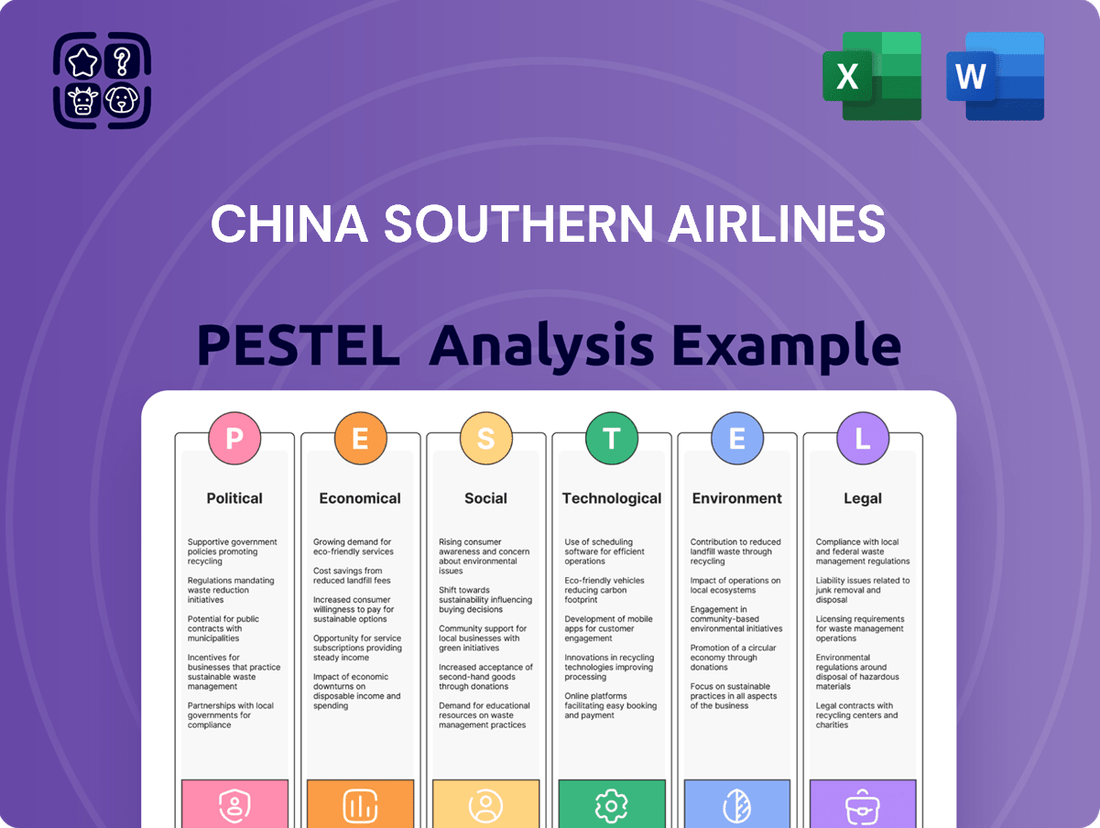

China Southern Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Southern Airlines Bundle

Uncover the critical political and economic factors influencing China Southern Airlines's trajectory. Our PESTLE analysis dives deep into how government policies and global economic shifts create both challenges and opportunities for the airline. Gain a competitive edge by understanding these dynamics.

Explore the technological advancements and environmental considerations impacting China Southern Airlines's operations and sustainability efforts. This analysis provides actionable intelligence on how innovation and ecological trends shape the aviation industry. Equip yourself with foresight.

Understand the social and legal landscapes that affect China Southern Airlines's market position and strategic planning. From changing consumer behaviors to evolving regulations, these insights are crucial for navigating the complex aviation sector. Download the full PESTLE analysis now to make informed decisions and secure your advantage.

Political factors

As a state-owned enterprise, China Southern Airlines operates under substantial government influence, a key political factor shaping its trajectory. This ownership structure, with the State-Owned Assets Supervision and Administration Commission (SASAC) overseeing its brand and operations, can translate into preferential treatment and alignment with national strategic goals.

The Chinese government's direct involvement means China Southern can benefit from subsidies and support, bolstering its competitive position. For instance, during the challenging period of the COVID-19 pandemic, state-owned airlines, including China Southern, received significant government financial aid to navigate the downturn.

