Crayon Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crayon Group Bundle

The Crayon Group operates within a dynamic IT services landscape, where understanding competitive pressures is crucial. Our analysis reveals moderate bargaining power for buyers, as IT solutions can be commoditized, yet Crayon's specialized offerings mitigate this. The threat of new entrants is significant, given the relatively low barriers to entry in some IT consulting areas, but Crayon's established relationships and expertise offer a strong defense.

We've also evaluated the intensity of rivalry, finding it high due to numerous global and local players vying for market share. The threat of substitutes is a constant concern, with evolving technologies and service delivery models offering alternatives to traditional IT consulting. Finally, supplier power is generally low, as Crayon deals with a diverse range of technology vendors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Crayon Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Crayon Group's dependence on hyperscalers like Microsoft, AWS, and Google Cloud is a significant factor in supplier power. These giants control the essential cloud infrastructure and platforms Crayon utilizes for its services, from migration to data analytics. Their market dominance, extensive infrastructure, and the proprietary nature of their offerings grant them substantial leverage.

Crayon's strategic partnerships with these hyperscalers are vital, evidenced by their recognition through awards such as the Microsoft Partner Award and AWS Industry Partner of the Year. These accolades underscore the critical nature of these relationships, but also highlight Crayon's reliance on the terms and conditions set by these powerful suppliers.

The market for highly skilled IT professionals, especially in fields like AI, cybersecurity, and cloud architecture, grants these individuals considerable bargaining power. For Crayon Group, a company reliant on specialized IT expertise, attracting and keeping this talent is crucial for delivering its services.

This escalating demand for niche IT skills directly impacts labor costs, potentially leading to higher compensation for sought-after professionals. These increased talent acquisition and retention costs can, in turn, influence Crayon's service pricing strategies in 2024.

Software vendors like Microsoft and Broadcom hold significant bargaining power over Crayon Group. These vendors set the licensing terms, pricing structures, and future product development, which directly impacts Crayon's ability to serve its clients. For instance, Microsoft’s dominant position in operating systems and productivity software means Crayon must largely accept its licensing conditions to offer these essential solutions. This inherent vendor control limits Crayon's flexibility in negotiating favorable terms for resale and advisory services, as demonstrated by the ongoing adjustments in cloud licensing models that often benefit the vendor.

Limited Number of Key Technology Providers

The concentration of key technology providers significantly impacts Crayon Group's bargaining power. For instance, specialized platforms for advanced analytics and AI, such as Google's Vertex AI, are often dominated by a few major players. This limited competition among suppliers of these crucial components grants them considerable leverage. Crayon may find itself with fewer viable alternatives when sourcing these technologies, thereby increasing the suppliers' ability to dictate terms and prices. In 2024, the market for AI infrastructure, including specialized platforms, continued to consolidate, with a handful of companies holding substantial market share, reinforcing supplier power.

This dynamic is particularly evident in areas beyond the major hyperscalers. Critical cybersecurity tools and advanced software frameworks are frequently supplied by companies with proprietary technology that is difficult to replicate. For Crayon, this means that the cost and availability of these essential technologies are heavily influenced by the strategic decisions of a small number of dominant vendors. Consequently, Crayon's negotiation flexibility is constrained, as switching costs or the lack of comparable alternatives empower these suppliers.

- Concentrated Market: A limited number of dominant vendors supply essential advanced analytics and AI platforms.

- Reduced Flexibility: Crayon faces fewer choices for critical technology components, impacting its ability to negotiate favorable terms.

- Supplier Leverage: Dominant providers in specialized tech sectors can exert significant influence over pricing and contract conditions.

- 2024 Trends: Market consolidation in AI and cybersecurity infrastructure in 2024 further amplified supplier bargaining power.

Potential for Supplier Forward Integration

The potential for large software vendors and major cloud providers to integrate forward presents a significant challenge to intermediaries like Crayon Group. These powerful suppliers, such as Microsoft or Amazon Web Services (AWS), could expand their direct consulting and asset management services, directly competing with the value-added services Crayon currently offers. This would effectively bypass the need for a reseller or managed service provider in certain scenarios.

