Crocs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

Crocs navigates a competitive footwear landscape where buyer power is significant due to readily available alternatives and brand loyalty challenges. The threat of new entrants is moderate, as establishing a strong brand and distribution network requires substantial investment, but the low capital requirements for basic shoe production offer some accessibility.

The complete report reveals the real forces shaping Crocs’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Crocs' reliance on its proprietary Croslite material means that suppliers of the specific chemical compounds or resins needed for this unique foam could hold significant bargaining power. If these suppliers are the sole or primary source for these key ingredients, their leverage increases, especially given the intellectual property protection around Croslite which can limit alternative sourcing options.

Crocs faces a potential challenge with a limited supplier base for highly specialized manufacturing equipment and unique tooling essential for its distinctive molded footwear. This scarcity can empower these niche suppliers, especially if the costs associated with switching to alternative equipment or processes are substantial, impacting Crocs' operational flexibility and cost structure.

Suppliers of labor, especially in key manufacturing regions, can significantly influence Crocs' costs. In 2024, reports indicated rising labor costs in Southeast Asia, a primary manufacturing base for many footwear companies, potentially increasing Crocs' production expenses. This power is further amplified by potential labor shortages, forcing companies to offer higher wages to attract and retain workers.

Beyond labor, fluctuations in the cost of raw materials like the proprietary Croslite foam, dyes, and other shoe components also grant suppliers leverage. For instance, increases in petrochemical prices, a key component in many plastics and foams, can directly impact the cost of manufacturing Crocs' signature material. While Crocs' diversified manufacturing strategy across multiple countries helps mitigate some of these supplier-driven cost risks, it doesn't entirely insulate them from global commodity price volatility.

Logistics and Distribution Network Control

The bargaining power of suppliers in logistics and distribution is a significant factor for Crocs. Third-party logistics (3PL) providers and shipping companies hold considerable sway, influencing freight costs and delivery timelines, which directly impact Crocs' operational efficiency and bottom line. For instance, in 2024, global shipping costs saw fluctuations due to geopolitical events and increased demand, potentially raising the cost of getting Crocs products to market.

Crocs’ reliance on a robust and cost-effective global distribution network means that any disruption or price hike from logistics partners can erode profitability and market competitiveness. The ability of these suppliers to dictate terms, especially concerning fuel surcharges and capacity availability, directly affects Crocs' ability to maintain its pricing strategies and meet consumer demand promptly.

- Global Shipping Cost Volatility: In 2024, the cost of ocean freight, a critical component for Crocs' international distribution, experienced significant swings, impacting landed costs.

- Dependence on Key Carriers: Crocs, like many global apparel brands, relies on a limited number of major shipping lines, granting these carriers enhanced bargaining power.

- Fuel Surcharges: Fluctuations in global oil prices directly translate into variable fuel surcharges imposed by logistics providers, adding an unpredictable cost element for Crocs.

Brand and Marketing Agency Influence

The bargaining power of suppliers, particularly in the realm of brand and marketing agencies, is a significant factor for companies like Crocs. Agencies that have a proven history of creating successful campaigns and driving consumer engagement can leverage their expertise to command higher fees and influence strategic marketing directions. For Crocs, which thrives on a distinctive brand identity and strong customer connection, aligning with high-caliber agencies is crucial for maintaining its market presence and appeal.

For instance, in 2024, the global advertising and marketing industry saw continued growth, with digital advertising spending projected to reach over $600 billion. This robust market environment empowers leading agencies that possess specialized skills in areas like influencer marketing and digital content creation, which are vital for brands like Crocs. These agencies can therefore exert considerable influence over campaign execution and creative direction, demanding terms that reflect their value and market demand.

- High-Demand Agencies: Agencies with a strong portfolio and demonstrated success in building brand equity, especially for lifestyle and fashion brands, hold significant leverage.

- Strategic Partnerships: Crocs needs to cultivate strategic relationships with these agencies to ensure their marketing efforts are both impactful and aligned with the brand's evolving image.

- Creative Control and Fees: The power of these suppliers can translate into higher service fees and a degree of influence over the creative output and overall marketing strategy.

