Charles River Laboratories International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles River Laboratories International Bundle

Gain a critical advantage with our comprehensive PESTLE analysis of Charles River Laboratories International. Uncover how political, economic, social, technological, legal, and environmental factors are shaping its trajectory and identify potential opportunities and threats. Equip yourself with actionable intelligence to refine your own market strategy and investment decisions.

Political factors

Government funding for life sciences research, including biotechnology and pharmaceuticals, directly fuels demand for Charles River Laboratories' (CRL) services. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion in fiscal year 2023 for biomedical research, a significant portion of which supports early-stage drug discovery. Increased funding initiatives like these translate into more preclinical and clinical research projects for CROs like CRL, bolstering their revenue streams.

The regulatory environment for drug approval, particularly by agencies like the FDA and EMA, directly impacts Charles River Laboratories (CRL). Changes in the stringency and complexity of these processes can significantly alter the demand for CRL's preclinical and safety assessment services. For instance, increased regulatory scrutiny, a trend observed with evolving guidelines on gene therapies and novel modalities, often boosts the need for comprehensive testing, a core strength of CRL.

In 2024, the FDA continued to emphasize data integrity and robust scientific evidence in its approval pathways, which generally benefits contract research organizations (CROs) like CRL that provide these essential services. The agency's ongoing efforts to adapt to new scientific advancements, such as those in personalized medicine, create opportunities for CRL to expand its specialized testing capabilities.

Conversely, any political initiatives aimed at streamlining drug approvals, while potentially beneficial for drug developers by shortening time-to-market, could also necessitate adjustments in CRL's service offerings and capacity planning. The balance struck by regulators between speed and thoroughness remains a critical political consideration that shapes the operational landscape for CRL.

Charles River Laboratories (CRL) navigates a complex international trade landscape. Global trade agreements, such as the USMCA and various EU trade pacts, influence the cost and ease of moving research models and specialized biological reagents across borders. For instance, changes in import duties or regulatory compliance requirements stemming from these agreements can directly impact CRL's operational expenses and its ability to supply clients efficiently worldwide.

Geopolitical stability is a significant consideration for CRL's international footprint. Trade tensions, like those seen between major economic blocs in recent years, can lead to increased tariffs or outright restrictions on the import and export of critical research materials. In 2023, ongoing trade disputes contributed to supply chain volatility across many industries, a factor CRL actively manages by diversifying its sourcing and operational locations to mitigate potential disruptions.

Furthermore, geopolitical conflicts pose direct risks to CRL's global operations and client relationships. Regional instability can disrupt ongoing research projects, alter client spending patterns in affected areas, and create safety concerns for CRL's facilities and employees in those geographies. This necessitates a proactive approach to risk assessment and the development of agile strategies to adapt to evolving international political and economic conditions.

Healthcare Policy and Pharmaceutical Pricing

Government policies directly impact Charles River Laboratories (CRL) by shaping the R&D investment climate for its pharmaceutical and biotechnology clients. For instance, legislative efforts to control drug pricing, a recurring theme in the US and Europe, can compress client R&D budgets, potentially reducing demand for CRL's preclinical and clinical services. In 2024, discussions around prescription drug cost reduction continued, with potential implications for the volume of outsourced research.

Conversely, political support for innovation, such as extended patent protection or tax incentives for R&D, can bolster client spending. The US Inflation Reduction Act of 2022, which allows Medicare to negotiate some drug prices, represents a significant policy shift that CRL and its clients are closely monitoring for its long-term effects on R&D pipelines and outsourcing strategies.

- Government healthcare spending: Fluctuations in national healthcare budgets can directly affect the funding available for drug development, influencing client decisions to outsource.

- Drug pricing regulations: Policies aimed at capping or negotiating drug prices can lead pharmaceutical companies to re-evaluate their R&D investments and outsourcing partnerships.

- Intellectual property laws: The strength and duration of patent protections are critical for pharmaceutical clients, impacting their willingness to invest in new drug discovery and development, thereby affecting CRL's service demand.

Animal Welfare Legislation and Oversight

Political pressure and evolving legislative changes concerning animal welfare in research significantly impact Charles River Laboratories (CRL), a major player in preclinical services. For instance, in 2024, several European Union member states continued to debate and implement stricter guidelines on the housing and care of laboratory animals, potentially increasing CRL's operational costs.

These stricter regulations often necessitate substantial investments in facility upgrades and enhanced compliance measures to meet evolving ethical standards. For example, the cost of maintaining advanced animal welfare facilities, including enriched environments and specialized veterinary care, can add a considerable percentage to operational expenditures.

The ongoing political discourse surrounding animal rights and the potential for outright bans on specific types of animal research present a strategic challenge for CRL. This could necessitate a proactive shift towards developing and offering a broader range of alternative testing methods, influencing the company's long-term service portfolio and investment priorities. The global market for animal alternatives in research is projected to grow, with some estimates suggesting it could reach over $2 billion by 2027, underscoring the strategic imperative for CRL to adapt.

- Increased Compliance Costs: Stricter animal welfare laws can lead to higher operational expenses for CRL due to facility upgrades and enhanced care protocols.

- Investment in Alternatives: Political pressure may drive CRL to invest more heavily in non-animal testing methods, such as in vitro and in silico models.