While Crayon has cultivated robust partnerships with these vendors, the inherent threat of direct competition remains. The ability of these suppliers to leverage their existing customer relationships and deep technical expertise means they could potentially offer similar or even enhanced services directly, diminishing Crayon's role. For instance, Microsoft's growing Azure consulting services directly vie for market share in areas Crayon also targets.

- Supplier Forward Integration Threat: Major software and cloud providers may move into direct service delivery, impacting resellers.

- Competitive Landscape Shift: This integration could reduce reliance on partners like Crayon for consulting and asset management.

- Vendor Partnership Dynamics: Strong partnerships need to be managed carefully to mitigate the risk of direct vendor competition.

- Example: Microsoft Azure Consulting: Microsoft's expansion in direct Azure services exemplifies the potential for forward integration.

Crayon Group faces significant bargaining power from its key suppliers, primarily hyperscalers like Microsoft, AWS, and Google Cloud. These providers control the foundational infrastructure and proprietary technologies Crayon relies on, limiting negotiation flexibility. The concentration of specialized AI and analytics platforms among a few dominant vendors further amplifies their leverage, especially as market consolidation continued through 2024. This supplier power directly impacts Crayon's operational costs and service offerings.

| Supplier Category | Key Providers | Impact on Crayon | 2024 Trend Reinforcement |

|---|---|---|---|

| Hyperscalers | Microsoft, AWS, Google Cloud | Control infrastructure, pricing, and platform access | Continued dominance and expansion of services |

| Specialized Software | Microsoft (OS, Productivity), Broadcom | Dictate licensing terms and future product roadmaps | Vendor-centric licensing adjustments |

| AI/Analytics Platforms | Google (Vertex AI), other niche providers | Limited alternatives for critical components, leading to higher costs | Increased market consolidation among AI infrastructure providers |

| Skilled IT Talent | Highly sought-after professionals | Drives up labor costs and impacts service pricing strategies | Escalating demand for AI, cloud, and cybersecurity expertise |

