CSPC Pharmaceutical Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSPC Pharmaceutical Group Bundle

Uncover the strategic brilliance behind CSPC Pharmaceutical Group's market dominance. This analysis delves into their innovative product portfolio, competitive pricing, expansive distribution networks, and impactful promotional campaigns. Discover how these elements interweave to create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for CSPC Pharmaceutical Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Explore how CSPC Pharmaceutical Group’s product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning for CSPC Pharmaceutical Group.

The full report offers a detailed view into the CSPC Pharmaceutical Group’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

Product

CSPC Pharmaceutical Group boasts a diverse product offering, encompassing finished drugs, bulk drugs, and crucial pharmaceutical intermediates. This wide spectrum ensures the company addresses a variety of healthcare needs and solidifies its position across different pharmaceutical market segments. For instance, in 2023, CSPC's finished drug sales reached approximately RMB 23.4 billion, highlighting the strength of their innovative and generic drug offerings.

The company's extensive product lines feature both cutting-edge innovative drugs and widely used generic medications. This dual approach allows CSPC to capture market share from both specialized and mass-market demands. Furthermore, their bulk product offerings, including key items like Vitamin C, antibiotics, and caffeine series, provide a stable revenue stream and demonstrate their integrated manufacturing capabilities.

CSPC Pharmaceutical Group sharpens its focus on key therapeutic areas including cardiovascular health, oncology, neurology, immunology, metabolism, and anti-infectives. This strategic specialization allows the company to channel substantial research and development investment into fields with significant unmet medical needs and strong market growth potential, aiming to create highly effective, targeted treatments.

The company's commitment to these critical disease domains is clearly demonstrated in its product pipeline. For instance, CSPC's investments in oncology saw significant progress, with several innovative drugs advancing through clinical trials in late 2024 and early 2025, targeting various cancer types. This focused approach is designed to maximize the impact of their R&D efforts.

CSPC Pharmaceutical Group's robust innovative drug pipeline is a cornerstone of its product strategy. The company is actively pursuing over 130 drug development projects, demonstrating a significant commitment to R&D. This ambitious pipeline aims for more than 50 new product or indication approvals within the next five years, signaling a strong drive for market expansion and innovation.

This focus on innovation is backed by increasing R&D expenditures, which are critical for CSPC's long-term growth and its ambition to lead the Chinese pharmaceutical market. The company has already achieved notable progress, securing breakthrough therapy designations and clinical trial approvals for several promising new compounds, underscoring the tangible advancements within their development pipeline.

High-Quality Standards and Approvals

CSPC Pharmaceutical Group places a paramount focus on quality, evident in its rigorous manufacturing processes and extensive product development pipeline. This commitment is validated by a significant number of marketing and clinical trial approvals for its pharmaceutical products.

A notable recent achievement was the US Food and Drug Administration (FDA) approval of Xuanning, a novel molecule drug developed in China. This marks a crucial advancement, demonstrating CSPC's ability to navigate and satisfy the stringent regulatory standards of major international markets.

Domestically, CSPC has also secured numerous approvals in China for new indications and products. These include approvals for Cobamamide Capsules and Olaparib Tablets, further solidifying the company's regulatory compliance and innovation capabilities within its home market.

These approvals are not merely administrative milestones; they represent CSPC's dedication to ensuring the safety, efficacy, and quality of its medicines. This dedication translates into tangible value for patients and stakeholders by providing access to advanced therapeutic options.

- US FDA Approval: Xuanning's approval by the US FDA signifies a major international regulatory success for a Chinese-developed novel molecule.

- Domestic Approvals: Multiple approvals in China for new indications and products like Cobamamide Capsules and Olaparib Tablets highlight domestic market strength.

- Regulatory Compliance: CSPC consistently meets and exceeds rigorous regulatory requirements, both in China and globally.

- Quality Assurance: The extensive approval portfolio underscores the high quality inherent in CSPC's manufacturing and product development.

