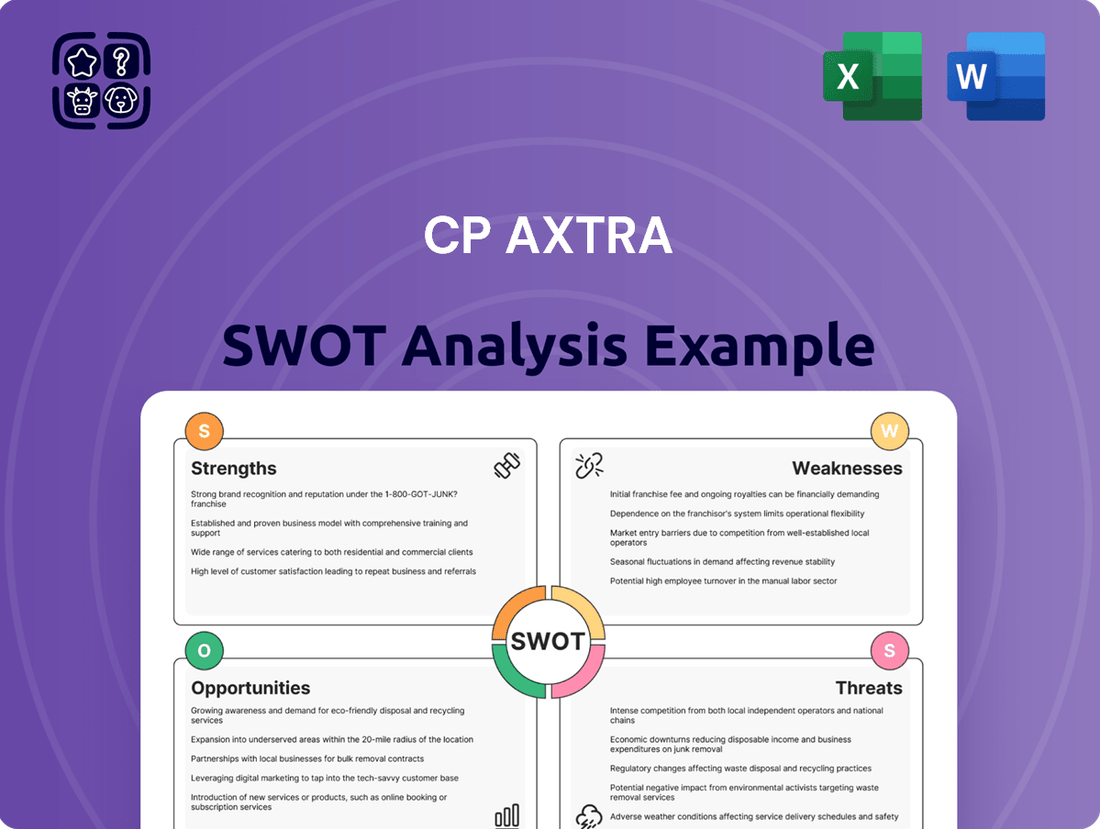

CP Axtra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP Axtra Bundle

CP Axtra's market position is defined by its strong operational efficiencies and a growing customer base, but it also faces potential threats from evolving industry regulations and intense competition. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind CP Axtra's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CP Axtra boasts an impressive retail and wholesale infrastructure, operating over 2,600 Makro and Lotus's stores throughout Thailand. This expansive network solidifies its leading position in the country's diverse retail and wholesale landscape.

This extensive reach ensures broad service availability and streamlined distribution, catering effectively to a wide array of clients. These include small to medium-sized enterprises, food service businesses, institutional buyers, and everyday consumers.

The strategic integration of Makro's wholesale proficiency with Lotus's established retail and rental market presence generates substantial operational and market synergies, enhancing overall competitiveness.

CP Axtra showcased impressive financial strength in 2024, achieving a total revenue of THB 512.04 billion and a net profit of THB 10.84 billion. This represents a significant year-on-year increase of 23.5%, fueled by strong sales performance and enhanced gross profit margins in both its wholesale and retail operations.

The company also benefited from strategic debt restructuring, which led to a reduction in finance costs, further bolstering its profitability. Looking ahead to 2025, CP Axtra is poised for continued revenue growth, supported by its strategic initiatives to expand its diverse store formats and enhance its omnichannel customer experience.

