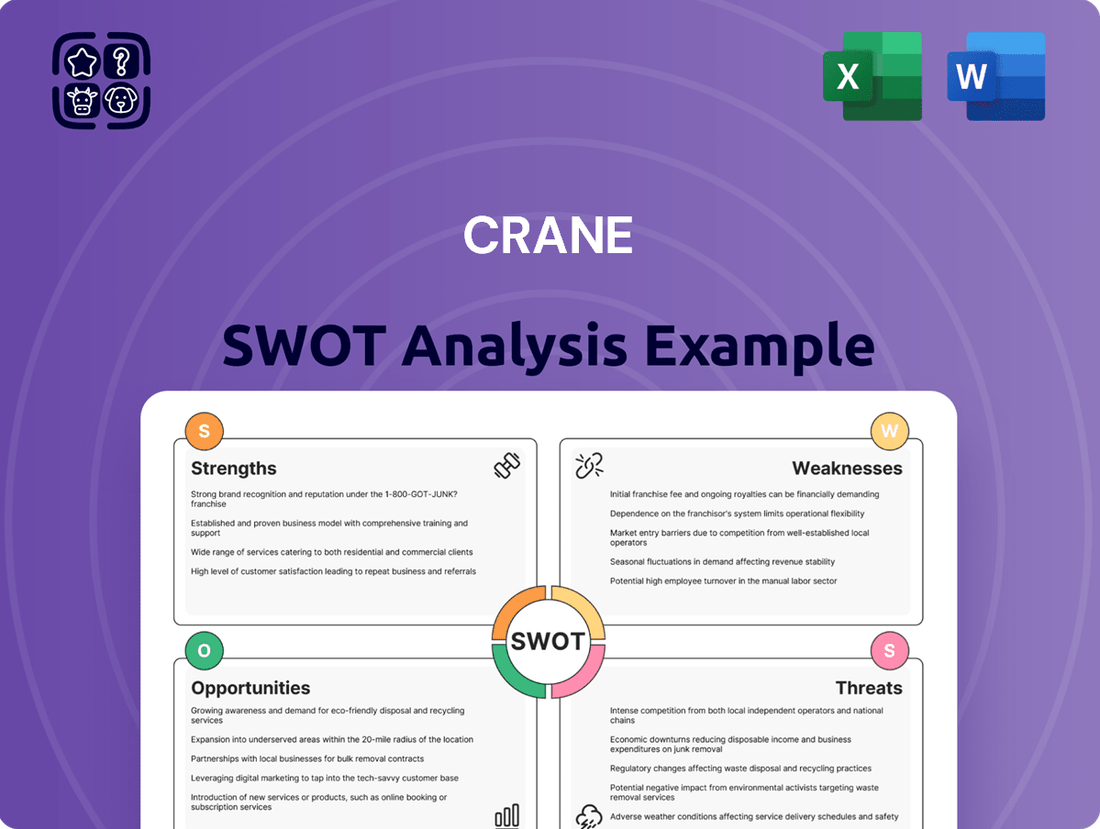

Crane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

Crane's brand recognition and established market presence are significant strengths, allowing them to command customer loyalty. However, their reliance on a few key product lines presents a vulnerability to market shifts. Explore the full picture behind Crane's competitive edge and potential pitfalls.

Uncover Crane's opportunities for expansion into emerging markets and their potential to leverage technological advancements. Want the full story behind Crane's growth drivers and competitive landscape?

Discover the complete strategic advantage Crane holds, alongside the threats posed by increasing competition and regulatory changes. This in-depth report reveals actionable insights for informed decision-making.

Gain access to a professionally written, fully editable report designed to support planning, pitches, and research. Purchase the complete SWOT analysis to understand Crane's full potential and challenges.

Strengths

Crane Company's diversified and highly engineered product portfolio is a significant strength, spanning key sectors like Aerospace & Electronics, Process Flow Technologies, and Engineered Materials. This strategic breadth, encompassing everything from advanced aircraft components to essential fluid handling systems, insulates the company from downturns in any single market. In 2023, Crane reported total revenue of $2.4 billion, with its diverse segments contributing to this stability, showcasing its ability to navigate varied economic landscapes.

Crane has shown robust financial performance, reporting substantial core sales growth and adjusted earnings per share (EPS) growth in 2024. The company projects continued positive momentum into 2025, indicating sustained operational strength.

