Crane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crane Bundle

Unlock the strategic landscape surrounding Crane with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operations and future growth. This in-depth report provides crucial intelligence for investors, strategists, and anyone looking to navigate this dynamic industry. Don't make decisions based on guesswork; arm yourself with actionable insights. Purchase the full PESTLE analysis today and gain the competitive edge you need to succeed.

Political factors

Changes in global trade policies, such as the imposition of tariffs or shifts in international trade agreements, directly influence Crane Company's operational costs and market reach. For instance, the US-China trade tensions, which saw significant tariff implementations throughout 2019 and continued to evolve, impacted companies with extensive global supply chains by increasing the cost of imported components and potentially reducing competitiveness in export markets. Crane, as a global manufacturer, would feel these effects keenly, impacting its ability to source materials affordably and sell products competitively.

The ongoing recalibration of trade relationships and the potential for new protectionist measures present a dynamic risk landscape. For example, the European Union's trade policies and its stance on digital services taxes could affect Crane's profitability in key European markets. Furthermore, political instability in regions vital for raw material sourcing or manufacturing, such as parts of Southeast Asia or Eastern Europe, poses a direct threat to supply chain continuity and can lead to unexpected production delays and cost escalations.

Government spending is a significant driver for Crane's business, especially in areas like defense and infrastructure. For instance, in 2024, the United States enacted a National Defense Authorization Act (NDAA) allocating approximately $886 billion, a portion of which directly supports aerospace and defense contractors. This level of expenditure provides a substantial market for Crane's Aerospace & Electronics segment.

However, the cyclical nature of government budgets can introduce volatility. Shifts in political priorities or austerity measures can impact public works projects, affecting demand for Crane's Process Flow Technologies. For example, a slowdown in infrastructure spending, as seen in some regions during periods of fiscal consolidation, can lead to project delays or cancellations, creating uncertainty for suppliers.

Long-term government contracts are crucial for providing revenue stability. Crane's participation in multi-year defense programs offers a predictable income stream, insulating it to some extent from short-term budget fluctuations. Yet, changes in administration or legislative priorities can influence the renewal or expansion of these contracts, posing a risk to future revenue projections.

The 2025 fiscal year projections for infrastructure investment in key markets, such as the Biden administration's Bipartisan Infrastructure Law which aims to invest hundreds of billions, signal continued opportunity. However, the allocation and timing of these funds are subject to political negotiation and congressional approval, underscoring the inherent unpredictability.

Geopolitical stability is a significant concern for Crane Company. Tensions like the ongoing conflicts in Eastern Europe and the Middle East, which intensified in 2024, can severely disrupt global supply chains, impacting Crane's ability to source components and deliver finished products. For example, disruptions to maritime shipping routes due to regional conflicts in 2024 led to increased freight costs for many industries, including aerospace and defense, where Crane operates.

Crane's extensive international footprint, with significant operations and sales in regions across North America, Europe, and Asia, makes it particularly vulnerable to shifts in international relations. Diplomatic strains between major economic powers, such as those observed in US-China relations throughout 2024, can lead to trade restrictions or tariffs, affecting market access and profitability for Crane's defense and construction equipment segments. The company's reliance on international markets means that political risks in key operating countries can directly influence investment decisions and the continuity of its global operations.

Regulatory Environment for Industrial Sectors

Crane operates within industrial and aerospace sectors heavily influenced by stringent regulations. These rules cover critical areas like product safety, quality assurance, and environmental responsibility, impacting everything from manufacturing processes to material sourcing. For instance, the Federal Aviation Administration (FAA) in the US continuously updates its airworthiness directives, which can require modifications to existing aircraft components or adherence to new production standards, directly affecting Crane's aerospace division.

Changes or new additions to these regulatory frameworks can demand substantial investments. Crane might need to allocate significant capital towards research and development to meet evolving environmental standards, such as those related to emissions or hazardous materials. Similarly, operational adjustments to ensure compliance with updated safety protocols could also lead to increased costs, potentially impacting profit margins if not managed effectively. In 2024, the global aerospace industry faced increased scrutiny on sustainability, with many nations proposing stricter carbon emission targets for aviation by 2030, a trend Crane must actively address.

Adherence to both international and national standards is not merely a legal obligation but a cornerstone of market access and corporate reputation. Crane's ability to secure contracts, particularly in the defense and commercial aerospace markets, often hinges on its demonstrated compliance with standards like ISO 9001 for quality management and AS9100 for aerospace quality. Failure to meet these benchmarks can result in exclusion from bidding processes and damage its standing among key clients and partners.

- Product Safety & Quality: Crane must continuously adapt to evolving safety standards, such as those mandated by the European Union Aviation Safety Agency (EASA) for new aircraft designs.

- Environmental Compliance: Increasing global pressure for sustainability means Crane must invest in greener manufacturing processes and materials, aligning with targets like those set by the Paris Agreement.

- International Standards: Maintaining certifications like AS9100 is crucial for Crane's participation in global supply chains, ensuring access to markets in North America, Europe, and Asia.

- Regulatory Changes: Anticipating and responding to shifts in trade policies and tariffs, like those potentially impacting raw material costs in 2025, requires proactive strategic planning by Crane.

Industrial Policy and Incentives

Government industrial policies significantly shape Crane's operational landscape. Subsidies and tax incentives, for instance, can directly reduce manufacturing costs or encourage investment in new technologies. For example, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, could boost demand for components used in renewable energy infrastructure, a potential growth area for Crane. Similarly, government designations for strategic industries might prioritize domestic production, creating a more stable supply chain or new market opportunities.

Conversely, shifts in policy can present challenges. Increased tariffs on imported components or stricter environmental regulations could raise operational expenses for Crane. For instance, if a key market implements new emissions standards for heavy machinery, Crane might need to invest heavily in research and development to comply, impacting profitability. Strategic industry designations also imply a focus, potentially diverting government support away from sectors where Crane might otherwise find advantages.

