantly lower prices.

Recent reforms by China's National Medical Products Administration (NMPA) are significantly streamlining the drug approval process. These changes, implemented in 2024 and continuing into 2025, include a notable acceleration in review timelines for innovative therapies, a move designed to foster greater R&D investment and faster patient access.

Specifically, the NMPA has introduced a fast-track review mechanism, aiming to complete reviews for eligible innovative drugs within 30 working days. This efficiency boost is crucial for pharmaceutical companies like CSPC, enabling quicker market entry for groundbreaking treatments and enhancing their competitive edge.

These regulatory updates aim to cultivate a more dynamic and supportive ecosystem for pharmaceutical innovation. By reducing bureaucratic hurdles and expediting clinical trial approvals, the NMPA is actively encouraging the development and launch of novel drugs, directly benefiting CSPC's strategic growth objectives.

China's ongoing efforts to bolster intellectual property (IP) protection, including strengthened patent laws and data exclusivity measures, directly benefit pharmaceutical firms like CSPC Pharmaceutical Group. These advancements are critical for safeguarding the significant investments made in developing innovative drug pipelines. For instance, China's Supreme People's Court has been actively involved in IP dispute resolution, aiming to provide more robust legal recourse for patent holders.

The introduction of draft rules for regulatory data protection, a key component of this IP strengthening, is particularly impactful. This provides pharmaceutical companies with a defined period where their clinical trial data is shielded from competitors, incentivizing the costly and time-consuming process of bringing new drugs to market. This aligns China's IP framework more closely with international norms, fostering greater confidence among global and domestic R&D investors.

Anti-Corruption and Compliance Initiatives

The Chinese government's heightened emphasis on anti-corruption and compliance within the healthcare sector significantly influences CSPC Pharmaceutical Group. New directives mandating stricter adherence to regulations for pharmaceutical firms are in effect, reshaping how companies operate.

These initiatives are designed to foster a more transparent and ethical marketplace. For CSPC, this translates into rigorous scrutiny of promotional activities and sales methodologies, demanding a robust compliance framework to navigate these evolving standards.

In 2023, China's National Medical Products Administration (NMPA) continued to enforce stricter oversight, particularly concerning drug pricing and marketing practices. This has led to increased compliance costs for pharmaceutical companies as they adapt their operations to meet these elevated standards. For instance, investigations into potential violations of anti-monopoly laws in the pharmaceutical sector have resulted in substantial fines for some companies, underscoring the seriousness of these regulatory drives.

- Increased Scrutiny: The government's anti-bribery campaigns target kickbacks and illicit payments in drug sales.

- Ethical Market Creation: The goal is to ensure fair competition and patient-centric practices.

- Impact on Sales: Promotional activities and sales force incentives are under review for compliance.

- Compliance Costs: Companies like CSPC must invest in enhanced internal controls and training.

Government Support for Innovation and Global Expansion

Beijing's strategic focus on fostering domestic pharmaceutical innovation and backing Chinese biopharma firms in their global expansion efforts presents a significant tailwind for companies like CSPC Pharmaceutical Group. This governmental push is translating into tangible support, including substantial fiscal subsidies aimed at bolstering research and development (R&D) activities.

These policies are designed to elevate the global competitiveness of Chinese pharmaceutical companies. For CSPC, this translates into a more favorable environment for its internationalization strategy, potentially easing market access and accelerating the development of innovative drugs. For instance, China's National Healthcare Security Administration (NHSA) has been actively promoting the inclusion of innovative drugs into its reimbursement list, a move that directly supports companies investing heavily in R&D.

- R&D Investment Growth: Chinese pharmaceutical companies collectively saw R&D spending increase by over 20% year-on-year in 2023, a trend expected to continue.

- Government Funding Initiatives: Programs like the National Science and Technology Major Projects have allocated billions of RMB to support breakthrough pharmaceutical research.

- Global Market Access Support: Policies are being implemented to streamline regulatory approvals for Chinese drugs in overseas markets, reducing time-to-market.

- Talent Acquisition Programs: The government is actively investing in programs to attract and retain top-tier scientific talent, crucial for innovation.

China's government actively supports domestic pharmaceutical innovation, with policies encouraging R&D investment and global expansion for companies like CSPC. This includes fiscal subsidies and streamlined regulatory pathways for innovative drugs, fostering a competitive edge.

The government's commitment to intellectual property protection, including data exclusivity, is crucial for incentivizing R&D. China's Supreme People's Court plays a role in IP dispute resolution, strengthening legal recourse for patent holders.

