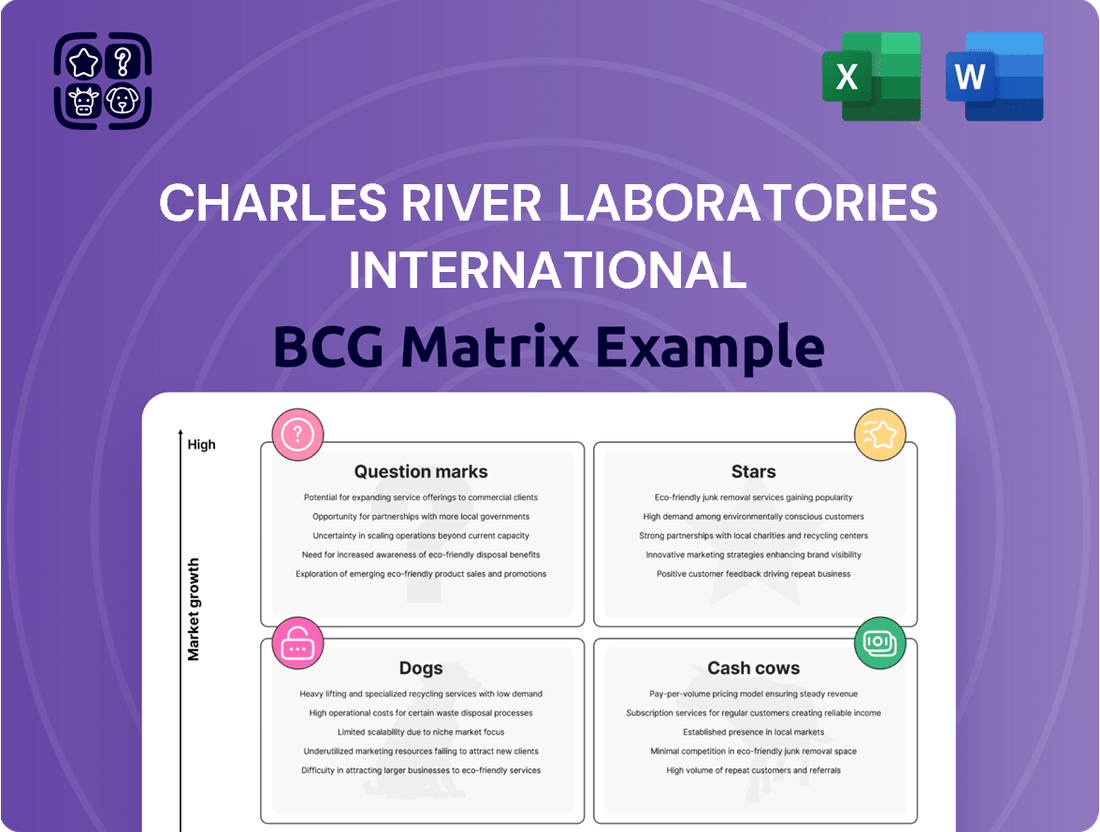

Charles River Laboratories International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles River Laboratories International Bundle

Unlock the strategic potential of Charles River Laboratories International with a comprehensive BCG Matrix analysis. Understand which of their services are market leaders and which require careful consideration for future investment.

This preview offers a glimpse into the strategic positioning of Charles River Laboratories International. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your investment and product portfolio decisions.

Don't miss out on the complete picture! The full Charles River Laboratories International BCG Matrix provides quadrant-by-quadrant insights and actionable strategic takeaways, giving you the competitive clarity you need in today's dynamic market.

Stars

Charles River Laboratories (CRL) is making substantial strides in the cell and gene therapy sector, a burgeoning area within the broader pharmaceutical landscape. Their commitment is evident through strategic acquisitions and investments aimed at bolstering their capacity for essential services like plasmid DNA, viral vector, and cell therapy manufacturing.

The market for cell and gene therapy manufacturing services is experiencing robust growth, with projections indicating an increase from $1.88 billion in 2024 to $2.02 billion in 2025. This upward trend underscores the significant demand and potential within this specialized field.