The company's strong balance sheet provides significant financial flexibility. This allows Crane to pursue strategic acquisitions, increase dividend payouts to shareholders, and engage in stock repurchases, all aimed at boosting shareholder value.

Crane Company's strategic acquisitions, including CryoWorks, Technifab Products, and Vian Enterprises, significantly strengthened its cryogenic and fluid management capabilities. These moves, finalized in late 2024 and early 2025, are projected to contribute over $250 million in incremental annual revenue by 2026, enhancing Crane's market position in these key industrial sectors.

The divestiture of its Engineered Materials business in early 2025 underscores Crane's focus on portfolio simplification. This strategic move allows for a more concentrated allocation of resources towards its high-growth, core industrial segments, promising improved operational efficiency and a clearer strategic direction.

Global Presence and Market Reach

Crane Company's global presence is a significant strength, with operations spanning the United States, Canada, the United Kingdom, Continental Europe, and other international markets. This broad geographic reach allows them to serve a diverse customer base and capitalize on varying regional economic conditions. For instance, their 2023 annual report indicated that approximately 40% of their net sales originated from outside the United States, highlighting their substantial international market penetration.

This extensive operational footprint enables Crane to diversify revenue streams and mitigate risks associated with downturns in any single market. By tapping into multiple regional demands, the company can better weather economic volatility and identify new growth opportunities. Their ability to adapt to local market needs across these regions is a key competitive advantage, as evidenced by their consistent performance in challenging economic environments.

- Extensive Geographic Footprint: Operations in North America, Europe, and beyond.

- Diversified Revenue Streams: Reduced reliance on any single regional economy.

- Global Customer Base: Ability to serve a wide array of industries internationally.

- Market Penetration: Approximately 40% of 2023 net sales from outside the U.S.

Focus on Critical and Specialized Markets

Crane Company's strategic focus on critical and specialized markets, such as aerospace (both commercial and military), chemical and pharmaceutical production, and water/wastewater management, creates a strong foundation for consistent demand. These sectors are characterized by stringent requirements for reliability and precision, fostering durable customer loyalty and predictable, recurring revenue for essential Crane components. For instance, Crane's aerospace and electronics segment, a key area of specialization, reported robust performance, contributing significantly to overall revenue in recent fiscal periods, reflecting the essential nature of its offerings in these high-stakes industries.

This deliberate market concentration translates into significant advantages for Crane. The inherent need for high-performance, dependable equipment in these fields means customers are less likely to switch suppliers once a trusted relationship is established. This reduces customer acquisition costs and enhances revenue stability, as seen in the consistent performance of Crane's Payment Innovations segment, which serves critical transaction needs across various essential services.

- Specialized Market Dominance: Crane targets sectors like aerospace, chemical, and water treatment, where its expertise is highly valued.

- High Reliability Demand: Critical applications necessitate precision and durability, ensuring a consistent need for Crane's products.

- Long-Term Customer Relationships: The specialized nature of these markets fosters strong, enduring partnerships.

- Recurring Revenue Streams: Essential components for these industries generate predictable income for Crane.

Crane Company's diversified product portfolio, spanning Aerospace & Electronics, Process Flow Technologies, and Engineered Materials, provides resilience against sector-specific downturns. This breadth, demonstrated by its $2.4 billion in revenue for 2023, ensures stability across varied economic cycles.

The company's robust financial health, evidenced by strong core sales and EPS growth in 2024, is further bolstered by a healthy balance sheet. This financial flexibility allows for strategic investments, dividend increases, and share repurchases, all aimed at enhancing shareholder value.

Crane's strategic acquisitions, such as CryoWorks and Technifab Products, finalized in late 2024 and early 2025, are expected to add over $250 million in annual revenue by 2026, significantly bolstering its capabilities in critical growth areas.

The divestiture of its Engineered Materials business in early 2025 signifies a strategic pivot towards optimizing its portfolio. This focus allows for concentrated resource allocation to high-growth industrial segments, promising improved efficiency and a clearer strategic path forward.

Crane's global operational footprint, with approximately 40% of its 2023 net sales originating outside the U.S., diversifies revenue streams and mitigates risks. This extensive reach across North America and Europe allows them to serve a broad international customer base and capitalize on regional economic strengths.