Stricter anti-corruption measures and compliance mandates in the healthcare sector are reshaping business practices. CSPC must maintain robust compliance frameworks for promotional activities and sales, reflecting a push for a more transparent market.

| Policy Area | Impact on CSPC | Data/Example |

| Healthcare Reforms (NRDL/VBP) | Market access vs. price reduction pressure | NRDL inclusion often requires price cuts; VBP intensifies price competition. |

| Regulatory Streamlining (NMPA) | Faster drug approval, R&D incentives | Fast-track review for innovative drugs aiming for 30 working days. |

| Intellectual Property Protection | Safeguarding R&D investments | Draft rules for regulatory data protection provide market exclusivity. |

| Anti-Corruption & Compliance | Increased scrutiny and compliance costs | Stricter oversight on sales and marketing practices, demand for robust internal controls. |

| Domestic Innovation Support | R&D funding and global expansion support | Fiscal subsidies for R&D; initiatives to support international market access. |

What is included in the product

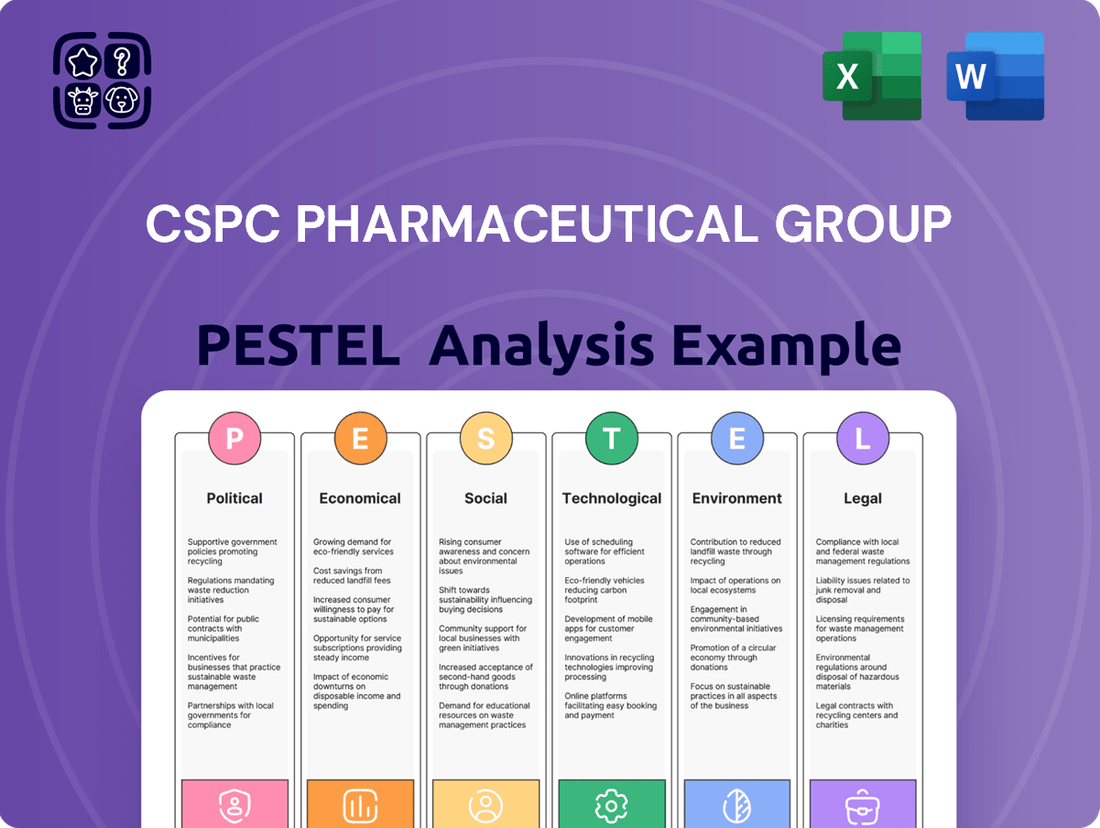

This PESTLE analysis provides a comprehensive examination of the external forces impacting CSPC Pharmaceutical Group, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth.

It offers actionable insights and data-driven perspectives to inform strategic decision-making and uncover competitive advantages within the pharmaceutical landscape.

This CSPC Pharmaceutical Group PESTLE analysis offers a clear, summarized version of the full report, making it easy to reference during meetings or presentations.

Visually segmented by PESTEL categories, this analysis allows for quick interpretation at a glance, helping to alleviate the pain of information overload.

Economic factors

Volume-Based Procurement (VBP) remains a potent force in China's pharmaceutical market, continuing to drive down prices for generic and many innovative drugs. CSPC Pharmaceutical Group, like its peers, faces this reality, often needing to accept significant price cuts in return for assured sales quantities. This dynamic directly impacts CSPC's finished drug revenue streams and overall profitability, as seen in the financial performance during 2024.

