Charles River Associates PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles River Associates Bundle

Gain a critical understanding of the external forces shaping Charles River Associates's strategic landscape. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are influencing the company's operations and future growth. Equip yourself with actionable intelligence to navigate these complex dynamics and identify opportunities. Download the full version now for a comprehensive breakdown that will inform your strategic decisions.

Political factors

Government policy significantly shapes the demand for Charles River Associates (CRA) consulting services. For instance, increased fiscal stimulus or infrastructure spending, as seen with the Infrastructure Investment and Jobs Act (IIJA) in the US, which allocated over $1.2 trillion in 2021, can boost demand for economic impact analysis and strategic planning. Industry-specific regulations, particularly in sectors like energy and healthcare, also create direct opportunities. In 2024, heightened focus on climate change regulation is likely to drive demand for CRA's expertise in environmental economics and energy transition strategies.

Regulatory shifts can also unlock new avenues for CRA. Emerging compliance requirements in financial services, for example, necessitate specialized advisory. Furthermore, changes in antitrust enforcement or data privacy laws can create substantial demand for litigation support and strategic advisory services. The ongoing evolution of AI regulation presents a prime example where CRA can leverage its analytics capabilities to assist clients in navigating complex compliance landscapes and identifying strategic advantages.

Geopolitical stability and evolving trade policies significantly shape the landscape for consulting firms like Charles River Associates (CRA). Uncertainty in international relations, such as ongoing trade disputes or regional conflicts, can directly impact global supply chains and investment flows, creating a heightened need for CRA's expertise in risk assessment and market entry strategies for multinational corporations. For instance, the ongoing restructuring of global trade, with trends towards regionalization and new trade pacts emerging in 2024 and anticipated through 2025, presents both challenges and opportunities for businesses seeking to navigate these shifts effectively.

The impact of these geopolitical dynamics is substantial, as evidenced by the projected global economic growth rate of around 2.6% for 2024, as forecast by the IMF, which is sensitive to such disruptions. CRA's advisory services become crucial for clients looking to understand and mitigate the risks associated with cross-border operations, including navigating tariffs, sanctions, and evolving regulatory environments. This demand is further amplified by the increasing complexity of international dispute resolution, where CRA's economic and financial analysis capabilities are often leveraged.

Antitrust and competition policy is a significant political factor for economic consulting firms like Charles River Associates (CRA). Government agencies actively enforce these policies, impacting CRA’s core business areas such as merger reviews and litigation. For instance, in 2023, the U.S. Federal Trade Commission (FTC) saw a notable increase in merger filings, and the agency continued its aggressive stance on challenging potentially anti-competitive transactions, requiring extensive economic analysis and expert testimony that CRA provides.

The increasing scrutiny of large technology companies by antitrust regulators globally presents both challenges and opportunities for CRA. In 2024, we're seeing continued investigations and potential lawsuits against major tech players, demanding sophisticated economic analysis of market power and competitive effects. This heightened regulatory environment directly translates into demand for CRA's specialized expertise in competition economics.

CRA's involvement in monopolization cases is another key area influenced by competition policy. These cases often involve complex economic arguments about market definition, market power, and the impact of alleged exclusionary conduct. The political will to prosecute such cases, driven by legislative priorities and enforcement agency mandates, directly influences the volume and nature of work in this sector.

Furthermore, the evolution of antitrust law itself, often shaped by political discourse and judicial interpretation, creates a dynamic landscape for economic consultants. Decisions made in high-profile cases can set precedents, influencing future enforcement actions and the economic theories that are most relevant. For example, ongoing debates around the application of traditional antitrust frameworks to digital markets are a direct reflection of this political interplay.

Public Sector Consulting Demand

Government spending on consulting services significantly influences Charles River Associates' (CRA) public sector business. When governments decide to outsource advisory roles for policy development, program evaluation, or economic impact assessments, it creates direct opportunities for firms like CRA. For instance, in 2024, many governments continued to leverage external expertise to navigate complex economic challenges and implement new initiatives.

Changes in government budgets and shifting priorities regarding the use of external expertise directly impact CRA's engagement potential within the public sector. A focus on fiscal responsibility might lead to reduced outsourcing, while a push for specific policy reforms could increase demand for specialized consulting. The US federal government, a significant consumer of consulting services, allocated an estimated $20 billion to IT and management consulting in fiscal year 2024, with a portion dedicated to policy and evaluation.

- Government outsourcing for consulting is a key driver for CRA's public sector revenue.

- Policy development, program evaluation, and economic impact assessments are common areas of government consulting demand.

- In 2024, governments continued to rely on external consultants to address complex economic and policy issues.

- Budgetary constraints and evolving government priorities directly shape CRA's public sector consulting opportunities.

Political Stability and Corruption Indices

Political stability is a key consideration for Charles River Associates (CRA), influencing the demand for their consulting services. Regions with lower political stability or higher perceived corruption often necessitate more robust risk management and due diligence, directly benefiting CRA's litigation and regulatory practices.

For instance, the 2023 Corruption Perceptions Index, released by Transparency International, ranked Denmark highest with a score of 90, indicating very low perceived corruption. Conversely, countries facing significant political upheaval might see increased engagement with CRA's expertise in navigating complex legal and regulatory landscapes. The World Bank's Worldwide Governance Indicators for 2023 also highlight variations in political stability across global markets where CRA and its clients operate, with some regions demonstrating stronger governance frameworks than others.

- Political Instability: Can lead to increased demand for CRA's risk assessment and dispute resolution services.

- Corruption Indices: Lower scores in these indices often correlate with higher demand for CRA's compliance and regulatory advisory.

- Client Interests: Geopolitical shifts impacting client operations directly influence the need for CRA's strategic counsel.

- Regulatory Environment: Unstable political climates can create complex regulatory challenges, boosting demand for specialized legal and economic consulting.

