Charles River Associates Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles River Associates Bundle

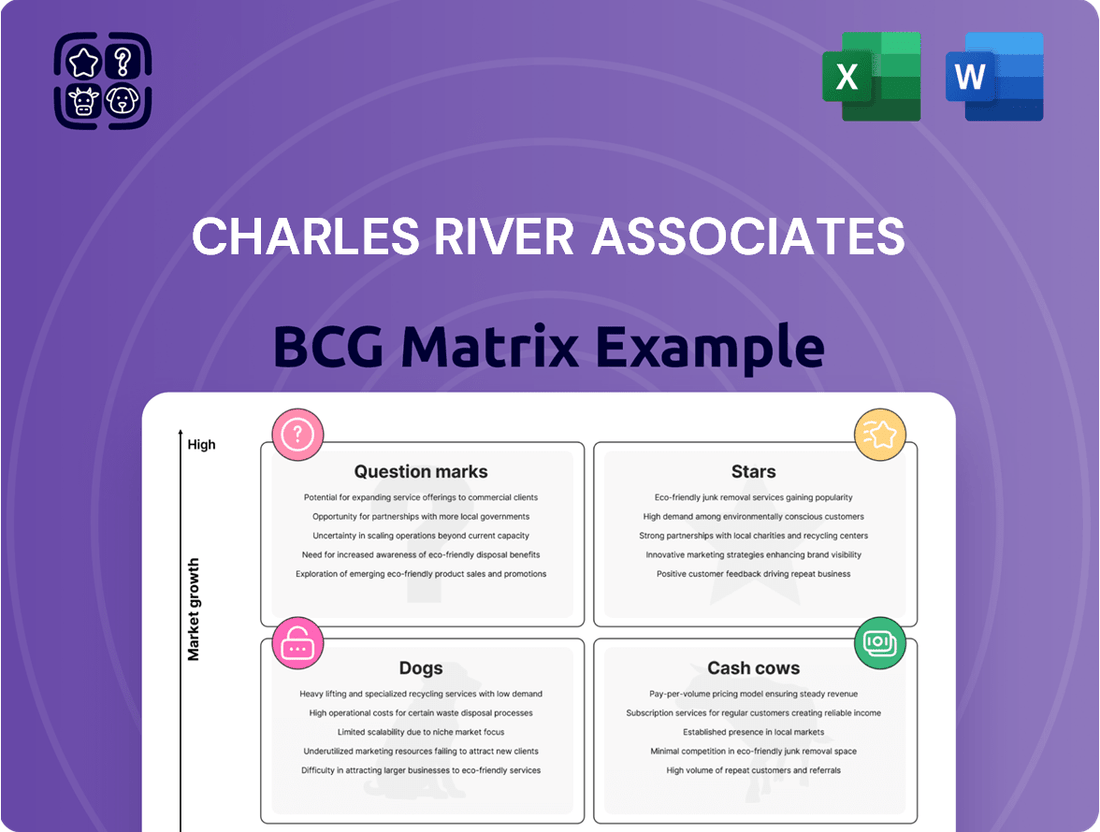

Unlock the strategic potential of Charles River Associates' product portfolio with this insightful BCG Matrix preview. See at a glance which products are poised for growth and which require careful consideration. This snapshot is designed to highlight the critical distinctions between Stars, Cash Cows, Dogs, and Question Marks within their offerings. Don't settle for a glimpse; dive into the full report to gain a comprehensive understanding of their market positioning and identify actionable strategies. Purchase the complete BCG Matrix for detailed quadrant analysis and expert recommendations to optimize your investment decisions.

Stars

Charles River Associates' Life Sciences consulting practice is a strong performer, indicated by its double-digit revenue growth in the first quarter of fiscal year 2025. This robust expansion aligns with the broader market trend, as the global life science consulting services market is expected to see a healthy Compound Annual Growth Rate (CAGR) of 10% between 2024 and 2029.

Key drivers for this market surge include the pervasive impact of digital transformation within the sector, a significant increase in the utilization of real-world evidence (RWE) data for decision-making, and a growing demand for specialized consulting services focused on advanced therapies. These factors collectively position life sciences consulting as a high-growth area for firms like CRA.