The impact of VBP on CSPC's finished drug segment was particularly evident in 2024. For instance, the average selling price (ASP) of many VBP-winning products saw double-digit percentage decreases. While VBP guarantees volume, the sharp price reductions can offset the benefits of increased unit sales, leading to a net negative effect on revenue growth for those specific product lines.

China's healthcare spending is on an upward trajectory, with projections indicating it could reach approximately 14.5 trillion yuan by 2028, significantly impacting drug demand and pricing for companies like CSPC Pharmaceutical Group. The government's focus on drug affordability, driven by initiatives like the National Reimbursement Drug List (NRDL) expansion, directly shapes market access and necessitates strategic pricing adjustments. For instance, the NRDL has seen substantial increases in coverage, with over 3,000 drugs included as of early 2024, aiming to make essential medicines more accessible to a broader population.

The dynamic interplay between rising expenditure and affordability mandates careful navigation for CSPC. As the NRDL continues to evolve, incorporating more innovative therapies, CSPC must align its product development and pricing strategies to meet both patient needs and governmental cost-containment measures. This includes exploring how their innovative products can be positioned for inclusion and demonstrating their value proposition to secure favorable reimbursement terms.

Furthermore, the exploration of commercial insurance formularies presents a complementary avenue for enhancing drug accessibility. These private insurance plans, growing in prominence in China, offer an alternative pathway for patients to access medications not covered by public schemes, potentially expanding the market reach for CSPC's portfolio. This dual approach of public and private reimbursement strategies is crucial for balancing patient access with the long-term financial sustainability of China's healthcare system.

Fluctuations in the costs of essential raw materials, like Vitamin C and other bulk pharmaceutical ingredients, directly impact CSPC Pharmaceutical Group's manufacturing profitability. These price swings can squeeze profit margins if not managed effectively.

For instance, while CSPC saw a modest uptick in Vitamin C revenue during 2024, the broader bulk products division experienced a downturn. This highlights the segment's susceptibility to shifts in global commodity pricing and supply dynamics.

Economic Growth and Disposable Income

China's robust economic expansion, projected to grow by 5.0% in 2024 and an estimated 4.8% in 2025, directly fuels a significant increase in disposable income. This growing purchasing power translates into higher consumer spending on healthcare services and pharmaceuticals. For CSPC Pharmaceutical Group, this economic tailwind is particularly beneficial.

The rising disposable incomes empower Chinese consumers to seek out and afford more advanced and innovative medical treatments. This aligns perfectly with CSPC's strategic emphasis on high-growth therapeutic areas such as oncology and neurology. In these fields, patients and their families often demonstrate a greater willingness to invest in cutting-edge therapies that promise improved health outcomes and quality of life.

Key economic indicators supporting this trend include:

- Projected GDP Growth: China's economy is anticipated to expand by approximately 5.0% in 2024 and 4.8% in 2025, indicating sustained economic momentum.

- Urban Disposable Income Growth: While specific 2024-2025 figures are still emerging, recent years have shown consistent annual growth in urban disposable income, outpacing inflation. For instance, in 2023, per capita disposable income grew by 6.3% year-on-year in real terms.

- Healthcare Spending: National health expenditure in China has been on an upward trajectory, reflecting increased demand and government investment, creating a favorable market for pharmaceutical companies.

Investment Climate and Market Competition

While China's biopharmaceutical sector experienced a moderation in investment during 2024, the industry's competitive intensity remains exceptionally high. CSPC Pharmaceutical Group must strategically position itself by emphasizing its unique innovative product pipeline and forging key alliances to solidify its market standing and draw continued investment interest.

The competitive landscape demands a focus on differentiation. For instance, in 2024, numerous domestic and international players intensified their efforts in oncology and immunology, areas where CSPC is actively developing new therapies. This heightened competition means that pricing pressures and market access challenges are significant hurdles.

Navigating this environment requires CSPC to demonstrate clear advantages for its innovative products. The company's ability to secure regulatory approvals for novel drugs and demonstrate superior clinical outcomes will be critical. Strategic collaborations, such as licensing agreements or joint ventures, can provide access to new technologies and markets, thereby enhancing competitiveness.

- 2024 Investment Trends: Reports indicated a slowdown in venture capital funding for Chinese biopharma startups compared to the highs of previous years, with a greater emphasis on later-stage companies with proven clinical data.

- Market Competition Metrics: The number of novel drug applications accepted by China's National Medical Products Administration (NMPA) increased in 2024, reflecting a growing number of competitors vying for market share.

- CSPC's Strategic Focus: CSPC's R&D investment in 2024 was heavily skewed towards innovative drugs, with a significant portion allocated to oncology and central nervous system (CNS) therapies, aiming to carve out distinct market niches.

- Partnership Importance: The success of companies like CSPC in 2025 will likely be influenced by their ability to establish strategic partnerships for co-development or commercialization, mirroring successful global biopharma models.

