China Southern Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Southern Airlines Bundle

Curious about China Southern Airlines' strategic positioning? This preview hints at the power of the BCG Matrix, revealing how their diverse offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

China Southern Airlines commands a dominant position within China's domestic aviation sector. As of July 2025, the airline holds a substantial 15% market share, offering 12.1 million seats domestically. This leadership allows for significant economies of scale, bolstering its competitive advantage in a market that has demonstrated impressive recovery.

The domestic market's resurgence is evident in the strong passenger growth observed during the first half of 2024. This upswing directly translates to higher flight load factors for China Southern, positively impacting revenue streams and reinforcing its domestic market dominance.

China Southern Airlines is aggressively pursuing international route expansion, a key strategy for its BCG Matrix positioning. The airline has announced plans to introduce 17 new long-haul international routes throughout 2024. This proactive approach includes adding services to key destinations such as Melbourne, Sydney, Doha, Riyadh, and Tehran, with launches scheduled for late 2024 and into 2025.

This expansion into new and recovering international markets is designed to capitalize on the projected rebound in global travel demand. By the close of 2024, China Southern aims to have its international route network reach 85% of its pre-pandemic capacity. This strategic move positions the airline to capture a larger share of the recovering global air travel market.

China Southern Airlines is actively modernizing its fleet, introducing fuel-efficient aircraft such as the Airbus A350-900 and Boeing 787-9 Dreamliner. This initiative replaces older models like the A330-300 and Boeing 787-8s on crucial routes, directly boosting operational efficiency and lowering fuel expenses.

This strategic shift is projected to significantly reduce fuel consumption and carbon emissions. For instance, the A350-900 can offer a fuel burn reduction of up to 25% compared to previous generation aircraft, enhancing the airline's environmental performance and cost structure.

Furthermore, the airline is set to introduce new cabin designs on its upcoming A350-900 and A321NX fleets, with deliveries commencing in 2027. These upgrades will feature advanced in-flight entertainment and improved seating, aiming to elevate the passenger experience and strengthen its competitive edge.

Cargo and Mail Transportation Growth

China Southern Airlines experienced robust growth in its cargo and mail transportation segment during 2024. Total cargo and mail volume surged by an impressive 22.1% year-on-year, underscoring a strong demand for the airline's freight services.

This expansion translated directly into financial gains, with cargo and mail revenue climbing by 22.4%. The airline's freight unit demonstrated exceptional profitability, reporting a 72% increase in profit to CNY4.2 billion for the year.

A primary driver for this remarkable performance was the booming cross-border e-commerce sector. This high-growth area is proving to be a significant contributor to China Southern's overall revenue and profitability.

- Cargo and Mail Volume Growth: 22.1% year-on-year increase in total volume in 2024.

- Revenue Increase: 22.4% rise in cargo and mail revenue in 2024.

- Freight Unit Profitability: Profit widened by 72% to CNY4.2 billion in 2024.

- Key Growth Driver: Explosive growth of cross-border e-commerce.

Digital Transformation and Operational Efficiency

China Southern Airlines is heavily investing in digital transformation to boost operational efficiency. This includes the widespread adoption of electronic bunker delivery notes (eBDN), a move that streamlines a critical logistical process.

The airline is also developing advanced operational service management systems. These systems are designed to create smoother workflows and reduce operational friction across the board.

These technological advancements are projected to significantly cut costs and elevate the passenger experience. For instance, by digitizing documentation like eBDNs, China Southern aims to reduce administrative overhead and speed up turnaround times, potentially impacting fuel cost management positively.

- Digitalization of Bunker Delivery Notes (eBDN): Facilitates faster, more accurate record-keeping and reduces paper-based processes.

- Operational Service Management Systems: Enhances real-time tracking and management of flight operations, maintenance, and ground services.

- Cost Reduction: Digital initiatives are expected to lower administrative expenses and improve resource allocation.

- Enhanced Customer Experience: Streamlined operations contribute to improved on-time performance and service quality.

China Southern's cargo segment is a clear star in its BCG Matrix. In 2024, the airline saw a remarkable 22.1% year-on-year increase in total cargo and mail volume, with revenue climbing by 22.4%. This segment is highly profitable, with its freight unit profit widening by an impressive 72% to CNY4.2 billion. The booming cross-border e-commerce sector is a significant catalyst for this stellar performance.