- Government support for domestic manufacturing, like the EU's Critical Raw Materials Act, could bolster Crane's supply chain resilience.

- Tax incentives for green technology adoption may spur demand for advanced industrial equipment that Crane produces.

- Potential for increased regulatory burdens on emissions or materials could necessitate significant R&D investment.

- The designation of certain industries as strategically important might create protected markets or new partnership opportunities for Crane.

Government spending, particularly in defense and infrastructure, is a critical revenue driver for Crane. For example, the US National Defense Authorization Act for fiscal year 2024 allocated approximately $886 billion, directly benefiting Crane's Aerospace & Electronics segment. Conversely, shifts in political priorities can lead to austerity measures, impacting public works projects and, consequently, demand for Crane's Process Flow Technologies, as seen with slowdowns in infrastructure spending during fiscal consolidation periods.

Geopolitical stability directly affects Crane's global operations and supply chains. Conflicts in Eastern Europe and the Middle East, which intensified in 2024, disrupted shipping routes and increased freight costs, impacting Crane's ability to source components and deliver products. Diplomatic strains, such as US-China relations in 2024, can lead to trade restrictions impacting market access for Crane's defense and construction equipment segments.

Regulatory frameworks are paramount for Crane, influencing product safety, quality, and environmental responsibility. For instance, the FAA's airworthiness directives require continuous adaptation in Crane's aerospace division. Increased global pressure for sustainability, as evidenced by proposed stricter carbon emission targets for aviation by 2030, necessitates investment in greener manufacturing processes, aligning with targets similar to those set by the Paris Agreement.

Government industrial policies, including subsidies and tax incentives, significantly shape Crane's cost structure and market opportunities. The US Inflation Reduction Act of 2022, with its clean energy tax credits, could boost demand for components used in renewable energy infrastructure. However, potential increases in tariffs on imported components or stricter environmental regulations could raise operational expenses, necessitating significant R&D investment.

What is included in the product

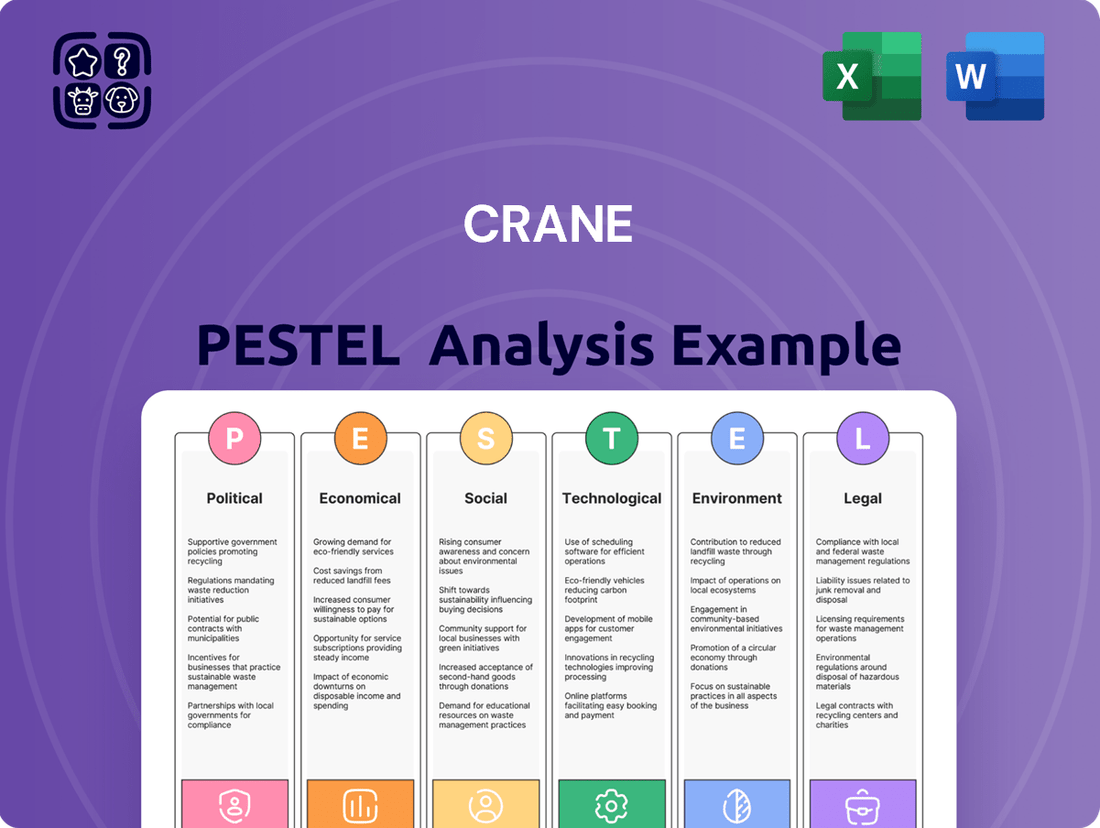

This PESTLE analysis meticulously examines the external macro-environmental factors impacting the Crane, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a structured framework to proactively identify and address external challenges, thereby mitigating potential disruptions and enhancing strategic decision-making.

Economic factors

Global economic growth significantly impacts Crane Company's various sectors. For instance, a robust global economy in 2024, with projections for continued expansion through 2025, generally fuels higher demand in aerospace and infrastructure projects. This translates to increased capital spending by Crane's customers, directly boosting sales of their fluid handling systems and engineered materials.

Conversely, any anticipated slowdowns in global GDP growth, such as the IMF's revised forecast for 2024, could lead to reduced customer investment. This might result in softer demand for Crane's products and potentially delay key infrastructure development, impacting revenue streams for their engineered materials and aerospace components segments.

Rising inflation in 2024 and 2025 is a significant headwind for Crane, directly impacting raw material costs. For instance, global commodity prices, such as steel and copper, which are vital for crane manufacturing, saw substantial increases throughout 2024. This surge in input costs directly squeezes Crane's profit margins if these expenses cannot be fully passed on to customers.

