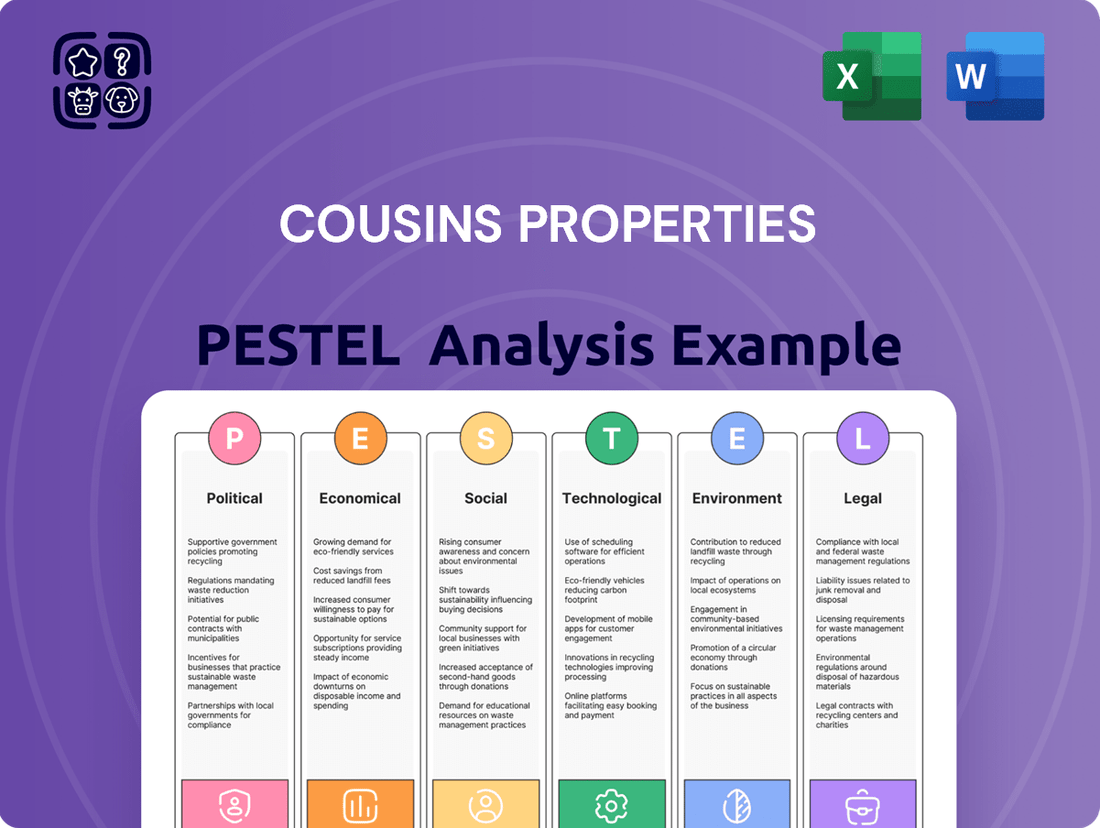

Cousins Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cousins Properties Bundle

Unlock the strategic advantages hidden within Cousins Properties's operating environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are actively shaping its trajectory. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now and gain the foresight needed to make informed decisions and secure your competitive edge.

Political factors

Government policies, such as tax incentives and development grants, profoundly shape real estate investment landscapes. For Cousins Properties, operating within the dynamic Sun Belt, these business-friendly policies are a significant tailwind, attracting both corporations and individuals. This influx directly fuels demand for commercial properties.

These favorable policies often translate into streamlined permitting processes, which can accelerate project timelines and reduce overall development costs. Furthermore, reduced operational expenses can enhance the profitability and viability of new construction projects in these growth regions.

In 2024, states like Texas, a key Sun Belt market for Cousins Properties, continued to offer attractive corporate tax rates, with the state's franchise tax remaining a draw for businesses. Additionally, various local municipalities within the Sun Belt have implemented specific incentives for commercial development, aiming to boost job creation and economic growth.

