Crocs Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

Discover the strategic genius behind Crocs's iconic footwear empire with our comprehensive Business Model Canvas. This in-depth analysis reveals how Crocs masterfully connects with diverse customer segments, leverages unique value propositions, and builds strong partnerships to drive their distinctive brand.

Dive into the core components that fuel Crocs's success, from their innovative product development and efficient distribution channels to their robust revenue streams and cost management. Understand the "why" and "how" of their market dominance.

Ready to apply these insights to your own venture? Unlock the full strategic blueprint by downloading the complete Crocs Business Model Canvas, a professionally crafted resource perfect for entrepreneurs, students, and anyone seeking to dissect a thriving business model.

Partnerships

Crocs leverages strategic brand collaborations as a cornerstone of its marketing and product strategy. These high-profile partnerships, featuring celebrities like Justin Bieber and fashion designers such as Christopher Kane, along with brands like Balenciaga, create buzz and exclusivity around limited-edition footwear.

These collaborations, including notable ones with Swarovski and Salehe Bembury, have been instrumental in repositioning Crocs as a fashion-forward entity. The limited nature of these releases not only drives significant consumer demand but also expands the brand's reach to new demographics, moving beyond its core customer base.

In 2024, Crocs continued to build on this success. For instance, their collaboration with anime franchises like One Piece and Naruto generated considerable online engagement and sell-out demand, demonstrating the ongoing power of these strategic alliances in driving sales and brand perception.

Crocs leverages a robust network of wholesale partners, encompassing shoe stores and sporting goods retailers worldwide, to ensure broad product distribution. This multi-channel strategy, including collaborations with major retailers like Walmart, significantly expands Crocs' market reach and accessibility to a diverse customer base.

Crocs depends on a worldwide web of factories and material providers, both Tier 1 and Tier 2, to create its footwear and accessories. These relationships are vital for crafting its signature molded clogs, which are made using the unique Croslite™ material.

The company actively collaborates with its suppliers to incorporate bio-circular content into its materials, a key step in achieving its environmental targets. For instance, in 2023, Crocs continued to advance its use of recycled and bio-based materials, aiming to increase the percentage of sustainable content in its products over time.

Logistics and Distribution Partners

Crocs relies heavily on its logistics and distribution partners to move its iconic footwear across the globe. These relationships are critical for maintaining a smooth flow of products from manufacturing facilities to consumers. In 2024, Crocs continued to leverage established global carriers and regional specialists to manage its complex supply chain, ensuring products reach wholesale partners, its own retail stores, and online shoppers efficiently.

These partnerships are fundamental to Crocs' ability to manage inventory effectively and ensure product availability, which directly impacts sales and customer satisfaction. The company's commitment to timely delivery is underscored by its ongoing investments in optimizing logistics, a key factor in its direct-to-consumer strategy and overall operational success.

- Global Reach: Crocs partners with major international shipping companies to facilitate its presence in over 85 countries.

- E-commerce Fulfillment: Dedicated logistics providers ensure timely delivery for Crocs' growing online sales channels.

- Retail Distribution: Partnerships with transportation firms are essential for stocking Crocs' more than 350 company-operated stores.

Sustainability and Community Partners

Crocs actively engages with sustainability-focused organizations like Soles4Souls and ReCircled for its 'Old Crocs. New Life.' program. This initiative allows customers to return used footwear, which is then either donated or recycled, diverting waste from landfills. In 2023, Crocs reported that its takeback program had collected over 1.2 million pairs of shoes globally, with a significant portion being repurposed or recycled.

Further demonstrating its commitment to social impact, Crocs collaborates with youth development organizations through its 'STEP UP TO GREATNESS' initiative. Partnerships with entities such as UNICEF's UPSHIFT program and Big Brothers Big Sisters provide resources and support to young people. These collaborations highlight Crocs' dedication to fostering positive community outcomes beyond its core business operations.

- Soles4Souls and ReCircled: Key partners in the 'Old Crocs. New Life.' takeback program, facilitating shoe donation and recycling.

- UNICEF's UPSHIFT and Big Brothers Big Sisters: Collaborators in the 'STEP UP TO GREATNESS' initiative, supporting youth development and empowerment.

- Community Impact: These partnerships underscore Crocs' commitment to corporate social responsibility and making a tangible difference in the communities it serves.

Crocs' key partnerships extend across brand collaborations, supply chain management, and social impact initiatives. These alliances are crucial for product innovation, market penetration, and brand enhancement. The company's strategic alliances in 2024, including those with anime franchises, underscore a continued focus on leveraging cultural trends to drive demand and broaden its appeal.

In terms of product development and distribution, Crocs relies on a network of factories and material suppliers, ensuring the consistent production of its signature footwear. Their commitment to sustainability is also evident through partnerships aimed at incorporating recycled and bio-based materials, a trend that gained further traction in 2023 and continued into 2024.

Logistics and distribution partners are vital for global product availability, supporting both wholesale and direct-to-consumer channels. Furthermore, social impact partnerships, such as those with Soles4Souls and youth development organizations, reinforce Crocs' corporate social responsibility efforts, diverting waste and supporting community growth.

| Partnership Type | Key Partners | Impact/Focus | 2024/Recent Data Highlight |

|---|---|---|---|

| Brand Collaborations | Celebrities (e.g., Justin Bieber), Fashion Designers (e.g., Balenciaga), Anime Franchises (e.g., One Piece) | Brand elevation, exclusivity, new demographics, buzz generation | Anime collaborations generated significant online engagement and sell-out demand. |

| Supply Chain & Manufacturing | Global Factories, Tier 1 & Tier 2 Material Providers | Production of Croslite™ footwear, material innovation | Continued advancement in using recycled and bio-based materials in product lines. |

| Distribution & Logistics | Major Retailers (e.g., Walmart), Global Shipping Companies | Broad market reach, product accessibility, efficient fulfillment | Supported operations in over 85 countries and stocking of 350+ company-operated stores. |

| Sustainability & Social Impact | Soles4Souls, ReCircled, UNICEF, Big Brothers Big Sisters | Product recycling, waste diversion, youth development, community support | 'Old Crocs. New Life.' program collected over 1.2 million pairs in 2023. |

What is included in the product

This Crocs Business Model Canvas provides a strategic blueprint, detailing customer segments like comfort-seekers and fashion-forward individuals, and their value proposition centered on distinctive style and comfort.