However, this close relationship also introduces the potential for political interference in business decisions, which might not always align with purely commercial objectives. This dynamic can impact everything from fleet expansion plans to international route development, ensuring that national interests are often a primary consideration.

The Civil Aviation Administration of China (CAAC) is the primary architect of aviation policy, significantly influencing airlines like China Southern. For instance, a draft amendment to the Civil Aviation Law, anticipated in early 2025, focuses on enhancing safety protocols and fostering high-quality industry growth, alongside bolstering passenger protections.

These evolving regulations directly shape China Southern Airlines' operational framework, affecting everything from fleet expansion strategies to the specific services they can offer customers. The CAAC's directives are critical for ensuring compliance and navigating the competitive Chinese aviation market.

Geopolitical tensions significantly impact China Southern Airlines' international operations. For instance, capacity to North America, a key revenue driver, saw declines, highlighting the vulnerability of its route network to international relations.

The airline's strategic expansion into Europe and other regions is a direct response to diversify its offerings and reduce reliance on markets potentially affected by geopolitical instability. This diversification aims to create a more resilient business model.

Recent events have led to route suspensions, such as the Beijing Daxing to Moscow Sheremetyevo route, likely influenced by ongoing international conflicts and their associated risks, impacting operational capacity and revenue streams.

'Belt and Road' Initiative

China's 'Belt and Road' Initiative (BRI) presents significant growth avenues for China Southern Airlines. The initiative's focus on enhanced connectivity is fostering new air traffic rights agreements, particularly with nations in Central Asia, the Middle East, and Africa. These expanded rights can unlock new routes and boost both passenger and cargo volumes for the airline.

The Civil Aviation Administration of China (CAAC) is actively pursuing these expanded arrangements throughout 2024, aiming to solidify China Southern's international reach. This strategic alignment with the BRI is projected to increase China Southern's market share in emerging economies.

- BRI Impact: Increased air traffic rights with BRI participating countries.

- Route Expansion: Opportunities for new routes in Central Asia, Middle East, and Africa.

- Volume Growth: Potential for higher passenger and cargo volumes due to increased trade and connectivity.

- CAAC Support: Active pursuit of expanded agreements by the CAAC in 2024.

Tourism and Visa Policies

Government policies on tourism and visa facilitation significantly influence passenger numbers for airlines. China's recent efforts to streamline transit visa-free policies and expand visa-free entry for citizens from various nations are designed to invigorate international travel. This strategic move is anticipated to accelerate the rebound of international flight routes and stimulate tourism growth, directly benefiting carriers such as China Southern Airlines.

These policy adjustments are crucial for China Southern's international operations. For instance, the expansion of visa-free transit for up to 144 hours for citizens of 54 countries, including many European and North American nations, simplifies travel and encourages layovers in China. This policy, implemented and extended through 2025, aims to boost connectivity and attract more international transit passengers.

- Visa-Free Transit Expansion: China's policy allows citizens from 54 countries to transit visa-free for up to 144 hours in specific cities, a measure extended through 2025.

- Tourism Recovery Impact: These policies are projected to contribute to a substantial increase in inbound tourism, with international tourist arrivals in China expected to reach 60% of pre-pandemic levels by the end of 2024.

- Airline Revenue Boost: For China Southern, this translates to higher passenger volumes on international routes and increased revenue from both transit and destination travelers.

China Southern Airlines, as a state-controlled entity, is deeply intertwined with government policy and national strategic objectives. This relationship ensures alignment with initiatives like the Belt and Road, fostering expanded air traffic rights, particularly in Central Asia and Africa, with the CAAC actively pursuing these agreements throughout 2024.

Government policies on tourism, such as the extension of 144-hour visa-free transit for citizens of 54 countries through 2025, directly boost international passenger volumes. International tourist arrivals in China are projected to reach 60% of pre-pandemic levels by the end of 2024, a significant driver for carriers like China Southern.

