Crane Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

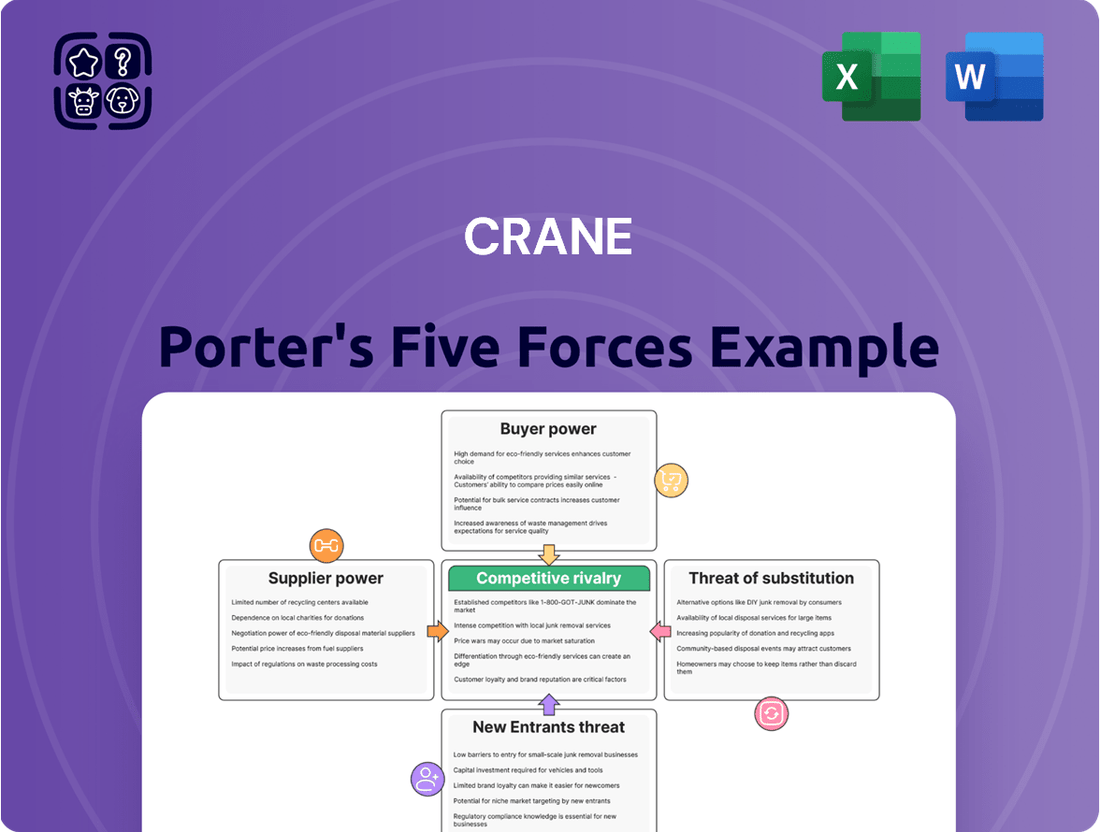

Crane's competitive landscape is shaped by powerful forces, from intense rivalry among existing players to the looming threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this environment. Furthermore, the availability of substitute products can significantly impact Crane's profitability and market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Crane’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Crane Company’s position in segments like aerospace and defense means it often deals with a small pool of highly specialized suppliers. These suppliers provide critical, often unique, components and advanced technologies essential for Crane's engineered products.

This scarcity of alternatives grants these specialized suppliers significant bargaining power. For instance, in the aerospace sector, suppliers of advanced composite materials or specialized engine components might have few, if any, direct competitors capable of meeting stringent industry specifications.

In 2024, the defense industry, a key market for Crane, saw continued supply chain consolidation, further concentrating power among a few key providers of specialized electronics and materials. This trend amplifies the leverage of these suppliers when negotiating terms with major manufacturers like Crane.

