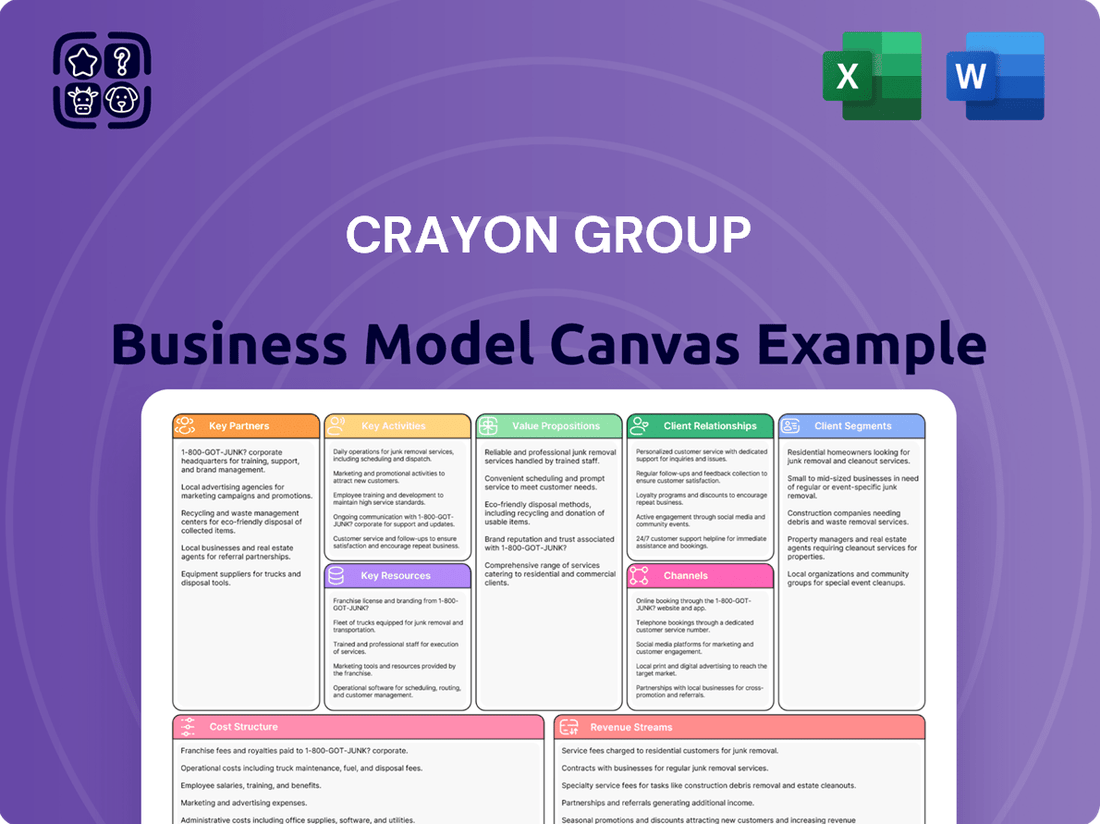

Crayon Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crayon Group Bundle

Unlock the strategic blueprint behind Crayon Group's innovative business model. This comprehensive Business Model Canvas dissects their customer segments, value propositions, and key partnerships, offering a clear roadmap to their success.

Discover how Crayon Group leverages its key resources and activities to deliver exceptional value, driving revenue streams and managing its cost structure effectively.

This in-depth analysis is perfect for entrepreneurs, consultants, and investors seeking actionable insights into a thriving company.

Gain a competitive edge by understanding Crayon Group's approach to market engagement and competitive advantage.

Download the full Business Model Canvas today to accelerate your own strategic thinking and planning.

Partnerships

Crayon Group's business model heavily relies on deep strategic alliances with hyperscalers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP). These critical partnerships grant Crayon access to essential partner programs, extensive co-selling opportunities, and vital technical resources. This symbiotic relationship saw Crayon drive significant cloud consumption, with Microsoft cloud services revenue growing 40% in Q1 2024. Crayon ensures clients optimize their cloud spend while accelerating the adoption of these providers' platforms, reinforcing their position as a leading global IT economics expert.

Crayon Group's partnerships with major global software publishers like Oracle, SAP, Adobe, and VMware are fundamental to their software asset management (SAM) services. These crucial agreements, continuously strengthened in 2024, empower Crayon to manage, resell, and audit complex licensing agreements directly on behalf of their clients. This capability enables Crayon to negotiate favorable terms and ensure compliance, directly contributing to their value proposition and bolstering client trust. For instance, their gross profit from software and cloud services reached NOK 1,029 million in Q1 2024, underscoring the success of these vendor relationships.

