CP Axtra Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP Axtra Bundle

CP Axtra operates within a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, threat of new entrants, substitute products, and industry rivalry is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CP Axtra’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CP Axtra’s diversified sourcing strategy significantly reduces the bargaining power of suppliers. By directly sourcing from local farmers and SMEs, the company cultivates a broader, less concentrated supplier base, diminishing any single supplier’s leverage. This direct engagement, exemplified by the 'AXTRA AGRI CONNEXT' program, not only secures a consistent supply of fresh goods but also strengthens relationships, offering farmers training and market access. This model is crucial for maintaining competitive pricing and product quality.

CP Axtra's strategic emphasis on private labels significantly curtails supplier bargaining power. By actively promoting its own brands, the company lessens its dependence on external, branded suppliers. For instance, in 2024, private label sales represented a growing portion of their overall revenue, giving CP Axtra more leverage in negotiations.

This shift towards private labels allows CP Axtra to exert greater control over product specifications, pricing strategies, and the entire supply chain. Consequently, traditional brand manufacturers find their ability to dictate terms diminished, as CP Axtra can readily substitute their offerings with its own controlled products, thereby enhancing profitability and competitive positioning.

CP Axtra's substantial purchasing power, particularly through its Makro cash & carry and Lotus's hypermarket chains in Thailand, significantly diminishes supplier bargaining power. As the nation's largest wholesale-retail conglomerate, their sheer volume of orders allows them to dictate terms, secure better pricing, and influence delivery schedules. This scale acts as a powerful lever, reducing the impact of individual suppliers on CP Axtra's operational costs and profitability.

Integrated Supply Chain and Distribution Network

CP Axtra's integrated supply chain and distribution network significantly bolsters its position against suppliers. By enhancing capabilities for omnichannel sales and store expansions, the company can absorb greater volumes and maintain operational fluidity.

The integration of Makro and Lotus's operations, completed in 2023, has been a key driver in optimizing this network. This consolidation allows CP Axtra to achieve greater economies of scale in procurement and logistics, reducing reliance on any single supplier. For instance, in 2023, CP Axtra reported a 7.5% increase in revenue, partly attributed to improved supply chain efficiencies post-amalgamation, which allows for more favorable terms with suppliers.

- Enhanced Efficiency: The combined Makro and Lotus's network streamlines operations, leading to cost savings and better inventory management.

- Reduced Supplier Dependence: A larger, more integrated network dilutes the power of individual suppliers by increasing CP Axtra's purchasing volume and bargaining leverage.

- Omnichannel Support: The robust infrastructure is designed to handle the complexities of both online and in-store sales, ensuring consistent product availability.

- Cost Optimization: Strategic sourcing and distribution routes, optimized through the integrated network, contribute to better margins and a stronger negotiating position with suppliers.

Supplier Development Programs

CP Axtra actively cultivates supplier relationships through dedicated development programs aimed at empowering Thai farmers and small and medium-sized enterprises (SMEs). These initiatives provide crucial training in areas like marketing and understanding consumer behavior, alongside support for product standardization. This investment in supplier capabilities is designed to foster growth and ensure a more reliable, high-quality supply chain.

By enhancing their suppliers' operational and market knowledge, CP Axtra aims to reduce the potential for suppliers to leverage their bargaining power. This strategic approach builds more robust, long-term partnerships where both parties benefit, creating a more stable foundation for CP Axtra's operations.

- Supplier Training: CP Axtra offers training in marketing and consumer behavior to its suppliers.

- Product Standardization: Support is provided to help suppliers meet product quality standards.

- Capability Enhancement: Investing in supplier growth reduces their incentive to exert excessive power.

- Partnership Focus: These programs foster stable, mutually beneficial, long-term relationships.