What is included in the product

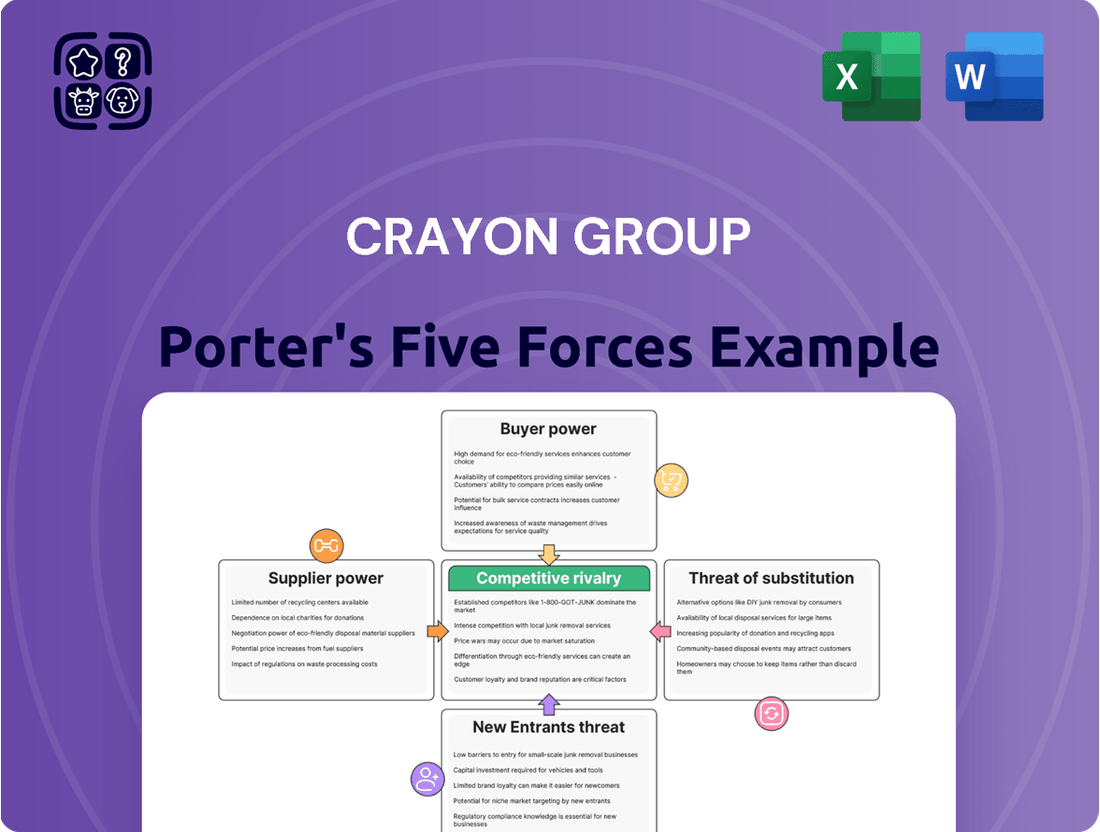

Analyzes the five competitive forces impacting Crayon Group, detailing industry rivalry, the threat of new entrants, buyer and supplier power, and the threat of substitutes.

Instantly identify and address competitive threats with a clear, visual breakdown of each of Porter's Five Forces.

Customers Bargaining Power

While the general trend for cloud services shows decreasing switching costs, for companies like Crayon Group, which offers deeply integrated IT infrastructures, the reality for their clients can be quite different. Migrating complex systems involving extensive software asset management, data analytics platforms, and robust cybersecurity solutions requires substantial investment in time, resources, and potential operational disruption.

These significant switching costs create a degree of customer stickiness. Clients who have heavily invested in Crayon's tailored and interconnected solutions are less likely to move to a competitor due to the considerable effort and expense involved in replicating that integrated environment. For instance, a business relying on Crayon for optimizing its software licenses across multiple cloud platforms and ensuring compliance would face considerable challenges and costs in disentangling and re-establishing these services elsewhere.

Customers benefit from a vast selection of IT consulting providers. This includes global giants like Accenture and Deloitte, alongside niche specialists and in-house IT teams. This abundance of choice significantly strengthens the bargaining power of buyers.

With numerous IT consulting firms vying for business, clients can readily compare offerings and negotiate more favorable pricing and service terms. For instance, the IT services market is projected to reach $1.5 trillion globally in 2024, indicating intense competition among service providers.

This competitive environment allows customers to demand better value, pushing down prices and increasing the quality of service level agreements. Businesses can leverage this to secure cost-effective solutions tailored to their specific needs.

Customers are increasingly savvy when it comes to IT, especially cloud services and software asset management. Many now have their own internal IT teams who understand these areas well.

This heightened knowledge means clients can more effectively scrutinize vendor proposals and seek out customized solutions that truly fit their needs. For instance, a recent survey indicated that 65% of enterprise clients now conduct in-depth technical evaluations before engaging with IT service providers.

As a result, customers are in a stronger position to negotiate pricing and terms, often pushing for more competitive offers. This trend directly enhances their bargaining power, making it harder for vendors to dictate terms.

Focus on Value-Driven Engagements and ROI

Customers are increasingly focused on tangible returns, demanding clear evidence of return on investment (ROI) and pricing models tied to measurable outcomes from IT consulting partners. Crayon's core mission aligns with this by helping businesses maximize their technology spending and achieve cost efficiencies, which inherently amplifies customer scrutiny over delivered value. This heightened focus on demonstrable results empowers customers, increasing their bargaining leverage.

Consider Crayon's position in the Software Asset Management (SAM) and Cloud Optimization space. As of 2024, businesses are actively seeking ways to reduce cloud spend, with reports indicating significant potential savings. For instance, Gartner predicted in 2023 that organizations could reduce cloud costs by up to 30% through better management. This drives demand for services like Crayon's, but also means clients will closely evaluate the cost savings and performance improvements achieved, directly impacting their negotiation power.

- Increased Demand for Measurable ROI: Clients expect concrete proof of value, making outcome-based pricing models more attractive.

- Focus on Cost Optimization: As businesses tighten budgets, the ability of consultants to demonstrably reduce technology expenditure becomes a key negotiation point.

