China Resources Gas Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Gas Group Bundle

China Resources Gas Group navigates a landscape shaped by intense competition, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping China Resources Gas Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Resources Gas Group's reliance on a select group of natural gas providers, notably state-owned giants like PetroChina, Sinopec, and CNOOC, alongside international LNG and pipeline gas sources, highlights a concentrated supplier market. This limited supplier base grants them considerable leverage, particularly in the domestic pipeline gas sector where long-term agreements and government regulations shape pricing and availability.

Natural gas is the absolute bedrock of China Resources Gas Group's business. It's not just a commodity; it's the fuel for their piped gas sales, the energy for their vehicle refueling stations, and the core of their gas appliance distribution. This means if the natural gas supply falters, the company's entire operation is in jeopardy, giving suppliers significant leverage.

Switching natural gas suppliers presents considerable hurdles for China Resources Gas Group. These can include the substantial expense of renegotiating existing long-term supply agreements, which often contain complex terms and conditions. Furthermore, adapting infrastructure to accommodate different gas sources, such as transitioning between pipeline gas and Liquefied Natural Gas (LNG), requires significant capital investment and technical expertise.

Securing new transportation and distribution agreements also adds to the complexity and cost of switching. While China Resources Gas Group has strategically broadened its procurement by entering into new LNG contracts and gaining direct access to import terminals, these efforts do not eliminate the inherent costs and operational disruptions associated with such significant changes. For instance, in 2023, the company continued to invest in its LNG receiving terminals, indicating a commitment to flexibility but also highlighting the ongoing capital expenditure involved in managing diverse supply chains.

Availability of Substitute Inputs for Suppliers

The bargaining power of suppliers for China Resources Gas Group is influenced by the availability of substitute inputs for those suppliers. While natural gas is a specific commodity, major gas producers and suppliers possess significant flexibility. They can readily export Liquefied Natural Gas (LNG) to international markets or redirect pipeline gas to other domestic buyers, particularly as global natural gas demand remains robust.

This ability for suppliers to easily find alternative customers, such as in the European or Asian LNG markets, significantly enhances their negotiating leverage. For instance, in 2024, global LNG prices have seen fluctuations influenced by geopolitical events and demand shifts, creating opportunities for suppliers to secure more favorable terms elsewhere if negotiations with China Resources Gas Group prove difficult.

- Supplier Flexibility: Major natural gas suppliers can export LNG or sell to other domestic buyers, reducing reliance on any single customer like China Resources Gas Group.

- Global Market Dynamics: Robust global demand for natural gas in 2024 provides suppliers with alternative, often lucrative, outlets for their product.

- Negotiating Power: This flexibility strengthens suppliers' positions, allowing them to command better prices and terms from China Resources Gas Group.

Threat of Forward Integration by Suppliers

Major natural gas producers in China, like PetroChina and Sinopec, are integrated from upstream exploration and production all the way through to transmission and even some downstream distribution. This inherent vertical integration presents a significant threat of forward integration for China Resources Gas Group.

These integrated producers could, in theory, decide to expand their direct involvement in urban gas distribution, effectively becoming competitors in the very markets China Resources Gas Group serves. This capability grants them considerable bargaining power during negotiations for gas supply contracts.

While market structures and regulatory frameworks may currently limit the extent of this direct competition, the potential for suppliers to move downstream remains a key factor influencing supply agreements. For instance, in 2024, China's natural gas production reached approximately 230 billion cubic meters, with major state-owned enterprises dominating this output.

- Vertical Integration: Key Chinese gas producers are involved in exploration, production, and transmission.

- Forward Integration Threat: Suppliers can potentially enter urban gas distribution, directly competing with China Resources Gas Group.

- Supplier Leverage: This potential competition enhances suppliers' bargaining power in price and contract negotiations.

- 2024 Production Data: China's natural gas output was around 230 billion cubic meters, highlighting the scale of major producers.