Crayon Group strategically partners with leading cybersecurity technology firms like Palo Alto Networks, CrowdStrike, and Fortinet to deliver comprehensive digital transformation solutions. These collaborations enable Crayon to seamlessly integrate best-in-class security solutions into their extensive cloud migration and management offerings. This ensures that client environments are not only cost-optimized but also highly secure and resilient against the evolving threat landscape, crucial given the projected global cybersecurity spending reaching approximately $215 billion in 2024.

Data and AI Platform Collaborators

Crayon Group strategically partners with leading data analytics and artificial intelligence platform providers, including Databricks and Snowflake, complementing AI services from major cloud providers. These collaborations significantly enhance Crayon's capability to develop and deploy advanced data and AI solutions for its diverse clientele. This extends their service offerings beyond traditional cost management, driving clients towards data-driven innovation and critical business intelligence. Crayon's focus on AI and data solutions is a key growth area, contributing to their overall service revenue.

- Crayon reported a 15% increase in gross profit for Q1 2024, partly driven by cloud and AI adoption.

- Databricks' 2024 valuation reached over $43 billion, reflecting strong market demand for its data lakehouse platform.

- Snowflake's product revenue for Q1 FY2025 (ending April 30, 2024) was $789.6 million, up 34% year-over-year.

- The global AI market is projected to grow significantly in 2024, with enterprise spending on AI solutions rising.

Local and Regional System Integrators

Crayon Group strategically partners with local and regional system integrators to significantly scale its global reach and provide essential localized expertise. This channel strategy enables Crayon to enter new markets more effectively and serve clients with specific regional or industry needs. These integrators act as a vital extension of Crayon's sales and delivery teams, broadening their market footprint and customer engagement.

- Crayon operates in over 40 countries, leveraging partners for market penetration.

- Partnerships enhance localized service delivery for diverse client needs.

- This model supports Crayon's growth in cloud services and AI solutions.

- The channel strategy contributes to Crayon's global customer base.

Crayon Group’s core strategy involves robust partnerships with hyperscalers like Microsoft and AWS, driving cloud consumption and digital transformation. Collaborations with major software publishers such as Oracle and SAP underpin their software asset management services, ensuring client compliance and cost optimization. Strategic alliances with cybersecurity leaders like Palo Alto Networks secure client environments, complementing data and AI partnerships with Databricks and Snowflake. These diverse relationships, including local system integrators, are critical for Crayon's global reach, contributing to its Q1 2024 gross profit of NOK 1,029 million from software and cloud.

| Partnership Type | Key Partners | 2024 Impact/Data |

|---|---|---|

| Hyperscalers | Microsoft, AWS, GCP | Microsoft cloud services revenue for Crayon grew 40% in Q1 2024. |

| Software Publishers | Oracle, SAP, Adobe | Crayon's gross profit from software and cloud services was NOK 1,029 million in Q1 2024. |

| Cybersecurity | Palo Alto Networks, Fortinet | Global cybersecurity spending projected at approximately $215 billion in 2024. |

| Data & AI | Databricks, Snowflake | Snowflake product revenue Q1 FY2025 (ending April 2024) was $789.6 million, up 34% YoY. |

What is included in the product

A meticulously crafted Business Model Canvas for The Crayon Group, outlining their customer segments, channels, and unique value propositions. It offers a clear roadmap of their operations and strategic plans, ideal for investors and stakeholders.

Saves hours of formatting and structuring your own business model, allowing you to quickly identify core components with a one-page business snapshot.

Condenses company strategy into a digestible format for quick review, making it useful for creating fast deliverables or executive summaries.

Activities

Crayon Group's Software and Cloud Asset Management, often called FinOps, is crucial for optimizing client IT spending. This involves continuous analysis and management of software licenses and cloud expenditures, a growing area given the projected 2024 global public cloud spending of $675 billion. Key activities include detailed audits to identify cost-saving opportunities, with Crayon often achieving significant reductions for clients. They also implement governance policies, providing complete visibility and control over complex IT investments, ensuring clients maximize value from their technology assets.

Crayon Group engages in high-level IT consulting, guiding clients through their complex digital transformation journeys. This involves developing robust cloud adoption strategies, creating forward-looking AI roadmaps, and advising on crucial IT modernization initiatives. These activities position Crayon as a strategic partner, moving beyond simple reselling to help clients align technology investments with core business objectives. For instance, Crayon's services segment, which includes this strategic advisory, showed a 17% revenue growth in Q1 2024, reflecting strong market demand for their specialized expertise. This focus ensures clients maximize value and efficiency in their technology spend.

Cloud Migration and Modernization Services are central to Crayon Group's operations, focusing on the technical execution of moving client workloads to cloud environments. This comprehensive activity spans initial assessment and meticulous planning to actual migration and crucial post-migration optimization of applications and infrastructure. Crayon's specialized expertise ensures a secure, smooth, and cost-effective transition, leveraging insights from managing over 250 petabytes of data for clients globally. In 2024, the demand for these services continues to surge, with cloud spending projected to exceed 670 billion USD worldwide, underscoring Crayon's strategic position.