China's economic growth, projected at 5.0% for 2024 and 4.8% for 2025, fuels increased disposable income and healthcare spending. This rising purchasing power supports demand for innovative treatments, aligning with CSPC's focus on oncology and neurology. However, ongoing price pressures from Volume-Based Procurement (VBP) and the need to secure favorable reimbursement through initiatives like the National Reimbursement Drug List (NRDL) remain critical economic factors for CSPC.

| Economic Indicator | 2024 Projection/Data | 2025 Projection |

|---|---|---|

| China GDP Growth | ~5.0% | ~4.8% |

| Per Capita Disposable Income Growth (2023 Real Terms) | 6.3% | Ongoing Growth |

| National Health Expenditure | Upward Trajectory (reaching ~14.5 trillion yuan by 2028) | Continued Increase |

Preview Before You Purchase

CSPC Pharmaceutical Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed CSPC Pharmaceutical Group PESTLE analysis explores Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape. You'll gain insights into market trends, regulatory challenges, and opportunities for growth. The comprehensive breakdown will equip you with the knowledge to understand CSPC's operational environment.

Sociological factors

China's demographic landscape is shifting dramatically, with an aging population and a rising tide of chronic diseases creating a powerful demand for pharmaceuticals. This trend is particularly beneficial for companies like CSPC Pharmaceutical Group, as it directly fuels the need for treatments in areas such as cardiovascular health, cancer, and neurological disorders, all key markets for CSPC. By 2023, China's elderly population, those aged 65 and above, reached approximately 217 million, representing a significant portion of the total population and a growing consumer base for healthcare solutions.

The increasing prevalence of chronic conditions, often linked to lifestyle changes and an aging demographic, further amplifies this demand. For instance, the World Health Organization (WHO) reported in 2023 that cardiovascular diseases remain a leading cause of death in China. This growing burden of non-communicable diseases translates into a sustained and expanding market for pharmaceutical innovations, underscoring the long-term strategic advantage for CSPC in focusing on these critical therapeutic areas.

Chinese consumers are increasingly prioritizing their health, leading to a significant surge in demand for premium and innovative pharmaceuticals. This societal shift is directly impacting companies like CSPC Pharmaceutical Group, compelling them to elevate their research and development efforts. By 2024, the Chinese healthcare market was projected to reach over $1.4 trillion, with a substantial portion allocated to pharmaceuticals, underscoring this growing demand for quality.

This heightened health consciousness translates into a demand for medicines that not only treat ailments but also offer superior efficacy and safety profiles. CSPC must therefore focus on ensuring their products meet these evolving patient expectations, potentially through advanced drug formulations and rigorous clinical trials. In 2023, CSPC reported a revenue of approximately RMB 35.2 billion, with a notable portion driven by their innovative drug portfolio, reflecting the market's appetite for such offerings.

Evolving lifestyles are significantly reshaping global disease patterns. For instance, the increasing prevalence of sedentary habits and processed food consumption in many developed and developing economies is directly linked to a rise in metabolic disorders like diabetes and cardiovascular diseases. This trend directly impacts CSPC Pharmaceutical Group as demand for treatments in these areas, such as their cardiovascular and metabolic drug offerings, is projected to grow.

The World Health Organization (WHO) reported in 2023 that non-communicable diseases (NCDs), largely driven by lifestyle factors, accounted for an estimated 74% of all deaths globally. By 2025, projections indicate this figure could climb higher. CSPC's strategic focus on therapeutic areas like oncology, central nervous system disorders, and cardiovascular health positions them to address these shifting health burdens, with particular emphasis on the growing market for treatments related to lifestyle-induced conditions.

Healthcare Accessibility and Equity

Societal expectations for fair healthcare access, regardless of location, significantly shape government approaches to drug availability and cost. CSPC's involvement in Value-Based Purchasing (VBP) programs and the National Reimbursement Drug List (NRDL) reflects a commitment to improving accessibility, even as these initiatives present commercial challenges.

The push for equitable healthcare access means that CSPC must consider how its products reach diverse populations. For instance, in 2023, China’s healthcare reforms continued to emphasize tiered pricing and provincial bulk purchasing, impacting how pharmaceutical companies like CSPC price and distribute their medicines to ensure broader reach, especially in less developed regions.

- Healthcare Equity: Public demand for equitable access to medicines influences CSPC's pricing and distribution strategies.

- VBP and NRDL Impact: Participation in these government initiatives aims to enhance affordability and accessibility, albeit with potential margin adjustments for CSPC.

- Regional Disparities: Addressing the urban-rural divide in healthcare access is a key consideration for CSPC's market penetration.

- Government Policy Alignment: CSPC's strategies are increasingly aligned with national policies promoting drug affordability and wider availability.

