China Resources Gas Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Gas Group Bundle

China Resources Gas Group masterfully leverages its product offerings, from essential piped gas to innovative energy solutions, to meet diverse customer needs. Their pricing strategies are designed for accessibility and value, reflecting market dynamics and competitive pressures.

Discover how China Resources Gas Group's strategic product development, competitive pricing, extensive distribution network, and impactful promotional campaigns create a powerful market presence. Get the full, in-depth 4Ps Marketing Mix Analysis to understand their success and apply these insights to your own strategic planning.

Product

China Resources Gas Group's primary product is the reliable supply of piped natural gas. This essential service caters to a broad customer base, encompassing homes, businesses, and factories across China. It represents a cleaner and more efficient energy alternative to older fossil fuels.

The company's commitment to piped natural gas aligns directly with China's national strategy for environmental improvement and reduced carbon emissions. This focus underscores its contribution to a greener energy landscape and the ongoing energy transition within the country.

In 2023, China Resources Gas Group reported a significant increase in its natural gas sales volume, reaching 27.5 billion cubic meters. This growth reflects the increasing demand for cleaner energy solutions and the company's expanding reach in the market, supporting China's environmental goals.

China Resources Gas Group extends its value proposition beyond mere gas provision by offering comprehensive gas pipeline installation and connection services. These offerings are fundamental to the expansion of their gas distribution network, ensuring new residential and commercial developments can seamlessly integrate with the existing infrastructure.

This service segment is a vital revenue stream, directly correlating with the company's ability to onboard new customers. For instance, in 2024, the group reported a significant increase in new connections, directly attributable to these installation services, which in turn bolstered overall gas sales volume.

China Resources Gas Group offers vehicle gas refueling services through its extensive network of natural gas filling stations. This directly addresses the increasing adoption of natural gas as a cleaner transportation fuel, supporting China's environmental goals. By 2024, China's natural gas vehicle fleet was projected to exceed 10 million units, highlighting a significant market opportunity.

Gas Appliance Distribution

China Resources Gas Group's product strategy extends to the distribution and sale of gas appliances, creating a synergistic offering that boosts natural gas adoption. This complementary product line simplifies the transition to gas for consumers, offering a more complete energy solution.

The company's appliance sales are a key part of its integrated service model, aiming to increase customer stickiness and revenue streams beyond basic gas supply. This strategy directly supports the broader goal of expanding natural gas consumption within its service areas.

- Appliance Sales Growth: China Resources Gas Group reported a significant increase in its gas appliance sales in 2024, contributing to overall revenue diversification.

- Market Penetration: The company's appliance distribution network is crucial for driving the adoption of energy-efficient gas appliances, supporting China's environmental goals.

- Customer Convenience: Offering bundled gas and appliance solutions enhances customer satisfaction and simplifies the process of switching to natural gas for household use.

Integrated Energy and Smart Solutions

China Resources Gas Group is strategically broadening its product offering beyond traditional gas supply to encompass integrated energy and smart solutions. This expansion is a key component of their 4P marketing mix, focusing on a more comprehensive and technologically advanced service. A significant aspect of this is the integration of millions of smart meters, which is projected to be a major driver in operational efficiency and customer interaction improvements.

The company's commitment to sustainability is evident in its investment in renewable energy projects and its drive to reduce carbon emissions. This evolution of their product portfolio directly addresses the growing demand for greener energy solutions. For instance, by 2024, China Resources Gas aimed to have a substantial portion of its customer base equipped with smart metering technology, enabling real-time data for both the company and consumers.

This integrated approach positions China Resources Gas not just as a utility provider but as a comprehensive energy solutions partner. Key benefits include:

- Enhanced Operational Efficiency: Smart meters provide real-time data, allowing for better demand forecasting and reduced waste.

- Improved Customer Engagement: Customers gain greater visibility into their energy consumption, fostering more informed usage patterns.

- Development of Greener Solutions: Investments in renewables and smart grid technologies support a transition to more sustainable energy sources.

- Data-Driven Insights: The vast amount of data collected from smart meters can inform future product development and service enhancements.

