Charles River Associates Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles River Associates Bundle

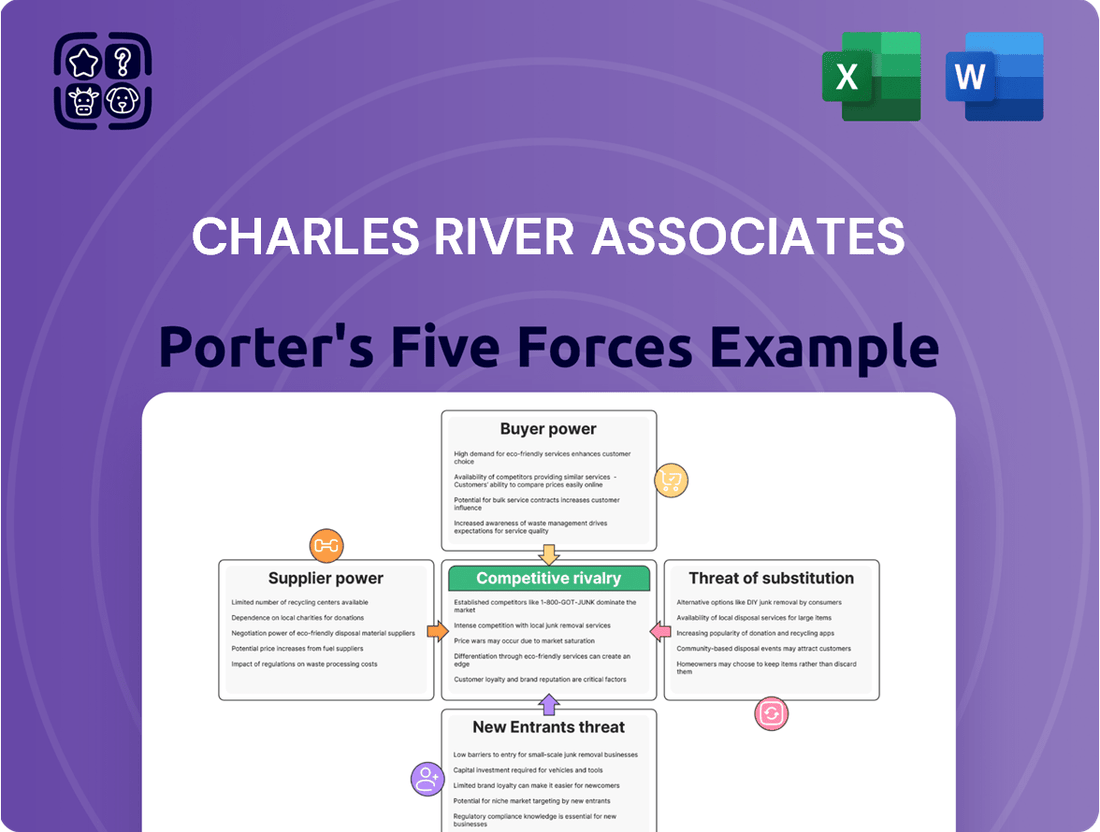

Charles River Associates operates within a dynamic consulting landscape shaped by Porter's Five Forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success. This analysis provides a foundational understanding of these competitive pressures.

The complete report reveals the real forces shaping Charles River Associates’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Charles River Associates' (CRA) most critical suppliers are its highly skilled consultants, especially those possessing advanced degrees and specialized knowledge in economic, financial, and management consulting. The limited availability of such elite talent, particularly in fields like antitrust, intellectual property, and life sciences, grants these individuals substantial bargaining power.

This scarcity necessitates that CRA offers competitive compensation and appealing work environments to secure and retain these in-demand professionals. For instance, the consulting sector generally sees high starting salaries for experienced consultants; in 2024, top-tier firms often offered base salaries exceeding $200,000 for experienced consultants, alongside significant bonus structures.