Charles River Associates (CRA) is well-positioned in the burgeoning energy transition consulting market. Their Energy practice demonstrated robust performance, achieving double-digit revenue growth in the first quarter of 2025. This growth reflects the increasing demand for specialized expertise in navigating the complexities of global decarbonization initiatives.

The overall energy transition market is experiencing substantial expansion, with a projected compound annual growth rate (CAGR) of 15.41% expected between 2024 and 2032. This impressive growth trajectory is fueled by multiple factors, including widespread decarbonization efforts, the integration of novel energy systems, and a rising demand for renewable energy solutions.

Charles River Associates' Intellectual Property consulting practice is a standout performer. In the first quarter of fiscal 2025, this specialized area saw impressive double-digit revenue growth.

This robust performance highlights CRA's strong market standing within economic consulting, particularly in intellectual property. The consistent demand stems from continuous innovation and the intricate litigation surrounding valuable intellectual assets.

CRA's specialized knowledge enables them to secure high-value projects, driving this significant growth. Their expertise positions them to effectively navigate and profit from the complexities of IP valuation and disputes.

Financial Consulting (High-Growth Segments)

Charles River Associates' (CRA) Finance practice demonstrated robust momentum, achieving double-digit revenue growth in the first quarter of 2025. This impressive performance points to CRA's successful penetration into high-growth areas within financial consulting. These segments likely include complex financial litigation, where their expertise is highly valued, and regulatory advisory services, crucial given the constantly shifting financial regulations.

CRA's ability to secure high-stakes assignments stems from their deep analytical capabilities and specialized industry knowledge. This strategic positioning allows them to effectively navigate and capitalize on evolving market demands. The firm's focus on specialized, knowledge-intensive services is a key driver of their sustained growth in these competitive segments.

- Double-digit revenue growth in Q1 2025 for CRA's Finance practice.

- Key growth drivers include complex financial litigation and regulatory advisory.

- CRA leverages analytical rigor and industry expertise for high-stakes projects.

- Strategic focus on specialized, knowledge-intensive financial consulting services.

Antitrust & Competition Economics

Charles River Associates' Antitrust & Competition Economics practice is a cornerstone of their business, consistently demonstrating market leadership. This area is characterized by sophisticated economic analysis for intricate antitrust and competition cases, which fuels sustained demand.

In a testament to its strength, the practice reported its highest quarterly revenue ever in the first quarter of 2025. This robust performance highlights the ongoing need for expert economic insights in this specialized field.

- Market Leadership: CRA is recognized for its strong reputation and leading position in antitrust and competition economics.

- Sophisticated Analysis: The practice provides in-depth economic analysis for complex legal and regulatory matters.

- Sustained Demand: The increasing complexity of litigation ensures a consistent need for CRA's specialized services.

- Record Revenue: Q1 2025 marked a new revenue high for the Antitrust & Competition Economics practice.

Charles River Associates' (CRA) Life Sciences practice is a high-growth area, reporting double-digit revenue growth in Q1 2025. This aligns with the global life science consulting market's projected 10% CAGR from 2024-2029, driven by digital transformation and real-world evidence. CRA's Energy practice also saw double-digit growth in Q1 2025, mirroring the energy transition market's anticipated 15.41% CAGR (2024-2032) fueled by decarbonization efforts. Their Intellectual Property practice achieved impressive double-digit revenue growth in Q1 2025, underscoring consistent demand for IP valuation and litigation expertise.

| Practice Area | Q1 2025 Performance | Market Growth (CAGR) | Key Drivers |

| Life Sciences | Double-digit revenue growth | 10% (2024-2029) | Digital transformation, RWE, advanced therapies |

| Energy | Double-digit revenue growth | 15.41% (2024-2032) | Decarbonization, novel energy systems, renewables |

| Intellectual Property | Double-digit revenue growth | N/A (Specialized demand) | Innovation, IP litigation, valuation |

What is included in the product

Strategic overview of a company's portfolio, classifying units as Stars, Cash Cows, Question Marks, or Dogs.