Government policies and enforcement actions are critical drivers for Charles River Associates (CRA). Increased regulatory activity, particularly in areas like antitrust, environmental standards, and data privacy, directly fuels demand for CRA's economic and litigation consulting services. For example, the U.S. Federal Trade Commission's proactive stance in merger reviews during 2023, challenging more transactions than in prior years, underscores this trend.

Geopolitical stability and international trade agreements also significantly influence CRA's client base. As global trade patterns shift, with trends towards regionalization anticipated through 2025, companies require expert analysis on supply chain resilience and market access, areas where CRA excels. The International Monetary Fund's forecast of 2.6% global growth for 2024 highlights the sensitivity of businesses to these political and economic shifts.

Government spending on consulting, particularly for policy analysis and program evaluation, represents a substantial revenue stream for CRA's public sector work. In fiscal year 2024, the US federal government's continued reliance on external expertise for complex economic challenges and policy implementation, estimated at $20 billion for IT and management consulting, illustrates this demand.

| Political Factor | Impact on CRA | Supporting Data/Trend (2023-2025) |

| Antitrust Enforcement | Increased demand for litigation support and economic analysis in merger reviews and competition litigation. | FTC challenged more mergers in 2023; ongoing scrutiny of tech giants in 2024. |

| Geopolitical Shifts & Trade Policy | Demand for risk assessment, market entry strategy, and supply chain analysis for multinational clients. | Trend towards regionalization in trade expected through 2025; global growth forecast sensitive to geopolitical stability (IMF 2.6% for 2024). |

| Government Consulting Spending | Direct revenue opportunities for public sector advisory services like policy development and program evaluation. | US federal government consulting spend estimated at $20 billion (FY2024); continued outsourcing for policy initiatives. |

What is included in the product

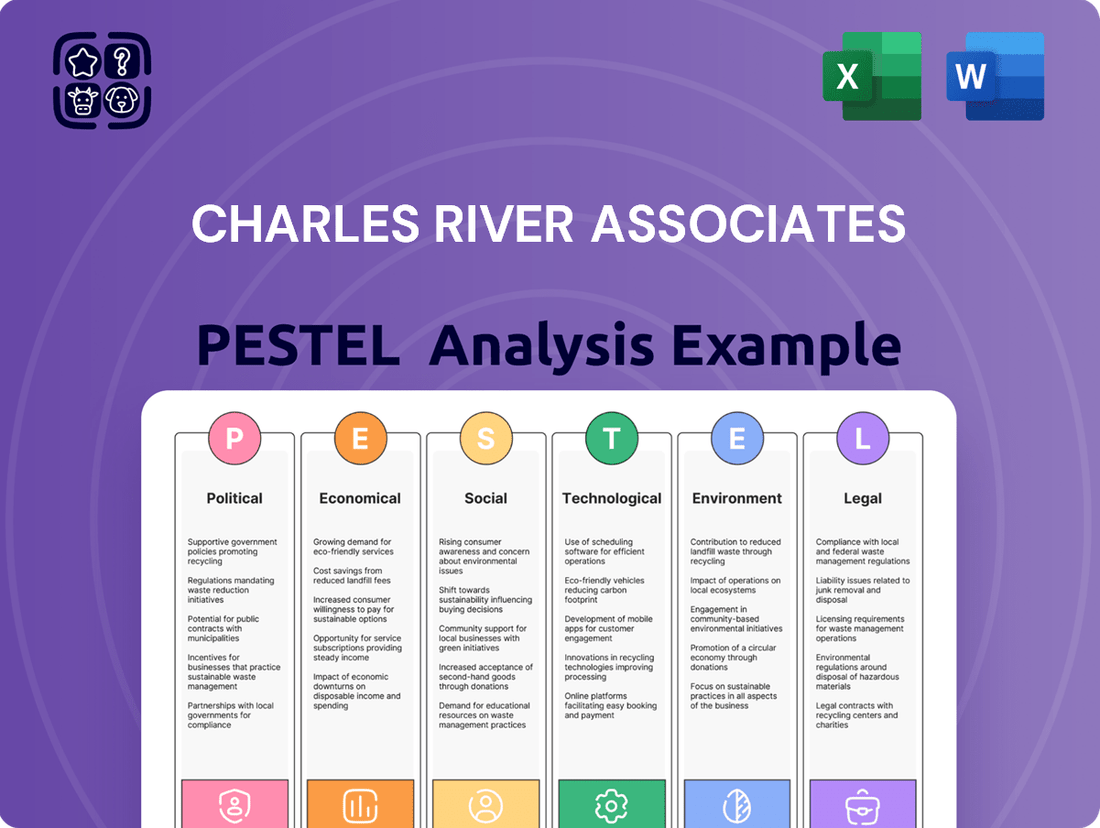

The Charles River Associates PESTLE analysis examines how external Political, Economic, Social, Technological, Environmental, and Legal forces influence its operations and strategic decisions.

Charles River Associates' PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of sifting through extensive data.

Economic factors

Global economic growth is projected to see moderate expansion in 2024 and 2025, though at a slower pace than in previous years. The International Monetary Fund (IMF) in its April 2024 World Economic Outlook forecast global growth at 3.2% for 2024 and 3.2% for 2025, slightly down from 3.5% in 2023. This environment influences corporate investment in strategic projects and mergers.

However, recession risks remain a significant concern, particularly in certain developed economies. Factors like persistent inflation, tighter monetary policies, and geopolitical instability contribute to this uncertainty. For instance, the Eurozone's growth was sluggish in late 2023 and early 2024, highlighting regional vulnerabilities.

Periods of economic downturn often spur demand for Charles River Associates (CRA) services in areas such as restructuring and cost optimization. Conversely, robust growth periods can increase M&A activity, directly benefiting CRA's advisory capabilities.