- Regulatory Uncertainty: Potential legislative bans on certain animal research could create uncertainty, impacting CRL's service offerings and strategic planning.

- Global Regulatory Landscape: Variations in animal welfare regulations across different countries require CRL to navigate a complex and evolving international compliance environment.

Government funding for life sciences research, particularly through agencies like the NIH, directly influences the demand for Charles River Laboratories' (CRL) services, with NIH funding for biomedical research reaching approximately $47.4 billion in fiscal year 2023. Evolving regulatory landscapes from bodies like the FDA and EMA, which continue to emphasize data integrity and adapt to new modalities like gene therapies in 2024, necessitate comprehensive testing, a core offering for CRL.

International trade agreements and geopolitical stability significantly impact CRL's global operations, affecting the cost and ease of transporting research materials. Trade tensions and regional conflicts, as seen in 2023, create supply chain volatility, prompting CRL to diversify its operational footprint to mitigate disruptions.

Political pressures regarding drug pricing and R&D incentives, such as the ongoing discussions around prescription drug cost reduction in 2024 and the implications of the US Inflation Reduction Act of 2022, directly shape client R&D budgets and outsourcing strategies. Similarly, evolving animal welfare regulations, with stricter guidelines debated in the EU in 2024, increase operational costs and may drive investment in alternative testing methods, a market projected to grow significantly.

What is included in the product

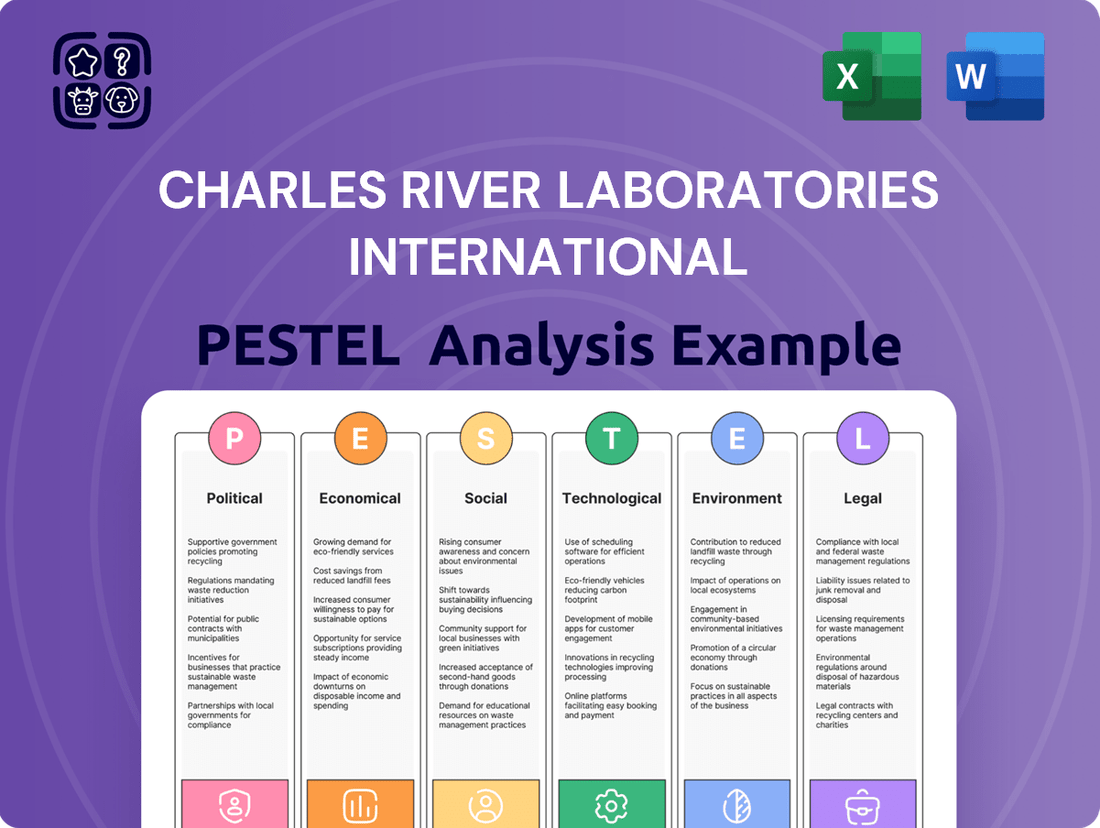

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Charles River Laboratories International, providing a comprehensive understanding of its operating landscape.

Provides a concise version of the Charles River Laboratories International PESTLE analysis, offering a clear overview of external factors that can be easily integrated into strategic planning documents and discussions.

Helps support discussions on external risks and market positioning by presenting a structured PESTLE analysis that can be quickly referenced and understood by all stakeholders.

Economic factors

Global pharmaceutical and biotechnology R&D spending is a critical economic factor for Charles River Laboratories (CRL). In 2023, the pharmaceutical industry saw R&D investment reach approximately $240 billion, a figure expected to grow. This robust spending directly translates to increased demand for CRL's contract research services, from early-stage drug discovery to preclinical testing.