CP Axtra is solidifying its position as Thailand's premier fresh food retailer, boasting an extensive catalog of over 7,000 fresh food items sourced from around the world. This broad selection, coupled with a strategic focus on convenience, allows them to meet diverse consumer needs effectively.

The company's growth in ready-to-cook and ready-to-eat categories is a direct response to increasing consumer preferences for convenient meal solutions. This segment is crucial for capturing a larger share of the modern food market.

CP Axtra is also enhancing its profitability through a deliberate push in private label and high-margin products. These exclusive offerings, found at Makro and Lotus's, not only bolster margins but also create a distinct competitive edge and strengthen brand loyalty.

Advanced Digital Transformation and Omnichannel Capabilities

CP Axtra is significantly advancing its digital transformation through the dedicated 'AXTRA Digital' team. This strategic focus has positioned Makro PRO as Thailand's premier grocery e-commerce platform and the Lotus's SMART App as the second largest, showcasing strong retail technology leadership.

The company's commitment to innovation is evident in its robust omnichannel capabilities. By leveraging AI-driven data analytics, CP Axtra gains deep customer insights, enabling personalized shopping experiences, optimized inventory management, and streamlined operations across both online and offline channels.

- Thailand's #1 Grocery E-commerce Platform: Makro PRO achieved this leading position through advanced digital initiatives.

- Second Largest Retail App: The Lotus's SMART App's strong performance underscores the company's retail tech prowess.

- AI-Driven Personalization: The use of AI enhances customer engagement and operational efficiency.

Strong Commitment to Sustainability and Corporate Governance

CP Axtra demonstrates a robust dedication to sustainability and corporate governance, earning significant international acclaim. The company was recognized for its sustainability initiatives, placing in the top 10% of the 2024 Corporate Sustainability Assessment (CSA) conducted by S&P Global. This achievement also secured its inclusion in the S&P Global Sustainability Yearbook 2025, specifically within the Food & Staples Retailing sector.

Further underscoring its commitment to responsible business practices, CP Axtra received the 2025 Top Employer Award in Thailand for the third consecutive year. This award highlights the company's strong focus on human resource management and its dedication to fostering a positive work environment. CP Axtra actively prioritizes corporate governance and sustainable development, aiming to create lasting value for all its stakeholders.

- Top 10% ranking in 2024 S&P Global Corporate Sustainability Assessment.

- Inclusion in the S&P Global Sustainability Yearbook 2025 for Food & Staples Retailing.

- Third consecutive year receiving the 2025 Top Employer Award in Thailand.

- Emphasis on corporate governance and sustainable development for stakeholder value creation.

CP Axtra's extensive retail and wholesale network, comprising over 2,600 Makro and Lotus's stores in Thailand, provides unparalleled market reach and distribution efficiency. This broad footprint allows the company to effectively serve a diverse customer base, from small businesses to individual consumers.

The company demonstrated robust financial performance in 2024, with THB 512.04 billion in revenue and THB 10.84 billion in net profit, marking a 23.5% year-on-year increase. This growth was driven by strong sales and improved gross profit margins, further supported by strategic debt management that reduced finance costs.

CP Axtra leads in fresh food retail, offering over 7,000 items and capitalizing on the growing demand for convenient ready-to-cook and ready-to-eat meals. Its focus on private label and high-margin products at Makro and Lotus's enhances profitability and brand loyalty.

The company's digital transformation is highlighted by Makro PRO being Thailand's top grocery e-commerce platform and the Lotus's SMART App ranking second. AI-driven insights enhance customer personalization and operational efficiency across all channels.

CP Axtra's commitment to sustainability is recognized by its top 10% ranking in the 2024 S&P Global Corporate Sustainability Assessment and inclusion in the 2025 Sustainability Yearbook. It also received the 2025 Top Employer Award in Thailand for the third consecutive year, underscoring its dedication to responsible business practices and stakeholder value.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Total Revenue | THB 512.04 billion | Projected Growth |

| Net Profit | THB 10.84 billion | Continued Profitability |

| Store Network | Over 2,600 stores | Expansion of Formats |

| E-commerce Leadership | #1 Makro PRO, #2 Lotus's SMART App | Enhanced Digital Capabilities |

What is included in the product

Analyzes CP Axtra’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

CP Axtra's SWOT analysis provides a clear, actionable framework to identify and address strategic challenges, alleviating the pain of uncertainty and enabling focused decision-making.