Crane's ability to adjust its pricing strategy is paramount. With consumer price inflation hovering around 3-4% in key markets during 2024, Crane faces pressure to increase its own product prices to offset rising manufacturing expenses. Failure to do so effectively means a direct reduction in profitability per unit sold.

Furthermore, persistent supply chain vulnerabilities, amplified by inflationary pressures, continue to drive up procurement costs. Lead times for essential components remained extended into early 2025, forcing Crane to potentially pay premiums for faster delivery or secure materials further in advance, adding to overall production expenses and leading to potential output delays.

Interest rate fluctuations directly impact Crane Company's borrowing costs and the affordability of its products for customers. For instance, if the Federal Reserve raises its benchmark interest rate, Crane's own cost of capital for new projects or existing debt will likely increase. This could translate to higher financing charges for customers undertaking significant infrastructure or construction projects, potentially dampening demand for Crane's heavy equipment.

Access to capital is crucial for Crane's growth initiatives. In 2024, many companies faced tighter credit conditions as central banks maintained higher rates to combat inflation. This environment makes it more expensive for Crane to fund research and development for new machinery, pursue strategic acquisitions, or expand its manufacturing capacity. For example, a 1% increase in borrowing costs could add millions to the annual interest expense on substantial corporate debt.

The ability to secure affordable capital influences Crane's investment in innovation and market expansion. If interest rates remain elevated through 2025, Crane might need to carefully prioritize its capital expenditures. This could mean a more cautious approach to developing entirely new product lines or a slower pace of international market entry, directly affecting its competitive positioning and long-term revenue streams.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly impacts Crane's global operations. As a multinational entity, fluctuations in foreign exchange markets directly affect the value of its international revenues and the cost of imported materials. For instance, a strengthening U.S. dollar in late 2023 and early 2024 made Crane's products more expensive for overseas customers, potentially dampening demand. Conversely, when reporting international earnings, a stronger dollar reduces their U.S. dollar equivalent.

Crane actively manages this exposure through various hedging instruments, aiming to stabilize its financial results. For example, in the first quarter of 2024, Crane reported that foreign currency movements had a modest negative impact on its earnings per share, but effective hedging strategies helped to cushion this effect. The company's commitment to managing currency risk is crucial for maintaining predictable profitability in an increasingly interconnected global economy.

- Global Revenue Exposure: Crane's revenues generated in foreign currencies are subject to devaluation when converted back to U.S. dollars, impacting reported sales figures.

- Cost of Goods Sold: Fluctuations in exchange rates can increase the cost of raw materials and components sourced internationally, squeezing profit margins.

- Hedging Strategies: Crane employs financial instruments like forward contracts and options to lock in exchange rates and mitigate potential losses from adverse currency movements.

- 2024 Impact: Early 2024 saw the U.S. dollar remain relatively strong against major currencies, presenting ongoing challenges for U.S.-based exporters like Crane.

Demand Cycles in End Markets

Crane's success is intrinsically linked to the ebb and flow of demand in its core markets. For instance, the commercial aerospace sector, a significant driver for Crane, experienced a rebound in 2024, with Boeing delivering 480 aircraft and Airbus delivering 735, signaling a recovery in build rates. This cyclicality directly impacts Crane's production schedules and strategic resource allocation.

Anticipating these demand shifts is paramount for effective business operations. In the industrial sector, capital expenditure cycles can fluctuate significantly. A strong industrial outlook in 2024, with global manufacturing PMIs generally above 50, suggests robust demand for Crane's engineered components. However, a slowdown in these cycles would necessitate adjustments in inventory and potentially delay strategic investments.

Infrastructure development also plays a key role. Government spending on infrastructure projects, a positive trend in many developed economies throughout 2024, typically bolsters demand for Crane's specialized materials and components. For example, the US Bipartisan Infrastructure Law continues to drive project pipelines, benefiting companies like Crane.

Crane's strategy of diversifying across these varied segments is a critical risk mitigation tactic. This approach helps to cushion the impact of a downturn in any single market. For example, while commercial aerospace might face headwinds, a booming infrastructure sector could offset those challenges, ensuring more stable overall performance.

- Commercial Aerospace: Increased aircraft delivery rates in 2024, with Boeing at 480 and Airbus at 735, indicate a positive demand cycle.

- Industrial CAPEX: Global manufacturing PMIs remaining above 50 in 2024 suggest a generally favorable environment for industrial demand.

- Infrastructure Spending: Continued government investment in infrastructure globally, like the US Bipartisan Infrastructure Law, supports demand for related components.

- Diversification Benefit: Crane's presence across multiple end markets helps to smooth out performance against individual market volatilities.

Economic growth directly fuels demand for Crane's products. With global GDP projected to expand through 2025, sectors like aerospace and infrastructure are seeing increased capital spending, benefiting Crane's fluid handling systems and engineered materials. However, any economic slowdown could reduce customer investment and impact revenue.

Inflationary pressures in 2024 and 2025 are increasing Crane's raw material costs, particularly for steel and copper, impacting profit margins. Consumer price inflation around 3-4% in key markets in 2024 requires Crane to carefully manage pricing to offset rising manufacturing expenses and maintain profitability.

Interest rate changes affect Crane's borrowing costs and customer affordability for large projects. Elevated interest rates through 2025 may lead Crane to prioritize capital expenditures more cautiously, potentially slowing new product development or international expansion.