While CRL has faced some challenges, such as recent contract losses, their comprehensive 'concept to cure' approach for advanced therapies positions them as a critical player. This integrated offering addresses the entire lifecycle of these complex treatments, highlighting their strategic focus on this high-potential market segment.

Microbial Solutions stands out as a star performer within Charles River Laboratories' Manufacturing Solutions segment, consistently fueling organic revenue growth. This business unit demonstrates a commanding market share in a crucial and expanding niche of manufacturing support.

In the fourth quarter of 2024, Microbial Solutions was the primary engine behind the Manufacturing segment's impressive organic growth. Furthermore, the segment's non-GAAP operating margin saw a significant jump, rising to 27.4% in 2024 from 21.8% in 2023, underscoring its profitability and market strength.

Charles River Laboratories is making significant strides in New Approach Methods (NAMs) and alternative testing for drug development. Their Alternative Methods Advancement Project (AMAP) is a key initiative, aiming to generate $200 million in annual revenue. This strategic investment positions them as a leader in a rapidly evolving field.

The company's focus on NAMs and alternative methods directly addresses a growing industry and regulatory demand for reduced reliance on traditional animal testing. This forward-thinking strategy taps into a high-growth market segment where Charles River Laboratories is actively building its leadership presence.

Comprehensive Preclinical CRO Services

Charles River Laboratories (CRL) stands as a dominant force in the preclinical Contract Research Organization (CRO) sector. This market is experiencing substantial expansion, fueled by pharmaceutical companies increasingly outsourcing R&D activities. CRL's comprehensive suite of services, spanning from early-stage discovery to late-stage clinical support, positions it exceptionally well within this growth trajectory.

The global preclinical CRO market is a significant and expanding arena. Projections indicate the market will reach an estimated USD 6.76 billion by 2025, demonstrating a strong upward trend. CRL's expansive global footprint and its ability to offer integrated solutions across the drug development continuum are key factors contributing to its substantial market share.

- Market Leadership: CRL is a leading global provider in the preclinical CRO market.

- Market Growth: The preclinical CRO market is experiencing robust growth due to increased outsourcing and R&D investment.

- Market Valuation: The global preclinical CRO market is projected to reach USD 6.76 billion by 2025.

- CRL's Strengths: Extensive service offerings and a global presence solidify CRL's high market share.

Strategic Technology Integration (e.g., AI/ML in Discovery)

Charles River Laboratories (CRL) is actively integrating advanced technologies like AI and ML into its drug discovery services, aiming to boost efficiency and speed. This strategic move positions them to capitalize on the preclinical CRO market's growing demand for technological innovation.

The preclinical CRO market is seeing a significant shift towards adopting AI, ML, and robotics to accelerate drug discovery. CRL's investment in platforms like Apollo™ demonstrates their commitment to staying at the forefront of these technological advancements, which are crucial for future market leadership and operational improvements.

- AI/ML in Drug Discovery: The preclinical CRO market is increasingly adopting AI and ML to streamline research and development processes.

- CRL's Strategic Focus: Charles River Laboratories is investing in advanced technology platforms, such as Apollo™, to enhance its drug discovery capabilities.

- Market Trends: The adoption of robotics and AI is a key trend in the preclinical CRO sector, driving efficiency and innovation.

- Competitive Landscape: CRL's technological integration aims to solidify its market leadership in a rapidly evolving and competitive environment.

Microbial Solutions is a standout performer for Charles River Laboratories, driving significant organic revenue growth within the Manufacturing Solutions segment. This unit holds a strong market position in a vital and expanding niche of manufacturing support.

In the fourth quarter of 2024, Microbial Solutions was the primary driver of the Manufacturing segment's impressive organic growth. Furthermore, the segment's non-GAAP operating margin saw a substantial increase, rising to 27.4% in 2024 from 21.8% in 2023, highlighting its profitability and market strength.