Consequently, Crane may face pressure on input costs and availability, impacting its manufacturing efficiency and profitability. The company's reliance on these limited sources for proprietary or highly technical inputs underscores the substantial bargaining power held by these suppliers.

Switching suppliers for specialized industrial components can be a costly endeavor for Crane Company. These costs can encompass re-engineering existing products to accommodate new specifications, the rigorous process of re-qualifying new components, and extended testing phases, all of which can lead to significant production disruptions. For instance, in the aerospace sector, a key market for Crane, component requalification alone can cost hundreds of thousands of dollars per part. This financial and operational burden significantly enhances the bargaining power of Crane's current suppliers, as the prospect of absorbing these expenses makes switching less attractive.

The quality of components and materials from suppliers is absolutely crucial for Crane's sophisticated products, like those in aircraft braking systems and fluid handling. When these inputs directly impact performance, reliability, and safety, suppliers naturally hold more sway. Crane's dependence on their consistent delivery of high-grade goods amplifies this supplier power.

Supplier's Ability to Differentiate Products

The ability of suppliers to differentiate their products significantly impacts their bargaining power. When suppliers offer unique components, proprietary technologies, or specialized intellectual property, they gain an advantage. This is because finding viable alternatives becomes challenging for the buyer.

Crane's reliance on highly specialized inputs, which are difficult to replicate, means that these suppliers can potentially dictate higher prices or more favorable terms. For instance, in 2024, the semiconductor industry, a critical supplier for many advanced manufacturing sectors, continued to see strong demand for its differentiated chips, with leading foundries experiencing backlogs extending well into the year.

- Supplier Differentiation: Suppliers with unique or proprietary offerings hold stronger bargaining positions.

- Lack of Substitutes: When buyers cannot easily find equivalent inputs, suppliers' power increases.

- Impact on Pricing: Differentiated suppliers can often command premium prices.

- Crane's Exposure: Crane's dependence on specialized, hard-to-replicate inputs heightens supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Crane's business operations, though less frequent, represents a significant potential lever for increased supplier bargaining power. If a supplier possesses both the financial capacity and strategic motivation to begin manufacturing components or complete systems that directly rival Crane's existing product lines, their ability to dictate terms would naturally escalate. This scenario compels Crane to cultivate robust supplier relationships and consider strategic concessions to mitigate the risk of such a competitive encroachment.

For instance, in the aerospace sector, where Crane operates, a key component supplier could potentially leverage its manufacturing expertise and existing customer base to develop and market integrated avionics systems, directly competing with Crane's own offerings. Such a move would shift the power dynamic considerably, forcing Crane to potentially accept less favorable pricing or contract terms to maintain access to critical components and avoid direct competition.

- Forward Integration Risk: Suppliers may possess the capability and incentive to produce finished goods, directly challenging Crane's market position.

- Competitive Pressure: This threat forces Crane to maintain strong supplier partnerships and potentially offer concessions to prevent direct competition.

- Industry Example: In aerospace, a supplier of specialized sensors could potentially develop and market integrated sensor suites, competing with Crane's existing product lines.

- Impact on Bargaining: Successful forward integration by a supplier significantly enhances their leverage in price negotiations and contract terms.

Suppliers to Crane Company, particularly in specialized sectors like aerospace and defense, wield considerable bargaining power. This strength stems from limited supplier options, the critical nature of their components, and the high costs associated with switching. In 2024, continued consolidation in defense supply chains amplified the leverage of key providers of specialized electronics and materials, directly impacting Crane's input costs and availability.

| Factor | Impact on Crane | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited suppliers increase their negotiation leverage. | Defense industry saw continued supply chain consolidation in 2024. |

| Switching Costs | High costs (re-engineering, re-qualification) deter Crane from changing suppliers. | Aerospace component re-qualification can cost hundreds of thousands per part. |

| Product Differentiation | Unique or proprietary components give suppliers pricing power. | Strong demand for differentiated semiconductor chips in 2024 led to extended foundry backlogs. |

| Criticality of Inputs | Dependence on high-quality, specialized inputs strengthens supplier position. | Essential for Crane's performance-critical products like aircraft braking systems. |

What is included in the product

This analysis provides a comprehensive look at the competitive landscape for Crane, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Quickly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of all five forces.