Suppliers of specialized data, advanced analytics, and proprietary research platforms exert a degree of bargaining power over firms like Charles River Associates (CRA). These providers can offer unique or high-value resources that are crucial for conducting in-depth economic and financial analyses, thereby differentiating CRA's services in the market.

The reliance of CRA on access to robust and often exclusive datasets means that providers who control these resources can influence CRA's operational costs. For instance, data licensing fees can represent a significant expenditure, and without viable alternatives, CRA may face higher costs for essential analytical inputs.

In 2024, the market for financial data and analytics saw continued growth, with key players investing heavily in AI and machine learning to enhance their offerings. For example, Bloomberg Terminal subscriptions, a benchmark for financial data, remained a significant operational cost for many financial advisory firms. While specific figures for CRA are proprietary, industry-wide data suggests that such services can account for a substantial portion of a firm's technology budget.

Technology and software vendors hold significant bargaining power, particularly as consulting firms increasingly rely on AI and data analytics. Companies providing advanced AI tools, data management platforms, and robust cybersecurity solutions are essential for maintaining competitive edge and operational efficiency. Their power is amplified by the proprietary nature of their software and the substantial costs and complexities involved in switching to alternative providers, often involving extensive data migration and retraining.

Recruitment and Talent Acquisition Firms

Recruitment and talent acquisition firms hold significant bargaining power over Charles River Associates (CRA) due to the specialized nature of the consultants they supply. These firms possess the crucial networks and expertise to identify candidates with niche skills, which are essential for CRA's project-based consulting model. The ability to tap into a pool of high-demand talent directly impacts CRA's operational capacity and project success.

Their bargaining power is amplified by the continuous need for specialized expertise in fields like economic consulting and management strategy. For instance, the global management consulting market was valued at approximately $350 billion in 2023 and is projected to grow, indicating sustained demand for skilled consultants. This scarcity of specialized talent means recruitment firms can command higher fees and favorable terms.

- Specialized Talent Access: Firms that can source hard-to-find consultants in areas like advanced analytics or regulatory compliance have considerable leverage.

- Network Dominance: Executive search firms with deep relationships in specific industries can dictate terms for accessing top-tier talent.

- Market Demand: High demand for consulting services translates to a seller's market for qualified professionals, strengthening recruitment agencies' position.

- Cost of Replacement: The time and resources CRA would need to invest in building its own internal talent acquisition capabilities further enhance the bargaining power of external recruiters.

Infrastructure and Support Service Providers

Suppliers of physical infrastructure like office space and essential support services, such as IT, hold a degree of bargaining power for Charles River Associates (CRA). While these are vital for day-to-day operations, their market is often more diverse, offering CRA a wider array of choices. This fragmentation generally limits the individual power of these suppliers.

However, this dynamic can shift. For instance, specialized IT infrastructure crucial for the secure management of sensitive client data or for powering complex economic modeling can significantly enhance a provider's leverage. In 2024, the demand for robust cybersecurity solutions and advanced cloud computing services within the consulting sector has seen increased pricing power for specialized providers.

- Office Space: While generally a commoditized market, prime locations or highly specialized office configurations can offer landlords some negotiating strength.

- IT Infrastructure: Providers of cloud computing, data analytics platforms, and cybersecurity services are gaining leverage due to increasing demand for advanced capabilities.

- Support Services: Outsourced administrative or research support can offer cost savings, but providers with unique skill sets or geographic advantages may command higher rates.

The bargaining power of suppliers for consulting firms like Charles River Associates (CRA) is primarily driven by the scarcity of specialized talent and proprietary data resources. Highly skilled consultants, particularly those with niche expertise in areas like advanced analytics or regulatory economics, represent a significant supplier group where demand often outstrips supply. Similarly, providers of unique datasets or sophisticated analytical software can wield considerable influence due to their ability to offer capabilities not easily replicated elsewhere. These factors collectively allow certain suppliers to command higher prices and favorable terms.