It outlines key channels including direct-to-consumer e-commerce and wholesale partnerships, supported by robust cost structures and revenue streams from footwear sales and collaborations.

The Crocs Business Model Canvas effectively addresses the pain point of needing a clear, structured overview for strategic analysis.

It provides a digestible, one-page snapshot of Crocs' core business components, simplifying complex strategies for quick review and adaptation.

Activities

Crocs' primary function revolves around the ongoing design, development, and production of its distinctive footwear and accessories. This encompasses enhancing the well-known clog and broadening the product range to include items like sandals, platforms, and boots.

A crucial element of this activity is the utilization of their exclusive Croslite™ material. This proprietary foam resin is key to delivering the comfort, lightweight feel, and odor-resistant qualities that define Crocs products.

In 2023, Crocs Inc. reported net revenue of $3.97 billion, reflecting the success and demand for their continuously developed product lines.

Crocs invests heavily in global marketing and brand building, a key activity that drives its success. This includes impactful advertising campaigns across various media, consistent and engaging social media presence, and strategic partnerships with celebrities and influencers to amplify brand reach and desirability. For instance, in 2023, Crocs continued its collaborations with prominent figures, contributing to a strong brand narrative and increased consumer engagement.

Crocs orchestrates a sophisticated multi-channel distribution network, a critical element in its business model. This strategy ensures their distinctive footwear reaches a broad global audience.

The company leverages wholesale partnerships, its own fleet of retail stores, and a strong direct-to-consumer e-commerce presence to maximize product accessibility. In 2023, Crocs' direct e-commerce sales represented a significant portion of their revenue, demonstrating the effectiveness of their digital distribution channels.

Research and Development for Material Innovation

Crocs' core activities heavily involve continuous research and development, particularly around its proprietary Croslite™ material, aiming for enhanced comfort and durability. This innovation extends to exploring and integrating new, sustainable materials.

A significant focus for 2024 and beyond is the incorporation of bio-circular content. Crocs is committed to reducing its environmental impact, with material innovation playing a crucial role in achieving its sustainability targets and appealing to eco-conscious consumers.

- Material Innovation: Ongoing R&D into Croslite™ and novel materials.

- Sustainability Focus: Integration of bio-circular content to lower carbon footprint.

- Product Enhancement: Improving comfort, performance, and design through material science.

- Environmental Responsibility: Aligning material development with corporate sustainability goals.

Inventory and Supply Chain Optimization

Crocs is deeply invested in refining its inventory and supply chain, a critical component for sustained growth and profitability. In 2023, the company reported a significant focus on improving inventory turnover, aiming to reduce carrying costs while ensuring product availability. This strategic emphasis helps manage the flow of goods and combat the impact of unauthorized resellers.

Key activities in this area include implementing advanced demand forecasting models and strengthening relationships with manufacturing partners to ensure timely and efficient production. Crocs also actively works to mitigate 'gray market' sales, which can disrupt pricing and brand perception. This proactive approach to supply chain management is vital for supporting wholesale partners and meeting consumer demand effectively.

- Demand Forecasting: Utilizing data analytics to predict product demand more accurately, minimizing overstock and stockouts.

- Gray Market Mitigation: Implementing strategies to control product distribution and prevent unauthorized sales channels.

- Supplier Collaboration: Working closely with manufacturing and logistics partners to optimize production schedules and delivery times.

- Inventory Turnover: Continuously monitoring and improving the rate at which inventory is sold and replaced, a key indicator of operational efficiency.

Crocs' core activities center on designing, developing, and producing its unique footwear, leveraging its proprietary Croslite™ material for comfort and lightness. In 2023, Crocs Inc. achieved net revenues of $3.97 billion, underscoring the market's strong demand for its evolving product lines.

The company also prioritizes robust marketing and brand building, utilizing advertising, social media, and celebrity endorsements to enhance its appeal. Sustainability is a key focus, with Crocs actively integrating bio-circular content into its products starting in 2024 to reduce its environmental footprint.

Crocs manages a complex distribution network, combining wholesale, retail stores, and a growing e-commerce presence. Its direct e-commerce sales represented a substantial revenue stream in 2023, highlighting the effectiveness of its digital strategy.

Supply chain optimization, including advanced demand forecasting and supplier collaboration, is crucial for Crocs. Efforts to mitigate unauthorized sales channels are also a significant activity, ensuring brand integrity and efficient inventory management.

| Key Activity | Description | 2023 Data/Focus |

| Product Design & Development | Creating and enhancing footwear using Croslite™ material. | Broadening product range (sandals, platforms, boots). |

| Marketing & Brand Building | Advertising, social media, celebrity partnerships. | Continued collaborations to boost engagement. |

| Distribution | Multi-channel approach: wholesale, retail, e-commerce. | Strong growth in direct e-commerce sales. |

| Sustainability Initiatives | Integrating bio-circular content, reducing environmental impact. | Key focus for 2024 and beyond. |

| Supply Chain Management | Demand forecasting, supplier relationships, gray market mitigation. | Focus on improving inventory turnover. |