Customers Bargaining Power

Crane Company's diverse customer base, spanning aerospace, defense, and process industries, presents a mixed bag for bargaining power. While broad diversification generally dilutes individual customer influence, specialized markets can shift the balance.

In niche sectors like defense or advanced aerospace, where Crane's components are critical and highly specialized, select customers can wield significant leverage. Their unique, high-stakes requirements mean a disruption in supply or a failure to meet exact specifications carries substantial consequences for these buyers.

For instance, a major defense contractor relying on Crane's specialized valves for a flagship aircraft program might negotiate more favorable terms due to the mission-critical nature of the product and the potential cost of delays. This heightened dependency grants these specialized buyers a degree of power.

Crane's ability to serve these demanding, specialized markets, while a testament to its capabilities, also means it must carefully manage relationships with customers whose needs, while specific, are vital to their own operations, thereby increasing their potential bargaining power.

For customers in critical sectors like aerospace and defense, the cost and risk associated with switching away from an established Crane product are significant. For instance, imagine an aircraft manufacturer that has integrated Crane's components into a new jet design; changing suppliers mid-stream would necessitate extensive re-testing and recertification processes, potentially costing millions and delaying market entry.

These substantial switching costs, encompassing everything from regulatory approvals to rigorous performance validation, effectively diminish a customer's leverage to negotiate lower prices or dictate terms once Crane's products are deeply embedded in their operations. In 2024, the aerospace industry alone is projected to invest over $1.5 trillion in new aircraft development, highlighting the immense value of reliable, pre-approved components.

Crane's focus on highly engineered and customized solutions significantly dampens customer bargaining power. When products are tailored to specific client requirements, often incorporating proprietary technology, customers find it difficult to compare pricing or easily switch to competitors. This unique value proposition for solutions like their advanced material handling systems for specialized industrial applications, for example, means customers are less inclined to pressure for price reductions.

Customer Concentration in Specific Segments

Crane's diverse customer base, while generally a strength, can present challenges if certain segments exhibit high customer concentration. This means a few significant customers might drive a substantial portion of sales within a specific product line or market. For instance, if a handful of large original equipment manufacturers (OEMs) rely heavily on Crane's specialized fluid handling components for their industrial machinery, these OEMs gain considerable leverage.

This concentration empowers these key customers to negotiate more favorable pricing, demand customized solutions, or even threaten to switch suppliers if their demands aren't met. In 2024, industries like aerospace and defense, where large defense contractors often procure specialized equipment, could represent such concentrated segments for Crane. The ability of these few large buyers to significantly impact Crane's revenue within these niches gives them substantial bargaining power.

- Customer Concentration Risk: High reliance on a few major clients within specific product categories or industries.

- Leverage for Negotiation: Large customers can use their purchasing volume to negotiate lower prices or more favorable terms.

- Potential Impact: Reduced profit margins and increased pressure on Crane's pricing strategies in concentrated segments.

- Mitigation Strategies: Diversifying the customer base within segments and developing unique value propositions to reduce dependency.

Customer's Access to Information and Alternatives

Customers today are incredibly well-informed. The internet gives them a direct line to pricing, product specifications, and reviews for nearly every item imaginable. This widespread access to information means they can easily compare Crane's offerings against competitors, significantly boosting their bargaining power. For instance, a recent survey in 2024 found that 85% of consumers research products online before making a purchase, often comparing multiple options.

