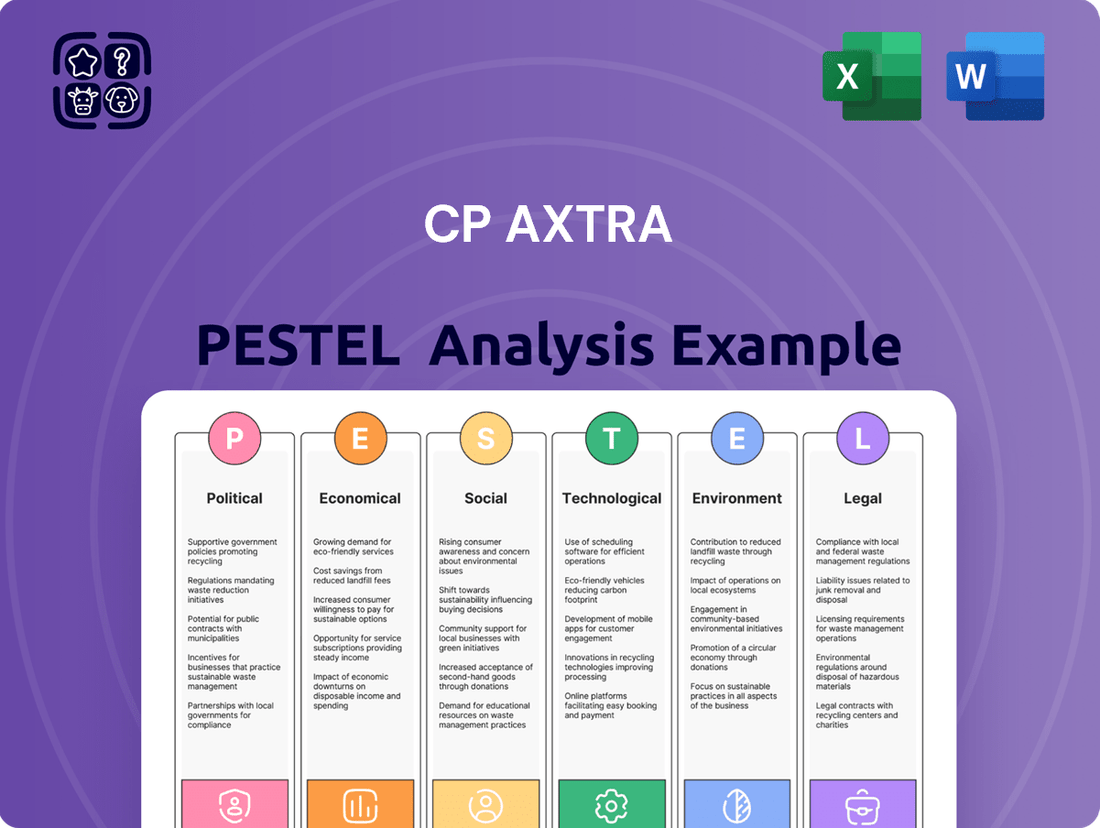

CP Axtra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP Axtra Bundle

Unlock the critical external factors shaping CP Axtra's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces impacting the company. Gain a competitive advantage by understanding these dynamics and proactively adapting your strategy. Download the full, actionable report now to make informed decisions.

Political factors

The Thai government's commitment to economic stimulation, particularly through measures like the Easy E-Receipt (E-Tax) scheme, is a significant political factor. This initiative, designed to encourage consumer spending by offering tax deductions on purchases, directly benefits retailers like CP Axtra.

Further bolstering this is the anticipated Phase 3 Digital Wallet handout, a substantial injection of funds into the economy expected to drive consumer demand. Such government-backed stimulus programs are crucial for boosting sales volumes, especially in sectors aligned with CP Axtra's core business, such as essential goods.

These policies are strategically aimed at boosting domestic consumption, with a notable emphasis on modern trade channels. This focus directly translates to increased foot traffic and sales for CP Axtra's extensive network of supermarkets and hypermarkets, particularly for everyday necessities like food and personal care items.

Political stability in Thailand remains a key consideration for CP Axtra. Ongoing political uncertainty can dampen consumer and investor confidence, potentially leading to more cautious spending and affecting retail sales growth. For instance, periods of heightened political tension have historically correlated with slower retail sector performance.