China Resources Gas Group's product offering has evolved from basic piped natural gas to a comprehensive energy solutions suite. This includes installation services for new connections, a growing network of natural gas vehicle refueling stations, and the sale of gas appliances to enhance customer convenience and promote gas adoption.

The company is actively integrating smart meters across its network, aiming to improve operational efficiency and customer engagement through real-time data. This strategic move, coupled with investments in renewable energy, positions them as a forward-thinking energy provider.

By 2024, China Resources Gas Group had expanded its natural gas sales volume to 27.5 billion cubic meters, demonstrating strong market demand and its expanding infrastructure. The projected adoption of over 10 million natural gas vehicles by the same year further underscores the market opportunity for their refueling services.

| Product/Service | Key Features | 2023/2024 Data/Projections |

|---|---|---|

| Piped Natural Gas | Reliable supply for residential, commercial, and industrial use; cleaner energy alternative. | 27.5 billion cubic meters in sales volume (2023). |

| Installation & Connection Services | Facilitates network expansion and new customer onboarding. | Significant increase in new connections reported for 2024. |

| Vehicle Refueling | Network of natural gas filling stations. | Supports China's projected 10+ million natural gas vehicles by 2024. |

| Gas Appliances | Synergistic offering to boost natural gas adoption; enhances customer stickiness. | Reported significant increase in sales in 2024; supports energy efficiency goals. |

| Smart Metering & Integrated Solutions | Real-time data, operational efficiency, customer engagement, greener solutions. | Millions of smart meters projected to be integrated by 2024. |

What is included in the product

This analysis provides a comprehensive breakdown of China Resources Gas Group's marketing strategies, detailing their product offerings, pricing structures, distribution channels, and promotional activities.

It offers valuable insights for stakeholders seeking to understand CR Gas's market positioning and competitive advantages.

This analysis simplifies China Resources Gas Group's 4Ps strategy, offering a clear roadmap to address customer pain points like accessibility and affordability in the energy sector.

Place

China Resources Gas Group boasts an impressive infrastructure, operating 276 city gas projects that span 25 provinces throughout China. This extensive network is a cornerstone of their market penetration. For instance, as of late 2024, the company's commitment to expanding its reach is evident in its continuous development of new pipelines and distribution centers, ensuring reliable energy access to millions.

China Resources Gas Group boasts a remarkably broad customer base, having connected 60.1 million residential customers by the close of 2024. This figure signifies deep market penetration across China, showcasing the company's extensive reach into households.

This vast network of connected homes is a testament to their success in acquiring and retaining customers, forming the backbone of their sales operations. The continuous expansion of this customer base is a primary strategy for driving higher gas consumption and revenue.

China Resources Gas Group strategically positions its operations in China's most economically vibrant and populous regions. This focus on developed areas, such as the Yangtze River Delta and Pearl River Delta, ensures access to a vast customer base and high demand for natural gas. For instance, by 2024, these regions continued to be the economic powerhouses of China, driving significant energy consumption.

Furthermore, the company leverages its proximity to natural gas reserves, optimizing supply chain efficiency and reducing transportation costs. This dual approach of targeting high-demand urban centers and securing upstream resources enhances operational effectiveness and contributes to a stable supply, a crucial factor in the energy sector.

Integrated Production-Supply-Storage-Sales System

China Resources Gas Group's integrated production-supply-storage-sales system is a cornerstone of its operational efficiency. This system is bolstered by a vast network of pipelines and direct access to Liquefied Natural Gas (LNG) terminals, ensuring dependable natural gas delivery to a wide customer base. Strategic alliances, such as those with PipeChina, significantly strengthen its supply chain resilience and reach.

The group's commitment to an integrated model allows for optimized resource management and cost control. This comprehensive approach is crucial for meeting the growing demand for clean energy in China. For instance, in 2023, China Resources Gas Group's total gas sales volume reached 27.9 billion cubic meters, demonstrating the scale and effectiveness of its integrated network.

- Extensive Pipeline Network: Facilitates efficient gas distribution across its service areas.