- Scrutiny of Delivered Value: The emphasis on ROI means customers will rigorously assess the benefits received against the fees paid.

- Empowerment Through Transparency: Greater visibility into technology usage and costs gives customers more confidence to negotiate terms.

Consolidation of Customer IT Spending

Large enterprises increasingly consolidate their IT spending, opting for fewer, larger vendors to secure better terms and streamline operations. This trend significantly amplifies customer bargaining power. Crayon's strategy of providing a broad spectrum of services, from software licensing to cloud and AI solutions, positions it to capture these consolidated deals. However, competing for these larger contracts means facing customers with greater leverage, demanding customized solutions and competitive pricing, directly impacting Crayon's margins.

The consolidation of IT spending means that a single large client can represent a substantial portion of revenue, giving them considerable sway. For instance, if a major enterprise decides to renegotiate terms or shift a significant portion of their IT budget, it can have a noticeable effect on a vendor like Crayon. This concentration of spend requires Crayon to maintain strong client relationships and demonstrate ongoing value to retain these key accounts.

- Consolidation Trend: Enterprises are reducing their vendor count to simplify management and leverage purchasing power.

- Crayon's Opportunity: Offering a comprehensive service portfolio appeals to consolidated spending needs.

- Customer Leverage: Larger, consolidated contracts increase customer bargaining power and price sensitivity.

- Impact on Crayon: Competition for these large deals necessitates competitive pricing and strong value propositions to maintain profitability.

Customers possess substantial bargaining power due to the availability of numerous IT service providers and their increasing technical acumen. This allows them to negotiate favorable terms and pricing, especially as they demand clear return on investment (ROI) and cost optimization from their IT partners.

| Factor | Impact on Crayon | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Availability of Alternatives | Weakens Crayon's pricing power. | Global IT services market projected to reach $1.5 trillion in 2024, indicating high competition. |

| Customer Knowledge | Enables more effective negotiation and demand for tailored solutions. | 65% of enterprise clients conduct in-depth technical evaluations before engagement. |

| Focus on ROI & Cost Savings | Pressures Crayon to demonstrate tangible value and cost efficiencies. | Organizations aim to reduce cloud costs by up to 30% through better management. |

| Customer Consolidation | Increases leverage of large clients, demanding competitive pricing. | Large enterprises are consolidating IT spending, reducing vendor numbers. |

Same Document Delivered

Crayon Group Porter's Five Forces Analysis

This preview displays the complete Crayon Group Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document upon purchase. You'll gain immediate access to this in-depth strategic assessment, providing a clear understanding of the competitive landscape. Every detail, from the analysis of competitive rivalry to the bargaining power of suppliers, is present and ready for your immediate use. This is the final, unedited version you will download, offering no surprises and requiring no further work.

Rivalry Among Competitors

The IT consulting and services market, a space Crayon operates within, is characterized by its fragmentation. This means there are a great many companies offering similar services, from cloud solutions to software asset management. This sheer number of competitors naturally fuels intense rivalry, as each firm vies for market share.

However, this fragmented landscape is also in a state of flux due to increasing consolidation. Mergers and acquisitions (M&A) are becoming more common, leading to the formation of larger, more dominant players. A prime example is the proposed combination of Crayon and SoftwareOne, a move that would significantly alter the competitive dynamics.

This ongoing consolidation means that while many small to medium-sized firms continue to compete, the market is also seeing the rise of fewer, but much larger, entities. These larger companies often possess broader service portfolios and greater resources, intensifying competition for all participants.

For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $1.7 trillion by 2027, according to Statista. This growth, coupled with M&A activity, highlights the dual pressures of widespread competition and the strategic advantages gained by scale.

Crayon Group contends with formidable rivals in the form of large global consulting firms such as Deloitte, Accenture, KPMG, and EY. These established players offer comprehensive IT consulting, cloud solutions, and cybersecurity services, directly overlapping with Crayon's core offerings.

These global giants benefit from substantial resources, strong brand recognition, and deep-rooted client relationships, allowing them to leverage a wider market reach and often command premium pricing. For instance, Accenture reported revenues of approximately $62.1 billion for its fiscal year ending August 31, 2023, showcasing its immense scale and market presence.