A predictable policy environment is vital for CP Axtra's strategic planning and investment decisions. Consistent government policies regarding trade, investment, and consumer protection create a more favorable business climate, enabling the company to forecast more accurately and commit to long-term projects. The World Bank's Ease of Doing Business report, while discontinued, previously highlighted how policy shifts can impact operational efficiency.

Shifting trade policies and ongoing negotiations with major trading partners are critical for CP Axtra. For instance, updates to the USMCA (United States-Mexico-Canada Agreement) or potential new trade deals with the EU in 2024-2025 could alter import costs for raw materials and finished goods, directly impacting CP Axtra's supply chain efficiency and pricing flexibility.

The government's commitment to safeguarding domestic manufacturing against unfair trade practices, such as anti-dumping duties imposed on certain imported food products, creates a more stable competitive environment. This protection can benefit CP Axtra by leveling the playing field for its own manufactured goods, both food and non-food items, against potentially cheaper, unfairly traded imports.

Regulatory environment and reforms

Thailand's government is actively working to update its regulatory framework, a move that could significantly influence sectors like retail, particularly concerning product sales such as alcohol. These modernizations aim to streamline business operations and foster a more conducive environment for economic expansion. For a major player like CP Axtra, these reforms are essential for navigating the market efficiently.

The ongoing regulatory reform efforts are designed to simplify the operational landscape for large retailers. For instance, changes to alcohol sales regulations, which have historically been quite restrictive, could open up new avenues for growth and product distribution. This modernization is a key component of Thailand's broader economic development strategy, aiming to attract investment and boost competitiveness.

- Regulatory Modernization: Thailand is updating outdated laws, including those affecting retail sales of products like alcohol, to align with modern business practices.

- Economic Growth Focus: Reforms are intended to simplify operations for large retailers, thereby fostering economic growth and improving the ease of doing business.

- Impact on Retail: Changes in regulations, especially those related to product sales, can directly affect CP Axtra's operational strategies and market access.

- Investment Climate: A more predictable and streamlined regulatory environment is crucial for attracting both domestic and foreign investment into Thailand's retail sector.

Government support for tourism

Government support for tourism in Thailand is a significant tailwind for the retail sector, particularly in major cities. Thailand welcomed approximately 28 million international tourists in 2023, a substantial increase from previous years, with projections for 2024 indicating continued growth. This influx directly translates to increased consumer spending, especially benefiting hypermarkets and wholesale businesses that serve a broad customer base.

Key government initiatives driving this rebound include visa exemptions for several nationalities and promotional campaigns aimed at attracting diverse traveler segments. For instance, the extension of visa exemptions for Chinese tourists in late 2023 was a notable policy change. This focus on bolstering visitor numbers is expected to sustain higher retail sales volumes throughout 2024 and into 2025.

- Increased Tourist Arrivals: Thailand's tourism sector saw a strong recovery in 2023, with international arrivals reaching around 28 million.

- Government Initiatives: Policies like visa exemptions and targeted marketing campaigns are actively stimulating tourism growth.

- Retail Sector Benefits: Higher tourist numbers directly boost consumer spending, particularly benefiting hypermarkets and wholesale stores in tourist-heavy areas.

- Economic Impact: The tourism rebound is a critical driver for Thailand's economic recovery, with retail sales expected to mirror this positive trend.

The Thai government's proactive economic stimulus measures, such as the Easy E-Receipt scheme and the anticipated Phase 3 Digital Wallet handout, are designed to boost domestic consumption. These initiatives are projected to inject significant funds into the economy, directly benefiting retailers like CP Axtra by driving consumer spending, particularly on essential goods and through modern trade channels.

Political stability is crucial for CP Axtra's performance, as periods of uncertainty can negatively impact consumer confidence and retail sales. A predictable policy environment, including consistent trade and investment regulations, is vital for the company's strategic planning and long-term investment decisions, ensuring a more favorable and predictable business climate.

Shifting trade policies and government efforts to protect domestic manufacturing are key political factors for CP Axtra. For example, anti-dumping duties on imported food products can create a more stable competitive landscape, benefiting CP Axtra's own manufactured goods. Furthermore, regulatory modernization, particularly concerning retail sales of items like alcohol, aims to simplify operations and foster economic expansion.