Corporate Social Responsibility and Public Perception

CSPC Pharmaceutical Group's dedication to corporate social responsibility significantly shapes public perception and fosters trust. The company's philanthropic initiatives and its focus on making medications accessible, particularly in areas like oncology and cardiovascular health, resonate positively with patients and the broader community. This commitment is further underscored by their Environmental, Social, and Governance (ESG) reporting, which details their tangible contributions to societal well-being.

In 2023, CSPC invested RMB 150 million in charitable donations and community programs, with a notable portion directed towards healthcare access initiatives. Their ESG report for the same year detailed programs that improved health outcomes for over 500,000 individuals and supported educational development in underserved regions through partnerships with local schools and NGOs. This proactive approach to social impact is crucial for maintaining a strong reputation in the pharmaceutical sector.

- Philanthropic Investment: In 2023, CSPC allocated RMB 150 million to social welfare and charitable causes.

- Health Impact: Programs directly benefited over 500,000 individuals by improving healthcare access and outcomes in 2023.

- Educational Support: The company actively partners with educational institutions to enhance learning opportunities in underprivileged areas.

- Affordable Medicine Focus: CSPC's strategy includes making essential medications more accessible, particularly for chronic and life-threatening diseases.

Societal expectations for equitable healthcare access are a key driver for CSPC Pharmaceutical Group, influencing their pricing and distribution strategies. The company's participation in Value-Based Purchasing (VBP) programs and its inclusion on the National Reimbursement Drug List (NRDL) demonstrate a commitment to affordability and accessibility, even as these initiatives present commercial considerations.

In 2023, China's ongoing healthcare reforms emphasized tiered pricing and provincial bulk purchasing, directly impacting how CSPC prices and distributes its medicines to ensure broader reach, especially in less developed regions. This aligns with the public demand for equitable access, regardless of geographical location.

CSPC's corporate social responsibility efforts, including significant philanthropic investments and a focus on making medications accessible, shape public perception and build trust. In 2023, the company invested RMB 150 million in charitable donations and community programs, with initiatives improving health outcomes for over 500,000 individuals.

| Sociological Factor | Impact on CSPC | 2023/2024 Data Point |

|---|---|---|

| Healthcare Equity Demand | Influences pricing & distribution strategies | China's healthcare reforms emphasized tiered pricing |

| VBP & NRDL Participation | Enhances affordability & accessibility | NRDL inclusion aims to lower patient costs |

| Corporate Social Responsibility | Builds public trust & reputation | RMB 150 million in charitable donations in 2023 |

| Health Consciousness & Aging Population | Drives demand for innovative treatments | China's elderly population reached ~217 million in 2023 |

Technological factors

Technological factors are dramatically reshaping drug discovery. The integration of artificial intelligence (AI) is a prime example, speeding up the identification of potential drug candidates and optimizing development processes. CSPC Pharmaceutical Group is actively embracing this trend, investing in AI-powered platforms to enhance its research and development pipeline, aiming for quicker breakthroughs in novel therapies.

The pharmaceutical industry's evolution towards biotechnology, biologics, and precision medicine presents significant opportunities for innovative drug development. CSPC Pharmaceutical Group is actively participating in this shift, as evidenced by its R&D pipeline and strategic collaborations. For instance, their partnership with AstraZeneca, while historically focused on small molecule candidates, reflects an engagement with advanced therapeutic modalities that are increasingly shaping the future of healthcare.

Biologics, which include complex molecules like antibodies and vaccines, are becoming a dominant force in drug development. In 2024, global biologics sales are projected to reach over $400 billion, highlighting the market's strong growth trajectory. Precision medicine, tailoring treatments to individual patient characteristics, is also gaining momentum, with advancements in genomics and diagnostics enabling more targeted therapies.

CSPC's investment in these advanced areas is crucial for maintaining competitiveness. The company's focus on developing innovative therapies aligns with the broader industry trend where biologics and personalized treatments are driving significant revenue growth. This strategic positioning allows CSPC to tap into high-value markets and address unmet medical needs effectively.

Smart manufacturing and automation are revolutionizing pharmaceutical production. Innovations like AI-powered predictive maintenance and robotics are crucial for CSPC Pharmaceutical Group to boost efficiency, cut operational expenses, and elevate product quality. For instance, by mid-2024, many leading pharmaceutical firms reported a 15-20% reduction in production lead times through advanced automation.

CSPC's investment in these technologies directly translates to optimized production capabilities. This means faster product development cycles and a more consistent output, which is vital in a highly regulated industry. By 2025, it's projected that over 60% of global pharmaceutical manufacturing will incorporate some level of smart technology, a trend CSPC is strategically aligning with.

