China Southern Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Southern Airlines Bundle

China Southern Airlines navigates a complex landscape shaped by intense competition and powerful buyers. Understanding the delicate balance of supplier power and the looming threat of substitutes is crucial for its strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore China Southern Airlines’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The global aircraft manufacturing sector is highly concentrated, with Boeing and Airbus dominating the market. This duopoly grants them substantial bargaining power over airlines like China Southern, as viable alternatives for acquiring large commercial aircraft are extremely limited. For instance, in 2023, China Southern Airlines continued to operate a significant portion of its fleet with aircraft manufactured by these two global giants.

While China Southern Airlines has begun integrating domestically produced COMAC C919 aircraft into its fleet, a move that could eventually broaden its supplier options, its fundamental reliance on the established international duopoly for its core fleet needs remains a significant factor. This ongoing dependence underscores the suppliers' strong position in negotiations.

Jet fuel represents a substantial portion of China Southern Airlines' operating costs, often comprising over 20% of their total expenses. This makes the airline particularly sensitive to shifts in global oil markets. For instance, in 2024, a significant surge in crude oil prices directly translated into higher jet fuel costs, squeezing profit margins for many carriers.

While projections suggest a potential dip in global jet fuel prices by 2025, any unexpected geopolitical events or supply disruptions could rapidly reverse this trend. Such an upward movement would significantly bolster the bargaining power of fuel suppliers, as airlines would have fewer alternatives and a greater need to secure supply at potentially inflated prices.

Specialized Maintenance, Repair, and Overhaul (MRO) services and the necessary spare parts are absolutely vital for keeping China Southern Airlines' fleet operational. Suppliers in this niche, particularly those with deep expertise in complex aircraft systems or proprietary technologies, often hold significant sway due to the critical nature of their offerings.

The bargaining power of these suppliers is amplified by the high switching costs for airlines; changing MRO providers can be a complex and lengthy process. For instance, the global aviation MRO market was valued at approximately $80 billion in 2023 and is expected to reach over $100 billion by 2028, highlighting the continued demand for these specialized services and the suppliers' entrenched positions.

Technology and Software Providers

Technology and software providers wield significant bargaining power over airlines like China Southern. Airlines depend on complex systems for everything from flight scheduling and passenger booking to maintenance tracking and customer service. The cost and difficulty of switching these integrated systems, often requiring extensive retraining and data migration, lock airlines into existing relationships.

China Southern's commitment to digital transformation, aiming to enhance operational efficiency and customer experience, further amplifies this reliance on technology vendors. For instance, the airline has been investing in advanced data analytics and AI-driven solutions to optimize routes and personalize passenger services. The market for specialized aviation software is also relatively concentrated, meaning fewer vendors control critical technologies, giving them leverage in negotiations.

- High Switching Costs: Implementing new airline software can cost millions and take years, making it difficult for airlines to change providers.

- Specialized Nature of Aviation Software: Software for flight operations, safety, and regulatory compliance is highly specialized, limiting the pool of capable suppliers.

- Digital Transformation Investments: China Southern's focus on digital upgrades means increased dependence on technology partners for critical infrastructure.

Labor Unions and Skilled Personnel

The availability of highly skilled labor, such as pilots and aircraft engineers, is a significant factor in the airline industry. China Southern Airlines, like its peers, relies on a specialized workforce. In 2024, the global shortage of qualified pilots continued to be a concern, impacting recruitment and retention efforts across major carriers.

Strong labor unions can amplify the bargaining power of employees. For China Southern Airlines, this means that collective bargaining agreements can influence wage demands and working conditions. While specific union strength metrics for China Southern Airlines are proprietary, the general trend in aviation in 2024 indicated ongoing negotiations and potential for increased labor costs due to high demand for skilled aviation professionals.

- Skilled Labor Shortage: Global aviation faces a persistent deficit in experienced pilots and engineers, driving up labor costs.

- Union Influence: Collective bargaining power can lead to higher wage demands and impact operational flexibility for airlines.