Highlights which units to invest in, hold, or divest based on market growth and share.

Clear visualization of business unit potential, simplifying strategic resource allocation decisions.

Cash Cows

Charles River Associates' General Economic Litigation Support is a quintessential Cash Cow within their BCG Matrix. This practice area leverages CRA's deep-rooted reputation for delivering sophisticated economic analysis and expert testimony in intricate litigation and regulatory matters.

The strength of this segment is underscored by the fact that legal and regulatory consulting constitutes a significant 80% of CRA's overall revenue. This highlights a dominant market share within a mature, yet perpetually vital, service domain.

Consequently, General Economic Litigation Support consistently generates substantial and predictable cash flows. The high degree of repeat business from satisfied clients further solidifies its position as a reliable and high-performing asset for the firm.

Charles River Associates (CRA) leverages its deep economic and financial expertise for valuation and damages assessment, a cornerstone of its consulting services. This offering, while not witnessing rapid expansion, enjoys a consistent and reliable demand from a diverse clientele, underpinning stable revenue streams and robust profit margins thanks to CRA's recognized authority in the field.

In 2024, CRA's valuation and damages assessment practice continues to be a significant contributor, reflecting the ongoing need for sophisticated financial analysis in litigation, mergers, and acquisitions. The firm's ability to provide precise economic impact studies and loss calculations in complex disputes, such as those involving intellectual property or antitrust matters, solidifies its position as a trusted advisor.

Charles River Associates' (CRA) Established Regulatory Compliance Advisory operates as a classic cash cow within their broader consulting portfolio. CRA leverages its extensive experience and deep understanding of economic and financial principles to guide clients through complex regulatory landscapes, particularly in sectors with mature, well-defined compliance frameworks. This established expertise translates into a consistent demand for their services, fostering long-term client relationships that contribute to predictable revenue streams.

In 2024, the regulatory compliance consulting market continued to show robust growth, driven by ongoing enforcement and evolving legal requirements. Firms like CRA, with a proven track record in established areas such as antitrust, intellectual property, and energy regulation, benefit from this sustained demand. Their ability to navigate these intricate, long-standing regulatory environments allows them to maintain a significant market share, ensuring stable and reliable earnings.

Forensics and Investigations

Charles River Associates (CRA) provides critical forensics and investigations services, closely tied to their litigation support expertise. This segment addresses the consistent demand for forensic analysis in complex disputes, fraud cases, and financial irregularities, reflecting a mature market. CRA's strong reputation and extensive network of experts in this field translate into a steady flow of profitable engagements.

The demand for these specialized services is driven by increasing regulatory scrutiny and the complexity of financial transactions. For instance, in 2024, cybersecurity breaches and financial misconduct continued to fuel the need for forensic accounting and investigation services. CRA's ability to offer deep analytical insights and expert testimony positions them well in this stable, high-margin area.

- Market Maturity: Forensics and investigations represent a well-established market with consistent demand.

- High-Margin Engagements: CRA leverages its credibility and expert network for profitable work.

- Litigation Support Link: Services are often integrated with broader litigation and dispute resolution offerings.

- Drivers of Demand: Regulatory compliance and the increasing complexity of financial dealings sustain this business.

Labor & Employment Economics

Charles River Associates' Labor & Employment Economics practice is a strong performer within their consulting offerings. This area experienced year-over-year growth in the fourth quarter of 2024, building on its reported growth in the second quarter of the same year.

The practice focuses on providing critical economic analysis for a range of legal and policy issues, including labor disputes, employment discrimination cases, and significant policy matters. This specialization allows CRA to leverage deep expertise in a market where such analysis is consistently in demand.

Labor & Employment Economics represents a mature but active market segment. CRA's established reputation and specialized knowledge allow it to maintain a strong market position, ensuring a steady and reliable revenue stream for the firm.

- Consistent Revenue: The practice contributes stable revenue due to ongoing demand for economic expertise in labor and employment matters.

- Market Position: CRA holds a strong market position, reflecting its established reputation and deep expertise in this specialized field.

- Growth Indicators: The practice demonstrated positive growth trends, with year-over-year increases noted in Q4 2024 and earlier in Q2 2024.