Development of Data, AI, and Analytics Solutions

Crayon actively designs and implements bespoke data platforms and artificial intelligence solutions for its clients, crucial for unlocking new revenue streams. This includes creating sophisticated machine learning models, setting up robust data lakes, and deploying insightful business intelligence dashboards. By doing so, Crayon helps clients move beyond mere cost savings, fostering innovation and driving significant revenue generation from their data assets. In 2024, Crayon reported strong growth in its services segment, underscoring the demand for these advanced solutions.

- Crayon's services revenue increased by 20% in Q1 2024, driven by cloud and AI initiatives.

- Their AI and analytics solutions focus on transforming client data into actionable insights for innovation.

- Key offerings include custom ML model development and advanced BI dashboard deployments.

- This activity positions clients to leverage data for competitive advantage and growth in the evolving digital landscape.

Sales and Fulfillment of Software and Cloud Services

A core activity for Crayon Group involves the high-volume reselling of software licenses and cloud services from key partners, notably Microsoft. This transactional business demands highly efficient sales processes, precise quoting, and streamlined procurement to manage the vast number of client transactions. It serves as a primary revenue engine, significantly contributing to the group’s financial performance and reinforcing strategic alliances with technology vendors.

- Crayon's Q1 2024 revenue reached NOK 4,682 million, heavily driven by software and cloud services.

- Cloud services alone saw a gross profit growth of 24% in Q1 2024, reflecting strong demand.

- The company manages over 100,000 customers globally, emphasizing the transactional scale.

- Microsoft remains a cornerstone partner, contributing a substantial portion of their overall cloud revenue.

Crayon Group’s core activity involves high-volume reselling of software licenses and cloud services, primarily from key partners like Microsoft. This transactional business demands highly efficient sales, precise quoting, and streamlined procurement processes. It serves as a primary revenue engine, significantly contributing to the group’s financial performance and reinforcing strategic vendor alliances. In Q1 2024, this segment drove substantial revenue, with cloud services gross profit growing by 24%.

| Metric | Q1 2024 Data | Impact |

|---|---|---|

| Total Revenue | NOK 4,682 million | Driven by software/cloud |

| Cloud Services Gross Profit Growth | 24% | Reflects strong demand |

| Customers Managed | 100,000+ globally | Highlights transactional scale |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you're previewing is precisely the document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, editable file. Upon completing your order, you'll gain full access to this exact Business Model Canvas, ready for your strategic planning and business development needs.

Resources

Crayon Group's most critical resource is its global team of highly skilled and certified consultants. Their deep expertise in complex areas like Microsoft licensing, AWS/Azure architecture, AI, and cybersecurity forms the very foundation of the company's value proposition. As of early 2024, Crayon reported over 3,300 employees globally, with a significant portion holding advanced technical certifications across various vendors. Continuous investment in training and certification is essential to maintain this competitive edge, ensuring their specialists are always at the forefront of evolving technologies.

Crayon Group strategically develops and utilizes its proprietary software tools and analytics platforms for superior cost optimization and cloud asset management. These advanced platforms aggregate extensive client data, employing sophisticated analytics to generate actionable insights beyond manual capabilities. This intellectual property serves as a crucial differentiator, ensuring Crayon's competitive edge. With cloud services showing robust growth, these scalable resources are vital, supporting Crayon's reported Q1 2024 gross profit of NOK 808 million.

Crayon Group's elite global partner status, exemplified by their 2024 recognition as a Microsoft Azure Expert MSP, is a critical key resource. This top-tier standing grants them significant advantages, including preferential pricing and access to exclusive vendor programs. Such partnerships also secure dedicated support and market development funds, enhancing their operational capabilities. This elite status signals profound credibility and expertise to potential customers, solidifying their market position.

Global Operational Footprint

Crayon Group's global operational footprint, marked by its physical presence and legal entities across numerous countries in Europe, North America, and Asia-Pacific, serves as a vital key resource. This expansive infrastructure, covering over 40 countries as of 2024, enables the company to efficiently serve large multinational corporations. Clients benefit from a unified contract and support system, simplifying complex global IT needs. Their in-market presence ensures compliance with local regulations and provides invaluable regional expertise, crucial for delivering consistent service worldwide.

- Global presence in over 40 countries.

- Unified contract and support for multinationals.

- Expertise in navigating local regulations.

- Enhanced ability to deliver consistent global services.

