China Resources Beer (Holdings) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Beer (Holdings) Bundle

China Resources Beer (Holdings) operates within a dynamic landscape shaped by evolving political stability, economic growth, and technological advancements in China. Understanding these external forces is crucial for anticipating market shifts and identifying strategic opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable intelligence.

Gain a competitive edge by exploring the political, economic, social, technological, legal, and environmental influences impacting China Resources Beer (Holdings). This ready-made analysis delivers expert-level insights, perfect for investors and business strategists. Buy the full version to get the complete breakdown instantly and make informed decisions.

Political factors

The Chinese government's ongoing efforts to curb alcohol consumption at official functions, a policy dating back to 2012 and reinforced in May 2025, could impact the premium segments of the beer market, particularly those associated with corporate hospitality. This regulatory environment, while primarily aimed at traditional spirits like baijiu, subtly shapes broader drinking habits and limits certain business entertainment avenues.

Despite these restrictions, national policies in 2025 are also geared towards fostering economic growth and encouraging consumer spending, which directly benefits major players like China Resources Beer. The company's strategic positioning within the rapidly expanding Chinese beer market, estimated to reach over 45 billion liters in 2025, suggests resilience and continued upside potential driven by these supportive macro-economic directives.

China's State Administration for Market Regulation (SAMR) is intensifying its oversight of the beer industry. By July 2025, local authorities are mandated to boost random inspections and monitoring of beer production, focusing on strict adherence to food safety protocols and robust quality control of raw materials and manufacturing processes.

Further strengthening this regulatory environment, China is set to review amendments to its Food Safety Law in June 2025. These proposed changes could introduce a licensing framework for the transportation of bulk liquid foods and impose more severe penalties for non-compliance, directly impacting supply chain operations and requiring enhanced diligence from companies like China Resources Beer.

While specific tariffs on beer between the U.S. and China were not detailed, broader trade tensions in March 2025 meant some Chinese tariffs on U.S. alcohol imports persisted. This situation could subtly shift the competitive dynamics for imported beers in China and potentially impact the cost of specific raw materials if similar trade barriers were applied.

China Resources Beer, as a dominant domestic player, might find an advantage in this environment through a more predictable internal market, potentially shielding it from some of the volatility affecting international competitors.

Government Support for Domestic Industries

China Resources Beer (Holdings) anticipates continued expansion through 2025, bolstered by national strategies designed to invigorate the economy. The government’s commitment to enhancing consumer expenditure creates a supportive landscape for major domestic companies such as CR Beer, potentially through targeted stimulus measures or programs. This governmental backing offers a buffer against wider economic volatility.

This support is particularly relevant as China's economic growth targets for 2024 and 2025 are set to encourage domestic consumption. For instance, the State Council has outlined plans to boost spending on goods and services, which directly benefits the beverage sector. CR Beer, as a market leader, is well-positioned to capitalize on these initiatives.

- Government Economic Stimulus: Policies aimed at boosting GDP growth in 2024-2025 will likely include measures to increase disposable income and consumer confidence.

- Consumer Spending Initiatives: Direct government efforts to encourage spending on domestic brands and products will create a more favorable market for CR Beer.

- Support for National Champions: Policies often favor established domestic players like CR Beer, providing them with advantages over foreign competitors.

Political Stability and Business Environment

China Resources Beer (CR Beer) acknowledges the complexities of the global economic landscape but remains optimistic for 2025, citing national policies and consistent economic expansion as key drivers. This political stability fosters a predictable, though regulated, business climate, enabling major corporations like CR Beer to pursue long-term strategic objectives such as enhancing product quality and increasing market reach.

The Chinese government's continued focus on economic development and its supportive stance towards large domestic enterprises create a generally favorable environment for CR Beer's ambitious growth plans. For instance, the government's push for consumption upgrades aligns directly with CR Beer's premiumization strategy, aiming to capture a larger share of the higher-value segment of the beer market.

- Policy Support: Government initiatives aimed at boosting domestic consumption and supporting national champions provide a solid foundation for CR Beer's expansion.

- Economic Growth: China's projected GDP growth, estimated to be around 5.0% for 2024 and potentially similar for 2025, underpins consumer spending power, benefiting the beverage sector.

- Regulatory Framework: While regulated, the established legal and political structures offer a degree of certainty for long-term strategic planning and investment.