Charles River Associates' (CRA) expertise in providing economic analysis for mergers and acquisitions (M&A) is a textbook example of a Cash Cow. This practice area benefits from CRA's established reputation for delivering rigorous valuation, due diligence, and antitrust analysis, crucial components in the M&A lifecycle.

The ongoing need for these specialized services, particularly in a dynamic market, ensures a consistent and predictable revenue stream. In 2024, the M&A market, while subject to fluctuations, continued to see significant activity, especially in sectors like technology and healthcare, where CRA's expertise is highly valued.

CRA's M&A consulting services are characterized by high-margin engagements due to the specialized knowledge and analytical rigor required. This segment consistently generates substantial cash flow, a hallmark of a mature business with a strong market position.

| Practice Area | BCG Category | 2024 Market Relevance | CRA's Strength | Revenue Contribution |

| M&A Economics | Cash Cow | Consistent demand in technology, healthcare, and other sectors. | Rigorous valuation, due diligence, and antitrust analysis. | Stable, high-margin revenue. |

Delivered as Shown

Charles River Associates BCG Matrix

The preview you see is the identical Charles River Associates BCG Matrix document you will receive upon purchase. This means the analysis, formatting, and strategic insights are exactly as presented, ready for immediate application in your business planning. You can be confident that no additional content or alterations will be made, ensuring you get precisely what you previewed for your strategic decision-making.

Dogs

Charles River Associates' (CRA) management consulting services, while present, represent a smaller slice of their overall business, bringing in about 20% of revenue. This contrasts with their stronger footing in legal and regulatory advisory.

In the crowded general management consulting arena, services that don't heavily leverage CRA's distinct economic and quantitative strengths might find it challenging to capture substantial market share or experience rapid expansion.

For instance, in 2024, the broader management consulting market, while robust, often favors firms with highly specialized niches or proven expertise in areas like digital transformation or sustainability.

CRA's approach, which often integrates deep economic analysis, may face headwinds in more commoditized consulting segments where differentiation is less pronounced and client acquisition can be more price-sensitive.

Outdated economic modeling techniques and niche software solutions are firmly in the 'Dog' quadrant of the Charles River Associates BCG Matrix. The consulting industry's shift towards AI and advanced analytics means that reliance on legacy systems can significantly hinder a firm's competitive edge. For instance, a consulting firm still primarily using manual economic forecasts instead of AI-powered predictive models might face substantial delays in delivering client insights.

This technological lag translates directly into tangible business disadvantages. A study by McKinsey in 2023 indicated that companies leveraging advanced analytics saw revenue growth up to 30% higher than those that didn't. Firms clinging to outdated software risk increased operational costs due to inefficiencies and a shrinking client base that expects cutting-edge solutions.

Consider the cost of maintaining proprietary software that requires extensive manual input and lacks integration capabilities. This contrasts sharply with modern platforms that can process vast datasets in minutes, providing deeper, more nuanced analysis. By 2024, the demand for data-driven insights has made such inefficiencies untenable for growth.

Charles River Associates, with its extensive global footprint of over 20 offices spanning 10 countries, might find certain smaller, less strategically vital regional outposts operating as Dogs within its BCG Matrix. These could be localized practices in economically stagnant regions, struggling to gain meaningful market share or drive substantial growth.

If these underperforming offices or specialized practices consume valuable resources without yielding commensurate returns or contributing significantly to the firm's overarching strategic objectives, they risk becoming financial drains. For instance, a regional office in a declining industrial area might represent a significant overhead cost without generating proportional revenue, a classic Dog characteristic.

The strategic decision for such entities often involves careful consideration: either a divestment or a significant restructuring to improve performance. Without a clear path to revitalization or a strategic rationale for their continued existence, these units can detract from the overall health and efficiency of the larger organization.

Legacy Advisory Services for Contracting Industries

Charles River Associates (CRA) might categorize legacy advisory services within contracting industries, such as traditional manufacturing or certain segments of print media, as potentially fitting into a 'question mark' or even 'dog' quadrant of the BCG matrix if they are indeed in long-term decline with limited growth prospects. These specialized practices, while historically valuable, may face shrinking demand, impacting revenue growth and profitability.