Charles River Laboratories is also making substantial strides in New Approach Methods (NAMs) and alternative testing for drug development. Their Alternative Methods Advancement Project (AMAP) is a key initiative, aiming to generate $200 million in annual revenue, positioning them as a leader in this evolving field.

The company's focus on NAMs and alternative methods directly addresses a growing industry and regulatory demand for reduced reliance on traditional animal testing, tapping into a high-growth market segment where CRL is building leadership.

| Business Unit | Market Position | Growth Driver | Profitability Indicator |

| Microbial Solutions | Strong Niche Leader | Key contributor to organic revenue growth | 27.4% non-GAAP operating margin (2024) |

| Alternative Methods (AMAP) | Emerging Leader | Targeting $200M annual revenue | Strategic investment in high-growth area |

What is included in the product

This BCG Matrix analysis of Charles River Laboratories identifies strategic priorities for each business unit based on market growth and share.

A clear visualization of Charles River Laboratories' business units, simplifying strategic decision-making and resource allocation.

Cash Cows

Charles River Laboratories' Established Discovery and Safety Assessment (DSA) services are a significant cash cow, representing the largest portion of their business. In 2023, this segment brought in a substantial 61% of the company's total revenue. While 2024 saw a slight dip of 6.3% in DSA revenue, it's important to note this is a mature market where Charles River commands a dominant market share.

This strong market position allows the DSA segment to generate considerable cash flow for the company. Charles River anticipates client demand in this area to remain steady, mirroring the trends observed in the latter half of 2024. This suggests a stable, though facing some headwinds, high market share that continues to be a reliable source of income.

Charles River Laboratories' Research Models and Services (RMS) segment stands as a cornerstone of its business. This division is renowned for supplying essential, high-quality research models and associated services, making it a vital resource for the broader biomedical research landscape. In 2024, RMS contributed a significant 20.5% to Charles River's total revenue, underscoring its importance.

Despite a slight organic revenue dip in 2024 and the first quarter of 2025, attributed to evolving market dynamics, the RMS segment continues to hold a dominant position within its mature market. This strong market standing ensures a steady and predictable revenue stream, bolstering the company's overall financial resilience.

Charles River Laboratories' Biologics Testing Solutions are a prime example of a Cash Cow within their BCG Matrix. This segment benefits from a deeply entrenched global infrastructure, crucial for the characterization, development, and release of vital biologics and biosimilars.

The pharmaceutical industry's consistent and high demand for these mature, essential services underpins its strong revenue generation. Charles River's ongoing investments to expand capacity and capabilities in biologics testing solidify its sustained high market share and predictable financial performance.

Regulatory and Quality Expertise

Charles River Laboratories International's (CRL) deep regulatory and quality expertise is a cornerstone of its operations, acting as a significant competitive advantage. This capability, developed over many years of supporting clients through the complex drug development lifecycle, from initial research to large-scale manufacturing, provides a stable and high-value service. This ensures clients navigate the highly regulated pharmaceutical industry with efficiency and compliance.

This established expertise is a mature asset for CRL, contributing substantially to client retention and reinforcing its market leadership. In 2023, CRL reported revenue of $4.4 billion, with a substantial portion attributed to its integrated drug discovery and development services, where regulatory acumen is paramount.

- Regulatory Compliance: CRL's extensive knowledge of global regulatory requirements (FDA, EMA, etc.) minimizes client risk.

- Quality Assurance: Robust quality systems ensure the integrity and reliability of research and manufacturing processes.

- Client Trust: Decades of successful regulatory submissions and audits build strong client confidence and loyalty.

- Market Stability: This expertise provides a consistent revenue stream, less susceptible to market fluctuations than newer, unproven services.

Global Operational Footprint

Charles River Laboratories' extensive global operational footprint, with production centers spanning North America, Europe, and Asia, positions it as a significant player in the life sciences industry. This broad infrastructure is key to its ability to support a diverse international clientele.

The company's mature asset base, characterized by its widespread operational capabilities, underpins its status as a cash cow. This allows for consistent service delivery and reliable revenue streams, reflecting a strong and stable market presence.