What You See Is What You Get

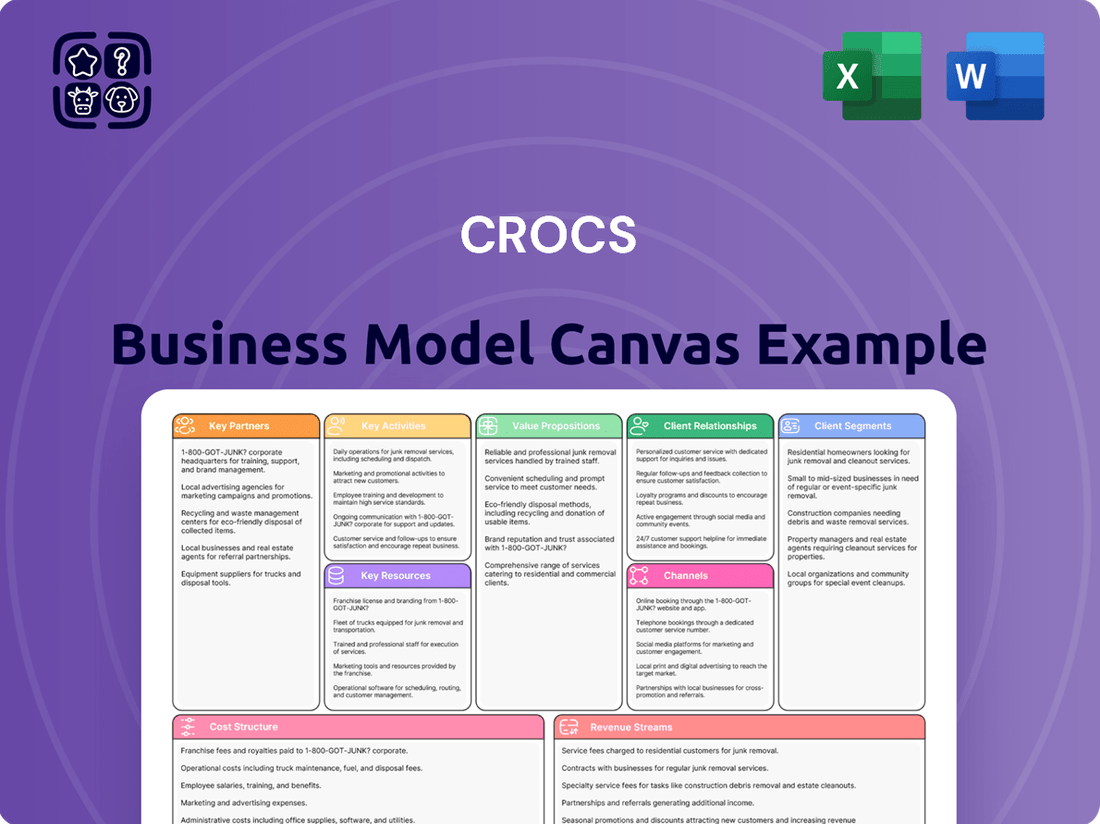

Business Model Canvas

The Crocs Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the complete file, showcasing the same structure and content. Once your order is processed, you'll gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Crocs' most critical resource is its proprietary Croslite™ material, a unique closed-cell resin that delivers exceptional comfort, light weight, and odor resistance. This material is the bedrock of Crocs' brand identity and product performance, setting them apart in the competitive footwear landscape.

The company's commitment to innovation is evident in its ongoing development of Croslite™, including the integration of bio-circular content. This focus on material science not only enhances product appeal but also aligns with sustainability goals, a key consideration for today's consumers.

Crocs, and its acquired brand HEYDUDE, boast substantial global brand recognition, a key resource that fosters strong consumer loyalty and attracts new customers. The instantly recognizable design of its signature clogs significantly bolsters its market presence and brand equity.

Crocs' expansive global supply chain, a critical resource, includes numerous manufacturing facilities and strategically located distribution centers. This robust network is the backbone that allows the company to efficiently produce and deliver its distinctive footwear to customers in over 80 countries worldwide.

The company's ability to serve a broad international market hinges directly on this well-managed infrastructure. In 2023, Crocs reported net sales of $3.96 billion, underscoring the scale and reach facilitated by its global distribution capabilities.

Intellectual Property and Design Patents

Crocs holds significant intellectual property, notably design patents for its iconic shoe silhouettes and the proprietary Croslite™ material. These patents are crucial for safeguarding its unique products against replication, thereby preserving its market edge. In 2023, Crocs continued its investment in innovation, which directly fuels the generation of new intellectual property assets.

The company's commitment to design and material innovation is a cornerstone of its business strategy. This focus ensures a steady stream of new intellectual property that reinforces its brand identity and product differentiation. For instance, the ongoing development of new colorways and comfort-enhancing features for its footwear contributes to its IP portfolio.

- Design Patents: Protecting the unique aesthetic of Crocs footwear.

- Material Patents: Safeguarding the innovative Croslite™ foam technology.

- Brand Trademarks: Ensuring the distinctiveness of the Crocs brand name and logo.

- Ongoing Innovation: Continuous investment in R&D to generate new IP.

Skilled Workforce and Management Team

Crocs' skilled workforce, encompassing design, manufacturing, and marketing professionals, forms a critical resource. This human capital directly fuels product innovation and the development of compelling marketing strategies.

The management team's strategic direction is equally vital. Their ability to anticipate and respond to evolving market demands, as demonstrated by Crocs' successful pivot to comfort-focused footwear and digital engagement, underpins the company's sustained growth.

- Human Capital: Design, manufacturing, marketing, and retail expertise.

- Management Acumen: Strategic vision and adaptability to market shifts.

- Operational Excellence: Efficient execution in production and supply chain.

- Brand Stewardship: Expertise in marketing and customer engagement.