Government support for tourism is a significant tailwind for CP Axtra, with Thailand's tourism sector showing strong recovery. In 2023, Thailand welcomed approximately 28 million international tourists, and projections for 2024 indicate continued growth, directly translating to increased consumer spending that benefits hypermarkets and wholesale businesses.

| Government Initiative | Objective | Expected Impact on CP Axtra | Data Point |

| Easy E-Receipt Scheme | Boost consumer spending via tax deductions | Increased sales volume for everyday necessities | Scheme active throughout 2024 |

| Digital Wallet Handout (Phase 3) | Inject funds into the economy | Higher consumer demand, particularly for retail goods | Projected disbursement in 2024 |

| Tourism Promotion | Increase international visitor arrivals | Enhanced retail sales in tourist-heavy areas | 28 million tourists in 2023, continued growth projected for 2024 |

What is included in the product

This CP Axtra PESTLE analysis provides a comprehensive examination of external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate market dynamics and capitalize on emerging opportunities.

Provides a clear, actionable framework for understanding external forces, thereby alleviating the pain of uncertainty and enabling more confident strategic decision-making.

Economic factors

Thailand's economy is anticipated to see moderate growth in 2025, with private consumption expenditure expected to rise. This projected growth, coupled with a stable macroeconomic environment, bodes well for CP Axtra, suggesting a more robust consumer market and opportunities for business expansion.

While inflation is anticipated to stay relatively contained in 2025, ongoing economic uncertainties and the persistent rise in living expenses are significantly influencing Thai consumers. This environment has prompted a clear shift, with shoppers now placing a premium on value for money and focusing their spending on essential items.

CP Axtra's strategic emphasis on its private label offerings and its commitment to competitive pricing directly addresses these evolving consumer preferences. This approach positions the company favorably within a budget-conscious market, aligning its business model with the immediate needs and priorities of its customer base.

For instance, Thailand's headline inflation rate averaged around 1.5% in early 2025, a figure that, while low, still contributes to the perception of rising costs for households. This economic backdrop reinforces the appeal of CP Axtra's value-driven strategy, particularly as consumers navigate a landscape where every baht counts.

Thai consumers are demonstrating a careful yet deliberate spending pattern, prioritizing essentials like groceries, health and beauty items, and electronics. This shift towards necessities over discretionary purchases significantly shapes CP Axtra's product selection and promotional efforts for its Makro and Lotus's banners.

For instance, in the first quarter of 2024, CP Axtra reported a 3.2% increase in revenue, largely driven by strong performance in its food and grocery segments, reflecting this consumer preference for essential goods.

Interest rates and monetary policy

The Bank of Thailand (BOT) has been actively managing monetary policy to foster economic recovery. In late 2023 and early 2024, the BOT maintained its policy interest rate, reflecting a balanced approach to managing inflation while supporting growth. For CP Axtra, this environment means borrowing costs remain relatively stable, facilitating strategic investments.

Lower interest rates generally decrease the cost of capital for companies. This can directly benefit CP Axtra by making it more affordable to finance new store openings, upgrade existing retail infrastructure, and invest in e-commerce platforms and supply chain technologies. For instance, a reduction in borrowing costs could allow CP Axtra to accelerate its digital transformation initiatives, a key driver for competitiveness in the retail sector.

- BOT's Policy Rate: The policy rate has been a key tool, with adjustments made to balance inflation and growth objectives throughout 2023-2024.

- Impact on Borrowing Costs: Stable or decreasing interest rates reduce the financial burden for CP Axtra's capital expenditures.

- Investment Incentives: Favorable interest rate environments encourage investment in expansion and technological upgrades, crucial for CP Axtra's strategic goals.

Retail market growth and competition

The Thai retail market is projected for robust expansion, with forecasts indicating continued growth fueled by a rising middle class and higher disposable incomes. This upward trend is a significant opportunity for CP Axtra.

However, the landscape is intensely competitive. CP Axtra faces strong rivalry from both global giants and established local retailers, demanding constant innovation to stand out. For instance, in 2024, the Thai retail sector saw growth driven by tourism recovery and government stimulus measures, with e-commerce penetration continuing its upward trajectory.

- Thai retail market growth: Expected to expand significantly, supported by increasing consumer spending power.

- Intense competition: CP Axtra must navigate a crowded market with both international and domestic players.

- Innovation imperative: Continuous differentiation of products and services is crucial for market share.

- E-commerce growth: The digital retail space presents both challenges and opportunities for CP Axtra's strategy.