The health of the broader economy significantly influences R&D budgets. For instance, periods of economic expansion, like the projected 2.7% global GDP growth for 2024 according to the IMF, typically encourage higher investment in innovation, benefiting CRL. Conversely, economic slowdowns or rising interest rates, which can tighten venture capital availability for emerging biotech firms, may lead to scaled-back R&D projects, impacting CRL's client pipeline.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Charles River Laboratories (CRL). Increased costs for labor, specialized research materials, energy, and transportation directly impact CRL's operational expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, and while projections for 2024 suggest some moderation, persistent elevated levels are anticipated, directly affecting CRL's input costs.

If CRL cannot effectively pass these escalating costs onto its clients through price adjustments or achieve substantial operational efficiencies, its profit margins could be squeezed. The ability to maintain competitive pricing while absorbing higher expenses is crucial. This dynamic is particularly relevant in the contract research organization (CRO) space, where client budgets are a key consideration.

Effectively managing these inflationary pressures necessitates robust financial planning, strategic supply chain optimization to secure favorable pricing on essential inputs, and potentially agile pricing strategies. CRL's focus on maintaining profitability and market competitiveness will hinge on its capacity to navigate these economic headwinds through proactive cost management and value-driven service delivery.

Charles River Laboratories, as a global entity, navigates the economic landscape where currency exchange rate fluctuations are a significant factor. These movements directly influence the company's reported financial performance, impacting revenues, expenses, and ultimately, profitability when foreign currency transactions are converted into U.S. dollars.

For instance, if the U.S. dollar strengthens against other major currencies, revenues earned by Charles River Laboratories in those foreign markets will translate into fewer U.S. dollars, potentially dampening reported international sales. Conversely, a weaker dollar can boost the translated value of those foreign earnings.

In 2024, for example, many multinational corporations experienced the effects of a fluctuating dollar. The U.S. Dollar Index (DXY), which measures the dollar against a basket of major currencies, saw periods of both appreciation and depreciation, creating a dynamic environment for companies like Charles River Laboratories. Managing these risks involves employing sophisticated hedging strategies and maintaining diligent financial oversight across its worldwide operations to cushion against adverse currency movements.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact Charles River Laboratories' (CRL) financial strategy. For instance, a rising interest rate environment, like the Federal Reserve's rate hikes throughout 2022 and into 2023, increases the cost of borrowing for CRL's capital expenditures and potential acquisitions. This higher cost of debt can dampen investment enthusiasm and chip away at profitability margins.

The broader economic climate, heavily influenced by interest rates, also plays a crucial role. As of early 2024, continued concerns about inflation and potential future rate adjustments by central banks can affect the availability and cost of venture capital. This, in turn, influences the funding landscape for many of CRL's biotech clients, potentially moderating their R&D spending and indirectly impacting CRL's revenue growth opportunities.

- Federal Reserve Rate Hikes: The Fed raised the federal funds rate target range from 0-0.25% in March 2022 to 5.25-5.50% by July 2023, significantly increasing borrowing costs.

- Impact on Debt: Higher rates make it more expensive for CRL to finance new projects or acquisitions through debt, potentially slowing expansion.

- Venture Capital Sensitivity: Biotech startups, a key CRL client segment, rely on venture capital. Higher interest rates can make venture capital less accessible or more expensive, potentially reducing their R&D budgets.

Competitive Landscape and Pricing Pressure

The contract research organization (CRO) market is highly competitive, with Charles River Laboratories (CRL) facing pressure from both large, established players and nimble, specialized firms. This rivalry directly impacts pricing, often compelling CRL to offer more aggressive rates or enhanced service packages to secure and retain clients in the drug development lifecycle.

In 2024, the global CRO market was valued at approximately $70 billion, with projections indicating continued growth. However, this expansion is accompanied by increasing pricing sensitivity from pharmaceutical and biotechnology companies aiming to optimize R&D spending. CRL's ability to maintain its market position hinges on its capacity to innovate and differentiate its offerings beyond just price.

- Intense competition from major CROs like Labcorp and IQVIA

- Emergence of niche CROs offering specialized services

- Client demand for cost-effectiveness in drug development

- Pressure to demonstrate value beyond basic service provision

The global economic outlook directly influences Charles River Laboratories' (CRL) performance. With projected global GDP growth around 2.7% for 2024, a stable economic environment generally supports increased R&D investment by pharmaceutical and biotech clients, a key driver for CRL's services. However, persistent inflation, with the US CPI remaining elevated in 2023 and expected to moderate but stay high into 2025, increases CRL's operational costs for labor and materials, potentially squeezing profit margins if these costs cannot be passed on to clients.

Currency fluctuations also play a significant role, as demonstrated by the U.S. Dollar Index (DXY) movements in 2024, which can impact the translated value of CRL's international earnings. Furthermore, interest rate hikes, such as those by the Federal Reserve reaching 5.25-5.50% by July 2023, increase borrowing costs for CRL and can affect the venture capital funding available to its biotech clients, influencing their R&D budgets.

The highly competitive CRO market, valued at approximately $70 billion globally in 2024, also exerts pricing pressure on CRL, necessitating a focus on differentiation beyond cost to maintain market share and profitability amidst client demands for cost-effectiveness.