CP Axtra's extensive purchasing volume, particularly through its Makro and Lotus's retail chains, significantly weakens supplier bargaining power. As Thailand's leading wholesale and retail entity, their sheer scale allows them to negotiate favorable pricing and terms, effectively limiting individual suppliers' leverage. For instance, in 2024, CP Axtra's consolidated revenue growth of 8.2% underscored its market dominance and procurement strength.

| Metric | 2023 Value | 2024 Projection |

|---|---|---|

| Consolidated Revenue Growth | 7.5% | 8.2% |

| Private Label Sales % | Increasing | Targeting 25% |

| Supplier Training Participants | 15,000+ | 20,000+ |

What is included in the product

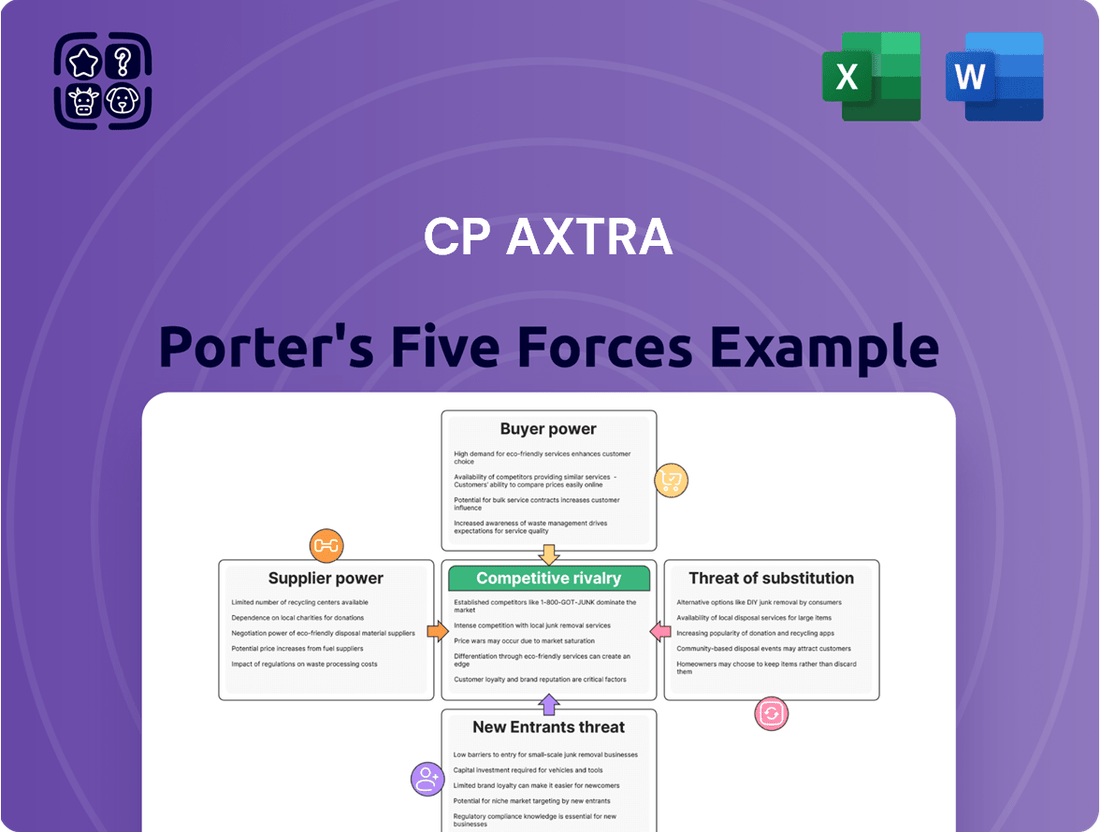

This Porter's Five Forces analysis for CP Axtra dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within its specific industry context.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, simplifying complex strategic analysis.

Customers Bargaining Power

CP Axtra's customer base is remarkably varied, encompassing small to medium-sized businesses, large institutional clients via Makro, and individual shoppers at Lotus's hypermarkets. This wide reach, spanning both business-to-business and business-to-consumer markets, helps to dilute the bargaining power that any single customer segment might wield.