The sensitivity of CRA's diverse service lines to these macroeconomic cycles means that shifts in global growth or the likelihood of recession can materially impact revenue streams and the types of engagements undertaken.

Prevailing interest rates significantly shape capital markets activity, directly impacting Charles River Associates' (CRA) business. When interest rates are low, as seen in periods following economic downturns, borrowing becomes cheaper, often stimulating investment and M&A transactions. For instance, in early 2024, the expectation of potential Federal Reserve rate cuts fueled optimism in capital markets, leading to an uptick in deal-making activity, which in turn would likely increase demand for CRA's valuation and transaction advisory services.

Conversely, periods of higher interest rates can dampen capital markets enthusiasm. As borrowing costs rise, companies may postpone expansion plans or M&A, leading to a slowdown in transactions. This environment could see a shift in demand towards CRA's services related to financial restructuring or litigation support arising from distressed assets, rather than pure transaction advisory.

The vibrancy of capital markets, characterized by factors like stock market performance and bond yields, also plays a crucial role. Robust markets often correlate with increased corporate confidence and a greater willingness to engage in strategic financial activities. For example, if major indices like the S&P 500 reach new highs in late 2024 or early 2025, it would suggest a healthy economic climate conducive to higher levels of M&A and corporate financing, benefiting CRA.

High levels of M&A activity, often a byproduct of favorable interest rates and strong capital markets, directly translate into increased demand for CRA's specialized financial consulting, valuation, and litigation support services. These complex transactions require expert financial analysis and modeling, areas where CRA excels, thus driving revenue growth for the firm.

Inflationary pressures in 2024 and 2025 are forcing businesses to re-evaluate their pricing models and operational costs. For instance, the US Consumer Price Index (CPI) saw significant increases throughout 2024, impacting raw material and labor expenses for many sectors. This necessitates a strategic approach to cost management and pricing, where expert advice on supply chain optimization and efficiency gains becomes crucial for maintaining profitability.

Charles River Associates' (CRA) management consulting and performance improvement services are particularly relevant in this economic climate. Companies are actively seeking guidance on how to navigate rising costs, optimize procurement, and implement leaner operational processes. The ability to provide data-driven recommendations on pricing elasticity and cost reduction initiatives directly addresses the core challenges faced by businesses aiming to preserve margins amidst persistent inflation.

Industry-Specific Economic Trends

Charles River Associates (CRA) operates by serving diverse industries, and economic trends within these sectors significantly shape its consulting demand. For instance, the energy sector's pivot towards renewables is a major driver. In 2024, global investment in the energy transition was projected to reach around $2 trillion, creating opportunities for CRA’s expertise in market analysis and strategy within this evolving landscape.

The life sciences industry also presents distinct economic factors. Pharmaceutical R&D spending is a key indicator; in 2025, global pharmaceutical R&D spending is expected to exceed $250 billion. Increased spending often translates to higher demand for regulatory consulting, economic impact assessments, and intellectual property strategy, all core competencies for CRA.

Financial services, another critical client base, is influenced by macroeconomic conditions and regulatory changes. For example, the ongoing adjustments in interest rate environments and evolving compliance requirements for financial institutions in 2024 and 2025 necessitate specialized advisory services.

- Energy Transition Investment: Global investment in the energy transition is forecast to approach $2 trillion in 2024, impacting demand for energy market strategy consulting.

- Pharmaceutical R&D Growth: Projected pharmaceutical R&D spending exceeding $250 billion in 2025 signals increased need for life sciences regulatory and market access consulting.

- Financial Services Dynamics: Evolving interest rate policies and intensified regulatory scrutiny in 2024-2025 create opportunities for financial advisory services.

- Economic Volatility Impact: Broader economic shifts and potential recessions in key markets influence the demand for CRA's litigation, dispute resolution, and forensic accounting services.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations significantly impact Charles River Associates' (CRA) international operations and its clients' global businesses. Currency volatility can directly affect the profitability of cross-border transactions and the valuation of international assets. For instance, a strengthening US dollar in late 2023 and early 2024 made US exports more expensive, potentially impacting clients with substantial international sales, thereby increasing demand for CRA's expertise in navigating these complex economic environments.

Significant movements in exchange rates can alter the perceived value of international investments and revenue streams for CRA's clients. This volatility often translates into a heightened need for economic consulting services to assess financial risks, forecast currency impacts, and develop hedging strategies. As of mid-2024, major currencies like the Euro and Japanese Yen have experienced notable shifts against the US dollar, creating a dynamic landscape for global businesses that CRA advises.

- Impact on Profitability: A stronger domestic currency can reduce the value of foreign earnings when translated back, impacting net income for multinational corporations.

- Asset Valuation: Fluctuations can alter the book value of international subsidiaries and investments, requiring expert valuation services.

- Demand for Expertise: Increased currency volatility, such as observed in the major G10 currency pairs throughout 2023-2024, drives demand for CRA's economic and financial advisory services.

- Cross-Border Transactions: Volatile exchange rates complicate pricing, payments, and the overall financial management of international trade and investment flows.

Global economic growth is anticipated to expand moderately in 2024 and 2025, though at a slightly slower pace than in prior years, with the IMF projecting 3.2% growth for both years. This environment influences corporate investment decisions and M&A activity, which directly impacts demand for advisory services. However, recession risks persist in certain regions due to inflation, tighter monetary policies, and geopolitical issues, potentially increasing demand for CRA's restructuring and dispute resolution services.

Interest rates significantly influence capital markets; lower rates in early 2024 fueled deal-making, boosting demand for CRA's valuation services. Conversely, higher rates can slow M&A, shifting demand toward financial restructuring advice. Strong capital markets, indicated by rising stock indices like the S&P 500, generally correlate with increased corporate confidence and strategic financial activities, benefiting firms like CRA through higher transaction volumes.