In 2024, the consulting industry continued to face intense competition for top talent. For instance, the average salary for experienced management consultants in the US often exceeded $200,000 annually, reflecting the high value placed on specialized skills. This trend underscores the leverage held by individual consultants and the recruitment firms that source them.

| Supplier Type | Key Bargaining Factors | Impact on CRA | 2024 Data/Trend |

|---|---|---|---|

| Skilled Consultants | Scarcity of niche expertise, advanced degrees | Higher compensation demands, retention challenges | High demand for data scientists and regulatory economists; average consultant salaries rising |

| Data & Analytics Providers | Proprietary data access, advanced analytics capabilities | Increased licensing costs, reliance on specific platforms | Growth in AI-driven analytics tools; increased investment in data infrastructure |

| Technology & Software Vendors | Specialized software, AI tools, cybersecurity solutions | Significant software licensing and implementation costs, switching costs | Continued investment in cloud and AI by consulting firms; cybersecurity providers gaining leverage |

| Recruitment Agencies | Access to specialized talent pools, industry networks | Higher recruitment fees, dependence on agency placements | Executive search firms commanding higher placement fees due to talent shortages |

What is included in the product

Charles River Associates' Porter's Five Forces analysis provides a comprehensive understanding of the competitive intensity and attractiveness of the consulting market, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing firms.

Instantly assess competitive intensity with a comprehensive yet concise overview of all five forces, enabling rapid strategic adjustments.

Customers Bargaining Power

Charles River Associates' (CRA) clients, including major corporations, law firms, and government entities, wield considerable bargaining power. These sophisticated buyers possess substantial resources and experience with consulting services, enabling them to negotiate for competitive pricing and customized solutions. For instance, in 2024, many large corporate clients are actively seeking cost efficiencies, putting pressure on service providers to demonstrate clear ROI.

The sheer scale of these clients, particularly for substantial, multi-year projects, allows them to secure more favorable contract terms. Their ability to compare proposals and leverage alternative service providers further amplifies their negotiating leverage. This dynamic means CRA must consistently deliver high-value, cost-effective solutions to retain these crucial relationships.

The project-based engagement model in consulting, like that of Charles River Associates (CRA), inherently empowers customers. Clients can select specific projects, which allows them to switch providers if dissatisfaction arises or if better terms are offered elsewhere. This flexibility directly enhances their bargaining leverage.

When consulting services lack strong differentiation, customers can easily pit firms against each other. For instance, if CRA's strategic advisory or economic consulting offerings are perceived as commoditized, clients can shop around for the best price and value. This competitive bidding process significantly amplifies customer power.

The ability for clients to solicit multiple bids for discrete projects means they are not locked into long-term, exclusive relationships. In 2024, many clients across industries like technology and finance were actively seeking cost-effective solutions, making them more sensitive to competitive pricing. This trend further strengthens the customer's hand in negotiations.

Furthermore, clients can leverage insights gained from one project to negotiate better terms on subsequent engagements. If a client has worked with CRA and is satisfied, they might still use that experience to secure more favorable rates or scope in the future, knowing CRA's capabilities. This continuous comparison and evaluation process drives down prices and demands for service quality.

The management consulting landscape is quite crowded, offering clients a wealth of choices. This includes large, well-known global consulting houses, smaller, more focused boutique firms, and even expert networks that connect clients with specialized knowledge on demand. This sheer volume of available alternatives significantly boosts the bargaining power of customers.

Clients aren't just limited to economic consulting specialists; they can also turn to broad-based management consultancies that have developed deep expertise in specific areas. Furthermore, many companies are building out their internal consulting capabilities, providing yet another option that limits the leverage of external providers. In 2023, the global management consulting market was valued at approximately $333 billion, underscoring the intense competition and the numerous players vying for market share.

Cost Sensitivity and Value Perception

Clients are laser-focused on the return on investment from consulting services. High fees mean they scrutinize every dollar spent, demanding clear evidence of value. This cost sensitivity pushes firms like Charles River Associates (CRA) to consistently demonstrate tangible outcomes and measurable impact from their expert analysis and strategic advice.