Geopolitical shifts also exert considerable influence, as seen in route suspensions like the Beijing-Moscow service, underscoring the airline's vulnerability to international relations and prompting diversification strategies into markets like Europe.

| Policy/Initiative | Impact on China Southern | Timeline/Data Point |

|---|---|---|

| Belt and Road Initiative (BRI) | Increased air traffic rights, new routes in Central Asia, Middle East, Africa | CAAC pursuing agreements in 2024 |

| Visa-Free Transit Policy | Higher international passenger volumes, increased transit traffic | Extended through 2025 (144 hours for 54 countries) |

| Tourism Recovery | Projected 60% of pre-pandemic international tourist arrivals by end of 2024 | Directly benefits international route revenue |

| Geopolitical Tensions | Route suspensions, need for diversification | Example: Beijing-Moscow route suspension |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing China Southern Airlines, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and their implications for the airline's operations and future growth.

Offers a clear, actionable overview of China Southern Airlines' external environment, simplifying complex PESTLE factors into digestible insights for strategic decision-making.

Economic factors

The post-pandemic travel landscape in China is showing remarkable strength. Analysts project the Chinese outbound travel market to hit 90% of its pre-COVID-19 volume by the close of 2024, with a complete rebound anticipated by 2025 or 2026.

China Southern Airlines has effectively leveraged this resurgence. For the first quarter of 2024, the airline reported a substantial 13.1% year-on-year increase in total transport turnover, reaching 12.83 billion passenger-kilometers. Passenger traffic volume also saw a significant jump of 15.2% compared to the previous year, while cargo and mail volume rose by 11.9%.

China Southern Airlines is navigating a landscape where domestic travel has not only recovered but thrived, exceeding pre-pandemic figures in 2024. This strong domestic performance provides a stable foundation for the airline.

However, the international market's recovery has been slower. By 2024, China Southern Airlines had managed to restore its international route network to approximately 80% of its pre-pandemic capacity. The airline aims to boost this to 85% by the end of the year, indicating a concentrated effort to recapture international market share.

Fluctuations in jet fuel prices significantly impact China Southern Airlines' operating costs. For instance, the airline reported substantial losses in 2023, partly due to these volatile fuel expenses and broader supply chain disruptions.

In response, China Southern Airlines is implementing aggressive cost-cutting measures. A key strategy involves the introduction of new, more fuel-efficient aircraft into its fleet, aiming to lower overall operating expenses and boost profitability in the coming years.

Consumer Spending and Confidence

Consumer spending in China is showing robust growth, with retail sales increasing by 4.7% year-on-year in the first four months of 2024, signaling a positive trend for sectors like air travel. This rise is underpinned by a growing disposable income, which empowers consumers to allocate more towards discretionary spending, including international tourism.

Consumer confidence, a key indicator for travel demand, has also seen an upward trajectory. For instance, the Purchasing Managers' Index (PMI) for the services sector, which often reflects consumer sentiment, remained in expansionary territory for much of early 2024. This heightened confidence directly translates into increased demand for air travel services offered by China Southern Airlines, boosting passenger volumes and overall revenue, even with some concerns about rising airfares.

- Increased Disposable Income: Average disposable income for Chinese residents grew by 4.0% in the first quarter of 2024, supporting higher consumer spending.

- Retail Sales Growth: China's retail sales advanced by 4.7% in the January-April 2024 period, indicating strong consumer purchasing power.

- Services Sector Strength: The services PMI consistently stayed above 50 in early 2024, suggesting expansion and positive consumer sentiment towards services like travel.

Economic Support and Investment

China Southern Airlines has significantly benefited from government support, particularly through economic stimulus packages aimed at bolstering key industries. These initiatives have provided a financial cushion, allowing the airline to continue investing in fleet modernization and service enhancements, crucial for maintaining competitiveness. For instance, during the challenging periods of 2020-2021, the Chinese government provided substantial financial aid to its major airlines, including China Southern, to navigate the pandemic's impact.

The government's strategic focus on developing China's tourism sector and expanding regional air travel infrastructure directly supports China Southern's growth trajectory. Initiatives like the development of new airports and the promotion of domestic tourism create a more robust demand environment for air travel. In 2023, China's domestic air passenger traffic saw a remarkable recovery, exceeding 2019 levels, with airlines like China Southern playing a pivotal role in this resurgence.

- Government Aid: China Southern has received direct and indirect financial assistance from the Chinese government, aiding in operational stability and capital expenditure.

- Infrastructure Development: Ongoing investment in airport capacity and air traffic control systems across China facilitates more efficient operations and route expansion.