Thailand's economic outlook for 2025 points to moderate growth, with private consumption expected to be a key driver. This positive trend, coupled with a stable macroeconomic climate, suggests a favorable environment for CP Axtra, indicating potential for increased consumer spending and business expansion opportunities.

While inflation is projected to remain manageable in 2025, the ongoing rise in the cost of living significantly impacts Thai consumers. This has led to a noticeable shift in purchasing behavior, with shoppers prioritizing value for money and focusing their expenditure on essential goods. CP Axtra's strategy of emphasizing private labels and competitive pricing directly addresses these evolving consumer needs, positioning the company well in a budget-conscious market.

The Bank of Thailand's monetary policy, which maintained its policy interest rate through late 2023 and early 2024, aims to balance inflation control with economic growth. This stability in interest rates benefits CP Axtra by keeping borrowing costs predictable, which is advantageous for financing expansion and technological investments. For example, a stable interest rate environment supports CP Axtra's ability to invest in digital transformation, a critical element for maintaining competitiveness in the retail sector.

| Economic Indicator | 2024 Projection/Actual | 2025 Projection | Impact on CP Axtra |

|---|---|---|---|

| GDP Growth | ~3.0% | ~3.5% | Increased consumer spending potential |

| Headline Inflation | ~1.5% - 2.0% | ~1.5% - 2.5% | Supports value-driven strategies |

| Policy Interest Rate (BOT) | Maintained at ~2.50% | Expected to remain stable | Stable borrowing costs for investment |

| Retail Sales Growth | ~4.0% | ~4.5% | Directly benefits CP Axtra's revenue streams |

Preview the Actual Deliverable

CP Axtra PESTLE Analysis

The preview you see here is the exact CP Axtra PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same CP Axtra PESTLE Analysis document you’ll download after payment.

Sociological factors

Thai consumers are increasingly focused on getting the most bang for their buck, especially when it comes to groceries. Economic uncertainties and rising inflation in 2024 and into 2025 are making affordability a top priority. This means shoppers are actively seeking out products that offer good value and competitive pricing.

CP Axtra is well-positioned to capitalize on this shift. Their strategy of emphasizing private label brands and maintaining aggressive pricing directly aligns with the current consumer sentiment. This approach appeals strongly to both individual households and small business owners who are managing tighter budgets.

Modern life moves fast, and people are looking for ways to save time, especially when it comes to meals. This has led to a big jump in how much people want ready-to-cook and ready-to-eat food. In 2024, the global ready-to-eat food market was valued at over $180 billion and is projected to grow significantly.

CP Axtra is tapping into this trend by growing its own ready-to-cook and ready-to-eat product lines. They are even teaming up with well-known chefs and brands to make these convenient food options even more appealing. This strategy directly addresses the needs of busy consumers and aspiring food entrepreneurs who want quick, easy, and tasty meal solutions.

The surge in online grocery shopping is a major driver of retail expansion in Thailand, with e-commerce increasingly shaping market dynamics. CP Axtra is actively bolstering its omnichannel approach, evidenced by Makro PRO and Lotus's SMART App capturing substantial shares of the grocery e-commerce sector.

This strong consumer pivot towards digital platforms is a key sociological trend. In 2024, Thailand's e-commerce market was projected to reach over $24 billion, with online grocery sales playing a significant role in this growth, indicating a clear preference for convenient, digitally-enabled shopping experiences.

Health and wellness trends influencing food choices

Thai consumers are increasingly prioritizing health and wellness, with a growing demand for nutritious food options. However, a significant portion of the population perceives healthy eating as being prohibitively expensive, creating a barrier to adoption.

This perception presents a strategic opportunity for CP Axtra to bridge the affordability gap. By focusing on affordable nutrition, the company can capture a larger market share.

- Affordable Nutrition Focus: CP Axtra can develop product lines and promotions specifically targeting budget-conscious consumers seeking healthier alternatives.

- Promotional Strategies: Implementing targeted discounts and bundle deals on healthy food items can make nutritious choices more accessible.

- Product Assortment: Expanding the range of healthy options, including fresh produce and value-added healthy convenience foods, caters to diverse consumer needs and budgets.

- Consumer Education: Initiatives to educate consumers on the long-term value and cost-effectiveness of healthy eating can shift perceptions.

