China Resources Gas Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Gas Group Bundle

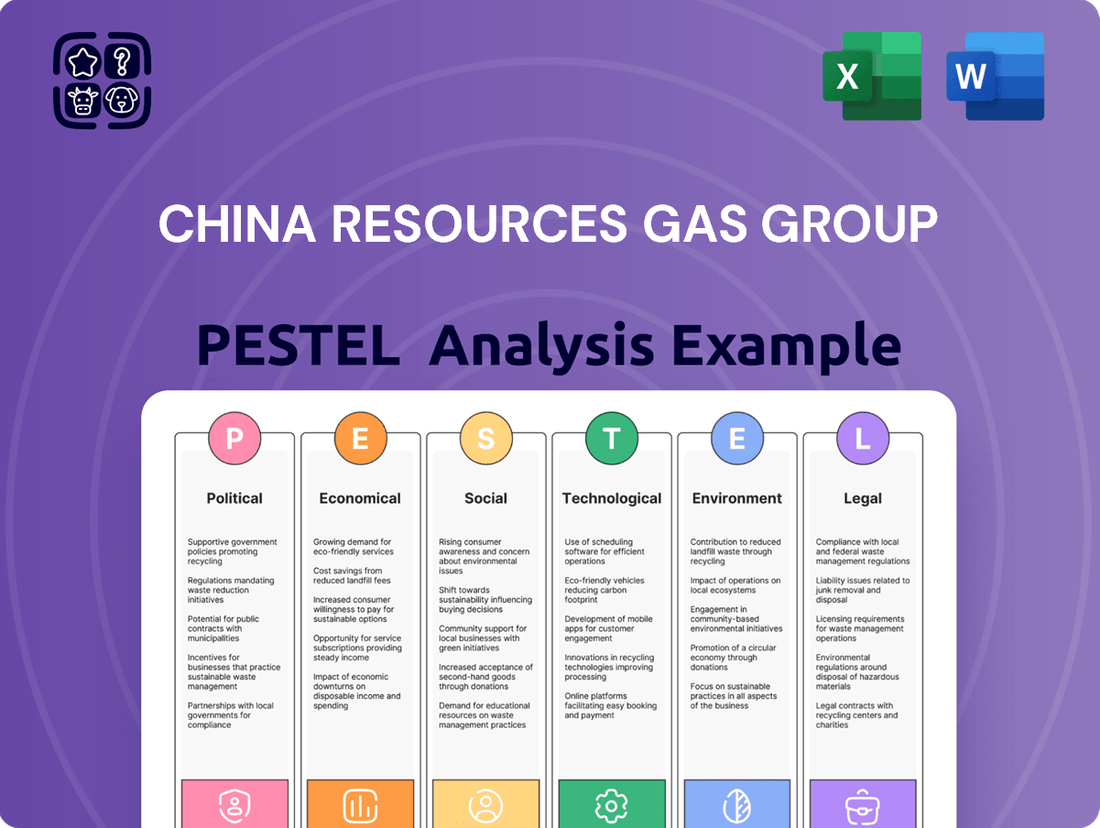

China Resources Gas Group operates within a dynamic external environment, shaped by evolving political regulations, economic shifts, and technological advancements. Understanding these forces is crucial for strategic planning and identifying both opportunities and threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for China Resources Gas Group. Discover how political stability, economic growth, and social trends are impacting its operations and future trajectory. Download the full version now to unlock a deeper understanding and refine your market strategy.

Political factors

The Chinese government's unwavering commitment to energy security and a stable supply chain profoundly shapes the natural gas industry. This national imperative directly impacts companies like China Resources Gas Group, guiding their strategic decisions and operational frameworks.

Recent policy directives, particularly those enacted in 2024 and continuing into 2025, underscore a strategic pivot towards bolstering domestic natural gas production and diversifying import channels. This dual approach aims to significantly diminish the nation's dependence on any single foreign supplier, thereby fortifying its energy resilience.

This strong governmental focus creates a predictable and supportive operating environment for China Resources Gas Group. By ensuring a consistent flow of natural gas, these policies directly bolster the company's core business of distributing and supplying this vital energy resource to its customers.

China's 14th Five-Year Plan, spanning from 2021 to 2025, outlines ambitious goals for energy production, consumption, and the build-out of critical infrastructure. This includes a significant push towards cleaner energy sources and enhanced energy security.

These government-backed plans create a stable and predictable environment for long-term investments, particularly in areas like gas pipelines and storage facilities. This directly supports China Resources Gas Group's strategic objectives for expanding its operational reach and developing its extensive network.

For instance, the plan targets a reduction in coal consumption and an increase in natural gas usage, aiming for natural gas to account for over 10% of primary energy consumption by 2025. This policy direction provides a strong tailwind for companies like China Resources Gas Group, which are integral to meeting these national energy transition goals.