The presence of these large firms intensifies competitive rivalry by setting high industry standards and driving innovation. Crayon must continually differentiate itself through specialized expertise, agile service delivery, and a keen understanding of niche market needs to effectively compete.

Beyond the major IT service providers, Crayon Group faces intense competition from a multitude of niche and specialized firms. These smaller, focused companies often concentrate on very specific areas like software asset management, cloud migration strategies, advanced data analytics, or cybersecurity solutions. For instance, prior to its acquisition, SoftwareOne was a prominent competitor in the software asset management space, highlighting the presence of highly specialized entities.

These niche players can often offer a depth of expertise in their chosen domain that larger, more generalist competitors might struggle to match. Their focused approach allows them to develop highly specialized skill sets and tailor their offerings precisely to the needs of clients within that particular niche. This specialization can translate into a competitive advantage, enabling them to deliver targeted solutions more effectively.

Furthermore, these specialized competitors can sometimes offer more competitive pricing within their specific service areas. Their lean operational structures and focused market approach can allow them to undercut larger organizations on price for specialized services. This pricing flexibility is a significant factor for clients seeking cost-effective solutions for particular IT challenges.

Rapid Technological Advancements

The IT services market is a hotbed of innovation, with technologies like artificial intelligence, cloud computing, and cybersecurity evolving at breakneck speed. This constant flux means companies like Crayon Group and their rivals must perpetually invest in R&D and adapt their offerings to stay relevant. The race to provide cutting-edge solutions fuels a fierce competitive landscape.

This rapid technological churn directly impacts competitive rivalry. Companies that fail to keep pace risk obsolescence, creating a strong incentive for aggressive competition to capture market share with new technologies. For example, the global IT services market was projected to reach over $1.4 trillion in 2024, a significant portion of which is driven by the adoption of these rapidly advancing technologies.

- AI Integration: Competitors are heavily focused on integrating AI capabilities into their service portfolios, from automation to advanced analytics, to differentiate themselves.

- Cloud Dominance: The ongoing shift to cloud-based solutions means companies must offer robust and competitive cloud migration and management services.

- Cybersecurity Demands: With increasing cyber threats, the demand for advanced cybersecurity solutions is a key battleground for IT service providers.

- Talent Acquisition: The rapid pace of technological change also intensifies the competition for skilled IT professionals who can implement and manage these new technologies.

Price Sensitivity and Value Proposition

The IT solutions and services market, where Crayon Group operates, is characterized by significant price sensitivity among clients. Companies are consistently looking to optimize their technology spending, making cost a major factor in purchasing decisions. This forces firms like Crayon to not only offer competitive pricing but also to clearly articulate their unique value proposition, which goes beyond just the price tag. For instance, in 2024, many businesses are scrutinizing cloud spend, actively seeking partners who can demonstrate tangible cost savings and efficiency improvements. The pressure to deliver demonstrable return on investment (ROI) is immense, pushing competitors to innovate on service delivery and expertise rather than solely competing on price.

Crayon's strategy to focus on optimizing technology investments and reducing costs directly addresses this client need. However, the inherent competitiveness means that simply offering lower prices isn't a sustainable differentiator. Instead, success hinges on building a strong value proposition that highlights expertise, specialized knowledge, and a proven track record of delivering measurable business outcomes. This approach helps to mitigate the direct impact of price wars by shifting the focus to the overall value delivered. The ability to prove ROI becomes paramount in securing and retaining clients in this environment.

- Price Sensitivity: Clients in the IT solutions sector are highly attuned to costs, actively seeking ways to reduce technology expenditure.

- Value Differentiation: Firms must distinguish themselves through expertise, service quality, and demonstrable ROI, not just price.

- Competitive Pressures: The market's nature creates constant pressure on pricing, requiring strategic cost management and value articulation.

- Proven ROI: Clients increasingly demand clear evidence of how technology investments translate into tangible business benefits and cost savings.

Competitive rivalry within the IT consulting and services market is intense, driven by a fragmented landscape and ongoing consolidation. Crayon Group faces competition from global IT giants like Accenture, whose 2023 revenues neared $62.1 billion, and specialized niche players. The constant evolution of technologies such as AI and cloud computing further fuels this rivalry, compelling companies to innovate rapidly.