Inflationary pressures in 2024 and 2025 are compelling businesses to adjust pricing and manage costs, with US CPI showing significant increases throughout 2024. This drives demand for CRA's performance improvement and cost optimization services, as companies seek guidance on supply chain efficiency and pricing strategies to maintain profitability amidst rising expenses.

Industry-specific economic trends shape consulting demand, with the energy sector's $2 trillion investment in transition in 2024 creating opportunities in market strategy. Life sciences, with projected R&D spending over $250 billion in 2025, drives demand for regulatory and market access consulting. Financial services' adaptation to interest rate shifts and regulatory changes in 2024-2025 also necessitates specialized advisory.

| Economic Factor | 2024/2025 Outlook | Impact on CRA |

|---|---|---|

| Global Growth | Moderate expansion (IMF: 3.2% in 2024 & 2025) | Influences M&A, strategic investments; potential for restructuring demand during downturns. |

| Interest Rates | Mixed; expectations of cuts in early 2024, but potential for higher rates later. | Low rates boost M&A; high rates increase demand for restructuring and litigation support. |

| Inflation | Persistent pressures (e.g., US CPI increases in 2024) | Drives demand for cost optimization, pricing strategy, and operational efficiency consulting. |

| Industry Trends | Energy transition ($2T investment in 2024), Pharma R&D ($250B+ in 2025) | Creates demand for specialized consulting in energy strategy and life sciences regulatory/market access. |

What You See Is What You Get

Charles River Associates PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Charles River Associates offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm. It's designed to provide actionable insights for strategic decision-making. You'll gain a clear understanding of the external landscape influencing CRA's operations and future growth.

Sociological factors

Sociological factors significantly shape talent acquisition and retention within the consulting sector, directly impacting firms like Charles River Associates (CRA). The demand for highly specialized economists, financial analysts, and industry experts remains intense, creating a fiercely competitive talent market. For instance, in 2024, the global management consulting market size was valued at approximately $373 billion, underscoring the substantial need for skilled professionals.

CRA's ability to attract and retain this top-tier talent is paramount to maintaining its service quality and intellectual capital. A key driver is the evolving expectations of the workforce, with younger professionals often prioritizing work-life balance, continuous learning opportunities, and a strong company culture, alongside competitive compensation. Reports in early 2025 indicate a growing emphasis on flexible work arrangements and professional development programs as critical retention tools in professional services.

The intellectual capital housed within CRA's consultants is its core asset, and a high turnover rate can directly erode its service delivery capabilities and client trust. Therefore, strategic investments in employee development, mentorship, and fostering an inclusive and engaging work environment are essential for long-term success in this demanding professional services landscape.

Clients increasingly expect consulting engagements to be deeply rooted in data, demanding not just analysis but actionable, data-driven insights. This shift means firms like Charles River Associates (CRA) must leverage advanced analytics and AI to deliver quantifiable value and demonstrate ROI. For instance, a 2024 survey of C-suite executives revealed that 78% prioritize consultants who can translate complex data into clear strategic recommendations, up from 65% in 2022.

The demand for speed is also accelerating, with clients seeking rapid project turnaround times without compromising quality. CRA must optimize its project management and resource allocation to meet these expedited timelines, often requiring agile methodologies. This pressure is evident in the consulting market, where the average project cycle for strategic advisory services has shortened by approximately 15% over the past two years.

Furthermore, clients are moving towards seeking integrated solutions that address multiple facets of a business challenge, rather than siloed expertise. This necessitates a more collaborative and cross-functional approach from consultants, blending economic, financial, and strategic capabilities. The trend towards integrated solutions is reflected in the growing market share of consulting firms that offer end-to-end services, with such segments experiencing an average annual growth rate of 10% in 2024.

Charles River Associates (CRA) recognizes the growing imperative for diversity, equity, and inclusion (DEI) in professional services. A strong commitment to DEI not only bolsters CRA's reputation but also broadens its access to top talent, crucial in a competitive market.

In 2024, the demand for diverse perspectives in problem-solving is at an all-time high, with many clients actively seeking firms that reflect societal diversity. For instance, a 2023 survey by McKinsey & Company found that companies in the top quartile for ethnic and cultural diversity on executive teams were 39% more likely to outperform on profitability.

CRA's ongoing initiatives in DEI are designed to attract a wider range of candidates, fostering an environment where all employees feel valued and can contribute their best work. This inclusive approach can lead to more innovative solutions and a better understanding of a diverse client base.

Corporate Social Responsibility (CSR) and ESG Focus

The increasing focus on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) factors presents a significant opportunity for Charles River Associates (CRA). Investors and consumers alike are prioritizing companies that demonstrate a commitment to sustainability and ethical practices. For instance, the global ESG investing market was projected to reach $50 trillion by 2025, showcasing the immense financial incentive for businesses to integrate ESG principles.

CRA can capitalize on this trend by providing specialized consulting services. These services could include developing robust ESG strategies, assisting with transparent ESG reporting frameworks, and conducting thorough impact assessments for clients. By aligning its expertise with these growing societal values, CRA can position itself as a key partner for organizations navigating the evolving landscape of responsible business operations.

- Growing Investor Demand: BlackRock, a major asset manager, has emphasized the importance of ESG integration in investment decisions, noting its potential to enhance long-term returns.

- Regulatory Push: Governments worldwide are implementing stricter regulations and disclosure requirements related to ESG performance, creating a need for expert guidance.

- Consumer Preference: Surveys consistently show that consumers are more likely to support brands perceived as socially and environmentally responsible.

- Competitive Advantage: Companies with strong ESG credentials often enjoy improved reputation, talent attraction, and operational efficiency.