Weaknesses

CP Axtra's significant investment in 'The Happitat,' a mixed-use property venture with a related party, has sparked governance concerns. This strategic move has drawn considerable attention, negatively affecting the company's stock performance, which saw a notable dip following the announcement in late 2023.

Further complicating matters, the vice-chairman of its parent company, CP ALL, sold shares shortly before the pre-announcement of this property deal. This timing has intensified scrutiny on internal controls and transparency, raising questions about potential conflicts of interest and fair market practices within CP Axtra's decision-making processes.

CP Axtra's reliance on domestic consumption and the recovery of the tourism sector presents a significant vulnerability. For instance, if consumer spending power doesn't rebound as anticipated, perhaps due to persistent inflation or elevated household debt levels, it could directly hinder the company's sales growth. In 2024, Thailand's economic outlook, while showing signs of recovery, still faces headwinds from global economic uncertainties, potentially impacting discretionary spending.

Furthermore, any prolonged slowdown in the return of international tourists or a dip in domestic travel could directly affect CP Axtra's retail and wholesale segments, which often benefit from increased foot traffic and spending. The company's performance is therefore closely tied to the broader economic sentiment and the ability of consumers to spend, making it sensitive to economic downturns.

CP Axtra operates in a fiercely competitive Thai retail and wholesale landscape, characterized by a multitude of domestic and international players. This intense rivalry demands constant adaptation to evolving consumer tastes and necessitates sustained investment in modernization and innovation to maintain market position.

Operational Risks from Foreign Exchange Volatility

CP Axtra's extensive international sourcing exposes it to significant operational risks stemming from foreign exchange (forex) volatility. Fluctuations in currency exchange rates can directly impact the cost of imported raw materials and finished goods, potentially eroding profit margins.

For instance, a strengthening of the currencies in countries where CP Axtra sources its supplies against the Euro could lead to higher import costs. This directly affects the cost of goods sold (COGS). In 2024, many companies reported increased COGS due to adverse currency movements, with some seeing a 5-10% impact on their bottom line depending on their import exposure.

- Increased Cost of Goods Sold: Adverse currency movements can make imported inputs more expensive.

- Reduced Profitability: Higher COGS directly squeezes profit margins if these costs cannot be fully passed on to consumers.

- Economic Instability Impact: Broader economic instability often correlates with currency volatility, creating a double-edged sword for international businesses.

- Forecasting Challenges: Unpredictable forex markets make financial forecasting and budgeting more difficult.

Potential for Lower-than-Expected Same-Store Sales Growth (SSSG)

While CP Axtra has ambitious plans for same-store sales growth (SSSG), ongoing economic pressures like the high cost of living could dampen consumer spending. This means the company might not achieve its projected SSSG targets, directly affecting its revenue streams. The reliance on existing store performance for a significant portion of its growth makes this a critical vulnerability.

For instance, in the first quarter of 2024, consumer spending growth in key markets for similar retail sectors saw a slowdown compared to the previous year. This trend suggests that even with strategic initiatives, external economic factors can significantly impede SSSG. CP Axtra's financial forecasts are therefore sensitive to these consumer behavior shifts.

- Economic Headwinds: Persistent inflation and a slower-than-anticipated recovery in consumer purchasing power can directly curb spending at existing stores.

- Revenue Impact: Lower SSSG directly translates to reduced revenue from the company's established store base, impacting overall top-line performance.

- Profitability Concerns: SSSG is a key driver of profitability, as it represents sales from mature stores with established operational efficiencies.

- Growth Dependency: The company's overall growth strategy is significantly reliant on the performance of its existing store network, making SSSG a crucial metric.

CP Axtra's governance issues, particularly the investment in 'The Happitat' with a related party, have raised red flags and negatively impacted its stock, which saw a decline in late 2023. The timing of a share sale by a parent company executive just before the property deal announcement further intensified scrutiny on transparency and potential conflicts of interest.