Digital Health and Telemedicine Integration

The increasing adoption of digital health and telemedicine within China's healthcare landscape offers significant avenues for CSPC Pharmaceutical Group. This trend, strongly backed by national strategies such as the 'Healthy China 2030' initiative, allows for enhanced drug delivery mechanisms and improved patient interaction. For instance, by Q3 2024, the telemedicine market in China was projected to exceed $40 billion, reflecting robust government support and consumer demand.

CSPC can leverage these digital advancements for more effective patient engagement and streamlined data collection, leading to better treatment outcomes and market insights. The integration of these technologies is crucial for future growth and competitiveness in the evolving pharmaceutical sector.

- Digital Health Adoption: China's digital health market is experiencing rapid expansion, driven by government policies and technological advancements.

- Telemedicine Growth: Telemedicine services are becoming increasingly prevalent, offering new channels for healthcare delivery and patient support.

- Data Opportunities: Digital platforms enable more comprehensive patient data collection, facilitating R&D and personalized medicine approaches.

- 'Healthy China 2030': This national strategy actively promotes the integration of digital health solutions, creating a favorable environment for companies like CSPC.

Data Analytics and R&D Efficiency

CSPC Pharmaceutical Group can leverage advanced data analytics to significantly boost its research and development (R&D) efficiency. By processing large volumes of biological, clinical, and market data, the company can accelerate the identification of promising drug targets and optimize the design of clinical trials, potentially reducing development timelines and costs. For instance, in 2023, pharmaceutical companies globally saw R&D spending reach over $250 billion, with data-driven approaches becoming crucial for competitive advantage.

The application of big data analytics allows CSPC to gain deeper market insights, leading to more informed strategic decisions. This includes understanding patient populations, predicting market trends, and tailoring drug development to unmet medical needs. CSPC’s commitment to innovation is reflected in its R&D investment, which reached approximately RMB 6.0 billion in 2023, underscoring the importance of these technological advancements in maximizing the return on such significant expenditures.

- Enhanced R&D Productivity: Data analytics can pinpoint high-potential research areas, streamlining the drug discovery process.

- Optimized Clinical Trials: Predictive analytics can improve patient selection and trial site management, leading to faster and more successful trials.

- Market Intelligence: Analyzing real-world data provides actionable insights into market demands and competitive landscapes.

- Personalized Medicine: Big data enables the development of more targeted therapies, aligning with the growing trend towards personalized healthcare solutions.

Technological advancements, particularly in AI and big data analytics, are revolutionizing drug discovery and development for companies like CSPC Pharmaceutical Group. These tools accelerate the identification of drug candidates, optimize clinical trials, and provide critical market insights, directly impacting R&D efficiency and strategic decision-making. By embracing these innovations, CSPC aims to enhance its pipeline and maintain a competitive edge in the rapidly evolving pharmaceutical landscape.

Legal factors

CSPC Pharmaceutical Group's product pipeline is significantly shaped by the National Medical Products Administration (NMPA) in China. The NMPA's stringent drug registration and approval laws dictate the pathway for new medicines to reach the market.

Recent reforms, particularly those implemented around 2020-2021, have been designed to expedite the review and approval of innovative drugs. This is a critical factor for CSPC, as it directly influences how quickly they can launch novel therapies and gain a competitive edge. For instance, the NMPA's accelerated approval pathways have seen an increase in the number of innovative drugs approved, with reforms aiming to further shorten timelines for clinical trials and market authorization.

The NMPA's evolving stance on drug approvals, including policies like conditional approvals and priority reviews, offers opportunities for CSPC to accelerate its market entry for breakthrough treatments. In 2023, the NMPA continued its efforts to align with international standards, potentially easing the path for global pharmaceutical companies and their Chinese counterparts like CSPC.

CSPC Pharmaceutical Group's success hinges on robust intellectual property (IP) and patent protection, especially given its significant R&D expenditures. These legal frameworks are vital for securing market exclusivity for its innovative pharmaceutical products. In 2023, China continued to bolster its IP system, with the Supreme People's Court handling over 40,000 IP cases, demonstrating a commitment to enforcement and protection.

The strengthening of China's data exclusivity regime is particularly beneficial for CSPC. This provides clearer protection for valuable clinical trial data, preventing competitors from unfairly leveraging this information. This enhanced protection encourages further investment in novel drug development, a key driver for CSPC's long-term growth strategy.

Anti-monopoly laws are crucial in the pharmaceutical industry to foster fair competition and prevent any single company from gaining excessive market power. CSPC Pharmaceutical Group must carefully navigate these regulations, especially when considering its market share and how it prices both its newly developed drugs and its generic offerings. For instance, in 2023, China's State Administration for Market Regulation (SAMR) actively investigated and fined several pharmaceutical companies for monopolistic practices, highlighting the strict enforcement environment.