Crocs' key resources include its proprietary Croslite™ material, global brand recognition for both Crocs and HEYDUDE, and an extensive global supply chain. Intellectual property, particularly design and material patents, along with a skilled workforce and adept management, further solidify its competitive advantage.

| Resource Category | Specific Assets | Significance |

|---|---|---|

| Material Innovation | Croslite™ resin, bio-circular content integration | Core to product comfort, lightweight design, and brand identity. |

| Brand Equity | Crocs and HEYDUDE brand recognition | Drives consumer loyalty and market penetration; iconic clog design is a major asset. |

| Intellectual Property | Design patents, material patents, trademarks | Protects unique product designs and proprietary technology, maintaining market exclusivity. |

| Operational Infrastructure | Global manufacturing and distribution network | Enables efficient production and delivery to over 80 countries; supported $3.96 billion in net sales in 2023. |

| Human Capital | Design, manufacturing, marketing talent; management expertise | Drives product innovation, effective marketing, and strategic adaptation to market trends. |

Value Propositions

The core of Crocs' appeal lies in its unparalleled comfort, thanks to the signature Croslite™ material. This proprietary foam resin is key to their unique feel. In 2023, Crocs reported a net revenue of $3.96 billion, underscoring the broad market acceptance of this comfort-driven value proposition.

This material isn't just about softness; it actively molds to the wearer's foot, providing a personalized and supportive fit that reduces fatigue. The incredibly lightweight design further enhances this, making Crocs a go-to choice for extended wear and daily activities, a significant factor in their enduring popularity.

Crocs' distinctive, versatile, and odor-resistant footwear is a core value proposition. Their unique design, featuring the iconic clog, immediately sets them apart in a crowded market. This visual identity is a significant draw for consumers seeking something different.

The proprietary Croslite™ material is key to the odor-resistant feature, providing a practical benefit that enhances the user experience. This material also contributes to the shoes' lightweight and comfortable feel, further solidifying their appeal.

Beyond their unique look and material benefits, Crocs are incredibly versatile. They transition seamlessly from casual wear to more active or even semi-professional settings, demonstrating their adaptability to various lifestyles and occasions. In 2024, Crocs continued to leverage this versatility, with their Classic Clog remaining a top seller across multiple demographics.

Crocs’ Jibbitz™ charms offer a powerful avenue for personalization, allowing customers to transform their footwear into a unique canvas for self-expression. This customization transforms a comfortable shoe into a statement piece, reflecting individual tastes, hobbies, and affiliations. In 2023, the global footwear market saw robust growth, with personalized products increasingly driving consumer engagement.

By offering a vast and frequently updated selection of Jibbitz™, Crocs empowers customers to continually refresh their shoe's look, fostering a deeper, ongoing connection. This ability to adapt and personalize encourages repeat purchases and builds brand loyalty, as seen in the continued strong performance of Crocs' accessories segment.

Durability and Easy Care

Crocs footwear is designed for longevity, offering consumers a durable and cost-effective choice. This resilience means fewer replacements are needed, making them a practical investment. For instance, in 2023, Crocs reported a significant increase in their brand strength, a testament to their product's enduring appeal and perceived value.

The proprietary Croslite material used in Crocs shoes is incredibly easy to clean. A simple wash with soap and water is usually all that's needed to keep them looking fresh, which is a major convenience for busy individuals and families. This ease of maintenance directly translates into a higher perceived value for the customer.

- Durability: Crocs are built to last, reducing the need for frequent purchases.

- Easy Maintenance: The material is simple to clean, saving consumers time and effort.

- Cost-Effectiveness: Long-lasting and low-maintenance products offer better value over time.

- Customer Satisfaction: These practical attributes contribute to high levels of customer satisfaction and brand loyalty.

Fashion Relevance and Trend Adoption

Crocs has masterfully transformed from a niche comfort shoe to a sought-after fashion statement, largely due to high-profile collaborations. These partnerships, including those with luxury brands and influential celebrities, have injected a significant dose of fashion relevance. For instance, their 2023 collaborations with brands like Balenciaga and designers such as Christopher Kane cemented their place in high fashion circles.

The brand's willingness to embrace its distinctive look and adapt to evolving style preferences is key to its appeal. This strategy allows Crocs to connect with consumers who value both comfort and a unique personal style. This fashion-forward approach has resonated strongly, contributing to their impressive financial performance; in the first quarter of 2024, Crocs reported a revenue of $937 million, a 1.5% increase year-over-year, showcasing continued market demand for their stylish offerings.

- Celebrity Endorsements: Collaborations with figures like Justin Bieber and Bad Bunny have significantly boosted brand visibility and desirability.

- Designer Partnerships: Working with high-fashion designers has allowed Crocs to enter premium market segments and gain critical fashion approval.

- Embracing Uniqueness: Crocs has leveraged its unconventional design as a strength, appealing to consumers seeking individuality and self-expression.

- Trend Responsiveness: The brand has shown agility in adopting current fashion trends, integrating them into their product lines to maintain relevance with style-conscious demographics.

Crocs offers unparalleled comfort through its proprietary Croslite™ material, which molds to the foot for a personalized fit. This focus on comfort, combined with a unique, odor-resistant design, forms the foundation of their appeal. Their extensive range of Jibbitz™ charms allows for deep personalization, transforming footwear into a canvas for self-expression and fostering repeat engagement.

The brand's strategic high-profile collaborations with designers and celebrities have successfully repositioned Crocs as a fashion-forward item, appealing to a broader, style-conscious audience. This adaptability, coupled with the inherent durability and ease of maintenance of their products, creates a compelling value proposition centered on comfort, style, and practicality.

| Value Proposition | Key Features | Customer Benefit |

|---|---|---|

| Unmatched Comfort | Croslite™ material, lightweight design | All-day wearability, reduced fatigue |

| Unique Style & Personalization | Distinctive design, Jibbitz™ charms | Self-expression, fashion statement |

| Durability & Ease of Care | Long-lasting Croslite™ material, easy to clean | Cost-effectiveness, convenience |

| Fashion Relevance | Designer/celebrity collaborations | Trendiness, social desirability |

Customer Relationships

Crocs actively cultivates deep customer connections by maintaining a vibrant presence on social media, particularly Instagram and TikTok. This direct engagement allows the brand to converse with its audience, addressing inquiries and responding to comments in real-time.

By consistently interacting, Crocs builds significant trust and fosters a loyal community around its products. This approach effectively transforms passive observers into enthusiastic brand advocates, strengthening overall customer loyalty.