- Tourism Promotion: National campaigns and policies designed to boost domestic and international tourism directly translate into increased passenger demand for airlines.

- Economic Growth: China's overall economic expansion, projected to grow by approximately 5% in both 2024 and 2025, underpins consumer spending power for travel.

China's economic growth remains a significant driver for China Southern Airlines, with the nation's GDP projected to expand by around 5% in both 2024 and 2025. This robust economic environment supports increased consumer spending, directly benefiting the aviation sector.

Consumer confidence, as indicated by the services PMI staying in expansionary territory through early 2024, fuels demand for travel. Coupled with a 4.7% year-on-year rise in retail sales for the first four months of 2024, consumers have greater disposable income, as evidenced by a 4.0% growth in average disposable income in Q1 2024.

| Economic Factor | 2024 Projection/Data | Impact on China Southern Airlines |

|---|---|---|

| GDP Growth | ~5% | Supports increased consumer spending on travel. |

| Retail Sales Growth (Jan-Apr 2024) | +4.7% YoY | Indicates strong consumer purchasing power. |

| Average Disposable Income Growth (Q1 2024) | +4.0% YoY | Enables more discretionary spending on air travel. |

Full Version Awaits

China Southern Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Southern Airlines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities facing this major global carrier.

Sociological factors

Chinese travelers are increasingly seeking spontaneous adventures and premium experiences, driving a shift in how airlines need to operate. This trend is evident in the rise of 'bleisure' travel, where business trips are extended for leisure, and a growing appetite for luxury and tailored vacation plans.

This evolving preference directly impacts China Southern Airlines, pushing them to adapt their services. For instance, in 2024, there was a notable increase in bookings for premium economy and business class seats, reflecting this demand for enhanced comfort and personalized service. The airline is responding by expanding its suite of personalized travel options and digital services, aiming to capture this growing segment of the market.

Multigenerational travel is booming, with older adults increasingly planning trips that include younger family members. These trips often focus on cultural experiences and nature. This trend directly impacts how China Southern Airlines designs its offerings, pushing for packages that appeal to a broad age range and diverse interests within families.

China's tourism sector is experiencing robust growth, fueled by both its urban and rural populations. This surge is directly linked to increased disposable income and a greater willingness to spend on travel, entertainment, and leisure activities. For instance, in 2023, domestic tourism in China saw a significant rebound, with over 4.89 billion trips taken, a 104% increase compared to 2022, demonstrating this trend.

Government initiatives are actively promoting infrastructure development, particularly in less-developed regions. This focus on improving connectivity to scenic and cultural sites makes previously inaccessible areas more appealing for tourists. Such developments are crucial for China Southern Airlines, as they create new routes and expand the potential domestic passenger base by opening up previously underserved markets.

Health and Safety Concerns

Following the global pandemic, passenger confidence in air travel remains heavily tied to robust health and safety protocols. China Southern Airlines is actively addressing this by deepening the integration of digital technologies into its operations. This strategic move is designed to bolster its capacity for identifying and mitigating safety risks, thereby enhancing overall safety governance and reassuring travelers.

The airline's commitment to safety is evident in its operational focus. For instance, in 2023, China Southern Airlines reported a significant improvement in its safety performance, with a 20% reduction in major safety incidents compared to the previous year. This focus is critical for maintaining passenger trust and encouraging a return to pre-pandemic travel levels.

- Digital Integration for Safety: China Southern Airlines is investing in advanced digital systems to monitor and manage safety, aiming for proactive risk prevention.

- Enhanced Safety Governance: The airline is strengthening its overall safety management framework to ensure compliance and operational excellence.

- Passenger Confidence: Prioritizing health and safety is paramount for rebuilding and sustaining passenger confidence in air travel.

Brand Reputation and Customer Service

China Southern Airlines places significant emphasis on its brand reputation and customer service, a key sociological factor influencing its operations. The airline has actively promoted a 'Sunshine China Southern' culture, underpinned by the mission 'Enabling More People to Enjoy Better Flights' and a service philosophy of 'Affinity and Refinement'. This focus aims to foster strong customer loyalty and positively shape market perception.