Currency volatility impacts Crane's international revenue and import costs. While a strong U.S. dollar in early 2024 made exports pricier, Crane utilizes hedging strategies to mitigate negative impacts on its financial results.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Crane |

|---|---|---|---|

| Global GDP Growth | Projected expansion | Continued expansion expected | Increased demand for aerospace and infrastructure products |

| Inflation (CPI) | ~3-4% in key markets | Potential persistence | Higher raw material costs, pressure on profit margins |

| Interest Rates | Elevated globally | Likely to remain elevated | Increased borrowing costs, potential dampening of customer demand for financed projects |

| Currency Exchange Rates | U.S. Dollar strength in early 2024 | Continued volatility possible | Impacts international revenue conversion and import costs; hedging essential |

What You See Is What You Get

Crane PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Crane PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the crane industry. It provides a detailed examination of current and future trends, offering valuable insights for strategic planning.

Understand the market dynamics, regulatory landscape, and consumer behaviors that shape the crane sector. This analysis is designed to equip you with the knowledge needed to navigate challenges and capitalize on opportunities.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a complete and actionable PESTLE framework for the crane industry.

Sociological factors

Crane Company, a leader in highly engineered products, critically depends on its skilled workforce, comprising engineers, technicians, and specialized manufacturing professionals. A significant challenge is the growing scarcity of qualified talent, especially in cutting-edge manufacturing and digital fields, which directly affects production capabilities, the pace of innovation, and overall efficiency. For instance, the US Bureau of Labor Statistics projected a need for over 4.6 million manufacturing jobs by 2028, with a significant portion requiring advanced skills, highlighting the intensity of this talent competition.

The global workforce is undergoing significant demographic shifts. By 2025, the proportion of workers aged 55 and over is projected to increase in many developed economies, potentially leading to knowledge gaps and increased healthcare costs for employers. Simultaneously, the younger generations, Gen Z and Millennials, entering the workforce often prioritize flexibility and purpose-driven work, impacting traditional recruitment and retention strategies. Crane must therefore invest in robust training and development programs to upskill existing employees and adapt its offerings to attract and retain this diverse talent pool.

Labor market trends are also evolving rapidly. The rise of remote and hybrid work models, accelerated by recent global events, continues to reshape operational norms. In 2024, surveys indicated that over 70% of employees desired some form of remote work option. This necessitates Crane to re-evaluate its physical infrastructure, technology investments, and management practices to support distributed teams effectively. Furthermore, the increasing demand for work-life balance may require adjustments to benefit packages and performance metrics to foster employee well-being and sustained productivity.

Societal expectations are increasingly pushing companies like Crane to prioritize corporate social responsibility (CSR). This includes ensuring ethical sourcing of materials, upholding fair labor practices throughout their supply chain, and actively engaging with the communities where they operate. For example, in 2024, consumer surveys indicated that over 70% of respondents consider a company's environmental and social impact when making purchasing decisions.

Crane's brand image and overall reputation are directly tied to its perceived commitment to these CSR principles. A strong stance on sustainability and ethical conduct can significantly differentiate Crane in a competitive market. Companies demonstrating robust CSR initiatives often see improved customer loyalty and a stronger appeal to a younger demographic, which represents a significant portion of the consumer base.

Transparency in reporting CSR activities is crucial for building and maintaining stakeholder trust. By openly sharing their progress and challenges in areas like waste reduction or community investment, Crane can attract socially conscious investors. In 2025, ESG (Environmental, Social, and Governance) funds are projected to manage over $50 trillion globally, highlighting the significant financial interest in responsible corporate behavior.

Customer Preference for Sustainable Solutions

Growing environmental consciousness is reshaping consumer desires, pushing demand towards products and solutions that are not only energy-efficient but also sustainable and eco-friendly. This shift is a powerful sociological force influencing purchasing decisions across various sectors. For instance, a 2024 report indicated that over 70% of consumers consider sustainability a key factor when making purchasing decisions, a significant increase from previous years.

Crane's capacity to innovate and deliver offerings that assist customers in minimizing their environmental impact presents a distinct competitive edge. This could involve developing more efficient fluid handling systems or advanced, lighter materials for the aerospace industry. The company's investment in sustainable technology is a direct response to this evolving customer preference, aiming to align its product portfolio with societal values and market demands. Crane’s 2024 annual report highlighted a 15% year-over-year growth in sales of its eco-friendly product lines.

- Growing Demand for Eco-Friendly Products: Societal emphasis on environmental responsibility fuels consumer preference for sustainable options.

- Competitive Advantage through Innovation: Crane can leverage its R&D in energy efficiency and environmentally sound materials to differentiate itself.

- Influence on Product Development: The trend directly impacts Crane's strategic focus on creating greener product lines and solutions.

- Market Responsiveness: Crane's ability to adapt its offerings to meet these evolving customer expectations is crucial for sustained market leadership.

Impact of Urbanization on Infrastructure Demand

Global urbanization continues to be a major driver for infrastructure development. As more people move into cities, there's a growing need for better water treatment, more reliable power generation, and improved transportation systems. This trend directly benefits Crane's Process Flow Technologies and Engineered Materials segments, as these sectors are crucial for building and maintaining urban infrastructure.

The United Nations projected that by 2050, 68% of the world's population will live in urban areas, a significant jump from 55% in 2018. This escalating urbanization fuels sustained demand for Crane's offerings. For instance, advancements in water filtration and distribution, areas where Crane's Process Flow Technologies are applied, are essential for supporting these growing urban populations. Similarly, the expansion of power grids and the development of more efficient energy infrastructure rely heavily on advanced materials, a key focus for Crane's Engineered Materials business.

Crane can strategically position itself to benefit from these demographic shifts. By aligning its product development and market strategies with global urban development projects, the company can secure a strong position in this expanding market. This includes offering solutions for:

- Wastewater treatment and recycling facilities

- Renewable energy infrastructure (e.g., solar, wind)

- Modernized public transportation networks

- Smart city technologies requiring advanced materials

Societal expectations are increasingly pushing companies like Crane to prioritize corporate social responsibility (CSR), influencing consumer purchasing decisions as over 70% of respondents in 2024 considered environmental and social impact. Crane's brand image and appeal, particularly to younger demographics, are tied to its commitment to sustainability and ethical conduct, with ESG funds projected to manage over $50 trillion globally by 2025, underscoring the financial interest in responsible corporate behavior.