In 2024, many clients, particularly in the technology and financial sectors, reported increased pressure to justify consulting expenditures. For example, a significant portion of Fortune 500 companies stated that demonstrable ROI was a primary driver in selecting consulting partners. This makes CRA's ability to quantify the financial benefits of its work, especially in complex areas like litigation support and business strategy, absolutely critical.

- Clients demand clear ROI: A majority of businesses now require explicit proof of value from consulting engagements.

- Price sensitivity rises with fees: Higher consulting costs amplify client scrutiny and expectations for measurable results.

- CRA must prove impact: Demonstrating the tangible benefits of analysis is paramount, especially in high-stakes scenarios.

- Sector-specific demands: Industries like tech and finance are particularly keen on quantifiable outcomes from external advisors.

In-house Expertise Development

Sophisticated clients, especially large corporations and government bodies, are increasingly building their own internal expertise in economic analysis and strategic planning. This internal capability directly lessens their need for external consulting firms, particularly for standard or even some intricate analytical tasks. Consequently, clients with robust in-house teams gain significant bargaining power when they do decide to engage outside consultants.

The growing integration of advanced Artificial Intelligence tools within client organizations further amplifies this trend. Companies leveraging AI for data analysis and strategic insights can conduct more of their required work internally, reducing their dependence on external providers. This self-sufficiency strengthens their negotiation position, allowing them to demand more favorable terms and pricing from consulting firms.

- Increased Client Self-Sufficiency: Clients developing in-house analytical capabilities reduce reliance on external consultants.

- AI Adoption by Clients: Internal use of AI tools by clients enhances their analytical power and negotiation leverage.

- Reduced Demand for Routine Services: In-house expertise diminishes the need for external firms in basic and intermediate analytical work.

- Negotiating Power Enhancement: Clients with strong internal teams can secure better rates and terms from consulting providers.

Customers possess significant power in the consulting market due to the availability of numerous alternatives and their ability to internalize functions. This forces firms like Charles River Associates (CRA) to focus on delivering exceptional value and clear return on investment to secure and retain business. The 2024 market shows a strong client demand for cost-efficiency and demonstrable ROI, impacting how consulting services are procured and priced.

| Factor | Impact on CRA | 2024 Trend |

|---|---|---|

| Availability of Alternatives | Increases client negotiation leverage | Crowded market with boutiques and internal teams |

| Client's Ability to Internalize Services | Reduces reliance on external consultants | Growing use of AI and in-house expertise |

| Demand for Clear ROI | Requires demonstrable value and cost-effectiveness | Clients scrutinize every dollar spent |

| Price Sensitivity | Pressures firms to offer competitive pricing | Tech and finance sectors are particularly cost-conscious |

Preview the Actual Deliverable

Charles River Associates Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Charles River Associates Porter's Five Forces Analysis. What you're previewing is exactly what you will receive, fully formatted and prepared for your strategic decision-making. This detailed examination of competitive forces within an industry is provided without any placeholders or altered content, ensuring you get the full, professional analysis. You are looking at the actual document, guaranteeing instant access to this comprehensive report upon purchase.

Rivalry Among Competitors

While the overall management consulting sector is vast, specialized niches like economic and financial consulting exhibit higher concentration. Charles River Associates (CRA) faces intense competition from other prominent economic consulting firms, including NERA Economic Consulting, Cornerstone Research, and Analysis Group. These specialized firms, alongside the economic divisions of larger, multi-disciplinary consultancies, vie for market share in areas demanding deep analytical expertise.

Charles River Associates (CRA) operates in an environment where competitive rivalry is fierce, largely due to the high-stakes nature of its engagements. The firm frequently tackles complex litigation, significant regulatory issues, and crucial business strategy decisions, making its reputation and demonstrated expertise absolutely essential for winning new business. This dynamic fuels intense competition for the most prominent cases, as successful outcomes significantly boost a firm's industry standing and attract further high-profile opportunities.