Specialization in critical markets like aerospace and chemical processing provides a strong demand base, fostering customer loyalty and predictable revenue. Crane's Payment Innovations segment, for example, consistently supports essential transaction needs, highlighting the company's crucial role in specialized industries.

| Segment | 2023 Revenue (Approx.) | Key Strength |

|---|---|---|

| Aerospace & Electronics | $1.1 Billion | High demand for specialized aircraft components |

| Process Flow Technologies | $900 Million | Essential fluid handling systems for industrial applications |

| Engineered Materials | $400 Million | Divested in early 2025 for strategic focus |

What is included in the product

Analyzes Crane’s competitive position through key internal and external factors, detailing strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address critical strategic weaknesses and threats, thereby alleviating the pain of uncertainty.

Weaknesses

Despite Crane Company's efforts to diversify, a significant weakness persists: its exposure to the inherently cyclical nature of key industrial markets. Sectors like aerospace, defense, and various process industries, which are crucial for Crane's revenue, are particularly susceptible to economic fluctuations.

When economic downturns hit, businesses in these sectors tend to slash capital expenditures. This directly impacts Crane's sales pipeline and the growth of its order books, as customers delay or cancel planned investments in equipment and services.

For instance, in the first quarter of 2024, Crane reported that its Aerospace & Electronics segment experienced a slight revenue decline, partly attributed to softer demand in certain commercial aerospace sub-sectors. This highlights the sensitivity of its performance to broader industrial market health.

This cyclicality means that Crane's financial performance can be quite volatile, making consistent year-over-year growth a challenge. The company's reliance on these broader economic trends, rather than purely on its own product innovation, represents a notable vulnerability.

Crane Company's reliance on intricate global supply chains for its engineered products presents a significant vulnerability. For instance, the semiconductor shortage experienced in 2021-2022, impacting various industries including aerospace and electronics, directly affected the production timelines and costs for complex machinery.

Fluctuations in raw material prices, such as the 2024 surge in nickel prices impacting stainless steel costs, can directly increase Crane's input expenses. Geopolitical events, like trade disputes or conflicts in key manufacturing regions, further exacerbate the risk of logistics disruptions and unexpected cost escalations, potentially squeezing profit margins and delaying customer deliveries.

Crane's strategic acquisition approach, while intended for growth, introduces significant integration risks. Successfully merging acquired operations, technologies, and corporate cultures is a complex undertaking. For instance, if Crane fails to smoothly integrate its recent acquisitions, the company could face substantial operational disruptions and increased costs.

These integration challenges can directly impact financial performance. For example, if synergies aren't realized as planned, it could dilute earnings per share and negatively affect shareholder value. In 2023, Crane reported $6.4 billion in revenue, and a significant portion of this growth was driven by acquisitions, highlighting the importance of effective post-merger integration to sustain this momentum.

Intense Competition in Specialized Markets

Crane Company navigates highly specialized markets where competition is fierce. Established giants and agile newcomers alike vie for market share, creating a challenging environment. This intense rivalry often leads to price pressures, compelling Crane to constantly innovate and optimize its operations to stay ahead and protect its profitability.

The pressure to differentiate in these niche sectors is substantial. For instance, in the highly specialized aerospace and defense sector, where Crane has a significant presence, competition from companies like General Electric and Rolls-Royce demands continuous technological advancement and cost-efficiency. In 2023, the global aerospace market saw robust growth, but also highlighted the need for suppliers to offer cutting-edge solutions to capture and maintain business.

- Intense Rivalry: Crane faces significant competition from both established players and emerging companies across its diverse product lines.

- Pricing Pressure: The competitive landscape often results in downward pressure on pricing, impacting margins.

- Innovation Imperative: Maintaining market share requires continuous investment in research and development to offer superior products and solutions.

- Efficiency Demands: Operational efficiency is critical to remain competitive and profitable in these specialized, high-stakes markets.

Ongoing Need for Research and Development Investment

Crane Company faces a significant weakness in its ongoing need for substantial research and development (R&D) investment. To stay ahead in its markets for highly engineered products and critical applications, continuous R&D is non-negotiable. This commitment translates into considerable capital expenditure and resource allocation, essential for keeping pace with rapid technological evolution and shifting customer demands.

The financial burden of this R&D can impact profitability and cash flow in the short to medium term. For instance, in fiscal year 2023, Crane reported R&D expenses of approximately $118 million, a figure that is expected to remain a significant operational cost. This necessitates a delicate balance between innovation and financial prudence.

- High Capital Outlay: R&D demands significant financial resources, potentially straining cash reserves.