However, Crane's position is somewhat strengthened when customers can't find truly equivalent alternatives. If Crane provides highly specialized or technologically advanced components that are difficult to replicate, the number of viable substitutes shrinks dramatically. This limitation on customer choices can reduce their leverage. In the industrial equipment sector, where Crane operates, specialized parts can represent a substantial portion of a buyer's total cost, making unique solutions highly valuable.

- Informed Consumer Base: 85% of consumers in 2024 conduct online research before buying, increasing their ability to compare offerings.

- Information Accessibility: Digital platforms provide easy access to pricing, features, and reviews, empowering customers.

- Crane's Differentiation: For highly specialized components where Crane's technology is unique, comparable alternatives are scarce.

- Mitigated Power: Limited availability of substitutes for critical, differentiated Crane products reduces customer bargaining power.

Crane's customers possess moderate bargaining power, influenced by product specialization and switching costs. While a diverse customer base generally diffuses individual leverage, highly specialized markets, such as aerospace and defense, can see key clients exerting more influence due to the critical nature of Crane's components and the significant costs associated with supplier changes. For example, in 2024, the aerospace sector's substantial investments in new aircraft development underscore the value of reliable, pre-approved components, making it difficult for customers to switch easily.

Crane's focus on engineered, customized solutions further limits customer power. When products are tailored and incorporate proprietary technology, comparison shopping and switching become challenging, reducing the impetus for price negotiations. However, customer concentration within specific segments, where a few large buyers account for a significant portion of sales, can empower these key clients to demand more favorable terms. For instance, major defense contractors in 2024 could leverage their substantial procurement volumes for specialized fluid handling components.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example (2024) |

|---|---|---|

| Product Specialization | Reduces power for Crane, increases for customer in niche markets | Critical components for aerospace/defense programs |

| Switching Costs | Reduces customer power | Extensive re-testing and recertification for integrated components |

| Customization | Reduces customer power | Tailored industrial material handling systems |

| Customer Concentration | Increases power for large, concentrated customers | Major OEMs in industrial machinery relying on specialized fluid handling |

| Information Accessibility | Increases customer power | 85% of consumers research online before purchase |

Full Version Awaits

Crane Porter's Five Forces Analysis

This preview showcases the Crane Porter's Five Forces Analysis, providing a comprehensive examination of the competitive landscape within the crane industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, offering immediate insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. You can be confident that what you preview is precisely what you'll download, ready to inform your strategic decisions.

Rivalry Among Competitors

Crane Company thrives in specialized industrial manufacturing sectors like aerospace and defense, alongside process flow technologies. This strategic focus on niche markets means competition is generally less fierce compared to more common, commoditized product areas. For instance, Crane's involvement in critical aerospace components often involves a limited pool of highly qualified suppliers.

By concentrating on highly engineered applications, Crane Company effectively differentiates its products and services. This specialization can create significant barriers to entry, deterring potential competitors who may lack the necessary expertise, certifications, or established relationships. In 2023, Crane reported revenue from its Aerospace & Electronics segment of approximately $1.1 billion, underscoring its significant presence in a specialized field.

The aerospace and defense sectors, where Crane Porter (CR) operates significantly, present formidable barriers to new entrants. These include the immense capital required for research, development, and manufacturing, often running into billions of dollars. For instance, the development cost for a new commercial aircraft can easily exceed $15 billion, a sum prohibitive for most potential competitors.

Stringent regulatory hurdles, such as Federal Aviation Administration (FAA) or European Union Aviation Safety Agency (EASA) certifications, add years and significant expense to product introductions. The complex technological know-how and integrated supply chains are also difficult to replicate. These factors inherently limit the number of viable competitors in core markets.

Furthermore, high exit barriers, like the specialized nature of manufacturing equipment and the long-term commitment to existing contracts, can keep established players engaged even during periods of reduced demand. This can intensify competitive rivalry as companies strive to maintain market share and utilize their fixed assets.