In 2023, Crocs reported over 10 million followers across its key social media channels, demonstrating the reach of its community-building efforts. This active engagement directly contributes to brand visibility and customer retention.

Crocs cultivates direct relationships with its customers through its own retail stores and online platforms. This allows them to present their complete product lineup, collect feedback firsthand, and offer a tailored shopping experience.

In 2023, Crocs reported that its direct-to-consumer (DTC) channel represented 47.3% of its total revenue, highlighting the significant role these interactions play. This direct engagement is crucial for understanding what customers want and fostering a strong sense of brand loyalty.

Crocs masterfully leverages hype-driven limited-edition collaborations with artists and celebrities, a strategy that significantly boosts customer engagement. For instance, their 2023 partnerships, like the one with Post Malone, saw immediate sell-outs, demonstrating the immense demand for these exclusive drops. This scarcity cultivates a collector's mentality, driving repeat purchases and strengthening brand loyalty.

Customer Service and Support

Crocs offers comprehensive customer service and support across multiple channels to address inquiries, facilitate purchases, and provide after-sales assistance. This dedication to customer care, whether online or in-store, is crucial for fostering satisfaction and a strong brand reputation.

In 2024, Crocs continued to emphasize responsive customer interactions. For instance, their website features detailed FAQs, live chat options, and easily accessible contact information, ensuring customers can get timely help. This multi-faceted approach aims to resolve issues efficiently and enhance the overall shopping experience.

- Online Support: Crocs provides extensive online resources, including order tracking, return policies, and product information, accessible 24/7.

- In-Store Assistance: Trained staff at Crocs retail locations offer personalized service, helping customers with product selection and resolving any immediate concerns.

- Customer Feedback: The company actively collects and analyzes customer feedback through surveys and reviews to continuously improve its service offerings.

- Omnichannel Experience: Crocs ensures a seamless customer journey by integrating online and offline support, allowing for consistent assistance regardless of the touchpoint.

Sustainability Initiatives and Brand Purpose

Crocs actively cultivates relationships with environmentally aware consumers through its commitment to sustainability. A prime example is the 'Old Crocs, New Life' program, which encourages customers to return worn-out footwear for recycling. This initiative directly appeals to those who prioritize responsible consumption and seek brands that actively reduce their environmental impact.

By engaging in circular economy practices and visibly working to shrink its ecological footprint, Crocs fosters a deeper connection with its customer base. This commitment transcends the mere sale of shoes, aligning the brand with a purpose that resonates with consumers who value ethical and sustainable choices. In 2023, Crocs reported a 3% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2021 baseline, underscoring its dedication to tangible environmental progress.

- Circular Economy Focus: The 'Old Crocs, New Life' program promotes product longevity and waste reduction.

- Environmental Footprint Reduction: Crocs is actively working to lower its greenhouse gas emissions and overall environmental impact.

- Purpose-Driven Connection: The brand aligns itself with consumers who prioritize sustainability and responsible consumption.

- Consumer Engagement: These initiatives create a dialogue and strengthen loyalty with a growing segment of environmentally conscious shoppers.

Crocs excels at building strong customer relationships through consistent, multi-channel engagement. Their social media presence, particularly on Instagram and TikTok, fosters direct conversations and builds a loyal community, evident in their over 10 million followers in 2023. This direct interaction, combined with their robust direct-to-consumer (DTC) channels which accounted for 47.3% of revenue in 2023, allows for immediate feedback and a tailored brand experience.

Limited-edition collaborations, like those with Post Malone in 2023, create significant hype and demand, driving repeat purchases and a collector's mentality. Furthermore, Crocs' commitment to sustainability, exemplified by their 'Old Crocs, New Life' recycling program and a 3% reduction in Scope 1 and 2 emissions in 2023, resonates deeply with environmentally conscious consumers, strengthening brand loyalty beyond product transactions.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Social Media Engagement | Instagram & TikTok presence, real-time interaction | Over 10 million followers (2023) |

| Direct-to-Consumer (DTC) | Owned retail stores, online platforms | 47.3% of total revenue (2023) |

| Hype & Exclusivity | Celebrity/Artist collaborations | Immediate sell-outs (e.g., Post Malone partnership, 2023) |

| Sustainability Focus | 'Old Crocs, New Life' program, emission reduction | 3% reduction in Scope 1 & 2 emissions (vs. 2021 baseline, 2023) |

Channels

Crocs leverages wholesale distribution extensively, partnering with a diverse range of retailers worldwide. This includes independent shoe stores, sporting goods outlets, and major department store chains, ensuring broad product accessibility.

In 2023, wholesale channels were a cornerstone of Crocs' sales strategy, contributing a substantial portion to their overall revenue. This widespread network is crucial for achieving significant market penetration and brand visibility across various consumer segments.

Crocs operates a robust network of company-owned retail stores globally, acting as a primary avenue for direct-to-consumer engagement. These physical locations are crucial for showcasing the brand's identity and offering customers an immersive experience with their diverse product offerings. As of the close of 2024, the company proudly maintained 390 Crocs Brand stores and an additional 52 HEYDUDE Brand stores, underscoring a significant investment in brick-and-mortar retail.

Crocs leverages its direct-to-consumer strategy through robust e-commerce platforms, including crocs.com and heydude.com. These websites serve as primary channels for reaching a global customer base, providing a convenient shopping experience and showcasing the full breadth of their product offerings.

In 2024, digital sales represented a substantial contributor to Crocs' overall revenue, highlighting the critical role these online channels play in their business model. This direct engagement allows for greater control over brand messaging and customer relationships.

Third-Party Online Marketplaces

Crocs leverages third-party online marketplaces like Amazon to extend its digital footprint beyond its own e-commerce channels. This strategy is crucial for reaching a wider demographic and capitalizing on existing online traffic. In 2023, Amazon’s global net sales reached approximately $574.8 billion, highlighting the significant customer access these platforms offer.

