Crocs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

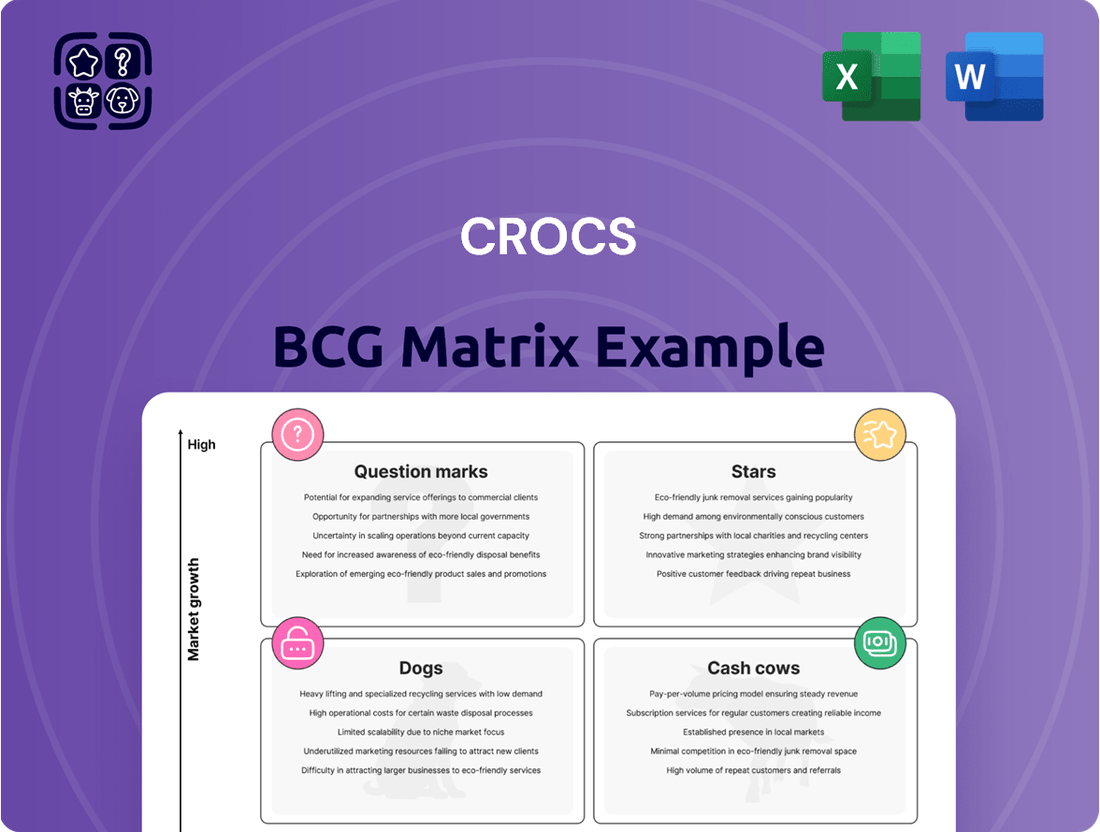

Curious about Crocs' product portfolio performance? Our BCG Matrix analysis reveals their current market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't just wonder where Crocs' iconic clogs and newer ventures fit—gain a comprehensive understanding.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Classic Clog remains Crocs' star product, consistently delivering strong growth and dominating the casual footwear market. Its enduring appeal, driven by comfort and distinctive style, has captured the attention of younger demographics like Gen Z, solidifying its status as a fashion essential.

Crocs' strategic approach, including popular collaborations and customizable Jibbitz charms, significantly boosts the Classic Clog's desirability and market share. In 2023, Crocs reported a 13% increase in revenue, with the Classic Clog being a primary contributor to this success, underscoring its position as a cash cow.

Crocs' international expansion is a critical driver of its success, with markets like China, India, and Western Europe showing robust growth. These regions are becoming increasingly important for the brand's overall performance.