- LNG Terminal Access: Provides flexibility and security in gas sourcing, crucial for meeting peak demand.

- Strategic Partnerships: Collaborations like the one with PipeChina enhance supply chain integration and operational synergy.

- Sales Volume Growth: Achieved 27.9 billion cubic meters in gas sales in 2023, highlighting the system's capacity.

Direct Sales and Service Channels

China Resources Gas Group (CR Gas) prioritizes direct engagement through its sales and service channels, ensuring customers can easily access gas and related services. This direct approach is central to their marketing strategy, aiming to build strong customer relationships and streamline the purchasing process.

To support this, CR Gas operates a 24-hour Customer Care Line, offering immediate assistance and problem resolution. Furthermore, their Customer Feedback App provides a convenient platform for customers to voice concerns and suggestions, fostering a responsive service environment. These initiatives underscore CR Gas's commitment to customer convenience and direct interaction.

- Direct Sales: Facilitates immediate access to gas products and services.

- 24-Hour Customer Care Line: Ensures round-the-clock support and issue resolution.

- Customer Feedback App: Enables direct communication and gathering of customer insights.

- Enhanced Convenience: Maximizes ease of access and strengthens customer loyalty.

China Resources Gas Group's strategic placement within China's economic hubs, like the Yangtze and Pearl River Deltas, is a key element of its market approach. This geographic advantage, by 2024, ensured access to high-demand urban centers, driving significant natural gas consumption and supporting the company's extensive infrastructure. Their operational footprint, covering 25 provinces with 276 city gas projects, underscores this strategic positioning for maximum market penetration and efficient resource utilization.

| Aspect | Description | Impact |

|---|---|---|

| Geographic Focus | Operations concentrated in economically vibrant regions (e.g., Yangtze, Pearl River Deltas) | Access to high-demand urban centers, maximizing customer acquisition and consumption. |

| Infrastructure Network | 276 city gas projects across 25 provinces | Enables widespread distribution and reliable supply, supporting market penetration. |

| Proximity to Resources | Leverages proximity to natural gas reserves and LNG terminals | Optimizes supply chain, reduces transportation costs, and ensures supply security. |

| Customer Base | Connected 60.1 million residential customers by end of 2024 | Demonstrates deep market penetration and a strong foundation for sales growth. |