Strategic Global Expansion

CSPC Pharmaceutical Group is actively pursuing global expansion beyond its core Chinese market. This strategy involves advancing innovative drugs through international clinical trials and building out overseas sales infrastructure. For example, CSPC's investments in research and development are yielding promising results, with several novel drug candidates progressing through various stages of global clinical development as of early 2025.

Key to this international push are strategic alliances and out-licensing agreements. A notable partnership with AstraZeneca is already in place, and CSPC has been in discussions for significant multi-billion dollar licensing deals. These collaborations are crucial for amplifying CSPC's global reach and maximizing the return on its substantial R&D expenditures.

- Global Clinical Trials: CSPC's innovative drug pipeline is undergoing trials in multiple international markets, aiming for global regulatory approvals.

- Overseas Sales Networks: The company is investing in establishing and strengthening its sales and marketing presence in key international regions.

- Strategic Partnerships: Collaborations like the one with AstraZeneca are instrumental in accessing new markets and leveraging global expertise.

- Out-Licensing Agreements: CSPC is actively seeking out-licensing opportunities for its drug candidates, potentially generating significant revenue and expanding market access.

CSPC Pharmaceutical Group's product strategy centers on a diversified portfolio, spanning innovative and generic drugs, along with bulk pharmaceuticals. This breadth allows them to cater to a wide range of healthcare needs and market segments. In 2023, finished drug sales alone reached approximately RMB 23.4 billion, showcasing the strength of their offerings.

The company strategically targets key therapeutic areas such as oncology, neurology, and immunology, with a robust R&D pipeline featuring over 130 projects. This focus aims to address significant unmet medical needs and capitalize on market growth. As of early 2025, several novel drug candidates are progressing through international clinical trials, demonstrating a strong commitment to innovation and global expansion.

Quality and regulatory compliance are paramount, underscored by the US FDA approval of their novel molecule drug, Xuanning. Domestically, approvals for Cobamamide Capsules and Olaparib Tablets further validate their capabilities. These achievements highlight CSPC's dedication to delivering safe, effective, and high-quality medicines to patients worldwide.

What is included in the product

This analysis offers a comprehensive review of CSPC Pharmaceutical Group's marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights for understanding CSPC Pharmaceutical Group's market approach and competitive positioning.

Simplifies complex pharmaceutical marketing strategies into actionable insights, addressing the challenge of effectively communicating the CSPC Pharmaceutical Group's 4Ps to diverse audiences.

Place

CSPC Pharmaceutical Group boasts an impressive domestic distribution network within China, a critical component of its marketing strategy. This expansive reach covers over 35,000 medical institutions, a significant figure demonstrating deep penetration into the Chinese healthcare system.

The company’s network extends to more than 90% of Class 3 hospitals and over 70% of Class 2 hospitals, ensuring its finished drugs are readily available in key medical facilities. This broad accessibility is vital for reaching a large patient population and solidifying its market presence across the nation.

CSPC Pharmaceutical Group boasts an extensive presence beyond hospitals, reaching approximately 26,000 additional medical terminals across China. This vast network ensures broad accessibility for its diverse product portfolio.

Furthermore, CSPC's reach extends to over 350,000 drug stores nationwide, making its products readily available to a significant portion of the population. This multi-channel strategy is key to maximizing convenience for both patients and healthcare providers.

This widespread distribution network facilitates easy access to CSPC's prescription and over-the-counter medications, supporting patient adherence and overall healthcare outcomes. The sheer volume of these terminals underscores CSPC's commitment to market penetration.

CSPC Pharmaceutical Group leverages over 10 major production bases, with a significant concentration in Shijiazhuang City, Hebei Province, China. This strategic placement of manufacturing facilities is key to their operational efficiency.

These hubs are critical for optimizing production processes and ensuring robust supply chain management. This allows CSPC to effectively distribute its wide array of pharmaceutical products across its vast market network.