In 2024, international sales for the Crocs brand saw a substantial uplift. Notably, China emerged as a standout performer, reporting an impressive 64% growth in sales, underscoring the brand's strong appeal in this key market.

To further leverage this momentum, Crocs is strategically investing in these high-potential regions. This includes expanding its physical retail footprint with new store openings and bolstering its digital presence to meet the escalating demand for its comfort-focused footwear.

While Crocs is famously known for its clogs, the brand is strategically broadening its horizons into other footwear styles, particularly sandals, which are demonstrating significant growth potential. This expansion is a key move to capture new market segments and occasions for wearing their products.

Styles like the Miami Toe Loop Sandal and Brooklyn 4u Low Wedge are becoming increasingly popular, partly fueled by their visibility on platforms like TikTok and through strategic collaborations. This indicates a successful diversification strategy that resonates with current consumer trends.

This diversification into sandals is crucial for Crocs, aiming to attract a wider consumer base beyond their traditional clog wearers and tap into new revenue streams. For instance, in the first quarter of 2024, Crocs reported a 2.1% increase in total revenue to $937.1 million, with their sandal category showing strong performance, contributing to this overall growth.

Direct-to-Consumer (DTC) Channel

The direct-to-consumer (DTC) channel is a significant growth engine for Crocs, encompassing both their robust e-commerce operations and company-owned retail stores. This strategic focus allows Crocs to cultivate deeper customer relationships and benefit from enhanced profit margins. In 2023, DTC sales for the Crocs brand saw a notable increase, underscoring the success of their investments in digital platforms and physical store expansion.

This channel provides Crocs with invaluable direct interaction with its customer base, enabling them to gather real-time feedback and tailor product offerings more effectively. The company’s commitment to strengthening its online presence and expanding its brick-and-mortar footprint has directly translated into improved financial performance within this segment. For instance, Crocs reported that its DTC business represented a substantial portion of its overall revenue growth in recent periods.

- DTC Revenue Growth: Crocs' DTC channel has consistently shown strong revenue increases, driven by effective online marketing and a growing physical retail network.

- Customer Relationships: This channel allows for direct engagement, fostering brand loyalty and providing valuable customer insights.

- Margin Enhancement: By cutting out intermediaries, Crocs captures higher profit margins on sales made through its DTC platforms.

- 2023 Performance: The DTC segment was a key contributor to Crocs' overall financial success in 2023, reflecting strategic investments in e-commerce and retail.

Sustainability Initiatives (Bio-Circular Croslite)

Crocs' dedication to sustainability, especially through its bio-circular Croslite material, firmly places it as a Star. This innovation caters to the growing demand for eco-friendly products.

The brand has successfully incorporated 25% bio-circular content into its signature Croslite material. This significant step has already reduced the carbon footprint associated with its popular Classic Clog by a notable margin.

- Bio-circular Croslite Adoption: Crocs has integrated 25% bio-circular content into its proprietary Croslite material.

- Environmental Impact Reduction: This initiative has demonstrably lowered the carbon footprint of the Classic Clog.

- Market Positioning: The focus on sustainability appeals to environmentally conscious consumers, creating a competitive edge.

The Classic Clog is Crocs' undisputed Star product, driving significant revenue and market dominance. Its appeal is amplified by strategic collaborations and customizable Jibbitz, attracting younger consumers like Gen Z. This strong performance is evident in Crocs' 2023 revenue growth, with the Classic Clog being a major contributor.

Crocs' international markets, particularly China, are experiencing robust growth, with China reporting a 64% sales increase in 2024. This expansion is supported by investments in retail and digital presence to meet demand for their comfort-focused footwear.

The brand's diversification into sandals, like the Miami Toe Loop Sandal, is also proving successful, contributing to a 2.1% overall revenue increase in Q1 2024. This strategy broadens their consumer base and taps into new revenue streams.