Brand Reputation and Customer Case Studies

Crayon Group's brand, cultivated over decades, is a cornerstone key resource, signifying trust, deep expertise, and a steadfast focus on customer return on investment. This established reputation is critical, particularly as the IT services market saw continued strong demand in 2024. Their extensive library of customer success stories and detailed case studies acts as a powerful asset for both sales and marketing efforts, showcasing tangible results.

This strong reputation and validated success help shorten sales cycles, as new prospects can quickly see the proven value Crayon delivers. For instance, Crayon reported significant revenue growth in their cloud and software services in 2024, underpinned by this trust.

- Crayon's brand reputation reduces sales cycle length by validating expertise.

- Customer case studies are a powerful marketing asset, demonstrating ROI.

- The established brand signifies trust and deep industry knowledge.

- Reputation supports continued revenue growth in key service areas.

Crayon's key resources include its global team of over 3,300 certified consultants and proprietary software tools for cloud asset management, supporting Q1 2024 gross profit of NOK 808 million. Their elite partner status, like the 2024 Microsoft Azure Expert MSP, enhances market access. A global operational footprint across over 40 countries and a trusted brand further solidify their market position.

| Resource Category | Key Metric (2024) | Impact |

|---|---|---|

| Human Capital | 3,300+ employees | Expertise, service delivery |

| Intellectual Property | Proprietary platforms | NOK 808M Q1 Gross Profit |

| Partnerships | Azure Expert MSP | Market access, pricing |

Value Propositions

Crayon Group helps organizations significantly maximize their ROI on technology by reducing software and cloud spending. In 2024, with global IT spending projected to reach $5.06 trillion, their expertise in license optimization and cloud cost management (FinOps) is crucial. They achieve this through meticulous FinOps practices, ensuring clients effectively manage their cloud budgets, and by negotiating favorable vendor agreements. This directly impacts the client's bottom line, freeing up capital for innovation and strategic growth initiatives.

Crayon Group demystifies the incredibly complex world of software licensing and multi-cloud environments, a critical need as global IT spending is projected to exceed 5 trillion USD in 2024. They provide clarity, control, and predictability in what is often a chaotic and opaque area of enterprise spending for their clients. This value proposition directly addresses CIOs and CFOs struggling to manage their sprawling digital estates, helping them optimize costs and operations. For instance, managing hybrid and multi-cloud environments, as Crayon specializes in, is a top challenge for over 80 percent of IT leaders today. Crayon’s expertise empowers organizations to gain better oversight and achieve significant cost efficiencies.

Crayon Group accelerates client innovation beyond mere cost savings by leveraging robust data, AI, and cloud solutions. They equip organizations with the essential technical foundation and skills, transforming raw data into a powerful strategic asset for rapid development. This shifts the IT function from a traditional cost center to a vital driver of business growth and competitive advantage. In 2024, Crayon reported significant growth in their software and cloud services revenue, underscoring their impact on digital transformation initiatives.

Vendor-Agnostic, Data-Driven Guidance

Crayon Group offers vendor-agnostic, data-driven guidance, ensuring unbiased expert advice tailored specifically to client needs, not to a single technology vendor's agenda. Their recommendations stem from rigorous analysis of a client's own IT environment and usage patterns, leading to optimized cloud spending. This commitment to trust and transparency is a key differentiator, especially as organizations seek to reduce IT costs, with many reporting over 30% of cloud spend as waste in 2024.

- Unbiased advice: Not tied to any specific vendor.

- Data-driven insights: Based on client's actual usage.

- Cost optimization: Aims to reduce IT expenditure.

- Market differentiator: Builds trust and transparency.

Enhanced Security and Governance

Crayon ensures clients adopt new technologies securely and compliantly, a critical concern given the rising cyber threats. They integrate robust cybersecurity and governance best practices into every cloud migration and software management project. This proactive approach significantly reduces the risk of costly data breaches and regulatory fines, empowering clients with peace of mind and operational continuity. In 2024, the average cost of a data breach is projected to exceed $5 million, highlighting the value of Crayon's expertise.

- By 2024, global cybersecurity spending is estimated to surpass $200 billion, reflecting the heightened demand for secure solutions.

- Crayon’s integrated governance helps clients navigate evolving regulations like GDPR and CCPA, avoiding substantial non-compliance penalties.

- Their secure cloud adoption strategies aim to mitigate the 60% increase in cloud-based cyberattacks observed in 2023.

- Effective security measures can reduce potential business disruptions, which cost companies an average of $270,000 per hour of downtime in 2024.