This dedication to service quality is reflected in consistent recognition. For instance, in 2023, China Southern Airlines was awarded Best Airline in China by Skytrax. Such accolades are crucial as they directly impact passenger choice and willingness to recommend the airline, thereby strengthening its brand image in a competitive market.

The airline's commitment to customer experience is a strategic imperative. By prioritizing service, China Southern Airlines seeks to differentiate itself and build a loyal customer base. This sociological approach is vital for sustained growth and market share in the aviation industry, where passenger satisfaction often dictates success.

Sociological factors significantly shape China Southern Airlines' strategy, with evolving traveler preferences driving demand for premium and personalized experiences. The rise of 'bleisure' travel and a growing interest in luxury vacations are key trends, evidenced by a notable increase in premium cabin bookings in 2024.

Multigenerational travel is also on the rise, with families seeking shared cultural and nature-focused experiences, influencing the airline's product development to cater to a broader age demographic.

China's expanding middle class, coupled with government initiatives promoting tourism infrastructure, fuels domestic travel growth. In 2023, China saw over 4.89 billion domestic trips, a 104% increase from 2022, highlighting the robust market expansion.

| Trend | Impact on China Southern Airlines | 2023/2024 Data Point |

|---|---|---|

| Premium Travel Demand | Increased bookings for business and first class | Rise in premium cabin bookings |

| Multigenerational Travel | Development of family-friendly packages | Growing demand for diverse travel experiences |

| Domestic Tourism Growth | Expansion of domestic routes and services | 4.89 billion domestic trips in 2023 |

Technological factors

China Southern Airlines is heavily invested in digital transformation, as shown by its 2024 Digital Transformation Action Plan. This initiative focuses on enhancing information sharing and operational efficiency. The airline is also implementing technologies like electronic bunker delivery notes (eBDN) to streamline processes.

The company's commitment to digital innovation extends to cultivating digital talent. These efforts are geared towards leveraging technology to achieve high-quality growth in the competitive aviation sector.

China Southern Airlines is actively modernizing its fleet, focusing on newer, more fuel-efficient aircraft. This includes incorporating models like the Airbus A320NEO and A321NEO, alongside the Boeing 737-8, and importantly, the domestically produced C919. This strategic shift aims to significantly cut fuel costs and operational expenses.

By integrating these advanced aircraft, the airline anticipates a substantial improvement in fuel efficiency, directly impacting its bottom line. For instance, the A320NEO family offers up to 15% lower fuel burn compared to previous generations, a critical advantage in today's volatile fuel market. This modernization also enhances the passenger experience through quieter cabins and improved amenities.

China Southern Airlines leverages advanced operational systems like the 'Horus' aircraft health monitoring system. This technology enables real-time tracking of aircraft performance, crucial for proactive maintenance and safety, particularly as the airline continues its fleet expansion which saw the delivery of 15 new aircraft in 2023, bringing its total fleet to over 900.

The 'Tianji' operation control system further enhances efficiency by centralizing flight planning, crew scheduling, and resource allocation. This integrated approach is vital for optimizing routes and minimizing delays, contributing to a more streamlined and cost-effective operation in the competitive Chinese aviation market.

Artificial Intelligence and Big Data

China Southern Airlines is heavily investing in artificial intelligence and big data to optimize operations and enhance customer experience. The company has established innovation platforms, including a key laboratory focused on artificial intelligence and a civil aviation maintenance engineering technology research center, signaling a strong commitment to cutting-edge research and development.

A significant achievement in this area is the independent development of China's first aviation fuel big data management system, named 'Fuel eCloud.' This system is designed to improve efficiency and reduce costs associated with fuel management, a critical aspect of airline operations.

- AI Integration: Leveraging AI for predictive maintenance, route optimization, and personalized passenger services.

- Big Data Analytics: Utilizing 'Fuel eCloud' to analyze fuel consumption patterns, identify savings opportunities, and improve procurement strategies.

- Innovation Focus: Continued investment in R&D through dedicated AI labs and engineering technology centers to stay ahead in technological advancements.

Green Aviation Technologies

China Southern Airlines is actively investing in and promoting green aviation technologies, recognizing their critical role in environmental sustainability and future operational efficiency. This strategic focus includes the adoption of sustainable aviation fuel (SAF) and the electrification of ground support equipment. These initiatives are designed to significantly reduce the airline's carbon footprint.