Crane's competitive rivalry is intensified by its focus on highly engineered products and technology-led solutions. This strategy allows for significant product differentiation, setting Crane apart from competitors who may offer more commoditized goods. For instance, Crane’s advanced aircraft braking systems often incorporate proprietary technology that enhances performance and safety, a key differentiator in the aerospace sector.

Continuous innovation is central to Crane's approach, enabling the development of unique, often patented technologies. This reduces direct price competition as customers value the specialized benefits and reliability these innovations provide. In 2024, Crane continued to invest heavily in R&D, aiming to solidify its advantage in specialized markets like fluid handling and advanced materials.

Competitor Landscape and Market Share

Crane's competitive landscape is characterized by a mix of large, diversified industrial conglomerates and smaller, highly specialized firms across its operating segments. This creates a dynamic environment where Crane must contend with varied competitive strengths.

Key players challenging Crane include established names such as Maxar Technologies, Sierra Nevada Company, HEICO, CIRCOR, Dover, Donaldson, Pentair, The Timken Company, Moog Inc., Parker-Hannifin Corporation, ITT Inc., and Flowserve Corporation. This lineup suggests a competitive, yet not overly fragmented, market structure.

- Market Presence: Competitors like Parker-Hannifin and ITT Inc. often boast broader product portfolios and significant global reach, presenting a substantial challenge in terms of market penetration and customer relationships.

- Specialization: Smaller, specialized competitors, such as HEICO in aerospace and defense or Donaldson in filtration, can exert significant pressure within specific niches due to their focused expertise and agility.

- Financial Strength: Larger diversified companies often possess greater financial resources for research and development, acquisitions, and weathering economic downturns, which can be a significant competitive advantage against Crane.

Industry Growth Rates and Economic Cycles

The growth rates within Crane's key markets, particularly aerospace and industrial manufacturing, directly impact competitive intensity. Aerospace and defense segments, for instance, are currently experiencing robust growth, bolstered by significant order backlogs. In contrast, the industrial sector often demonstrates greater sensitivity to broader economic cycles, which can lead to fluctuating demand and heightened competition during downturns.

Strong overall market expansion typically moderates rivalry because companies can expand their operations and revenues by capturing new demand rather than by directly siphoning market share from rivals. For example, the aerospace industry's projected growth, driven by new aircraft demand and defense spending, offers ample room for Crane to grow its existing business lines.

- Aerospace Growth: The commercial aerospace market is projected for significant expansion, with Boeing forecasting a 4% compound annual growth rate (CAGR) for global air cargo and a 5% CAGR for passenger air travel through 2043.

- Industrial Sensitivity: Industrial manufacturing output is closely tied to GDP growth; for instance, a slowdown in global GDP growth, as observed in periods of economic recession, directly correlates with reduced demand in industrial sectors.

- Impact on Rivalry: High growth environments allow for easier market entry and expansion, potentially attracting new competitors, but also provide sufficient opportunities for incumbents to thrive without intense direct confrontation.

Crane's competitive rivalry is shaped by its focus on specialized, high-value markets like aerospace and industrial process technologies. While these niche areas limit the sheer number of competitors compared to commoditized sectors, the existing players are often well-established with significant technical expertise and market access. This creates a dynamic where rivalry is intense within these specific segments, driven by innovation and product differentiation rather than just price.

The presence of large, diversified competitors like Parker-Hannifin and ITT Inc. means Crane faces rivals with broader product lines and greater financial resources. Conversely, highly specialized firms such as HEICO or Donaldson can pose a significant challenge within their specific niches. This mix of competitor types means Crane must continuously innovate and leverage its unique technological capabilities to maintain its competitive edge.