Crocs' commitment to sustainability, exemplified by its bio-circular Croslite material containing 25% bio-circular content, further solidifies its Star status. This eco-friendly innovation appeals to a growing segment of environmentally conscious consumers.

| Product Category | BCG Matrix Status | Key Drivers | 2023/2024 Data Points |

| Classic Clog | Star | Enduring comfort, style, Gen Z appeal, collaborations, Jibbitz | Primary contributor to 13% revenue increase in 2023 |

| Sandals | Star | Diversification strategy, TikTok visibility, collaborations | Contributed to 2.1% total revenue growth in Q1 2024 |

| International Markets (e.g., China) | Star (as a growth driver for products) | Expanding retail, digital presence, growing demand | China sales grew 64% in 2024 |

| Sustainability Initiatives | Star (as a brand differentiator) | Bio-circular Croslite material (25% content) | Reduced carbon footprint of Classic Clog |

What is included in the product

This BCG Matrix overview highlights Crocs' product portfolio, categorizing footwear into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights for each category, guiding decisions on investment, holding, or divestment.

The Crocs BCG Matrix offers a clear, actionable overview of their product portfolio, alleviating the pain of strategic indecision by highlighting growth opportunities.

Cash Cows

In mature markets like North America, the Classic Clog operates as a Cash Cow for Crocs. Despite slower growth compared to emerging regions, its entrenched popularity and strong brand loyalty ensure a high market share and a steady, substantial cash flow.

This product's established presence means it demands minimal promotional spending, leading to impressive profit margins. For instance, in 2023, North America represented a significant portion of Crocs' revenue, underscoring the enduring strength of the Classic Clog in its home territory.

The wholesale channel, encompassing multi-brand retailers and distributors, is a significant Cash Cow for Crocs. This segment consistently generates a substantial portion of the company's revenue, offering a stable and predictable cash flow. In 2023, wholesale represented approximately 55% of Crocs' total revenue, demonstrating its foundational role.

Operational overhead in the wholesale channel is generally lower than direct-to-consumer (DTC) efforts, further enhancing its profitability. Crocs' strategic focus here is on nurturing robust relationships with key retail partners and ensuring an efficient, reliable supply chain to maximize this revenue stream's contribution.

Jibbitz charms are a prime example of a Cash Cow for Crocs, generating significant, high-margin revenue with minimal investment. These customizable accessories tap into the existing customer base, fostering repeat purchases and enhancing brand loyalty. Their success is a testament to Crocs' ability to leverage its core product's popularity.

In 2023, Crocs reported that Jibbitz represented approximately 20% of their total revenue, a substantial contribution that highlights their role as a powerful revenue driver. This recurring income stream requires little additional marketing spend, as the demand is largely driven by the established popularity of the Crocs footwear itself.

Core Crocs Brand in North America

The core Crocs brand in North America represents a significant Cash Cow for the company. Despite facing a slightly moderated growth trajectory compared to its international counterparts, it continues to hold a commanding market share within the region.

This strong market position, coupled with enduring consumer demand, ensures a steady and predictable stream of revenue. The emphasis for this segment is on operational excellence and maximizing profitability from its established customer base.

- Dominant Market Share: North America remains the largest market for Crocs, contributing significantly to overall sales.

- Consistent Demand: The brand's iconic footwear continues to see consistent demand, underpinning its cash-generating ability.

- Profitability Focus: Strategies revolve around optimizing production, distribution, and marketing to maximize cash flow from this mature segment.

- 2024 Performance Snapshot: While specific North American brand-only figures for 2024 are integrated into broader financial reporting, the brand's historical performance indicates a stable, high-volume contributor to Crocs' financial health.

Established Collaborations and Limited Editions

Established collaborations and limited editions have become a significant cash cow for Crocs. These partnerships, featuring brands like Balenciaga and luxury designer Salehe Bembury, consistently drive demand and revenue.