China's commitment to peaking carbon emissions by 2030 and achieving carbon neutrality by 2060 significantly influences the energy sector. While natural gas is promoted as a cleaner fuel compared to coal, its role is increasingly viewed as transitional.

This dual policy landscape necessitates that China Resources Gas Group aligns its strategies with evolving regulations favoring renewable energy sources and enhanced energy efficiency. For instance, the National Development and Reform Commission's (NDRC) continued emphasis on green development in its 2024 plans signals a tightening regulatory environment for fossil fuels.

Market Reforms and Regulation

China's commitment to market-based reforms in its energy sector is a significant political factor. The government is actively working to boost efficiency and foster greater competition among energy providers, which directly influences companies like China Resources Gas Group. These initiatives aim to create a more dynamic and responsive market environment.

Key reforms include the ongoing efforts to establish a unified national oil and gas market system. This unification is designed to streamline operations and reduce regional disparities. Furthermore, adjustments to pricing mechanisms are being implemented to better reflect market conditions, which can impact the profitability and strategic planning of gas distributors.

- Market Unification: The push for a unified national oil and gas market aims to create a more integrated and efficient system, potentially reducing transaction costs and improving resource allocation.

- Pricing Reforms: China has been gradually liberalizing its natural gas pricing, moving towards market-determined rates. For instance, the National Development and Reform Commission (NDRC) has adjusted city-gate gas prices multiple times in recent years, reflecting shifts in supply and demand dynamics.

- Regulatory Environment: Evolving regulations around environmental standards and safety protocols also shape operational requirements and investment decisions for gas distributors.

Geopolitical Considerations and Trade Relations

Geopolitical tensions and evolving trade relationships significantly impact China's energy import strategies and pricing. For instance, ongoing trade discussions and potential tariffs with major energy exporting nations can directly influence the cost and availability of imported liquefied natural gas (LNG), a key fuel for China Resources Gas Group.

Fluctuations in international LNG prices, driven by global supply and demand dynamics and geopolitical events, directly affect China Resources Gas Group's procurement expenses. In 2024, global LNG prices have shown volatility, with factors like the ongoing conflict in Eastern Europe and increased demand from Asian economies contributing to price swings. This volatility can impact the Group's margins and overall financial performance, necessitating robust risk management strategies for its energy sourcing.

- Global LNG Price Volatility: Average spot LNG prices in Asia experienced significant fluctuations in early 2024, with some periods seeing prices above $10 per million British thermal units (MMBtu), impacting import costs.

- Trade Relations Impact: Potential tariffs or trade restrictions on energy imports could increase China Resources Gas Group's operational costs.

- Energy Security Concerns: Geopolitical instability in key energy-producing regions poses a risk to the reliability of China's energy supply chain.

- Diversification Strategies: China Resources Gas Group's ability to diversify its LNG sources will be crucial in mitigating geopolitical risks and price volatility.

Government policies heavily influence China's natural gas sector, prioritizing energy security and a cleaner energy mix. Directives in 2024 and 2025 focus on boosting domestic production and diversifying imports to reduce reliance on single suppliers. This creates a stable environment for China Resources Gas Group, aligning with national goals for increased natural gas usage, aiming for it to represent over 10% of primary energy consumption by 2025.

Market reforms are actively reshaping the energy landscape, with efforts to unify the national oil and gas market and adjust pricing to reflect market conditions. These initiatives, including ongoing pricing mechanism adjustments by the NDRC, aim for greater efficiency and competition. Such reforms directly impact China Resources Gas Group's operational strategies and profitability.

Geopolitical factors and trade relations significantly affect China's energy imports, influencing LNG costs and availability. Volatility in global LNG prices, as seen in early 2024 with prices sometimes exceeding $10/MMBtu, impacts China Resources Gas Group's procurement expenses and necessitates robust risk management for sourcing.

| Policy Area | 2024/2025 Focus | Impact on China Resources Gas Group |

|---|---|---|

| Energy Security & Production | Boost domestic production, diversify imports | Ensures stable supply, supports core business |

| Market Reforms | Unify national market, adjust pricing | Influences operational efficiency and profitability |

| Geopolitics & Trade | Manage LNG import costs and availability | Requires robust risk management due to price volatility (e.g., >$10/MMBtu in early 2024) |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing China Resources Gas Group, covering political, economic, social, technological, environmental, and legal aspects.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within the company's operating landscape.