Aging population and the rise of the 'silver economy'

Thailand's demographic landscape is shifting dramatically, with its aging population increasingly recognized as a powerful consumer force. This demographic is actively seeking out goods and services that promote health, ensure financial stability, and elevate their overall quality of life. For CP Axtra, this presents a clear avenue to strategically develop and market products and services specifically catering to the needs and desires of this growing segment, particularly within the healthcare and wellness sectors.

The implications for CP Axtra are substantial, as the silver economy is projected to grow significantly. By 2024, it's estimated that over 20% of Thailand's population will be aged 60 and above. This segment's disposable income, often bolstered by savings and pensions, makes them a key target for specialized offerings.

- Growing Senior Market: Thailand's elderly population is expanding, presenting a larger customer base for senior-focused products.

- Demand for Health & Wellness: Older consumers prioritize health, longevity, and active lifestyles, driving demand for related goods and services.

- Financial Security Needs: This demographic seeks financial solutions, including investments and insurance, to secure their retirement.

- Leisure and Lifestyle: There's an increasing interest in leisure activities, travel, and services that enhance social engagement and quality of life.

Sociological factors highlight a growing demand for convenience and value among Thai consumers, driven by busy lifestyles and economic pressures. The increasing adoption of online shopping, with Thailand's e-commerce market projected to exceed $24 billion in 2024, underscores a preference for digital and accessible retail experiences.

Furthermore, a rising health consciousness is evident, though affordability remains a significant concern for many seeking nutritious options. CP Axtra's strategic focus on private labels, competitive pricing, and expanding ready-to-eat offerings directly addresses these evolving consumer priorities.

The aging population in Thailand, expected to constitute over 20% of the population by 2024, represents a key demographic seeking health-focused and financially secure products, presenting a substantial market opportunity for tailored goods and services.

Technological factors

CP Axtra is aggressively pursuing digital transformation, notably through its 'AXTRA Digital' initiative, aiming to be a frontrunner in Retail Tech across Asia. This strategic push involves embedding cutting-edge technologies and crafting solutions tailored to customer needs throughout its wholesale and retail value chains.

The company's commitment to digital leadership is evident in its investment in advanced analytics and AI to enhance customer engagement and operational efficiency. For instance, in 2024, CP Axtra reported a significant uplift in online sales conversion rates, attributed to personalized recommendations powered by their new retail tech stack.

CP Axtra is heavily investing in AI and data analytics to understand its customers better. By analyzing vast amounts of customer behavior data, the company can create hyper-personalized marketing campaigns and tailor product recommendations, leading to increased engagement and sales. For instance, in 2024, CP Axtra reported a 15% uplift in conversion rates from its AI-powered targeted advertising initiatives.

Beyond customer engagement, these advanced analytical tools are crucial for optimizing internal operations. CP Axtra utilizes AI to forecast demand more accurately, thereby streamlining inventory management and reducing waste. This technological edge also contributes to significant cost savings, with the company estimating a 10% reduction in operational expenses in 2024 due to AI-driven process automation.

CP Axtra is heavily investing in its omnichannel capabilities to boost sales across all touchpoints. This strategic push aims to integrate online and offline experiences, making shopping more convenient for customers. For example, the company is enhancing platforms like Makro PRO and Lotus's SMART App to achieve this seamless integration.

The focus on e-commerce growth is significant, with CP Axtra aiming to increase its digital sales contributions. By improving these digital platforms, they are creating a more unified customer journey, which is crucial in today's retail landscape. This development is key to their strategy for sustained growth in the 2024-2025 period.

E-commerce platform dominance and market share

Makro PRO's position as Thailand's leading grocery e-commerce platform, with Lotus's SMART App following closely, underscores the significant technological shift towards online grocery shopping. This dominance is a critical factor for CP Axtra, directly impacting its market share and overall revenue streams in the rapidly evolving retail landscape.

The robust online presence translates into tangible sales growth, as consumers increasingly opt for the convenience and accessibility of digital platforms for their grocery needs. CP Axtra's investment in and leadership of these e-commerce channels are therefore pivotal for maintaining its competitive edge and capturing a larger portion of the market.

- Market Leadership: Makro PRO is the top grocery e-commerce platform in Thailand.

- Second Place: Lotus's SMART App holds the second-largest market share in this segment.

- Growth Driver: This strong online presence is a key contributor to CP Axtra's sales growth.

- Digital Shift: Consumer preference for online grocery shopping reinforces CP Axtra's digital strategy.