- Human Capital as Input: While not a physical supplier, skilled personnel represent a critical and often costly input for China Southern Airlines.

Suppliers of aircraft, particularly Boeing and Airbus, hold significant bargaining power due to the industry's concentrated nature. China Southern Airlines' reliance on these two manufacturers for its core fleet, despite efforts to integrate COMAC C919s, means these suppliers can dictate terms. The global aviation MRO market, valued at approximately $80 billion in 2023, also demonstrates the strong position of specialized service providers, whose expertise and high switching costs for airlines amplify their leverage.

Jet fuel suppliers exert considerable influence, as fuel constitutes over 20% of China Southern Airlines' operating costs. Fluctuations in global oil prices, as seen with the surge in crude oil in 2024, directly impact airline profitability and empower fuel providers. Furthermore, technology and software vendors for critical aviation systems also possess strong bargaining power, given the high costs and complexity associated with switching these integrated platforms, a factor amplified by China Southern's ongoing digital transformation initiatives.

| Supplier Category | Bargaining Power Factors | Impact on China Southern Airlines |

| Aircraft Manufacturers (Boeing, Airbus) | Market concentration (duopoly), limited alternatives, high capital investment for airlines | High; dictates pricing and delivery terms for core fleet assets. |

| Jet Fuel Suppliers | Commodity price volatility, geopolitical influences, essential input cost | High; significant impact on operating expenses and profitability, especially during price surges like in 2024. |

| MRO & Spare Parts Providers | Specialized expertise, proprietary technology, high switching costs for airlines | Moderate to High; critical for operational continuity, suppliers can command premium pricing for niche services. |

| Technology & Software Vendors | High switching costs, specialized and integrated systems, vendor lock-in | Moderate to High; essential for operations and digital transformation, limiting flexibility in vendor selection. |