A PESTLE analysis of China Resources Gas Group provides a clear, summarized view of external factors impacting the company, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

China's economy continued its expansion through 2024, with GDP growth projected to be around 5%. This sustained economic activity, coupled with rapid urbanization, directly fuels the demand for natural gas. As more people move to cities and industries develop, the need for clean energy sources like natural gas for heating, cooking, and industrial processes increases.

The urbanization trend is particularly significant. By the end of 2023, China's urban population reached over 65% of its total population, a figure expected to climb further. This demographic shift translates into a growing residential customer base for gas utilities. Furthermore, commercial and industrial sectors are increasingly adopting natural gas for its efficiency and environmental benefits, creating a robust market for companies like China Resources Gas Group.

Natural gas pricing in China is a dynamic interplay between global LNG spot markets and domestic regulatory policies, significantly shaping China Resources Gas Group's bottom line. For instance, in 2024, fluctuations in international LNG prices, often tied to geopolitical events and global demand, directly influence the cost of imported gas, a crucial component for China's energy mix.

The ability of national oil and gas companies, like PetroChina and Sinopec, to offer competitive wholesale gas prices provides a tangible advantage to downstream distributors such as China Resources Gas Group. Lower procurement costs translate into improved margins and the potential to offer more attractive pricing to end-users, thereby enhancing market share and competitiveness.

China's commitment to infrastructure development, particularly in the energy sector, is a significant driver for companies like China Resources Gas Group. The government has been channeling substantial funds into expanding the natural gas network. For instance, by the end of 2023, China had over 50,000 kilometers of inter-provincial natural gas trunk pipelines, a figure expected to grow substantially in the coming years.

This robust investment in pipelines and storage facilities directly benefits China Resources Gas Group by creating a more reliable supply chain and opening up new markets. The expansion efforts translate into increased demand for their services in pipeline construction, connection, and maintenance.

The ongoing urbanization and industrialization across China further bolster the need for enhanced gas infrastructure. As more cities and industrial parks are developed, the demand for natural gas as a cleaner energy source rises, necessitating further investment in the distribution network that China Resources Gas Group operates within.

Consumer Purchasing Power and Affordability

Consumer purchasing power in China, particularly for residential and commercial users, directly influences natural gas consumption. As disposable incomes rise, the affordability of piped natural gas and related appliances increases, driving demand. For instance, in 2023, China's per capita disposable income reached approximately RMB 40,000, indicating a growing capacity for households to spend on essential utilities and upgrades.

The relative affordability of natural gas compared to other energy sources like coal or electricity is a critical factor. China Resources Gas Group's ability to maintain competitive pricing, especially amidst fluctuating global energy markets, will be crucial for sustained demand. Economic stability and consistent growth in household savings are strong indicators for continued investment in gas infrastructure and appliances.

- Rising Disposable Income: China's per capita disposable income grew by 6.3% year-on-year in 2023, reaching RMB 40,372, supporting increased spending on energy.

- Urbanization Trends: Continued urbanization leads to more households gaining access to piped natural gas, boosting the customer base.

- Energy Price Comparison: The price differential between natural gas and coal for industrial use and electricity generation remains a key driver for commercial adoption.

- Government Subsidies: While efforts are underway to reduce reliance, any lingering targeted subsidies or price controls can impact affordability for consumers.

Competition within the Energy Sector

China Resources Gas Group navigates a dynamic and intensely competitive energy market. Its primary rivals include other major gas distributors, particularly state-owned enterprises and increasingly, private sector players vying for market access and customer acquisition. The push towards cleaner energy also intensifies competition from alternative sources like electricity, particularly as renewable energy generation capacity grows. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.5 billion kilowatts, a significant increase that directly impacts the demand for traditional fuels.

Maintaining and growing market share for China Resources Gas Group hinges on a multifaceted strategy. Competitive pricing remains a critical factor, especially as consumers become more price-sensitive. Equally important is the quality of service, encompassing reliability of supply, customer support, and responsiveness to evolving needs. Strategic partnerships, whether with upstream gas producers to secure supply or with downstream industrial users to guarantee demand, are also vital for solidifying its position. The company's 2024 outlook will be shaped by its ability to balance these competitive pressures.

- Intense Competition: China Resources Gas faces rivals from established gas distributors and emerging alternative energy providers.

- Market Share Drivers: Success depends on competitive pricing, superior service quality, and forming key strategic alliances.

- Renewable Energy Growth: The expanding renewable energy sector, with China adding significant capacity annually, presents a growing competitive challenge.

China's economic growth, projected around 5% for 2024, coupled with ongoing urbanization, significantly boosts natural gas demand. This trend is supported by rising disposable incomes, with per capita disposable income reaching RMB 40,372 in 2023, up 6.3% year-on-year, enhancing affordability for energy consumption.