In 2023, CSPC's revenue reached RMB 35.4 billion, underscoring the scale and reach facilitated by its manufacturing infrastructure. The company's commitment to these strategically located hubs supports its ability to meet growing market demands.

International Market Penetration

CSPC Pharmaceutical Group has a significant international footprint, exporting its diverse range of pharmaceutical products to 114 countries and regions spanning all six inhabited continents. This broad reach underscores its commitment to global accessibility and market diversification. The company's strategic establishment of dedicated marketing centers in key regions like the U.S., Germany, and Brazil highlights a proactive approach to directly engaging with these important markets, fostering stronger customer relationships and facilitating smoother business operations.

This direct presence is crucial for understanding and adapting to local regulatory landscapes and consumer needs, thereby enhancing market penetration. The company's international revenue streams are a testament to the success of these efforts, with a notable portion of its sales generated from these overseas markets.

- Global Reach: Exports to 114 countries across six continents.

- Key Market Focus: Established marketing centers in the U.S., Germany, and Brazil.

- Strategic Expansion: Aims to build direct presence and enhance accessibility in major international markets.

Integrated Supply Chain Management

CSPC Pharmaceutical Group’s integrated supply chain management is a cornerstone of its operations, covering everything from initial research and development through to manufacturing and final sales. This comprehensive approach includes bulk drugs, intermediates, and finished goods, ensuring a seamless flow from concept to customer. This vertical integration provides significant control over crucial aspects like product quality, manufacturing efficiency, and the intricate details of distribution, ultimately guaranteeing that their products are consistently available and dependable for the market.

The company’s strategy emphasizes controlling the entire value chain, which is a key factor in their market competitiveness. For instance, in 2023, CSPC reported that its drug manufacturing segment revenue reached approximately RMB 23.8 billion, showcasing the scale and importance of its production capabilities. This tight control allows CSPC to swiftly adapt to market demands and maintain high standards throughout the production process.

Key advantages of this integrated model include:

- Enhanced Quality Control: Direct oversight from raw materials to finished products minimizes deviations and ensures consistent pharmaceutical quality.

- Improved Production Efficiency: Streamlined processes and reduced reliance on external suppliers contribute to cost savings and faster production cycles.

- Reliable Distribution: A managed logistics network ensures timely delivery and product availability across diverse markets.

- Cost Optimization: By managing multiple stages of the supply chain, CSPC can identify and implement cost-saving measures more effectively.

CSPC Pharmaceutical Group's place strategy is characterized by its extensive domestic distribution network, reaching over 35,000 medical institutions, including more than 90% of Class 3 hospitals, ensuring broad product accessibility. This is complemented by a significant international presence, with exports to 114 countries and dedicated marketing centers in key markets like the U.S., Germany, and Brazil, highlighting a commitment to global reach and direct market engagement. The company's integrated supply chain, from R&D to sales, with RMB 23.8 billion in drug manufacturing revenue in 2023, further solidifies its ability to ensure product availability and quality across its vast network.

| Distribution Channel | Reach/Volume | Key Markets/Regions |

|---|---|---|

| Domestic Hospitals | 35,000+ institutions | China (90%+ Class 3, 70%+ Class 2) |