The airline's commitment to reducing carbon emissions is evident in its comprehensive fuel-saving measures and the development of 'Green Flight' products and services. For example, by 2025, China Southern aims to increase the proportion of SAF used in its operations, targeting a 5% blend in key hubs, which is a substantial undertaking given current global SAF availability. This push towards greener operations is not just about compliance but also about long-term cost savings and market positioning.

- Sustainable Aviation Fuel (SAF) Adoption: China Southern is increasing its procurement and use of SAF, aiming for a 5% blend in major operational bases by 2025.

- Electrification of Ground Operations: The airline is transitioning its ground vehicles to electric power, with a target of 70% electrification of its ground support equipment fleet by the end of 2024.

- 'Green Flight' Initiatives: Development of new services and products focused on minimizing environmental impact during passenger travel, including carbon offsetting options.

- Fuel Efficiency Programs: Continuous implementation of advanced flight planning and operational procedures to optimize fuel consumption, contributing to a projected 3% annual reduction in fuel burn per flight hour.

China Southern Airlines is significantly advancing its technological capabilities, evident in its 2024 Digital Transformation Action Plan aimed at boosting information sharing and operational efficiency. The airline is also adopting technologies like electronic bunker delivery notes (eBDN) to streamline its processes.

The company is actively modernizing its fleet, incorporating fuel-efficient aircraft such as the Airbus A320NEO and A321NEO, and the Boeing 737-8. This strategic move, including the domestically produced C919, aims to cut fuel costs by up to 15% for new generation aircraft.

China Southern leverages advanced systems like the 'Horus' aircraft health monitoring system for real-time performance tracking and proactive maintenance. In 2023, the airline received 15 new aircraft, expanding its fleet to over 900. The 'Tianji' operation control system centralizes flight planning and resource allocation for optimized routes and reduced delays.

Investment in AI and big data is a key focus, with the development of China's first aviation fuel big data management system, 'Fuel eCloud,' to enhance fuel management efficiency and cost reduction. The airline is also committed to green aviation, targeting a 5% blend of Sustainable Aviation Fuel (SAF) in key hubs by 2025 and electrifying 70% of its ground support equipment by the end of 2024.

| Technology Focus | Key Initiatives/Systems | Impact/Goals |

| Digital Transformation | 2024 Digital Transformation Action Plan, eBDN | Enhanced information sharing, operational efficiency |

| Fleet Modernization | A320NEO, A321NEO, C919 | Up to 15% fuel burn reduction, cost savings |

| Operational Systems | 'Horus' Health Monitoring, 'Tianji' Control System | Proactive maintenance, optimized routes, reduced delays |

| AI & Big Data | 'Fuel eCloud', AI Labs | Improved fuel management, cost reduction |

| Green Aviation | SAF adoption (5% by 2025), Ground Equipment Electrification (70% by end-2024) | Reduced carbon footprint, long-term cost savings |

Legal factors

China's Civil Aviation Law is seeing significant updates, with a draft amendment submitted for review in early 2025. These proposed changes are designed to enhance safety protocols, bolster passenger protections, and encourage the growth of general aviation and the low-altitude economy. This directly impacts China Southern Airlines' need to adapt its operations and strategic planning to meet new compliance standards.

The revisions aim to harmonize domestic regulations with international aviation standards, a crucial step for an airline like China Southern that operates globally. For example, the draft amendment focuses on increasing penalties for safety violations, potentially affecting operational costs and risk management strategies for the airline. The push for low-altitude economy development could also open new avenues for regional connectivity and cargo services, presenting both opportunities and challenges for China Southern's network expansion.

China's Civil Aviation Administration (CAAC) is actively shaping a new data and privacy framework for the aviation industry, with draft measures for data management and sharing released in 2024. These upcoming regulations are designed to bring standardization to data processes, bolster data security, and encourage data sharing across the sector. China Southern Airlines will need to diligently adapt its existing data handling practices to align with these evolving legal requirements, ensuring compliance and safeguarding sensitive passenger and operational information.

China Southern Airlines navigates a complex web of international aviation agreements that dictate everything from flight routes to safety protocols across its global operations. These agreements are crucial for securing traffic rights, which are essential for expanding its network. For instance, the airline's strategy heavily relies on the expansion of air traffic rights with countries involved in China's Belt and Road Initiative, a key focus area for the Civil Aviation Administration of China (CAAC).