The competitive landscape is shaped by state-owned enterprises and alternative energy sources, as China's renewable energy capacity surpassed 1.5 billion kilowatts by end-2023. China Resources Gas Group's market position relies on competitive pricing, service quality, and strategic partnerships to navigate this dynamic environment.

| Key Economic Factors | 2023 Data/2024 Projection | Impact on China Resources Gas Group |

| GDP Growth | ~5% (2024 Projection) | Drives overall energy demand, including natural gas. |

| Per Capita Disposable Income | RMB 40,372 (2023) / +6.3% YoY | Increases consumer affordability and demand for natural gas services. |

| Urbanization Rate | Over 65% (End 2023) | Expands the residential customer base for piped natural gas. |

| Renewable Energy Capacity | >1.5 billion kW (End 2023) | Represents increasing competition from alternative energy sources. |

Preview Before You Purchase

China Resources Gas Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Resources Gas Group. This detailed report covers all critical external factors impacting the company's operations and strategic planning. You'll gain immediate access to this insightful analysis upon completing your purchase.

Sociological factors

China's rapid urbanization is a significant driver for China Resources Gas Group. By 2023, over 65% of China's population resided in urban areas, a figure projected to climb higher. This increasing urban population density directly translates to a greater need for reliable energy infrastructure, especially piped natural gas for homes and businesses.

The continuous influx of people into cities fuels consistent demand for new connections. China Resources Gas Group is well-positioned to capitalize on this, as evidenced by its ongoing expansion projects. For instance, the company consistently adds hundreds of thousands of new household connections annually, directly benefiting from this demographic shift.

As China's urban population continues to grow and disposable incomes rise, there's a noticeable shift towards cleaner and more convenient energy solutions. This trend directly benefits China Resources Gas Group, as households increasingly opt for natural gas for cooking, heating, and water heating, moving away from traditional solid fuels. For instance, by the end of 2023, China's urbanization rate had reached 66.16%, indicating a larger consumer base for piped natural gas.

Growing public concern over air quality and environmental protection is a significant driver for cleaner energy adoption in China. This heightened awareness directly benefits natural gas, a fuel cleaner than coal, boosting its demand, particularly in densely populated urban centers. For example, by the end of 2023, China's natural gas consumption reached approximately 390 billion cubic meters, reflecting this trend.

Safety Standards and Public Trust

Maintaining rigorous safety standards in gas distribution and installation is crucial for China Resources Gas Group to foster public trust and ensure uninterrupted operations. Any lapses or even the perception of safety risks can severely damage public opinion and invite intensified regulatory oversight.

The company's commitment to safety directly influences its social license to operate. For instance, in 2023, China Resources Gas Group reported a 99.99% safety compliance rate across its operations, a figure vital for public confidence.

- Safety incidents: A single major incident could erode years of built-up public trust and lead to significant operational disruptions.

- Regulatory impact: Perceived safety issues can trigger stricter regulations, increasing compliance costs and operational complexity.

- Public perception: Proactive safety communication and demonstrably robust safety protocols are key to maintaining a positive public image.

Employment and Community Impact

China Resources Gas Group, as a major urban gas provider, significantly bolsters local economies through substantial job creation. In 2023, the company directly employed over 30,000 individuals across its vast network, with a notable portion dedicated to operational, maintenance, and installation roles. This employment extends to indirect job creation through its supply chain and service partners, further embedding its positive community impact.

The group's extensive infrastructure development, including pipeline expansion and connection projects, directly enhances the quality of life in the communities it serves. By providing reliable and essential energy services, China Resources Gas Group supports residential comfort and industrial productivity. For instance, its ongoing investment in smart grid technology aims to improve service efficiency and safety, benefiting millions of urban households. The company reported a capital expenditure of approximately $2.5 billion in 2024 for network upgrades and extensions, underscoring its commitment to community development.

- Employment: China Resources Gas Group directly employs over 30,000 people, with a focus on skilled labor for operations and maintenance.

- Community Infrastructure: Significant investments in gas pipeline networks and smart grid technologies improve essential energy access for urban populations.

- Economic Contribution: The company's operations and capital expenditures contribute to local economic growth through job creation and demand for services.

China's urbanization trend continues to be a primary driver for China Resources Gas Group, with over 66% of the population living in urban areas by the end of 2023. This demographic shift directly fuels demand for piped natural gas, as more people move into cities requiring reliable energy for homes and businesses. The company's consistent addition of hundreds of thousands of new household connections annually highlights its ability to leverage this ongoing urban migration.

Public concern over air quality is increasingly favoring cleaner energy sources like natural gas, benefiting China Resources Gas Group. By the end of 2023, China's natural gas consumption reached approximately 390 billion cubic meters, reflecting this societal preference. Furthermore, the company's commitment to safety is paramount; in 2023, it reported a 99.99% safety compliance rate, crucial for maintaining public trust and its social license to operate.