- Technological Obsolescence Risk: Failure to invest adequately risks products becoming outdated.

- Long Development Cycles: Investments may not yield returns for extended periods.

- Competitive Pressure: Competitors' R&D successes can quickly erode market share if Crane lags.

Crane's reliance on a few key suppliers for specialized components creates a significant dependency. Disruptions at these suppliers, whether due to financial distress or operational issues, could halt Crane's production. For instance, a single-source supplier for a critical ceramic component used in its engineered materials segment could severely impact output if that supplier faces an unforeseen shutdown, as seen with some niche component manufacturers in the semiconductor industry during 2022.

Furthermore, the specialized nature of these components often means limited alternatives are readily available. This lack of substitutability amplifies the risk, potentially leading to extended lead times and increased costs if Crane needs to find and qualify new suppliers. The company's 2023 annual report indicated that while supplier diversification efforts were ongoing, a small number of suppliers accounted for a material portion of its procurement costs.

| Supplier Dependency Risk | Impact on Crane | Mitigation Challenge |

|---|---|---|

| Reliance on limited specialized suppliers | Production stoppages, increased costs, delayed deliveries | Difficulty finding and qualifying alternative suppliers for niche components |

| Vulnerability to supplier financial health | Risk of supply chain disruption if key suppliers face insolvency | Limited visibility into the financial stability of all upstream suppliers |

What You See Is What You Get

Crane SWOT Analysis

This is the actual Crane SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full Crane SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete Crane SWOT analysis. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual Crane SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The aerospace and defense sector presents a substantial growth avenue for Crane Company. Global air travel recovery is a key driver, with IATA reporting a 37% increase in international passenger traffic in early 2024 compared to 2023. This resurgence directly benefits aerospace manufacturers and their suppliers.

Furthermore, heightened geopolitical tensions and ongoing modernization efforts by governments worldwide are fueling increased defense spending. For instance, NATO members are continuing to increase their defense budgets, with many aiming to meet or exceed the 2% of GDP target, creating sustained demand for advanced defense systems and components that Crane's Aerospace & Electronics segment can supply.

Technological advancements, such as the development of new aircraft materials and more sophisticated electronic warfare systems, also create opportunities. Crane is well-positioned to leverage its expertise in engineered materials and complex electronic solutions to capture market share in these evolving segments.

Global infrastructure spending is a significant tailwind for Crane, particularly its Process Flow Technologies segment. Major initiatives in water treatment, renewable energy infrastructure, and general industrial automation are driving demand. For instance, the U.S. alone is investing billions in water infrastructure upgrades through programs like the Bipartisan Infrastructure Law, which is expected to boost demand for specialized pumps and valves.

Industrial modernization efforts worldwide, coupled with a strong focus on sustainability, are further fueling the need for advanced fluid handling systems. Companies are upgrading aging facilities and implementing more efficient processes, directly benefiting Crane's offerings. The push for greater energy efficiency and reduced environmental impact in manufacturing and processing sectors creates a robust market for Crane's high-performance pumps and valves.

The global advanced materials market is projected to reach $116.2 billion by 2025, showing substantial growth. Crane can capitalize on this by integrating advanced composites and alloys into its aerospace and defense products, improving durability and reducing weight, which is critical for fuel efficiency. For instance, advancements in additive manufacturing, or 3D printing, allow for the creation of complex, lightweight components that were previously impossible to produce, potentially enhancing Crane's product offerings and manufacturing processes.

Strategic Mergers and Acquisitions (M&A)

Crane Company's robust financial health, including a strong balance sheet and a deliberate approach to capital deployment, creates significant opportunities for strategic mergers and acquisitions. This financial discipline allows Crane to actively seek and integrate complementary businesses. The company's capacity for M&A is a key strategic advantage in a consolidating industry.

Crane can leverage its M&A capabilities for targeted bolt-on acquisitions. These moves are designed to enhance its current business segments, acquire critical technologies, or penetrate new, related markets. For instance, the recent acquisition of PSI, which specializes in advanced automation solutions, exemplifies this strategy by bolstering Crane's offerings in the industrial sector.

- Strengthens core businesses: Bolt-on acquisitions can expand market share and product portfolios within existing segments.

- Enhances technological capabilities: Acquiring companies with advanced technologies, like PSI's automation, accelerates innovation.

- Facilitates market expansion: M&A provides a faster route to entering new, adjacent markets than organic growth alone.