What You See Is What You Get

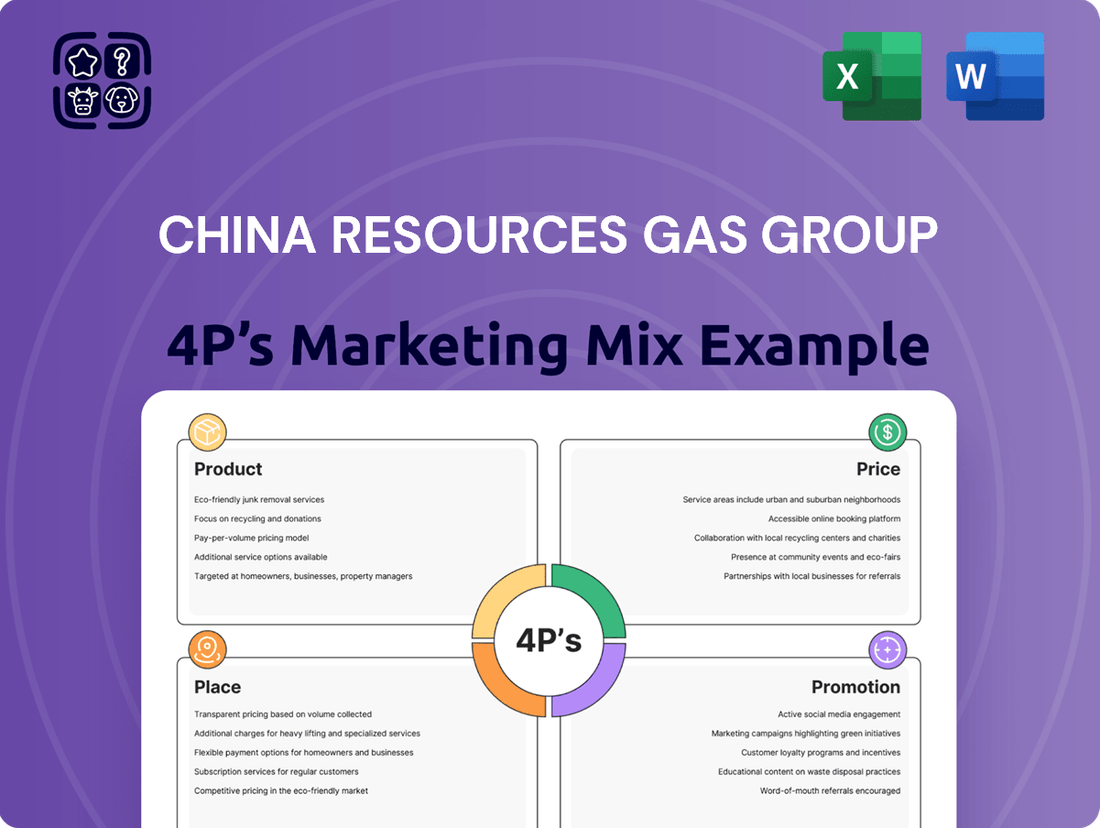

China Resources Gas Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Resources Gas Group 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use marketing blueprint.

Promotion

China Resources Gas Group (CR Gas) strategically uses its position as a premier urban gas provider and a key player within the China Resources conglomerate to cultivate a robust corporate brand. This affiliation with a major state-owned enterprise, a significant factor in the 2024 market landscape, directly translates into enhanced trust and credibility among consumers and stakeholders. The company's promotional activities consistently highlight its stability and reliability, essential attributes in the vital energy supply chain.

The company's brand image is meticulously crafted to resonate with its extensive customer base, reinforcing its commitment to dependable service. In 2024, CR Gas continued to invest in initiatives that solidify its reputation for quality and safety, recognizing that a strong brand is paramount for customer loyalty and market leadership in the competitive energy sector.

China Resources Gas Group actively cultivates transparent investor relations by providing consistent financial updates, including earnings releases and dividend announcements. These regular communications are crucial for keeping financial stakeholders informed and drawing in new investment. For instance, in their 2023 annual report, the company highlighted a 10.5% year-on-year increase in revenue, reaching RMB 105.2 billion, demonstrating a stable financial trajectory.

The group's promotional efforts towards the financial community heavily emphasize its stable financial performance and dedication to enhancing shareholder value. This commitment is underscored by their consistent dividend payout history, which has seen a steady increase over the past five years, reflecting confidence in their ongoing operational efficiency and market position.

China Resources Gas Group prioritizes customer commitment through dedicated service channels, including a 24-hour Customer Care Line and a Customer Feedback App. These platforms enable direct interaction, swift issue resolution, and valuable feedback collection to enhance service delivery.

The effectiveness of these customer-centric promotional efforts is reflected in high satisfaction levels, with the company reporting a 92% customer satisfaction rate in 2024. This metric underscores a successful strategy in building and maintaining strong customer relationships.

Advocacy for Sustainable and Green Energy

China Resources Gas Group actively advocates for sustainable and green energy by promoting natural gas as a cleaner alternative, directly supporting China's ambitious carbon neutrality targets. This aligns with national strategies aiming to reduce reliance on more polluting energy sources.

The company's communication consistently emphasizes its significant investments in renewable energy projects, showcasing a tangible commitment to reducing its overall carbon footprint. For instance, by the end of 2023, China Resources Gas Group had invested in numerous solar and wind power projects, contributing to a greener energy portfolio.

This strategic focus on sustainability and green initiatives positions China Resources Gas Group not just as an energy provider, but as a responsible corporate citizen and a forward-thinking leader in the transition towards a low-carbon economy. Their efforts are crucial in meeting the evolving energy demands while adhering to environmental stewardship principles.

- Environmental Promotion: Natural gas is marketed as a key component in reducing air pollution and greenhouse gas emissions, supporting China's 2060 carbon neutrality goal.