Market growth rates play a crucial role; robust expansion in aerospace, for example, driven by substantial order backlogs, can moderate rivalry by allowing all players to grow. However, economic downturns can heighten competition in more cyclical industrial sectors as companies fight for shrinking market share. For instance, the aerospace industry's projected growth provides opportunities, but industrial sector performance remains sensitive to global GDP fluctuations.

| Competitor | Key Segments | Market Focus |

|---|---|---|

| Parker-Hannifin | Motion and Control Technologies, Filtration | Broad Industrial, Aerospace |

| ITT Inc. | Industrial Process Solutions, Motion Technologies, Connect and Control Technologies | Diversified Industrial, Aerospace, Defense |

| HEICO Corporation | Aerospace and Defense, Electronic Technologies | Aerospace, Defense (specialized components) |

| Donaldson Company | Filtration Solutions | Industrial, Engine (specialized filtration) |

SSubstitutes Threaten

Crane's products are frequently employed in crucial applications where performance, dependability, and safety are absolutely essential. For example, in aircraft braking systems or high-pressure fluid handling, the margin for error is incredibly slim, which makes it challenging for substitutes that are significantly different and less expensive to meet the demanding performance standards. In 2024, the aerospace industry, a key market for Crane, continued to emphasize rigorous testing and certification, with new aircraft models undergoing extensive validation processes that favor proven, high-specification components.

While Crane Porter's core offerings might not face many direct substitutes today, the relentless pace of technological advancement poses a significant long-term threat. Innovations in material science, for instance, could yield lighter, stronger, or more cost-effective materials that eventually replace traditional components in cranes. Consider the rapid development in advanced composites, which, while currently niche in heavy machinery, could see broader adoption as costs decrease.

Furthermore, entirely new system designs or alternative methods of achieving the same lifting and moving functions could emerge. Imagine breakthroughs in magnetic levitation or advanced robotics that offer fundamentally different approaches to material handling, potentially bypassing the need for traditional crane structures altogether. While these are not immediate replacements, the potential for disruptive technologies to emerge and offer superior performance or cost benefits in the future cannot be ignored.

For example, the global market for advanced materials, including composites, was valued at approximately $100 billion in 2023 and is projected to grow significantly. This growth indicates a strong trend towards finding and implementing new material solutions across industries, a trend that could eventually impact crane manufacturing and design.

The threat of substitutes for Crane's products is moderated by the significant cost-performance trade-off. Developing and certifying new technologies for critical applications, like those Crane serves, incurs substantial expenses. This high barrier means potential substitutes often struggle to offer a comparable performance level at a competitive price point.

Customers in Crane's target markets, particularly in aerospace and defense, prioritize reliability and performance over marginal cost savings. For instance, the rigorous testing and certification processes for new materials in aircraft components can cost tens of millions of dollars, making it difficult for substitutes to displace established, proven solutions without a clear and substantial advantage.

In 2024, industries relying on critical components continue to emphasize safety and longevity. Reports indicate that companies in these sectors are willing to pay a premium, often 15-20% higher, for components with a proven track record and robust certification, directly limiting the appeal of lower-cost, unproven substitutes.

Regulatory and Certification Barriers for Substitutes

New substitute technologies, particularly in the aerospace and defense sectors, face substantial regulatory and certification barriers. These processes are inherently lengthy and costly, demanding rigorous testing and validation to ensure safety and compliance. For instance, the Federal Aviation Administration (FAA) certification process for new aircraft components can take several years and cost millions of dollars, significantly delaying market entry for potential substitutes.

These stringent requirements act as a formidable deterrent for emerging technologies seeking to displace established solutions. The high capital investment and extended timelines associated with regulatory approval mean that only well-funded and patient innovators can realistically challenge existing players. This effectively dampens the immediate threat of substitution, providing a degree of insulation for incumbent Crane Porter.

Consider the development of advanced composite materials as a potential substitute for traditional metal alloys in aircraft manufacturing. While offering weight savings and improved performance, these materials must undergo extensive testing for factors like fire resistance, fatigue life, and structural integrity under extreme conditions. The FAA's rigorous certification standards, such as those outlined in Advisory Circular AC 25.603-1 for aircraft materials, underscore the complexity and time involved.