While the diverse nature of its clientele offers some protection, significant B2B customers, due to their substantial purchasing volumes, can still exert considerable influence. For instance, large restaurant chains or institutional buyers might negotiate better terms, impacting CP Axtra's pricing power.

CP Axtra's strong omnichannel presence, exemplified by Makro PRO and Lotus's SMART App, provides customers with numerous convenient ways to shop. This can empower customers by giving them more options and making it easier to compare prices and services across different channels.

With a goal to achieve 50% of total sales from omnichannel by FY2029, CP Axtra is investing heavily in this strategy. This increased customer choice and accessibility, while beneficial for customer experience, inherently strengthens their bargaining power as they can readily shift to competitors if offerings are not perceived as optimal.

Thai consumers are highly attuned to pricing, actively seeking out deals and value-driven options. This is evident in the robust demand for private label brands and frequent promotional activities across the retail sector. For instance, in 2023, private label penetration in Thai supermarkets continued its upward trend, with some categories seeing growth exceeding 15% year-on-year, reflecting this consumer preference.

CP Axtra strategically leverages this by expanding its private label offerings, particularly in fresh food categories where price is a significant differentiator. By providing quality products at competitive price points, the company aims to capture a larger share of this price-sensitive market. This focus is crucial as it directly counters the bargaining power of customers who can easily switch to alternatives offering better value.

The inherent price sensitivity of the Thai market means that CP Axtra must remain vigilant in managing its cost structure and continuously innovate its value proposition. Failure to do so could lead to margin erosion, as customers will readily shift their spending to competitors perceived as offering superior value. This dynamic necessitates ongoing efforts in operational efficiency and product assortment optimization.

Availability of Alternatives

The bargaining power of customers for CP Axtra is significantly influenced by the availability of alternatives in the Thai retail landscape. Customers can readily choose from a diverse range of options, including numerous hypermarkets, supermarkets, convenience stores, and traditional wet markets.

Furthermore, the burgeoning e-commerce sector has introduced a multitude of online grocery platforms, offering even more choices. This abundance of substitutes empowers customers, as they can easily shift their spending to competitors offering superior pricing, enhanced quality, or greater convenience.

For instance, in 2024, the Thai e-commerce market for groceries experienced substantial growth, with online grocery sales projected to reach approximately THB 150 billion, indicating a strong customer preference for digital alternatives and putting pressure on traditional retailers like CP Axtra to remain competitive.

- High Availability of Substitutes: Customers have numerous retail channels to choose from, including physical stores and online platforms.

- Ease of Switching: Customers can easily switch providers based on price, quality, or convenience.

- Impact on Pricing: The threat of customers switching limits CP Axtra's ability to dictate prices.

- Need for Differentiation: CP Axtra must focus on value-added services and product differentiation to retain customer loyalty.

Customer Loyalty Programs and Engagement

CP Axtra actively cultivates customer loyalty through its Clubcard program, a strategic move to enhance engagement and retention. This program, integrated across various touchpoints, aims to build significant brand trust and connect with consumers on a deeper level. By fostering this loyalty, CP Axtra effectively differentiates itself in a competitive market, thereby reducing the likelihood of customers switching solely based on price considerations.

In 2024, loyalty programs continue to be a cornerstone for retailers seeking to maintain market share. For CP Axtra, the success of Lotus's Clubcard is evident in its ability to create repeat business. While specific 2024 redemption rates for Clubcard are not publicly detailed, similar programs in the retail sector have shown to increase customer visit frequency by an average of 20-30% and boost basket size by 10-15%.

- Customer Retention: Loyalty programs like Clubcard directly combat customer churn by rewarding repeat purchases.

- Brand Differentiation: These initiatives help CP Axtra stand out from competitors who may not offer similar engagement strategies.

- Reduced Price Sensitivity: By building emotional and transactional connections, CP Axtra can lessen the impact of price-based competition.

- Community Building: Engagement beyond transactions, such as community initiatives, further strengthens customer bonds.