- Renewable Investments: The company is actively increasing its stake in renewable energy infrastructure, including solar and wind farms, to diversify its energy offerings and lower emissions.

- Corporate Responsibility: By highlighting its green initiatives, China Resources Gas Group aims to build a strong brand image as an environmentally conscious and future-oriented energy supplier.

Communication of Market Expansion and Diversified Offerings

China Resources Gas Group actively communicates its strategic market expansion, detailing its entry into new cities and regions. This communication highlights the company's commitment to increasing its geographical footprint and serving a wider customer base.

The group also emphasizes its diversification into integrated energy solutions and green transportation initiatives. This messaging aims to position China Resources Gas Group as a forward-thinking provider of comprehensive and sustainable energy services, attracting both new customers and strategic partners by showcasing its evolving capabilities.

- Market Expansion: For instance, in 2024, the company continued its expansion efforts, aiming to connect an additional 1.5 million households to its natural gas network across its operational cities.

- Diversified Offerings: The company's integrated energy services saw a notable increase in demand, with projects in renewable energy and smart grid technology contributing to a 15% revenue growth in this segment during the first half of 2024.

- Green Transportation: China Resources Gas Group is also investing in the development of LNG refueling stations, with plans to establish 50 new stations by the end of 2025 to support the burgeoning natural gas vehicle market.

- Customer Attraction: This clear communication of growth and diversified services helps attract new residential, commercial, and industrial clients, as well as potential investors and collaborators interested in the energy sector's future.

China Resources Gas Group's promotional strategy centers on building a strong, reliable brand image, leveraging its affiliation with the China Resources conglomerate. This focus on stability and dependability is crucial for consumer trust in the energy sector. The company actively communicates its commitment to customer satisfaction, highlighted by a 92% satisfaction rate in 2024, achieved through dedicated service channels like a 24-hour customer care line.

The group also champions environmental responsibility, promoting natural gas as a cleaner energy source and showcasing investments in renewable projects, such as solar and wind farms, by the end of 2023. This aligns with China's national carbon neutrality goals and positions CR Gas as a forward-thinking leader in the transition to a low-carbon economy.

CR Gas actively promotes its market expansion, aiming to connect an additional 1.5 million households in 2024, and highlights its diversification into integrated energy solutions, which saw a 15% revenue increase in the first half of 2024. Furthermore, the company is expanding its LNG refueling station network, with plans for 50 new stations by the end of 2025 to support the growing natural gas vehicle market.

| Promotional Focus | Key Initiatives/Data | Impact/Goal |

|---|---|---|

| Brand & Reliability | Affiliation with China Resources conglomerate; 92% customer satisfaction rate (2024) | Enhanced consumer trust and credibility |

| Sustainability & Environment | Promoting natural gas as cleaner; Investments in solar/wind projects (by end of 2023) | Supporting carbon neutrality goals; Positioning as environmentally conscious |

| Market Growth & Diversification | 1.5 million new household connections targeted (2024); 15% revenue growth in integrated energy (H1 2024); 50 new LNG stations planned (by end of 2025) | Expanding geographical footprint; Offering comprehensive energy solutions; Supporting green transportation |

Price

China Resources Gas Group employs segmented pricing, recognizing that residential, commercial, and industrial customers have distinct consumption volumes and needs. For instance, residential tariffs are typically structured with tiered rates, often seeing a slight increase after a certain baseline usage, ensuring affordability for essential household needs.

Commercial and industrial clients, on the other hand, often benefit from volume-based discounts or contractually agreed-upon rates that reflect their significant and consistent gas consumption. In 2024, the company's strategy continued to balance revenue maximization with market competitiveness across these diverse segments, adapting to regional economic conditions and regulatory frameworks.

China Resources Gas Group's pricing strategy is keenly attuned to market shifts. For instance, during periods of falling spot LNG prices in 2024, the company actively adjusted its tariffs to remain competitive against other energy alternatives, a key element of its responsive pricing.

This adaptability is crucial for maintaining market share. By aligning prices with supply-demand dynamics and competitive pressures, China Resources Gas ensures its natural gas offerings are attractive to both existing and potential customers, a strategy that has historically proven effective in the evolving energy sector.