The bargaining power of suppliers is a key consideration for Crocs, particularly concerning its proprietary Croslite material. Suppliers of the specific chemical compounds or resins for this unique foam can wield significant influence if they are the sole or primary source, especially given the intellectual property surrounding Croslite which limits alternative sourcing. This dependence can translate into higher material costs for Crocs.

| Supplier Type | Impact on Crocs | 2024 Context/Data |

|---|---|---|

| Raw Material (Croslite Foam) | Potential for increased costs due to petrochemical price volatility. | Petrochemical prices saw fluctuations in 2024, directly impacting plastic and foam production costs. |

| Specialized Manufacturing Equipment | Higher costs and limited flexibility if few suppliers exist. | The market for highly specialized footwear tooling remains concentrated, empowering existing providers. |

| Logistics & Distribution | Increased freight costs and potential delivery delays. | Global shipping costs experienced volatility in 2024, with ocean freight rates fluctuating significantly. |

What is included in the product

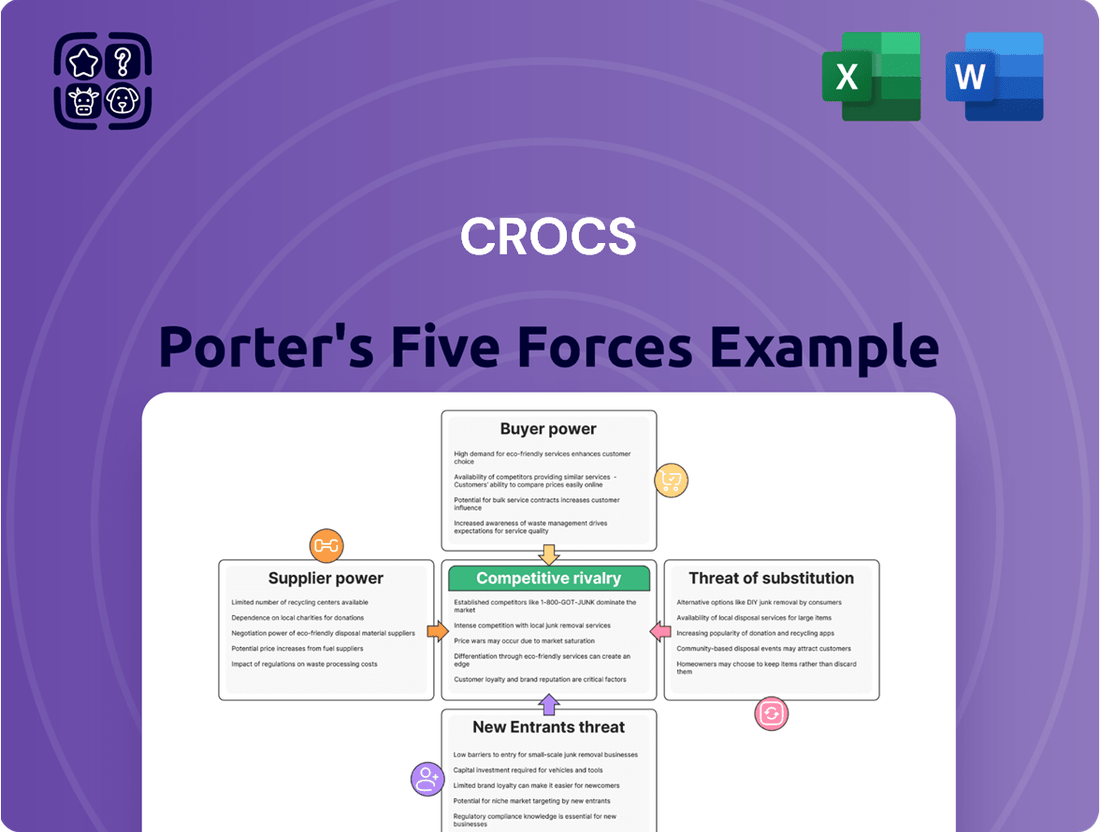

Analyzes the competitive intensity within the footwear industry and Crocs' strategic positioning against rivals, new entrants, suppliers, buyers, and substitutes.

Instantly identify competitive pressures with a visual representation of Porter's Five Forces, enabling swift strategic adjustments.