Government policies in 2024-2025 are a dual-edged sword for CR Beer. While efforts to curb excessive alcohol consumption, particularly at official functions, could temper growth in premium segments, broader economic stimulus measures are designed to boost overall consumer spending. This creates a supportive backdrop for domestic giants like CR Beer, especially with China's economic growth targets encouraging consumption upgrades.

The State Administration for Market Regulation's (SAMR) intensified oversight, with local authorities mandated by July 2025 to increase inspections on beer production and raw materials, signifies a commitment to food safety. Amendments to the Food Safety Law, expected in June 2025, could introduce stricter supply chain regulations, demanding greater diligence from companies like CR Beer.

China's commitment to economic expansion, targeting GDP growth around 5.0% for 2024 and likely similar for 2025, directly fuels consumer purchasing power. This, coupled with government initiatives to promote domestic brands, positions CR Beer favorably to capitalize on increased spending in the beverage sector.

| Policy Area | Impact on CR Beer | 2024-2025 Outlook |

|---|---|---|

| Alcohol Consumption Policies | Potential dampening of premium segment growth, especially in corporate hospitality. | Continued, subtle influence on drinking habits. |

| Economic Stimulus & Consumer Spending | Direct benefit to CR Beer through increased disposable income and confidence. | Strong support for domestic brands and CR Beer's expansion. |

| Food Safety & Quality Regulation | Increased operational costs and compliance requirements due to stricter inspections and potential new licensing. | Mandatory adherence to enhanced protocols by July 2025. |

What is included in the product

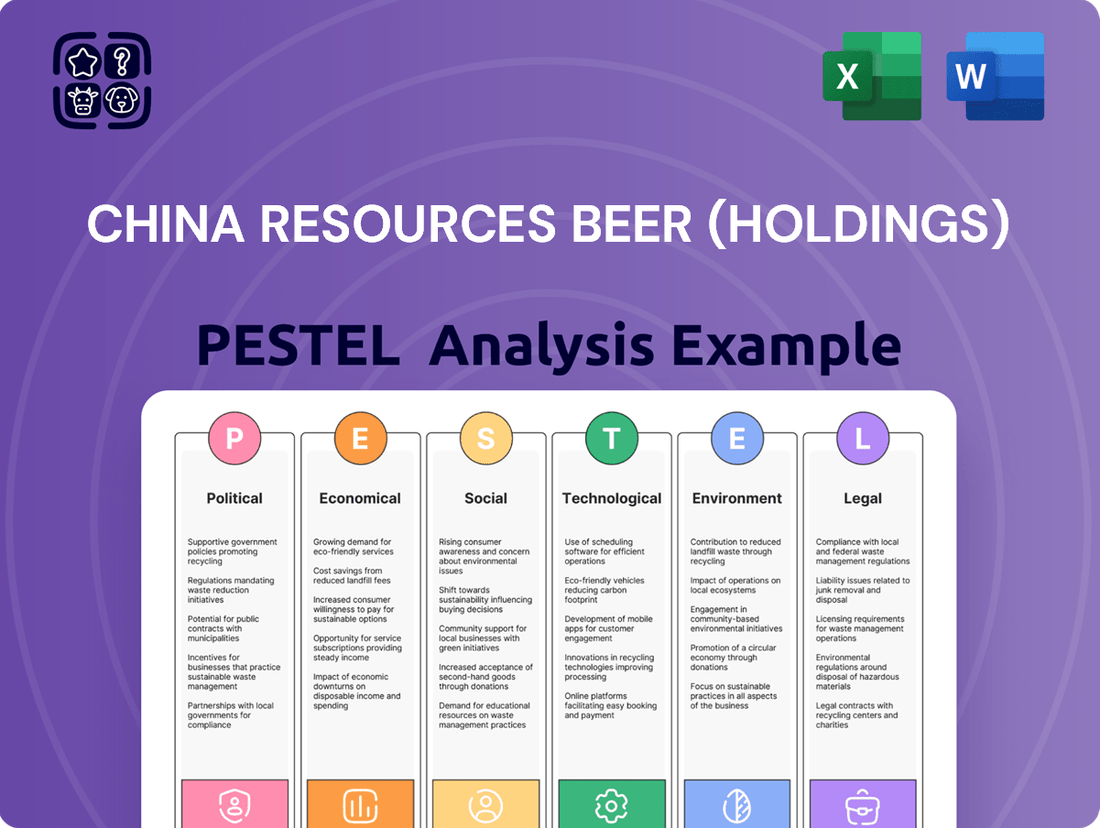

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting China Resources Beer (Holdings), providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within the Chinese beverage market.