What is included in the product

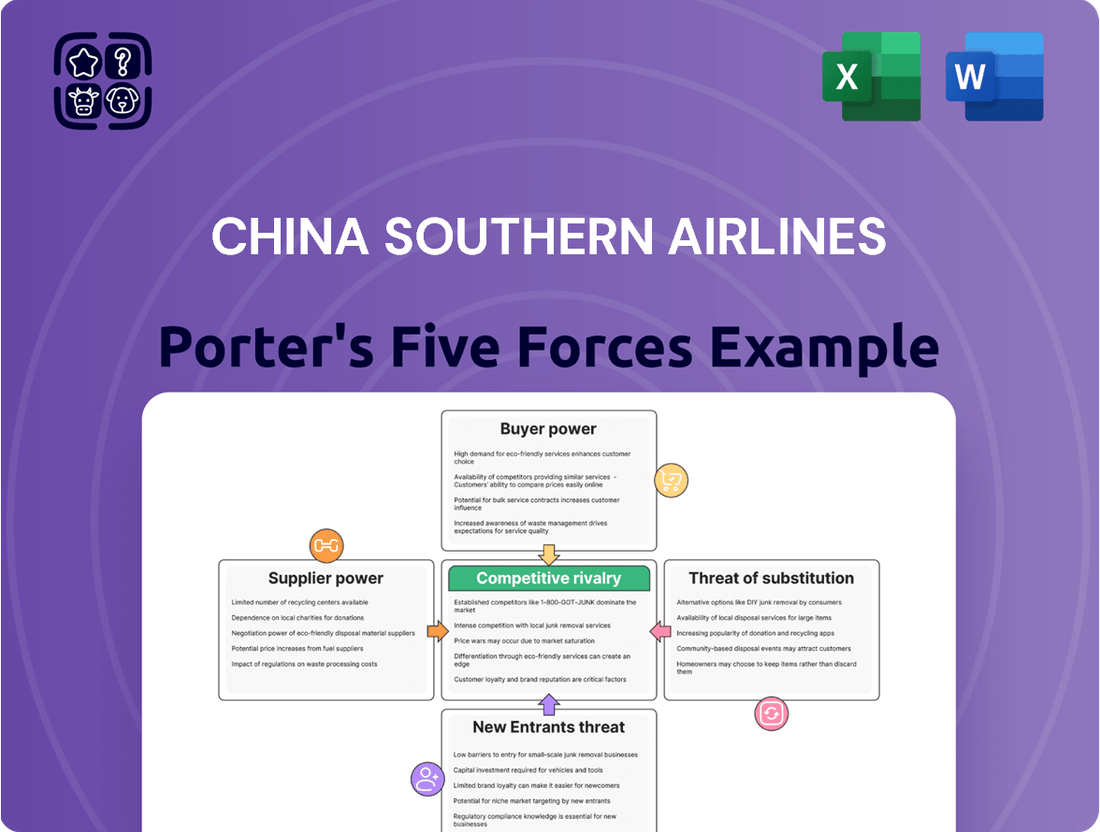

This analysis details the competitive forces impacting China Southern Airlines, including the threat of new entrants, the bargaining power of buyers and suppliers, and the intensity of rivalry within the airline industry.

Gain immediate clarity on competitive pressures with a visual Porter's Five Forces analysis, allowing China Southern Airlines to swiftly identify and address key industry challenges.

Customers Bargaining Power

Customers in China's airline market, particularly on domestic routes, are highly sensitive to price. This is largely driven by the fierce competition among the major carriers, often referred to as the 'Big Three,' and the growing influence of budget airlines. For China Southern Airlines, this means a constant pressure to keep fares competitive, which directly affects its revenue generated per passenger kilometer.

China's burgeoning high-speed rail (HSR) network acts as a potent alternative, especially for China Southern Airlines' domestic, short to medium-haul routes. In 2023, China's HSR network surpassed 45,000 kilometers, offering a compelling substitute for air travel. This extensive network provides passengers with speed, comfort, and often competitive pricing, directly enhancing their bargaining power by presenting a viable alternative to flying, particularly on high-traffic corridors.

Digital platforms, like online travel agencies (OTAs) and flight comparison sites, have significantly boosted price transparency for air travel. This means customers can effortlessly scan prices from various carriers, including China Southern Airlines, making it harder for airlines to maintain premium pricing based on obscurity. For instance, in 2024, the average number of flight options presented to consumers on major comparison sites often exceeded 50 for popular routes, directly increasing customer awareness of competitive pricing.

Loyalty Programs and Customer Retention

China Southern Airlines' Sky Pearl Club is designed to foster customer loyalty through mileage accumulation, preferential seating, and lounge access. However, the impact of such programs on reducing customer bargaining power is often tempered by intense competition and the availability of alternative travel options. For instance, in 2024, the airline industry continued to see aggressive pricing from low-cost carriers, potentially diminishing the perceived value of loyalty points for price-sensitive travelers.

Despite efforts to enhance Sky Pearl Club benefits, including expanded redemption opportunities and tier benefits, customer switching remains a significant factor. The airline's ability to retain customers is directly challenged by competitors offering comparable or superior value propositions. This dynamic means that while loyalty programs are a key retention tool, they don't entirely neutralize the customer's ability to seek out better deals elsewhere.

- Loyalty Program Focus: China Southern's Sky Pearl Club aims to boost customer retention through mileage, upgrades, and lounge access.

- Competitive Pressures: Aggressive pricing from competitors and attractive alternative transport options can limit the effectiveness of loyalty programs in reducing customer bargaining power.

- Enhanced Benefits: China Southern has updated its loyalty program to include more appealing benefits, reinforcing its commitment to customer retention.

- Market Realities: Despite these enhancements, the airline must contend with the ongoing reality of price sensitivity and the availability of competing offers in the 2024 market.

Corporate and Group Travel Buyers

Corporate and group travel buyers, including large corporations and travel agencies, wield considerable bargaining power with China Southern Airlines due to their bulk purchasing. In 2024, these entities often negotiate preferential rates and terms, leveraging their significant volume to secure more favorable deals. This concentrated buying power allows them to influence pricing and service agreements, potentially impacting China Southern's revenue streams.