For instance, the 2023 collaboration with Balenciaga reportedly sold out within minutes, demonstrating the immense appeal and revenue-generating power of these limited releases. The collectible nature and strong fan base engagement ensure these products continue to perform well long after the initial hype.

- Consistent Demand: Established collaborations leverage existing brand equity, ensuring a steady stream of revenue.

- Collectible Appeal: Limited edition releases foster a sense of urgency and exclusivity, driving sales.

- Brand Synergy: Partnerships with popular entities like Post Malone and Justin Bieber amplify brand visibility and attract new customer segments.

- Revenue Generation: These ongoing successful ventures contribute significantly to Crocs' overall financial performance, solidifying their cash cow status.

The wholesale channel remains a bedrock for Crocs, consistently delivering substantial and predictable revenue. In 2023, this segment accounted for approximately 55% of Crocs' total revenue, highlighting its crucial role. The operational efficiency inherent in wholesale partnerships, compared to direct-to-consumer efforts, further bolsters its profitability.

| Product/Segment | BCG Category | 2023 Revenue Contribution | Key Characteristics |

| Classic Clog (North America) | Cash Cow | Significant contributor to overall sales | High market share, strong brand loyalty, low promotional spend |

| Jibbitz Charms | Cash Cow | Approx. 20% of total revenue | High margin, minimal investment, drives repeat purchases |

| Wholesale Channel | Cash Cow | Approx. 55% of total revenue | Stable cash flow, lower overhead than DTC, efficient supply chain |

| Established Collaborations/Limited Editions | Cash Cow | Significant revenue driver | High demand, collectible appeal, brand synergy |

Delivered as Shown

Crocs BCG Matrix

The preview you are seeing is the exact Crocs BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview without any alterations or watermarks. This means you get the fully formatted, analysis-ready document that has been meticulously crafted to provide actionable insights into Crocs' product portfolio. Once purchased, this complete report will be immediately available for your use, whether for internal strategy sessions, investor presentations, or further market analysis.

Dogs

Certain Heydude product lines are currently underperforming, potentially fitting into the Dogs category of the BCG Matrix. These are lines that haven't captured consumer interest or have encountered significant inventory issues. For instance, if specific Heydude shoe models are consistently overstocked and sales are lagging, they represent a drain on resources.

The broader Heydude brand experienced a revenue decline in the first quarter of 2025, with projections indicating a continued downturn for the full year 2025. This overall performance suggests that some of Heydude's product segments likely hold a low market share and are operating in low-growth markets, a hallmark of the Dogs quadrant.

These underperforming segments tie up valuable capital within the company. This capital could otherwise be reinvested in more promising Heydude product lines or other Crocs Inc. brands that demonstrate higher growth potential and market share, thereby improving overall profitability.

Older, less popular Crocs styles or those that have fallen out of fashion trends may fall into the Dogs quadrant of the BCG Matrix. These products typically exhibit low market share and low growth potential. For instance, if a particular classic clog design saw a significant dip in sales in 2024 compared to previous years, it might be categorized here.

These 'dog' products often require disproportionate marketing efforts to move inventory, eating into profitability. Crocs' strategy of continuous innovation and diversification, such as introducing new materials or collaborations, is crucial to prevent the accumulation of these underperforming items and to shift focus towards more promising product lines.

Heydude's wholesale segment might be facing challenges, as indicated by a notable drop in wholesale revenues during the first quarter of 2025. This decline suggests that certain wholesale partnerships for the brand are not performing as expected.

These underperforming partnerships likely exhibit low sales volumes and minimal growth, fitting the profile of a 'Dog' in the BCG matrix. The resources and effort required to maintain these channels may exceed the financial returns they generate.

Underperforming International Regions (HEYDUDE)

Underperforming international regions for Heydude, within the context of Crocs' BCG Matrix, represent markets where the brand exhibits a low market share and struggles to gain significant traction. These areas are characterized by limited growth prospects and potentially low returns on investment, prompting a critical review of current strategies or even consideration of divestment.