Demographic Shifts and Labor Market Dynamics

Demographic shifts are significantly reshaping labor markets, presenting both challenges and opportunities for consulting firms like Charles River Associates (CRA). An aging population, for instance, can lead to labor shortages in certain sectors while simultaneously increasing demand for services catering to seniors. In 2024, the U.S. Bureau of Labor Statistics projected that the labor force participation rate for those aged 65 and over would grow, indicating a sustained trend of older workers remaining employed.

Generational differences also impact consumer behavior and workforce expectations. Younger generations, such as Gen Z, often prioritize work-life balance and purpose-driven careers. This dynamic creates a need for companies to adapt their human capital strategies, an area where CRA can offer expertise in talent management and organizational design. The increasing diversity of the workforce also necessitates strategies for inclusive leadership and equitable workplace practices.

These evolving demographics directly translate into new consulting avenues for CRA. For example, the growing demand for elder care services and retirement planning creates opportunities for market analysis and strategic advisory within the healthcare and financial services sectors. Similarly, understanding the spending habits and preferences of different age groups allows CRA to assist clients in developing targeted marketing and product development strategies.

- Aging Workforce Impact: By 2030, all baby boomers will be 65 or older, a demographic shift expected to strain pension systems and increase demand for healthcare and senior living services.

- Generational Preferences: Surveys in 2024 indicate that over 70% of Gen Z employees value company culture and flexibility, influencing how businesses attract and retain talent.

- Consulting Opportunities: CRA can leverage its expertise in human capital strategy to help clients navigate intergenerational workforce dynamics and develop effective employee engagement programs.

- Market Analysis: The projected growth in the 65+ consumer market, estimated to reach trillions in spending power by 2030, offers significant opportunities for market entry and expansion strategy development.

Sociological factors, including evolving workforce expectations and the increasing demand for diversity and inclusion, directly influence how consulting firms like Charles River Associates (CRA) attract and retain talent. In 2024, the global consulting market's substantial size, around $373 billion, highlights the fierce competition for skilled professionals, making employee value propositions crucial.

The emphasis on work-life balance and continuous learning, particularly among younger professionals, necessitates adaptive human capital strategies. Furthermore, clients' growing demand for data-driven insights and rapid project delivery requires consulting firms to foster agile, cross-functional teams capable of integrating diverse expertise.

CRA's commitment to diversity, equity, and inclusion (DEI) is not only a reputational enhancer but also a strategic imperative for talent access, as companies with diverse leadership are demonstrably more profitable. For instance, a 2023 McKinsey report showed a 39% likelihood of outperformance for ethnically diverse executive teams.

The rising importance of Corporate Social Responsibility (CSR) and ESG factors presents significant opportunities for CRA to offer specialized consulting services. With the global ESG investing market projected to reach $50 trillion by 2025, firms that can guide clients on sustainability and ethical practices are well-positioned for growth.

Technological factors

Rapid advancements in data analytics and artificial intelligence significantly enhance Charles River Associates' (CRA) capacity for economic and financial analysis. The ability to process vast datasets with machine learning algorithms allows for more precise forecasting and risk assessment for clients.

For instance, AI-powered tools can uncover subtle market trends and predict consumer behavior with greater accuracy, a critical advantage in economic consulting. In 2024, the global big data analytics market was projected to reach $374.2 billion, indicating a strong demand for these sophisticated analytical capabilities.

Leveraging these technologies not only boosts the efficiency and depth of existing services but also opens avenues for new service offerings focused on predictive modeling and AI strategy development. This technological edge directly translates into more valuable insights for CRA's diverse client base.

Cybersecurity risks and data privacy are critical technological factors impacting businesses, especially those like Charles River Associates (CRA) that handle sensitive client data and intellectual property. The escalating sophistication of cyber threats, including ransomware and phishing attacks, necessitates continuous investment in robust security infrastructure and employee training. For instance, the global average cost of a data breach reached an all-time high of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the significant financial and reputational damage that can result from a security lapse. Compliance with evolving data privacy regulations, such as GDPR and CCPA, adds another layer of complexity, requiring meticulous data handling protocols and transparent privacy policies to maintain client trust and avoid substantial fines, which can reach millions of dollars.

The rapid digital transformation across Charles River Associates' (CRA) client industries is a significant technological factor. This ongoing shift is driving substantial demand for CRA's advisory services, particularly in areas like technology adoption, digital strategy development, and assessing the economic consequences of digitalization. For instance, the financial services sector, a key client base for CRA, saw global fintech investment reach an estimated $150 billion in 2024, highlighting the urgency for companies to modernize their operations and customer engagement through digital means.

This trend extends to sectors like energy, where digital technologies are crucial for optimizing operations, managing grid complexity, and developing smart energy solutions. By 2025, the industrial IoT market, which is central to digital transformation in energy and manufacturing, is projected to be valued at over $200 billion globally. CRA's ability to provide data-driven insights into these technological shifts positions them to assist clients in navigating this evolving landscape, from implementing AI-driven analytics to developing robust cybersecurity strategies.

Automation of Consulting Processes

The consulting industry is increasingly seeing automation applied to routine tasks. This includes leveraging AI and machine learning for data collection, generating initial report drafts, and performing preliminary analysis. For Charles River Associates (CRA), this presents an opportunity to enhance efficiency and potentially free up consultants for higher-value strategic thinking.

However, the key challenge for CRA lies in integrating these automation tools without diluting the personalized, expert-driven approach that defines its premium services. The firm must ensure that technology acts as an enabler for its consultants, rather than a replacement for their deep industry knowledge and bespoke problem-solving capabilities. This strategic balance is crucial for maintaining client trust and the firm's competitive edge in a market that values tailored solutions.

- Efficiency Gains: Automation can reduce the time spent on data gathering and report formatting, allowing consultants to focus more on client interaction and strategic insight.

- Data-Driven Insights: Advanced analytics platforms can process vast datasets to identify trends and patterns that might be missed by manual review, enhancing the depth of analysis.