Customers Bargaining Power

The sheer volume of footwear choices available to consumers significantly bolsters their bargaining power against companies like Crocs. With countless brands offering everything from athletic shoes to casual sandals and specialized boots, customers can readily find alternatives that meet their needs and budgets.

For instance, in 2024, the global footwear market is projected to reach over $400 billion, showcasing the immense competition and the wide array of options consumers have. This means if Crocs were to increase prices or fail to innovate, customers could easily shift their spending to brands like Nike, Adidas, or even more niche comfort-focused labels without experiencing a significant loss in utility.

The cost for a customer to switch from Crocs to a competitor's footwear is practically zero. It involves little more than the simple act of selecting a different brand or style. This lack of significant barriers means consumers can easily explore alternatives without incurring substantial financial or logistical hurdles.

There are no binding contracts or hefty fees that tie customers to Crocs. This absence of commitment further amplifies consumer freedom. Consequently, buyers are empowered to readily shift their preference based on price, design, or perceived value at any given moment, directly impacting Crocs' pricing power.

In 2024, the footwear market remains highly competitive, with numerous brands offering similar casual shoe options. This landscape, characterized by a wide array of choices and minimal switching costs, allows consumers to readily compare and purchase from competitors, putting pressure on Crocs to maintain competitive pricing and product appeal.

Many consumers in the casual footwear market are quite sensitive to price, especially for items seen as everyday essentials rather than premium fashion statements. This means that even with a strong brand like Crocs, substantial price hikes could push some customers towards alternatives. For instance, in 2023, the casual footwear market saw a noticeable shift with consumers actively seeking value, with many major retailers offering discounts of 20-30% on popular casual styles to drive sales.

Access to Information and Online Reviews

Customers today have unprecedented access to information. Through online platforms and social media, they can easily research products, compare prices across different retailers, and read reviews from other buyers. This transparency significantly boosts their bargaining power.

For a company like Crocs, this means customers can quickly identify the best deals and assess product quality based on peer experiences. This puts direct pressure on Crocs to ensure their products are high-quality and competitively priced. A single negative review or widespread dissatisfaction can rapidly influence purchasing decisions and harm sales.

- Information Accessibility: Over 80% of consumers research products online before purchasing, utilizing review sites and comparison tools.

- Price Sensitivity: Online price comparison tools allow customers to find the lowest prices, increasing pressure on brands to offer competitive pricing.

- Reputation Management: In 2023, a significant percentage of consumers reported being influenced by online reviews, making brand reputation a critical factor.

Multi-channel Distribution and Wholesale Influence

Crocs' extensive multi-channel distribution, which includes a significant wholesale segment, grants considerable bargaining power to its large retail partners. These major customers, by virtue of their substantial order volumes and control over prime retail shelf space, can negotiate for more favorable pricing, extended payment terms, and increased promotional assistance from Crocs. For instance, in 2023, wholesale revenue represented a substantial portion of Crocs' overall sales, underscoring the importance of these relationships.

- Wholesale Dependence: Large retailers can leverage their purchasing power to influence Crocs' pricing and promotional strategies.

- Shelf Space Control: Dominant retailers can dictate terms based on the visibility and access they provide to Crocs products.

- Negotiation Leverage: Favorable pricing and payment terms are common demands from high-volume wholesale customers.

The bargaining power of customers remains a significant force for Crocs. With the global footwear market exceeding $400 billion in 2024 and offering a vast array of choices, consumers can easily switch to competitors if Crocs' pricing or product appeal falters. The minimal cost and effort involved in changing brands further empower buyers, as there are no contractual obligations to keep them tied to Crocs.

Price sensitivity is also a key factor. Many consumers view casual footwear as a necessity where value is paramount, making them receptive to discounts. In 2023, widespread promotions of 20-30% on casual styles highlighted this trend. Furthermore, enhanced information accessibility, with over 80% of consumers researching online, allows for easy price comparison and reliance on reviews, directly influencing purchasing decisions and pressuring Crocs on pricing and quality.

| Factor | Impact on Crocs | Supporting Data (2023-2024) |

|---|---|---|

| Market Size & Competition | High consumer choice amplifies bargaining power. | Global footwear market projected over $400 billion in 2024. |

| Switching Costs | Virtually zero, allowing easy brand shifts. | No contractual ties or significant financial barriers. |

| Price Sensitivity | Customers seek value, respond to discounts. | Retailers offered 20-30% discounts on casual footwear in 2023. |

| Information Accessibility | Online research empowers informed price comparison. | Over 80% of consumers research online before buying. |

Same Document Delivered

Crocs Porter's Five Forces Analysis

This preview displays the complete Crocs Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the footwear industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability. You can confidently expect to download this exact, professionally formatted analysis, ready to inform your strategic decisions without any hidden steps or additional content.