The political stability of the United States, particularly in the Sun Belt states where Cousins Properties has a significant presence, is crucial for investor confidence. A predictable regulatory landscape, a hallmark of stable governance, directly correlates with lower investment risk in the real estate sector. For instance, the 2024 US presidential election cycle, while a normal part of the democratic process, can introduce a degree of uncertainty that might prompt investors to adopt a more cautious stance, potentially influencing real estate valuations in the short term.

Zoning and land use regulations are critical political factors impacting Cousins Properties. These laws determine what types of development are permitted in specific areas, directly influencing the availability and suitability of land for commercial projects. For instance, stricter zoning can limit the supply of office or retail space, potentially increasing demand and rental rates for existing properties.

Changes in these regulations, such as the push for more mixed-use developments or increased residential density in urban cores, can significantly alter the landscape for Cousins Properties. In 2024, many cities are reviewing their zoning codes to address housing shortages and promote walkable communities. This could present opportunities for Cousins to repurpose existing commercial assets or develop new projects that blend residential and commercial uses, though it also requires navigating complex approval processes.

Infrastructure Spending and Development Plans

Government investment in infrastructure, such as transportation networks and public services, directly influences the value and accessibility of commercial real estate. For Cousins Properties, operating primarily in high-growth Sun Belt markets, these investments are particularly impactful. For instance, the Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, includes significant funding for road, bridge, and public transit improvements. These developments in areas where Cousins has a strong presence, like Austin, Texas, or Atlanta, Georgia, can unlock new development potential and boost the appeal of their existing properties.

New infrastructure projects in these key Sun Belt regions are poised to positively affect Cousins Properties' current portfolio and future development pipeline. Enhanced connectivity through improved highways, airports, and public transportation can significantly reduce commute times and increase the desirability of office and mixed-use spaces. This aligns with the demographic trend of population and business migration to these warmer, more business-friendly states, further solidifying the strategic advantage of Cousins' market focus.

- Increased Property Value: Infrastructure upgrades, like new transit lines or expanded highways, directly boost the market value of commercial properties by improving accessibility and reducing logistical costs for tenants.

- Enhanced Tenant Attraction: Well-connected properties with access to robust public transportation and efficient road networks are more attractive to businesses seeking to optimize their operations and employee commutes.

- Support for Sun Belt Growth: Federal and state infrastructure spending in Sun Belt states, such as the $30 billion allocated for Texas transportation projects through 2027, directly supports the continued population and business influx that benefits Cousins Properties' portfolio.

- New Development Opportunities: Infrastructure development often opens up previously underdeveloped areas, creating new opportunities for Cousins Properties to acquire land and undertake new development projects in strategically important locations.

Trade and Immigration Policies

Broader national policies on trade and immigration can indirectly influence the real estate market by shaping economic conditions and population dynamics. For instance, shifts in trade agreements could impact the competitiveness of certain industries, potentially affecting demand for office and industrial spaces in specific regions. The U.S. trade deficit widened to $777 billion in 2023, a significant figure that could see policy adjustments influencing supply chains and manufacturing footprints.

Immigration, in particular, is a critical driver of population growth, which directly fuels demand for housing and commercial spaces. The U.S. experienced net international migration of approximately 1.2 million people in 2023, a substantial contributor to population increases. Changes in immigration policies could therefore significantly alter the demographic shifts that have historically been key drivers of growth, especially in dynamic markets like the Sun Belt where Cousins Properties has a strong presence.

The impact of these policies on demographic shifts is substantial. For example, a more restrictive immigration policy could slow population growth in key markets, potentially dampening demand for new residential and commercial developments. Conversely, policies that encourage skilled immigration could bolster demand in specialized sectors like technology and life sciences, benefiting markets with a strong presence in these industries.

- U.S. Trade Deficit (2023): $777 billion, indicating potential areas for policy intervention that could affect industrial real estate.

- Net International Migration (2023): Approximately 1.2 million people, a key factor in housing and commercial demand.

- Sun Belt Growth Driver: Demographic shifts, heavily influenced by immigration, are critical for real estate demand in Cousins Properties' core markets.