- Scalability: Automation can help consulting firms handle a larger volume of work or more complex projects without a proportional increase in headcount.

- Talent Development: By offloading mundane tasks, automation allows junior consultants to engage with more challenging analytical work earlier in their careers, fostering skill development.

Cloud Computing and Remote Work Technologies

Cloud computing and advanced remote work technologies are fundamentally reshaping how firms like Charles River Associates (CRA) operate. The ability to leverage scalable cloud infrastructure allows for greater flexibility in managing data, analytics, and client projects, irrespective of geographical location. This is crucial for a global consulting firm that relies on distributed teams to deliver specialized expertise. By 2024, the global cloud computing market was projected to reach over $600 billion, underscoring its widespread adoption and importance for operational efficiency.

These technological advancements directly support distributed teams, enhancing CRA's capacity to attract and retain top talent worldwide by offering flexible work arrangements. Furthermore, sophisticated remote collaboration tools, such as enhanced video conferencing and shared digital workspaces, ensure seamless communication and project continuity across different time zones. A 2024 Gartner report indicated that 45% of knowledge workers would continue to work remotely at least part of the time, a trend that CRA's technological investments must accommodate to remain competitive.

- Cloud infrastructure offers scalability and cost-efficiency for data-intensive consulting work.

- Remote collaboration tools are essential for managing geographically dispersed project teams.

- The increasing prevalence of remote work necessitates robust technological support for talent acquisition and client service.

- Investments in these areas directly impact operational agility and the ability to tap into a global talent pool.

The increasing reliance on advanced analytics and AI is transforming how Charles River Associates (CRA) operates, enabling more sophisticated economic and financial modeling. These tools allow for deeper insights into market dynamics and client challenges, as evidenced by the projected $374.2 billion global big data analytics market in 2024. This technological integration enhances service delivery and creates new opportunities in predictive analytics and AI consulting.

Legal factors

The landscape of litigation and regulatory enforcement continues to evolve, impacting firms like Charles River Associates (CRA) which specialize in litigation support. For instance, the U.S. Securities and Exchange Commission (SEC) reported a 7% increase in enforcement actions in fiscal year 2023 compared to 2022, reaching 784 actions, underscoring a rising demand for expert analysis in financial disputes. This trend suggests a growing need for CRA's expertise in areas such as antitrust litigation, intellectual property, and financial consulting, as companies face more complex legal challenges and increased scrutiny.

Class action lawsuits, particularly in the financial services and technology sectors, remain a significant driver of litigation support demand. In 2023, the number of securities class action filings saw a moderate increase, with approximately 10% of public companies facing such litigation, according to industry reports. This persistent volume necessitates sophisticated economic and financial modeling, a core competency for CRA, as they assist clients in navigating these complex legal proceedings and providing expert testimony.

Intellectual property (IP) disputes, especially in high-growth sectors like pharmaceuticals and technology, continue to generate substantial litigation. The U.S. International Trade Commission (ITC) reported an increase in Section 337 investigations in 2023, many of which involve complex IP infringement claims requiring detailed economic analysis. CRA's ability to provide damages calculations and market analysis in these IP-heavy cases positions them to benefit from this ongoing trend.

Global regulatory enforcement also plays a critical role, with agencies worldwide increasing their oversight and penalties for non-compliance. For example, the European Union's Digital Markets Act (DMA) and Digital Services Act (DSA) are creating new avenues for regulatory investigations and potential litigation, requiring businesses to adapt their practices and seek expert counsel. CRA's international presence and expertise in regulatory economics are crucial for advising clients operating across multiple jurisdictions facing these evolving enforcement actions.

Charles River Associates (CRA) operates within an increasingly complex global landscape shaped by robust data protection and privacy laws. The General Data Protection Regulation (GDPR) in Europe, for example, and the California Consumer Privacy Act (CCPA) in the United States, along with similar legislation enacted in numerous other jurisdictions by 2024-2025, impose strict requirements on how companies collect, process, and store personal data. Non-compliance can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

CRA must meticulously ensure its internal operations and client advisory services adhere to these evolving regulations. This includes implementing rigorous data security measures and transparent data handling practices, especially when dealing with sensitive financial information of clients and their customers. The reputational damage from a data breach or privacy violation could be severe, impacting client trust and business relationships.

The sheer volume of data processed by firms like CRA means that navigating these legal frameworks is a continuous challenge. By 2024, the global economy was increasingly reliant on data-driven insights, making adherence to privacy laws not just a legal obligation but a critical component of business strategy and risk management. CRA's commitment to data privacy is therefore paramount for maintaining its integrity and competitive edge.

Charles River Associates (CRA) operates within a legal framework where professional liability and indemnity are paramount. Consulting services, particularly those involving expert advice in areas like litigation support and economic analysis, carry inherent risks of errors or omissions, potentially leading to liability claims. For instance, the legal landscape governing expert testimony, as seen in court rulings and regulatory updates throughout 2024, continues to emphasize the need for rigorous methodology and objective findings.

To navigate these risks, CRA must maintain comprehensive professional indemnity insurance. This coverage is essential to protect the firm against financial losses arising from claims of negligence or misconduct in its advisory services. The market for such insurance saw continued premium adjustments in late 2024, reflecting the evolving risk profiles of professional services firms in complex industries.

Robust risk management practices are therefore critical. This includes clear contractual terms with clients that define scope of work, responsibilities, and limitations of liability. Adherence to professional standards and ethical guidelines, as overseen by relevant industry bodies and regulatory agencies, further underpins CRA’s ability to mitigate potential legal challenges and maintain client trust.

Intellectual Property Rights and Protection

Intellectual property rights are a cornerstone for Charles River Associates (CRA), safeguarding its proprietary analytical methodologies, research findings, and expert insights. The legal framework governing patents, copyrights, and trade secrets directly impacts CRA's ability to maintain its competitive edge and the value it provides to clients.