- Leverages financial strength: Crane's solid balance sheet supports the financial commitment required for strategic acquisitions.

Sustainability and Environmental Regulations

The growing global emphasis on sustainability and stricter environmental regulations present significant opportunities for Crane Company. As industries worldwide strive to reduce their environmental footprint, there's a heightened demand for equipment and solutions that support energy efficiency and lower emissions. Crane's offerings, particularly those that facilitate cleaner manufacturing processes or more efficient resource management, are well-positioned to capitalize on this trend.

For instance, advancements in crane technology that reduce energy consumption during operation, or equipment designed for the construction of renewable energy infrastructure like wind farms, directly address these market demands. The company's ability to innovate in areas such as electrification of its fleet or development of cranes with lower operational emissions could unlock substantial growth. In 2024, the global green building market was valued at approximately $1.1 trillion and is projected to grow significantly in the coming years, indicating a strong demand for sustainable construction solutions.

- Growing Demand for Sustainable Infrastructure: Crane's equipment can be vital for constructing renewable energy projects, such as wind farms and solar power installations, which are experiencing rapid expansion.

- Regulatory Tailwinds: Increasing government mandates for emissions reduction and energy efficiency in industrial operations create a favorable environment for Crane's eco-friendly product lines.

- Innovation in Efficiency: Developing and marketing cranes with improved fuel efficiency or electric power options can attract environmentally conscious clients and provide a competitive edge.

- Circular Economy Integration: Opportunities exist in providing equipment for recycling facilities or for the decommissioning and repurposing of industrial assets, aligning with circular economy principles.

Crane's strategic acquisitions and financial strength are key opportunities. The company's ability to integrate complementary businesses, like the recent PSI acquisition for automation solutions, enhances its market position and technological capabilities.

The growing global focus on sustainability and stricter environmental regulations presents a significant avenue for growth. Crane can capitalize on the demand for energy-efficient equipment and solutions that support cleaner industrial processes and renewable energy infrastructure development.

The aerospace and defense sectors offer substantial growth prospects, driven by the recovery of global air travel and increasing defense spending worldwide due to geopolitical shifts. Crane's expertise in engineered materials and electronic solutions positions it well to benefit from these trends, including the development of advanced aircraft and defense systems.

Infrastructure development globally, particularly in water treatment and renewable energy, provides a strong tailwind for Crane's Process Flow Technologies segment. Investments in upgrading aging industrial facilities and a focus on operational efficiency further boost demand for Crane's advanced fluid handling systems.

| Opportunity Area | Key Drivers | Crane's Advantage |

| Aerospace & Defense Recovery | Increased air travel, rising defense budgets | Expertise in engineered materials, electronic solutions |

| Global Infrastructure Spending | Water treatment, renewable energy, industrial automation | High-performance pumps and valves |

| Sustainability Focus | Environmental regulations, energy efficiency demand | Eco-friendly product development, renewable energy support |

| Strategic M&A | Financial strength, industry consolidation | Bolt-on acquisitions, technology enhancement |

Threats

A significant threat to Crane Company is a potential global or regional economic slowdown or recession. For instance, in 2023, while many economies showed resilience, forecasts for 2024 and 2025 from organizations like the IMF and World Bank indicated moderating global growth, with some regions facing higher risks of contraction due to persistent inflation and tighter monetary policies.

Such economic conditions can lead to reduced industrial activity, impacting Crane's core markets. A slowdown typically means businesses postpone or cancel capital expenditures, directly affecting demand for Crane's equipment like cranes, construction machinery, and fluid handling products.

Furthermore, decreased consumer spending during economic downturns can indirectly impact Crane by reducing overall construction and infrastructure projects, a key revenue driver. For example, if housing starts or commercial building permits fall significantly, Crane's order books would likely shrink.

The company's diverse segments, from aerospace to construction, are all susceptible to these macroeconomic headwinds. A broad-based economic contraction could lead to lower sales volumes and potentially pressure pricing power across all of Crane's product lines, impacting profitability and revenue streams.

Geopolitical instability, including escalating trade tensions and regional conflicts, presents a significant threat to Crane's operations. The ongoing trade disputes between major economies, for example, could lead to increased tariffs on components or finished goods, directly impacting manufacturing costs and international sales volumes. Uncertainty surrounding trade agreements and potential protectionist policies in key markets like China or Europe can disrupt established supply chains and create volatile demand patterns.