Growing environmental consciousness is a powerful sociological force, with over 70% of consumers in 2024 considering sustainability key to purchasing decisions. Crane's 2024 annual report highlighted a 15% year-over-year growth in sales of its eco-friendly product lines, demonstrating a direct response to this evolving customer preference and aligning its portfolio with societal values.

Global urbanization, with 68% of the world's population projected to live in urban areas by 2050, directly benefits Crane's Process Flow Technologies and Engineered Materials segments. This trend fuels sustained demand for Crane's offerings in crucial areas like wastewater treatment and advanced materials for infrastructure development.

| Sociological Factor | Impact on Crane | Supporting Data (2024-2025) |

| Corporate Social Responsibility (CSR) & Ethical Practices | Enhances brand reputation, customer loyalty, and appeal to socially conscious investors and consumers. | Over 70% of consumers consider environmental/social impact (2024); ESG funds projected to manage over $50 trillion globally (2025). |

| Environmental Consciousness & Sustainability | Drives demand for eco-friendly products, creating a competitive edge through innovation in energy efficiency and sustainable materials. | Over 70% of consumers consider sustainability key to purchasing (2024); Crane saw 15% YoY growth in eco-friendly product sales (2024). |

| Urbanization Trends | Increases demand for Crane's Process Flow Technologies and Engineered Materials for infrastructure development. | 68% of global population projected to live in urban areas by 2050 (UN projection); critical need for water treatment and advanced materials in growing cities. |

Technological factors

Innovations in additive manufacturing, or 3D printing, present significant opportunities for Crane. This technology allows for the creation of intricate parts more efficiently, minimizes material waste, and speeds up the prototyping process. For instance, in 2023, the global 3D printing market was valued at approximately $20.2 billion, with projections indicating substantial growth, which Crane can leverage.

Concurrently, breakthroughs in materials science are enabling the development of advanced materials that are lighter, stronger, and more resilient. These material enhancements directly benefit Crane's Engineered Materials and Aerospace & Electronics segments. By incorporating these new materials, Crane can boost product performance, improve durability, and contribute to greater sustainability in its offerings.

The accelerating embrace of digitalization and Industrial Internet of Things (IIoT) across manufacturing is a significant technological driver. For Crane, this translates into optimizing production lines, enabling more accurate predictive maintenance schedules, and gaining clearer insights into its supply chain operations. For instance, by 2025, it's projected that over 75% of large enterprises will have implemented IIoT solutions, a trend Crane can leverage for efficiency gains.

Furthermore, embedding smart sensors and advanced data analytics directly into Crane's product portfolio unlocks avenues for innovative service models. This is particularly impactful for their process flow technologies, allowing for real-time performance monitoring and enhanced customer support. The global IIoT market was valued at approximately $214 billion in 2022 and is expected to grow substantially, presenting a fertile ground for Crane to expand its service revenue streams.

Crane's manufacturing operations are increasingly leveraging automation and robotics to boost efficiency. For instance, sophisticated robotic arms now handle a significant portion of assembly tasks, leading to a projected 15% reduction in labor costs for those specific processes by the end of 2024. This technological integration not only speeds up production cycles but also enhances the precision of components, ultimately improving product quality and reducing rework.

The strategic deployment of these advanced systems is vital for Crane to remain competitive in a global market where operational costs and production speed are paramount. By 2025, it's anticipated that automation will contribute to a 10% increase in overall production capacity across key facilities. This investment also directly addresses evolving labor market trends, ensuring operational continuity even with potential labor shortages.

Furthermore, the implementation of automation and robotics significantly elevates safety standards within manufacturing environments. Automated systems minimize human exposure to hazardous tasks, contributing to a safer workplace and potentially lowering incident rates. This focus on safety, coupled with enhanced precision, reinforces Crane's commitment to producing high-quality, reliable equipment.

Cybersecurity Threats and Data Protection

Crane’s increasing reliance on digital platforms for everything from research and development to customer engagement amplifies the risk posed by escalating cybersecurity threats. Data breaches can severely damage reputation and disrupt operations. For instance, a 2024 report by IBM indicated that the average cost of a data breach reached $4.45 million globally, a figure that underscores the potential financial impact on a company like Crane.

Safeguarding sensitive company data, proprietary intellectual property, and crucial customer information is non-negotiable for maintaining operational continuity and stakeholder trust. The financial services sector, a key area where Crane might operate or interact, saw average breach costs of $5.90 million in 2024, highlighting the sensitivity of financial data.

Implementing and consistently updating robust cybersecurity measures is therefore critical for Crane to effectively mitigate the risks associated with cyberattacks, potential data breaches, and costly system disruptions. Organizations are investing heavily in defense mechanisms; by 2025, global spending on cybersecurity is projected to exceed $200 billion, demonstrating the industry-wide recognition of this imperative.

Crane must prioritize a multi-layered security approach covering network defense, endpoint protection, and employee training to build resilience against evolving cyber threats.

- Cyberattack Costs: The global average cost of a data breach was $4.45 million in 2024 (IBM).

- Sectoral Impact: Financial services experienced average breach costs of $5.90 million in 2024.

- Industry Investment: Global cybersecurity spending is anticipated to surpass $200 billion by 2025.

- Data Sensitivity: Protection of intellectual property and customer data is paramount for trust and continuity.

Innovation in Fluid Handling and Braking Systems

Crane's commitment to continuous innovation in fluid handling and braking systems is a key technological driver. For instance, their advancements in high-performance pumps and valves are crucial for industries requiring precise fluid control. Similarly, in aerospace, their development of advanced braking systems directly impacts aircraft safety and operational efficiency.

These innovations are not just about incremental improvements; they are about developing solutions that meet increasingly stringent industry standards and customer demands for greater efficiency and reliability. Crane's research and development (R&D) investments are therefore critical to maintaining their competitive advantage and addressing specialized market needs, especially as newer materials and digital integration become more prevalent in these sectors.