This PESTLE analysis for China Resources Beer acts as a pain point reliever by providing a concise, easily digestible overview of external factors impacting the business, enabling quicker strategic decision-making and risk mitigation.

Economic factors

China's beer market is seeing a strong move towards premium products. This is fueled by more people living in cities and having more money to spend, with China's GDP per capita now over $10,000. This shift is great news for companies like China Resources Beer.

China Resources Beer's focus on premiumization is paying off. Their 2024 turnover reached RMB38.6 billion, with premium beer and baijiu playing a big role. Consumers are clearly ready to spend more on better quality, unique, and diverse beer choices, including craft options.

The Chinese beer market is a significant growth area, forecasted to hit around USD 134.1 billion by 2025, with a steady 5.6% annual growth rate. By the same year, beer consumption volume is expected to surpass 53 billion liters.

Despite some projections of a slight decline in overall beer volumes for 2024 and a smaller contraction in 2025, China Resources Beer has shown remarkable resilience. The company actually outperformed its rivals in beer sales volume during 2024, highlighting its strong market position.

Beyond beer, China's non-alcoholic beverages sector is also booming. This market was valued at USD 169.0 billion in 2024 and is on track to reach a substantial USD 291.0 billion by 2033, presenting further opportunities for diversification.

Rising inflation and the associated increases in raw material costs present a significant hurdle for China's beer sector. These escalating expenses can directly impact production costs and, consequently, profit margins for brewers.

Despite these pressures, China Resources Beer demonstrated resilience. In 2024, their gross profit margin saw an improvement, growing by 1.3 percentage points to reach 42.6%. This positive movement was partly attributed to a moderation in raw material costs during the period.

Looking ahead to 2025, the company's strategic approach to cost management is a critical element supporting their positive outlook. This focus on efficiency is expected to be a key driver for both profit recovery and anticipated turnover growth.

Competitive Landscape

The Chinese beer market is a battleground dominated by a few major players. In 2024, the top five companies, including China Resources Beer, controlled a staggering 92.9% of the market. While overall beer sales volume saw a slight dip this year, CR Beer demonstrated resilience, holding its ground against competitors.

CR Beer's success in this concentrated market is largely due to its focus on premium brands. The company's strategy, which includes leveraging popular brands like Heineken, SuperX, and Snow Draft, is key to its ability to compete effectively and secure future growth in an intensely competitive environment.

- Market Concentration: Over 92.9% of the Chinese beer market is held by the top five companies.

- 2024 Performance: CR Beer maintained market share despite a slight decline in overall market volume.

- Key Growth Drivers: Premiumization strategy and strong brands like Heineken, SuperX, and Snow Draft are crucial.

Impact of Economic Uncertainty on Consumer Spending

Economic uncertainty, marked by employment instability and rising inflation throughout 2024, has noticeably impacted overall consumer spending in China. This has translated into a less pronounced but still present decline in beer sales, as consumers become more cautious with their discretionary budgets. For instance, while the overall retail sales growth in China slowed in early 2024 compared to previous years, the beverage sector, including beer, experienced a more subdued performance.

Consumers are increasingly prioritizing experiences such as travel and leisure activities over traditional indulgences like alcohol. This shift in preference means that companies like China Resources Beer must be agile in adapting their strategies. Maintaining competitive pricing and a strong value proposition is crucial to navigate these evolving consumer behaviors and retain market share amidst economic headwinds.

- Consumer Caution: 2024 data suggests a heightened consumer sensitivity to price increases and a greater focus on essential goods over discretionary items.

- Spending Prioritization: Reports indicate a trend of consumers reallocating funds from non-essential purchases, like premium alcoholic beverages, towards experiences.

- Market Adaptation: China Resources Beer faces pressure to optimize its product portfolio and promotional activities to align with a more value-conscious consumer base.

Economic factors continue to shape China's beer market, with inflation and consumer spending patterns being key considerations. Despite a slight slowdown in overall retail sales growth in early 2024, the beverage sector, including beer, has felt the impact of economic uncertainty, leading to more cautious consumer spending.

Rising inflation has driven up raw material costs, directly affecting production expenses for brewers like China Resources Beer. However, the company demonstrated resilience in 2024, improving its gross profit margin to 42.6%, partly due to moderating raw material costs during the period.