CRA's business model relies heavily on its intellectual capital. For instance, in 2024, the global intellectual property market saw continued growth, with significant investments in patent filings and licensing, underscoring the commercial importance of IP protection.

- Protection of Proprietary Models: CRA's unique analytical tools and databases are protected through a combination of copyright and trade secret law, preventing unauthorized use or replication by competitors.

- Expert Opinion and Testimony: The legal standing of CRA's expert witnesses and their opinions in litigation is bolstered by clear IP ownership and the firm's reputation for rigorous, original analysis.

- Client IP Advisory: A key service offering for CRA involves advising clients on their own intellectual property strategies, including IP valuation, litigation support, and patent portfolio management.

- Global IP Trends: Staying abreast of evolving IP laws and enforcement mechanisms across different jurisdictions is critical for CRA, especially as it operates internationally and advises global clients.

International and Domestic Contract Law

Charles River Associates (CRA) must navigate the intricate web of international and domestic contract law to ensure smooth operations and mitigate risks when serving a global clientele. This involves understanding the nuances of contract enforceability, dispute resolution mechanisms, and regulatory compliance across various legal systems. For example, in 2024, cross-border transactions continue to be a significant part of the consulting landscape, necessitating expertise in areas like the United Nations Convention on Contracts for the International Sale of Goods (CISG) and varying national contract statutes.

Effective management of client agreements, strategic partnerships, and service delivery hinges on robust legal frameworks. CRA's ability to draft, negotiate, and enforce contracts that are compliant with diverse legal requirements is paramount. This includes adhering to data privacy regulations, intellectual property protections, and service level agreements that may differ significantly between countries, impacting revenue streams and operational costs.

Key considerations for CRA include:

- Jurisdictional Differences: Ensuring contract terms are legally sound and enforceable in all relevant jurisdictions where CRA operates or has clients.

- Dispute Resolution: Understanding and incorporating appropriate dispute resolution clauses, such as arbitration or mediation, to manage potential conflicts efficiently.

- Compliance with International Standards: Staying abreast of evolving international legal standards and conventions that govern cross-border business dealings.

- Local Regulatory Adherence: Complying with specific domestic contract laws and regulations in each country where services are provided.

Charles River Associates (CRA) operates within a legal environment that is increasingly shaped by complex regulations and evolving enforcement actions. The rise in securities enforcement actions by bodies like the SEC, which saw a 7% increase in fiscal year 2023, directly fuels demand for CRA's litigation support and expert analysis services in financial disputes. Furthermore, the persistent volume of class action lawsuits, with roughly 10% of public companies facing such litigation in 2023, necessitates sophisticated economic modeling and expert testimony, core competencies for CRA.

The firm's reliance on intellectual capital means that robust intellectual property (IP) protection is critical, especially as global IP markets saw continued investment in patent filings and licensing throughout 2024. CRA's ability to protect its proprietary models and provide expert opinions in litigation is directly tied to this legal framework. Moreover, navigating diverse international and domestic contract laws is paramount for CRA's global operations, with cross-border transactions remaining a significant aspect of the consulting landscape in 2024.

Data privacy laws, such as GDPR and CCPA, impose strict requirements on data handling, with potential fines reaching up to 4% of global annual revenue for non-compliance. CRA must ensure its operations and advisory services adhere to these regulations, making data privacy a critical component of its business strategy. Professional liability also remains a key concern, necessitating comprehensive indemnity insurance and rigorous risk management practices to mitigate claims arising from errors or omissions in advisory services.

Legal Factors Impacting Charles River Associates (CRA)

| Factor | Trend/Implication | Relevance to CRA |

| Regulatory Enforcement (e.g., SEC) | Increased actions (7% in FY23) | Drives demand for litigation support and expert analysis. |

| Class Action Litigation | Persistent volume (~10% of public companies in 2023) | Requires sophisticated economic modeling and expert testimony. |

| Intellectual Property (IP) | Growing global IP market (2024 investments) | Crucial for protecting proprietary models and providing IP advisory services. |

| Data Privacy Laws (GDPR, CCPA) | Strict requirements, significant penalties | Necessitates rigorous data security and transparent handling practices. |

| Professional Liability | Inherent risk in advisory services | Requires comprehensive indemnity insurance and robust risk management. |

| Contract Law (International & Domestic) | Complexity in cross-border transactions | Demands expertise in drafting, negotiating, and enforcing compliant contracts. |

Environmental factors

The increasing emphasis on Environmental, Social, and Governance (ESG) criteria by both corporations and investors is fueling a significant demand for specialized consulting services. This trend is directly translating into new business opportunities for firms like Charles River Associates (CRA).

CRA can capitalize on this by offering expertise in crucial areas such as climate risk assessment, guiding clients through the complexities of sustainable finance, and developing robust ESG strategies tailored to individual client needs. The global ESG consulting market was valued at approximately $15 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 18% through 2030.

This growth is driven by regulatory pressures, investor activism, and a growing awareness of the financial implications of sustainability. For instance, a 2024 report indicated that over 80% of institutional investors consider ESG factors in their investment decisions, underscoring the market's responsiveness to sustainability performance.

Governments worldwide are intensifying efforts to combat climate change, leading to more stringent regulations and policies. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose carbon costs on imports, impacting industries like manufacturing and steel. This regulatory shift is already prompting companies to reassess their carbon footprints and supply chains, creating opportunities for specialized analysis.

In the United States, the Inflation Reduction Act (IRA) of 2022 continues to drive significant investment in clean energy and climate resilience, offering substantial tax credits and incentives. By the end of 2023, the IRA had already spurred over $100 billion in new manufacturing investments in clean energy technologies. This evolving policy landscape necessitates strategic adjustments for businesses, particularly in the energy and manufacturing sectors, highlighting the demand for expert economic and policy analysis.