The company's heavy reliance on domestic consumption and the tourism sector's recovery makes it vulnerable to economic downturns. If consumer spending power falters due to inflation or high debt, CP Axtra's sales growth could be significantly hampered. Thailand's economic outlook in 2024, despite recovery signs, still faces global uncertainties that could affect consumer spending.

Intense competition in the Thai retail and wholesale market necessitates continuous adaptation to consumer preferences and ongoing investment in modernization. CP Axtra's exposure to foreign exchange volatility through international sourcing also poses a risk, as currency fluctuations can increase the cost of imported goods and squeeze profit margins.

Furthermore, CP Axtra's ambitious same-store sales growth (SSSG) targets are at risk from persistent economic pressures like the high cost of living, which could dampen consumer spending. A slowdown in consumer spending growth, as observed in early 2024 for similar retail sectors, could impede the achievement of these SSSG projections, directly impacting revenue.

Same Document Delivered

CP Axtra SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive analysis of CP Axtra's Strengths, Weaknesses, Opportunities, and Threats. Unlock the full, detailed report to gain actionable insights.

Opportunities

CP Axtra has a substantial runway to grow its online presence, with a strategic goal to elevate its omnichannel and e-commerce sales from 18% in FY2024 to a commanding 50% by FY2029. This ambition is well-supported by the proven success of Makro PRO, already Thailand's leading grocery e-commerce platform, and Lotus's SMART App, the second-largest player in the market.

Leveraging these existing strengths, continued investment in cutting-edge technology, robust platform development, and AI-powered data analytics will be crucial. These investments are expected to further amplify online sales and deepen customer engagement, driving significant growth in the digital space for CP Axtra.

CP Axtra is strategically increasing its physical presence by planning to open 7-12 large-format stores and an impressive 200 Lotus's go fresh outlets. This dual approach aims to capture a wider market, from larger retail needs to localized convenience in smaller communities.

The company's vision to transform existing shopping centers into smart community hubs is a key opportunity to deepen customer engagement and loyalty. This initiative leverages technology to create more interactive and personalized shopping experiences.

With an existing network of over 2,600 stores across the nation, CP Axtra possesses a robust infrastructure. This extensive footprint serves as a powerful platform for executing its expansion plans and broadening service accessibility effectively.

CP Axtra has a clear opportunity to enhance its profitability by focusing on products that naturally carry higher profit margins. Think about their wellness and private-label goods; these are often areas where retailers can command better pricing and control the supply chain more effectively.

Looking ahead, the company has set a target to achieve a 35 basis point margin improvement in fiscal year 2025. This goal is directly tied to their strategy of bolstering their exclusive brands and speeding up the creation of new health and beauty products, which are typically strong performers in terms of profit.

Furthermore, CP Axtra can capitalize on the growing consumer preference for convenience by expanding its ready-to-cook and ready-to-eat product lines. This move not only caters to changing lifestyles but also presents a significant chance to boost overall margins by offering value-added, higher-priced convenience foods.

Leveraging AI and Data Analytics for Operational Efficiency and Customer Insights

CP Axtra is actively integrating AI-driven data analytics to unlock deeper customer understanding, refine inventory management, and enhance operational workflows. This strategic adoption of technology is poised to significantly boost efficiency and drive down costs throughout the organization.

Further investment in AI and data analytics promises to deliver more tailored customer interactions and improve the accuracy of demand predictions. For instance, in 2024, companies in the retail sector saw an average improvement of 15% in forecast accuracy through AI implementation, leading to reduced stockouts and overstock situations.

- Enhanced Customer Understanding: AI can analyze vast datasets to identify purchasing patterns and preferences, enabling personalized marketing campaigns.

- Optimized Inventory Management: Predictive analytics can forecast demand more accurately, minimizing holding costs and preventing stockouts.

- Streamlined Operations: AI can automate routine tasks, optimize logistics, and identify bottlenecks for improved efficiency.

- Cost Reduction: By improving efficiency and reducing waste, AI implementation can lead to substantial cost savings. For example, a 2024 report indicated that AI adoption in supply chain management can reduce operational costs by up to 10%.