Consumer behavior is also shifting, with a greater prioritization of experiences like travel over discretionary spending on alcohol. This necessitates agile strategies from companies like China Resources Beer to maintain competitive pricing and a strong value proposition.

| Metric | 2023 (Approx.) | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| China GDP Per Capita | ~$13,000 | ~$13,700 | ~$14,400 |

| Beer Market Value | ~$127 billion | ~$130 billion | ~$134 billion |

| CR Beer Turnover | RMB 37.3 billion | RMB 38.6 billion | ~RMB 40 billion |

| CR Beer Gross Profit Margin | 41.3% | 42.6% | ~43% |

What You See Is What You Get

China Resources Beer (Holdings) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Resources Beer (Holdings).

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for China Resources Beer.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the strategic landscape for China Resources Beer.

Sociological factors

Chinese consumers are increasingly seeking out higher-quality, more diverse beer options, moving beyond traditional lagers. This includes a growing appetite for craft beers and imported brands, with consumers prioritizing unique flavors and premium ingredients. This trend towards premiumization is fueled by rising disposable incomes and ongoing urbanization across the country.

China Resources Beer has capitalized on this shift, with its premium portfolio demonstrating strong performance. For instance, its partnership with Heineken and its own premium brand, Lao Xue, experienced significant sales growth throughout 2024, reflecting the successful alignment with evolving consumer tastes.

Consumers in China are increasingly focused on health and wellness, which is directly impacting the beverage industry. This shift is evident in the growing demand for low-alcohol and non-alcoholic beer options. For instance, in 2024, the market for non-alcoholic beverages in China was projected to reach over $100 billion, with beer being a significant contributor.

China Resources Beer, a major player, is actively adapting to this trend by expanding its portfolio of non-alcoholic and low-alcohol beers. Their strategy includes introducing new products and marketing campaigns that highlight the health benefits and lifestyle choices associated with these beverages. This proactive approach aims to capture a larger share of this expanding market segment.

This rising health consciousness means consumers are actively seeking out drinks that align with their wellness objectives. This is a key driver for innovation, pushing companies like China Resources Beer to develop and promote healthier alternatives. The company's investment in research and development for healthier beverage options reflects a strategic response to evolving consumer preferences, anticipating continued growth in this area through 2025.

China's rapid urbanization continues to reshape consumer habits, fueling a growing demand for convenient beverage choices. This shift is particularly evident in the non-alcoholic sector, where ready-to-drink teas and coffees are gaining significant traction as consumers seek quick and easy options for their busy, urban lifestyles.

For the beer market, the trend points towards a dominance of out-of-home consumption, with bars and restaurants projected to be the primary sales channels by 2025. This reflects a societal evolution where socializing and enjoying premium beverages in social settings are becoming increasingly popular, presenting a clear opportunity for beverage companies with robust distribution and strong ties to the hospitality industry.

Demographic Shifts and Generational Influence

China Resources Beer's consumer base is largely concentrated between 25 and 44 years old, with a significant male majority, primarily in major urban centers. These consumers increasingly prioritize premiumization, seeking higher quality and innovative beer options rather than just the lowest price point. This shift is evident as the market moves beyond basic lagers towards craft and imported styles.

Gen Z is emerging as a powerful demographic force, influencing product development with their distinct preferences. They show a strong interest in:

- Aesthetic appeal: Visually engaging packaging and branding are key purchase drivers.

- Health consciousness: Lower calorie and healthier ingredient options are gaining traction.

- Novelty: Unique flavors and innovative packaging formats resonate well with this group.

In 2023, the premium beer segment in China saw robust growth, outpacing the overall market. China Resources Beer's Snow brand, a market leader, has been actively expanding its premium offerings to capture this evolving consumer demand, reflecting a strategic response to these demographic trends.

Impact of E-commerce and Digitalization

The COVID-19 pandemic significantly accelerated e-commerce adoption for beer sales in China. Online purchases surged, climbing from 53% in 2022 to an impressive 83% in 2023. This dramatic shift underscores the critical need for companies like China Resources Beer to maintain strong online distribution and digital marketing capabilities to connect with consumers directly in their homes and effectively adapt to evolving consumer behavior.