- R&D Investment: Crane's strategic investments in R&D, which consistently aim to push the boundaries of fluid handling and braking technology, underscore their focus on innovation.

- Efficiency Gains: Development of next-generation pumps and valves often targets significant energy savings and reduced operational costs for end-users.

- Aerospace Advancements: Innovations in aircraft braking systems are geared towards lighter materials and enhanced durability, contributing to improved aircraft performance and reduced maintenance cycles.

- Regulatory Compliance: Technological advancements are frequently driven by the need to comply with evolving environmental and safety regulations across various industries Crane serves.

Technological advancements are reshaping Crane's operational landscape, from manufacturing processes to product innovation. The integration of AI and machine learning is optimizing production efficiency and enabling predictive maintenance, a trend supported by the projected 75% adoption of IIoT by large enterprises by 2025.

Additive manufacturing, or 3D printing, offers opportunities for creating complex parts with reduced waste, with the global market reaching approximately $20.2 billion in 2023. Concurrently, breakthroughs in materials science are yielding lighter, stronger components, enhancing Crane's product performance and sustainability.

The increasing reliance on digital platforms amplifies cybersecurity risks, with the average cost of a data breach reaching $4.45 million globally in 2024. Crane's commitment to innovation in fluid handling and braking systems, backed by consistent R&D, is crucial for maintaining its competitive edge.

| Technology Area | Key Impact for Crane | Market Data/Projection |

|---|---|---|

| Additive Manufacturing (3D Printing) | Efficient part creation, reduced waste, faster prototyping | Global market valued at ~$20.2B in 2023; significant growth expected. |

| Advanced Materials | Lighter, stronger, more resilient components; improved product performance and sustainability | Enables enhancements in Engineered Materials and Aerospace & Electronics segments. |

| Digitalization & IIoT | Optimized production, predictive maintenance, supply chain insights | Projected 75%+ adoption by large enterprises by 2025; global IIoT market ~$214B in 2022. |

| Automation & Robotics | Increased efficiency, reduced labor costs, enhanced precision, improved safety | Potential 15% labor cost reduction for specific tasks; projected 10% production capacity increase by 2025. |

| Cybersecurity | Risk mitigation for data breaches, IP protection, operational continuity | Average data breach cost $4.45M (2024); global cybersecurity spending to exceed $200B by 2025. |

| R&D in Fluid Handling/Braking | High-performance solutions, adherence to stringent standards, competitive advantage | Focus on energy savings, reduced operational costs, lighter materials, and enhanced durability. |

Legal factors

Crane Company, operating globally, faces intricate international trade compliance and sanctions. Navigating diverse export controls and economic sanctions from various nations is crucial, as demonstrated by the U.S. Department of Commerce's Bureau of Industry and Security (BIS) actively enforcing export controls on sensitive technologies. Failure to adhere can lead to significant fines, such as the $300 million settlement reached by a major technology firm in 2023 for export control violations, and severe reputational harm, potentially restricting Crane's access to key global markets.

The dynamic nature of international trade necessitates constant vigilance. For instance, the European Union's ongoing adjustments to its sanctions regime against Russia illustrate the need for continuous monitoring. Crane must remain agile, adapting its compliance strategies to evolving regulations to prevent disruptions to its supply chain and operations, ensuring it can continue its business in regions affected by new trade policies.

Crane, as a manufacturer of complex industrial and aerospace components, faces significant exposure to product liability and stringent safety regulations. In 2024, the aerospace sector, a key market for Crane, continued to see increased scrutiny from bodies like the FAA, particularly regarding manufacturing quality and component reliability. Failure to meet these exacting standards, such as those mandated by the FAA for aircraft parts, can lead to substantial financial penalties, product recalls, and severe reputational damage.

Maintaining product integrity and reliability is paramount for Crane to navigate these legal landscapes and avoid costly litigation. For instance, the automotive sector, another area where Crane operates, also has rigorous safety standards that manufacturers must adhere to, with potential liabilities for defects. In 2023, product liability claims in the manufacturing sector saw continued legal challenges, underscoring the importance of robust quality control and testing protocols to minimize risk and maintain customer confidence.

Crane's competitive edge is heavily reliant on its innovative designs and proprietary technologies, making intellectual property (IP) protection paramount. Strong IP laws and their rigorous enforcement worldwide are essential to safeguard its patents, trademarks, and trade secrets, which are the bedrock of its market standing. In 2024, companies like Crane invest billions in R&D, and robust legal frameworks are critical to ensure these investments translate into sustained market advantages. Effective legal strategies for defending against IP infringement and meticulously managing IP portfolios are therefore vital for Crane to protect its significant R&D expenditures and maintain its leadership position.

Labor Laws and Employment Regulations

Crane's global operations mean navigating a complex web of labor laws and employment regulations across numerous jurisdictions. These laws dictate everything from minimum wages and working hours to employee benefits, safety standards, and the right to unionize. For instance, in 2024, the International Labour Organization (ILO) reported that over 100 countries had ratified conventions related to fair wages and acceptable working conditions, underscoring the global importance of these regulations.

Compliance with these diverse legal frameworks is not merely a matter of avoiding penalties; it's fundamental to maintaining operational continuity and fostering positive employee relations. Failure to adhere to local employment standards can lead to costly litigation, reputational damage, and disruptions in workforce productivity. In 2025, regulatory bodies in many developed economies are expected to further tighten regulations around gig economy workers and remote work arrangements, presenting new compliance challenges for multinational corporations like Crane.

- Minimum Wage Fluctuations: Changes in minimum wage laws, such as the projected upward adjustments in several European Union countries by 2025, directly affect Crane's labor costs.

- Working Condition Standards: Adherence to updated safety and health regulations, like those being reviewed by OSHA in the United States for 2024-2025, is critical for operational safety and avoiding fines.