- Global Reach: Operations across three continents ensure a wide service area.

- Market Position: Extensive infrastructure supports a strong competitive standing worldwide.

- Revenue Generation: Mature assets contribute to consistent and reliable income.

- Clientele: Ability to serve a diverse global client base efficiently.

Charles River Laboratories' (CRL) established services, particularly in Discovery and Safety Assessment (DSA), are key cash cows. In 2023, DSA generated 61% of CRL's revenue, highlighting its mature market dominance. While 2024 saw a slight revenue dip of 6.3% in this segment, its high market share ensures a steady income stream, with demand anticipated to remain stable.

The Research Models and Services (RMS) segment also functions as a cash cow, contributing 20.5% to total revenue in 2024. Despite minor organic dips in early 2025 due to market shifts, RMS maintains a strong market position, offering predictable revenue and financial resilience.

Biologics Testing Solutions represent another significant cash cow for CRL, driven by a robust global infrastructure and consistent industry demand. Ongoing capacity expansions reinforce CRL's high market share and dependable financial performance in this essential service area.

CRL's deep regulatory and quality expertise acts as a stable, high-value asset, ensuring client compliance and retention. This mature capability, crucial for navigating the pharmaceutical industry's complexities, contributes substantially to consistent revenue, as evidenced by the company's $4.4 billion revenue in 2023.

| Segment | 2023 Revenue Contribution | 2024 Trend (Est.) | Cash Cow Characteristics |

|---|---|---|---|

| Discovery & Safety Assessment (DSA) | 61% | Slight revenue dip, stable demand | Mature market, dominant share, steady cash flow |

| Research Models & Services (RMS) | 20.5% | Slight organic dip, strong market position | Mature market, predictable revenue, financial resilience |

| Biologics Testing Solutions | N/A (Significant contributor) | Consistent demand, capacity expansion | Essential service, stable revenue, high market share |

| Regulatory & Quality Expertise | Integrated into services | High client value, retention driver | Mature asset, consistent revenue, market leadership |

Delivered as Shown

Charles River Laboratories International BCG Matrix

The preview you are currently viewing is the complete and final Charles River Laboratories International BCG Matrix report that you will receive upon purchase. This means the document is fully formatted, contains all the essential analysis, and is ready for immediate use without any watermarks or demo content. You can confidently use this preview as an accurate representation of the high-quality, professionally designed strategic tool you will acquire. This ensures you know exactly what you are getting—a comprehensive BCG Matrix ready to inform your business decisions.

Dogs

Charles River Laboratories International is actively addressing underperforming legacy sites and facilities as part of its strategic portfolio review. The company anticipates closing or consolidating around 15 additional sites within the next two years, primarily impacting its Drug Safety Assessment (DSA) and Research Models Services (RMS) segments. This move signals a clear effort to divest or streamline older, less efficient locations that exhibit low productivity or diminished market relevance.

Charles River Laboratories (CRL) has signaled that its Manufacturing segment's growth will be tempered in 2025 due to specific commercial CDMO contract headwinds. This slowdown is partly attributed to losing a commercial-stage cell therapy client to a rival and experiencing lower-than-anticipated revenue from another cell therapy contract. These specific client issues are impacting the otherwise robust CDMO sector for CRL.

Charles River Laboratories' Research Models and Services (RMS) segment saw a dip in its Cell Solutions business revenue during the first quarter of 2025. This underperformance indicates that particular services within this unit may be facing challenges, potentially due to softer market demand or heightened competitive pressures. This situation contributes to the overall organic revenue decline observed in the RMS segment.

Services Highly Reliant on Traditional Animal Testing

Charles River Laboratories (CRL) offers a range of services that have historically been dependent on traditional animal testing. While the company is actively investing in and developing alternative methods, the biopharmaceutical sector is experiencing a push from regulatory bodies like the FDA and NIH to move away from these traditional approaches.