For instance, if Heydude's presence in a specific European market shows minimal sales growth, perhaps only a 2% increase in 2024 compared to a strong 15% for Crocs in the same region, and its market share remains stagnant at 1%, these territories would be classified as Dogs. Such a scenario indicates that the resources allocated to these underperforming segments might be better utilized elsewhere to maximize overall brand profitability.

- Low Market Share: Heydude holds a negligible market share in these identified international territories, failing to compete effectively against established brands or local players.

- Struggling Traction: Despite marketing efforts, the brand is not resonating with consumers in these regions, leading to minimal sales growth and brand recognition.

- Limited Growth Prospects: Economic forecasts or market trends for these specific international areas suggest a subdued future for casual footwear, making significant expansion unlikely.

- Low Investment Yield: The capital invested in these markets is not generating adequate returns, highlighting an inefficient allocation of resources.

Products with High Returns/Customer Dissatisfaction

Products experiencing high return rates and customer dissatisfaction, often labeled as Dogs in the BCG Matrix, represent a significant drain on resources. These items, regardless of brand, typically suffer from poor quality, unmet customer expectations, or ineffective marketing. For instance, a hypothetical footwear brand might see a specific sandal line consistently returned due to material defects, leading to substantial costs in processing and logistics. This not only erodes profitability but also actively harms the brand's image, making it harder to attract new customers or retain existing ones. Data from 2024 indicates that products with return rates exceeding 15% often struggle to achieve profitability, especially when coupled with negative online reviews.

These underperforming product lines consume valuable capital and management attention that could be better allocated to more promising ventures. The financial impact is multifaceted, including:

- Increased operational costs: Handling returns, processing refunds, and managing customer complaints directly impact the bottom line.

- Damaged brand equity: Persistent dissatisfaction erodes customer trust and loyalty, leading to long-term revenue loss.

- Opportunity cost: Resources tied up in these products could be invested in developing or marketing successful items.

- Low sales velocity: Poor customer reception results in slow inventory turnover and potential write-offs.

Certain Heydude product lines are currently underperforming, potentially fitting into the Dogs category of the BCG Matrix. These are lines that haven't captured consumer interest or have encountered significant inventory issues. For instance, if specific Heydude shoe models are consistently overstocked and sales are lagging, they represent a drain on resources.

The broader Heydude brand experienced a revenue decline in the first quarter of 2025, with projections indicating a continued downturn for the full year 2025. This overall performance suggests that some of Heydude's product segments likely hold a low market share and are operating in low-growth markets, a hallmark of the Dogs quadrant.

These underperforming segments tie up valuable capital within the company. This capital could otherwise be reinvested in more promising Heydude product lines or other Crocs Inc. brands that demonstrate higher growth potential and market share, thereby improving overall profitability.

Older, less popular Crocs styles or those that have fallen out of fashion trends may fall into the Dogs quadrant of the BCG Matrix. These products typically exhibit low market share and low growth potential. For instance, if a particular classic clog design saw a significant dip in sales in 2024 compared to previous years, it might be categorized here.

These 'dog' products often require disproportionate marketing efforts to move inventory, eating into profitability. Crocs' strategy of continuous innovation and diversification, such as introducing new materials or collaborations, is crucial to prevent the accumulation of these underperforming items and to shift focus towards more promising product lines.

Heydude's wholesale segment might be facing challenges, as indicated by a notable drop in wholesale revenues during the first quarter of 2025. This decline suggests that certain wholesale partnerships for the brand are not performing as expected.

These underperforming partnerships likely exhibit low sales volumes and minimal growth, fitting the profile of a 'Dog' in the BCG matrix. The resources and effort required to maintain these channels may exceed the financial returns they generate.