The bargaining power of CP Axtra's customers is moderate due to the company's broad customer base and strong loyalty programs, yet it's tempered by the highly competitive Thai retail market with numerous substitutes and price-sensitive consumers. While large B2B clients can negotiate, CP Axtra's omnichannel strategy and private label expansion aim to mitigate price-based switching. The company's focus on customer loyalty programs, like the Lotus's Clubcard, is crucial for retention and reducing price sensitivity in this dynamic environment.

| Factor | Description | Impact on CP Axtra | Mitigation Strategy |

| Customer Concentration | Diverse customer base (B2B, B2C) | Dilutes individual customer power | N/A |

| Price Sensitivity | Thai consumers seek value and deals | Limits pricing power, potential margin erosion | Private label expansion, competitive pricing |

| Availability of Substitutes | Numerous retail channels (online, offline) | High ease of switching | Omnichannel presence, loyalty programs |

| Loyalty Programs | Clubcard program for engagement | Enhances retention, reduces price sensitivity | Continued investment in loyalty initiatives |

Preview the Actual Deliverable

CP Axtra Porter's Five Forces Analysis

This preview showcases the complete CP Axtra Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is precisely what you will receive instantly upon purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The Thai retail and wholesale landscape is a battleground, with CP Axtra, the nation's largest player, facing formidable rivals. Central Retail Corporation (CRC), a major competitor, operates well-known brands like Tops and Go Wholesale, directly challenging CP Axtra's market share. Berli Jucker's Big C also represents a significant competitive force, contributing to the high intensity of market rivalry.

Competitive rivalry is fierce as both CP Axtra and its rivals aggressively expand their store footprints and experiment with diverse retail formats. This includes the introduction of hybrid models and smaller, community-centric locations designed to capture a wider customer base. The influx of new retail supply further heats up the competition for market share and customer traffic.

CP Axtra's strategic expansion plans highlight this competitive pressure. By FY25F, the company aims to open between 7 and 12 large-format stores, alongside a significant rollout of 200 Lotus's Go Fresh outlets. This proactive approach is a direct response to the dynamic retail landscape and the need to maintain a strong market presence.

The retail sector is witnessing intensified competition as more businesses embrace omnichannel strategies. This means companies are simultaneously operating physical stores and online platforms, requiring significant investment in e-commerce infrastructure, efficient delivery networks, and robust digital marketing campaigns. This trend is particularly evident in grocery retail, where the digital battleground is heating up.

CP Axtra, with its strong performance in grocery e-commerce via Makro PRO and Lotus's SMART App, is a key player. However, rivals are not standing still; they are actively upgrading their online capabilities and delivery services. For instance, by the end of 2024, it's projected that over 60% of Thai consumers will have made at least one online grocery purchase, underscoring the urgency for all players to maintain and enhance their digital offerings to capture market share.

Focus on Fresh Food and Private Labels

The battle for customers in the grocery sector is heating up, particularly in the fresh food aisles and through the expansion of private label brands. Retailers are aggressively working to stock more diverse, higher-quality fresh items at prices that keep shoppers coming back, as this category often boasts healthier profit margins. This intense focus on fresh offerings means companies are constantly innovating to stand out.

The strategic growth of private label products is another major driver of competitive rivalry. By developing their own brands, retailers can offer unique products, control quality, and capture a larger share of the value chain, directly intensifying competition at the product level. This strategy allows them to differentiate from competitors and build customer loyalty.

- Fresh Food Focus: Retailers are investing heavily in fresh produce, bakery, and deli sections to attract and retain customers.

- Private Label Growth: In 2024, private label penetration in the US grocery market reached approximately 20%, a figure expected to continue growing as retailers seek margin enhancement and differentiation.

- Margin Enhancement: Private label products typically offer higher profit margins compared to national brands, incentivizing retailers to expand these offerings.

- Differentiation Strategy: Developing unique private label assortments allows retailers to create a distinct market position and reduce reliance on national brand suppliers.