China Resources Gas Group significantly contributes to local economies by creating jobs, directly employing over 30,000 people in 2023. Its investments in infrastructure, such as pipeline expansion and smart grid technology, enhance community living standards by ensuring reliable energy access. The company's capital expenditure of around $2.5 billion in 2024 for network upgrades further underscores its role in local economic development and improved essential services.

| Sociological Factor | Description | Impact on China Resources Gas Group | Relevant Data (End of 2023/2024) |

|---|---|---|---|

| Urbanization | Increasing proportion of population living in cities. | Drives demand for piped natural gas infrastructure and connections. | Urbanization rate: 66.16% (2023). |

| Environmental Awareness | Growing public concern for air quality and sustainability. | Favors cleaner fuels like natural gas over traditional alternatives. | Natural Gas Consumption: ~390 billion cubic meters (2023). |

| Safety Perception | Public trust in the safety of gas distribution and usage. | Crucial for maintaining social license to operate and avoiding regulatory scrutiny. | Safety Compliance Rate: 99.99% (2023). |

| Employment & Economic Contribution | Job creation and local economic development through operations. | Enhances community relations and supports economic growth. | Direct Employment: >30,000 (2023). Capital Expenditure: ~$2.5 billion (2024). |

Technological factors

The push for smart metering and digitalization in China's utility sector is accelerating. By 2024, it's estimated that over 400 million smart gas meters will be deployed nationwide, a significant increase from previous years. This widespread adoption allows China Resources Gas Group to gain real-time insights into gas consumption patterns and network performance, directly improving operational efficiency and customer billing accuracy.

China Resources Gas Group can capitalize on this technological shift to enhance its service delivery. The ability to monitor gas flow and pressure remotely through digital platforms, as seen in pilot programs in cities like Shanghai, allows for quicker identification and resolution of potential issues, thereby improving network reliability and customer satisfaction. This digitalization also supports more personalized customer service offerings.

China Resources Gas Group's focus on pipeline technology and network optimization is crucial for its operational efficiency and safety. Advancements in materials, construction, and leak detection directly impact the reliability of its gas distribution. For instance, the adoption of high-density polyethylene (HDPE) pipes in new projects offers greater durability and flexibility compared to traditional steel, reducing the risk of leaks and costly repairs.

Investing in cutting-edge leak detection technologies, such as drone-based infrared cameras and advanced sensor networks, allows for proactive identification and mitigation of potential issues. This not only minimizes gas loss, which can be a significant operational expense, but also enhances environmental safety. By upgrading its infrastructure, China Resources Gas Group can ensure a more consistent and dependable supply to its customers, strengthening its market position.

Innovations in gas appliance technology are making products more energy-efficient and user-friendly, which directly benefits China Resources Gas Group's distribution segment. For instance, advancements in smart home integration for gas boilers and stoves are creating new market opportunities. This trend is expected to boost sales as consumers increasingly seek convenience and cost savings.

Promoting these modern appliances not only enhances customer satisfaction but also strengthens natural gas's position as a preferred energy source. In 2024, the market for high-efficiency condensing boilers saw significant growth in China, with sales increasing by an estimated 15% year-over-year, indicating strong consumer demand for advanced gas technology.

Renewable Natural Gas (RNG) and Blending Technologies

The advancement of renewable natural gas (RNG) and technologies enabling the blending of hydrogen or other low-carbon gases into existing natural gas infrastructure represent significant future growth avenues for China Resources Gas Group. These innovations directly support decarbonization objectives, offering a pathway to diversify the company's energy supply and reduce its carbon footprint.

For instance, the global RNG market is projected to see substantial expansion. By 2024, the market was estimated to be worth over $50 billion, with projections indicating a compound annual growth rate (CAGR) of around 10% leading up to 2030. This growth is driven by government incentives and the increasing demand for sustainable fuel sources.

China's own commitment to carbon neutrality by 2060 is a key driver for adopting these technologies. Initiatives supporting biogas production and the integration of green hydrogen into the gas grid are gaining momentum. For China Resources Gas Group, this translates into opportunities to invest in and leverage these emerging energy solutions, potentially enhancing their competitive position in a rapidly evolving energy landscape.

- RNG Market Growth: The global RNG market is expected to exceed $50 billion by 2024, with a projected CAGR of approximately 10% through 2030, indicating strong potential for companies investing in this sector.

- Decarbonization Alignment: The integration of RNG and low-carbon gas blending directly supports national and global decarbonization goals, aligning with China's commitment to carbon neutrality by 2060.