The bargaining power of suppliers for China Resources Gas Group is substantial due to the concentrated nature of the natural gas market and the critical role of gas in the company's operations. Suppliers, often large state-owned enterprises or international entities, can leverage their market position and the high switching costs for China Resources Gas Group to negotiate favorable terms.

The global demand for natural gas, particularly LNG, in 2024 means suppliers have viable alternative markets, strengthening their negotiating stance. For instance, in 2023, China's natural gas consumption reached approximately 390 billion cubic meters, indicating a significant and consistent demand base for suppliers.

| Factor | Impact on China Resources Gas Group | Supplier Leverage |

|---|---|---|

| Concentrated Supplier Market | Reliance on a few key providers | High |

| High Switching Costs | Significant investment and disruption to change suppliers | High |

| Supplier Flexibility (Global Markets) | Suppliers can sell to other nations, especially with strong 2024 LNG demand | High |

| Potential for Forward Integration | Suppliers could enter distribution, creating competition | Moderate to High |

What is included in the product

This analysis of China Resources Gas Group's competitive landscape reveals significant barriers to entry, moderate supplier power, and intense rivalry among existing players, all while highlighting the growing influence of customers and the threat of substitutes.

Gain a strategic advantage by instantly visualizing the competitive landscape of China Resources Gas Group, highlighting key pressures from suppliers, buyers, new entrants, substitutes, and rivals.

Customers Bargaining Power

China Resources Gas Group's customer base is extensive, encompassing 60.1 million residential customers by the close of 2024, alongside numerous commercial and industrial clients spread across many Chinese cities. This broad reach means that while individual residential users have minimal influence, larger industrial and commercial entities with significant gas consumption can exert more pressure during price and contract negotiations.

China Resources Gas Group's customers do have some alternatives, like electricity, LPG, and even coal for industrial needs. While government policy leans towards natural gas for its cleaner profile, the presence of these substitutes gives customers leverage, especially those focused on cost, such as industrial clients.

For residential and many commercial clients of China Resources Gas Group, switching to alternative energy sources presents considerable switching costs. These can include replacing gas appliances, modifying existing infrastructure, and incurring new installation fees, which collectively dampen their individual bargaining power.

However, the landscape shifts for new construction projects and large industrial consumers. At the initial decision-making stage, these entities often have greater flexibility in selecting their primary energy source, potentially increasing their leverage during negotiations with gas suppliers.

Price Sensitivity of Customers

China Resources Gas Group faces varying price sensitivity among its customer base. Residential customers, while needing gas for essential services, are largely insulated from direct price fluctuations due to government-regulated tariffs. For instance, in 2024, domestic gas prices in many regions remained stable, reflecting policy rather than market forces.

Conversely, industrial and commercial clients exhibit a much higher degree of price sensitivity. These users, particularly in manufacturing and energy-intensive sectors, view natural gas as a significant operational cost. A 2024 report indicated that a 10% increase in industrial gas prices could lead to a 3-5% reduction in demand from this segment as they explore alternative fuels or efficiency improvements.

- Residential Customer Price Sensitivity: Low, influenced by regulated pricing and essential service nature.

- Industrial Customer Price Sensitivity: High, as energy costs directly impact competitiveness and profitability.

- Impact of Price Changes: Industrial customers may switch to alternatives or reduce consumption if prices rise significantly.

- 2024 Data Point: A 10% industrial gas price hike could decrease demand by 3-5%.

Threat of Backward Integration by Customers

The threat of backward integration by customers for China Resources Gas Group (CR Gas) is generally low. It's highly impractical for individual residential or even most commercial clients to generate their own natural gas supply.

While large industrial users possess greater resources, the significant capital investment and technical expertise required for natural gas production and distribution make backward integration a very remote possibility for them. For instance, building and operating liquefaction plants or extensive pipeline networks are prohibitively expensive for most individual customers.

However, there's a nuanced consideration for very large industrial parks or major property developers. These entities might explore the feasibility of direct natural gas procurement or even localized production if the scale and economics align. For example, a large industrial zone could potentially invest in its own gasification facilities if it secures a consistent and substantial off-take agreement.