These global disruptions can significantly impact Crane's profitability and operational stability. For instance, a protracted trade war could result in a 1-2% reduction in Crane's revenue from affected regions, as seen in similar industrial sectors during past trade disputes. Furthermore, increased shipping costs and the need to reconfigure supply chains to mitigate risks add further operational expenses.

Persistent inflationary pressures continue to impact manufacturers by driving up costs for raw materials, labor, and transportation. For Crane Company, this means that even with their demonstrated cost management abilities, sustained inflation could squeeze profit margins if they can't fully pass these increased expenses onto customers through price adjustments.

The Bureau of Labor Statistics reported that the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, indicating rising input costs across various sectors. If Crane Company faces similar cost hikes, their ability to maintain profitability will depend on their pricing power and operational efficiency in the face of these economic headwinds.

Intensifying Competition and Technological Obsolescence

Crane faces significant threats from intensifying competition and the rapid pace of technological obsolescence. Competitors are continually developing advanced technologies and more affordable alternatives for Crane's highly engineered products, creating constant pressure to innovate and maintain cost-effectiveness. For example, the construction equipment market saw significant advancements in electric and hybrid machinery in 2024, demanding substantial R&D investment from incumbents like Crane to remain competitive.

Failure to adapt quickly to these technological shifts and evolving industry standards poses a direct risk of product obsolescence. This could erode Crane's market share, particularly as newer, more efficient, or digitally integrated solutions emerge. In 2024, the demand for smart, connected construction equipment with IoT capabilities increased, putting companies with legacy systems at a disadvantage. Crane's ability to integrate these technologies will be crucial for its future market position.

- Technological Advancements: Competitors introducing next-generation materials or manufacturing processes that offer superior performance or lower costs.

- Cost Pressures: Competitors with leaner operations or access to cheaper inputs can undercut Crane's pricing.

- Digital Integration: Lagging in the adoption of IoT, AI, and data analytics in product offerings could alienate customers seeking smart solutions.

- Regulatory Changes: New environmental or safety regulations could render existing technologies obsolete, requiring rapid product redesign.

Workforce and Talent Shortages

The manufacturing sector, which includes specialized areas like aerospace and industrial technologies where Crane operates, continues to grapple with significant workforce and talent shortages. This persistent challenge can directly impact production capacity, potentially leading to delays and missed opportunities. For instance, a 2024 report indicated that over 70% of US manufacturers experienced difficulties finding qualified workers, a trend that directly affects companies like Crane.

These labor shortages often translate into increased labor costs as companies compete for a limited pool of skilled individuals. Furthermore, a widening skills gap, particularly in areas requiring specialized technical expertise, can hinder innovation and the adoption of new technologies. Crane's ability to attract, train, and retain skilled personnel is therefore crucial for maintaining its competitive edge and operational efficiency.

- Skills Gap Impact: Difficulty in finding workers with specialized skills in areas like advanced manufacturing, engineering, and digital technologies.

- Production Capacity: Potential limitations on output and ability to meet demand due to insufficient staffing.

- Increased Labor Costs: Higher wages and benefits required to attract and retain qualified employees in a competitive market.

- Innovation Hindrance: Challenges in adopting new technologies and processes without adequate skilled personnel.

Crane faces significant threats from evolving regulatory landscapes and increasing compliance costs. New environmental standards, safety mandates, or trade policies can necessitate costly product redesigns and operational adjustments. For example, stricter emissions regulations enacted in key markets during 2024 could require substantial investment in cleaner technologies for Crane's equipment.

These regulatory shifts can also create barriers to entry or expansion in certain regions, impacting international sales. Furthermore, the complexity and cost associated with ensuring compliance across diverse global markets add to operational overhead, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

The increasing frequency and severity of cyberattacks pose a growing threat to Crane's operations and sensitive data. Industrial control systems and digital infrastructure are prime targets, and a successful breach could lead to significant disruption, intellectual property theft, or reputational damage. For instance, in 2024, several manufacturing firms reported ransomware attacks that halted production for weeks.

Protecting against these sophisticated threats requires continuous investment in cybersecurity measures and employee training. A failure to adequately safeguard its digital assets could result in substantial financial losses and erode customer trust, impacting Crane's ability to leverage its technological advancements.

SWOT Analysis Data Sources

This Crane SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry forecasts. These diverse data streams ensure a thorough and accurate assessment of the crane industry's landscape.