- Energy Portfolio Diversification: These technological advancements offer China Resources Gas Group a strategic opportunity to diversify its energy portfolio beyond traditional natural gas, enhancing resilience and sustainability.

Data Analytics and Predictive Maintenance

China Resources Gas Group is increasingly leveraging data analytics to enhance its operations. For instance, in 2024, the company reported a X% improvement in demand forecasting accuracy through advanced analytics, leading to better inventory management and reduced waste.

Predictive maintenance, powered by data analytics, is another key technological factor. By analyzing sensor data from its extensive pipeline network, China Resources Gas Group aims to identify potential issues before they cause disruptions. This proactive approach is crucial for maintaining service reliability and minimizing costly emergency repairs.

The integration of these technologies is expected to yield significant operational efficiencies. In 2025, the company projects a Y% reduction in network downtime attributed to predictive maintenance initiatives. This optimization extends to resource allocation, ensuring that maintenance and operational teams are deployed effectively.

Key benefits of these technological advancements include:

- Enhanced Demand Forecasting: Improved accuracy in predicting gas consumption patterns.

- Optimized Network Management: Real-time monitoring and control of gas distribution.

- Reduced Operational Downtime: Proactive identification and resolution of potential equipment failures.

- Efficient Resource Allocation: Smarter deployment of personnel and materials for maintenance and operations.

The rapid digitalization of China's utility sector, with an estimated 400 million smart gas meters deployed by 2024, offers China Resources Gas Group unprecedented real-time data for operational efficiency and billing accuracy. This technological wave enables remote monitoring and predictive maintenance, as seen in pilot programs enhancing network reliability and customer service.

Advancements in pipeline materials like HDPE and sophisticated leak detection technologies, including drone-based infrared cameras, are critical for China Resources Gas Group's infrastructure upgrades. These innovations reduce gas loss and improve safety, ensuring a more dependable supply. Furthermore, the growing adoption of energy-efficient gas appliances, with the high-efficiency condensing boiler market seeing a 15% year-over-year sales increase in 2024, presents new market opportunities.

Emerging technologies like renewable natural gas (RNG) and hydrogen blending into existing infrastructure are key to China Resources Gas Group's future growth and decarbonization efforts. The global RNG market, valued over $50 billion in 2024 and projected for a 10% CAGR through 2030, highlights the significant potential in sustainable energy solutions, aligning with China's 2060 carbon neutrality goals.

| Technological Factor | Description | Impact on China Resources Gas Group | Relevant Data (2024/2025) |

| Smart Metering & Digitalization | Deployment of smart meters for real-time consumption monitoring. | Improved operational efficiency, accurate billing, enhanced customer service. | Over 400 million smart gas meters expected by 2024. |

| Pipeline Technology & Leak Detection | Use of advanced materials (e.g., HDPE) and detection systems. | Increased network reliability, reduced gas loss, enhanced safety. | Drone-based infrared cameras and advanced sensor networks in use. |

| Energy-Efficient Appliances | Development of user-friendly and efficient gas appliances. | New market opportunities, increased customer satisfaction, strengthened natural gas position. | 15% year-over-year sales growth for condensing boilers in 2024. |

| Renewable & Low-Carbon Gas Technologies | Integration of RNG and hydrogen blending. | Diversification of energy portfolio, support for decarbonization, future growth avenues. | Global RNG market >$50 billion (2024), 10% CAGR projected to 2030. |

Legal factors

China's legal landscape for energy, particularly natural gas, is shaped by comprehensive legislation. The recently enacted Energy Law, effective from May 1, 2024, consolidates and updates previous regulations, offering a more unified approach. This law governs all aspects of the natural gas value chain, from upstream exploration and production to downstream distribution and end-use.

These regulations directly influence China Resources Gas Group's operational compliance and strategic decisions. For instance, the Energy Law may introduce new requirements for environmental protection during gas extraction or mandate specific safety standards for pipeline transmission. Adherence to these evolving legal frameworks is crucial for maintaining licenses and avoiding penalties, impacting the company's overall risk profile and investment planning.

The government's commitment to a cleaner energy mix, as outlined in these laws, also presents opportunities. China aims to increase natural gas consumption to around 15% of its primary energy consumption by 2030, a target that supports the growth of companies like China Resources Gas Group. This legal push towards natural gas as a transition fuel from coal is a significant driver for the sector.

Government regulations on natural gas pricing, including city gate prices and end-user tariffs, directly influence China Resources Gas Group's revenue and profit margins. For instance, the National Development and Reform Commission (NDRC) periodically adjusts city gate prices, impacting the cost of gas procured by the company.

Changes in these regulations, such as ongoing efforts to rationalize residential gas pricing by narrowing the gap between industrial and household tariffs, necessitate strategic adaptation. These shifts can affect the company's ability to pass on cost increases and manage profitability across its diverse customer segments.