- Low Threat for Residential and Commercial Customers: Individual households and small to medium-sized businesses lack the scale and resources to undertake gas production.

- Impracticality for Most Industrial Customers: The immense capital and technological barriers prevent most large industrial users from backward integrating into gas production.

- Potential for Large Industrial Parks/Developers: Extremely large consumers, like industrial parks or major developers, might investigate direct procurement or localized production if economically viable.

The bargaining power of China Resources Gas Group's customers is moderate, influenced by customer segmentation and price sensitivity. While millions of residential customers have little individual power due to regulated tariffs and high switching costs, large industrial and commercial clients can exert more pressure, especially given their sensitivity to price changes and the availability of alternative energy sources.

For instance, in 2024, a 10% increase in industrial gas prices could have led to a 3-5% reduction in demand from this segment, highlighting their leverage. Backward integration is generally not a threat, though very large industrial parks might explore direct procurement.

| Customer Segment | Bargaining Power Driver | 2024 Impact |

|---|---|---|

| Residential | Low individual power, high switching costs, regulated pricing | Minimal price sensitivity |

| Commercial/Industrial | Higher volume, price sensitivity, availability of alternatives | Potential demand reduction (3-5% for 10% price hike) |

| Large Industrial Parks/Developers | Potential for direct procurement/localized production | Low, but growing consideration for significant scale |