Price sensitivity is a significant factor, pushing firms to differentiate through demonstrable value and ROI rather than solely competing on cost. For example, businesses in 2024 are actively scrutinizing cloud expenditures, seeking cost-saving solutions. This environment necessitates a strong value proposition built on expertise and proven business outcomes.

| Competitor Type | Examples | Key Differentiators | Market Share Driver |

| Global IT Service Providers | Accenture, Deloitte | Scale, Brand Recognition, Comprehensive Services | Broad Client Relationships, Full-Service Offerings |

| Niche/Specialized Firms | (e.g., specific cloud migration specialists) | Deep Expertise in Specific Areas, Agility | Targeted Solutions, Specialized Knowledge |

| Technology Vendors with Services | Microsoft, AWS | Product Integration, Ecosystem Control | Bundled Solutions, Platform Lock-in |

SSubstitutes Threaten

Organizations increasingly possess the capacity to develop robust in-house IT capabilities. This trend allows them to manage complex software assets, cloud infrastructure, and data analytics directly, thereby lessening their dependence on external providers like Crayon Group. The availability of skilled IT professionals, coupled with dedicated internal investment in advanced tools, presents a significant substitute option.

Clients increasingly have the option to bypass intermediaries like Crayon and engage directly with hyperscalers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. This direct access allows customers to procure cloud services, manage their infrastructure, and even access advanced analytics tools without an intermediary.

Hyperscalers are actively expanding their own managed services and consulting arms, offering comprehensive support for cloud migration and ongoing optimization. For instance, in 2024, AWS continued to heavily invest in its professional services and partner network, providing direct pathways for customers seeking expertise, thereby reducing reliance on third-party specialists.

Similarly, Microsoft Azure's robust partner ecosystem and direct enterprise support channels empower large organizations to manage their cloud deployments and software licensing directly. This trend poses a significant threat as it diminishes the unique value proposition of specialized resellers for certain core cloud functionalities.

The ability of clients to negotiate directly with software vendors for licenses and support also presents a substitution threat. Many software-as-a-service (SaaS) providers are streamlining their sales processes, making direct procurement more accessible and potentially more cost-effective for businesses, especially for standard software solutions.

The increasing sophistication of AI-powered analytics tools, automated software asset management platforms, and self-service cloud governance solutions presents a significant threat of substitution for traditional advisory and management services. These technologies empower clients to derive valuable insights and optimize their operations with reduced reliance on external human expertise.

For instance, the global AI market, projected to reach over $1.8 trillion by 2030 according to Grand View Research, signifies the growing investment and adoption of these automated capabilities. Companies can leverage these platforms to gain real-time visibility into their software usage, cloud spending, and compliance, thereby diminishing the need for manual analysis and consultation that Crayon Group historically provided.

Freelance Networks and Independent Consultants

For specific, project-based needs, clients might opt for independent consultants or leverage freelance platforms to access specialized expertise, rather than engaging a full-service consulting firm like Crayon. This offers flexibility and potentially lower costs for discrete tasks.

The rise of platforms like Upwork and Fiverr means clients can easily find niche talent for short-term projects. In 2024, the global freelance platform market was valued significantly, with millions of freelancers actively seeking and completing projects across various industries.

- Flexibility: Clients can scale their workforce up or down as needed, paying only for the services rendered.

- Cost-Effectiveness: Independent consultants often have lower overheads than larger firms, potentially translating to more competitive pricing.

- Specialized Expertise: Freelance networks provide access to highly specialized skills that might not be available in-house or through a generalist consulting firm.

- Market Growth: The gig economy continues to expand, with projections indicating further growth in the number of independent workers and the services they offer through digital platforms.

Generic IT Outsourcing Providers

Generic IT outsourcing providers pose a significant threat as substitutes. Companies seeking to reduce costs might opt for these broader service providers, which offer basic cloud management and IT support, instead of Crayon's specialized consulting and optimization services. This is particularly true if cost savings are prioritized over achieving strategic value and maximizing software investments.