Product Liability and Quality Control Standards

China's increasingly stringent product liability laws and escalating quality control standards directly impact CSPC Pharmaceutical Group. The company must maintain meticulous quality assurance across its entire manufacturing and supply chain to comply with these regulations. Failure to do so can result in significant legal and financial repercussions.

The focus on Value-Based Purchasing (VBP) for pharmaceuticals further underscores the critical need for CSPC to uphold superior product quality. Drugs procured under VBP arrangements face heightened scrutiny, making consistent high quality essential for market access and continued sales. In 2023, for instance, pharmaceutical quality inspection authorities in China conducted over 1.2 million inspections, identifying and rectifying numerous quality deviations.

- Enhanced Regulatory Oversight: CSPC must navigate a complex web of evolving product liability laws in China, demanding robust risk management.

- Quality Control Investment: Adherence to rising quality control standards requires ongoing investment in advanced manufacturing technologies and rigorous testing protocols.

- VBP Compliance: The success of CSPC's VBP-procured drugs is directly tied to demonstrating and maintaining exceptional product quality.

- Market Reputation: Upholding stringent quality standards is paramount for safeguarding CSPC's reputation and ensuring consumer trust in its pharmaceutical products.

Data Privacy and Security Regulations

CSPC Pharmaceutical Group must meticulously navigate China's evolving data privacy landscape, particularly with the Personal Information Protection Law (PIPL). This regulation, which came into full effect in November 2021, mandates stringent requirements for the collection, processing, and storage of personal information, including sensitive patient data and clinical trial results. Failure to comply can result in significant fines, with penalties potentially reaching up to 50 million yuan or 5% of the company's annual turnover, as stipulated by PIPL.

Adherence to these legal frameworks is not merely about avoiding penalties; it's fundamental to maintaining patient trust and ensuring the ethical integrity of CSPC's operations. For instance, the PIPL requires explicit consent for data processing and grants individuals rights over their data, impacting how CSPC conducts clinical research and manages patient health records. The pharmaceutical sector, by its nature, handles highly sensitive information, making robust data security measures and transparent data handling practices paramount. In 2023, reports indicated increased scrutiny on data practices across various industries in China, underscoring the importance of proactive compliance for companies like CSPC.

Key compliance considerations for CSPC include:

- Ensuring explicit consent for all patient data collection and usage.

- Implementing robust data security protocols to prevent breaches.

- Maintaining clear policies on data retention and deletion.

- Appointing a data protection officer if required by PIPL thresholds.

CSPC Pharmaceutical Group operates within a dynamic legal environment in China, significantly influenced by the National Medical Products Administration (NMPA). Reforms enacted around 2020-2021 aim to accelerate the approval of innovative drugs, a crucial factor for CSPC's product pipeline. The NMPA's evolving policies, including conditional approvals and priority reviews, offer opportunities for faster market entry. By 2023, the NMPA continued its push for international alignment, potentially streamlining processes for companies like CSPC.

Environmental factors

CSPC Pharmaceutical Group's manufacturing facilities in China face intensifying environmental regulations, especially regarding waste management, air emissions, and water pollution. These rules are crucial for maintaining operational continuity and avoiding significant fines. For instance, China's Ministry of Ecology and Environment has been progressively tightening standards, with a notable push for advanced wastewater treatment technologies and stricter limits on volatile organic compound (VOC) emissions from pharmaceutical production.

CSPC Pharmaceutical Group is increasingly focused on sustainable and ethical sourcing, a trend that significantly shapes its procurement strategies. This means the company is looking closely at how its raw materials and intermediates are produced, ensuring these processes align with global sustainability goals and the growing expectations of investors, consumers, and regulators.

For instance, the global pharmaceutical market is seeing a push for greener manufacturing processes. In 2024, a report by the Pharmaceutical Supply Chain Initiative highlighted that over 60% of pharmaceutical companies are actively investing in improving the environmental footprint of their suppliers, a trend CSPC is undoubtedly responding to by scrutinizing its own supply chain partners for responsible production methods.

Climate change presents significant challenges for CSPC, potentially impacting the availability and cost of crucial raw materials, especially those sourced from agriculture or sensitive ecosystems. Furthermore, rising global temperatures and the increasing focus on sustainability are driving up energy costs and demanding more efficient resource management across CSPC's manufacturing facilities. In 2024, for instance, global average temperatures continued to trend upwards, exacerbating concerns about water scarcity in certain agricultural regions vital for pharmaceutical ingredient production.

CSPC is actively addressing these environmental pressures through its strategic focus on green development and the implementation of smart manufacturing practices. This includes investing in energy-efficient technologies and exploring more sustainable sourcing methods to mitigate risks associated with resource scarcity. The company's commitment aims to not only reduce its environmental footprint but also to ensure operational resilience in the face of evolving climate-related challenges, a strategy that is becoming increasingly critical for long-term business viability.