Regional Expansion into High-Growth Markets

CP Axtra is strategically targeting countries exhibiting robust GDP growth, aiming to replicate its success beyond Thailand. This expansion leverages its significant operational scale and proven expertise to tap into promising emerging markets. For instance, Vietnam's projected GDP growth of approximately 6.5% in 2024 and 6.0% in 2025 presents a prime opportunity for CP Axtra to diversify its revenue streams and capture new market share.

The company's established business model and sophisticated supply chain infrastructure are highly adaptable, facilitating a smoother entry into these new territories. This allows CP Axtra to capitalize on the increasing consumer spending power in regions like Southeast Asia, where disposable incomes are on the rise. For example, the ASEAN region's combined GDP is expected to reach over $4 trillion by 2025, indicating substantial market potential.

- Targeting High-Growth Economies: Focusing on countries with GDP growth exceeding 5% annually, such as Vietnam and the Philippines.

- Leveraging Existing Strengths: Adapting its successful retail and food business models to diverse consumer preferences in new markets.

- Diversifying Revenue: Reducing reliance on the Thai market by establishing a presence in at least two new high-potential countries by 2026.

- Capitalizing on Consumer Trends: Tapping into the growing demand for convenient and quality food products in emerging economies, driven by urbanization and rising middle classes.

CP Axtra can significantly boost its digital footprint by expanding its e-commerce and omnichannel sales, aiming for 50% by FY2029, building on the success of Makro PRO and Lotus's SMART App. Continued investment in technology and AI-driven analytics will be key to enhancing online sales and customer engagement.

The company's strategic physical expansion, including new large-format stores and numerous Lotus's go fresh outlets, coupled with transforming existing centers into smart community hubs, will broaden market reach and deepen customer loyalty.

CP Axtra has a prime opportunity to enhance profitability by focusing on high-margin products like wellness and private-label goods, targeting a 35 basis point margin improvement in FY2025 through exclusive brands and faster new product development.

Expanding ready-to-cook and ready-to-eat lines caters to convenience trends and offers higher margins, while AI integration promises improved customer understanding, inventory management, and operational efficiency, potentially reducing costs by up to 10% as seen in other retail supply chains in 2024.

International expansion into high-growth economies, such as Vietnam with projected GDP growth of around 6.5% in 2024, offers diversification and market share capture, leveraging its adaptable business model and supply chain to tap into the growing consumer spending power in regions like Southeast Asia, where the combined GDP is expected to exceed $4 trillion by 2025.

Threats

The Thai economy is vulnerable to an economic slowdown, exacerbated by high household debt. This situation could significantly curb consumer spending power, a critical factor for CP Axtra's performance.

Retail sales growth in Thailand is expected to decelerate in 2025, reaching its slowest pace in four years. This projected slowdown directly threatens CP Axtra's revenue streams.

Inflation rates in key Southeast Asian markets are estimated to range between 3.5% and 6% for 2024-2025. Such inflationary pressures diminish consumers' discretionary spending, leading to increased price sensitivity and potentially lower sales volumes for CP Axtra.

CP Axtra faces a fiercely competitive and fragmented retail and wholesale landscape across Thailand and Southeast Asia. This necessitates constant strategic adjustments to maintain market share.

Traditional players like CP Axtra must significantly boost their online capabilities and supply chain infrastructure to counter the digital shift and stay relevant. For instance, the e-commerce market in Southeast Asia is projected to reach $211 billion by 2025, highlighting the urgency of digital investment.

The presence of global retailers and expansive online marketplaces intensifies this pressure, posing a significant challenge for local businesses to differentiate and compete effectively.

Heightened geopolitical tensions and ongoing global trade disputes present a significant threat. For instance, the US imposition of tariffs on goods from various nations, including those that could impact Thailand's export markets, can create economic headwinds. These external pressures can lead to broader economic instability, potentially dampening consumer confidence and discretionary spending, which directly affects CP Axtra's sales performance.

The interconnectedness of the global economy means that trade wars can disrupt supply chains and increase the cost of imported raw materials or components. This could squeeze profit margins for CP Axtra, particularly if the company relies on international sourcing for its products. For example, in 2023, global trade growth was projected to slow significantly, partly due to these trade frictions, impacting companies with substantial international operations.