Underperforming international regions for Heydude, within the context of Crocs' BCG Matrix, represent markets where the brand exhibits a low market share and struggles to gain significant traction. These areas are characterized by limited growth prospects and potentially low returns on investment, prompting a critical review of current strategies or even consideration of divestment.

For instance, if Heydude's presence in a specific European market shows minimal sales growth, perhaps only a 2% increase in 2024 compared to a strong 15% for Crocs in the same region, and its market share remains stagnant at 1%, these territories would be classified as Dogs. Such a scenario indicates that the resources allocated to these underperforming segments might be better utilized elsewhere to maximize overall brand profitability.

- Low Market Share: Heydude holds a negligible market share in these identified international territories, failing to compete effectively against established brands or local players.

- Struggling Traction: Despite marketing efforts, the brand is not resonating with consumers in these regions, leading to minimal sales growth and brand recognition.

- Limited Growth Prospects: Economic forecasts or market trends for these specific international areas suggest a subdued future for casual footwear, making significant expansion unlikely.

- Low Investment Yield: The capital invested in these markets is not generating adequate returns, highlighting an inefficient allocation of resources.

Products experiencing high return rates and customer dissatisfaction, often labeled as Dogs in the BCG Matrix, represent a significant drain on resources. These items, regardless of brand, typically suffer from poor quality, unmet customer expectations, or ineffective marketing. For instance, a hypothetical footwear brand might see a specific sandal line consistently returned due to material defects, leading to substantial costs in processing and logistics. This not only erodes profitability but also actively harms the brand's image, making it harder to attract new customers or retain existing ones. Data from 2024 indicates that products with return rates exceeding 15% often struggle to achieve profitability, especially when coupled with negative online reviews.

These underperforming product lines consume valuable capital and management attention that could be better allocated to more promising ventures. The financial impact is multifaceted, including:

- Increased operational costs: Handling returns, processing refunds, and managing customer complaints directly impact the bottom line.

- Damaged brand equity: Persistent dissatisfaction erodes customer trust and loyalty, leading to long-term revenue loss.

- Opportunity cost: Resources tied up in these products could be invested in developing or marketing successful items.

- Low sales velocity: Poor customer reception results in slow inventory turnover and potential write-offs.

| Product Category | Market Share (2024) | Market Growth (2024) | Profitability Impact | BCG Quadrant |

|---|---|---|---|---|

| Specific Heydude Shoe Models (Overstocked) | Low | Low | Resource Drain, Inventory Holding Costs | Dog |

| Certain Classic Crocs Clog Designs (Declining Sales) | Low | Low | Reduced Revenue, Potential Markdowns | Dog |

| Heydude Products in Underperforming European Markets | 1% (e.g., Specific Market) | 2% (e.g., Specific Market) | Low ROI, Inefficient Resource Allocation | Dog |

| Footwear with High Return Rates (>15% in 2024) | Low | Low | Increased Operational Costs, Brand Damage | Dog |

Question Marks

HEYDUDE's strategic push into sneakers, boots, and sandals represents a significant diversification effort beyond its established Wendy and Wally styles. These new product lines are entering markets with strong growth potential, but HEYDUDE currently holds a minimal share within them.

To elevate these ventures from Question Marks to Stars within the BCG matrix, substantial investments in marketing and product innovation are critical. For instance, the global footwear market was valued at approximately $380 billion in 2023 and is projected to grow, offering ample room for new entrants to capture share with the right strategy.

Heydude's foray into new international territories positions it as a Question Mark within the Crocs BCG matrix. These emerging markets, while promising for future growth, currently see Heydude with a relatively small footprint and market share. For instance, in the burgeoning Southeast Asian footwear market, which is projected to grow at a CAGR of over 7% through 2028, Heydude's brand recognition is still in its nascent stages.

Crocs must strategically allocate significant capital to research local tastes and build robust brand awareness in these regions. This investment is crucial to shift Heydude from its current Question Mark status to a potential Star. Without this focused effort, the high growth potential of markets like India, where the casual footwear segment is expanding rapidly, might not translate into substantial market penetration for Heydude.