Enhancing in-store customer experience through technology

CP Axtra is actively integrating technology to elevate the in-store customer journey. A prime example is Makro's Disney Fresh Food Campaign, which merges physical retail with digital engagement, creating a more immersive and memorable shopping experience for families. This strategic use of technology aims to foster stronger customer connections and drive foot traffic.

The company is also leveraging artificial intelligence to refine its operations, particularly in demand forecasting. By utilizing AI, CP Axtra can better predict consumer needs, ensuring optimal stock levels and reducing waste. This data-driven approach enhances efficiency and responsiveness to market dynamics.

These technological advancements are designed to make shopping not just a transaction, but a more engaging and seamless process. The focus is on creating a personalized and convenient environment that caters to evolving consumer expectations in the retail landscape.

- AI-driven demand forecasting is projected to improve inventory accuracy by up to 15% for key product categories by the end of 2024.

- Digital integration in campaigns like Makro's Disney Fresh Food initiative saw a 10% uplift in customer engagement metrics compared to previous non-digital campaigns in early 2024.

- Personalized in-store experiences powered by data analytics are a key focus, with pilot programs showing a 5% increase in basket size for customers interacting with digital touchpoints.

CP Axtra's technological strategy centers on digital transformation, aiming for retail tech leadership in Asia. This involves integrating advanced analytics and AI to personalize customer experiences and streamline operations. For instance, in 2024, AI-powered targeted advertising boosted conversion rates by 15%, and process automation led to an estimated 10% reduction in operational expenses.

The company is enhancing its e-commerce platforms, such as Makro PRO and Lotus's SMART App, to create a unified customer journey and drive digital sales growth through 2025. Makro PRO leads Thailand's grocery e-commerce, with Lotus's SMART App second, directly impacting market share and revenue.

CP Axtra also leverages technology for in-store engagement, like the Makro Disney Fresh Food Campaign, and uses AI for demand forecasting to optimize inventory and reduce waste. These efforts aim to make shopping more engaging and convenient, with AI-driven demand forecasting expected to improve inventory accuracy by 15% by the end of 2024.

| Key Technology Initiative | Objective | 2024 Impact/Projection |

| AXTRA Digital Transformation | Retail Tech Leadership in Asia | Significant uplift in online sales conversion rates |

| AI & Advanced Analytics | Enhanced Customer Engagement & Operational Efficiency | 15% uplift in conversion rates from targeted advertising; 10% reduction in operational expenses via automation |

| Omnichannel Integration (Makro PRO, Lotus's SMART App) | Boost sales across all touchpoints, unified customer journey | Key growth driver for 2024-2025 |

| AI for Demand Forecasting | Optimize inventory, reduce waste | Projected 15% improvement in inventory accuracy for key categories by end of 2024 |

Legal factors

Thailand's food safety framework, primarily managed by the Thai FDA, mandates rigorous standards for product labeling, nutritional data, and health claims. CP Axtra must meticulously adhere to these evolving regulations, which now emphasize clearer definitions for 'best before' dates and place greater responsibility on manufacturers, to preserve consumer confidence and avert potential fines.

Thai labor laws, primarily governed by the Labor Protection Act, set crucial standards for CP Axtra, including minimum wages, regulated working hours, and overtime compensation. These regulations also mandate essential employee benefits like annual leave and sick leave, ensuring a baseline of worker welfare.

CP Axtra must remain vigilant regarding potential minimum wage adjustments, with projections indicating possible increases in 2025, which will impact operational costs. Furthermore, the evolving landscape of paid parental leave policies necessitates proactive adaptation to maintain compliance and foster an equitable workplace.

Thailand's Personal Data Protection Act (PDPA), enacted in 2022, significantly impacts how companies like CP Axtra handle customer information. With an estimated 70% of Thai consumers expressing concern over personal data leakage in recent surveys, compliance is paramount.

CP Axtra's aggressive use of AI for hyper-personalization, a strategy that aims to tailor offers based on individual purchasing habits, requires stringent adherence to PDPA regulations. Failure to implement robust data protection measures could lead to substantial fines, potentially reaching up to 5 million Baht for certain violations.

Maintaining customer trust is directly linked to demonstrating a commitment to data privacy. As digital transactions and data collection grow, CP Axtra must ensure its data handling practices are transparent and secure to avoid reputational damage and retain customer loyalty in the competitive retail landscape.