For instance, advisory work for industries experiencing secular decline, like those heavily reliant on fossil fuels facing regulatory pressure or legacy retail models challenged by e-commerce, would fall into this consideration. In 2024, sectors like coal mining advisory may see reduced demand. The International Energy Agency reported a significant decline in coal power generation capacity additions globally in recent years, indicating a contracting market for related consulting.

- Industry Decline: Advisory services focused on industries with persistent negative growth trends, such as traditional print advertising, are likely to be classified as dogs.

- Limited Growth Potential: The shrinking customer base and revenue streams in contracting industries directly limit the upside for advisory firms operating within them.

- Resource Allocation Question: CRA would need to carefully consider the return on investment for maintaining these specialized practices against other, higher-growth opportunities.

- Strategic Divestment or Niche Focus: Such legacy services might be candidates for divestment or require a very specific, high-margin niche strategy to remain viable.

Service Lines Targeted by Recent Portfolio Optimization

Charles River Associates (CRA) has signaled a strategic shift through portfolio optimization, as evidenced by a reported 'restructuring expense associated with portfolio optimization actions' in Q2 2024. This move suggests a deliberate effort to refine their service offerings, aligning with the principles of a BCG Matrix where 'Dogs' are identified and managed. While CRA has not publicly detailed which specific practices were impacted, such optimization typically targets service lines exhibiting low growth potential or lacking a significant market presence, thereby hindering overall profitability.

These 'Dog' service lines, by definition, underperform relative to the company's strategic goals and profitability benchmarks. CRA's proactive approach to address these areas indicates a commitment to enhancing efficiency and focusing resources on more promising ventures. For instance, if a particular consulting practice saw revenue growth below 5% in 2023 and held a market share of less than 10%, it would likely be a candidate for such optimization.

- Focus on Profitability: Actions are taken to divest or restructure underperforming service lines that are not meeting profitability targets.

- Market Share Assessment: Service lines with limited market share and low growth prospects are prime candidates for optimization.

- Resource Reallocation: Streamlining the portfolio allows CRA to redirect capital and talent towards high-growth, high-share areas.

- Q2 2024 Expense Recognition: The reported restructuring expense directly reflects the financial impact of these optimization efforts.

In Charles River Associates' (CRA) strategic framework, 'Dogs' represent service lines or regional practices that exhibit low market share and low growth potential. These are often found in mature or declining industries, or in geographic areas with limited economic dynamism. For example, advisory services for sectors like traditional print media, which has seen a consistent revenue decline, would likely be classified as Dogs. In 2024, the consulting market for such legacy industries continues to shrink, making sustained growth challenging.

These underperforming units can become drains on resources, consuming capital and talent without generating commensurate returns. CRA's Q2 2024 report mentioned a restructuring expense related to portfolio optimization, indicating a deliberate move to address these 'Dog' segments. Such actions are crucial for maintaining overall firm efficiency and profitability.

A consulting practice with less than 5% annual revenue growth and a market share below 10% in 2023 would typically be considered a Dog. Divesting or significantly restructuring these areas allows CRA to reallocate resources to more promising, high-growth opportunities, thereby enhancing the firm's strategic focus and financial performance.

Question Marks

The consulting sector is experiencing a surge in demand for AI strategy and advanced analytics, presenting a fertile ground for growth. Charles River Associates (CRA) already leverages analytics internally, but a focused, external service offering in AI integration and advisory would tap into this high-growth market. This move would position CRA to compete more directly with specialized AI consultancies, a space where they are currently developing their market leadership.

The global AI market, projected to reach $1.8 trillion by 2030 according to Grand View Research, underscores the immense potential. For consulting firms, this translates into significant revenue opportunities. While CRA has a strong foundation in data analysis, formalizing AI integration services would allow them to capture a larger share of this expanding market, building on their existing expertise.

ESG advisory services represent a significant growth opportunity, driven by heightened investor and regulatory focus. Companies are increasingly seeking guidance on integrating environmental, social, and governance factors into their strategies. This surge in demand means the market is both attractive and competitive.