The competitive landscape for consulting firms like Charles River Associates (CRA) is intensely shaped by a fierce war for talent, especially those with deep academic and practical expertise. Attracting and keeping the best minds, those who can translate complex economic and financial theories into actionable solutions, is paramount.

Differentiation hinges on the unique depth and breadth of specialized knowledge a firm possesses. CRA, for instance, likely emphasizes its economists' and financial experts' ability to tackle intricate challenges, evidenced by their published research and successful case outcomes. Firms actively showcase their track records, demonstrating the tangible value they bring to clients.

In 2023, the consulting industry saw continued demand for specialized skills, with firms reporting growth in areas like litigation support and regulatory consulting, where deep expertise is a key differentiator. This talent war means competitive compensation and a stimulating work environment are crucial for retention.

Impact of Digitalization and AI Adoption

The consulting industry's competitive landscape is rapidly evolving due to widespread digitalization and the increasing adoption of artificial intelligence. This technological shift introduces a new layer of rivalry as firms invest significantly in AI capabilities to boost efficiency, automate routine processes, and develop cutting-edge client solutions.

Firms that successfully embed AI into their operational frameworks and service offerings are positioning themselves to gain a substantial competitive advantage. For instance, by mid-2024, many top-tier consulting firms reported substantial increases in project efficiency directly attributable to AI-powered analytics and automation tools, with some estimating productivity gains of 15-20% on specific client engagements.

- AI-driven insights allow consultants to analyze vast datasets faster, uncovering deeper client needs.

- Automation of repetitive tasks, like data cleaning and report generation, frees up consultants for higher-value strategic work.

- Development of proprietary AI platforms by leading firms creates unique service offerings, differentiating them from competitors.

- Increased demand for specialized AI consultants is driving up talent acquisition costs and intensifying the war for skilled professionals.

Global and Niche Market Competition

Charles River Associates (CRA) navigates a dynamic competitive landscape, contending with both global consulting giants and highly specialized boutique firms. This dual pressure means CRA must balance its broad service offerings with the need to excel in specific, high-demand niches.

The consulting market, particularly in areas like economic analysis and management consulting, saw significant growth. For instance, the global management consulting market size was estimated to be around $330 billion in 2023, with projections indicating continued expansion. This growth fuels intense competition as more players enter or expand their services.

Competition intensifies as niche consultancies carve out expertise in emerging fields. For example, firms focusing on Environmental, Social, and Governance (ESG) consulting or the ethical implications of Artificial Intelligence (AI) are increasingly sought after for specialized projects. This trend forces established firms like CRA to either develop deep expertise in these areas or risk losing out on lucrative engagements.

- Global Reach vs. Niche Specialization: CRA competes with large, diversified consultancies like McKinsey & Company and Boston Consulting Group, as well as smaller, specialized firms focusing on specific industries or service lines.

- Market Dynamics: The consulting industry is characterized by a high degree of fragmentation, with a multitude of players vying for market share across various sectors.

- Impact of Emerging Technologies: The rise of AI and big data analytics has created new competitive fronts, with firms offering advanced technological solutions gaining an advantage.

- Client Demand for Expertise: Clients increasingly seek highly specialized knowledge, leading to the growth of boutique firms that can offer deep expertise in areas such as regulatory compliance or digital transformation.

Competitive rivalry is intense for Charles River Associates (CRA), facing both large, multi-disciplinary firms and specialized economic consultancies. This battle is amplified by the high-stakes nature of CRA's work, where demonstrable expertise in litigation, regulation, and strategy is crucial for winning engagements.

The war for talent is a significant driver of this rivalry, as firms compete to attract and retain economists and financial experts capable of handling complex analytical challenges. Differentiation through deep, specialized knowledge and a proven track record is paramount in securing lucrative opportunities.

The consulting market's growth, estimated around $330 billion globally in 2023, fuels this competition, attracting new players and intensifying efforts to capture market share, especially in emerging fields like ESG and AI consulting.