What is included in the product

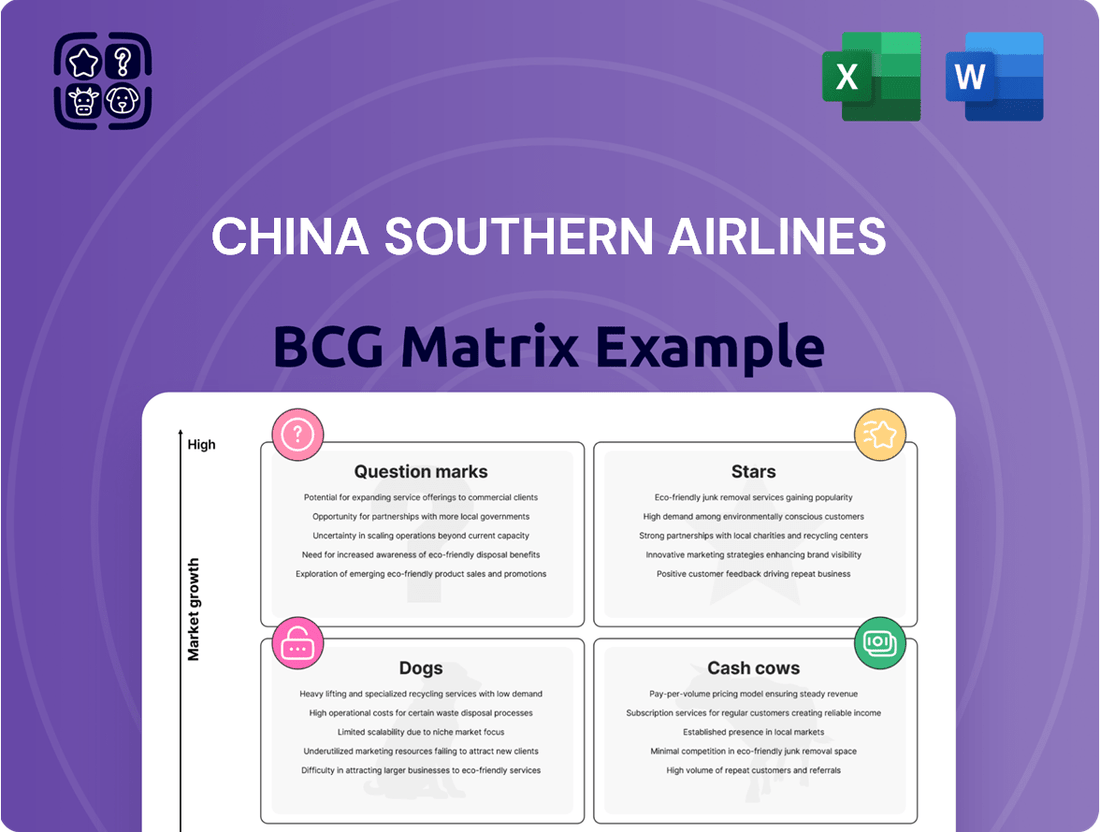

China Southern Airlines' BCG Matrix reveals a portfolio with potential Stars in growing markets, Cash Cows in established routes, Question Marks in emerging segments, and Dogs in declining areas.

A clear BCG matrix visualizes China Southern's business units, easing the pain of resource allocation by identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

China Southern Airlines' extensive domestic network, a key strength, positions its operations as a Cash Cow within the BCG Matrix. This network, spanning over 700 routes and connecting more than 160 cities, ensures a consistent flow of passengers, a hallmark of a mature business generating substantial cash.

The airline's dominant presence in the domestic market, evidenced by a 13.6% growth in domestic passenger volumes in 2024 compared to 2019, translates into stable, high-volume traffic. This allows for minimal promotional spending to maintain market share, directly contributing to strong cash generation.

China Southern Airlines' Beijing Daxing and Guangzhou Baiyun hubs are its primary cash cows. These strategically located airports are critical operational centers, enabling efficient connections and high passenger volumes. In 2023, China Southern transported approximately 100 million passengers across its network, with a significant portion flowing through these major hubs.

China Southern Airlines' aircraft maintenance and ground handling services function as a classic Cash Cow. These operations, which support its extensive fleet, generate a reliable and stable revenue. For instance, in 2023, China Southern’s maintenance, repair, and overhaul (MRO) segment, a key component of these services, demonstrated resilience, contributing positively to the airline’s overall financial performance despite the industry's recovery phase.

The significant scale of China Southern's operations means these services benefit from economies of scale, requiring relatively modest investment for continued profitability. Unlike the high capital expenditure needed for new route development or fleet expansion, maintaining and servicing existing aircraft and ground operations is a more predictable and less capital-intensive endeavor. This stability allows the airline to leverage its existing assets for consistent earnings.