This industry-wide shift, if it accelerates beyond CRL's pace of diversification into non-animal testing models, could impact segments heavily reliant on animal testing. Such reliance without adequate alternative service development might lead to reduced demand and profitability for those specific offerings within CRL's portfolio.

- Biopharmaceutical Services: Many early-stage drug discovery and development services, such as toxicology and efficacy studies, have traditionally used animal models.

- Regulatory Compliance Testing: Ensuring new drugs and therapies meet stringent regulatory requirements often involves animal testing protocols.

- Safety Assessment: Evaluating the safety profile of potential new medicines and medical devices has historically been a significant area for animal testing.

Segments Impacted by Goodwill Impairment

Charles River Laboratories International's Biologics Solutions segment, encompassing its Biologics Testing and CDMO businesses, was significantly impacted by goodwill impairment in 2024. The company recorded a substantial non-cash goodwill impairment charge of $215.0 million. This charge reflects a reassessment of the fair value of certain acquired assets within this segment, indicating that their current market worth is less than their book value.

The impairment suggests that the Biologics Solutions segment, particularly its Biologics Testing and CDMO operations, did not perform as favorably as initially projected at the time of acquisition. This situation often arises when anticipated synergies or market growth fail to materialize, leading to a downward revision in the estimated future cash flows attributable to these acquired businesses.

The impact of this goodwill impairment is primarily on the company's reported earnings and balance sheet, as it represents a non-cash reduction in asset value. It does not directly affect the ongoing operational cash flows of the business units themselves. However, it signals a potential overestimation of the value of past acquisitions within this specific segment of Charles River Laboratories.

Key areas within Biologics Solutions affected by the goodwill impairment include:

- Biologics Testing: This unit provides essential testing services for biologic drugs, a critical component of pharmaceutical development and manufacturing.

- CDMO (Contract Development and Manufacturing Organization): This arm offers services for the development and manufacturing of biologics for other pharmaceutical companies.

Charles River Laboratories' Research Models and Services (RMS) segment, particularly its cell therapy offerings, faced revenue challenges in early 2025. This underperformance, including a dip in Cell Solutions revenue, suggests that specific services within this unit are experiencing softer demand or increased competition. Such headwinds contribute to the overall organic revenue decline observed in the RMS segment.

The company's strategic review also involves addressing underperforming legacy sites, with plans to close or consolidate approximately 15 sites within the next two years. These closures are expected to impact segments like Drug Safety Assessment and Research Models Services, signaling a move to streamline less efficient or relevant locations.

Charles River Laboratories' Manufacturing segment's growth is projected to be tempered in 2025 due to specific commercial CDMO contract issues. Losing a cell therapy client and experiencing lower-than-expected revenue from another contract are key factors tempering growth in this otherwise robust sector for CRL.

The company's Biologics Solutions segment recorded a significant $215.0 million goodwill impairment in 2024, impacting its Biologics Testing and CDMO operations. This non-cash charge reflects a reassessment of acquired asset fair values, indicating underperformance relative to initial projections.

Question Marks

Charles River Laboratories International's foray into early-stage cell and gene therapy incubation and acceleration, marked by the 2024 launch of the Charles River Incubator Program (CIP) and Accelerator Program (CAP), positions them as a potential Stars or Question Marks within a BCG Matrix framework. These initiatives offer crucial regulatory guidance and lab resources to emerging biotech firms, aiming to foster innovation in advanced therapies. The partnership with BioTech Social Inc. further underscores their commitment to helping these nascent companies secure vital funding.

Charles River Laboratories (CRL) views China as a prime expansion opportunity for its Research Models and Services (RMS) segment, primarily due to the presence of less sophisticated local competitors. This strategic focus aligns with the BCG matrix's 'question mark' category, suggesting high growth potential but also requiring substantial investment to gain traction.

The Chinese market is experiencing robust growth in drug discovery and development, presenting a significant opportunity for CRL. However, the company's current market share within China for RMS, relative to its global RMS operations, is likely still developing. This necessitates strategic investment to build brand presence and capture a larger portion of this burgeoning market.