| Other Medical Terminals | 26,000+ | China |

| Drug Stores | 350,000+ | China |

| International Exports | 114 countries | Global (U.S., Germany, Brazil focus) |

Preview the Actual Deliverable

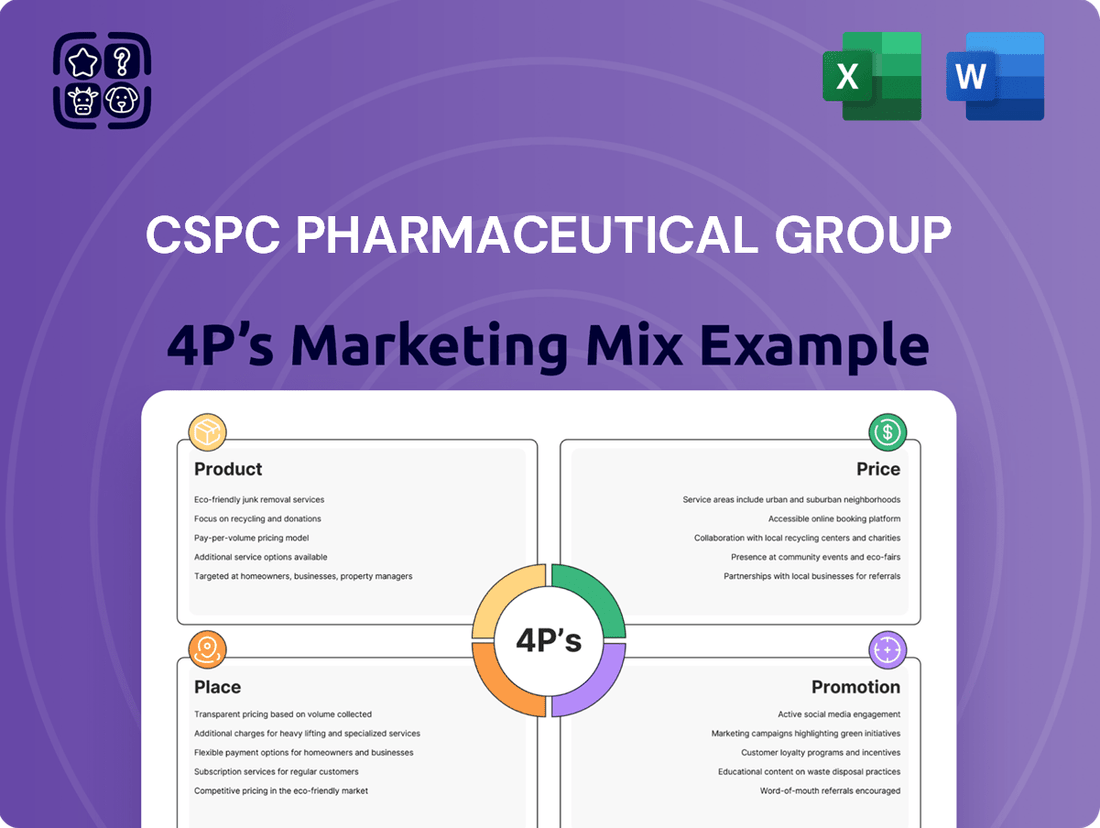

CSPC Pharmaceutical Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CSPC Pharmaceutical Group 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. You'll gain a complete understanding of their market positioning, product portfolio, pricing tactics, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with valuable insights into CSPC's approach.

Promotion

CSPC Pharmaceutical Group's promotional strategy is deeply rooted in its robust commitment to research and development, evidenced by a substantial RMB 5.191 billion investment in 2024.

This significant R&D expenditure fuels the communication of critical breakthroughs, new drug approvals, and the advancement of its drug pipeline.

The company actively disseminates this information to key audiences, including healthcare professionals, investors, and regulatory agencies, underscoring its dedication to pioneering innovative therapies.

These communications highlight CSPC's expanding portfolio and its position as a leader in developing high-value treatments, reinforcing its brand through tangible scientific progress.

CSPC Pharmaceutical Group's professional medical marketing strategy is deeply rooted in its extensive sales force, numbering over 10,000 individuals. This direct engagement model is crucial for prescription drug promotion, focusing on building relationships within medical institutions and with healthcare professionals.

The core of this promotion involves presenting compelling scientific data, including robust clinical trial results, to doctors and pharmacists. This evidence-based approach aims to clearly articulate product benefits, thereby influencing prescription patterns and driving product adoption.

In 2023, CSPC reported a significant portion of its revenue was generated from its prescription drug portfolio, underscoring the effectiveness of this direct marketing. The company's continued investment in its sales force reflects a commitment to this physician-centric promotional strategy.