High-end collaborations, like the Swarovski x Crocs partnership, position Crocs within the premium or luxury segment of the BCG matrix. These ventures target a niche, high-growth luxury market, but typically represent a very small market share for Crocs.

To determine if these collaborations can successfully expand Crocs' reach into a new, profitable territory, the company must invest in marketing and distribution channels specifically tailored for this affluent consumer base. For instance, Crocs reported a 7% increase in revenue for the first quarter of 2024, reaching $1.03 billion, indicating a strong overall market position that can support such strategic ventures.

Advanced Bio-Circular Materials Beyond Croslite

Crocs' exploration of advanced bio-circular materials, moving beyond its signature Croslite, positions it in a high-growth sector driven by sustainability. These ventures, while promising, are currently in nascent stages with minimal market penetration.

Significant capital infusion is essential to scale these material innovations, aiming for substantial market influence. For instance, the global bio-based materials market is projected to reach over $100 billion by 2027, indicating substantial growth potential for companies investing in this area.

- Research & Development Focus: Crocs is investing in next-generation materials that offer enhanced environmental benefits and performance characteristics.

- Market Potential: The push into bio-circular materials taps into a rapidly expanding market driven by consumer demand for sustainable products.

- Investment Needs: Scaling these advanced materials requires substantial R&D and manufacturing investment, crucial for competitive advantage.

- Strategic Positioning: This focus aligns with long-term business strategy, aiming to diversify product offerings and reduce environmental footprint.

Innovative Digital and Metaverse Initiatives

Crocs' foray into digital and metaverse initiatives, like utilizing TikTok Shop for its Heydude brand, signifies an investment in high-growth consumer engagement channels. While these platforms offer significant potential, Crocs' current market share and profitability within these emerging digital frontiers are still in formative stages.

These ventures are crucial for identifying future growth drivers, with strategic experimentation needed to assess their long-term viability and potential to evolve into Stars within the BCG matrix. For instance, in Q1 2024, digital sales represented a significant portion of overall revenue, indicating the growing importance of these channels.

- Digital Expansion: Crocs is actively exploring platforms like TikTok Shop to reach new demographics and drive sales, particularly for brands like Heydude.

- Metaverse/NFT Exploration: The company is investigating potential ventures into the metaverse and Non-Fungible Tokens (NFTs) to gauge their effectiveness in brand building and customer interaction.

- Nascent Market Position: While these digital initiatives represent high-growth potential, Crocs' market share and profitability in these new spaces are still developing, categorizing them as Question Marks.

- Strategic Investment: Continued strategic investment and experimentation are key to understanding the long-term impact and potential of these digital and metaverse endeavors.

The Heydude brand's expansion into new product categories like sneakers, boots, and sandals places it squarely in the Question Mark quadrant of the BCG matrix. These are high-growth markets, but Heydude currently holds a very small share within them.

To transition these ventures from Question Marks to Stars, significant investment in marketing and product development is essential. For example, the global footwear market was valued at approximately $380 billion in 2023, offering substantial room for growth if Heydude can effectively capture market share.

Crocs' strategic focus on emerging international markets for its Heydude brand also categorizes it as a Question Mark. These regions offer high growth potential, but Heydude's current market penetration and brand recognition are minimal.

To foster growth in these areas, Crocs needs to invest heavily in understanding local preferences and building brand awareness. This is crucial for moving Heydude from a Question Mark to a potential Star, especially in markets like India where casual footwear demand is rapidly increasing.

| BCG Quadrant | Crocs Initiatives | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Heydude expansion into new footwear categories (sneakers, boots, sandals) | High | Low | Requires significant investment to gain market share and become a Star. |

| Question Mark | Heydude's entry into emerging international markets | High | Low | Needs targeted marketing and product localization to capture growth. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.