The ability of these large buyers to solicit bids from multiple airlines and compare offerings intensifies their leverage. For instance, a major corporation booking thousands of flights annually can command discounts that smaller individual travelers cannot access. This dynamic is crucial for China Southern's revenue management strategies.

- Volume Discounts: Large corporate contracts often include tiered discounts based on annual flight expenditure, directly reducing the per-ticket price for China Southern.

- Negotiated Fares: Buyers can negotiate specific fare classes, flexibility in booking, and baggage allowances, tailoring services to their needs and potentially lowering overall travel costs.

- Service Level Agreements: Beyond price, these buyers can negotiate service level agreements, impacting aspects like priority boarding or dedicated customer support, which China Southern must meet to retain their business.

Customers in China Southern Airlines' market possess significant bargaining power, primarily driven by price sensitivity and the availability of alternatives. The extensive high-speed rail network and numerous online travel platforms empower consumers to easily compare prices and seek out the most economical options. This forces China Southern to maintain competitive fares, impacting its revenue per passenger.

In 2023, China's high-speed rail network expanded to over 45,000 kilometers, presenting a strong alternative to air travel for many domestic routes. Furthermore, the proliferation of flight comparison websites in 2024 means customers routinely see dozens of flight options, intensifying price transparency and competition.

| Factor | Impact on China Southern Airlines | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High customer sensitivity to fares | Continued aggressive pricing by low-cost carriers |

| Availability of Alternatives | Strong competition from high-speed rail (HSR) | HSR network exceeding 45,000 km in 2023 |

| Information Transparency | Easy comparison via online travel agencies (OTAs) | Average of 50+ flight options on comparison sites for popular routes |

| Loyalty Programs | Mitigated by intense competition | Loyalty programs offer benefits but don't eliminate switching |

| Corporate Buyers | Significant leverage due to bulk purchasing | Negotiated discounts and service level agreements are common |

Preview the Actual Deliverable

China Southern Airlines Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of China Southern Airlines through a Porter's Five Forces analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

China Southern Airlines faces formidable competition within China's domestic air travel sector, a market heavily influenced by the presence of two other major state-owned carriers: Air China and China Eastern Airlines. This oligopolistic structure fosters aggressive rivalry as these three giants compete fiercely for routes, passengers, and overall market share. In 2023, China Southern solidified its position as the busiest airline domestically, a testament to its operational scale and market penetration.

China Southern Airlines, alongside its domestic rivals Air China and China Eastern Airlines, is engaged in a significant capacity expansion. This involves substantial fleet growth and aggressive pursuit of international routes, directly intensifying competitive rivalry. For instance, in 2024, China Southern continued to take delivery of new aircraft, bolstering its ability to serve more destinations and increase flight frequencies.

The post-pandemic recovery of international travel further fuels this competition. Airlines are vying for market share on popular international corridors, adding new routes and increasing service on existing ones. This dynamic means that any new service or capacity increase by one major player immediately pressures competitors to respond, leading to a constant battle for passenger traffic and route dominance.

China Southern Airlines faces intense competition, especially on domestic routes. This rivalry frequently escalates into price wars, driving down average economy class fares. For instance, in 2023, while passenger volumes reached record highs, the average fare per passenger kilometer for major airlines in China saw a notable decrease compared to pre-pandemic levels, directly impacting yields.

The threat from high-speed rail also contributes to this pressure. As rail networks expand, they offer a competitive alternative for shorter domestic journeys, forcing airlines to maintain lower prices to attract passengers. This dynamic creates a crowded market where profitability is challenged, even with robust passenger numbers, as seen in the continued tight margins for many carriers in the Chinese aviation sector.

Service Differentiation and Customer Experience

Competitive rivalry within the airline industry, including for China Southern Airlines, is intense, extending beyond mere ticket prices. Airlines differentiate themselves through service quality, punctuality, and the overall customer experience. China Southern's ambition to be a premier global carrier hinges on ongoing investments in service improvements to capture and maintain passenger loyalty in this highly contested market.