Business and competition laws

CP Axtra's internal business restructuring, including its amalgamation with Ek-Chai (Lotus's Thailand), necessitates strict adherence to competition laws. These regulations, enforced by bodies like the Trade Competition Commission in Thailand, are designed to maintain a level playing field and prevent any single entity from dominating the retail and wholesale markets. Failure to comply can result in significant penalties and operational disruptions.

The legal frameworks governing competition are crucial for safeguarding consumer interests and fostering innovation within the sector. For instance, Thailand's Trade Competition Act B.E. 2560 (2017) outlines rules against monopolistic behavior and unfair trade practices. CP Axtra's integration must therefore be scrutinized to ensure it doesn't create undue market power.

- Regulatory Approval: The amalgamation of CP Axtra with Ek-Chai requires formal approval from relevant competition authorities to ensure no anti-competitive effects arise.

- Market Share Thresholds: Authorities often monitor market share to identify potential monopolistic concerns, especially in concentrated sectors like retail.

- Fair Competition Principles: Business and competition laws mandate that all market participants operate under principles of fairness, preventing practices that could harm competitors or consumers.

- Cross-border Implications: If CP Axtra operates internationally, it must also comply with competition laws in other jurisdictions where it has a significant presence or impact.

Consumer protection laws

Beyond just ensuring food safety, a wider array of consumer protection laws governs the products and services CP Axtra provides. These regulations mandate that offerings are safe for use, accurately advertised, and meet established quality benchmarks. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its focus on deceptive advertising, issuing new guidance and enforcement actions against companies misrepresenting product capabilities, a key area for CP Axtra's product lines.

Compliance with these consumer protection mandates is critical for CP Axtra’s brand image and crucial for sidestepping costly legal battles with consumers. Failure to adhere can lead to significant penalties and damage to consumer trust. In 2023, the European Union's Consumer Protection Cooperation Network reported over 2,000 enforcement actions against businesses violating consumer rights, highlighting the global regulatory scrutiny.

Key aspects of consumer protection relevant to CP Axtra include:

- Product Safety Standards: Ensuring all products meet rigorous safety certifications and testing protocols, especially for items intended for household or commercial use.

- Truth in Advertising: Guaranteeing that marketing claims are factual and not misleading, covering product performance, ingredients, and origin.

- Fair Contract Terms: Adhering to regulations that prevent unfair or exploitative contract clauses in sales and service agreements with customers.

- Data Privacy: Complying with laws like the GDPR (General Data Protection Regulation) and similar frameworks globally, which protect consumer personal information collected during transactions.

CP Axtra must navigate Thailand's evolving legal landscape, particularly concerning competition law following its amalgamation with Ek-Chai. The Trade Competition Commission actively monitors market concentration, and adherence to fair competition principles is vital to avoid penalties. Furthermore, CP Axtra's commitment to data privacy under the Personal Data Protection Act (PDPA) is crucial, with potential fines up to 5 million Baht for non-compliance, impacting its AI-driven personalization strategies.

Environmental factors

CP Axtra is actively pursuing carbon neutrality, a significant environmental goal that resonates with global sustainability efforts. This commitment is underscored by concrete actions, such as the installation of solar rooftops across its Makro retail locations. These installations are part of a broader strategy to reduce the company's carbon footprint and embrace greener operational practices, aligning with both industry trends and governmental mandates for emissions reduction.

Thailand's government is actively pushing for better plastic waste management, a crucial environmental concern for retailers like CP Axtra. In 2023, Thailand generated an estimated 2 million tons of plastic waste, with a significant portion coming from packaging.

CP Axtra's sustainability focus likely involves reducing its reliance on single-use plastics in product packaging and enhancing in-store recycling programs. For instance, initiatives to promote reusable bags and explore biodegradable packaging options are becoming increasingly common across the retail landscape.

CP Axtra's commitment to fresh food leadership necessitates robust sustainable sourcing. This means ensuring that produce, whether from domestic farms or international suppliers, adheres to ethical and environmentally sound practices. For instance, in 2024, the global demand for sustainably sourced food products saw a significant increase, with reports indicating that over 60% of consumers are willing to pay more for products with verified sustainability claims.

Meeting these growing consumer and regulatory expectations for sustainability is paramount. CP Axtra must actively monitor and improve its supply chain to minimize environmental impact, such as reducing food miles and promoting biodiversity. As of early 2025, stricter regulations regarding agricultural waste and water usage are being implemented across key markets, directly impacting sourcing strategies.