CSPC Pharmaceutical Group actively pursues strategic partnerships and licensing deals to expand its global reach. In 2024, the company announced a significant out-licensing agreement for its novel oncology drug candidate, NBP1001, to a leading European pharmaceutical firm, securing upfront payments and future milestone potential. This collaboration is projected to generate substantial revenue streams and validate CSPC's R&D prowess in the competitive biopharmaceutical landscape.

Participation in Industry Conferences and Publications

CSPC Pharmaceutical Group strategically leverages participation in industry conferences and medical publications as a key element of its promotion strategy. This approach is vital for disseminating cutting-edge research and product information directly to healthcare professionals and key opinion leaders. By actively engaging in these platforms, CSPC aims to solidify its scientific standing and nurture crucial relationships within the medical fraternity.

In 2024, CSPC continued its robust engagement with the scientific community. The company presented data from its ongoing clinical trials at major international oncology and cardiovascular congresses, including highlights from its NSCLC pipeline. Furthermore, CSPC's research findings were featured in several high-impact peer-reviewed journals, underscoring its commitment to advancing medical knowledge. This consistent presence ensures its innovative therapies are recognized and considered by prescribers.

- Scientific Dissemination: CSPC actively presents clinical data and research outcomes at over 20 major domestic and international medical conferences annually.

- Publication Reach: In 2024, CSPC contributed to over 50 publications in leading medical journals, increasing the visibility of its therapeutic advancements.

- Key Opinion Leader Engagement: These platforms facilitate direct interaction with KOLs, fostering understanding and adoption of CSPC's innovative treatments.

- Brand Credibility: Consistent scientific engagement builds trust and establishes CSPC as a credible leader in pharmaceutical innovation.

Corporate Branding and Investor Relations

CSPC Pharmaceutical Group actively cultivates its corporate brand and investor relations by consistently providing transparent financial reporting. This includes the timely release of interim and annual results, alongside crucial news updates that detail their operational performance and strategic trajectory. For instance, in their 2024 fiscal year, CSPC continued its commitment to investor communication, with their annual report highlighting a steady revenue growth of 8% compared to the previous year.

The company's dedication to investor confidence is further evidenced by strategic financial actions such as share buy-back programs and consistent dividend declarations. These initiatives not only return value to shareholders but also signal the company's financial health and positive outlook. In the first half of 2025, CSPC announced a significant share repurchase plan amounting to HKD 500 million, reinforcing its commitment to shareholder value and projecting stability in the market.

This proactive approach to communication and financial stewardship is pivotal in solidifying CSPC's image. It positions them as a reliable and forward-thinking entity within the competitive pharmaceutical landscape. Their investor relations portal, updated frequently with market data and corporate announcements, serves as a central hub for stakeholders seeking to understand CSPC's position and future potential.

Key aspects of CSPC's corporate branding and investor relations include:

- Regular Publication of Financial Reports: Ensuring investors have access to up-to-date performance data.

- Strategic Share Buy-backs: Demonstrating financial strength and commitment to shareholder returns, such as the HKD 500 million buy-back in H1 2025.

- Consistent Dividend Declarations: Building investor confidence through predictable income streams.

- Transparent Communication of Strategic Direction: Keeping stakeholders informed about the company's growth plans and market positioning.

CSPC Pharmaceutical Group's promotional efforts focus on scientific credibility and physician engagement. Their substantial R&D investment, RMB 5.191 billion in 2024, directly fuels the communication of new drug approvals and pipeline advancements to healthcare professionals.

The company's large sales force of over 10,000 professionals is instrumental in presenting clinical data to doctors, driving prescription patterns. Strategic partnerships, like the 2024 out-licensing of NBP1001, further amplify their therapeutic reach and validate their innovation.