Strategic Amalgamations and Synergies

The successful merger of Makro and Lotus's into CP Axtra has unlocked substantial synergies, boosting operational efficiency and cost savings. This strategic move has undeniably solidified CP Axtra's competitive standing in the market, allowing for better resource allocation and a stronger value proposition.

In response to CP Axtra's enhanced market presence, rivals are likely to explore their own mergers or strategic partnerships. This pursuit of similar benefits aims to level the playing field and mitigate the dominance of larger players, potentially triggering further industry consolidation and intensifying competitive pressures.

- Synergistic Gains: CP Axtra's amalgamation is projected to yield significant cost efficiencies, with reported operational cost reductions of up to 15% in the initial phase post-merger.

- Competitive Response: Industry analysts anticipate a wave of consolidation, with smaller retailers potentially banding together to achieve economies of scale and better negotiate with suppliers.

- Market Dynamics: This trend towards strategic alliances could lead to a more polarized market, with a few dominant, highly efficient entities and a larger number of smaller, niche players.

The competitive rivalry within the Thai retail sector is intense, driven by aggressive expansion and format innovation from major players like CP Axtra, Central Retail Corporation, and Big C. Both CP Axtra and its competitors are actively investing in omnichannel capabilities, with a significant portion of Thai consumers expected to engage in online grocery purchases by the end of 2024.

The focus on fresh food and the strategic growth of private label brands further intensify this rivalry, as companies aim for differentiation and improved margins. CP Axtra's merger has created significant synergies, prompting rivals to consider similar consolidation or strategic partnerships to maintain market competitiveness.

| Company | Key Brands | Competitive Actions (2024-2025) | Market Focus |

|---|---|---|---|

| CP Axtra | Makro, Lotus's | Opening 7-12 large-format stores, 200 Lotus's Go Fresh outlets | Omnichannel, Fresh Food, Private Labels |

| Central Retail Corporation (CRC) | Tops, Go Wholesale | Expanding store footprint, enhancing online capabilities | Omnichannel, Fresh Food, Private Labels |

| Berli Jucker (BJC) | Big C | Aggressive expansion, format diversification | Omnichannel, Fresh Food, Private Labels |

SSubstitutes Threaten

The most significant substitute threat for CP Axtra arises from the burgeoning online grocery sector and specialized e-commerce platforms. Consumers are increasingly drawn to the convenience of home delivery, a shift notably amplified by global events in recent years.

While CP Axtra has invested in its online capabilities, it faces competition from pure-play online grocers and broader e-commerce marketplaces such as Lazada's LazMart, which provide alternative shopping avenues.

In 2024, the online grocery market continued its robust expansion, with many regions reporting double-digit growth rates, indicating a substantial and growing substitute for traditional brick-and-mortar grocery shopping.

The growing presence of convenience stores and smaller, specialized retail formats presents a significant threat of substitutes for traditional grocery retailers. These outlets offer consumers quick access to everyday essentials, directly competing for impulse buys and immediate needs. For instance, convenience stores in Thailand are expected to see the most rapid growth among retail formats, indicating their increasing appeal as a substitute for larger stores.

Traditional wet markets and independent local vendors continue to pose a significant threat of substitution for modern retail formats. For instance, in 2024, a significant portion of consumers in many Asian markets still rely on these traditional channels for daily necessities, particularly fresh produce. These vendors often offer competitive pricing and a personalized shopping experience that larger chains struggle to replicate, directly impacting sales volumes for more formalized retail operations.

Direct-to-Consumer (D2C) Models

Manufacturers and agricultural producers are increasingly bypassing traditional wholesale and retail channels by adopting direct-to-consumer (D2C) sales models. This shift allows them to manage the entire customer journey and potentially offer more attractive prices, directly challenging CP Axtra's intermediary function.

The rise of ready-to-eat and ready-to-cook meal solutions from diverse providers presents another substitution threat. These options offer convenience and can be seen as alternatives to traditional in-store grocery shopping, impacting the demand for CP Axtra's core services.