What You See Is What You Get

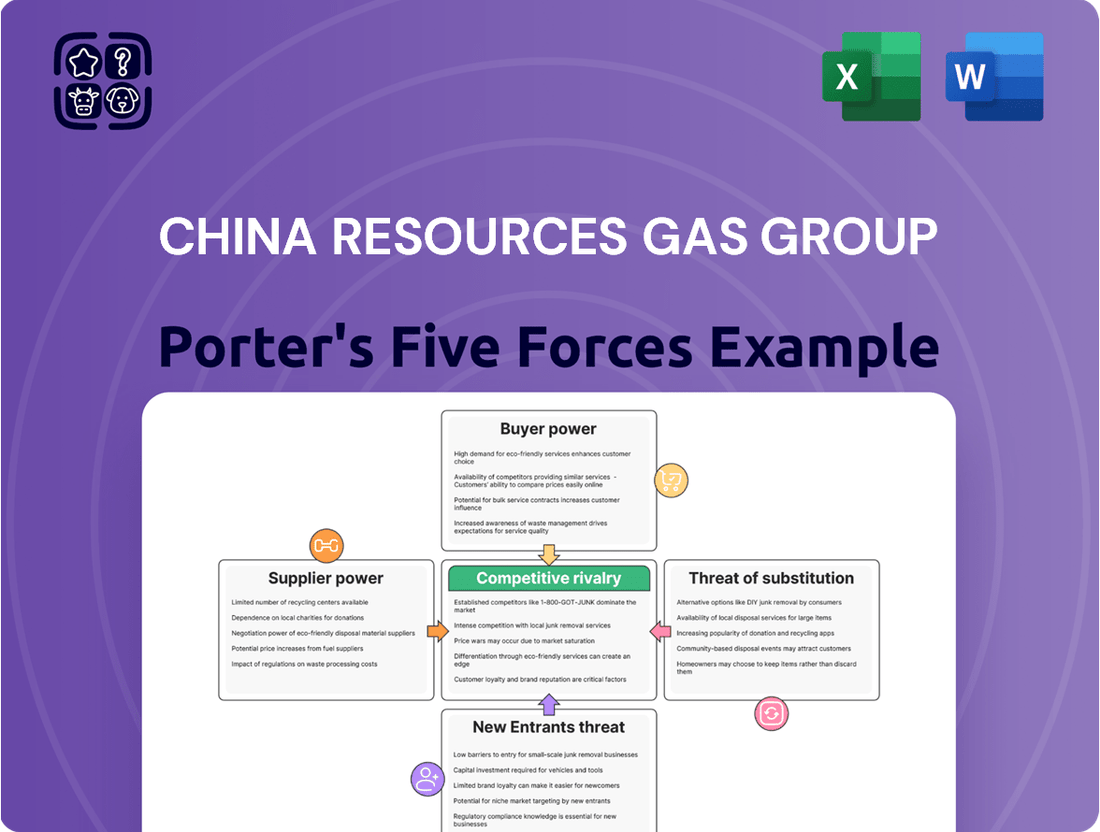

China Resources Gas Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for China Resources Gas Group, detailing the competitive landscape including threats of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry. The document you see here is precisely what you will receive, fully formatted and ready for immediate use upon purchase.

Rivalry Among Competitors

The urban gas market in China is quite crowded, with many companies vying for business. China Resources Gas Group stands out as a major player, securing over 9% of the market share based on gas sales volume in 2024.

While large state-owned enterprises and regional gas distributors are significant competitors, the way city gas concessions are awarded can actually reduce direct rivalry within particular cities or regions, creating pockets of less intense competition.

China's natural gas sector is experiencing robust expansion, with consumption projected to climb by an estimated 6.5% in 2025. This upward trend presents significant avenues for growth and market penetration.

However, this expanding market also fuels intensified competition. As more players enter or seek to increase their presence, companies like China Resources Gas Group face heightened rivalry for customer acquisition and regional dominance.

While piped natural gas itself is largely a commodity with minimal inherent differentiation, China Resources Gas Group actively distinguishes itself through a robust suite of value-added services. This includes seamless pipeline installation, the provision of gas appliances, and the expansion into diversified energy solutions such as vehicle gas refueling stations and integrated energy services.

This strategy allows China Resources Gas Group to move beyond basic gas provision, fostering customer loyalty and creating additional revenue streams. For instance, in 2023, the company reported significant growth in its integrated energy solutions segment, contributing to its overall competitive edge in a market where the core product offers little distinction.

Exit Barriers

Exit barriers for China Resources Gas Group are notably high in the urban gas distribution sector. This is largely due to the substantial capital tied up in extensive pipeline networks and gas receiving stations, which are critical but immobile assets. For instance, the company's significant investments in infrastructure across numerous Chinese cities represent a considerable sunk cost.

Furthermore, long-term concession agreements with local governments create another layer of commitment, making a swift exit impractical. These agreements often span decades and are designed to ensure stable service provision, effectively locking companies into their operational territories. The essential nature of gas supply also means regulators are unlikely to permit abrupt withdrawals, further solidifying these exit barriers.

These high exit barriers can lead to a situation where companies, including China Resources Gas, may continue to operate even when facing reduced profitability. The difficulty in divesting specialized infrastructure and fulfilling contractual obligations means that competitive pressures can persist, as exiting the market is not a straightforward or cost-effective option.

- Infrastructure Investment: Significant capital expenditure on pipelines and distribution networks creates substantial sunk costs, making asset liquidation difficult.

- Concession Agreements: Long-term contracts with local governments bind companies to service provision, hindering rapid market departure.

- Essential Service: The critical nature of gas supply for urban populations and industries means regulatory hurdles for exiting are high.

- Sustained Competition: High exit barriers can compel companies to remain in the market, potentially intensifying competition even in less profitable periods.

Strategic Stakes and Commitments

China Resources Gas Group, as a state-owned enterprise (SOE), holds significant strategic importance for China's energy security and environmental objectives. This backing translates into robust government support and a clear commitment to sustained growth, which can fuel aggressive expansion and investment within the competitive gas distribution landscape.

This strategic imperative intensifies rivalry, as CRG's long-term vision often involves substantial capital outlays. For instance, in 2024, China's natural gas consumption was projected to reach around 390 billion cubic meters, highlighting the vast market and the drive for market share among major players.

- Strategic Imperative: CRG's role in national energy security and environmental goals incentivizes aggressive market participation.

- Government Support: SOE status ensures backing for long-term investments and expansion plans.

- Market Intensity: The drive for market share in a growing sector like natural gas intensifies competition among established and emerging players.