These essential services are crucial for the group's overall profitability and operational efficiency. By ensuring the airworthiness of its large fleet and managing smooth ground operations, China Southern minimizes disruptions and maximizes aircraft utilization. The airline reported a significant increase in passenger traffic in 2023, underscoring the demand for these supporting services that keep its extensive network running effectively.

Sky Pearl Club Loyalty Program

The Sky Pearl Club loyalty program for China Southern Airlines is a significant cash cow. With over 100 million members, it represents a substantial and loyal customer base.

This vast membership base translates directly into recurring revenue. Repeat business from these loyal members provides a consistent and predictable cash flow for the airline. Furthermore, the program allows for highly targeted marketing campaigns, which typically have lower customer acquisition costs compared to attracting new customers.

- Over 100 million Sky Pearl Club members

- Recurring revenue from repeat business

- Lower customer acquisition costs through targeted marketing

- Consistent and predictable cash flow generation

Strategic Partnerships and Alliances

China Southern Airlines' strategic partnerships, like its joint venture with Vietnam Airlines, function as key drivers for its Cash Cows. These collaborations allow the airline to tap into new markets and strengthen its presence in existing ones without the heavy investment typically required for organic expansion. This approach is particularly effective in mature markets where incremental growth is often achieved through network optimization rather than new route development.

These alliances contribute to stable revenue streams by leveraging shared resources and expanding customer access. For instance, by integrating networks, China Southern can offer more comprehensive travel options, thereby increasing passenger volume and revenue on established routes. This strategic alignment enhances the efficiency of its operations and solidifies its position in competitive segments.

- Network Enhancement: Partnerships like the Vietnam Airlines JV expand China Southern's route network, offering customers more travel choices and increasing passenger traffic on existing, profitable routes.

- Resource Optimization: Joint ventures allow for the efficient sharing of resources, such as aircraft and operational infrastructure, leading to cost savings and improved profitability for established services.

- Stable Revenue Generation: By accessing new markets through alliances and leveraging existing infrastructure, China Southern can generate consistent and predictable revenue streams from its mature offerings.

- Reduced Capital Expenditure: Collaborations offer a cost-effective way to grow market share and revenue compared to the significant capital outlay required for building new infrastructure or launching entirely new routes independently.

China Southern Airlines' domestic network is a prime example of a Cash Cow, generating consistent revenue with minimal investment. Its vast reach, connecting over 160 cities, ensures high passenger volumes. In 2024, the airline saw a 13.6% growth in domestic passenger traffic compared to 2019, underscoring the stability of these operations.

The Sky Pearl Club loyalty program, boasting over 100 million members, also functions as a Cash Cow, delivering recurring revenue and enabling cost-effective marketing. This loyalty base translates into predictable cash flow, a hallmark of mature, profitable ventures.

| Business Unit | BCG Matrix Category | Key Financial Indicator | Supporting Data |

|---|---|---|---|

| Domestic Network | Cash Cow | Consistent Revenue Generation | 13.6% domestic passenger volume growth (2024 vs. 2019) |

| Sky Pearl Club | Cash Cow | Recurring Revenue & Low Acquisition Cost | Over 100 million members |

| Aircraft Maintenance & Ground Handling | Cash Cow | Stable Profitability & Economies of Scale | Resilient MRO segment performance in 2023 |

Full Transparency, Always

China Southern Airlines BCG Matrix

The China Southern Airlines BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis is designed for strategic clarity, offering actionable insights into China Southern Airlines' business units without any watermarks or demo content. You can confidently expect to download this complete, ready-to-use report, enabling immediate application in your strategic planning and competitive analysis.

Dogs

China Southern's international routes are showing signs of struggle, with passenger numbers still lagging behind pre-pandemic figures. In 2024, these numbers were 12.8% lower than in 2019, highlighting a slower-than-expected recovery in the international travel market.

Some international segments are particularly weak, characterized by low market share and minimal growth, especially those that haven't recovered to pre-COVID levels or are facing fierce competition. A clear example of this is the planned suspension of the Beijing Daxing to Moscow Sheremetyevo service in early 2025, signaling an underperforming route.

China Southern Airlines is planning to divest its entire fleet of 10 Boeing 787-8 aircraft by 2026. This strategic move stems from difficulties in reviving long-haul routes and a clear preference for the more capable Boeing 787-9 models.

These older 787-8s, potentially facing underutilization and higher operational expenses like fuel and maintenance compared to their newer counterparts, are likely candidates for the 'dog' category in a BCG matrix. In today's competitive aviation landscape, such aircraft might consume more cash than they generate, posing a drag on profitability.

The ongoing U.S.-China trade war has directly impacted China Southern Airlines by imposing tariffs on Boeing aircraft. This makes modernizing its fleet with certain Boeing models less financially viable, potentially increasing the costs associated with acquiring and maintaining aircraft.