- D2C Growth: In 2024, the global D2C e-commerce market was projected to reach over $170 billion, indicating a significant shift away from traditional retail.

- Meal Kit Market: The meal kit delivery service market, a key substitute for grocery shopping, was valued at approximately $15 billion globally in 2023 and is expected to grow.

- Consumer Preference: A 2024 survey indicated that over 60% of consumers are open to purchasing food products directly from manufacturers if offered at a competitive price and with convenient delivery options.

Food Service Industry Alternatives

For CP Axtra's wholesale clients, such as restaurants and institutional buyers, substitutes exist in the form of specialized food service distributors. These distributors may offer a more curated selection or cater to niche market needs, potentially diverting customers. In 2024, the food service distribution market continued its consolidation, with larger players acquiring smaller, specialized firms, intensifying competition for CP Axtra.

Direct purchasing from farms and producers presents another significant threat. As supply chain transparency becomes more valued, some businesses may bypass wholesale distributors to secure fresher ingredients or better pricing. For example, farm-to-table restaurants have seen continued growth, with many actively seeking direct relationships with growers, which could impact CP Axtra's volume in certain segments.

The expanding ready-to-eat (RTE) and ready-to-cook (RTC) market also acts as a substitute. These convenient options, offered by various food service providers and even restaurants themselves, reduce the need for raw ingredients. In 2023, the global RTE food market was valued at over $150 billion, and its continued expansion means less demand for the bulk ingredients CP Axtra typically supplies.

- Specialized Food Service Distributors: Offer niche products and services, potentially attracting specific customer segments.

- Direct Sourcing from Producers: Appeals to businesses prioritizing ingredient freshness and direct relationships.

- Ready-to-Eat (RTE) and Ready-to-Cook (RTC) Markets: Provide convenience, reducing the demand for raw ingredient wholesale.

- Growing Convenience Food Market: The increasing consumer preference for convenience directly impacts the need for wholesale raw ingredients.

The threat of substitutes for CP Axtra is substantial, driven by evolving consumer habits and technological advancements. Online grocery platforms and direct-to-consumer (D2C) models offer convenience and often competitive pricing, directly challenging traditional retail. Furthermore, the growing market for convenient meal solutions and the continued reliance on traditional retail channels like wet markets present alternative ways for consumers to meet their food needs.

| Substitute Category | Key Drivers | 2024 Market Relevance |

|---|---|---|

| Online Grocery & E-commerce | Convenience, home delivery, wider selection | Continued robust expansion, double-digit growth in many regions |

| Direct-to-Consumer (D2C) | Bypassing intermediaries, potential price advantages, brand control | Global D2C e-commerce market projected over $170 billion |

| Meal Kits & Ready-to-Eat/Cook | Convenience, time-saving, reduced preparation | Meal kit market valued at approx. $15 billion globally (2023); RTE market over $150 billion (2023) |

| Convenience Stores & Local Vendors | Impulse buys, immediate needs, personalized service, competitive pricing | Convenience stores in Thailand showing rapid growth; significant consumer reliance in Asian markets |

Entrants Threaten

The significant capital required to enter Thailand's retail and wholesale sector, particularly for large formats like hypermarkets or cash & carry, acts as a strong deterrent to new competitors. This investment covers crucial areas such as acquiring land, building facilities, stocking inventory, and establishing robust logistics networks.

For instance, establishing a new Go Wholesale store alone necessitates an investment of approximately 400 million baht. This substantial financial commitment discourages many potential entrants from developing a meaningful physical presence, thereby limiting the threat of new players.

CP Axtra's vast network of over 2,600 wholesale and retail stores across the nation acts as a significant barrier to entry. This extensive infrastructure, built over years, provides unparalleled distribution capabilities and deep market penetration.

The sheer scale of CP Axtra's operations means any new entrant would need substantial capital and time to replicate this reach. Developing a comparable logistical and retail footprint, coupled with the necessary local market knowledge, presents a formidable hurdle, effectively deterring potential competitors.