Competitive rivalry within China's urban gas market is significant, with China Resources Gas Group (CRG) holding a substantial market share. Despite pockets of reduced rivalry due to concession awards, the overall market is expanding, attracting more players and intensifying competition for customers and regional dominance.

CRG differentiates itself through value-added services beyond basic gas provision, aiming to build customer loyalty and generate diversified revenue streams, a strategy that proved successful in 2023.

High exit barriers, including substantial infrastructure investments and long-term concession agreements, mean companies like CRG are committed to their operational territories, potentially sustaining competition even during less profitable periods.

As a state-owned enterprise, CRG's strategic importance in national energy security fuels aggressive investment and expansion, intensifying competition in a market where natural gas consumption is projected to reach around 390 billion cubic meters in 2024.

| Competitor Type | Market Share (2024 Est.) | Key Differentiator | Growth Driver |

|---|---|---|---|

| State-Owned Enterprises | Varies by region | Scale, government backing | National energy policy |

| Regional Distributors | Varies by region | Local relationships, established networks | Local demand growth |

| China Resources Gas Group | >9% (by sales volume) | Value-added services, diversified energy solutions | Market expansion, integrated services |

SSubstitutes Threaten

China Resources Gas Group faces a significant threat from alternative energy sources. Customers can readily switch to electricity, liquefied petroleum gas (LPG), and even coal in certain industrial applications. This broad availability means that gas is not the only option for energy needs.

While the Chinese government favors natural gas over coal for environmental reasons, it is also heavily promoting renewable energy. Investments in solar and wind power are substantial, creating direct competition for natural gas, particularly in the power generation and heating sectors. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.5 billion kilowatts, a figure that continues to grow rapidly.

The relative price of natural gas compared to alternatives is a crucial factor in the threat of substitutes for China Resources Gas Group. For instance, in 2024, while natural gas is often favored for its environmental benefits, volatility in global Liquefied Natural Gas (LNG) spot markets and domestic pipeline gas pricing can shift the economic advantage towards other energy sources.

The performance of substitutes, especially renewables, is rapidly improving. In 2024, advancements in solar and wind technology continue to drive down costs and increase efficiency, making them increasingly competitive with natural gas for power generation and heating applications.

Customer propensity to substitute for China Resources Gas Group's services is shaped by their unique requirements and the existing infrastructure. Residential customers, having invested in gas appliances, are generally less likely to switch due to the inconvenience and cost of changing their setup.

Conversely, industrial and commercial clients often exhibit a higher propensity to substitute. This is driven by a strong focus on cost optimization and adherence to evolving environmental regulations, making them more receptive to alternative energy sources or strategies to diversify their energy consumption.

For instance, while residential gas consumption in China remained robust in 2024, with natural gas accounting for over 40% of household energy use in urban areas, industrial sectors are increasingly exploring options like electricity or even hydrogen for specific applications, especially in regions with favorable renewable energy policies.

Government Policy and Regulation

Government policies significantly influence the threat of substitutes for natural gas. China's push for cleaner energy sources, including natural gas, is a key driver, but this is balanced by ambitious renewable energy goals. For instance, China aims to have non-fossil fuels account for 20% of its primary energy consumption by 2025, a target that could accelerate the adoption of renewables and potentially reduce reliance on natural gas.

Policies promoting electrification, particularly in transportation and industrial heating, present a direct substitute threat. As China invests heavily in electric vehicles and electric heating systems, the demand for natural gas in these sectors may decline. The government's commitment to carbon neutrality by 2060 also incentivizes a shift towards zero-emission energy alternatives.

The evolving regulatory landscape creates uncertainty regarding the long-term demand for natural gas. While natural gas is viewed as a transitional fuel, policies favoring renewable energy sources like solar and wind power could cap or even reduce its market share. China's continued expansion of its renewable energy capacity, with solar and wind installations seeing substantial growth in 2023, underscores this potential shift.

- Government incentives for renewable energy adoption directly challenge natural gas demand.