These generalists can fulfill foundational IT needs, diverting potential customers who aren't focused on the nuanced optimization Crayon provides. For instance, a company might engage a large managed service provider for basic infrastructure upkeep, bypassing the need for Crayon's expertise in optimizing software license utilization and cloud spend, which can represent a substantial portion of IT budgets.

The availability of these comprehensive IT solutions means that businesses have readily accessible alternatives for managing their technology needs. This broad accessibility can dilute the perceived uniqueness of specialized optimization services if not clearly differentiated. In 2024, the global IT outsourcing market continued its growth, with many generalists expanding their service portfolios to capture a wider client base.

- Cost-Driven Decisions: Businesses may choose generic providers primarily for lower upfront costs, overlooking the long-term value of specialized optimization.

- Service Breadth: Providers offering a wide array of IT services, from helpdesk to basic cloud management, can appear as a one-stop shop, making them an attractive substitute.

- Market Accessibility: The sheer number of general IT outsourcing firms makes them easily discoverable and accessible to a broad range of businesses.

- Focus on Essentials: For companies prioritizing core IT functions over advanced optimization, these substitutes adequately meet their immediate needs.

Clients increasingly bypass intermediaries like Crayon, dealing directly with hyperscalers like AWS, Azure, and Google Cloud. These giants are expanding their own managed services, directly offering expertise that diminishes the need for third-party specialists. For example, in 2024, AWS heavily invested in its professional services, presenting a direct pathway for customers and reducing reliance on intermediaries.

The growing availability of AI-powered analytics and automated software management platforms offers a significant substitution threat. These technologies empower clients to gain insights and optimize operations with less external human expertise. The global AI market, projected to exceed $1.8 trillion by 2030, highlights the adoption of these automated capabilities, allowing companies to manage software usage and cloud spending without manual consultation.

| Substitute Option | Description | Impact on Crayon |

|---|---|---|

| Direct Hyperscaler Engagement | Clients bypass resellers to deal directly with AWS, Azure, Google Cloud. | Reduces Crayon's role in procurement and management. |

| AI & Automation Tools | Self-service platforms for analytics, software asset management, and cloud governance. | Decreases reliance on Crayon's advisory and optimization services. |

| Freelance Platforms | Access to independent consultants for project-specific needs. | Offers flexible and potentially cheaper alternatives for specialized tasks. |

| Generic IT Outsourcing | Broader service providers offering basic cloud management and IT support. | Captures cost-sensitive clients prioritizing essential IT functions over advanced optimization. |

Entrants Threaten

Entering the IT consulting and services sector, particularly in sophisticated domains such as cloud asset management, artificial intelligence, and cybersecurity, demands substantial capital. This includes investments in cutting-edge technology, industry-specific certifications, and the acquisition of highly skilled professionals.

The need for deep technical expertise and ongoing training further elevates these entry barriers. For instance, a firm looking to offer advanced AI solutions would need to employ data scientists and machine learning engineers, whose salaries can be quite high, contributing to significant upfront operational costs.

In 2024, the average salary for a senior cybersecurity consultant in the US was reported to be around $140,000, highlighting the talent acquisition cost. Similarly, obtaining advanced cloud certifications can cost thousands of dollars per employee, adding to the financial strain on new entrants.

This combination of high capital outlay and the necessity for specialized, often expensive, human capital significantly deters new companies from easily entering and competing within the IT consulting market, thus protecting established players like Crayon Group.

Established relationships and strong brand loyalty pose a significant barrier to new entrants in the IT solutions and services market, especially for companies like Crayon Group. Crayon has cultivated deep, long-standing partnerships with major technology vendors, including Microsoft and Amazon Web Services (AWS). For instance, Crayon's status as a Microsoft Cloud Solution Provider (CSP) and its advanced AWS competencies demonstrate a commitment that builds client trust and confidence. Newcomers must invest heavily in time and resources to replicate these trusted alliances and convince customers to switch from proven, reliable providers.