This digital transformation impacts consumer purchasing habits, making online accessibility a key differentiator. China Resources Beer must leverage these digital channels not only for sales but also for brand engagement and direct consumer interaction. The company's ability to navigate and capitalize on this digital shift will be crucial for sustained growth and market relevance in the coming years.

Key implications for China Resources Beer include:

- Enhanced Online Presence: Strengthening direct-to-consumer (DTC) e-commerce platforms and partnerships with major online retailers is paramount.

- Digital Marketing Focus: Investing in targeted digital advertising, social media engagement, and influencer collaborations to reach a broader online audience.

- Data Analytics: Utilizing data from online sales and consumer interactions to understand preferences and personalize marketing efforts.

- Supply Chain Agility: Ensuring the supply chain can efficiently support increased online order volumes and last-mile delivery expectations.

The evolving Chinese consumer is increasingly health-conscious, driving demand for lower-alcohol and non-alcoholic beer options, a segment projected to grow significantly through 2025. This shift is coupled with a strong preference for premiumization, with consumers willing to pay more for higher quality and unique flavor profiles, moving away from traditional lagers.

Urbanization and a younger demographic, particularly Gen Z, are influencing consumption patterns, favoring convenience, aesthetic appeal, and novelty in beverage choices. The rapid acceleration of e-commerce, with online beer sales hitting 83% in 2023, necessitates a robust digital strategy for brands like China Resources Beer.

| Sociological Factor | Trend | Impact on China Resources Beer |

|---|---|---|

| Health Consciousness | Growing demand for low/non-alcoholic beers | Expansion of non-alcoholic portfolio, R&D investment |

| Premiumization | Preference for craft and imported beers | Focus on premium brand offerings (e.g., Lao Xue) and partnerships (e.g., Heineken) |

| Demographics (Gen Z) | Interest in aesthetics, health, novelty | Product innovation, visually engaging packaging |

| E-commerce Adoption | Online sales surged to 83% in 2023 | Strengthening DTC platforms, digital marketing |

Technological factors

China Resources Beer (CR Beer) is actively investing in technological advancements, exemplified by its establishment of new intelligent factories in Jinan and Xiamen. These facilities represent a significant commitment to modernizing brewing processes, aiming to boost operational efficiency and elevate product consistency.

These technological upgrades are poised to enhance CR Beer's production capabilities, potentially leading to improved product quality and the introduction of innovative new beer varieties. The company's focus on intelligent manufacturing aligns with broader industry trends towards greater automation and data-driven production.

The global brewing sector is witnessing a surge in technological adoption, with a particular emphasis on lean production methodologies for craft breweries and a drive for innovative product development. This technological evolution supports CR Beer's strategic goals by enabling more agile and responsive manufacturing.

China Resources Beer (Holdings) is heavily invested in digital transformation to streamline its vast distribution system and capitalize on China's rapidly expanding e-commerce sector. This focus is essential as online beer sales have seen substantial growth, underscoring the need for robust digital infrastructure to effectively connect with customers and manage supply chains. In 2023, China's online retail sales of physical goods grew by 8.4%, indicating a strong consumer shift towards digital purchasing channels.

Consumer preferences, especially among younger demographics like Gen Z, are increasingly swayed by novel packaging. This trend pushes manufacturers to prioritize packaging improvements, encompassing visual appeal, user-friendliness like pre-chilled beer cups, and eco-friendly materials.

China Resources Beer can capitalize on these packaging advancements to engage emerging consumer groups and strengthen its brand identity. For instance, by 2024, the global sustainable packaging market is projected to reach $437.1 billion, indicating a significant consumer push towards environmentally conscious options.

Data Analytics for Consumer Insights

Data analytics is increasingly vital for decoding market demand and driving product innovation within the beverage sector, a trend directly relevant to China Resources Beer. By leveraging advanced analytics, companies can gain granular insights into shifting consumer preferences, such as the growing demand for healthier options like low-calorie or non-alcoholic beverages. This allows for the development of highly targeted products and more effective marketing strategies.

For instance, the global market for non-alcoholic beer experienced significant growth, reaching an estimated USD 25.1 billion in 2023 and projected to expand at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030. This highlights the strategic advantage for beverage companies that can accurately identify and respond to such evolving consumer tastes through sophisticated data analysis.

- Decoding Consumer Preferences: Utilizing data analytics to understand demand for low-calorie and non-alcoholic options.

- Product Innovation: Developing targeted products based on identified consumer trends.