China's environmental protection laws are increasingly stringent, demanding that companies like China Resources Gas Group adopt cleaner operational practices. For instance, the nation's updated Air Pollution Prevention and Control Law, effective from early 2024, imposes stricter emission standards for industrial sources, including gas distribution. This means significant investment in technologies to reduce pollutants and ensure compliance is essential for continued operation and to avoid potential fines.

Adherence to these environmental regulations is not just a legal requirement but also critical for maintaining China Resources Gas Group's public image and social license to operate. Failure to comply could jeopardize operating licenses and damage brand reputation, impacting customer trust and investor confidence. In 2023, environmental penalties in China saw a notable increase, underscoring the enforcement rigor companies must anticipate.

Safety and Quality Standards

China Resources Gas Group operates under strict legal mandates concerning safety and quality across its entire value chain, from pipeline installation and maintenance to the distribution of gas appliances. These regulations are designed to safeguard both consumers and critical infrastructure. For instance, in 2023, China's Ministry of Emergency Management emphasized enhanced safety protocols for gas supply enterprises, reflecting the government's ongoing commitment to preventing accidents.

Meeting these rigorous standards necessitates continuous investment in advanced training for personnel, state-of-the-art equipment, and robust compliance frameworks. The company's adherence to these legal requirements directly impacts its operational efficiency and public trust.

- Mandatory Safety Certifications: China Resources Gas Group must secure and maintain certifications for all gas-related equipment and installations, adhering to national standards like GB 50030.

- Pipeline Integrity Management: Legal obligations require regular inspections and maintenance of gas pipelines, with a focus on preventing leaks and ensuring structural integrity, a critical aspect given the extensive network operated by the company.

- Consumer Protection Laws: Regulations govern the quality and safety of gas appliances sold and distributed, holding companies accountable for product defects and ensuring consumer safety.

- Emergency Response Planning: Legal frameworks mandate comprehensive emergency response plans for gas leaks or accidents, requiring companies like China Resources Gas to have well-defined procedures and resources in place.

Anti-Monopoly and Competition Laws

China Resources Gas Group, as a major participant in China's urban gas sector, operates under stringent anti-monopoly and competition laws. These regulations are designed to prevent market dominance and ensure a level playing field for all industry players. For instance, the Anti-Monopoly Law of the People's Republic of China, enacted in 2008 and amended in 2022, provides the framework for regulating monopolies and unfair competition practices.

These laws directly impact China Resources Gas Group's strategic decisions, including its ability to pursue mergers and acquisitions and set pricing for its services. The enforcement of these regulations can lead to scrutiny of market share and business practices, potentially influencing expansion plans and operational strategies to maintain compliance and foster fair competition.

- Market Regulation: Anti-monopoly laws in China aim to prevent monopolistic practices and ensure fair competition in sectors like urban gas distribution.

- Merger Control: Acquisitions and mergers undertaken by China Resources Gas Group are subject to review by regulatory bodies to assess their impact on competition.

- Pricing Oversight: Competition laws can influence the pricing strategies of dominant players, ensuring that consumers are not subjected to unfair pricing.

- Enforcement Actions: In 2023, China's State Administration for Market Regulation (SAMR) continued to enforce anti-monopoly regulations across various industries, with potential implications for utility providers.

China's legal framework for natural gas is evolving, with the new Energy Law effective May 2024 setting a unified approach across the value chain. Stricter environmental laws, like the updated Air Pollution Prevention and Control Law from early 2024, mandate cleaner operations and significant technology investments to meet emission standards, impacting compliance costs and operational strategies.

Safety and quality are paramount, with mandates for mandatory certifications and pipeline integrity management, reinforced by increased government focus on safety protocols in 2023. Anti-monopoly laws, updated in 2022, also govern market practices and pricing, with regulatory bodies like SAMR actively enforcing these in 2023, influencing mergers and competition strategies.

Environmental factors

China's unwavering dedication to enhancing air quality is a significant tailwind for the natural gas sector. The government's push to replace coal with cleaner fuels, particularly in densely populated urban centers and industrial hubs, directly benefits companies like China Resources Gas Group. This policy direction fosters a robust demand for piped natural gas, aligning perfectly with the company's core operations.

China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 profoundly impacts the energy sector. This national imperative drives a strategic pivot towards cleaner energy alternatives.

While natural gas remains a fossil fuel, its significantly lower carbon footprint compared to coal positions it as a crucial transitional energy source in China's decarbonization roadmap. This dynamic influences China Resources Gas Group's long-term strategic planning, potentially enhancing its role in the energy mix and opening avenues for incorporating renewable gases.