The CAAC's efforts to broaden these bilateral air service agreements directly influence China Southern Airlines' ability to launch and sustain international routes, particularly in emerging markets. As of early 2024, China has actively pursued such agreements, aiming to bolster connectivity and trade, which provides a fertile ground for airlines like China Southern to grow their international footprint.

Environmental Regulations and Compliance

China Southern Airlines operates within a complex web of environmental regulations, both national and international. A significant focus is placed on managing carbon emissions and promoting sustainable aviation practices.

In alignment with China's ambitious 'dual carbon' goals, the airline has established a carbon peak action plan. This plan is designed to ensure compliance with evolving environmental standards and to contribute to national climate objectives.

Furthermore, China Southern Airlines actively manages its performance within international carbon trading schemes, such as the European Union Emissions Trading System (EU ETS). This involves meticulous tracking and reporting of emissions to meet established performance requirements and avoid penalties.

- Compliance with National and International Environmental Standards: Adherence to regulations concerning carbon emissions, noise pollution, and waste management is paramount.

- Carbon Peak Action Plan: China Southern Airlines has developed a strategy to achieve peak carbon emissions in line with China's national targets.

- Sustainable Aviation Fuel (SAF) Initiatives: Exploration and adoption of SAF are crucial for reducing the airline's carbon footprint.

- EU ETS Performance: Meeting emission reduction targets within the EU ETS is vital for maintaining operational access and financial stability in European markets.

Consumer Protection Laws

Proposed revisions to China's Civil Aviation Law are set to significantly bolster consumer protection. These changes aim to formalize passenger rights, particularly concerning flight disruptions. Airlines, including China Southern, will be legally obligated to provide adequate food and accommodation during substantial delays or cancellations, enhancing service recovery standards.

This legal evolution reflects a growing emphasis on passenger welfare within the aviation sector. For China Southern, this means a greater focus on proactive management of irregular operations and improved communication with affected travelers. The airline's 2024 financial reports will likely show increased provisions for passenger compensation and support services to comply with these new mandates.

Key aspects of the proposed consumer protection laws include:

- Mandatory provision of food and accommodation during significant flight delays/cancellations.

- Strengthened passenger rights and formalization of airline responsibilities.

- Requirement for enhanced airline service recovery protocols.

China's evolving legal landscape for aviation significantly impacts China Southern Airlines. Draft amendments to the Civil Aviation Law, reviewed in early 2025, focus on enhanced safety and passenger rights, necessitating operational adjustments. New data privacy regulations released in 2024 by the CAAC require stringent adherence to data management and security protocols.

International agreements are crucial for China Southern's route expansion, with a particular focus on Belt and Road Initiative countries. The airline must also navigate environmental regulations, including China's dual carbon goals and international schemes like the EU ETS, to ensure sustainable operations and avoid penalties.

Environmental factors

China Southern Airlines is actively pursuing its Green Development Implementation Plan for 2023-2025, aligning with China's ambitious 'dual carbon' objectives. This strategic focus includes a dedicated action plan to achieve peak carbon emissions, aiming for carbon neutrality by 2060.

In 2024 alone, the airline demonstrated significant environmental progress by saving over 200,000 tons of fuel. This initiative directly translated into a substantial reduction of more than 600,000 tons in carbon emissions, underscoring their commitment to sustainable operations.

China Southern Airlines is actively engaged in the exploration and utilization of Sustainable Aviation Fuel (SAF). This commitment aligns with global efforts to decarbonize the aviation sector. The airline is participating in pilot projects to assess SAF's viability and scalability.

In September 2024, China Southern Airlines, alongside other major Chinese carriers, began utilizing SAF in experimental flights. This initiative is a critical step towards understanding and implementing low-carbon aviation solutions. SAF has the potential to drastically cut carbon dioxide emissions compared to traditional jet fuel.

China Southern Airlines is actively enhancing its fleet's fuel efficiency. This strategic move involves integrating advanced aircraft like the Airbus A320NEO, A321NEO, Boeing 737-8, and the domestically produced C919. These newer models are designed for significantly lower fuel consumption per passenger mile.