Rivalry Among Competitors

The footwear market is incredibly crowded, featuring everyone from massive athletic brands like Nike and Adidas to smaller fashion labels and private store brands. This sheer volume of competitors means Crocs is constantly up against a wide array of choices for consumers.

Crocs directly competes with other companies focusing on casual and comfort footwear, but it also faces indirect competition from any brand that wants a share of a consumer's spending on shoes. For instance, in 2024, the global footwear market was projected to reach over $400 billion, highlighting the vastness of consumer spending that Crocs is vying for.

Crocs' signature Croslite material and instantly recognizable clog design have cultivated a dedicated following, setting them apart in the footwear market. This differentiation is a key factor in their brand loyalty.

However, the competitive landscape is dynamic, with rivals frequently introducing novel materials, stylish designs, and advanced comfort features. This ongoing innovation by competitors directly challenges Crocs' established unique selling proposition and the perceived exclusivity of its product.

To maintain and strengthen this crucial brand loyalty, Crocs must consistently invest in product innovation, execute impactful marketing campaigns, and ensure their products continue to offer strong perceived value to consumers. For instance, in 2023, Crocs reported a revenue of $3.96 billion, underscoring the importance of their brand strength in a competitive market.

The footwear industry is a battlefield of aggressive marketing, with brands like Crocs constantly vying for consumer attention. This includes high-profile celebrity endorsements, engaging social media campaigns, and frequent seasonal sales events. For instance, in 2023, the global footwear market saw significant marketing spend across the board, with major players investing millions to maintain brand visibility.

Competitors pour substantial resources into advertising, making it crucial for Crocs to sustain a strong marketing budget. This constant push for visibility and relevance intensifies the rivalry, as every campaign aims to capture a larger slice of the market share. The sheer volume of promotional activity means staying competitive requires continuous investment in creative and impactful marketing strategies.

Innovation and Trend Responsiveness

The fashion and footwear sectors are incredibly dynamic, driven by ever-shifting consumer tastes. Companies must be quick to adapt to these changes. For instance, in 2023, the global footwear market was valued at approximately $380 billion, highlighting the intense competition and the need for constant evolution. Competitors frequently launch new designs, partner with influencers or brands, and incorporate new materials or manufacturing techniques to capture market share.

Crocs faces significant pressure from rivals who are adept at quickly introducing fresh styles and engaging collaborations. This necessitates that Crocs consistently refreshes its product offerings and stays attuned to the latest fashion trends. The company's ability to innovate, adapt to fashion cycles, and forge strategic partnerships is crucial for maintaining its competitive edge and preventing its distinctive product from becoming a mere fad.

- Trend Sensitivity: The footwear industry is highly susceptible to fashion trends, demanding rapid product development and marketing.

- Competitive Innovation: Competitors are continuously launching new styles, utilizing novel materials, and engaging in high-profile collaborations.

- Crocs' Response: Crocs must maintain a robust innovation pipeline and strategic partnerships to stay relevant and avoid market saturation.

Global Market Presence and Expansion

The footwear industry is inherently global, with numerous companies vying for consumer attention across continents. Crocs, with its significant international footprint, contends with a wide array of competitors, ranging from global giants like Nike and Adidas to robust regional brands that hold strong sway in their local markets. This widespread competition means Crocs must constantly adapt its strategies to resonate with diverse consumer preferences and economic conditions.

The drive for global expansion by competitors only amplifies the intensity of this rivalry. As brands seek new growth avenues, they enter and strengthen their presence in markets where Crocs already operates, leading to increased competition for shelf space, marketing visibility, and ultimately, market share. For instance, in 2024, many athletic and casual footwear brands continued aggressive international marketing campaigns, further segmenting the market.