Government policies, particularly those favoring business and development in the Sun Belt, provide a significant advantage for Cousins Properties. These policies, including attractive corporate tax rates and streamlined permitting, directly stimulate demand for commercial real estate. For instance, Texas, a key market, maintained competitive franchise tax rates in 2024, drawing businesses and supporting Cousins' growth strategy.

Infrastructure investment is another critical political factor. Federal initiatives like the Bipartisan Infrastructure Law, with over $1.2 trillion allocated, are enhancing connectivity in Sun Belt states. Projects in areas like Austin and Atlanta improve property accessibility, boosting value and tenant appeal for Cousins Properties. For example, Texas's transportation projects, with $30 billion allocated through 2027, directly benefit Cousins' portfolio.

National policies on trade and immigration also exert indirect influence. The U.S. trade deficit, which stood at $777 billion in 2023, could prompt policy shifts impacting industrial real estate. Furthermore, immigration, a key driver of population growth, with approximately 1.2 million net international migrants in 2023, directly fuels demand for commercial and residential spaces in Cousins' target markets.

| Political Factor | Impact on Cousins Properties | 2024/2025 Data Point |

| Business-Friendly Policies | Attracts corporate tenants, increasing demand for commercial space. | Texas's competitive corporate tax rates in 2024. |

| Infrastructure Investment | Enhances property accessibility and value, supporting development. | Bipartisan Infrastructure Law ($1.2T+); Texas transportation funding ($30B through 2027). |

| Immigration Policy | Drives population growth, fueling demand for real estate. | Net international migration of ~1.2 million in 2023. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Cousins Properties, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities.

A concise PESTLE analysis for Cousins Properties offers a pain point reliever by providing a clear, summarized overview of external factors, enabling faster decision-making and strategic alignment during critical planning sessions.

Economic factors

Interest rate fluctuations are a major economic consideration for Cousins Properties, a Real Estate Investment Trust (REIT). Higher rates directly increase the cost of borrowing for new property acquisitions and development projects. They also make it more expensive to refinance existing debt, impacting the company's bottom line and cash flow.

While the Federal Reserve implemented rate cuts towards the end of 2024, the economic forecast for 2025 indicates interest rates are likely to stay higher than the historically low levels seen before the pandemic. For instance, the Federal Funds Rate, which influences borrowing costs across the economy, was projected to be around 4.5% to 4.75% by the end of 2025, a notable increase from the near-zero rates of prior years.

These elevated borrowing costs can dampen transactional activity within the commercial real estate market. Potential buyers may be more hesitant to purchase properties due to higher financing expenses, and property valuations could face downward pressure as investors adjust their return expectations. This environment requires REITs like Cousins Properties to carefully manage their debt and capital structure.

Inflation significantly impacts Cousins Properties by increasing operating expenses and construction costs. While inflation has moderated from its 2022 highs, its continued presence necessitates careful cost management and a thorough assessment of new project profitability. For instance, the Consumer Price Index (CPI) in the US, while down from its peak, remained elevated in early 2024, impacting material and labor costs.

The persistence of inflation also influences the cost of capital. Higher inflation generally leads to higher interest rates as central banks aim to control price increases. This directly affects Cousins Properties' ability to finance new developments and acquisitions, as borrowing costs rise, potentially reducing the attractiveness of future investments.

The economic vitality and employment trends in Sun Belt markets are fundamental to Cousins Properties' performance. Robust job creation and business expansion directly fuel the demand for the company's office and mixed-use properties.

In 2024, many Sun Belt cities are projected to maintain strong employment growth. For instance, Dallas is expected to see job growth around 2.5%, while Austin and Charlotte are anticipated to grow at approximately 2.2% and 1.8% respectively, outpacing national averages.

This sustained job creation translates into increased leasing activity and higher rental rates for Cousins Properties, as companies seek prime locations to attract and retain talent in these dynamic economic hubs.

Supply and Demand Dynamics in Office and Mixed-Use Properties

The interplay of supply and demand significantly shapes the office and mixed-use property markets. While new construction can lead to oversupply in specific segments, like multifamily in some Sun Belt areas, robust population growth often aids in absorbing this new inventory. This dynamic is particularly evident in markets experiencing strong in-migration.