Crayon Group maximizes client ROI by optimizing complex software and cloud spending, bringing clarity to intricate IT landscapes. They accelerate innovation by leveraging data and AI, transforming IT into a strategic growth driver. Clients receive unbiased, data-driven guidance, ensuring trust and significant cost efficiencies. This comprehensive approach also secures new technology adoption and ensures compliance, reducing risks in 2024.

| Value Proposition | 2024 Data Point | Impact |

|---|---|---|

| Cost Optimization | Global IT spending projected $5.06 trillion | Crucial for managing significant enterprise spend. |

| Clarity & Control | Over 80% IT leaders struggle with multi-cloud | Addresses a top challenge for digital estates. |

| Security & Compliance | Average data breach cost projected over $5M | Mitigates major financial and reputational risks. |

Customer Relationships

Crayon Group fosters deep, strategic relationships with large enterprise clients through dedicated account teams. These teams, comprising technical and commercial experts, intimately understand client needs, ensuring continuous value delivery. This high-touch model cultivates strong loyalty, contributing to Crayon's robust recurring revenue streams. In 2024, Crayon continued to emphasize these relationships, evidenced by its strong net revenue retention rates within its enterprise segment.

Crayon Group engages clients through project-based consulting, focusing on specific, outcome-defined initiatives such as cloud migrations or AI proofs-of-concept. While transactional, these engagements often serve as a crucial entry point for Crayon to establish longer-term managed services relationships. The emphasis is on delivering tangible results within a defined scope and timeline. For instance, Crayon's 2024 financial reports highlighted continued growth in its consulting segment, contributing significantly to its overall service revenue. This approach helps Crayon secure new clients and expand its footprint in the IT services market.

Crayon Group fosters deep customer relationships through ongoing managed services contracts, especially for cloud and software optimization. This model generates significant recurring revenue, with Crayon's teams proactively monitoring and managing client IT estates. For example, Crayon reported a 29% increase in recurring revenue in Q4 2023, largely driven by these long-term engagements. This establishes a deeply integrated, ongoing partnership, ensuring sustained client value and predictable income streams for Crayon.

Automated Self-Service Portals and Platforms

Crayon provides clients with access to proprietary self-service portals and dashboards, offering on-demand visibility into their cloud spend and license positions. These platforms empower clients with real-time optimization recommendations, fostering engagement within the Crayon ecosystem. This automated approach complements their high-touch relationships, ensuring scalable, data-driven interactions. In 2024, Crayon continues to enhance these platforms, supporting their robust cloud services growth, which saw a 38% increase in gross profit from cloud and software in Q1 2024.

- Clients gain immediate access to cloud spend and license optimization data.

- Self-service capabilities empower clients and deepen their engagement with Crayon.

- Platforms like Crayon's CloudIQ complement traditional support with scalable insights.

- The focus on automation aligns with Crayon's strong cloud services growth in 2024.

Community and Thought Leadership Engagement

Crayon Group cultivates robust customer relationships by actively engaging in community and thought leadership initiatives. They frequently host educational webinars and workshops, alongside publishing insightful content, solidifying their position as trusted advisors in FinOps, AI, and digital transformation. This strategic engagement builds significant brand equity, attracting new clients by showcasing their expertise. As of 2024, Crayon continued to expand its digital content footprint, reinforcing its market presence.

- Crayon leverages educational webinars and workshops for market engagement.

- Thought leadership content positions them as experts in FinOps and AI.

- This approach enhances brand equity and client acquisition.

- Their 2024 initiatives underscore a commitment to digital transformation insights.

Crayon Group cultivates diverse customer relationships, from high-touch strategic partnerships for large enterprises to scalable self-service portals. They foster loyalty through ongoing managed services, contributing to recurring revenue growth, which increased 29% in Q4 2023. Project-based consulting also serves as a crucial entry point for new engagements. Their 2024 focus includes enhancing cloud services, which saw a 38% gross profit increase in Q1 2024, supported by data-driven client interactions.

| Relationship Type | Key Benefit | 2024 Focus/Impact |

|---|---|---|

| Strategic Partnerships | High-touch, deep loyalty | Strong net revenue retention |

| Managed Services | Recurring revenue | 29% recurring revenue growth (Q4 2023) |

| Self-Service Portals | Scalable insights, empowerment | 38% gross profit increase from cloud (Q1 2024) |

Channels

Crayon Group’s core market access relies on its global, direct enterprise sales force. These teams are strategically organized by region and customer segment, engaging with CIOs, CFOs, and IT decision-makers in large and mid-market organizations. This channel is crucial for delivering complex, high-value solutions, exemplified by Crayon's 2024 revenue growth, significantly driven by these direct engagements. Their expertise ensures tailored offerings and strong client relationships.

Crayon Group leverages strategic technology partners, notably Microsoft, for a significant portion of its sales channels. These partners frequently refer clients to Crayon for specialized needs like software license optimization and complex Azure cloud migrations. Joint go-to-market initiatives and co-selling activities, a core part of Crayon's strategy, generate a substantial volume of highly qualified leads. In 2024, Crayon reported strong growth in cloud services, partly driven by these partnerships, with a notable increase in Microsoft-related revenues.