Technological advancements, particularly AI, are reshaping the competitive landscape, with firms leveraging these tools for efficiency gains and innovative client solutions. By mid-2024, many leading firms reported productivity boosts of 15-20% through AI integration.

SSubstitutes Threaten

The threat of substitutes for Charles River Associates (CRA) is significantly influenced by the rise of in-house consulting capabilities. Large corporations and government entities are increasingly investing in developing their internal expertise for economic analysis, strategic planning, and regulatory compliance. This trend allows them to build proprietary knowledge and maintain greater control over sensitive information, potentially reducing their reliance on external consulting firms.

For instance, in 2024, many Fortune 500 companies have expanded their internal strategy departments, hiring former consultants to replicate the services previously outsourced. This internal build-out can be more cost-effective for companies with recurring consulting needs, as they can amortize the cost of in-house talent over multiple projects. The ability to retain institutional knowledge also presents a compelling substitute for external advice.

While Charles River Associates (CRA) focuses on specialized economic and financial consulting, broad management consulting firms present a significant threat of substitution. Giants like McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, and Deloitte offer a wide array of services, including strategy, operations, and technology advisory that can directly compete with CRA’s business strategy and litigation support services. In 2024, the global management consulting market was valued at over $300 billion, indicating a substantial competitive landscape where these generalist firms leverage their extensive resources and brand recognition to attract clients seeking holistic solutions.

The increasing sophistication of AI and data analytics tools poses a significant threat of substitution for traditional consulting services. Clients are increasingly able to leverage advanced software and AI platforms to conduct tasks like data analysis, market research, and predictive modeling, potentially reducing their reliance on external human expertise.

For instance, by mid-2024, many firms were exploring or implementing AI-driven solutions for market segmentation and customer behavior analysis, tasks historically performed by consulting firms. This shift means that the value proposition of human consultants will need to focus more on strategic interpretation, complex problem-solving, and bespoke advisory services that AI cannot yet replicate.

Legal Software and E-Discovery Platforms

The rise of specialized legal software and e-discovery platforms presents a significant threat of substitutes for certain services offered by firms like Charles River Associates (CRA) in the legal and regulatory sector. These technologies can automate tasks that previously required extensive human analysis and consultation, such as document review and data extraction for litigation. For instance, platforms like Relativity or Disco offer advanced analytics and AI-powered review capabilities that can significantly speed up the e-discovery process. This automation directly competes with the labor-intensive data analysis aspects of expert witness support.

The increasing sophistication and accessibility of these legal tech solutions mean that law firms and corporations may opt to handle more of their data analysis and case preparation in-house, reducing their reliance on external expert consultants for these specific functions. The market for legal tech is experiencing robust growth; in 2023, the global legal tech market size was valued at approximately $29.1 billion, with projections indicating continued expansion. This growth signifies a widening availability and adoption of tools that can perform tasks previously exclusive to specialized consulting firms.

- Automation of Document Review: E-discovery platforms can process millions of documents far more quickly and cost-effectively than manual review.

- Data Analytics Capabilities: Advanced algorithms within these platforms can identify patterns, anomalies, and key information crucial for litigation support.

- Cost Reduction for Clients: By leveraging technology, clients can potentially lower their overall legal expenditure, making in-house solutions more attractive.

- Reduced Need for Specialized Human Expertise: For routine data analysis tasks, the demand for human consultants may diminish as software becomes more capable.

Independent Expert Networks and Freelancers

For very specific, short-term projects, clients may opt out of traditional consulting firms like Charles River Associates (CRA) and instead turn to independent experts or freelancers. This trend is fueled by specialized online platforms and professional networks that connect businesses directly with niche talent. This approach offers greater flexibility and can be more budget-friendly, allowing access to specialized knowledge without the broader costs associated with a full consulting firm engagement.

The rise of the gig economy has significantly impacted the consulting landscape. In 2024, it's estimated that over 60 million Americans participated in freelance work, a figure projected to grow. This readily available pool of specialized talent presents a viable substitute for traditional consulting services, particularly for tasks requiring highly focused, project-based expertise.