Full Version Awaits

Charles River Laboratories International PESTLE Analysis

The preview you see here is the exact, fully formatted Charles River Laboratories International PESTLE Analysis document you’ll receive after purchase. This comprehensive report is ready to be utilized immediately, offering a detailed examination of the external factors impacting the company. You can trust that what you're previewing is the final, professionally structured analysis you'll be working with.

Sociological factors

Public perception of animal research significantly impacts Charles River Laboratories. Growing ethical concerns and awareness of animal welfare are driving increased scrutiny, with advocacy groups actively lobbying for stricter regulations and greater transparency. This societal shift is pressuring companies like CRL to demonstrate robust ethical practices and a commitment to the 3Rs: Replace, Reduce, and Refine animal use.

For instance, in 2023, a significant portion of the public expressed concerns about animal testing, with surveys indicating a growing preference for non-animal alternatives. This sentiment directly influences consumer choices and investor decisions, pushing companies to invest more heavily in developing and validating alternative research methods. Charles River Laboratories, recognizing this trend, has been increasing its investment in in vitro and in silico technologies, aiming to align its operations with evolving societal expectations and maintain its social license to operate.

The world's population is getting older, with projections indicating that by 2050, over 1.6 billion people will be 65 or older. This demographic shift means a greater likelihood of age-related diseases like Alzheimer's, cardiovascular issues, and various cancers, significantly increasing the burden of chronic conditions globally.

This growing prevalence of chronic and age-related diseases directly fuels the demand for innovative pharmaceutical and biotechnology solutions. Consequently, companies like Charles River Laboratories (CRL), which provide essential preclinical and clinical research services, see a robust increase in the need for their expertise and support in developing new drugs and therapies.

For CRL, this aging global population is a fundamental driver, expanding the pipeline of drug development projects. The urgent societal need to address unmet medical needs in an aging demographic translates into more business opportunities for CRL as pharmaceutical companies accelerate their research and development efforts to bring new treatments to market.

Societal demands for accessible and affordable healthcare are increasingly shaping the pharmaceutical landscape. This trend directly influences Charles River Laboratories' (CRL) clients, as heightened pressure for lower drug prices can steer their research and development investments. For instance, a growing emphasis on cost-effective treatments might lead clients to prioritize drug discovery approaches that promise quicker, less expensive development cycles.

CRL's ability to adapt its service portfolio to these shifting client priorities is crucial. As pharmaceutical companies navigate the complex environment of drug affordability debates, they may seek CRO partners who can offer specialized services supporting the development of more budget-friendly therapeutics or focus on therapeutic areas with high unmet needs and potential for cost-effective solutions.

Talent Acquisition and Retention in Life Sciences

The life sciences sector, including Charles River Laboratories (CRL), is profoundly shaped by the availability of a skilled workforce. A strong pipeline of talent in science, technology, engineering, and mathematics (STEM), especially in specialized fields like toxicology, pharmacology, and veterinary science, is paramount for CRL's operational success and innovation. For instance, the U.S. Bureau of Labor Statistics projected a 9% growth for biological scientists between 2022 and 2032, indicating robust demand for these specialized roles.

CRL's reliance on highly educated professionals means that competition for top talent is fierce. Demographic shifts, such as an aging scientific workforce and the entry of new generations with different expectations, also play a significant role. In 2023, surveys indicated that over 60% of employees consider work-life balance a top priority when choosing an employer, a trend that directly influences CRL's strategies for attracting and retaining its specialized personnel. Furthermore, a growing emphasis on corporate social responsibility means that companies demonstrating strong ethical practices and community engagement are more appealing to prospective employees.

Key sociological factors influencing talent acquisition and retention at Charles River Laboratories include:

- STEM Workforce Availability: The demand for specialized skills in toxicology, pharmacology, and veterinary science directly impacts CRL's ability to staff its critical research and development functions.

- Talent Competition: Intense competition from other life sciences companies and academic institutions for highly qualified scientists and technicians necessitates competitive compensation and benefits packages.

- Demographic Trends: Evolving workforce demographics, including generational shifts and potential shortages in specific scientific disciplines, require adaptive recruitment and retention strategies.

- Employee Expectations: Increasing employee focus on work-life balance, flexible work arrangements, and corporate social responsibility influences CRL's employer brand and its ability to attract and retain talent.

Patient Advocacy and Personalized Medicine

The increasing influence of patient advocacy groups is reshaping pharmaceutical research, pushing for more personalized medicine. This societal shift is driving demand for targeted drug discovery and a focus on patient outcomes. For instance, by 2024, the global personalized medicine market was projected to reach $700 billion, highlighting the significant economic impact of this trend.

Charles River Laboratories needs to adapt its service offerings to align with these evolving research paradigms. This means potentially expanding capabilities in areas like disease-specific models and biomarker discovery. The company's ability to support the development of precision therapies will be crucial as societal expectations move towards more effective and individualized treatments.

- Growing Patient Voice: Patient advocacy groups are increasingly involved in clinical trial design and regulatory processes, influencing research priorities.

- Personalized Medicine Market Growth: The personalized medicine market is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond.

- Focus on Outcomes: There's a heightened societal emphasis on measurable patient outcomes, requiring research to demonstrate tangible benefits.

- Targeted Therapies: The demand for therapies tailored to specific genetic profiles or disease subtypes is a key driver for innovation in drug development services.