CSPC actively participates in over 20 medical conferences annually and published in more than 50 journals in 2024, disseminating research and engaging Key Opinion Leaders to build brand credibility.

| Promotional Activity | 2024/2025 Data Point | Impact |

| R&D Investment | RMB 5.191 billion (2024) | Fuels communication of scientific breakthroughs |

| Sales Force Size | Over 10,000 | Direct physician engagement for prescription drugs |

| Conference Participation | Over 20 major conferences annually | Disseminates research, engages KOLs |

| Journal Publications | Over 50 publications (2024) | Increases visibility of therapeutic advancements |

| Strategic Licensing | NBP1001 out-licensing (2024) | Expands global reach, validates R&D |

Price

CSPC Pharmaceutical Group's pricing is heavily shaped by China's Volume-Based Procurement (VBP) program, a policy designed to lower healthcare expenses and boost drug access. This initiative has driven significant price reductions across CSPC's product portfolio, particularly for generics, but also impacting some innovative therapies.

For instance, in the VBP rounds leading up to 2024, many pharmaceutical companies, including CSPC, saw their drug prices slashed by an average of 50% or more to secure inclusion in the national formulary.

This competitive pressure forces CSPC to recalibrate its pricing strategies to ensure its products remain viable within the national healthcare system, directly impacting revenue streams and profitability for affected products.

Navigating VBP requires CSPC to balance aggressive pricing to win bids with maintaining sufficient margins to fund ongoing research and development, a critical challenge for sustained growth.

CSPC Pharmaceutical Group is adopting a value-based pricing strategy for its innovative drugs, aiming to align prices with the substantial R&D expenditures and the significant clinical advantages these treatments provide. This approach is particularly crucial as the company navigates overall market price pressures.

For instance, the company's innovative oncology drug,如果瑞 (Ruifutai), which received approval in China for metastatic non-small cell lung cancer, exemplifies this strategy. By demonstrating superior efficacy and improved patient outcomes compared to existing treatments, CSPC can justify a premium price point, contributing to revenue diversification.

This premium pricing for breakthrough therapies, especially those targeting critical unmet medical needs like certain cancers or neurological disorders, is designed to counterbalance potential revenue dips from its established, more mature product portfolios.

CSPC's commitment to innovation, evidenced by its substantial investment in research and development, which reached RMB 5.42 billion in 2023, underpins its ability to command higher prices for novel treatments that offer tangible benefits to patients and healthcare systems.

CSPC Pharmaceutical Group's bulk drug and generic finished drug segments face intense price competition, driven by market demand and rival pricing strategies. For instance, the Vitamin C market, a key commodity, has seen significant price erosion, impacting profitability for all players.

To navigate this, CSPC emphasizes cost optimization across its operations. This includes streamlining production processes and supply chain management to reduce per-unit costs, allowing them to remain competitive even when commodity prices fluctuate.

Maintaining high product quality is another cornerstone of CSPC's strategy in these price-sensitive segments. By ensuring consistent quality, they aim to build customer loyalty and justify their pricing, even in a crowded market.

Expanding market share is crucial for CSPC to offset price pressures. A larger market footprint allows for greater economies of scale, further enhancing cost efficiencies and strengthening their position against competitors in the generics and bulk drug sectors.

Government Regulations and Reimbursement Policies

CSPC Pharmaceutical Group's pricing strategy is significantly shaped by the Chinese government's stringent regulations and its national medical insurance system. This system dictates reimbursement rates and the inclusion of drugs in official catalogues, directly impacting market access and affordability. For instance, inclusion in the National Reimbursement Drug List (NRDL) is crucial for widespread adoption, often requiring CSPC to make price concessions to meet government objectives.

The company actively navigates these complex regulatory landscapes. By engaging with the authorities and demonstrating the clinical and economic value of its products, CSPC aims to secure favorable reimbursement terms. This proactive approach is vital, as evidenced by the continuous updates to the NRDL, which can dramatically alter a drug's market potential. In recent years, the Chinese government has focused on lowering drug prices for key therapeutic areas, a trend CSPC must strategically accommodate.