- Cost Savings: Businesses can often secure freelance expertise at a lower hourly rate compared to the blended rates of a consulting firm.

- Access to Niche Skills: Freelancer platforms provide access to a vast array of specialized skills that might not be readily available within a single consulting firm.

- Agility and Speed: Engaging freelancers can sometimes be faster than initiating a formal consulting contract, allowing for quicker project starts.

- Reduced Overhead: Clients avoid the indirect costs associated with engaging larger consulting entities, such as administrative fees and marketing expenses.

The threat of substitutes for Charles River Associates (CRA) is multifaceted, encompassing in-house capabilities, broad management consulting firms, advanced technology, and freelance experts. The increasing ability of companies to develop internal expertise, coupled with the efficiency of AI and specialized legal tech, directly challenges traditional consulting models. Furthermore, the growing gig economy offers a flexible and often more cost-effective alternative for accessing specialized skills.

| Substitute Type | Key Characteristics | Impact on CRA | 2024 Data/Trend |

|---|---|---|---|

| In-house Capabilities | Cost-effectiveness, knowledge retention, control over sensitive data | Reduces demand for external strategic and analytical services | Expansion of internal strategy departments in Fortune 500 companies |

| Broad Management Consulting Firms | Wide service range, strong brand recognition, extensive resources | Direct competition for strategy, operations, and litigation support | Global management consulting market valued over $300 billion in 2024 |

| AI & Data Analytics Tools | Automation of data analysis, market research, predictive modeling | Diminishes need for human expertise in routine analytical tasks | Increased adoption of AI for market segmentation and customer analysis by mid-2024 |

| Specialized Legal Tech | Automated document review, e-discovery, data extraction | Competes with expert witness support and litigation data analysis | Global legal tech market valued around $29.1 billion in 2023 |

| Independent Experts/Freelancers | Niche skills, flexibility, cost savings, speed | Offers project-specific solutions as an alternative to firm engagements | Over 60 million Americans participated in freelance work in 2024 |

Entrants Threaten

While the general consulting landscape might seem accessible, specialized economic and financial consulting, especially in areas like expert witness services, presents a formidable challenge for newcomers. The need for deeply qualified individuals, often holding advanced degrees such as PhDs in economics, is paramount.

Establishing credibility in this niche requires more than just knowledge; a strong reputation built over years of successful engagements is crucial. Furthermore, cultivating robust industry relationships and demonstrating a consistent track record in handling intricate litigation and regulatory disputes are essential hurdles new entrants must overcome.

Establishing a firm comparable to Charles River Associates (CRA) demands significant capital, not just for infrastructure but crucially for human capital. The consulting industry, especially in areas like economic litigation and management consulting where CRA operates, is talent-intensive. Attracting and retaining individuals with advanced degrees, specialized knowledge, and proven analytical skills is paramount, and this competition drives up compensation costs significantly.

The ongoing war for talent, particularly for those with PhDs and deep expertise in fields like econometrics or specific industry sectors, presents a substantial barrier for new entrants. These firms must not only recruit but also invest heavily in training and development to cultivate the necessary expertise. For instance, in 2024, the demand for data scientists and economic consultants with advanced quantitative skills remained exceptionally high, with salary ranges for experienced professionals often exceeding $200,000 annually, making it difficult for nascent firms to build a competitive team quickly.

In the competitive landscape of high-stakes consulting, a firm's reputation and brand recognition are paramount, acting as significant barriers to new entrants. Charles River Associates (CRA) benefits from a long-standing history, having cultivated deep-seated trust and established relationships with a diverse clientele, including major law firms, large corporations, and various government agencies. This established credibility is not easily replicated.

New firms entering this specialized market would find it incredibly challenging to build the necessary trust and brand recognition required to secure complex, high-value engagements. For instance, CRA's consistent track record in delivering expert testimony and economic analysis in high-profile litigation, where stakes can run into billions of dollars, underscores the importance of proven performance. In 2024, the demand for specialized litigation support and economic consulting remains robust, with firms like CRA consistently sought after for their expertise, making it difficult for unproven competitors to gain a foothold.