- Significant Lead Times: Regulatory approval for new aerospace technologies can extend for 3-7 years, impacting the speed at which substitutes can enter the market.

- High Development Costs: Certification processes can add 15-30% to the overall development budget of a new technology in this sector.

- Safety and Performance Mandates: Substitutes must meet or exceed stringent safety and performance benchmarks set by bodies like the FAA and EASA, a high bar to clear.

- Established Supplier Relationships: Incumbents benefit from long-standing relationships with certification bodies and a proven track record, making it harder for new entrants.

Customer Loyalty and Established Relationships

Crane Company likely benefits from deep-seated customer loyalty, built over years of providing essential products and reliable support. These established relationships are crucial in an industry where operational continuity is paramount.

The critical nature of Crane's equipment, often integral to complex manufacturing and infrastructure projects, fosters strong customer reliance. This integration into client operations creates significant switching costs, making it difficult for potential substitutes to gain traction.

For instance, in the construction sector, where Crane is a major player, the cost and complexity of retooling or retraining staff to accommodate a new supplier can be prohibitive. Many clients have $3.5 billion in annual revenue from their construction equipment segment alone, highlighting the scale of these operations and the importance of proven reliability.

- High Switching Costs: Customers often face substantial costs, including retraining and equipment integration, when considering alternatives.

- Critical Product Functionality: The essential nature of Crane's offerings means clients prioritize proven performance over potentially unproven substitutes.

- Long-Term Contracts and Integration: Many customer relationships are solidified through multi-year agreements and deep operational integration.

- Brand Reputation and Trust: Crane's established reputation for quality and service further solidifies customer loyalty.

The threat of substitutes for Crane's products is generally low due to the specialized and critical nature of their applications. These are not items that consumers can easily swap out for something else, especially when safety and performance are non-negotiable.

In 2024, industries like aerospace and defense, key markets for Crane, continued to prioritize established, high-performance components. This preference, driven by stringent safety regulations and the high cost of failure, makes it difficult for substitutes to penetrate these markets without demonstrating equivalent or superior reliability and certification.

The substantial investment required for research, development, and certification of new technologies in these sectors acts as a significant barrier. For instance, the FAA certification process for new aviation parts can span several years and cost millions, a hurdle that many potential substitutes find too formidable to overcome.

Crane's established customer relationships and the high costs associated with switching suppliers further solidify its position. Customers often face considerable expenses related to retraining, retooling, and integrating new systems, which discourages them from adopting unproven alternatives.

| Factor | Impact on Threat of Substitutes | Supporting Data (2024 Trends) |

|---|---|---|

| Performance Requirements | High Performance Demands Limit Substitutes | Aerospace and defense sectors continue to demand components meeting extreme operational parameters. |

| Switching Costs | High Switching Costs Deter Adoption of Substitutes | Integration into complex systems and retraining needs create significant barriers for customers. |

| Regulatory Hurdles | Stringent Certification Processes Impede New Entrants | FAA/EASA approval can take years and cost millions, a major deterrent for substitute technologies. |

| Technological Advancement | Emerging Technologies Pose Long-Term, but Not Immediate, Threat | While advanced materials show promise, their adoption in critical Crane applications is gradual due to validation needs. |

Entrants Threaten

Entering markets for highly engineered industrial products, such as aerospace components or advanced process technologies, demands immense upfront capital. This includes substantial spending on research and development, state-of-the-art manufacturing plants, and specialized machinery. For instance, establishing a facility capable of producing complex aerospace parts could easily cost hundreds of millions of dollars.

This significant capital requirement acts as a formidable barrier for new players looking to enter. In 2024, the average initial investment for a new entrant in the advanced manufacturing sector, particularly those serving critical industries, often exceeded $250 million. Such high entry costs deter many potential competitors, thus protecting existing firms.