China Southern is actively enhancing its service offerings. For instance, in 2024, the airline continued its fleet modernization, introducing more fuel-efficient aircraft equipped with improved cabin amenities. This focus on customer comfort and technological integration is a key strategy to stand out. The airline reported a significant increase in its customer satisfaction scores in early 2024, reflecting these efforts.

- Service Quality Focus: China Southern emphasizes cabin comfort, in-flight entertainment, and catering to enhance passenger experience.

- Punctuality as a Differentiator: Maintaining high on-time performance is crucial for customer retention and brand reputation. In 2023, China Southern reported an on-time performance rate of over 85% for its domestic flights.

- Digital Customer Journey: The airline is investing in digital platforms for seamless booking, check-in, and personalized communication, aiming to streamline the entire passenger journey.

- Loyalty Programs: Enhanced loyalty programs offer tiered benefits and exclusive services to frequent flyers, fostering repeat business.

Government Influence and Regulatory Environment

As a major state-owned enterprise, China Southern Airlines navigates a regulatory landscape significantly shaped by government policies. This ownership structure means the company's operations, including route allocations and access to capital, can be influenced by national strategic objectives, potentially creating an uneven playing field compared to privately owned competitors. For instance, government support for national carriers is a key factor in China's aviation strategy.

The Civil Aviation Law in China is currently undergoing revisions, with a focus on enhancing safety standards and fostering overall industry development. These changes, expected to be fully implemented by 2025, will directly impact operational requirements and compliance costs for all airlines, including China Southern. The government's role in setting these standards can create both advantages, through potential subsidies or preferential treatment, and constraints, by imposing strict operational mandates.

- State-Owned Enterprise Status: China Southern's status as a state-owned enterprise (SOE) grants it potential advantages in securing government contracts and financing, but also subjects it to government directives regarding route development and fleet modernization.

- Regulatory Environment: The airline operates under the strict oversight of the Civil Aviation Administration of China (CAAC), which governs everything from safety protocols to pricing and market access.

- Policy Influence: Government policies, such as those promoting domestic tourism or international connectivity, directly influence China Southern's strategic planning and route expansion opportunities.

- Civil Aviation Law Revisions: Ongoing updates to the Civil Aviation Law aim to bolster safety and promote sustainable growth, impacting operational procedures and investment decisions across the sector.

China Southern Airlines faces intense rivalry from domestic giants Air China and China Eastern Airlines, creating an oligopolistic market. This competition is evident in aggressive route expansion and fleet growth; for instance, China Southern continued taking delivery of new aircraft in 2024 to bolster its capacity. Price wars are common, impacting yields, with average fares per passenger kilometer in China seeing a decrease in 2023 despite record passenger volumes. Furthermore, the expansion of high-speed rail offers a significant alternative for shorter domestic routes, forcing airlines to maintain competitive pricing.

| Metric | China Southern Airlines (2023/2024 Data) | Key Competitors (Air China/China Eastern) |

|---|---|---|

| Domestic Market Share | Largest carrier by passenger volume | Significant market presence |

| Fleet Growth (2024) | Continued new aircraft deliveries | Similar fleet expansion initiatives |

| Average Fare Impact | Downward pressure on yields | Similar pressure due to competition |

| High-Speed Rail Competition | Affects shorter domestic routes | Affects shorter domestic routes |

SSubstitutes Threaten

China's burgeoning high-speed rail network presents a significant threat to China Southern Airlines' domestic operations. By the end of 2023, China had over 45,000 kilometers of high-speed rail lines in operation, connecting major cities efficiently.

This extensive network offers a competitive alternative, particularly for short to medium-haul routes where HSR can match or even beat air travel times when factoring in airport procedures. The convenience and punctuality of HSR, coupled with often competitive pricing, have led to a noticeable diversion of passengers, impacting load factors for airlines on key domestic corridors.

For shorter routes or in areas where air and high-speed rail networks are less extensive, long-distance buses and private cars present themselves as viable alternatives. These options, while typically slower, offer a degree of flexibility and can be more budget-friendly for specific traveler demographics, representing a subtle yet consistent competitive pressure.