Regulatory and Legal Expertise Requirements

Charles River Associates (CRA) operates in a sector where regulatory and legal expertise is a significant barrier to entry. A substantial part of CRA's revenue comes from litigation support and regulatory consulting, demanding not just economic analysis but also a profound grasp of legal systems and judicial procedures.

New firms entering this space must meticulously navigate intricate legal frameworks and cultivate trust with courts and regulatory agencies. This requires building a reputation for rigorous, legally sound economic advice, which takes considerable time and investment.

- High Bar for Legal Acumen: New entrants must demonstrate a sophisticated understanding of diverse legal contexts, from antitrust litigation to intellectual property disputes, which often involve specialized economic arguments.

- Court and Agency Credibility: Establishing credibility with judges, regulatory bodies, and legal counsel is paramount and can take years of successful case work and demonstrable expertise.

- Investment in Specialized Talent: Attracting and retaining economists with deep legal knowledge and courtroom experience represents a significant upfront cost for potential competitors.

Emergence of Niche AI-Driven Startups

The rise of niche AI-driven startups presents a nuanced threat to established consulting firms. While AI itself can be seen as a substitute for certain human tasks, it simultaneously lowers barriers to entry for new, specialized technology-focused consulting businesses.

These emerging players can harness AI and automation to deliver highly specific, cost-efficient analytical services, potentially fragmenting and disrupting particular segments of the consulting market. For instance, AI-powered platforms offering rapid market sizing or competitor analysis could attract clients seeking immediate, data-driven insights at a lower price point than traditional full-service engagements.

However, for these new entrants to truly challenge established players in high-value advisory work, they must overcome significant hurdles. Building client trust and demonstrating deep expertise, particularly in complex strategic decision-making or sensitive organizational change initiatives, remains paramount. Many clients still prioritize the human element, relationship building, and the proven track record that established firms can offer, especially when dealing with critical business transformations.

- Lowered Barriers: AI tools and cloud computing reduce the capital expenditure needed for specialized data analytics startups compared to traditional consulting setups.

- Niche Specialization: Startups can focus on specific AI applications, like predictive analytics for supply chains or natural language processing for sentiment analysis, offering targeted expertise.

- Cost Efficiency: Automation of routine tasks allows these startups to offer services at a potentially lower cost, appealing to budget-conscious clients.

- Trust Deficit: Despite technological prowess, many new entrants struggle to build the deep client relationships and perceived credibility essential for winning complex, high-stakes advisory projects.

The threat of new entrants in specialized economic and financial consulting, particularly for firms like Charles River Associates (CRA), is significantly mitigated by high capital requirements and the need for specialized human capital. Building a team with advanced degrees, like PhDs in economics, and proven expertise in areas such as litigation support is costly. For example, in 2024, the competitive landscape for top-tier economic consultants saw compensation packages often exceeding $200,000 annually, a substantial barrier for emerging firms.

Furthermore, the established reputation and brand recognition of firms like CRA, built over years of successful engagements and strong client relationships, act as a formidable barrier. New entrants struggle to gain the trust and credibility necessary for high-value, complex projects, especially in litigation where proven track records in multi-billion dollar cases are often required. This is evident in 2024, where demand for firms with established expertise in regulatory consulting and expert testimony remained robust, favoring incumbents.

Navigating complex legal and regulatory frameworks is another critical barrier. Firms must possess deep legal acumen and establish credibility with courts and agencies, a process that demands significant time and investment in specialized talent. The ongoing need for economists with both advanced quantitative skills and a strong understanding of judicial procedures means that new entrants face substantial hurdles in building a competent and credible team, making it difficult to compete with established players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including detailed financial statements, proprietary market research reports from leading firms, and publicly available government statistics, to provide a robust understanding of industry dynamics.