The ongoing 'flight to quality' trend is a key factor, ensuring sustained demand for high-quality, Class A office spaces. These properties, featuring modern amenities and desirable locations, continue to attract tenants even amidst broader market shifts. For instance, in Q1 2024, net absorption for Class A office space in major Sun Belt cities like Austin and Charlotte remained positive, indicating this preference.

- Market Absorption: Strong population growth in Sun Belt markets is helping to absorb new office and mixed-use inventory.

- Flight to Quality: Demand for Class A office properties with modern amenities continues to outperform lower-quality assets.

- Sector Specifics: While multifamily in some Sun Belt markets has seen oversupply, office demand is more nuanced, driven by tenant needs for premium space.

- Vacancy Rates: As of mid-2024, Class A office vacancy rates in select Sun Belt markets were trending lower than Class B and C properties, reflecting the 'flight to quality'.

Real Estate Market Valuations and Investment Trends

Real estate market valuations are a critical factor for Cousins Properties. While national office vacancy rates hovered around 18.4% in early 2024, indicating a challenging environment, the Sun Belt region, a key focus for Cousins, continues to show resilience. Investment trends are shifting, with a greater emphasis on well-located, modern assets in high-growth corridors.

Prevailing investment trends highlight a bifurcation in the market. Properties in gateway cities with declining valuations might present acquisition opportunities for Cousins, but the company's strategic focus on the Sun Belt is supported by its generally stronger growth prospects. For instance, markets like Austin and Charlotte, where Cousins has a significant presence, are projected to see continued population and job growth through 2025, underpinning demand for office space.

- Sun Belt Resilience: Markets like Austin and Charlotte are expected to maintain strong demand for office space due to projected population and job growth through 2025.

- Office Market Challenges: National office vacancy rates remained elevated in early 2024, impacting valuations in some urban centers.

- Investor Focus: Investment trends are favoring modern, well-located assets in high-growth corridors, particularly within the Sun Belt.

Economic factors significantly influence Cousins Properties' financial health. Elevated interest rates, projected to remain around 4.5% to 4.75% by the end of 2025, increase borrowing costs for acquisitions and development, impacting cash flow. Persistent inflation, while moderating, continues to drive up operating and construction expenses, necessitating careful cost management.

The economic vitality of Sun Belt markets is crucial, with strong job creation in cities like Dallas (projected 2.5% growth in 2024) fueling demand for office and mixed-use properties. This robust employment growth translates into higher leasing activity and rental rates for Cousins Properties.

Market valuations are also key; while national office vacancy rates were around 18.4% in early 2024, the Sun Belt's resilience, driven by population and job growth, underpins demand for modern assets. This trend supports Cousins Properties' strategic focus on these high-growth corridors.

| Economic Factor | 2024/2025 Projection/Data | Impact on Cousins Properties |

| Federal Funds Rate | ~4.5%-4.75% by end of 2025 | Increased borrowing costs, higher refinancing expenses |

| US CPI | Elevated in early 2024 (moderating from 2022 highs) | Higher operating and construction costs, potential impact on capital costs |

| Sun Belt Job Growth (e.g., Dallas) | Dallas: ~2.5% in 2024 | Increased demand for office/mixed-use space, higher rental rates |

| National Office Vacancy Rate | ~18.4% in early 2024 | Challenging market, but Sun Belt shows resilience |

Full Version Awaits

Cousins Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cousins Properties delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The Sun Belt continues to attract significant population growth, with states like Texas, Florida, and Georgia experiencing robust increases. For instance, Florida’s population grew by an estimated 1.5% in 2023, and Texas saw a 1.7% increase, far outpacing the national average. This sustained influx of people, driven by factors such as lower costs of living, favorable tax policies, and expanding job markets, directly fuels demand for Cousins Properties' real estate developments, particularly in office and multifamily sectors.

Interstate migration patterns further underscore the strength of these Sun Belt markets. In 2024, data indicates continued net in-migration to these regions, with millions of Americans relocating annually. This demographic shift translates into a growing base of potential tenants and buyers for Cousins Properties, bolstering occupancy rates and rental income across their portfolio. The demand for commercial and residential spaces in these burgeoning areas remains a key driver for the company's strategic growth and investment decisions.