- Market Responsiveness: Enabling agile marketing campaigns that resonate with evolving tastes.

- Growth Opportunities: Capitalizing on expanding market segments like non-alcoholic beverages, which saw global market value of USD 25.1 billion in 2023.

Supply Chain Optimization and Logistics

Technological advancements are significantly reshaping China Resources Beer's (CR Beer) supply chain and logistics operations. The company is leveraging new technologies to enhance efficiency in distributing its products across China's expansive geography, a critical factor for a beverage company. This includes advancements in logistics management systems and potentially cold chain capabilities to ensure product quality from production to consumer.

CR Beer's investment in new intelligent factories underscores a strategic focus on optimizing production and supply chain processes. These facilities are designed to integrate automation and data analytics, aiming to meet fluctuating consumer demand more effectively while simultaneously reducing operational costs. For instance, by 2024, CR Beer was reportedly integrating advanced data analytics to forecast demand more accurately, leading to improved inventory management and reduced waste.

- Smart Warehousing: Implementation of automated storage and retrieval systems (AS/RS) and warehouse management systems (WMS) to improve inventory accuracy and throughput.

- Route Optimization: Utilization of AI-powered software to plan the most efficient delivery routes, reducing fuel consumption and delivery times.

- Cold Chain Monitoring: Deployment of IoT sensors to monitor temperature and humidity throughout the distribution process, ensuring the quality of its beer products.

- Production Automation: Increased use of robotics and automated systems in breweries to enhance production efficiency and consistency.

CR Beer's technological drive is evident in its smart factory initiatives, boosting efficiency and product consistency. The company is also heavily invested in digital transformation to optimize its vast distribution network, tapping into China's booming e-commerce market, which saw online retail sales of physical goods grow by 8.4% in 2023.

Data analytics is crucial for CR Beer, enabling it to decipher consumer trends like the growing demand for low-calorie and non-alcoholic beverages. The non-alcoholic beer market alone was valued at USD 25.1 billion in 2023 and is projected for a 7.5% CAGR from 2024 to 2030, showcasing significant growth opportunities.

| Technological Factor | Description | Impact on CR Beer | Relevant Data/Trend |

|---|---|---|---|

| Intelligent Manufacturing | Automation and data analytics in production facilities. | Increased operational efficiency, product quality, and innovation. | New intelligent factories in Jinan and Xiamen. |

| Digital Transformation | Streamlining distribution and leveraging e-commerce. | Enhanced market reach and supply chain management. | Online beer sales growth, 8.4% online retail growth in China (2023). |

| Data Analytics | Understanding consumer preferences and market demand. | Targeted product development and agile marketing. | Non-alcoholic beer market USD 25.1 billion (2023), projected 7.5% CAGR (2024-2030). |

Legal factors

China's robust food safety legal framework, particularly the Food Safety Law, underwent significant revisions in 2021, with further strengthening of oversight anticipated by July 2025 as the State Administration for Market Regulation (SAMR) intensifies its supervision of the beer industry. Draft amendments reviewed in June 2025 signal an intent to impose more stringent penalties for non-compliance, directly impacting companies like China Resources Beer.

The introduction of new standards, such as GB 2760-2024 for food additives effective from February 2025, necessitates continuous adaptation in production and quality control processes. These evolving regulations underscore a heightened focus on consumer protection and product integrity within China's rapidly growing beverage market.

Advertising and marketing regulations in China are continually evolving, with a general trend towards stricter government oversight. While specific recent amendments to alcohol advertising laws aren't readily available, the broader emphasis on public image and social responsibility, exemplified by measures like the alcohol ban for civil servants, signals a need for caution in marketing strategies. Companies like China Resources Beer must navigate these evolving guidelines, ensuring their campaigns promote responsible consumption and align with national directives, particularly as consumer attitudes and preferences for alcoholic beverages shift.

China Resources Beer, like others in the nation's burgeoning beer sector, is navigating an increasingly stringent environmental regulatory landscape. The government's commitment to sustainability means stricter rules on waste management and energy consumption are on the horizon, demanding operational flexibility. For example, by the end of 2024, major industrial polluters were expected to report emissions data more frequently, a trend likely to intensify.

The introduction of a draft Ecological and Environmental Code in May 2025 further underscores this shift. This comprehensive legislation aims to consolidate existing environmental protections and introduces new mandates, including enhanced disclosure requirements for chemical substances and more robust risk management protocols.