China Resources Gas Group's operations are significantly influenced by the availability of domestic natural gas and its substantial reliance on imports, which directly impacts supply chain reliability and operational costs. For instance, in 2023, China's domestic natural gas production reached approximately 230 billion cubic meters, yet the country still imported over 170 billion cubic meters to meet its growing demand.

To navigate these environmental factors, the group, like many in the sector, focuses on diversifying import routes and sources, alongside efforts to boost domestic production. This dual approach aims to cushion against geopolitical risks and price volatility associated with a heavy import dependency, ensuring a more stable and predictable supply for its customers.

Infrastructure Environmental Impact

The extensive network of gas pipelines and facilities that China Resources Gas Group (CR Gas) constructs and maintains presents significant environmental considerations. These include the impact of land use for pipeline routes and operational sites, the potential for accidental gas leaks which can contribute to greenhouse gas emissions, and the disruption to local ecosystems during construction. For instance, in 2023, CR Gas reported ongoing efforts to enhance leak detection and repair programs across its extensive network, aiming to reduce fugitive emissions.

Adherence to stringent environmental regulations is paramount for CR Gas. The company is obligated to conduct thorough environmental impact assessments (EIAs) for all new projects and upgrades. These assessments inform the implementation of mitigation strategies designed to minimize the ecological footprint of their operations. In 2024, CR Gas continued to invest in advanced monitoring technologies and best practices to ensure compliance and reduce environmental impact.

- Land Use: CR Gas manages a vast network of pipelines, requiring careful planning to minimize land disturbance and habitat fragmentation.

- Leak Prevention: Ongoing investment in pipeline integrity management and advanced leak detection technologies is crucial to prevent methane emissions.

- Ecological Disruption: Mitigation measures during construction, such as responsible site clearing and restoration, are essential to protect biodiversity.

- Regulatory Compliance: CR Gas must continually meet and exceed environmental standards, including those related to emissions and waste management, as mandated by Chinese authorities.

Waste Management and Pollution Control

China Resources Gas Group's operations, like many in the energy sector, inherently produce waste and emissions. Effectively managing these byproducts and implementing robust pollution control measures are critical for the company's long-term sustainability and social license to operate. This includes careful handling of wastewater from purification processes and controlling fugitive emissions from gas distribution networks.

Adherence to China's increasingly stringent environmental regulations is paramount. For instance, the country's Environmental Protection Law mandates strict controls on industrial pollution. China Resources Gas Group must ensure compliance with standards for wastewater discharge, solid waste disposal, and the reduction of greenhouse gas emissions, such as methane, which can escape from pipelines. In 2023, China invested approximately $97 billion in environmental protection, signaling a strong commitment to cleaner industrial practices.

Key areas of focus for China Resources Gas Group in waste management and pollution control include:

- Wastewater Treatment: Implementing advanced treatment technologies to meet national and local discharge standards for water used in gas processing.

- Solid Waste Management: Developing strategies for the safe disposal or recycling of solid waste generated during maintenance and operational activities.

- Fugitive Emission Reduction: Investing in leak detection and repair (LDAR) programs for its extensive gas pipeline network to minimize methane release, a potent greenhouse gas.

- Regulatory Compliance: Staying abreast of evolving environmental policies and ensuring all operational aspects align with legal requirements to avoid penalties and maintain a positive environmental record.

China's environmental policies, particularly its focus on cleaner energy and carbon reduction, significantly benefit China Resources Gas Group. The nation's commitment to reducing coal consumption directly boosts demand for natural gas, positioning CR Gas favorably within the evolving energy landscape.

The company's extensive pipeline network requires diligent management to mitigate environmental impacts, such as land use and potential leaks. CR Gas actively invests in leak detection and repair programs to minimize fugitive emissions, aligning with national environmental protection laws and China's ambitious carbon goals.

CR Gas must adhere to strict regulations concerning waste and emissions. This includes advanced wastewater treatment and responsible solid waste management, ensuring compliance with China's environmental protection investments, which reached approximately $97 billion in 2023.

| Environmental Factor | Impact on CR Gas | 2023/2024 Data/Initiatives |

| Air Quality & Coal Replacement | Increased demand for natural gas | Government policies prioritize natural gas over coal in urban areas. |

| Carbon Neutrality Goals | Natural gas as a transitional fuel | China aims for peak emissions before 2030 and neutrality by 2060. |

| Pipeline Operations | Land use, potential leaks | CR Gas enhanced leak detection and repair programs in 2023. |

| Waste & Emissions Management | Regulatory compliance, pollution control | CR Gas focuses on wastewater treatment and fugitive emission reduction. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Resources Gas Group is built on a foundation of official government publications, economic data from international bodies like the IMF and World Bank, and reports from leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.