Charles River Associates (CRA) is well-positioned to leverage its strengths in regulatory analysis and economic consulting to capture market share in this burgeoning sector. However, entering this relatively new space will require strategic investment to build capabilities and establish a strong presence. The global sustainable investing market reached an estimated $35.3 trillion in assets under management in 2024, highlighting the immense potential.

Charles River Associates (CRA) is well-positioned to expand its offerings in the cybersecurity and data privacy legal consulting space. The demand for specialized legal expertise in these areas is significant and growing rapidly, driven by increasingly complex regulations and the constant threat of cyber incidents. For instance, global spending on cybersecurity is projected to reach $267.2 billion in 2024, highlighting the substantial market for related legal services.

While CRA already offers litigation and regulatory support, creating dedicated service lines for cybersecurity law and data privacy would tap into a high-growth segment. This strategic move aligns with CRA's objective to build a specialized footprint in this evolving market. The global data privacy management market alone was valued at approximately $1.4 billion in 2023 and is expected to grow substantially.

Strategic New Geographic Market Entries

Entering new geographic markets presents a classic strategic challenge, especially when considering new, high-growth emerging markets or underserved regions where Charles River Associates (CRA) has a minimal existing client base. Such ventures are inherently capital-intensive.

While CRA's international operations showed positive contributions to revenue growth in Q4 2024, establishing a significant presence in entirely new markets requires substantial upfront investment. This includes building local teams, developing marketing strategies tailored to the region, and understanding nuanced regulatory environments. For instance, setting up a new office in a frontier market could easily require millions in initial capital expenditure for infrastructure, talent acquisition, and regulatory compliance.

- Market Research and Validation: Extensive due diligence is crucial to understand local demand, competitive landscape, and cultural nuances.

- Infrastructure and Talent Acquisition: Significant investment is needed for physical presence, technology, and hiring skilled local professionals.

- Regulatory and Legal Compliance: Navigating unfamiliar legal frameworks and obtaining necessary licenses can be costly and time-consuming.

- Brand Building and Client Acquisition: Establishing credibility and securing initial clients in a new market requires dedicated resources and a long-term approach.

Specialized Digital Health and MedTech Strategy

Within the dynamic life sciences sector, specialized areas like digital health and advanced MedTech market access are seeing explosive growth. Charles River Associates (CRA) is strategically positioning itself to capitalize on these high-potential, emerging niches. This involves developing targeted solutions for segments that, while currently small, are poised for significant expansion.

CRA's investment in these nascent areas aligns with a strategy to capture market share in high-growth segments where their current position might be relatively smaller. For instance, the digital health market was projected to reach approximately $660 billion globally by 2023, with continued strong growth anticipated. Similarly, innovative MedTech market access strategies are crucial as new technologies require sophisticated navigation of regulatory and reimbursement landscapes.

- Digital Health Market Growth: The global digital health market is experiencing robust expansion, driven by increasing adoption of telehealth, remote patient monitoring, and AI-powered diagnostics. Projections indicate continued double-digit compound annual growth rates through 2030.

- MedTech Innovation: The MedTech sector is characterized by continuous innovation, with significant investment flowing into areas like robotic surgery, personalized medicine devices, and advanced imaging technologies.

- Market Access Complexity: Successfully launching new MedTech products requires navigating complex regulatory pathways and securing favorable reimbursement, creating a demand for specialized consulting services.

- CRA's Strategic Focus: By concentrating on these specialized sub-segments, CRA aims to build expertise and a strong market presence, mirroring the BCG Matrix principle of investing in emerging stars to build future market leaders.

Question marks in the context of the Charles River Associates (CRA) BCG Matrix likely represent areas where CRA is exploring new opportunities or assessing existing service lines that may not fit neatly into the traditional categories. These could be nascent markets or evolving client needs where CRA is investing but the long-term potential or competitive positioning is not yet clearly defined. For example, CRA might be examining the viability of offering services in a newly regulated technology space or evaluating the expansion of existing capabilities into an adjacent industry. Identifying and understanding these question marks is crucial for strategic resource allocation and future growth planning.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.