- Global Reach: Many footwear companies, including major players like Nike, Adidas, and Skechers, operate in over 150 countries, directly competing with Crocs in key markets.

- Local Competitors: In specific regions, strong local brands can pose significant competitive threats, often leveraging deeper cultural understanding and established distribution networks.

- Market Saturation: The pursuit of international growth by multiple brands leads to increased competition for consumer wallets and attention in established and emerging markets alike.

The competitive rivalry within the footwear sector is intense, with a vast number of brands, from global powerhouses to niche players, all vying for consumer attention and spending. Crocs faces direct competition from casual footwear brands and indirect competition from any company seeking a share of the overall shoe market, which was projected to exceed $400 billion globally in 2024.

Crocs' unique design and material offer differentiation, but rivals frequently introduce innovative materials and styles, challenging Crocs' established market position. To combat this, Crocs must continuously invest in product development and marketing, as evidenced by their $3.96 billion revenue in 2023, which reflects the strength of their brand in a crowded marketplace.

The industry's dynamic nature, driven by shifting fashion trends, necessitates rapid adaptation. Competitors are quick to launch new designs and collaborations, requiring Crocs to consistently refresh its offerings and stay ahead of fashion cycles. This constant innovation and strategic partnership are vital for maintaining relevance and preventing its iconic product from becoming a passing trend.

| Competitor Type | Key Characteristics | Impact on Crocs |

|---|---|---|

| Global Athletic Brands (e.g., Nike, Adidas) | Extensive marketing budgets, broad product lines, strong brand loyalty, innovation in performance and lifestyle wear. | Indirect competition for consumer spending, influence on fashion trends, pressure to innovate in comfort and style. |

| Casual & Comfort Footwear Brands (e.g., Skechers, Clarks) | Focus on comfort, diverse styles, established distribution channels, competitive pricing. | Direct competition for the comfort-seeking consumer, pressure on pricing and product features. |

| Fashion & Lifestyle Brands | Trend-driven designs, celebrity collaborations, influencer marketing, limited-edition releases. | Challenge Crocs' unique selling proposition, demand for rapid trend adaptation, need for strategic partnerships. |

| Private Label & Fast Fashion Retailers | Lower price points, quick response to trends, wide accessibility. | Erosion of market share at lower price segments, pressure to maintain perceived value. |

SSubstitutes Threaten

The threat of substitutes for Crocs is significant, primarily stemming from a wide array of casual footwear made from different materials. Consumers can easily turn to canvas sneakers, traditional sandals, flip-flops, and other slip-on styles that serve a similar purpose of comfort and ease of wear. For instance, the global casual footwear market, valued at over $150 billion in 2023, presents a vast competitive landscape where style, brand perception, and price point often drive purchasing decisions away from specialized materials like Crocs' Croslite.

The growing trend of consumers wearing athletic footwear like sneakers and running shoes as everyday casual wear presents a significant threat of substitution for Crocs. Brands such as Nike, Adidas, and Skechers are particularly strong contenders, offering comfortable and fashion-forward options that directly compete in many casual settings. This blurring of lines between athletic performance and lifestyle fashion amplifies the substitution risk.

During warmer months, the market for sandals, flip-flops, and other open-toe footwear presents a significant threat of substitutes for Crocs. These alternatives are readily available from numerous brands across a wide spectrum of price points and styles, directly competing for consumer attention in the casual and outdoor footwear segments.

For instance, the global sandal market was valued at approximately USD 45 billion in 2023 and is projected to grow, indicating a robust demand for these alternatives. Consumers often opt for sandals and open-toe shoes for their superior breathability and diverse aesthetic appeal, particularly during spring and summer, which can directly influence Crocs' seasonal sales performance.

Slippers and Indoor Footwear

Slippers and other dedicated indoor footwear represent a significant threat of substitutes for Crocs, especially when consumers prioritize ultimate comfort within their homes. While Crocs can be worn indoors, specialized slipper brands offer designs and materials focused solely on home relaxation. For instance, in 2024, the global slipper market was projected to reach over $30 billion, indicating a substantial consumer base actively seeking these alternatives.