Societal expectations regarding ethical research practices continue to evolve, with a growing emphasis on animal welfare and the development of alternatives to animal testing. This trend pressures companies like Charles River Laboratories (CRL) to demonstrate a strong commitment to the 3Rs (Replace, Reduce, Refine) and invest in non-animal methodologies. For example, by 2024, public awareness campaigns against animal testing have intensified, influencing consumer and investor sentiment towards more humane research approaches.

The global demographic shift towards an aging population directly fuels demand for pharmaceutical and biotechnology solutions addressing age-related diseases. This creates a significant opportunity for CRL, as pharmaceutical companies accelerate their R&D efforts to develop new treatments for conditions like Alzheimer's and cardiovascular diseases, increasing the need for preclinical and clinical research services.

The increasing demand for accessible and affordable healthcare influences clients' R&D investment strategies, potentially steering them towards more cost-effective drug development pathways. CRL's adaptability in offering services that support the development of budget-friendly therapeutics or focus on high-need areas will be crucial for aligning with these evolving market demands.

Technological factors

Rapid advancements in drug discovery technologies like high-throughput screening and AI-driven computational biology are revolutionizing the pharmaceutical industry. These innovations are crucial for identifying promising drug candidates more efficiently. For example, the global AI in drug discovery market was valued at approximately $1.1 billion in 2023 and is projected to grow significantly, indicating a strong trend towards tech-enabled research.

Charles River Laboratories (CRL) must actively invest in and integrate these cutting-edge technologies to maintain its competitive edge. By adopting advanced genomics, proteomics, and AI tools, CRL can offer clients state-of-the-art preclinical testing and accelerate the drug development pipeline. This technological integration directly enhances CRL's value proposition by improving the speed and success rates of identifying new therapeutic agents.

Technological advancements like organ-on-a-chip, 3D cell cultures, and in silico modeling are rapidly emerging as viable alternatives to traditional animal testing in preclinical research. These innovative methods promise more predictive and ethically sound outcomes.

Charles River Laboratories (CRL), a leader in research models, must actively integrate and develop these alternative technologies to remain competitive and address growing scientific and ethical pressures. By embracing these innovations, CRL can expand its service offerings and cater to the increasing demand for humane research solutions.

For instance, the global organ-on-a-chip market was valued at approximately $70 million in 2023 and is projected to grow significantly, reaching an estimated $400 million by 2028, according to some market analyses. CRL's strategic investment in these areas, reported to be a key focus in their 2024-2025 R&D strategy, positions them to capitalize on this expanding market and align with the future trajectory of life sciences research.

The increasing integration of automation and robotics in laboratories significantly boosts efficiency, reproducibility, and overall throughput for Charles River Laboratories (CRL). This technological shift directly impacts CRL's ability to manage compounds, develop assays, and process samples more effectively.

Automating routine tasks within CRL's operations minimizes the potential for human error, thereby speeding up project timelines and potentially reducing operational expenses. For instance, automated liquid handling systems can process thousands of samples daily, a task that would be time-consuming and prone to error if done manually.

CRL's strategic deployment of these advanced technologies across its worldwide network is paramount for ensuring cost-competitiveness and delivering prompt, high-quality results to its clientele. The global laboratory automation market was projected to reach approximately $6.5 billion in 2024, highlighting the significant investment and adoption trend.

Data Analytics and Artificial Intelligence (AI)

The explosion of data in drug discovery and development is making advanced analytics and AI essential. Charles River Laboratories (CRL) is positioned to use AI and machine learning to sift through complex biological information, predict how well drugs might work and their potential side effects, and even refine how studies are designed. This technological leap helps speed up preclinical research and find new treatments, giving CRL a significant edge and boosting the value they offer clients.

By integrating AI, CRL can enhance its ability to process and interpret vast datasets generated during preclinical studies. For instance, in 2024, the biopharmaceutical industry continued to see massive investments in AI-driven drug discovery, with many companies reporting accelerated timelines for identifying promising drug candidates. CRL's adoption of these tools directly addresses this trend, allowing for more efficient analysis of genomics, proteomics, and clinical trial data.

- AI in Drug Discovery: Estimates suggest AI could reduce drug discovery timelines by 25-50% and cut costs significantly.

- Data Volume: The amount of biological data generated daily in research is in the petabytes, requiring sophisticated analytical solutions.

- Predictive Modeling: CRL can utilize AI for predictive toxicology, identifying potential safety issues earlier in the development process.

- Target Identification: Machine learning algorithms are proving effective in identifying novel therapeutic targets from complex biological networks.

Digitalization of Research and Development Workflows

The ongoing digital transformation of research and development (R&D) is fundamentally reshaping how companies like Charles River Laboratories operate. Embracing tools such as electronic lab notebooks (ELNs) and laboratory information management systems (LIMS) is crucial for enhancing data accuracy and streamlining complex research processes.

Integrating these digital solutions allows for improved collaboration, especially in multi-site studies and client interactions, leading to greater efficiency. For instance, in 2023, Charles River Laboratories continued to invest in its digital infrastructure, recognizing that robust systems are key to managing vast datasets and ensuring client confidentiality.

These advancements are not just about efficiency; they are vital for maintaining data integrity and security in an increasingly interconnected research landscape. CRL's commitment to a strong digital backbone, including advanced cybersecurity measures, is essential for meeting the evolving demands of modern scientific research and development.