Global businesses are increasingly grappling with resource scarcity, particularly concerning critical minerals essential for technology and energy transitions. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for minerals like lithium and cobalt could surge by 400% to 600% by 2040 for clean energy technologies. This scarcity directly impacts manufacturing costs and availability, forcing companies to re-evaluate their sourcing strategies and embrace more resilient supply chains.

Charles River Associates (CRA) assists clients in navigating these environmental challenges by offering expert consulting. CRA's services focus on assessing the specific risks associated with resource availability and supply chain vulnerabilities. For example, a company reliant on rare earth elements might engage CRA to identify alternative sourcing regions or develop strategies for material substitution, thereby mitigating potential disruptions and ensuring operational continuity.

Building supply chain resilience is paramount, especially in light of geopolitical tensions and climate-related events that can halt production. CRA helps businesses conduct thorough risk assessments, identifying single points of failure and developing contingency plans. This could involve diversifying suppliers, investing in local production, or implementing advanced inventory management systems, all aimed at creating a more robust and adaptable operational framework.

Environmental Litigation and Liability

Environmental litigation is a growing concern for businesses, with potential cases arising from pollution incidents, the tangible impacts of climate change, and breaches of environmental regulations. Charles River Associates (CRA) is well-positioned to assist clients navigating these complex legal landscapes. Their core competencies in assessing economic damages and providing expert testimony are crucial in environmental dispute resolution.

For instance, the increasing frequency and severity of climate-related events, such as extreme weather, directly contribute to potential litigation. Businesses may face claims for damages stemming from their contribution to greenhouse gas emissions or their failure to adapt to changing environmental conditions. The U.S. Environmental Protection Agency (EPA) reported that in 2023, there were over 100 significant enforcement actions related to environmental violations, highlighting a robust regulatory environment.

- Increased Litigation Risk: Companies face heightened exposure to lawsuits concerning pollution, waste management, and historical contamination.

- Climate Change Litigation: Emerging legal challenges target corporate responsibility for climate change impacts, demanding robust defense and damage assessment strategies.

- Regulatory Non-Compliance: Penalties and legal actions for failing to meet evolving environmental standards, such as those under the Clean Air Act or Clean Water Act, are a significant liability.

- CRA's Role: Expertise in quantifying economic losses and providing authoritative expert witness testimony is vital for both plaintiffs and defendants in these environmental cases.

Stakeholder Pressure for Environmental Responsibility

Stakeholders are increasingly demanding that companies operate responsibly, with a significant focus on environmental impact. This pressure comes from various groups, including investors, consumers, and employees, all of whom are looking for businesses to align with sustainability goals.

For a firm like Charles River Associates (CRA), this translates into a growing need for advisory services that help clients understand and improve their environmental performance. Companies are actively seeking guidance on how to meet these expectations, navigate complex regulations, and enhance their reputation through tangible environmental initiatives.

Consider these points:

- Investor Scrutiny: In 2024, ESG (Environmental, Social, and Governance) funds continued to grow, with global ESG assets projected to reach over $50 trillion by 2025, according to various financial industry reports. This means investors are more closely examining a company's environmental footprint before committing capital.

- Consumer Awareness: A significant percentage of consumers, often cited as over 60% in recent surveys, consider a brand's environmental practices when making purchasing decisions. This consumer preference directly impacts sales and brand loyalty.

- Employee Expectations: Many employees, particularly younger generations, seek to work for organizations that demonstrate a commitment to environmental stewardship. This influences talent acquisition and retention strategies.

- Regulatory Environment: Governments worldwide are implementing stricter environmental regulations, creating compliance challenges and opportunities for specialized consulting services. For instance, carbon pricing mechanisms are becoming more widespread.

Environmental factors significantly shape business strategy, influencing everything from resource acquisition to regulatory compliance. Charles River Associates (CRA) leverages its expertise to help clients navigate this complex landscape, offering critical analysis on climate risk, sustainability, and supply chain resilience.

The growing demand for ESG-compliant operations, underscored by the projected growth of ESG funds to over $50 trillion by 2025, necessitates a proactive approach to environmental management. Businesses must also contend with increasing litigation risks stemming from environmental incidents and climate change impacts, as evidenced by over 100 significant EPA enforcement actions in 2023.

Resource scarcity, particularly for minerals vital to clean energy, presents a tangible challenge; the IEA forecasts a 400%-600% surge in demand for minerals like lithium by 2040. Furthermore, evolving regulatory frameworks, such as the EU's Carbon Border Adjustment Mechanism (CBAM) set for full operation in 2026, require companies to adapt their operations and supply chains accordingly.

Companies are increasingly scrutinized by investors, consumers, and employees for their environmental performance, with over 60% of consumers considering a brand's environmental practices. CRA's services are thus essential for helping clients meet these stakeholder expectations, manage risks, and capitalize on opportunities within the evolving environmental landscape.

| Factor | 2024/2025 Projection/Data | Impact on Businesses | CRA's Role |

|---|---|---|---|

| ESG Investment Growth | ESG assets projected to exceed $50 trillion by 2025 | Increased investor scrutiny on environmental performance | ESG strategy development, reporting assistance |

| Climate Change Litigation | Over 100 significant EPA enforcement actions in 2023 | Heightened legal risk for non-compliance and environmental impact | Economic damage assessment, expert testimony |

| Resource Scarcity (Critical Minerals) | IEA: 400%-600% demand surge for lithium by 2040 | Supply chain disruption, increased manufacturing costs | Supply chain risk assessment, material substitution strategies |

| Regulatory Changes | EU CBAM fully operational in 2026 | Compliance challenges, need for carbon footprint analysis | Policy impact analysis, regulatory compliance advisory |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources including government economic reports, international policy journals, and leading industry publications. This ensures each aspect of the macro-environment is informed by credible, current information.