While navigating the complexities of the 'gray market,' which involves unauthorized resale of products, Crocs benefits from the broad consumer base these marketplaces attract. This approach enhances product accessibility and can drive incremental sales. For instance, Amazon’s vast customer base provides an opportunity to capture consumers who may not directly visit the Crocs website.

- Expanded Reach: Third-party marketplaces offer access to millions of potential customers who might not discover Crocs through direct channels.

- Sales Diversification: Relying on multiple online platforms reduces dependence on a single sales channel, creating a more robust revenue stream.

- Marketplace Growth: The global e-commerce market continues to expand, with online marketplaces playing a significant role in this growth, offering ongoing opportunities for brands like Crocs.

- Brand Visibility: Presence on popular marketplaces can also increase overall brand awareness and consideration among a diverse online shopping audience.

International Distribution Networks

Crocs leverages extensive international distribution networks, reaching customers in over 80 countries. This expansive global footprint is built upon a multi-channel strategy that includes wholesale agreements with retailers, a growing number of company-operated stores, and region-specific e-commerce platforms.

The company's international presence is a significant driver of its growth. In 2023, Crocs reported that its international segment accounted for a substantial portion of its revenue, with notable expansion in key markets like China and Western Europe. This global reach allows Crocs to tap into diverse consumer preferences and market trends, ensuring broad accessibility for its distinctive footwear.

- Global Reach: Products available in over 80 countries.

- Distribution Channels: Utilizes wholesale, company-operated stores, and e-commerce.

- Key Growth Markets: China and Western Europe are identified as crucial for expansion.

- Revenue Contribution: International sales represent a significant portion of overall company revenue, highlighting the importance of these networks.

Crocs utilizes a multi-faceted channel strategy, encompassing wholesale partnerships with a wide array of global retailers, company-owned brick-and-mortar stores, and direct-to-consumer e-commerce platforms. This approach ensures broad product accessibility and direct customer engagement. The company’s commitment to physical retail is evident, with 390 Crocs Brand stores and 52 HEYDUDE Brand stores operating globally by the end of 2024.

Digital channels, including crocs.com and heydude.com, are pivotal for reaching a worldwide audience, offering a convenient shopping experience and showcasing the full product range. In 2024, these digital sales were a substantial revenue driver, underscoring their importance in direct customer relationships and brand messaging.

Furthermore, Crocs extends its reach through third-party online marketplaces like Amazon, tapping into existing customer traffic and expanding brand visibility. This strategy is vital for capturing a wider demographic, as demonstrated by Amazon's significant global net sales of approximately $574.8 billion in 2023.

| Channel Type | Key Characteristics | 2024 Data/Trends |

|---|---|---|

| Wholesale | Partnerships with diverse retailers (shoe stores, sporting goods, department stores) | Continued cornerstone for broad market penetration and visibility. |

| Company-Owned Retail | Direct-to-consumer engagement, brand experience | 390 Crocs Brand stores, 52 HEYDUDE Brand stores operating globally. |

| E-commerce (Direct) | crocs.com, heydude.com; global reach, brand control | Substantial contributor to overall revenue in 2024. |

| E-commerce (Third-Party) | Marketplaces like Amazon; expanded reach, customer access | Leveraged for wider demographic access, capitalizing on existing traffic. |

| International Distribution | Presence in over 80 countries; wholesale, stores, e-commerce | Significant growth driver, with key expansion in China and Western Europe in 2023. |

Customer Segments

Crocs appeals to a vast consumer base, encompassing men, women, and children across all age groups. This wide demographic reach is a cornerstone of their mass-market strategy, facilitated by an extensive range of footwear designed to fit diverse tastes and needs.

In 2023, Crocs reported net revenue of $3.96 billion, showcasing the significant purchasing power of its broad consumer segments. This demonstrates the effectiveness of their inclusive product development in capturing a substantial portion of the casual footwear market.

A primary customer base for Crocs includes individuals who place a high value on comfort and practicality in their footwear choices. These are people looking for shoes that feel good for daily use, casual outings, or situations where they spend extended periods standing. In 2024, the global casual footwear market continued to show strong demand, with comfort-focused segments driving a significant portion of sales.

Crocs has masterfully captured the attention of fashion-forward and trend-driven consumers, especially within the Gen Z demographic. This segment is drawn to the brand's unapologetic 'ugly-chic' design, high-profile celebrity partnerships, and the extensive avenues for self-expression and customization that Crocs offer.

These consumers actively seek out Crocs as a canvas for their personal style, viewing the footwear as a bold declaration of individuality rather than just a casual shoe. This shift in perception has been a significant driver of Crocs' recent growth, with sales in the casual footwear segment, which includes their fashion-focused offerings, showing robust performance.

Niche Market Professionals (e.g., Healthcare)

Crocs has carved out a significant niche within the healthcare sector, recognizing the critical need for comfortable, functional, and hygienic footwear among medical professionals. The brand's iconic clog design offers exceptional support and cushioning, essential for long shifts. In 2024, the demand for specialized work footwear in healthcare remained robust, with many facilities prioritizing easy-to-clean materials and slip-resistant soles, areas where Crocs excels.

This segment values practicality and durability, and Crocs has consistently delivered on these fronts. The brand's ability to withstand frequent washing and its non-slip features are paramount for maintaining a safe and sterile working environment. This focus on performance in demanding settings has solidified Crocs' position as a go-to choice for many in the healthcare industry.

- Healthcare Professionals: A key demographic valuing comfort, slip-resistance, and ease of cleaning for long work hours.

- Workplace Functionality: Crocs are chosen for their ability to meet the practical demands of healthcare settings.

- Brand Loyalty: The footwear's performance in demanding environments fosters repeat purchases and strong brand affinity within this niche.

- Market Penetration: Continued appeal to individuals requiring practical, comfortable shoes for extended periods of standing and movement.

Consumers Seeking Uniqueness and Customization

This segment values products that help them stand out. They actively seek ways to express their personality and interests through their purchases. For them, owning something unique is a key motivator.