- Digital Workflow Adoption: Charles River Laboratories is actively integrating ELNs and LIMS to improve data management and research efficiency.

- Enhanced Collaboration: Digital platforms facilitate seamless data sharing and collaboration across multiple research sites and with external clients.

- Data Integrity and Security: Investments in digital infrastructure and cybersecurity are paramount for safeguarding sensitive research data.

- Operational Streamlining: CRL leverages digital solutions to optimize R&D operations and meet the demands of contemporary research environments.

Technological advancements are rapidly transforming preclinical research, with AI and automation becoming central to efficiency and innovation. Charles River Laboratories (CRL) must integrate these tools to stay competitive and meet client demands for faster, more accurate results.

The increasing adoption of AI in drug discovery, projected to significantly reduce timelines and costs, is a key trend. CRL's strategic investments in areas like organ-on-a-chip technology and advanced analytics position it to capitalize on these shifts, aligning with the future of life sciences research.

Digital transformation, including ELNs and LIMS, is crucial for data integrity and streamlined research processes. CRL's focus on robust digital infrastructure enhances collaboration and ensures the security of sensitive research data, vital for its operations.

| Technological Factor | Impact on CRL | Market Data/Projections (2024-2025) |

| AI in Drug Discovery | Accelerates candidate identification, improves predictive modeling | Global AI in drug discovery market expected to see substantial growth. Estimates suggest AI can reduce discovery timelines by 25-50%. |

| Automation & Robotics | Increases lab efficiency, reproducibility, and throughput | Global laboratory automation market projected to reach approximately $6.5 billion in 2024. |

| Alternative Research Models (Organ-on-a-chip, 3D cultures) | Offers more predictive and ethical alternatives to traditional methods | Organ-on-a-chip market projected to grow significantly, reaching an estimated $400 million by 2028. |

| Digital Transformation (ELNs, LIMS) | Enhances data accuracy, streamlines workflows, improves collaboration | CRL continues to invest in digital infrastructure for data management and client confidentiality. |

Legal factors

Charles River Laboratories (CRL) navigates a complex web of regulations, including Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP), essential for its preclinical safety studies and manufacturing support services. Failure to adhere to these standards can result in significant penalties, damage to client relationships, and invalidation of critical study data, impacting the company's reputation and revenue streams.

Maintaining compliance is paramount, requiring CRL to invest heavily in robust quality assurance systems and regular internal audits. For instance, in 2023, the company reported significant investments in its quality and compliance infrastructure to meet evolving global regulatory expectations, such as those from the FDA and EMA, ensuring the reliability and acceptance of its scientific output.

Animal welfare laws, such as the Animal Welfare Act (AWA) in the United States and European Union directives, are fundamental to Charles River Laboratories' operations. These regulations dictate the ethical treatment and use of animals in research, directly influencing CRL's preclinical services.

Compliance with these stringent national and international guidelines, alongside CRL's own robust animal care policies and oversight from ethical review boards, is non-negotiable. For instance, in 2023, CRL reported significant investments in animal welfare programs and facilities, underscoring their commitment to meeting and exceeding regulatory standards.

Non-compliance can lead to severe consequences, including substantial fines, operational limitations, and irreparable reputational harm. Such failures could jeopardize CRL's licenses and strain critical client relationships, impacting their ability to conduct vital research and development.

Intellectual property laws, particularly patents and trade secrets, are fundamental to Charles River Laboratories (CRL) given their work with sensitive client data and proprietary research. CRL’s business relies on safeguarding innovations and client-specific information.

Maintaining strong legal frameworks and internal controls is paramount for CRL to protect client intellectual property, prevent unauthorized disclosures, and effectively manage confidentiality agreements. This is critical for maintaining client relationships and operational integrity.

A breach of IP or confidentiality could result in severe legal consequences, erosion of client trust, and substantial financial penalties. For instance, in 2023, the pharmaceutical and biotech sectors faced an estimated $300 billion in losses due to IP theft, highlighting the significant financial risks involved.

Data Privacy Regulations (e.g., GDPR, CCPA)

Charles River Laboratories (CRL) faces significant legal considerations with evolving data privacy regulations like GDPR and CCPA. These laws dictate how CRL handles sensitive client and research data, impacting everything from IT infrastructure to contractual agreements. Non-compliance can lead to substantial financial penalties and reputational damage.

In 2024, the global focus on data protection intensified, with ongoing enforcement actions and potential updates to existing frameworks. For CRL, this means rigorous adherence to data minimization, consent management, and breach notification protocols. Maintaining robust data security measures is paramount to safeguarding client trust and avoiding legal repercussions.

- GDPR Fines: Companies can face fines up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Impact: The CCPA grants California consumers rights regarding their personal information, requiring businesses to be transparent about data collection and usage.

- Data Breach Costs: The average cost of a data breach in the healthcare industry reached $10.10 million in 2023, highlighting the financial risks of inadequate data security.

Product Liability and Contractual Obligations

Charles River Laboratories (CRL) navigates significant product liability risks. These stem from its role in supplying critical research models, reagents, and conducting studies essential for drug development. A single adverse outcome in a client's drug trial, potentially linked to CRL's offerings, could trigger substantial legal claims. For instance, in 2023, the life sciences sector saw a rise in litigation related to preclinical research data integrity, highlighting the sensitivity of CRL's operations.