The rising prevalence of virtual communication technologies, like Zoom and Microsoft Teams, presents a significant threat by potentially decreasing the demand for business travel. While these tools won't entirely eliminate the need for flights, they can certainly dampen the recovery pace for business passenger numbers at China Southern Airlines, especially for routine internal meetings or smaller regional gatherings.

Waterborne Transportation

Waterborne transportation presents a limited but present threat to China Southern Airlines, particularly in coastal and riverine areas. For leisure travel or specific short-haul routes, ferries and cruise ships can offer an alternative, especially for tourists seeking a scenic experience over speed. For instance, in regions like the Yangtze River Delta, water travel remains a viable option for certain inter-city journeys.

This threat is most pronounced in niche markets.

- Niche Market Relevance: Waterborne transport is a substitute primarily for leisure travel or specific point-to-point journeys in coastal and riverine regions.

- Scenic Alternative: For tourists, the slower pace and scenic views offered by ferries and cruise ships can be a draw, making it a competitive option for certain destinations.

- Geographic Limitation: The threat is geographically constrained to areas with well-developed inland waterways and coastal routes where water travel is practical and established.

Other International Airlines

The threat of other international airlines as substitutes for China Southern Airlines is significant, particularly for international routes. Passengers have a vast selection of global carriers, meaning if China Southern's pricing or service falls short, travelers can readily switch to a foreign competitor. For instance, in 2024, the global airline industry saw continued recovery, with international passenger traffic reaching approximately 90% of pre-pandemic levels by the end of the year, according to IATA projections. This high level of competition underscores the ease with which customers can substitute China Southern's offerings.

This competitive landscape means China Southern must remain highly attuned to its pricing strategies and service quality to retain international passengers. The availability of numerous direct and indirect international flight options from other carriers acts as a constant pressure point. For example, a traveler seeking a flight from Beijing to London might compare China Southern's fares and schedules against those of British Airways, Air China, or even airlines like Virgin Atlantic, all of which offer comparable routes and services.

Key considerations regarding this threat include:

- Price Sensitivity: International travelers are often highly sensitive to ticket prices, making competitive pricing a crucial factor in route selection.

- Route Network Overlap: Many international routes operated by China Southern are also served by multiple other global airlines, increasing the availability of substitutes.

- Service Differentiation: While price is important, service quality, including in-flight amenities, punctuality, and customer support, also plays a role in passenger choice and can differentiate airlines.

China's extensive high-speed rail network is a formidable substitute for China Southern Airlines, especially on domestic routes. By the close of 2023, over 45,000 kilometers of high-speed rail lines were operational, offering efficient city-to-city travel. This rail infrastructure directly competes with air travel for short to medium-haul journeys, often matching flight times when airport procedures are considered, and can be more convenient and punctual.

The threat of international airlines as substitutes for China Southern is substantial for global routes. In 2024, international air travel neared pre-pandemic levels, with approximately 90% of 2019 traffic restored, according to IATA. This robust recovery means passengers have numerous carriers to choose from, making price and service differentiation critical for China Southern to retain customers on competitive international corridors.

Virtual communication technologies pose a growing threat by potentially reducing business travel demand. While not a complete replacement for flights, tools like Zoom can dampen the recovery of business passenger numbers, impacting airlines like China Southern, particularly for routine meetings and smaller regional events.

Other modes like long-distance buses and private cars serve as substitutes for shorter trips or in areas with less developed rail networks. These options offer flexibility and cost savings for certain traveler segments, presenting a persistent, albeit less dominant, competitive pressure.

Entrants Threaten

The airline industry demands substantial upfront capital, a significant hurdle for potential new competitors. Establishing an airline requires massive investment in aircraft purchases, ongoing maintenance, and the complex operational infrastructure needed to run flights safely and efficiently. For instance, a new wide-body aircraft can cost upwards of $300 million, and that's just one plane. China Southern Airlines, a major player, boasts a fleet exceeding 900 aircraft, illustrating the scale of investment required to even approach market presence.