- Electrification policies in key sectors like transport and industry create substitute opportunities.

- China's carbon neutrality goals by 2060 encourage a move away from fossil fuels, including natural gas.

- The nation's 2025 target for non-fossil fuels in primary energy consumption (20%) highlights the growing competition from renewables.

Technological Advancements in Substitutes

Ongoing technological advancements are making electricity a more potent substitute for natural gas. For instance, by mid-2024, global solar panel efficiency continued to improve, with some leading manufacturers achieving over 23% efficiency in commercial modules, directly impacting the cost-competitiveness of solar-generated electricity. Similarly, wind turbine technology has seen increased rotor diameters, with some offshore turbines exceeding 250 meters, capturing more wind energy and reducing the levelized cost of electricity. Improved battery storage solutions are also making intermittent renewable electricity more reliable for a wider range of applications previously dominated by natural gas.

Within the gas sector itself, renewable natural gas (RNG) is emerging as a significant substitute. By the end of 2023, the U.S. RNG market had seen substantial growth, with production capacity increasing by approximately 20% year-over-year, driven by policy incentives and technological improvements in biogas upgrading. This 'greener' alternative directly competes with conventional natural gas, especially in sectors prioritizing decarbonization.

- Solar Panel Efficiency: Leading commercial modules surpassed 23% efficiency by mid-2024.

- Wind Turbine Size: Offshore turbines with rotor diameters over 250 meters are becoming more common.

- RNG Market Growth: U.S. RNG production capacity increased by roughly 20% in 2023.

The threat of substitutes for China Resources Gas Group is substantial, driven by the availability and improving economics of alternative energy sources like electricity, LPG, and renewables. While residential customers may be less inclined to switch due to existing infrastructure, industrial and commercial clients are more sensitive to cost and regulatory pressures, making them more prone to adopting substitutes. Government policies play a critical role, with China's push for cleaner energy and ambitious renewable targets creating a dynamic competitive landscape.

Technological advancements in solar and wind power are making them increasingly competitive, while renewable natural gas (RNG) presents a direct, greener alternative within the gas sector itself. These factors collectively exert pressure on natural gas demand and pricing.

| Substitute | Key Drivers | Impact on Natural Gas |

| Electricity (Renewable) | Falling costs, improved efficiency (e.g., solar panels >23% efficiency mid-2024), grid upgrades | Direct competition in power generation and heating; potential displacement in industrial processes |

| Liquefied Petroleum Gas (LPG) | Price volatility of natural gas, availability in certain regions | Alternative for heating and cooking, particularly in areas with less developed gas infrastructure |

| Renewable Natural Gas (RNG) | Policy incentives, technological advancements in biogas upgrading (e.g., ~20% capacity growth in US 2023) | Greener alternative, competes for market share in sectors prioritizing decarbonization |

| Coal | Historically lower cost, established infrastructure (though increasingly disfavored environmentally) | Declining role due to environmental policies, but still a factor in some industrial applications |

Entrants Threaten

The urban gas distribution sector in China demands immense upfront capital. Establishing the necessary pipeline networks, storage facilities, and operational infrastructure can easily run into billions of dollars, creating a formidable financial hurdle for any potential new competitor looking to enter the market.

These high capital requirements serve as a significant deterrent. For instance, China Resources Gas Group itself has consistently invested heavily in expanding its network; in 2023, its capital expenditure was reported to be in the tens of billions of RMB, underscoring the scale of investment needed and thus limiting the pool of capable new entrants.

Established players like China Resources Gas Group enjoy significant cost advantages due to economies of scale in gas procurement, distribution networks, and customer service operations. For instance, in 2023, China Resources Gas Group reported revenue of RMB 105.6 billion, demonstrating its substantial operational footprint. New entrants would find it exceedingly difficult to match these efficiencies without substantial initial investment and accumulated operational experience.