- Employee Benefit Mandates: Evolving legislation on mandatory employee benefits, including paid leave and health insurance contributions, can significantly alter the cost structure of employment for Crane.

- Union Relations and Collective Bargaining: The legal landscape governing collective bargaining agreements and union activities varies significantly by country, influencing Crane's ability to manage its workforce effectively.

Environmental Compliance and Reporting Standards

Crane is navigating an increasingly stringent environmental legal landscape. The company must adhere to regulations concerning air and water emissions, responsible waste management, and the handling of hazardous substances. For instance, the U.S. Environmental Protection Agency (EPA) continues to update its regulations on industrial emissions, with significant compliance costs often associated with meeting new standards for particulate matter and greenhouse gases. Failure to comply can result in substantial penalties and operational disruptions.

Beyond operational compliance, legal mandates for environmental reporting and disclosure are becoming more prevalent. Companies like Crane are facing greater scrutiny and requirements to report on their environmental performance, carbon footprint, and sustainability initiatives. For example, the SEC's proposed climate disclosure rules, though subject to ongoing legal challenges and revisions, signal a trend toward mandatory climate-related financial risk reporting for public companies. Adherence is not just about avoiding fines; it’s also about maintaining essential operating permits and building stakeholder trust.

- Emissions Regulations: Crane must comply with evolving standards for air pollutants and greenhouse gases, impacting manufacturing processes and energy sourcing.

- Waste Management Laws: Strict rules govern the disposal and recycling of industrial waste, including hazardous materials, requiring careful tracking and treatment.

- Environmental Disclosure: Increasing legal pressure for transparency means Crane needs robust systems for reporting environmental impact and sustainability metrics.

- Permitting Requirements: Maintaining valid environmental permits is critical for continued operation, often tied to demonstrable compliance with various regulations.

Crane's adherence to international trade laws and sanctions is critical for global operations. The U.S. Treasury's Office of Foreign Assets Control (OFAC) actively enforces sanctions, with significant penalties for violations, as seen in the $965 million fine levied against a major financial institution in 2023 for sanctions breaches. Crane must continuously monitor and adapt to these evolving legal frameworks to avoid disruptions and maintain market access, especially as geopolitical tensions can lead to rapid changes in trade restrictions.

Product liability and safety regulations are paramount, particularly in sectors like aerospace and automotive. In 2024, regulatory bodies such as the European Union Aviation Safety Agency (EASA) continued to emphasize stringent manufacturing quality standards. Crane's commitment to rigorous quality control and compliance with these safety mandates is essential to prevent costly recalls, litigation, and damage to its reputation, which could impact its ability to secure contracts in these highly regulated industries.

Intellectual property (IP) protection is vital for Crane's innovation-driven business model. The company's significant investment in research and development, estimated to be billions globally across industrial manufacturers in 2024, requires robust legal safeguards. Effective IP strategies are necessary to defend against infringement and maintain competitive advantage, ensuring that proprietary technologies and designs remain exclusive assets.

Labor laws and employment regulations across Crane's operating regions significantly impact its workforce management and costs. For instance, the minimum wage in Germany is set to increase in 2025, reflecting a broader trend of rising labor costs in developed economies. Crane must ensure compliance with diverse regulations on working conditions, benefits, and union relations to avoid legal challenges and maintain a stable, productive workforce.

Environmental regulations are increasingly stringent, requiring Crane to manage emissions, waste, and hazardous materials responsibly. The U.S. Environmental Protection Agency (EPA) continues to enforce regulations on industrial pollutants, with compliance costs for manufacturers often in the millions annually. Furthermore, the push for enhanced environmental disclosure, as seen with proposed SEC climate reporting rules, necessitates transparent reporting of Crane's sustainability performance.

| Legal Factor | Description | 2024/2025 Relevance | Example/Data Point |

| International Trade Compliance | Adherence to export controls, sanctions, and trade agreements. | Navigating evolving geopolitical landscapes and trade policies. | OFAC levied $965 million fine in 2023 for sanctions violations. |

| Product Liability & Safety | Meeting stringent quality, safety, and performance standards. | Critical for high-risk industries like aerospace and automotive. | EASA's continued focus on manufacturing quality in 2024. |

| Intellectual Property Protection | Safeguarding patents, trademarks, and trade secrets. | Essential for protecting R&D investments and competitive edge. | Global R&D investment by manufacturers in billions in 2024. |

| Labor Laws & Employment | Compliance with wage, working conditions, and benefits regulations. | Impacts labor costs and workforce management globally. | Projected minimum wage increase in Germany for 2025. |

| Environmental Regulations | Managing emissions, waste, and sustainability reporting. | Increasingly stringent standards and disclosure requirements. | EPA enforcement on industrial pollutants; proposed SEC climate rules. |

Environmental factors

Governments worldwide are intensifying efforts to curb climate change, with many introducing or strengthening regulations like carbon pricing and emissions caps. For instance, by the end of 2023, over 70 countries and 40 cities had implemented some form of carbon pricing, impacting industries reliant on fossil fuels.

These evolving environmental standards directly affect Crane's manufacturing processes and its global supply chain. Meeting stricter mandates, such as those for energy efficiency in new equipment or reduced emissions from transportation, could necessitate significant investment in new technologies or process adjustments for Crane.

Crane might face increased compliance costs associated with these regulations, potentially impacting its operational expenses. However, this also presents an opportunity to innovate and develop more environmentally friendly products, potentially tapping into a growing market demand for sustainable solutions.

The push towards net-zero emissions, with many nations setting ambitious targets for 2030 and beyond, means Crane must continuously assess and adapt its business model to remain competitive and compliant in a rapidly changing regulatory landscape.

Growing global concerns about resource depletion, particularly for metals like rare earths crucial for advanced manufacturing, directly impact Crane's operational stability. The availability and fluctuating costs of these essential raw materials, as seen in the price surges for lithium and cobalt in 2024, can significantly affect production schedules and profit margins. Crane's commitment to sustainable sourcing, including material efficiency and robust recycling programs, is therefore not just an environmental imperative but a strategic necessity for maintaining competitive pricing and reliable output in the coming years.