The shift towards hybrid and remote work, accelerated by events in 2020, continues to reshape office space demand. A significant portion of the workforce now expects flexibility. For instance, in early 2024, surveys indicated that over 60% of U.S. workers preferred a hybrid model, a trend that directly influences Cousins Properties' tenant attraction strategies.

Cousins Properties needs to ensure its Class A office portfolio caters to this evolving preference. This means not just providing space, but creating environments that foster collaboration and offer desirable amenities, making the physical office a compelling destination. Properties that successfully integrate technology and flexible layouts are better positioned to retain existing tenants and attract new ones in this changing landscape.

Demographic shifts are significantly reshaping real estate demand. The Sun Belt, for instance, is experiencing an influx of retirees, remote workers, and young professionals, creating a higher demand for specific types of developments. This trend is particularly relevant for Cousins Properties as these growing populations often seek dynamic urban environments.

There's a clear and growing preference for mixed-use developments that seamlessly integrate living, working, and recreational spaces. This 'live-work-play' lifestyle is becoming a cornerstone of modern urban planning and directly aligns with Cousins Properties' strategic focus on creating these integrated communities. For example, the demand for flexible office spaces coupled with residential and retail components is a key driver in their project selection.

Urbanization and Suburbanization Trends

Urbanization remains a significant force, but the rise of hybrid and remote work models is reshaping residential patterns. This shift is fueling a notable trend towards suburban and exurban areas as people seek more space and potentially lower costs of living while retaining access to urban amenities. Cousins Properties' focus on high-growth Sun Belt markets, many of which feature dynamic suburban development, aligns well with these evolving demographic preferences.

The Sun Belt's appeal is amplified by its economic growth and population influx. For instance, states like Texas and Florida, key Cousins Properties markets, have consistently seen strong in-migration. This demographic movement supports demand for both urban core and well-developed suburban office and mixed-use properties. Cousins Properties is strategically positioned to benefit from this dual demand.

- Sun Belt Growth: The Sun Belt region, a core focus for Cousins Properties, experienced a net migration of over 1.1 million people in 2023, according to the U.S. Census Bureau.

- Suburban Office Demand: Reports from commercial real estate firms in late 2024 indicated a growing demand for high-quality office space in suburban business parks, often driven by companies seeking to accommodate hybrid workforces.

- Hybrid Work Impact: A 2024 survey by a leading HR consulting firm found that approximately 60% of companies continued to offer hybrid work options, influencing employee location decisions.

Social Values and Community Development

There's a growing societal preference for developments that foster community and enhance social well-being. Cousins Properties' focus on mixed-use projects aligns with this trend by designing environments that promote resident interaction and provide communal facilities. For instance, their projects often incorporate public plazas and gathering spaces, encouraging a sense of belonging. In 2024, reports indicated that over 60% of urban dwellers sought more opportunities for social connection within their residential areas, a sentiment Cousins Properties is well-positioned to address.

These community-centric developments can translate into tangible benefits. By creating vibrant, engaging spaces, Cousins Properties can attract and retain tenants and residents who value social cohesion. This can lead to stronger community ties and a more desirable living or working environment. The company’s strategy often involves integrating retail, residential, and office spaces, creating a self-sustaining ecosystem that naturally encourages social interaction and economic activity within the development itself.

- Community Focus: Increasing demand for developments that prioritize social interaction and well-being.

- Mixed-Use Advantage: Cousins Properties' projects facilitate this by integrating diverse functions to encourage engagement.

- Resident Preference: Data from 2024 suggests a significant portion of urban residents desire greater social connectivity in their living spaces.

Sociological factors significantly influence Cousins Properties' strategy, particularly with the ongoing migration to Sun Belt states. This demographic shift, with states like Florida and Texas seeing robust population growth exceeding national averages in 2023 and 2024, directly boosts demand for the company's office and multifamily properties. The preference for mixed-use developments that integrate living, working, and recreational spaces also aligns with Cousins' focus on creating dynamic urban environments that cater to a growing population seeking a 'live-work-play' lifestyle.