Crayon Group's extensive service catalog, encompassing software licensing, cloud solutions, data analytics, artificial intelligence, and cybersecurity, demands significant upfront investment in specialized talent and technology. Newcomers face a steep climb to replicate this breadth and depth, requiring substantial resources to build comparable expertise and operational capabilities across multiple complex domains.

For instance, developing a fully integrated cloud optimization and cybersecurity offering, akin to Crayon's, necessitates not only the technical prowess but also the established partner ecosystems and customer trust that take years to cultivate. The sheer complexity of integrating these diverse, high-value services creates a substantial barrier for potential new entrants seeking to challenge Crayon's market position.

Regulatory and Compliance Barriers

The cybersecurity and software asset management sectors, where Crayon Group operates, are heavily influenced by stringent regulatory frameworks. New entrants must invest significantly in understanding and adhering to compliance mandates like GDPR or CCPA, which demand robust data protection and privacy measures. This can be a substantial barrier, requiring specialized legal and technical expertise that many startups may lack.

- Regulatory Hurdles: Navigating complex global data privacy laws (e.g., GDPR, CCPA) demands substantial legal and operational resources.

- Compliance Costs: Achieving and maintaining certifications (like ISO 27001) for security and compliance adds significant overhead.

- Specialized Knowledge: Understanding niche regulations within specific industries (e.g., FinOps for financial services) is crucial and requires dedicated expertise.

- Enforcement and Penalties: Non-compliance can lead to severe financial penalties, deterring new players who cannot absorb such risks.

Access to Strategic Partnerships and Distribution Channels

New entrants face significant hurdles in replicating Crayon Group's established access to strategic partnerships with major hyperscalers like Microsoft, AWS, and Google. These alliances are not easily formed and require substantial investment and proven track records. In 2024, the cloud market continued its rapid expansion, with hyperscalers solidifying their positions, making it even harder for newcomers to secure comparable agreements. Without these foundational partnerships, new entrants are severely limited in their ability to offer comprehensive and competitive cloud and software solutions.

Gaining access to Crayon's robust distribution channels presents another formidable barrier. These channels have been cultivated over years and represent a significant competitive advantage. Imagine trying to reach customers without an established network – it's a major uphill battle. For instance, in 2024, the complexity of reaching diverse enterprise clients meant that established channel partners like Crayon held a distinct advantage in market penetration.

The difficulty in establishing similar partnership benefits and distribution networks directly impacts the threat of new entrants. A new player would need to invest heavily in building trust and relationships with hyperscalers and developing their own sales and distribution infrastructure, a process that is both time-consuming and capital-intensive. This creates a substantial moat around Crayon's business.

- Hyperscaler Partnerships: Crayon's deep ties with Microsoft, AWS, and Google provide preferential access and co-selling opportunities.

- Distribution Network: Crayon leverages extensive channels to reach a broad customer base effectively.

- Market Entry Barriers: New entrants struggle to match the scale and scope of Crayon's existing partnerships and distribution.

- Competitive Landscape: The increasing dominance of hyperscalers in 2024 further entrenches the advantage of established partners like Crayon.

The threat of new entrants into the IT consulting and services market, where Crayon Group operates, is significantly mitigated by high capital requirements and the need for specialized expertise. New companies must invest heavily in technology, certifications, and top-tier talent, like the reported average senior cybersecurity consultant salary of $140,000 in the US in 2024, to compete effectively.

Furthermore, replicating Crayon's established relationships with major technology vendors, such as Microsoft and AWS, is a lengthy and resource-intensive process. The complexity of Crayon's integrated service offerings, spanning cloud, AI, and cybersecurity, also presents a substantial hurdle for newcomers aiming to match its breadth and depth.

Regulatory compliance, including adherence to GDPR and CCPA, adds another layer of cost and complexity, demanding specialized knowledge and resources that new entrants may lack, especially given the potential for severe penalties in 2024 for non-compliance.

Finally, Crayon's deep-seated hyperscaler partnerships and robust distribution channels, solidified in the rapidly expanding cloud market of 2024, create significant barriers to entry, making it difficult for new players to gain comparable market access and competitive advantage.

Porter's Five Forces Analysis Data Sources

Our Crayon Group Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial filings, market research reports, and industry expert interviews to capture the full competitive landscape.