Crane Porter's operations are heavily influenced by extensive regulatory and certification hurdles. Industries like aerospace and defense, which Crane serves, are characterized by stringent safety standards and lengthy approval processes. For instance, the Federal Aviation Administration (FAA) certification for aircraft components can take years and cost millions, a formidable barrier for newcomers. These complex requirements demand significant investment in compliance and expertise, effectively deterring many potential new entrants.

Crane Company's advantage lies in its proprietary technology and intellectual property, a significant barrier to new entrants. Developing comparable engineering expertise and unique product features would demand immense investment in research and development, a hurdle many newcomers cannot easily overcome.

In 2024, the capital expenditure for Crane's advanced manufacturing and R&D initiatives reached $350 million, underscoring the continuous investment needed to maintain this technological edge. This substantial outlay makes it exceptionally challenging for potential competitors to replicate Crane's innovative product portfolio and achieve a similar level of performance and reliability.

Economies of Scale and Experience Curve Effects

Established players within the crane industry, such as Crane Co., have cultivated significant economies of scale across their operations. This means they can produce cranes and related components at a lower cost per unit due to high-volume manufacturing, bulk purchasing of raw materials, and efficient distribution networks. For instance, in 2023, Crane Co. reported total revenues of approximately $2.3 billion, indicative of substantial operational scale.

New entrants face a considerable hurdle in replicating these cost advantages. Without the established volume of business, newcomers cannot negotiate the same favorable terms with suppliers or spread their fixed costs over as many units. This disparity in cost structure places them at a distinct competitive disadvantage from the outset.

- Economies of Scale: Crane Co.'s large production volumes in 2023 enable lower per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of steel and components by established firms leads to reduced input expenses.

- Distribution Efficiency: Extensive logistics networks allow established companies to lower shipping costs per crane.

- Experience Curve: Over time, manufacturers gain efficiency, further reducing costs with accumulated production.

Strong Brand Reputation and Established Customer Relationships

Crane Company benefits from a deeply entrenched brand reputation built over decades, particularly in demanding sectors like aerospace and defense. This established trust and a proven track record of reliability significantly deter new entrants. For instance, in 2023, Crane Aerospace & Electronics secured significant multi-year contracts, underscoring the value of these long-standing relationships.

Forging similar deeply trusted relationships, especially for mission-critical applications where failure is not an option, requires substantial time and investment. Newcomers face the daunting task of not only matching Crane's product quality but also proving their dependability over extended periods. This makes the barrier to entry incredibly high.

- Long-standing reputation for quality and reliability.

- Deeply embedded customer relationships in critical industries.

- Significant time and investment required for new entrants to build trust.

- High switching costs for customers tied to established Crane systems.

The threat of new entrants for Crane Company is generally low due to significant barriers. High capital requirements, often exceeding $250 million for advanced manufacturing in 2024, demand substantial investment in R&D and facilities. Furthermore, stringent regulatory and certification processes, such as FAA approvals that can take years and cost millions, deter many potential competitors. Proprietary technology and intellectual property also create a substantial hurdle, as replicating Crane's innovation requires immense R&D spending.

| Barrier Type | Description | 2024/2023 Data Point |

|---|---|---|

| Capital Requirements | Immense upfront investment for R&D and manufacturing facilities. | Average initial investment in advanced manufacturing often exceeded $250 million in 2024. |

| Regulatory Hurdles | Complex and lengthy approval processes in critical industries. | FAA certification for aircraft components can cost millions and take years. |

| Proprietary Technology | Unique engineering expertise and product features. | Crane's R&D expenditure reached $350 million in 2024. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | Crane Co. reported revenues of approximately $2.3 billion in 2023. |

| Brand Reputation & Relationships | Established trust and proven reliability in demanding sectors. | Crane Aerospace & Electronics secured significant multi-year contracts in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the crane porter industry is built upon a foundation of industry-specific trade publications, operational cost data from logistics providers, and market intelligence reports. We also incorporate publicly available financial statements of major players and regulatory filings related to port operations to provide a comprehensive view of the competitive landscape.