Routes and services that are particularly dependent on regions experiencing significant geopolitical friction and economic instability can be categorized as question marks or dogs in the BCG matrix. These segments might exhibit low growth and a small market share, making them less attractive for investment.

For instance, in 2023, China Southern Airlines reported a net loss of RMB 7.06 billion, a significant improvement from the RMB 27.08 billion loss in 2022, but still reflecting the challenging operating environment. This financial performance underscores the sensitivity of airline operations to external economic and political factors.

Non-core or Less Profitable Ancillary Services

Non-core or less profitable ancillary services for China Southern Airlines, such as certain niche ground handling services or specialized cargo handling that faces stiff local competition, could be categorized as Dogs in the BCG matrix. These offerings might struggle to generate significant returns, potentially even requiring disproportionate investment for minimal gains. For instance, while the airline's primary focus is passenger and cargo transport, some smaller, less utilized airport services might fall into this category.

These services often operate in highly competitive local markets, making it difficult to achieve substantial profitability. The return on investment for these ancillary services may be low, and they might not align strategically with the airline's core competencies or growth objectives. In 2024, China Southern's overall revenue from ancillary services, which includes baggage fees, seat selection, and in-flight catering, continued to be a significant contributor, but the performance of smaller, less integrated services can vary greatly.

- Low Market Share: These ancillary services likely hold a small portion of their respective local markets.

- Low Growth Rate: The demand for these specific services may be stagnant or declining due to competition or changing customer preferences.

- Minimal Profitability: They may barely break even or incur losses, requiring careful management to avoid draining resources.

- Strategic Review: China Southern might periodically evaluate these services for potential divestment, restructuring, or integration into more profitable offerings.

Routes with High Competition and Low Yields

China Southern Airlines faces significant challenges on certain domestic routes characterized by intense competition and diminishing returns. The Chinese aviation sector, particularly its domestic segment, is notoriously oversaturated. This saturation, driven by both state-owned carriers and a growing number of low-cost airlines, frequently results in aggressive price wars. Consequently, margins are significantly compressed, making profitability a difficult feat on these high-volume, low-yield corridors.

These routes, often referred to as 'dogs' in the context of the BCG matrix, struggle to generate sufficient profit despite attracting substantial passenger numbers. The high operational costs associated with maintaining frequent flights on these competitive paths further exacerbate the low yield situation. For instance, in 2024, many intra-China routes saw load factors exceeding 85%, yet average fare yields remained stubbornly low, often below $0.05 per passenger kilometer.

- Intense Competition: The Chinese domestic market is crowded, with multiple airlines vying for passengers on popular routes.

- Price Wars: Fierce competition often leads to significant fare reductions, eroding profitability.

- Low Yields: Despite high passenger volumes, the revenue generated per passenger kilometer is often minimal.

- High Operational Costs: Maintaining service on these routes incurs substantial costs, further squeezing margins.

China Southern's older Boeing 787-8 aircraft, with 10 slated for divestment by 2026, exemplify 'dogs' due to difficulties reviving long-haul routes and a preference for newer models. These planes may incur higher operational costs, like fuel and maintenance, compared to the 787-9s, potentially consuming more cash than they generate.

Certain niche ancillary services, such as less utilized airport services or specialized cargo handling facing local competition, also fall into the dog category. These offerings often have low market share and growth rates, with minimal profitability, potentially requiring strategic review or divestment.

Domestically, routes characterized by intense competition and aggressive price wars, leading to low yields despite high passenger volumes, can be considered dogs. For example, in 2024, many intra-China routes maintained high load factors but saw average fare yields below $0.05 per passenger kilometer.

| Category | Characteristics | Examples for China Southern | Financial Implication |

| Dogs | Low market share, low growth rate, minimal profitability | Older B787-8 fleet, niche ancillary services, highly competitive domestic routes | Cash drain, low return on investment, potential divestment |

Question Marks

China Southern Airlines is strategically adding 17 new long-haul international routes in 2024, venturing into promising markets such as Doha, Riyadh, and Mexico City. These new routes represent significant investments in high-growth potential areas, positioning them as potential future Stars in the BCG Matrix.

While these new international routes are positioned in markets with substantial growth prospects, China Southern currently holds a low market share in these specific corridors. This means they are effectively Question Marks, requiring considerable investment in marketing and operational development to capture market share and transition into Stars.

China Southern Airlines is eyeing expansion into South America and further into Africa, recognizing these regions as potential high-growth markets for air travel. Despite this potential, the airline currently holds a minimal market share in these areas.