Crocs' Jibbitz™ charms are a perfect fit for these consumers. These small, collectible charms can be attached to the holes in Crocs shoes, allowing for endless personalization. This feature transforms a standard shoe into a canvas for self-expression, making each pair of Crocs a one-of-a-kind item.

In 2023, Crocs reported significant growth, with revenue reaching $3.96 billion. This success is partly driven by their ability to cater to diverse customer preferences, including those who prioritize customization and uniqueness. The popularity of Jibbitz™ directly contributes to this by offering an accessible and fun way for consumers to make their footwear their own.

Key aspects for this customer segment include:

- Desire for individuality: Customers want products that reflect their personal style and differentiate them from others.

- Engagement with customization: They enjoy the process of personalizing items, making them feel more connected to the product.

- Value of accessories: Products that offer complementary accessories, like Jibbitz™, are highly appealing as they enhance personalization options.

- Social sharing of unique items: Consumers often share their customized products online, further driving interest in unique offerings.

Crocs' customer base is remarkably broad, attracting individuals who prioritize comfort and practicality. This includes a significant segment of the population looking for durable, easy-to-wear footwear for everyday activities. In 2024, the market for comfortable casual footwear continued its upward trend, underscoring the enduring appeal of these attributes.

Furthermore, Crocs has successfully engaged fashion-conscious consumers, particularly Gen Z, who embrace the brand's distinctive style and customization options. This demographic views Crocs as a statement piece, utilizing Jibbitz™ charms to express personal identity. This innovative approach to personalization contributed to Crocs' robust performance, with the company reporting substantial revenue growth.

| Customer Segment | Key Characteristics | Example Needs | 2023/2024 Relevance |

|---|---|---|---|

| Comfort Seekers | Prioritize ease of wear, support, and practicality. | All-day comfort for standing, casual use. | Continued strong demand in the casual footwear market. |

| Fashion-Forward/Gen Z | Value self-expression, trends, and customization. | Unique designs, Jibbitz™ personalization, celebrity collaborations. | Driving brand visibility and sales through social media trends. |

| Healthcare Professionals | Need functional, hygienic, and slip-resistant footwear. | Comfort for long shifts, easy cleaning, safety features. | Consistent demand due to essential workplace requirements. |

Cost Structure

Manufacturing and production costs are a significant part of Crocs' expenses. This includes the price of raw materials, primarily their proprietary Croslite™ foam, along with labor costs for factory workers and general factory overhead. In 2023, Crocs reported cost of goods sold at $1.76 billion, reflecting these substantial production expenditures.

Crocs is also investing in more sustainable materials. Integrating bio-circular alternatives into their manufacturing process, while a positive step for environmental responsibility, can also influence these production costs. The company is focused on finding a balance between these eco-friendly initiatives and maintaining efficient production to manage its overall cost structure.

Crocs dedicates substantial resources to marketing and advertising, recognizing its importance in maintaining brand visibility and driving consumer demand for both the Crocs and HEYDUDE lines. These investments are strategically allocated across various channels to ensure broad reach and engagement.

Key initiatives include high-profile celebrity endorsements, extensive digital marketing efforts that leverage social media platforms and targeted online advertising, and continued investment in traditional advertising mediums. These multifaceted campaigns are designed to reinforce brand identity and stimulate sales growth.

For the fiscal year 2023, Crocs reported selling, general, and administrative expenses of $1.18 billion, a significant portion of which is attributable to marketing and advertising. This figure underscores the company's commitment to building and sustaining its brand presence in a competitive market.

Crocs' cost structure is significantly influenced by distribution and logistics, encompassing warehousing, shipping, and transportation for its global reach. These expenses are crucial for getting their iconic footwear from manufacturing to consumers worldwide.

In 2023, Crocs reported that their selling, general, and administrative expenses, which include a substantial portion of distribution and logistics, were approximately $867.2 million. This highlights the ongoing investment required to maintain their extensive supply chain and multi-channel distribution network.

Optimizing this network is a continuous effort, especially with the need to manage issues like 'gray market' sales, which can add complexity and cost to their logistics operations. Efficiently navigating these challenges is key to controlling these significant operational expenses.

Research and Development (R&D) Costs

Crocs dedicates significant resources to research and development (R&D) to drive innovation in its unique materials and product designs. These investments are crucial for staying ahead in the market, improving product performance, and advancing sustainability initiatives, such as incorporating more bio-circular content into their signature Croslite™ material.

For instance, in 2023, Crocs reported R&D expenses of $123.7 million, reflecting a commitment to product development and material science advancements. This spending supports the creation of new footwear styles and the enhancement of existing technologies, ensuring the brand remains relevant and appealing to consumers.

- Innovation in Materials: Crocs continues to explore and develop proprietary materials, focusing on comfort, durability, and sustainability.

- Product Design Evolution: R&D efforts are channeled into creating new, trend-driven designs that appeal to a broader demographic.

- Sustainability Focus: A key area of investment is increasing the use of bio-circular materials, aligning with environmental goals.

- Competitive Advantage: These R&D activities are fundamental to maintaining Crocs' unique market position and brand identity.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a significant part of Crocs' operating costs. These include expenses related to running their retail stores, managing their online presence, salaries for administrative staff, and general corporate overhead.

In 2024, Crocs saw an increase in SG&A expenses. For instance, the company reported SG&A expenses of $1.25 billion for the fiscal year 2023, representing approximately 30% of their total revenue. While this figure is expected to rise in 2024 due to strategic investments in marketing and brand building, Crocs is focused on optimizing these costs to maintain strong operating margins.

- Retail Store Operations: Costs associated with lease agreements, utilities, staffing, and inventory management for physical stores.

- E-commerce Platform Maintenance: Expenses for website development, hosting, digital marketing, and customer service for online sales.

- Administrative Salaries and Corporate Overhead: Compensation for executive, finance, HR, and other corporate functions, along with office rent and related expenses.