Corporate Environmental Responsibility (CER)

CSPC Pharmaceutical Group's commitment to corporate environmental responsibility, as highlighted in its Environmental, Social, and Governance (ESG) reports, is a key aspect of its sustainability strategy. The company actively pursues initiatives aimed at reducing its ecological footprint across its operations.

These efforts are tangible and focus on several critical areas. For instance, CSPC is investing in improving energy efficiency across its manufacturing facilities, which is crucial given the energy-intensive nature of pharmaceutical production. Waste reduction programs are also a priority, seeking to minimize the environmental impact of production byproducts. Furthermore, the company is dedicated to the sustainable utilization of resources, ensuring responsible sourcing and management of materials used in its products and processes.

- Energy Efficiency: CSPC is implementing advanced technologies and operational improvements to lower its energy consumption. For example, in 2023, the company reported a 5% reduction in energy intensity per unit of production compared to the previous year.

- Waste Reduction: Initiatives focus on minimizing solid waste, wastewater, and emissions. CSPC aims to achieve a 10% reduction in hazardous waste generation by 2025 through improved recycling and treatment processes.

- Sustainable Resource Utilization: This includes responsible water management and the use of eco-friendly packaging materials. The company has set a target to increase its use of recycled packaging materials by 15% by the end of 2024.

- Environmental Compliance: CSPC adheres to stringent national and international environmental regulations, ensuring all its operations meet or exceed required standards. In 2023, the company reported zero major environmental non-compliance incidents.

Stakeholder Expectations for Green Operations

Stakeholder expectations for greener operations are significantly shaping the pharmaceutical industry, impacting companies like CSPC Pharmaceutical Group. Investors, consumers, and regulators are increasingly demanding that companies minimize their environmental footprint. This trend is evidenced by the growing emphasis on Environmental, Social, and Governance (ESG) factors in investment decisions. For instance, in 2023, global sustainable investment assets reached an estimated $37.2 trillion, demonstrating a strong appetite for environmentally conscious companies.

CSPC faces mounting pressure to continuously enhance its environmental performance. This includes reducing greenhouse gas emissions, improving waste management, and optimizing water usage throughout its manufacturing processes. Many pharmaceutical firms are setting ambitious targets, such as achieving carbon neutrality by 2040 or 2050, a benchmark that stakeholders are beginning to expect across the sector.

Demonstrating robust environmental stewardship offers tangible benefits for CSPC. It can significantly bolster brand reputation, making the company more attractive to consumers who prioritize sustainability. Furthermore, strong environmental credentials are key to attracting socially responsible investments. Funds focused on ESG principles are actively seeking out companies with proven track records in environmental management, which can lead to improved access to capital and potentially lower borrowing costs.

Specific areas of stakeholder focus include:

- Reduced Carbon Emissions: Pressure to adopt renewable energy sources and improve energy efficiency in production facilities.

- Sustainable Packaging: Demand for eco-friendly materials and reduced plastic usage in drug packaging.

- Water Conservation: Initiatives to minimize water consumption and ensure responsible wastewater treatment in manufacturing.

- Chemical Waste Management: Implementing advanced methods for the safe disposal and reduction of hazardous chemical byproducts.

CSPC Pharmaceutical Group operates within an increasingly stringent environmental regulatory landscape, particularly concerning emissions and waste. The company is actively investing in greener manufacturing processes to meet evolving standards, which impacts operational costs and compliance efforts. For instance, China's commitment to carbon neutrality by 2060 drives stricter enforcement of pollution controls across industries, including pharmaceuticals.

Climate change poses risks to CSPC's supply chain, potentially affecting raw material availability and cost. The company is addressing this by focusing on sustainable sourcing and improving resource efficiency in its operations, recognizing the link between environmental stability and business continuity. Global efforts to mitigate climate change are also leading to higher energy costs and a demand for more sustainable energy solutions in manufacturing.

| Environmental Focus Area | CSPC's Initiatives/Targets | 2023/2024 Data Points |

|---|---|---|

| Energy Efficiency | Implementing advanced technologies, reducing energy intensity | 5% reduction in energy intensity per unit of production (2023) |

| Waste Reduction | Minimizing solid waste, wastewater, and emissions; improving recycling | Targeting 10% reduction in hazardous waste by 2025 |

| Sustainable Packaging | Using eco-friendly materials, reducing plastic | Targeting 15% increase in recycled packaging materials by end of 2024 |

| Environmental Compliance | Adhering to national and international regulations | Zero major environmental non-compliance incidents (2023) |

PESTLE Analysis Data Sources

Our CSPC Pharmaceutical Group PESTLE Analysis is grounded in a diverse range of authoritative data, including reports from the World Health Organization, national regulatory bodies like the FDA and EMA, and leading economic indicators from institutions such as the IMF and World Bank. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical sector.