These ambitious expansion plans represent significant investments for China Southern. Establishing a strong presence and capturing market share in these developing regions will necessitate substantial capital outlay, positioning these ventures as potential 'Question Marks' within the BCG matrix.

China Southern Airlines is actively involved in China's Sustainable Aviation Fuel (SAF) trials, with significant expansion planned for 2025. This aligns with a global push for greener air travel, driven by stricter environmental rules and growing passenger preference for sustainable options.

While SAF represents a promising high-growth sector, its path to widespread profitability and adoption remains somewhat unclear. The current production costs are high, and the supply chain is still developing, making it a strategic area with inherent uncertainties.

Consequently, SAF initiatives for China Southern can be viewed as a 'Question Mark' in a BCG Matrix. If technological advancements reduce costs and regulatory support solidifies, this investment could transition into a 'Star' performer, capturing a significant share of a rapidly expanding market.

Domestically Produced C919 Aircraft Integration

China Southern Airlines' decision to order 100 C919 aircraft, with deliveries commencing in 2024 and continuing through 2031, positions this new domestically produced model as a significant 'Question Mark' within its fleet strategy. This large order, valued in the billions, reflects a strategic bet on China's aviation manufacturing capabilities.

The integration of the C919 presents a classic BCG matrix 'Question Mark' scenario for China Southern. While the long-term potential for cost savings through domestic sourcing and government support is substantial, the immediate future is marked by uncertainties regarding operational performance, maintenance infrastructure, and passenger perception.

- Delivery Schedule: 100 C919s to be delivered between 2024 and 2031.

- Strategic Importance: Represents a significant investment in China's domestic aviation industry.

- Potential Benefits: Long-term cost advantages, government support, and supply chain independence.

- Integration Challenges: Initial operational efficiency, pilot training, passenger acceptance, and maintenance support.

Digital Transformation of Customer Services and AI Integration

China Southern Airlines is actively pursuing digital transformation to elevate its customer service. Initiatives like the 'China Southern E-Travel' app are central to this effort, aiming to streamline the travel experience. The airline is also exploring AI integration to further enhance customer interactions and operational efficiency.

The integration of AI into customer service presents a significant opportunity for China Southern. By leveraging AI, the airline can offer more personalized support, faster issue resolution, and proactive communication. This aligns with the broader industry trend of using technology to meet evolving customer expectations.

- Digital Transformation Focus: China Southern is investing in digital platforms like the 'China Southern E-Travel' app to improve customer engagement.

- AI Integration Potential: The airline is investigating AI for customer service, aiming for enhanced personalization and operational control.

- Market Adoption Uncertainty: While crucial for future growth, the full market impact and customer adoption of these advanced digital services are still emerging, positioning them as potential Stars in the BCG matrix if successful.

China Southern's expansion into new international markets like Mexico City in 2024, alongside its ventures into South America and Africa, places these nascent operations firmly in the Question Mark category. Despite the high growth potential of these regions, the airline's current market share is minimal, necessitating substantial investment to build brand recognition and operational capacity.

The airline's commitment to Sustainable Aviation Fuel (SAF) trials and planned 2025 expansion also represents a Question Mark. While the sector is poised for growth driven by environmental regulations and consumer demand, high production costs and an underdeveloped supply chain create significant uncertainty about immediate profitability and market penetration.

The large-scale integration of 100 C919 aircraft, with deliveries starting in 2024, positions this domestic model as a strategic Question Mark. While it offers long-term cost benefits and aligns with national industrial policy, initial uncertainties surrounding operational performance, maintenance, and passenger acceptance require careful management and investment.

China Southern's digital transformation, including the 'China Southern E-Travel' app and AI integration for customer service, also falls into the Question Mark quadrant. These initiatives aim to enhance customer experience and operational efficiency, but their full market impact and customer adoption are still developing, making them high-potential but uncertain investments.

| Initiative | BCG Category | Rationale | Key Data/Facts |

| New International Routes (e.g., Mexico City) | Question Mark | High growth potential markets, low current market share. | 17 new long-haul international routes added in 2024. |

| Sustainable Aviation Fuel (SAF) | Question Mark | Promising sector, but high costs and developing supply chain. | Significant expansion planned for 2025. |

| C919 Aircraft Integration | Question Mark | Potential cost savings and domestic support, but operational and acceptance uncertainties. | Order of 100 C919s, deliveries from 2024-2031. |

| Digital Transformation (AI, E-Travel App) | Question Mark | Enhances customer service and efficiency, but uncertain market impact and adoption. | Investment in AI for customer service. |

BCG Matrix Data Sources

Our China Southern Airlines BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.