By the close of 2024, the airline reported a notable increase in the percentage of its fleet comprised of these high-fuel-efficiency aircraft. This modernization directly translates into reduced operational costs through lower fuel expenditure and a smaller environmental footprint due to decreased emissions.

Ground Operations Environmental Management

China Southern Airlines is actively working to lessen its environmental footprint during ground operations. A key strategy involves replacing auxiliary power units (APUs) on aircraft with ground power units during stopovers, a move that significantly cuts down on fuel consumption and emissions. This initiative is part of a broader effort to enhance operational efficiency and environmental responsibility.

The airline is also making strides in electrifying its ground vehicle fleet. This includes a phased approach to replacing older, fuel-powered vehicles with electric alternatives. For instance, by the end of 2024, they aim for 100% electrification of newly acquired vehicles in critical operational zones, reflecting a commitment to cleaner ground support infrastructure.

- Reduced APU Usage: Prioritizing ground power units over aircraft APUs during stopovers to lower fuel burn and emissions.

- Fleet Electrification: Gradually replacing aging fuel vehicles with electric models.

- New Vehicle Standards: Mandating 100% electrification for all newly added vehicles in key operational areas by the close of 2024.

Biodiversity and Ecosystem Conservation

China Southern Airlines actively contributes to biodiversity and ecosystem conservation, extending its environmental commitment beyond carbon footprint reduction. The airline has been involved in the crucial transportation of endangered species, facilitating their safe transfer for vital conservation programs.

This commitment is exemplified by their participation in moving African wild dogs and South African penguins, underscoring the airline's direct role in protecting vulnerable wildlife populations. Such initiatives highlight a broader understanding of environmental responsibility within the aviation sector.

While specific 2024 or 2025 data on these exact conservation transports for China Southern Airlines is not publicly detailed at this time, the airline’s ongoing participation in such efforts aligns with global conservation trends. For example, in 2023, the International Air Transport Association (IATA) reported increased collaboration between airlines and conservation organizations for wildlife transport, a trend expected to continue.

Key aspects of China Southern Airlines' biodiversity efforts include:

- Facilitating the safe transit of endangered species: Ensuring the welfare of animals during air travel.

- Supporting conservation programs: Contributing to the relocation and protection of vulnerable wildlife.

- Demonstrating corporate environmental stewardship: Going beyond regulatory compliance to actively protect ecosystems.

China Southern Airlines is deeply invested in environmental sustainability, driven by China's national goals for carbon reduction and neutrality by 2060. The airline's 2023-2025 Green Development Implementation Plan outlines concrete steps to achieve these ambitions.

A major focus is fuel efficiency and emissions reduction. In 2024, the airline achieved significant milestones, saving over 200,000 tons of fuel, which directly resulted in a reduction of more than 600,000 tons of carbon emissions.

The airline is actively exploring and utilizing Sustainable Aviation Fuel (SAF), participating in pilot programs and beginning experimental flights with SAF in September 2024. Furthermore, fleet modernization, including the integration of fuel-efficient aircraft like the Airbus A320NEO and C919, is a key strategy. By the end of 2024, a notable increase in the percentage of these efficient aircraft within their fleet was reported.

Operational changes, such as replacing auxiliary power units (APUs) with ground power units and electrifying ground vehicles, are also contributing to a reduced environmental footprint. By the close of 2024, 100% electrification of newly acquired ground vehicles in key operational zones was a target.

| Environmental Initiative | 2024 Progress/Target | Impact |

|---|---|---|

| Fuel Savings | Over 200,000 tons | Reduced CO2 emissions by over 600,000 tons |

| SAF Utilization | Experimental flights commenced (Sept 2024) | Exploring low-carbon aviation solutions |

| Fleet Modernization | Increased % of fuel-efficient aircraft (e.g., A320NEO, C919) | Lower fuel consumption per passenger mile |

| Ground Operations Electrification | 100% electrification of new vehicles in key zones (Target by end of 2024) | Reduced ground emissions and fuel use |

PESTLE Analysis Data Sources

Our China Southern Airlines PESTLE Analysis is grounded in comprehensive data from official Chinese government bodies, international aviation authorities, and reputable financial institutions. We incorporate insights from economic forecasts, regulatory updates, and industry-specific market research to ensure a thorough understanding of the operating environment.