These indoor-specific options often feature plush linings, ergonomic footbeds, and breathable materials that directly compete with Crocs' comfort proposition for home use. Consumers looking for a distinct separation between outdoor and indoor wear will gravitate towards these specialized products. The perceived value of a dedicated slipper for lounging versus a versatile clog like Crocs can sway purchasing decisions.

- Market Size: The global slipper market is a multi-billion dollar industry, with projections indicating continued growth through 2025.

- Consumer Preference: A segment of consumers prioritizes specialized indoor footwear for enhanced comfort and a dedicated home-wear experience.

- Product Differentiation: Dedicated slipper brands often offer unique features like memory foam, shearling lining, and non-slip soles, directly challenging Crocs' comfort appeal for indoor use.

Barefoot or Minimalist Footwear Trends

The rise of barefoot or minimalist footwear presents a potential, though currently niche, threat of substitutes for Crocs. These trends, focusing on natural foot movement and lightweight construction, cater to a segment of consumers seeking distinct footwear experiences, diverging from Crocs' core comfort proposition. For instance, brands like Vivobarefoot and Xero Shoes have seen steady growth, with the global barefoot shoe market projected to reach approximately $1.5 billion by 2027, indicating a growing consumer interest in alternative foot health philosophies.

While not a direct substitute in terms of cushioning or iconic design, these alternatives attract consumers prioritizing different aspects of footwear. This evolving consumer preference necessitates that Crocs monitor these trends closely to understand potential long-term shifts in the market. The increasing popularity of wellness and natural living could further fuel the demand for such products, impacting market share in specific demographics.

Crocs should consider the following regarding this threat:

- Market Niche: Barefoot footwear currently occupies a smaller, specialized segment of the overall footwear market, but its growth indicates a developing consumer preference.

- Divergent Appeal: These substitutes attract consumers seeking natural foot function and minimal intervention, a contrast to Crocs' emphasis on comfort and ease of wear.

- Long-Term Monitoring: Crocs needs to track the expansion of this trend and its potential to influence broader consumer attitudes towards footwear design and function.

The broad casual footwear market presents numerous substitutes for Crocs, from inexpensive flip-flops to stylish canvas sneakers, all vying for consumer attention. In 2024, the global casual footwear market is projected to exceed $160 billion, underscoring the intense competition where price, brand, and evolving fashion trends can easily sway purchasing decisions away from Crocs' distinctive offerings.

Athletic sneakers, now a staple in casual wardrobes, pose a significant threat, with major players like Nike and Adidas offering comfort and style that directly compete. The sandal and flip-flop segment, valued at over $45 billion in 2023, also offers readily available, often more breathable alternatives, especially during warmer seasons.

Even the dedicated slipper market, expected to surpass $30 billion in 2024, presents a challenge for indoor comfort, offering specialized plushness and ergonomic designs that directly counter Crocs' home-wear appeal.

| Footwear Category | Estimated Market Value (USD Billion) | Key Substitutes/Competitors |

|---|---|---|

| Casual Footwear | 160+ (2024 Projection) | Canvas sneakers, loafers, slip-ons |

| Athletic Footwear (Casual Use) | N/A (Integrated into Casual) | Nike, Adidas, Skechers |

| Sandals & Flip-flops | 45 (2023) | Birkenstock, Havaianas, Reef |

| Slippers | 30+ (2024 Projection) | Ugg, Dearfoams, Isotoner |

Entrants Threaten

Establishing a footwear manufacturing operation, particularly one utilizing specialized materials like Crocs' proprietary Croslite, demands substantial capital. This includes significant investment in advanced machinery, ongoing research and development, and the creation of a robust supply chain. For instance, setting up a modern shoe manufacturing plant can easily run into tens of millions of dollars.

New players entering the market would face the daunting task of funding not only production facilities but also establishing a comprehensive global distribution network. This extensive financial commitment acts as a formidable barrier, deterring many potential competitors from entering the highly competitive footwear industry.

Crocs has spent considerable time and resources cultivating its unique brand image, making it instantly recognizable worldwide. A new competitor would need to spend a fortune on marketing to even begin to build awareness and gain consumer trust in the already packed footwear industry.