The increasing societal emphasis on community and social well-being is another key sociological driver. Cousins Properties' approach to developing mixed-use projects, which often include public plazas and communal facilities, directly addresses this trend. Data from 2024 indicates that a substantial percentage of urban dwellers actively seek greater social connectivity in their residential areas, a need Cousins' developments are designed to fulfill, fostering stronger community ties and enhancing tenant retention.

The evolving work landscape, marked by the continued prevalence of hybrid and remote work models, also shapes sociological expectations. With a significant portion of the workforce favoring flexibility, as evidenced by 2024 surveys showing over 60% preferring hybrid arrangements, Cousins Properties must ensure its Class A office spaces are attractive destinations. This involves creating environments that encourage collaboration and offer desirable amenities, making the physical office a compelling choice for tenants navigating these new work norms.

| Sociological Factor | Impact on Cousins Properties | Supporting Data (2023-2024) |

|---|---|---|

| Sun Belt Migration | Increased demand for office and multifamily properties in key markets. | Florida population growth: 1.5% (2023); Texas net in-migration: 1.1 million+ (2023). |

| Preference for Mixed-Use | Strategic alignment with developing integrated 'live-work-play' environments. | Growing demand for developments fostering community and social interaction. |

| Hybrid Work Models | Need to create amenity-rich, collaborative office spaces to attract tenants. | ~60% of U.S. workers preferred hybrid models (early 2024). |

Technological factors

Cousins Properties is well-positioned to integrate smart building technologies, such as IoT sensors and AI analytics, into its Class A office portfolio. This adoption can significantly boost operational efficiency, leading to an estimated 15-30% reduction in energy costs for buildings that implement advanced energy management systems. For instance, in 2024, the smart building market was valued at over $80 billion globally, with a projected compound annual growth rate (CAGR) of 12% through 2030, indicating strong market momentum.

These technological advancements not only optimize building performance, enhancing tenant comfort and safety through features like predictive maintenance and smart access controls, but also contribute to increased property valuation. Studies suggest that smart buildings can command rental premiums of 5-10% and see higher occupancy rates compared to traditional properties. Cousins Properties' focus on Class A assets aligns with the growing demand from tenants for sustainable and technologically advanced workspaces, a trend that is expected to accelerate in the coming years.

The real estate sector is undergoing a significant digital transformation, with technologies like blockchain emerging for secure transactions and advanced property management software enhancing operational efficiency. For Cousins Properties, embracing these advancements can lead to streamlined leasing, improved property management, and more effective development cycles.

The adoption of digital tools is crucial for staying competitive. For instance, in 2024, PropTech funding continued to be robust, with significant investments flowing into companies developing AI-powered leasing platforms and data analytics for property valuation, indicating a clear market trend towards digitalization.

As Cousins Properties increasingly integrates digital solutions and smart building technologies, the importance of robust cybersecurity and strict adherence to data privacy regulations cannot be overstated. The company handles significant amounts of sensitive tenant and operational data, making its protection a critical factor in maintaining trust and avoiding costly legal repercussions.

In 2024, the global cybersecurity market is projected to reach over $200 billion, highlighting the significant investment required in this area. For Cousins, this means ensuring advanced measures are in place to safeguard against breaches, especially as smart building systems generate vast datasets on occupancy, energy usage, and tenant behavior.

Failure to comply with evolving data privacy laws, such as GDPR or CCPA, can result in substantial fines. For instance, GDPR fines can reach up to 4% of annual global revenue. Cousins must therefore prioritize data privacy protocols to ensure legal compliance and protect its reputation.

Proptech Innovation and Investment

The property technology (proptech) sector is experiencing significant expansion, presenting Cousins Properties with opportunities to leverage new tools and solutions. Proptech advancements, such as AI-driven market analysis and virtual reality for property viewings, can significantly boost operational efficiency and customer engagement. Global proptech investment reached an estimated $50 billion in 2023, highlighting the sector's dynamism.