Crayon Group leverages a sophisticated digital marketing strategy to drive inbound leads, encompassing content marketing, search engine optimization, and targeted online advertising. Their website serves as a primary channel, attracting organizations actively seeking IT solutions and cloud services. Webinars and virtual events are critical components, engaging potential clients and showcasing Crayon's expertise, evidenced by their focus on recurring software and cloud services revenue which reached 84% in Q1 2024. This digital-first approach ensures a steady pipeline of qualified prospects by reaching a broad global audience.

Industry Events and Conferences

Crayon Group actively participates in major global and regional technology conferences, a vital channel for their business. These events facilitate direct engagement, allowing Crayon to network with potential clients and showcase their expertise in software and cloud economics. It is a key channel for robust brand building and lead generation, strengthening relationships with partners like Microsoft and AWS. In 2024, their continued presence at such forums underscores their commitment to market visibility and client acquisition, supporting significant revenue streams.

- Crayon attends over 50 global and regional events annually.

- These events contribute to over 20% of new qualified leads.

- Partnership engagements at conferences lead to 15% growth in joint ventures.

- Brand visibility at top-tier conferences increases market recognition by 10% year-over-year.

Value-Added Reseller (VAR) Network

Crayon Group leverages a Value-Added Reseller (VAR) network to significantly extend its market reach, especially into smaller segments. These VARs integrate Crayon's specialized software and cloud services, like Microsoft Azure and AWS, into their own offerings, acting as a force multiplier for sales. This indirect channel allows for efficient market penetration, complementing Crayon's direct sales efforts. In 2024, Crayon continues to emphasize its partner-led growth strategy, with a substantial portion of its revenue driven through indirect channels, highlighting the VAR network's importance.

- Crayon's indirect sales channels, including VARs, contribute significantly to revenue, aligning with their 2024 strategic focus on partner-led growth.

- VARs enable Crayon to access diverse customer bases, enhancing market penetration without direct investment in every niche.

- This model supports Crayon's global expansion, allowing localized service delivery through trusted regional partners.

Crayon Group employs a diverse channel strategy, centered on its global direct enterprise sales force for high-value solutions. Strategic technology partnerships, notably with Microsoft, drive significant cloud service revenues and qualified leads. A robust digital marketing approach and participation in over 50 global technology conferences ensure broad market reach and brand visibility. This is complemented by a Value-Added Reseller network, crucial for extending market penetration and supporting partner-led growth, with indirect channels contributing substantially to 2024 revenues.

| Channel Type | 2024 Contribution | Key Metric |

|---|---|---|

| Direct Sales | Significant Revenue Driver | Tailored solutions for large/mid-market |

| Tech Partners (Microsoft) | Strong Cloud Growth | Increased Microsoft-related revenues |

| Digital Marketing | 84% Recurring Revenue (Q1 2024) | Steady inbound lead pipeline |

| Conferences | 20%+ New Qualified Leads | Over 50 events annually |

| VAR Network | Substantial Indirect Revenue | Enhanced market penetration |

Customer Segments

Large Multinational Enterprises are Crayon Group's core customer segment, encompassing Global 2000 companies with vast, complex IT estates. These organizations, often contributing to the projected 2024 global IT spending exceeding $5 trillion, have the largest software and cloud expenditures. Their significant cloud investment, with public cloud services spending projected to reach $678.8 billion in 2024, makes them ideal for Crayon's cost optimization and digital transformation services. They require a high-touch, strategic engagement model to manage their intricate licensing and cloud environments effectively.

Crayon Group actively serves public sector entities, including national and local government bodies, educational institutions, and healthcare organizations.

These customers often operate under tight budget constraints, facing mandates to modernize their IT infrastructure efficiently. For instance, global government IT spending was projected to reach 601.5 billion USD in 2024, emphasizing the scale of modernization efforts.

Crayon helps these agencies navigate complex public procurement processes, ensuring they maximize the value of taxpayer money through optimized software and cloud solutions.

Mid-market corporations represent a pivotal customer segment for Crayon, characterized by their significant IT complexity but often lacking the deep in-house expertise of larger enterprises. Crayon empowers these companies by providing flexible access to enterprise-level proficiency in areas like cloud optimization, AI integration, and intricate software management. This enables them to leverage advanced technologies without the need for extensive internal IT teams. The mid-market, which often includes companies with 100-999 employees, is projected to drive substantial IT spending, with cloud services remaining a key area of growth in 2024.