New companies looking to enter China's gas distribution market face significant challenges in accessing established pipeline networks. These networks are often controlled by incumbent players like China Resources Gas Group, making it difficult for newcomers to reach customers efficiently. For instance, in 2023, China's natural gas pipeline network exceeded 150,000 kilometers, a substantial infrastructure that new entrants would need to tap into.

Securing distribution rights, especially in densely populated urban areas, presents another formidable barrier. City gas projects typically require long-term concession agreements with local governments, which are often granted to existing, reliable operators. This exclusivity can effectively lock out new competitors, as seen in many of China's major metropolitan areas where established companies hold exclusive rights for decades.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants in China Resources Gas Group's operating environment. The Chinese natural gas sector is characterized by substantial state intervention, with national five-year plans and specific policies guiding everything from infrastructure development to pricing mechanisms. This regulatory landscape, while evolving towards market liberalization, can erect considerable hurdles for new, independent companies seeking to enter the market.

For instance, the National Development and Reform Commission (NDRC) plays a crucial role in setting gas prices, which can influence the profitability and attractiveness of the market for potential new players. While reforms are ongoing, the state's continued influence in market structure and access can act as a de facto barrier.

- State-controlled pricing mechanisms can limit the pricing flexibility of new entrants.

- Licensing and approval processes mandated by government bodies can be complex and time-consuming.

- National energy strategies may prioritize state-owned enterprises or specific development zones, indirectly favoring incumbents.

- Infrastructure access, often controlled by state-affiliated entities, can be a significant barrier for those without existing networks.

Brand Identity and Customer Loyalty

While natural gas is fundamentally a commodity, China Resources Gas Group has cultivated significant brand identity and customer loyalty over years of operation and infrastructure investment. This deep-seated trust makes it challenging for new players to penetrate the market. New entrants would face the substantial hurdle of building comparable brand recognition and customer relationships, requiring considerable time and financial resources to establish credibility.

The threat of new entrants is further mitigated by the high capital expenditure required to replicate existing infrastructure. China Resources Gas Group's extensive network of pipelines and distribution systems represents a significant barrier. For instance, in 2023, China's urban gas pipeline network length exceeded 1.1 million kilometers, a testament to the scale of investment already made by established players like CRG.

- Brand Recognition: China Resources Gas Group benefits from decades of service, fostering strong customer loyalty.

- Infrastructure Investment: New entrants require massive capital to build comparable pipeline networks.

- Customer Trust: Establishing the same level of trust and reliability as an incumbent is a significant challenge.

- Regulatory Hurdles: Navigating complex regulations and obtaining permits can be a deterrent for new companies.

The threat of new entrants in China's urban gas distribution sector is considerably low due to substantial capital requirements, estimated in the billions of dollars for network construction. China Resources Gas Group's 2023 capital expenditure, in the tens of billions of RMB, highlights this barrier. Furthermore, established players benefit from economies of scale, with CRG's 2023 revenue of RMB 105.6 billion showcasing their operational advantage, making it difficult for newcomers to compete on cost efficiency.

Access to existing infrastructure, such as China's over 1.1 million kilometers of urban gas pipelines as of 2023, is a major hurdle for new entrants, often controlled by incumbents. Securing long-term distribution rights and navigating complex government regulations and licensing processes, influenced by entities like the NDRC, also present significant deterrents. Brand loyalty and customer trust cultivated by companies like China Resources Gas Group further solidify the position of existing players.

| Barrier Type | Description | Example Data (2023) |

|---|---|---|

| Capital Requirements | Immense upfront investment for infrastructure. | CRG Capital Expenditure: Tens of billions of RMB |

| Economies of Scale | Cost advantages for established players. | CRG Revenue: RMB 105.6 billion |

| Infrastructure Access | Control of existing pipeline networks. | China Urban Gas Pipeline Network: >1.1 million km |

| Regulatory Hurdles | Complex licensing and government policy. | NDRC influence on pricing mechanisms |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Resources Gas Group leverages data from official company filings, including annual reports and investor presentations, alongside industry-specific market research reports and government regulatory data to provide a comprehensive view of the competitive landscape.