- NRDL Inclusion: CSPC prioritizes getting its innovative drugs onto the National Reimbursement Drug List, a key driver for sales volume in China.

- Price Negotiations: The company participates in price negotiations with the National Healthcare Security Administration (NHSA) to secure optimal reimbursement rates, often involving price reductions.

- Volume-Based Procurement: CSPC, like other pharmaceutical firms, faces volume-based procurement policies that can drive down prices in exchange for guaranteed market share.

- Dynamic Regulatory Environment: The pricing and reimbursement landscape in China is dynamic, with regular updates to the NRDL and evolving policies that CSPC must continuously monitor and adapt to.

Strategic Out-Licensing for Global Revenue

CSPC Pharmaceutical Group is strategically leveraging out-licensing for its innovative drugs to expand its global revenue streams and offset domestic pricing pressures. This approach allows the company to monetize its research and development investments in key international markets.

These international licensing agreements are structured to provide CSPC with diverse income sources, including upfront payments, milestone payments tied to developmental progress, and ongoing royalties on sales. For instance, in 2024, CSPC announced a significant out-licensing deal for its novel oncology drug, generating an initial upfront payment of $50 million with potential milestones reaching over $400 million, plus tiered royalties starting at 10%.

- Upfront Payments: Provide immediate capital infusion.

- Milestone Payments: Reward successful drug development stages.

- Royalties: Offer long-term revenue participation.

- Global Market Access: Expand drug reach beyond China.

This global out-licensing strategy diversifies CSPC's revenue base, making it less vulnerable to the pricing regulations and market dynamics within China. It effectively unlocks the international potential of its R&D pipeline, contributing to sustained financial growth.

CSPC's pricing strategy is a delicate balancing act between aggressive cost reductions driven by China's Volume-Based Procurement (VBP) program and premium pricing for its innovative therapies. For instance, VBP mandates significant price cuts, often exceeding 50%, for drugs to gain national formulary access, impacting revenue for established products.

The company is increasingly adopting value-based pricing for its novel drugs, such as its oncology treatment 如果瑞 (Ruifutai), aiming to align prices with demonstrated clinical superiority and R&D investments. This strategy is critical, as CSPC's R&D spending reached RMB 5.42 billion in 2023, underscoring the need to recoup innovation costs.

Furthermore, CSPC strategically utilizes out-licensing deals for its innovative pipeline, securing upfront payments, milestones, and royalties. A 2024 deal for an oncology drug, for example, brought in $50 million upfront with potential milestones exceeding $400 million, diversifying revenue and mitigating domestic pricing pressures.

In the competitive generics and bulk drug segments, CSPC focuses on cost optimization and maintaining high product quality to offset price erosion, exemplified by the challenging Vitamin C market. Expanding market share in these areas is key to leveraging economies of scale and enhancing profitability.

| Pricing Strategy Component | Key Drivers | Impact on CSPC |

|---|---|---|

| Volume-Based Procurement (VBP) | Government policy for cost reduction, increased access | Significant price reductions on generics and some innovative drugs; necessitates aggressive bidding. |

| Value-Based Pricing | R&D investment, clinical superiority, unmet needs | Premium pricing for innovative drugs like 如果瑞 (Ruifutai); revenue diversification. |

| Out-Licensing Agreements | Global market access, revenue diversification | Upfront payments, milestone payments, royalties; offsets domestic price pressures. |

| Cost Optimization & Quality Focus | Market competition, commodity price fluctuations | Streamlined production, supply chain efficiency; customer loyalty in price-sensitive segments. |

4P's Marketing Mix Analysis Data Sources

Our CSPC Pharmaceutical Group 4P's Marketing Mix Analysis is grounded in a comprehensive review of the company's official filings, investor relations materials, and public product information. We also incorporate insights from industry research and market data to ensure a thorough understanding of their strategic positioning.