Labor Laws and Employment Regulations

China Resources Beer, as a significant employer in China, must navigate a complex landscape of labor laws and employment regulations. These rules dictate essential aspects of the employer-employee relationship, from minimum wage requirements and working hours to social insurance contributions and severance pay. Staying compliant is paramount for operational stability and mitigating the risk of costly litigation.

While specific recent legislative changes impacting the beer industry aren't readily available, general adherence to China's labor framework is non-negotiable. This includes ensuring fair wages, safe working conditions, and proper benefits for its substantial workforce. For instance, the average monthly wage in China's manufacturing sector, which often includes brewery operations, saw an increase, reflecting the evolving labor cost environment.

The company's commitment to these regulations directly influences its ability to attract and retain talent, critical for maintaining production efficiency and innovation. Failure to comply can lead to fines, reputational damage, and disruptions to operations, impacting overall business performance.

- Compliance Necessity: China Resources Beer must adhere to national and local labor laws governing wages, working hours, and employee benefits.

- Workforce Stability: Proper implementation of employment regulations is key to maintaining a motivated and stable workforce.

- Risk Mitigation: Adherence prevents legal disputes, fines, and reputational damage that could impact business operations.

Intellectual Property Rights and Brand Protection

Protecting its vast array of beloved beer brands, such as Snow Beer, and emerging baijiu ventures is paramount for China Resources Beer. The evolving legal landscape for intellectual property rights in China plays a crucial role in defending brand equity and combating counterfeit products.

The company's significant brand recognition, a cornerstone of its business strategy, is intrinsically linked to the strength and enforcement of its legal protections. For instance, in 2023, China's Supreme People's Court reported a notable increase in IP infringement cases, highlighting the dynamic legal environment.

- Brand Safeguarding: China Resources Beer's commitment to protecting its intellectual property, including trademarks and patents for its popular brands, is a critical legal consideration.

- Counterfeit Prevention: The effectiveness of China's legal framework in preventing the production and distribution of counterfeit goods directly impacts China Resources Beer's market share and brand reputation.

- Legal Enforcement: The company's ability to leverage legal recourse against infringers is essential for maintaining the value and integrity of its brand portfolio.

China Resources Beer must navigate evolving food safety laws, with the 2021 Food Safety Law revisions and anticipated 2025 oversight increases by SAMR impacting compliance. New standards like GB 2760-2024 for food additives, effective February 2025, require continuous adaptation in production and quality control. The company also faces stricter advertising regulations, emphasizing responsible consumption and alignment with national directives, as seen in broader public image campaigns.

Environmental factors

Brewing is inherently water-intensive, making effective water resource management a paramount environmental concern for China Resources Beer. The company's operations, particularly its numerous breweries across China, rely heavily on consistent and clean water supplies. This dependence means that any shifts in water availability or quality directly impact production capacity and costs.

China's ongoing commitment to environmental protection translates into increasingly stringent regulations concerning water usage, wastewater discharge, and overall water footprint reduction. For instance, by 2025, China aims to significantly improve water use efficiency across key industries, with a target of reducing water consumption per unit of industrial output. This regulatory environment necessitates proactive measures from companies like China Resources Beer to ensure compliance and maintain operational sustainability.

In response, China Resources Beer is expected to invest in and implement advanced water-saving technologies and practices. This could include optimizing brewing processes to minimize water consumption, enhancing wastewater treatment capabilities to meet higher discharge standards, and exploring water recycling initiatives within its facilities. Such investments are crucial not only for regulatory adherence but also for long-term cost efficiency and corporate social responsibility in a water-stressed nation.

The brewing sector, including major players like China Resources Beer, is under significant pressure to curb its energy consumption and carbon footprint. This is driven by global climate concerns and national policy directives.

China's emissions trading system, which began in 2021 and saw a significant expansion in March 2025 to encompass more large industrial entities, directly impacts companies like China Resources Beer. The system is designed to cap CO2 emissions and incentivize the transition to greener technologies.

Consequently, China Resources Beer must actively manage its energy usage and emissions to adhere to increasingly stringent environmental regulations and align with China's broader climate objectives. For instance, by the end of 2024, the national ETS covered over 7 billion tonnes of CO2 equivalent annually, a figure expected to grow with the 2025 expansion.

China's environmental regulations are tightening, particularly concerning waste management in the beer sector. This means companies like China Resources Beer must focus on handling brewing by-products, packaging materials, and general operational waste more responsibly.