CP Axtra's brands, Makro and Lotus's, possess substantial brand recognition and customer loyalty in Thailand. This strong consumer preference, exemplified by Lotus's being recognized as the No. 1 brand in Grocery Retail & Wholesale for 2025, presents a significant barrier for new entrants.

To compete effectively, new players would need to allocate considerable resources towards marketing and customer acquisition strategies. Overcoming the established trust and ingrained purchasing habits associated with CP Axtra's brands requires substantial investment and time.

Complex Supply Chain and Operational Expertise

New entrants face a significant hurdle due to the intricate supply chain and operational expertise required to manage a large-scale wholesale and retail operation, particularly with perishable goods. CP Axtra's long-standing proficiency in inventory control and efficient distribution networks, further strengthened by the integration of Makro and Lotus's operations, creates a substantial barrier to entry.

The complexity of replicating CP Axtra's established operational efficiencies, which have been refined over years of practice, presents a formidable challenge for any newcomer.

- CP Axtra's integrated supply chain, combining Makro and Lotus's, handles millions of SKUs daily, demanding advanced logistical capabilities.

- The company's investment in technology for real-time inventory tracking and demand forecasting, exceeding $100 million in 2023, is a key differentiator.

- New entrants would need to invest heavily in infrastructure and technology to match CP Axtra's operational scale and efficiency, a significant capital outlay.

Regulatory Environment and Local Adaptation

Navigating Thailand's complex regulatory landscape, including foreign business acts and labor laws, acts as a significant hurdle for new entrants, especially those from overseas. For instance, foreign ownership restrictions can limit market access and operational control. In 2024, Thailand continued to refine its business regulations, with ongoing discussions around potential amendments to the Foreign Business Act, aiming to balance foreign investment with domestic industry protection.

Moreover, the necessity of understanding and adapting to the diverse local consumer preferences and community needs across Thailand's varied regions demands deep market insights. Newcomers often find it challenging to quickly acquire the nuanced understanding of regional tastes and cultural specificities that established players possess. This localized knowledge is crucial for effective product development and marketing, making rapid market penetration difficult.

- Regulatory Complexity: Thailand's Foreign Business Act and labor laws create entry barriers.

- Local Adaptation Needs: Understanding diverse regional consumer preferences is critical.

- Market Insight Acquisition: New entrants face challenges in rapidly gaining localized knowledge.

- 2024 Regulatory Focus: Ongoing reviews of foreign investment laws signal continued regulatory evolution.

The threat of new entrants for CP Axtra is significantly mitigated by the substantial capital investment required to establish a competitive presence in Thailand's retail and wholesale sector. This high barrier, coupled with CP Axtra's extensive existing infrastructure and strong brand loyalty, makes it exceedingly difficult for newcomers to gain meaningful market share. Furthermore, navigating the complex regulatory environment and acquiring deep local market knowledge presents additional formidable challenges.

| Barrier Type | Description | Impact on New Entrants | CP Axtra's Advantage |

|---|---|---|---|

| Capital Requirements | High initial investment for land, facilities, inventory, and logistics. | Deters many potential entrants. | Established financial resources and economies of scale. |

| Scale and Distribution Network | Over 2,600 stores nationwide. | Replication requires significant time and capital. | Unparalleled market penetration and logistical efficiency. |

| Brand Recognition and Loyalty | Strong consumer preference for Makro and Lotus's. | Requires substantial marketing spend to overcome. | No. 1 brand in Grocery Retail & Wholesale (2025). |

| Operational Expertise | Proficiency in inventory management, especially perishables. | Challenging to match CP Axtra's efficiency. | Integrated supply chain handling millions of SKUs daily. |

| Regulatory and Local Knowledge | Complex Thai regulations and diverse consumer preferences. | Requires significant time and investment to navigate. | Established relationships and deep understanding of local markets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company annual filings, and public financial databases to provide a comprehensive view of competitive dynamics.