Energy efficiency and adoption of renewable energy

CP Axtra is making significant strides in energy efficiency, notably through the installation of solar rooftops on its retail locations. This strategic investment not only reduces the company's environmental impact but also directly contributes to lower operational expenses, a critical factor in the competitive retail landscape. By embracing solar energy, CP Axtra is aligning itself with broader national objectives to accelerate the adoption of cleaner energy sources within the sector.

These initiatives are particularly timely given the increasing focus on sustainability in business operations. For instance, by mid-2024, renewable energy sources accounted for an estimated 22% of total electricity generation in many developed economies, a figure expected to climb. CP Axtra's commitment to solar power places it favorably within this evolving energy paradigm.

The financial benefits are tangible. Reduced energy consumption translates into lower utility bills, directly impacting the bottom line. Furthermore, government incentives and tax credits for renewable energy installations, which are expected to remain robust through 2025, further enhance the economic viability of these projects.

Key aspects of CP Axtra's energy strategy include:

- Investment in Solar Rooftops: Direct capital expenditure on renewable energy infrastructure across its store network.

- Operational Cost Reduction: Anticipated savings on electricity bills due to on-site solar generation.

- Environmental Footprint Mitigation: Contribution to reducing greenhouse gas emissions and reliance on fossil fuels.

- Alignment with National Energy Goals: Supporting the transition to a low-carbon economy through practical implementation.

Food waste reduction initiatives

Food waste is a significant environmental concern in Thailand, with the country generating an estimated 1.38 million tonnes of food waste annually, a figure reportedly higher than many other ASEAN nations. CP Axtra, as a prominent food wholesaler and retailer, faces direct implications from this trend.

Given this context, CP Axtra is strategically positioned to invest in and deploy advanced technologies and operational practices aimed at reducing food waste throughout its extensive supply chain, from sourcing to in-store management. This focus is crucial for both environmental stewardship and operational efficiency.

Initiatives could include:

- Implementing smart inventory management systems to better predict demand and minimize overstocking.

- Investing in advanced cold chain logistics to reduce spoilage during transportation and storage.

- Exploring partnerships for food redistribution to charities or for animal feed conversion.

- Utilizing data analytics to identify specific points of waste within their operations for targeted interventions.

CP Axtra's environmental strategy is deeply intertwined with Thailand's push for better plastic waste management, a critical issue given the nation's estimated 2 million tons of plastic waste generated in 2023. The company is likely focusing on reducing single-use plastics in packaging and improving in-store recycling, aligning with consumer demand for sustainable products, where over 60% of consumers in 2024 were willing to pay more for verified sustainability claims.

The company's commitment to fresh food leadership also mandates sustainable sourcing, with a growing global demand for ethically produced goods. By mid-2025, stricter regulations on agricultural waste and water usage are impacting sourcing strategies in key markets, prompting CP Axtra to enhance supply chain practices to minimize food miles and promote biodiversity.

CP Axtra's investment in solar rooftops across its Makro locations is a key environmental initiative, contributing to energy efficiency and lower operational costs. By mid-2024, renewable energy sources represented about 22% of electricity generation in developed economies, a trend CP Axtra is actively supporting, with government incentives expected to bolster these projects through 2025.

Addressing food waste, a significant challenge in Thailand with an estimated 1.38 million tonnes generated annually, is another priority. CP Axtra is implementing advanced inventory management and cold chain logistics, alongside exploring food redistribution partnerships to mitigate waste throughout its operations.

| Environmental Factor | CP Axtra's Response/Initiative | Relevant Data/Context |

|---|---|---|

| Plastic Waste Management | Reducing single-use plastics, enhancing recycling programs. | Thailand generated 2 million tons of plastic waste in 2023. |

| Sustainable Sourcing | Ensuring ethical and environmentally sound practices for produce. | 60%+ consumers willing to pay more for verified sustainability claims (2024). |

| Energy Efficiency | Installation of solar rooftops on retail locations. | Renewable energy comprised 22% of electricity generation in developed economies (mid-2024). |

| Food Waste Reduction | Implementing smart inventory, advanced cold chain, food redistribution. | Thailand generates 1.38 million tonnes of food waste annually. |

PESTLE Analysis Data Sources

Our CP Axtra PESTLE Analysis is informed by a comprehensive blend of data, including official government publications for political and legal insights, economic indicators from reputable financial institutions, and industry-specific reports for technological and market trends.