As a major player, China Resources Beer faces increasing pressure to invest in robust waste reduction and recycling programs. For instance, a 2025 brewing conference highlighted innovative approaches like recycling liquor from waste yeast, indicating a growing industry focus on circular economy principles.

Sustainability Reporting and ESG Compliance

China Resources Beer (Holdings) Company Limited's commitment to sustainability is evident in its 12th Sustainability Report, released in April 2025. This report details their investments and performance across environmental, social, and governance (ESG) areas, underscoring the growing emphasis on transparent reporting and adherence to evolving ESG standards.

The company's reporting aligns with directives from key regulatory bodies, including the Chinese Corporate Sustainability Reports and the State-owned Assets Supervision and Administration Commission (SASAC). This focus on ESG compliance is becoming a critical factor for stakeholders and investors alike.

- ESG Reporting: China Resources Beer published its 12th Sustainability Report in April 2025, detailing ESG investments and performance.

- Regulatory Alignment: The company adheres to directives from Chinese Corporate Sustainability Reports and SASAC.

- Stakeholder Expectations: Transparent ESG disclosure is increasingly important for investor confidence and market positioning.

Climate Change Impacts on Raw Material Sourcing

Climate change poses a significant environmental challenge for China Resources Beer (Holdings) by potentially affecting the availability and quality of key agricultural inputs like barley and hops. Extreme weather events, such as droughts and floods, can disrupt crop yields, leading to price volatility and supply chain instability. For instance, global barley production faced challenges in 2023 due to adverse weather in major growing regions, underscoring the vulnerability of the brewing sector.

To address these risks, CR Beer, like other major brewers, must consider implementing robust strategies for resilient raw material sourcing. This includes diversifying supplier bases and exploring partnerships that promote climate-smart agricultural practices. Investing in research and development for drought-resistant barley varieties or alternative ingredients could also be crucial for long-term sustainability.

- Impact on Barley: Climate change can reduce barley yields and quality, essential for beer production.

- Hops Vulnerability: Changes in temperature and rainfall patterns can negatively affect hop cultivation.

- Supply Chain Risk: Extreme weather events can lead to shortages and price increases for raw materials.

- Mitigation Strategies: Diversification of sourcing and investment in sustainable agriculture are key.

China Resources Beer faces increasing scrutiny regarding its environmental impact, particularly concerning water usage and carbon emissions. Stricter regulations, such as China's expanding emissions trading system, which covered over 7 billion tonnes of CO2 equivalent annually by the end of 2024, necessitate significant investment in water-saving technologies and reduced energy consumption. The company's 12th Sustainability Report, released in April 2025, highlights its commitment to ESG principles and compliance with directives from bodies like SASAC.

Waste management is another critical environmental factor, with a growing industry focus on circular economy principles, as evidenced by discussions on recycling brewing by-products. Furthermore, climate change poses a tangible threat to the supply chain, potentially impacting the availability and cost of key agricultural inputs like barley and hops, prompting strategies for resilient sourcing and climate-smart agriculture.

| Environmental Factor | Impact on CR Beer | Regulatory Context/Industry Trend | CR Beer's Response/Mitigation |

| Water Scarcity & Quality | Directly affects production capacity and costs. | China aims to improve water use efficiency by 2025; stringent wastewater discharge standards. | Investment in water-saving technologies, enhanced wastewater treatment, water recycling initiatives. |

| Carbon Emissions & Energy Consumption | Pressure to reduce carbon footprint and energy usage. | China's ETS expanded in March 2025; national climate objectives. | Managing energy usage, emissions reduction efforts, transition to greener technologies. |

| Waste Management | Need for responsible handling of by-products and packaging. | Increased focus on waste reduction and recycling in the brewing sector. | Investment in robust waste reduction and recycling programs; exploring circular economy principles. |

| Climate Change & Raw Material Sourcing | Risk of disrupted crop yields and price volatility for barley and hops. | Global weather patterns impacting agricultural output (e.g., 2023 barley production challenges). | Diversifying suppliers, promoting climate-smart agriculture, R&D for resilient crop varieties. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Resources Beer (Holdings) is built on a robust foundation of data from official Chinese government agencies, including market regulatory bodies and environmental protection bureaus. We also incorporate insights from leading global economic institutions and reputable industry-specific market research reports.