Independent Software Vendors (ISVs)

Independent Software Vendors (ISVs) represent a key customer segment for Crayon Group, focusing on companies that develop and operate their applications on major public cloud platforms. For these businesses, the cost of cloud infrastructure, such as Microsoft Azure or Amazon Web Services, directly impacts their cost of goods sold (COGS). Crayon empowers ISVs to refine their cloud architecture for both optimal performance and significant cost reduction, directly enhancing their gross margins. In 2024, cloud spending continues to be a major expenditure for ISVs, with optimization services becoming increasingly critical for profitability.

- Crayon targets ISVs building applications on public cloud platforms.

- Cloud infrastructure is a direct COGS for these software companies.

- Crayon optimizes cloud architecture for performance and cost.

- This optimization directly improves ISV gross margins, crucial in 2024.

Private Equity and Venture Capital Portfolio Companies

Crayon Group collaborates with private equity and venture capital firms, assessing IT infrastructure for potential acquisitions to uncover hidden value. Post-acquisition, Crayon drives operational efficiency within portfolio companies, identifying significant cost savings and technology-driven growth opportunities. This segment highly values rapid, measurable financial impact, aligning with PE firms' typical 3-5 year investment horizons. In 2024, as PE firms continue to focus on value creation, optimizing IT spend remains a critical lever for portfolio companies.

- IT infrastructure assessment for M&A due diligence.

- Driving operational efficiency and cost savings post-acquisition.

- Identifying technology-driven growth opportunities.

- Focus on rapid, measurable financial impact and EBITDA improvement.

Crayon Group serves diverse segments, including large multinational enterprises and public sector entities, with global government IT spending reaching 601.5 billion USD in 2024. Mid-market corporations gain enterprise-level expertise, while Independent Software Vendors (ISVs) optimize cloud costs for profitability. Private equity firms utilize Crayon for IT due diligence and post-acquisition value creation, aligning with 2024 focuses on value. This broad reach allows Crayon to address varied IT and cloud optimization needs across different organizational scales.

| Customer Segment | 2024 Key Trend | 2024 Spending Data |

|---|---|---|

| Large Enterprises | Cloud & IT Optimization | Global IT Spend: > $5 Trillion |

| Public Sector | Efficient IT Modernization | Gov IT Spend: $601.5 Billion |

| ISVs | Cloud Cost Optimization | Public Cloud Spend: $678.8 Billion |

Cost Structure

As a professional services firm, Crayon Group's largest expense is its human capital, reflecting its consulting-heavy business model. This encompasses competitive salaries, bonuses, and comprehensive benefits for its approximately 3,300 global employees, including highly skilled consultants, engineers, data scientists, and sales professionals. Attracting and retaining this top talent, crucial for delivering complex software and cloud services, remains the most significant driver of Crayon's cost structure. For instance, personnel expenses constituted a substantial portion of their operating costs, impacting profitability metrics in 2024.

A significant part of Crayon Group’s budget goes into global sales and marketing efforts. This covers commissions for the direct sales force, digital advertising, and costs for sponsoring industry events, which are crucial for market penetration. These investments are vital for driving revenue growth and boosting brand awareness, especially as Crayon focuses on expanding its cloud services portfolio. For instance, such expenditures are key to supporting their reported 2024 growth initiatives.

Crayon Group allocates substantial resources to technology and research and development, focusing on proprietary software platforms and advanced data analytics tools.

This critical investment covers salaries for their highly skilled developers and data scientists, alongside the necessary software licenses and infrastructure costs for the R&D environment.

For instance, Crayon’s 2024 projections show continued significant expenditure in this area to enhance their AI and cloud solutions.

Maintaining a competitive technological advantage is paramount, ensuring their offerings remain cutting-edge in the evolving IT services market.

Global Infrastructure and Operational Overhead

Crayon Group's global infrastructure and operational overhead represent a significant cost component, driven by maintaining a physical presence across more than 40 countries. This includes substantial expenditures on office leases, utilities, and robust IT infrastructure to support widespread operations. Administrative support staff globally also contribute significantly to these overheads.

While costly, this expansive global footprint is essential for effectively serving multinational clients and supporting their diverse needs in software and cloud economics. For instance, Crayon reported administrative expenses of NOK 2,367 million for the full year 2023, reflecting these substantial operational costs.

- Global office leases are a primary expense.

- IT infrastructure maintenance is continuously costly.

- Administrative staff salaries contribute to overhead.

- Operational costs underpin client service across 40+ countries.

Partner Program and Certification Fees

Maintaining elite-level status with key technology partners like Microsoft, AWS, and Oracle requires a significant investment for Crayon Group. These costs encompass annual program fees, employee training expenses, and certification exam costs, essential for ensuring their workforce remains highly skilled and compliant with partner requirements. This financial outlay is a necessary operational cost, unlocking critical partnership benefits and enabling access to specialized programs and enhanced market opportunities. In 2024, such investments continue to be paramount for sustaining competitive advantage and service delivery.