To counter these liabilities, CRL places heavy emphasis on meticulously crafted legal contracts. These agreements typically include robust indemnification clauses and comprehensive insurance policies. These measures are designed to shield the company by clearly defining responsibilities and providing financial recourse in the event of unforeseen issues. The company's commitment to contractual compliance is a cornerstone of its risk management strategy.

Adherence to intricate contractual obligations with its diverse clientele, primarily pharmaceutical and biotechnology firms, is paramount. These relationships are built on trust and the consistent delivery of high-quality services. Failure to meet these commitments can lead not only to legal disputes but also to reputational damage and the loss of valuable business partnerships. In 2024, industry analysts noted that companies with strong contractual frameworks were better positioned to weather regulatory scrutiny.

Key legal considerations for Charles River Laboratories include:

- Product Liability: Potential claims arising from the performance or outcomes of research models, reagents, and services provided.

- Contractual Safeguards: Implementation of strong indemnification clauses and adequate insurance coverage to mitigate financial exposure.

- Client Agreements: Diligent management of complex contracts with pharmaceutical and biotech partners to maintain relationships and limit legal risk.

- Regulatory Compliance: Ensuring all products and services meet stringent industry regulations and quality standards to prevent legal challenges.

Charles River Laboratories (CRL) operates under a stringent legal framework governing preclinical research, manufacturing, and animal welfare. Compliance with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) is essential for data integrity and client trust, with significant investments in quality systems reported in 2023 to meet evolving FDA and EMA standards.

Animal welfare laws, like the Animal Welfare Act, directly impact CRL's preclinical services, necessitating robust policies and ethical oversight. The company's 2023 investments in animal welfare programs underscore its commitment to regulatory adherence and ethical research practices.

Intellectual property (IP) protection is critical, given the sensitive client data CRL handles. The risk of IP theft in the life sciences sector, estimated at $300 billion in losses in 2023, highlights the importance of CRL's strong internal controls and confidentiality agreements.

Evolving data privacy regulations such as GDPR and CCPA necessitate rigorous adherence to data protection protocols. The average cost of a data breach in the healthcare industry reached $10.10 million in 2023, emphasizing the financial risks of inadequate data security for CRL.

Product liability risks are managed through meticulously crafted contracts, indemnification clauses, and comprehensive insurance. In 2024, strong contractual frameworks were noted as key for companies navigating regulatory scrutiny in the life sciences sector.

| Legal Factor | Impact on CRL | Key Considerations/Data |

| Regulatory Compliance (GLP/GMP) | Ensures data integrity and client acceptance. | Significant investments in quality systems in 2023 to meet FDA/EMA standards. |

| Animal Welfare Laws | Dictates ethical treatment and use of animals in research. | 2023 investments in animal welfare programs; adherence to AWA and EU directives. |

| Intellectual Property Protection | Safeguards client data and proprietary research. | Life sciences IP theft losses estimated at $300 billion in 2023. |

| Data Privacy (GDPR/CCPA) | Governs handling of sensitive client and research data. | Average healthcare data breach cost: $10.10 million in 2023. |

| Product Liability & Contracts | Mitigates risks from research models, reagents, and services. | Strong indemnification clauses and insurance are crucial; robust contracts noted as key in 2024. |

Environmental factors

Charles River Laboratories (CRL) generates a significant amount of waste, encompassing biological, chemical, and general laboratory materials, with a portion classified as hazardous. The company's operations are subject to stringent environmental regulations concerning the handling, treatment, and disposal of these substances, a critical aspect of their compliance framework.

Adherence to these regulations is paramount, as non-compliance can lead to substantial penalties, environmental damage, and significant reputational harm. For instance, in 2023, the US Environmental Protection Agency (EPA) reported over $150 million in penalties for environmental violations across various industries, highlighting the financial risks involved.

CRL must therefore continually invest in robust waste management infrastructure and maintain strict adherence to disposal permits and environmentally sound practices. This ongoing commitment to sustainable waste management represents a persistent operational and regulatory challenge for the company, directly impacting its environmental stewardship and financial health.

Charles River Laboratories' extensive global network of research, vivarium, and manufacturing facilities inherently leads to substantial energy consumption. This operational footprint directly contributes to the company's carbon emissions, a factor increasingly scrutinized by regulators and the public alike. For instance, in 2023, the company reported its Scope 1 and Scope 2 greenhouse gas emissions, highlighting the need for targeted reduction strategies.

Addressing this energy consumption and carbon footprint is crucial for Charles River Laboratories. Growing environmental awareness and stricter regulations around climate change are pushing companies to actively manage their impact. By investing in energy-efficient upgrades, exploring renewable energy procurement, and optimizing facility management, the company can not only lower operational expenses but also bolster its reputation among environmentally conscious investors and partners.

Charles River Laboratories' operations, particularly in its vivariums and laboratory settings, are water-intensive, utilizing significant volumes for animal husbandry, sanitation, and critical research activities. Efficient water management is paramount to their operational sustainability.