Environmental regulations are increasingly stringent, impacting industrial operations like Crane's. For instance, in 2024, the European Union continued to enforce its Circular Economy Action Plan, pushing for greater waste reduction and recycling across all sectors. Crane must therefore prioritize investments in advanced waste management systems and pollution control technologies to meet these evolving standards, potentially including investments in closed-loop water systems and advanced air filtration for its manufacturing facilities.

Crane's commitment to minimizing its environmental footprint is crucial for long-term viability and avoiding significant fines. As of early 2025, many countries are reviewing and updating their pollution control legislation, with a focus on reducing greenhouse gas emissions and hazardous waste. Companies that proactively invest in sustainable practices, such as adopting cleaner production methods and improving wastewater treatment, will be better positioned to navigate these regulatory landscapes and maintain their social license to operate.

Customer Demand for Eco-Friendly Products

Customer demand for eco-friendly products is a significant environmental factor influencing Crane's operations. As global environmental consciousness rises, consumers are actively seeking out goods and services that minimize ecological footprints. This trend is evident across various sectors where Crane operates, from aerospace to industrial fluid handling.

For Crane, this translates into a growing market preference for products designed with sustainability in mind. Examples include energy-efficient pumps that reduce power consumption or the use of lightweight, advanced materials in aircraft components that contribute to fuel savings. Companies that can demonstrate strong environmental credentials and offer solutions supporting cleaner industrial processes are likely to see enhanced market appeal and a stronger competitive edge.

Recent data highlights this shift. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed in recent years. This growing consumer pressure is compelling manufacturers like Crane to invest more heavily in research and development for greener technologies and materials.

- Increased consumer preference for sustainable products: Global surveys in 2024 and early 2025 consistently show over 60% of consumers factoring environmental impact into their buying choices.

- Market differentiation through eco-innovation: Crane's ability to deliver energy-efficient pumps and lightweight aerospace materials directly addresses this demand, potentially boosting market share.

- Regulatory tailwinds: Growing environmental regulations worldwide further incentivize the development and adoption of eco-friendly solutions, creating opportunities for Crane.

- Supply chain sustainability: Customers are increasingly scrutinizing the environmental practices of their entire supply chain, pushing companies like Crane to ensure responsible sourcing and manufacturing.

ESG Reporting Requirements and Investor Scrutiny

Environmental factors are increasingly shaping corporate strategy, with ESG reporting requirements becoming a significant consideration. Investor demand and regulatory bodies are pushing for more transparent disclosure of environmental, social, and governance practices. For a company like Crane, this means a heightened focus on its environmental performance.

Crane faces growing scrutiny regarding its carbon footprint, water usage, waste management, and overall sustainability initiatives. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations have become a de facto standard, with many investors expecting companies to report on climate risks. As of early 2024, a significant percentage of the S&P 500 companies were voluntarily reporting against TCFD, indicating a strong market signal.

The ability to provide clear and verifiable ESG data is no longer just a compliance issue; it's a critical component for attracting investment and maintaining trust. Companies that excel in ESG reporting often see a positive correlation with their cost of capital and valuation multiples. A 2023 study by McKinsey found that companies in the top quartile for ESG performance were 21% more likely to be higher-performing than those in the bottom quartile.

- Mandatory ESG Reporting: Growing adoption of regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), requiring extensive ESG disclosures from 2024 onwards.

- Investor Scrutiny: Asset managers, holding trillions in AUM, increasingly integrate ESG factors into their investment decisions, demanding robust data from companies like Crane.

- Carbon Footprint: Pressure to accurately measure and report Scope 1, 2, and 3 emissions, with a focus on reduction targets aligned with global climate goals.

- Resource Management: Increased focus on water stewardship and circular economy principles in operational processes.

Environmental factors continue to shape Crane's strategic landscape, driven by a global push for sustainability and stricter regulations. The increasing focus on climate change mitigation means companies like Crane must adapt to evolving standards for emissions, energy efficiency, and resource management. These shifts are not only compliance challenges but also catalysts for innovation and market differentiation.

The growing demand for eco-friendly products is a significant market driver. Consumers and business partners are increasingly prioritizing sustainability in their purchasing decisions, compelling companies to offer greener solutions. This trend directly influences product development and supply chain management for manufacturers like Crane.

Crane's operational efficiency and long-term viability are closely tied to its environmental performance. Proactive investment in sustainable practices, such as advanced pollution control and resource-efficient manufacturing, is essential for navigating regulatory environments and meeting stakeholder expectations.

ESG reporting is becoming a critical aspect of corporate governance, with investors and regulators demanding greater transparency on environmental impacts. Crane must demonstrate robust environmental stewardship, from carbon footprint management to water conservation, to maintain investor confidence and a competitive edge.

| Environmental Factor | Impact on Crane | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Regulations | Increased compliance costs, potential for innovation in cleaner technologies. | Over 70 countries had carbon pricing by end of 2023; EU's Circular Economy Action Plan ongoing. |

| Resource Scarcity | Risk to raw material availability and cost, need for sustainable sourcing. | Price volatility for rare earth metals and battery materials like lithium and cobalt observed in 2024. |

| Consumer Demand for Sustainability | Market preference for eco-friendly products, opportunity for differentiation. | Over 60% of consumers consider sustainability in purchasing (2024 report). |

| ESG Reporting Requirements | Enhanced investor scrutiny, need for transparent environmental data disclosure. | Growing adoption of TCFD recommendations; EU's CSRD mandates extensive disclosures from 2024. |

PESTLE Analysis Data Sources

Our Crane PESTLE Analysis draws from a comprehensive range of data, including global economic reports from institutions like the IMF and World Bank, as well as national infrastructure development plans and construction industry forecasts.