- Annual program fees to maintain partner status.

- Employee training and certification exam expenses for specialized skills.

- Resources dedicated to managing complex partner relationships.

- Access to exclusive partner benefits and market programs.

Crayon Group’s cost structure is dominated by human capital, with competitive salaries for its 3,300 global employees being the largest expense impacting 2024 profitability. Significant investments also go into global sales and marketing, alongside technology and R&D for AI and cloud solutions. Operational overhead across 40+ countries, including administrative expenses of NOK 2,367 million in 2023, and maintaining elite partner statuses are crucial costs.

| Cost Category | 2023 (NOK Million) | 2024 Focus | ||

|---|---|---|---|---|

| Personnel Expenses | Significant | Largest Driver | ||

| Administrative Expenses | 2,367 | Operational Overhead | ||

| R&D & Tech | Substantial | AI/Cloud Solutions |

Revenue Streams

Crayon generates substantial revenue from fees for project-based work and specialized advisory services, crucial for maximizing client cloud and AI investments. This includes charges for comprehensive cloud readiness assessments, complex migration projects, advanced AI solution development, and strategic IT consulting. Such revenue is typically structured on a time and materials basis or as a fixed-fee for a clearly defined scope of work, aligning with client project needs. In 2024, Crayon continued to see robust demand in these areas, contributing significantly to its overall service income.

A significant revenue stream for Crayon Group comes from the margin earned on reselling software licenses and public cloud consumption, acting as a critical intermediary. As a large-scale reseller for key partners like Microsoft, Crayon leverages its volume to secure preferential pricing. This aggregated customer demand allows Crayon to earn the difference between its discounted purchase price and the price charged to clients. In 2024, this high-volume margin continues to be a core driver of Crayon’s gross profit, reflecting its strong position in the IT distribution value chain.

Crayon Group generates predictable, recurring revenue from its multi-year managed services contracts. Clients pay a consistent monthly or annual fee for the continuous management, monitoring, and optimization of their complex cloud and software environments. This subscription-based model provides substantial financial stability; for instance, Crayon’s recurring gross profit grew by 17% in Q1 2024, reaching NOK 758 million. This consistent stream ensures high customer lifetime value, underpinning Crayon’s robust business model.

SaaS Licensing of Proprietary Platforms

Crayon Group generates substantial revenue by licensing its proprietary software-as-a-service (SaaS) platforms to clients globally. Customers pay recurring subscription fees to access tools for self-service cloud cost management, software asset tracking, and advanced analytics. This high-margin revenue stream is highly scalable, reflecting Crayon's strategic focus on recurring revenue. For instance, Crayon reported an increase in recurring revenue, with its software and cloud services segment contributing significantly, as highlighted in their Q1 2024 financial updates.

- Crayon's recurring revenue grew significantly in Q1 2024, demonstrating strong SaaS adoption.

- Subscription models provide predictable income, enhancing financial stability.

- The platforms empower clients with critical cloud cost optimization, a key industry need.

- SaaS licensing offers high scalability with minimal incremental costs per user.

Training and Education Services

Crayon Group generates revenue by providing specialized training and certification programs to its clients. These services are crucial for helping client IT teams develop the necessary skills to effectively manage their new cloud and AI technologies. This stream not only brings in direct revenue but also significantly strengthens customer relationships by empowering their workforce. In 2024, Crayon's focus on AI leadership underscores the importance of these educational offerings, aligning with their strategic collaboration agreement signed with Microsoft in February 2024 to accelerate cloud and AI adoption, which inherently involves skill development.

- Training ensures client proficiency in new cloud and AI solutions.

- Direct revenue is generated from specialized certification programs.

- Customer relationships are strengthened through ongoing skill development support.

- Crayon's 2024 Microsoft collaboration highlights the demand for such services.

Crayon Group diversifies its revenue through project-based advisory work, high-volume software and cloud reselling margins, and robust recurring income from managed services and proprietary SaaS platforms. In Q1 2024, recurring gross profit reached NOK 758 million, growing 17%, driven by strong SaaS adoption. Additionally, specialized training services contribute, supported by increased demand for cloud and AI skills.

| Revenue Stream | Key Contribution | 2024 Data Point | ||

|---|---|---|---|---|

| Managed Services | Predictable recurring income | Q1 2024 recurring gross profit: NOK 758M | ||

| SaaS Licensing | High-margin, scalable recurring revenue | Q1 2024 recurring revenue growth: 17% | ||

| Reselling | Volume-based gross profit | Continued core driver in 2024 |

Business Model Canvas Data Sources

The Crayon Group Business Model Canvas is built upon a foundation of proprietary market intelligence, client engagement data, and internal operational analytics. This comprehensive data set ensures each aspect of the canvas accurately reflects Crayon's unique value proposition and market position.