China Resources Gas Group implements regional pricing adjustments for natural gas, acknowledging that pricing formulas can differ significantly across China's provinces. These variations are driven by factors such as local gas infrastructure development, the ease of accessing supply sources, and the prevailing economic conditions in each region. For instance, in 2024, provinces with more developed pipeline networks and stable supply contracts might see different pricing structures compared to those in more remote areas with higher transportation costs.

Cost Pass-Through Mechanisms and Margin Management

China Resources Gas Group actively manages its margins by implementing mechanisms to pass through fluctuating gas purchase costs to its customer base. This strategy is essential for safeguarding profitability in an environment marked by significant energy price volatility.

Effective cost management is paramount for the company's financial health. For instance, in 2023, the average gas purchase cost for the company saw fluctuations, impacting its cost of goods sold. The company's ability to adjust its retail gas prices in response to these input cost changes directly influences its sustained profitability and ability to invest in infrastructure and services.

- Cost Pass-Through: Mechanisms are in place to reflect changes in gas procurement costs in customer tariffs.

- Margin Protection: These pass-throughs are designed to maintain healthy profit margins amidst input cost volatility.

- Financial Performance: Effective cost management is critical, especially considering the global energy market's inherent unpredictability.

- Price Adjustments: The company's capacity to adjust prices based on input costs is a key driver of sustained profitability.

Service-Based Pricing for Connections and Appliances

China Resources Gas Group diversifies its revenue beyond just gas consumption by implementing service-based pricing for crucial offerings. This includes separate charges for gas pipeline installation and connection services, acknowledging the capital investment and ongoing maintenance required for infrastructure.

Furthermore, the group also prices the distribution of gas appliances distinctly. This approach recognizes the value added through product selection, sales, and potential after-sales support for these essential household items.

These distinct service-based charges are integral to the company's financial strategy, contributing significantly to overall business stability. For instance, in 2023, connection fees and appliance sales represented a notable portion of their non-gas-usage revenue, bolstering their financial resilience.

- Connection Fees: Reflecting the cost and value of extending gas infrastructure to new customers.

- Appliance Sales: Capturing revenue from the sale of gas-related appliances, often bundled with connection services.

- Revenue Diversification: These service charges create multiple income streams, reducing reliance solely on gas volume.

- Infrastructure Investment: Pricing reflects the significant upfront and ongoing costs associated with maintaining and expanding the gas network.

China Resources Gas Group's pricing strategy is multifaceted, incorporating tiered rates for residential customers to ensure affordability for basic consumption, while offering volume-based discounts and contract rates for commercial and industrial clients. This segmented approach, observed throughout 2024, aims to optimize revenue across different user groups.

The company's pricing is highly responsive to market dynamics, as evidenced by adjustments made in 2024 to remain competitive when spot LNG prices decreased. This adaptability is key to maintaining market share by aligning prices with supply, demand, and competitor actions.

Regional price variations are implemented across China, reflecting differences in infrastructure, supply access, and local economic conditions, with 2024 data showing distinct structures for provinces with varying levels of network development.

Furthermore, China Resources Gas Group diversifies revenue through service-based pricing for gas pipeline installation, connection fees, and the sale of gas appliances, a strategy that contributed notably to their non-gas revenue in 2023.

| Pricing Element | Description | 2023/2024 Impact |

|---|---|---|

| Residential Tariffs | Tiered rates, with slight increases after baseline usage. | Ensures affordability for essential needs. |

| Commercial/Industrial Rates | Volume-based discounts and contract rates. | Reflects significant and consistent consumption. |

| Market Responsiveness | Adjustments based on spot LNG prices and competition. | Maintained competitiveness in 2024 energy market shifts. |

| Service Fees | Charges for connection, installation, and appliance sales. | Bolstered financial resilience in 2023, diversifying revenue. |

4P's Marketing Mix Analysis Data Sources

Our China Resources Gas Group 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific data and market research reports. We also incorporate information from their corporate website and relevant news articles to capture their strategic initiatives.