- Marketing and Advertising: Investments in brand campaigns, influencer collaborations, and promotional activities to drive sales.

Crocs' cost structure is heavily influenced by its manufacturing and distribution. Key expenses include the proprietary Croslite™ foam, labor, and factory overhead, with cost of goods sold reaching $1.76 billion in 2023. Marketing and advertising are also substantial, with $1.18 billion allocated to SG&A in 2023, covering celebrity endorsements and digital campaigns.

Distribution and logistics, including warehousing and shipping, are critical, with SG&A expenses of approximately $867.2 million in 2023 reflecting the global supply chain investment. Research and development, totaling $123.7 million in 2023, fuels innovation in materials and designs, such as bio-circular content integration.

| Cost Category | 2023 Expense (USD Billions) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | 1.76 | Croslite™ foam, labor, factory overhead |

| Selling, General & Administrative (SG&A) | 1.18 (approx.) | Marketing, advertising, retail ops, e-commerce |

| Distribution & Logistics (within SG&A) | 0.87 (approx.) | Warehousing, shipping, global transportation |

| Research & Development (R&D) | 0.12 (approx.) | Material innovation, product design, sustainability |

Revenue Streams

Direct-to-consumer (DTC) sales represent a significant revenue engine for Crocs, encompassing transactions through their official e-commerce platforms and physical retail locations. This channel is crucial for fostering brand loyalty and capturing higher profit margins.

In 2024, Crocs reported substantial growth in its DTC segment, underscoring a clear consumer trend towards purchasing directly from the brand. This direct engagement allows Crocs to build stronger customer relationships and gather valuable feedback.

Crocs generates a substantial portion of its income by selling its footwear in bulk to a wide array of retailers, including major department stores and specialized sporting goods shops across the globe. This wholesale channel is fundamental for ensuring Crocs are widely available and easily accessible to a broad customer base.

While Crocs has experienced impressive growth in its direct-to-consumer (DTC) channels, the wholesale segment continues to be a vital component of its revenue generation strategy. In 2023, wholesale revenue represented a significant portion of Crocs' overall sales, demonstrating its continued importance in reaching diverse markets and maintaining broad brand visibility.

Crocs' revenue streams extend significantly through the sale of accessories, with Jibbitz™ charms being a prime example. These small, attachable decorations allow customers to personalize their footwear, turning a basic shoe into a unique expression of style.

This accessory segment is crucial for boosting the average transaction value. For instance, in the first quarter of 2024, Crocs reported that sales of casual footwear, which includes their core clogs and slides, saw a 2.1% increase. While specific figures for Jibbitz™ sales aren't always broken out, their contribution to overall sales is substantial, tapping into the growing consumer demand for customization.

International Market Sales

Crocs' international market sales are a powerhouse, consistently boosting the company's overall revenue. Their strategic global expansion is clearly paying off, with impressive growth observed in key regions. This geographic diversification is crucial, as it lessens the company's dependence on any single market, creating a more resilient business model.

In 2023, Crocs reported that international sales represented a substantial portion of their total revenue, demonstrating the success of their global strategy. For instance, their performance in China has been particularly strong, with double-digit growth in recent years. Similarly, Western Europe continues to be a significant contributor, showing robust demand for their iconic footwear.

- Significant Revenue Driver: International sales are a major contributor to Crocs' top line.

- Key Growth Markets: Strong performance in China and Western Europe highlights successful global penetration.

- Risk Mitigation: Geographic diversification reduces reliance on any one market, enhancing stability.

- 2023 Performance Indicator: International sales comprised a significant percentage of total revenue in 2023, underscoring their importance.

Sales from HEYDUDE Brand

Sales from the HEYDUDE brand, acquired by Crocs, Inc., represent a significant, albeit currently fluctuating, revenue stream. While the brand saw a revenue decrease in 2024, it remains a key component of Crocs' overall financial performance. Crocs is actively implementing strategies to revitalize HEYDUDE and drive future sales growth.

For the fiscal year 2024, HEYDUDE brand revenues were reported at $719.6 million, a notable decrease from $845.5 million in 2023. This decline underscores the current challenges, but also highlights the potential for recovery and expansion. Crocs' strategic focus is on leveraging HEYDUDE’s unique market position to achieve renewed success.

- HEYDUDE Brand Revenue (2024): $719.6 million

- HEYDUDE Brand Revenue (2023): $845.5 million

- Strategic Focus: Brand revitalization and future growth initiatives

Crocs' revenue streams are multifaceted, encompassing direct-to-consumer (DTC) sales through their own platforms and retail stores, as well as significant wholesale distribution to a broad network of retailers. The company also generates income from accessory sales, most notably Jibbitz™ charms, which enhance average transaction values and cater to consumer demand for personalization.

International market sales are a crucial growth engine, with strong performance in regions like China and Western Europe contributing substantially to overall revenue. Furthermore, the acquisition of the HEYDUDE brand adds another significant, though currently fluctuating, revenue stream, with Crocs actively working on revitalization strategies for this segment.

| Revenue Stream | 2023 Performance (Approximate) | 2024 Performance (Approximate) | Key Characteristics |

|---|---|---|---|

| Direct-to-Consumer (DTC) | Significant Growth | Continued Growth | Higher margins, brand loyalty |

| Wholesale | Substantial Portion of Revenue | Vital for Broad Reach | Wide accessibility, market penetration |

| Accessories (e.g., Jibbitz™) | Substantial Contribution | Boosts Average Transaction Value | Personalization, customization |

| International Sales | Significant Portion of Total Revenue | Strong Growth in Key Regions | Geographic diversification, risk mitigation |

| HEYDUDE Brand | $845.5 million | $719.6 million | Acquired brand, focus on revitalization |

Business Model Canvas Data Sources

The Crocs Business Model Canvas is built using a combination of internal sales data, customer feedback surveys, and competitor analysis. These sources provide a comprehensive view of market performance and customer preferences.