Supply Chain Disruptions and Fluctuating Costs

Global supply chain vulnerabilities, highlighted by events like the Red Sea shipping disruptions in early 2024, continue to pose a significant threat to CP Axtra. These disruptions, coupled with volatile commodity prices, directly affect the cost of raw materials and finished goods. For instance, the price of key components like semiconductors, critical for many electronics manufacturers, saw significant fluctuations throughout 2024, impacting production budgets.

CP Axtra must prioritize robust inventory management and waste reduction strategies to mitigate these risks. The ability to adapt to sudden price swings and ensure consistent product availability is paramount. Failure to do so could result in stockouts, leading to lost sales opportunities and increased operational expenses, thereby eroding profit margins.

- Supply Chain Vulnerability: Persistent global supply chain issues, exacerbated by geopolitical events, create uncertainty in material sourcing and delivery timelines.

- Cost Volatility: Fluctuations in the prices of key commodities, such as energy and metals, directly impact CP Axtra's cost of goods sold.

- Inventory Management Challenges: Maintaining optimal inventory levels becomes more complex and costly amid unpredictable lead times and potential stockouts.

- Operational Cost Increases: Disruptions can necessitate expedited shipping or alternative, more expensive suppliers, driving up overall operational expenditures.

Challenges in Attracting and Retaining Skilled Digital Talent

The intense competition for skilled digital talent, especially in cutting-edge fields like artificial intelligence, presents a significant hurdle for CP Axtra. As of early 2025, reports indicate a global shortage of AI specialists, with demand outpacing supply by over 300% in key tech hubs. This makes attracting and retaining top-tier professionals a constant challenge.

CP Axtra's investment in digital transformation necessitates a robust pipeline of highly skilled individuals. However, the rapidly evolving nature of digital technologies means that continuous learning and development are paramount. Failing to foster such an environment could hinder CP Axtra's ability to maintain its digital leadership position.

- Talent Scarcity: The global demand for AI and machine learning engineers is projected to grow by 40% annually through 2026, according to industry analysis.

- Retention Costs: High demand translates to increased salary expectations and benefits packages, potentially raising employee acquisition and retention costs by 15-20% for specialized roles.

- Skill Obsolescence: The rapid pace of technological advancement means that digital skills can become outdated quickly, requiring ongoing investment in training and upskilling programs.

The Thai economy's vulnerability to slowdowns, coupled with high household debt, could significantly impact CP Axtra's consumer spending. Furthermore, decelerating retail sales growth in Thailand, projected to be the slowest in four years by 2025, directly threatens revenue streams.

Inflation in key Southeast Asian markets, estimated between 3.5% and 6% for 2024-2025, will likely reduce discretionary spending. This heightened price sensitivity can lead to lower sales volumes for CP Axtra.

Intensifying competition from global retailers and expansive online marketplaces challenges CP Axtra's market share. The need to bolster online capabilities and supply chains is critical, especially as Southeast Asia's e-commerce market is expected to reach $211 billion by 2025.

Geopolitical tensions and trade disputes can create economic headwinds, dampening consumer confidence and discretionary spending. Supply chain disruptions and volatile commodity prices, as seen with Red Sea shipping in early 2024, also increase operational costs and impact raw material availability.

| Threat Category | Specific Risk | Impact on CP Axtra | Data Point/Projection |

|---|---|---|---|

| Economic Slowdown | High Household Debt in Thailand | Reduced Consumer Spending Power | Thai household debt to GDP ratio remains elevated. |

| Market Dynamics | Decelerating Retail Sales Growth | Lower Revenue Streams | Projected slowest retail sales growth in Thailand in four years by 2025. |

| Inflationary Pressures | Rising Inflation in Southeast Asia | Decreased Discretionary Spending, Price Sensitivity | Inflation forecast: 3.5%-6% in key SEA markets (2024-2025). |

| Competition | Intensified Online and Global Retailer Presence | Market Share Erosion, Need for Digital Investment | SEA e-commerce market projected at $211 billion by 2025. |

| Geopolitical & Supply Chain | Trade Wars, Supply Chain Disruptions | Economic Instability, Increased Operational Costs | Global trade growth slowed in 2023 due to trade frictions. |

SWOT Analysis Data Sources

This CP Axtra SWOT analysis is built upon a robust foundation of data, incorporating verified financial statements, comprehensive market research reports, and expert industry forecasts to ensure a thorough and actionable assessment.