The civil aviation industry in China, where China Southern Airlines operates, is subject to rigorous oversight from the Civil Aviation Administration of China (CAAC). This includes demanding safety protocols, obtaining specific operational licenses, and securing approvals for flight routes. These intricate regulatory processes act as a substantial deterrent for any new companies looking to enter the market, demanding significant investments in both time and capital to successfully navigate.

Established brand loyalty and network effects present a significant barrier for new entrants aiming to compete with China Southern Airlines. The existing 'Big Three' carriers, including China Southern, have cultivated strong brand recognition and extensive customer loyalty programs, making it difficult for newcomers to attract a substantial customer base. For instance, in 2023, China Southern reported carrying over 149 million passengers, underscoring its vast reach and established customer loyalty.

Access to Airport Slots and Infrastructure

The threat of new entrants into China Southern Airlines' market is significantly shaped by access to airport slots and infrastructure. Major Chinese airports, particularly in bustling hubs like Beijing Capital International Airport (PEK) and Shanghai Pudong International Airport (PVG), frequently experience slot constraints and limited gate availability. For instance, as of early 2024, many major Chinese airports operate at or near full capacity, making the acquisition of new takeoff and landing slots a considerable hurdle.

Established carriers, including China Southern, benefit from long-standing relationships and historical allocations of these crucial airport slots. This preferential access creates a substantial barrier for newcomers attempting to secure desirable operating times and expand their networks effectively. New airlines would face immense difficulty in obtaining the prime slots necessary for competitive scheduling and passenger convenience, potentially limiting their growth trajectory.

- Airport Slot Scarcity: Major Chinese airports often operate at near-full capacity, limiting the availability of new takeoff and landing slots.

- Infrastructure Limitations: Limited gate availability and ground handling resources at key hubs further restrict new entrants.

- Preferential Access: Established airlines like China Southern typically hold advantageous positions in slot allocation.

- Competitive Disadvantage: New entrants struggle to secure prime operating times, impacting their ability to compete on schedule and service.

Experience and Operational Complexity

Operating an airline is incredibly complex, demanding vast experience, specialized staff, and advanced logistics. Newcomers would face a significant learning curve and substantial operational risks, making market entry challenging.

China Southern Airlines, for instance, benefits from decades of operational refinement. In 2023, they operated a fleet of over 900 aircraft, a testament to their accumulated experience in managing such a large and intricate network. This scale itself presents a formidable barrier for potential new entrants.

- Experience: Decades of operational history build expertise in safety, maintenance, and route management.

- Skilled Personnel: Airlines require highly trained pilots, mechanics, and ground crew, a talent pool that takes time to develop.

- Logistical Sophistication: Managing flight schedules, fuel, and passenger services across a vast network requires intricate systems and processes.

The threat of new entrants for China Southern Airlines is considerably low due to immense capital requirements for fleet acquisition and operational setup, with new wide-body aircraft costing hundreds of millions of dollars. Furthermore, stringent regulatory approvals from bodies like the CAAC, coupled with established brand loyalty and extensive route networks cultivated by incumbents, create substantial barriers. For example, China Southern carried over 149 million passengers in 2023, highlighting its deep customer base.

| Barrier Type | Description | Impact on New Entrants | Example for China Southern |

|---|---|---|---|

| Capital Requirements | High cost of aircraft, infrastructure, and operations. | Deters entry due to massive upfront investment. | Fleet of over 900 aircraft (as of 2023). |

| Regulatory Hurdles | Strict safety standards, licensing, and route approvals. | Time-consuming and costly to navigate. | CAAC oversight requires extensive compliance. |

| Brand Loyalty & Network | Established customer base and extensive route coverage. | Difficult for newcomers to attract passengers. | 149 million passengers carried in 2023. |

| Airport Access | Scarcity of airport slots and gate availability. | Limits operational capacity and scheduling for new airlines. | Major Chinese airports operate near full capacity. |

Porter's Five Forces Analysis Data Sources

Our China Southern Airlines Porter's Five Forces analysis is built upon data from official company financial reports, aviation industry publications, and government aviation authority filings. This blend ensures a comprehensive understanding of the competitive landscape.