Established brand loyalty is a significant hurdle; a newcomer would require substantial investment and clever strategy to break through and capture market share, especially given the current market saturation.

Crocs' proprietary Croslite material and distinctive clog design are shielded by intellectual property rights, creating a substantial hurdle for newcomers aiming to directly copy their flagship product. This protection makes it challenging for new entrants to replicate the core Crocs offering without facing potential patent or trademark infringement issues.

While competitors can develop alternative comfortable footwear materials, replicating the unique properties and established market appeal of Croslite poses a significant technical and legal challenge. For instance, in 2023, Crocs reported net revenue of $3.97 billion, underscoring the market success their unique material and design have achieved, a success new entrants would struggle to quickly emulate.

Established Distribution Channels and Retailer Relationships

Crocs has built a robust network of established distribution channels and strong retailer relationships, making it difficult for new entrants to compete. The company operates its own direct-to-consumer retail stores and a significant e-commerce presence globally, in addition to its wholesale accounts. This extensive reach means newcomers face a considerable hurdle in securing prime retail shelf space and establishing efficient supply chains. For instance, as of the first quarter of 2024, Crocs reported a significant portion of its revenue coming from its direct-to-consumer channels, highlighting the importance of these established relationships.

New entrants would find it challenging to replicate Crocs' existing infrastructure and access to consumers. The brand's long-standing partnerships with major department stores and specialty retailers provide a distinct advantage. These established relationships not only ensure product visibility but also offer valuable market insights and consumer feedback, which are crucial for success. Building such a network from scratch requires substantial time, investment, and proven reliability, creating a high barrier to entry.

- Extensive Global Reach: Crocs operates over 350 company-operated stores worldwide and maintains a strong e-commerce platform, facilitating direct access to a broad customer base.

- Wholesale Partnerships: The company partners with thousands of wholesale accounts, including major footwear and apparel retailers, ensuring widespread product availability.

- Brand Recognition and Trust: Years of operation have fostered brand recognition and trust among consumers and retailers, a significant asset that new entrants lack.

Economies of Scale in Production and Sourcing

Crocs' established global presence grants significant economies of scale in sourcing materials like Croslite, manufacturing, and distribution. This translates to lower per-unit production costs, a formidable barrier for newcomers. For instance, in 2023, Crocs reported a gross margin of 51.7%, reflecting efficient cost management that would be difficult for a small-scale entrant to replicate.

New entrants entering the market at lower volumes would inevitably face higher per-unit costs. This cost disadvantage makes it challenging to compete on price with a well-established player like Crocs, which can leverage its scale to offer more attractive pricing to consumers. Achieving comparable cost efficiencies would necessitate substantial market share and considerable investment over time.

- Economies of Scale: Crocs' large-scale operations in sourcing and production lead to lower per-unit costs.

- Cost Disadvantage for Entrants: Newcomers face higher production costs due to smaller volumes, hindering price competitiveness.

- Barriers to Entry: Achieving cost parity requires significant market penetration and investment, creating a substantial barrier.

The threat of new entrants for Crocs is relatively low, primarily due to the significant capital investment required for manufacturing, global distribution, and brand building. Crocs' proprietary Croslite material and established intellectual property rights also present a substantial hurdle for potential competitors seeking to replicate their core product. Furthermore, Crocs' extensive distribution network and economies of scale in production create cost advantages that are difficult for newcomers to overcome.

| Factor | Crocs' Advantage | Impact on New Entrants |

|---|---|---|

| Capital Investment | Established infrastructure, R&D, supply chain | High barrier due to need for substantial funding (e.g., tens of millions for a modern plant) |

| Brand & Marketing | Strong global brand recognition and loyalty | Requires massive marketing spend to build awareness and trust |

| Intellectual Property | Patented Croslite material and distinctive design | Legal and technical challenges in replicating the core product |

| Distribution & Scale | Extensive global retail and e-commerce presence, economies of scale | Difficulty securing shelf space and facing higher per-unit costs (e.g., 2023 gross margin of 51.7%) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Crocs is built upon a foundation of publicly available financial reports, investor relations materials, and industry-specific market research from reputable firms. We also incorporate insights from trade publications and news archives to capture current competitive dynamics and potential threats.