Compliance with stringent environmental regulations necessitates robust wastewater treatment protocols before any discharge, ensuring minimal impact on local water bodies. This focus on treatment is a key operational consideration.

As of 2024, concerns over water scarcity in various operational regions and heightened public awareness of water resource stewardship are driving demand for advanced wastewater treatment technologies and water conservation strategies across the industry, impacting companies like CRL.

Biodiversity and Ecosystem Impact

Charles River Laboratories' global footprint, while primarily focused on research services, can indirectly touch upon biodiversity. The sourcing of certain research models or materials necessitates careful consideration of their ecological origin and impact. For instance, in 2024, the company continued to invest in sustainable sourcing initiatives, aiming to reduce the environmental impact of its supply chain.

Minimizing the ecological footprint of their facilities and supply chain is a key area of focus. This includes responsible waste management and energy efficiency programs across their numerous sites worldwide. Charles River Laboratories reported a 5% reduction in water consumption across its European operations in 2024, demonstrating a commitment to resource conservation.

Adherence to regulations concerning species protection and habitat preservation is crucial, even when not directly involved in conservation efforts. This commitment to environmental stewardship helps mitigate reputational risks associated with ecological impact. The company maintains rigorous compliance with international wildlife trade regulations, ensuring ethical sourcing of biological materials.

- Responsible Sourcing: Charles River Laboratories emphasizes ethical and sustainable sourcing of research models and materials to minimize ecological impact.

- Facility Footprint: Efforts are ongoing to reduce the environmental footprint of their global operations through waste reduction and energy efficiency.

- Regulatory Compliance: Adherence to species protection and habitat preservation regulations is maintained to ensure positive environmental stewardship.

- Water Conservation: In 2024, a 5% reduction in water consumption was achieved across European facilities, highlighting resource management efforts.

Climate Change and Operational Resilience

Climate change presents significant physical risks to Charles River Laboratories (CRL), impacting its facilities and global supply chain through events like extreme weather. For instance, the increasing frequency and intensity of storms or floods could directly threaten CRL's research sites and disrupt the delivery of vital research models and reagents, potentially halting critical studies. In 2024, companies globally are increasingly investing in climate risk assessments and resilience planning; for CRL, this means proactively identifying vulnerabilities in its infrastructure and supply routes to safeguard operations and assets.

Adapting to these escalating environmental challenges is crucial for CRL's operational continuity. The company must implement robust resilience strategies, which could include diversifying supplier bases, securing backup power for critical facilities, and potentially relocating certain operations away from high-risk zones. By investing in infrastructure upgrades and adaptive measures, CRL can better protect its services and maintain its commitment to scientific advancement amidst a changing climate.

- Physical Risks: Extreme weather events like hurricanes and floods can damage CRL's research facilities and disrupt logistics.

- Supply Chain Disruptions: Natural disasters can impede the timely delivery of essential research models, reagents, and other critical supplies.

- Operational Continuity: CRL must assess climate-related risks and implement resilience strategies to ensure uninterrupted services and protect its assets.

- Infrastructure Adaptation: Investing in adaptable infrastructure is key to mitigating the escalating effects of climate change on CRL's operations.

Charles River Laboratories (CRL) faces increasing pressure to reduce its environmental footprint, particularly concerning waste generation and energy consumption. The company's extensive global operations, including vivariums and manufacturing sites, contribute to its carbon emissions and water usage. As of 2024, CRL is actively investing in sustainable sourcing and water conservation, evidenced by a 5% reduction in water consumption across its European facilities in that year.

Climate change poses physical risks, such as extreme weather events, that could disrupt CRL's facilities and supply chains. Proactive resilience planning and infrastructure adaptation are critical for operational continuity. The company's commitment to environmental stewardship is also reflected in its adherence to species protection and habitat preservation regulations, ensuring ethical sourcing of biological materials.

| Environmental Factor | Impact on CRL | Mitigation/Response | 2023/2024 Data/Trend |

|---|---|---|---|

| Waste Management | Hazardous and biological waste requires strict handling and disposal. Non-compliance incurs significant penalties. | Investment in robust waste management infrastructure and adherence to disposal permits. | US EPA reported over $150 million in penalties for environmental violations across industries in 2023. |

| Energy Consumption & Carbon Emissions | High energy usage from global facilities contributes to carbon footprint. | Investing in energy-efficient upgrades, exploring renewable energy, optimizing facility management. | CRL reported Scope 1 and Scope 2 greenhouse gas emissions in 2023. |

| Water Usage | Water-intensive operations in vivariums and labs necessitate efficient management. | Implementing robust wastewater treatment protocols and water conservation strategies. | CRL achieved a 5% reduction in water consumption across European facilities in 2024. |

| Biodiversity & Sourcing | Sourcing of research models requires consideration of ecological origin and impact. | Emphasis on ethical and sustainable sourcing initiatives; adherence to international wildlife trade regulations. | CRL continued investment in sustainable sourcing initiatives in 2024. |

| Climate Change Risks | Physical risks from extreme weather events can disrupt facilities and supply chains. | Implementing resilience strategies, diversifying suppliers, securing backup power, infrastructure adaptation. | Increasing global investment in climate risk assessments and resilience planning in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Charles River Laboratories International is informed by a comprehensive review of governmental regulatory bodies, financial market data, and industry-specific research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.