Charles River Laboratories' niche or novel discovery service offerings represent potential stars in the BCG matrix, catering to the drug discovery services market's continuous innovation. These specialized platforms target emerging scientific areas with high-growth potential, reflecting a rising demand for specialized testing and new techniques.

While these offerings are in high-growth niches, they currently hold a relatively low market share as they gain traction and adoption. For example, the global drug discovery market was valued at approximately $70 billion in 2023 and is projected to grow significantly, with specialized services forming a key growth driver.

Integration of Advanced Analytics and Digital Transformation Tools

Charles River Laboratories (CRL) is actively pursuing technological advancements to bolster its market position. Initiatives like the Apollo™ platform underscore their commitment to digital transformation and strategic technology partnerships, aiming to enhance their service offerings and operational efficiency.

The integration of AI, machine learning, and advanced analytics is a defining trend within the preclinical contract research organization (CRO) sector. While CRL is investing in these areas, its current market share specifically attributable to these advanced digital solutions is likely still in its early stages. This represents a significant, high-potential growth avenue that requires continued strategic investment to fully realize its market impact and competitive advantage.

- Technology Partnerships: CRL is actively seeking collaborations to integrate cutting-edge digital tools and platforms into its research services.

- Apollo™ Platform: This initiative signifies CRL's focus on digital transformation, aiming to streamline operations and enhance client experience through technology.

- AI and Advanced Analytics Adoption: The preclinical CRO market is seeing increased adoption of AI and advanced analytics, a trend CRL is embracing to drive innovation.

- Nascent Digital Market Share: While a high-growth area, CRL's current market share derived solely from integrated digital solutions is likely nascent, indicating substantial future investment potential.

New Modalities and Therapies Beyond Core Focus

Charles River Laboratories is actively exploring and investing in emerging therapeutic modalities beyond its established core offerings. This strategic move acknowledges the dynamic nature of the life sciences sector, where personalized medicine and targeted therapies are increasingly prominent. The company is likely identifying areas where it can cultivate a strong future market position, even if current dominance isn't yet established.

These new modalities represent significant growth potential but also demand substantial investment in research and development, alongside dedicated market development initiatives. Charles River's engagement in these nascent areas is crucial for capturing future market share and maintaining its competitive edge.

- Personalized Medicine: Charles River is likely developing capabilities to support the growing demand for patient-specific treatments.

- Targeted Therapies: Investments are probably being made in technologies and services that enable the precise delivery of therapeutic agents.

- Advanced Modalities: This could include areas like cell and gene therapies, requiring specialized manufacturing and analytical support.

- R&D Investment: Significant capital allocation is expected to foster innovation and build expertise in these novel therapeutic areas.

Charles River Laboratories' expansion into China for its Research Models and Services (RMS) segment highlights a strategic focus on a high-growth market. While the overall drug discovery market is expanding, CRL's current share in China's RMS sector is likely still developing, positioning it as a Question Mark. This requires significant investment to build brand recognition and capture market share against less sophisticated local competitors.

CRL's investment in digital transformation, exemplified by its Apollo™ platform and the adoption of AI and advanced analytics, places these initiatives in the Question Mark category. The preclinical CRO market is rapidly integrating these technologies, offering substantial growth potential. However, CRL's market share derived specifically from these advanced digital solutions is likely nascent, necessitating continued strategic investment to capitalize on this trend.

Emerging therapeutic modalities, such as personalized medicine and targeted therapies, represent another area where Charles River Laboratories is likely positioned as a Question Mark. These fields offer significant future growth but demand substantial R&D investment and market development to establish a strong market position. The company's engagement in these nascent areas is crucial for future competitiveness.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| China RMS Expansion | High | Low | Question Mark | Requires significant investment to gain market share. |

| Digital Transformation (AI/Analytics) | High | Low | Question Mark | Invest to build market leadership in advanced digital solutions. |

| Emerging Therapeutic Modalities | High | Low | Question Mark | Invest in R&D and market development for future growth. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.