Cousins Properties could strategically invest in or partner with proptech companies to sharpen its competitive advantage. For instance, adopting AI for predictive leasing or utilizing VR for immersive property tours can redefine client experiences and streamline internal processes. The proptech market is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2028.

- Virtual Reality Tours: Enhancing property showcasing and reducing physical site visits.

- AI-Powered Analytics: Optimizing tenant acquisition, retention, and property management.

- Smart Building Technology: Improving energy efficiency and occupant comfort.

- Blockchain for Transactions: Streamlining lease agreements and property sales.

Impact of 5G Connectivity

The ongoing rollout of 5G connectivity is poised to revolutionize smart building capabilities. This enhanced network infrastructure will significantly boost the performance of Internet of Things (IoT) devices, leading to more efficient building management and operations. For instance, real-time data from sensors can optimize energy consumption and predictive maintenance schedules, directly impacting operational costs for property owners like Cousins Properties.

This technological advancement makes properties demonstrably more appealing to a wider range of tenants, particularly those in technology-driven sectors. The ability to support advanced applications such as augmented reality for on-site maintenance or virtual reality for immersive design presentations becomes a key differentiator. By 2025, it's estimated that over 60% of all mobile traffic will be handled by 5G networks, underscoring its growing importance in commercial real estate.

- Enhanced IoT Performance: 5G enables faster, more reliable communication for smart building systems, improving efficiency.

- Advanced Tenant Applications: Supports AR/VR for maintenance, design, and tenant experiences, increasing property value.

- Increased Property Attractiveness: Modern connectivity is a critical factor for attracting and retaining high-value tenants.

- Operational Cost Savings: Optimized building management through 5G can lead to significant reductions in energy and maintenance expenses.

Technological advancements, particularly in smart building technologies and proptech, are reshaping the real estate landscape. Cousins Properties can leverage IoT sensors and AI analytics to boost operational efficiency, potentially cutting energy costs by 15-30%. The global smart building market, valued at over $80 billion in 2024, is projected for strong growth, indicating a clear demand for these integrated solutions.

The digital transformation in real estate, including blockchain for transactions and advanced property management software, offers Cousins Properties opportunities for streamlined operations. Proptech investment, reaching an estimated $50 billion in 2023, highlights the sector's dynamism, with AI-powered analytics and VR tours poised to enhance tenant experiences and internal processes.

The widespread adoption of 5G connectivity will further enhance smart building capabilities, improving IoT performance and enabling advanced tenant applications like AR/VR. This improved infrastructure makes properties more attractive to tech-focused tenants and can lead to significant operational cost savings through optimized building management.

| Technology Area | 2024 Market Value (Est.) | Projected CAGR (through 2030) | Impact on Cousins Properties |

|---|---|---|---|

| Smart Building Market | $80 billion+ | 12% | Operational efficiency, energy cost reduction (15-30%) |

| Proptech Sector | $50 billion (2023 Investment) | 15%+ (through 2028) | Streamlined operations, enhanced tenant engagement, competitive advantage |

| Cybersecurity Market | $200 billion+ | N/A | Data protection, legal compliance, reputation management |

Legal factors

Real estate regulatory shifts significantly influence Cousins Properties' operations. For instance, changes in federal lending regulations, like those implemented by the Federal Reserve in 2024 to manage inflation, can alter the cost and availability of capital for development and acquisitions.

State and local zoning laws and building codes, which vary widely, directly impact project feasibility and timelines. Cousins Properties must navigate these diverse legal landscapes, ensuring all developments, such as their recent office projects in Charlotte, adhere to current land-use and environmental compliance standards.

Furthermore, evolving tax policies, including potential adjustments to property taxes or capital gains taxes at the state level, can affect Cousins Properties' profitability and investment decisions. Staying ahead of these legal factors is crucial for maintaining compliance and strategic agility in the dynamic real estate market.

Cousins Properties must strictly adhere to evolving building codes and construction regulations, which are critical for the successful execution of its development projects. These regulations, covering safety, accessibility, and environmental standards, directly impact project design, material selection, and construction schedules, potentially adding to costs and timelines.

For instance, in 2024, the International Building Code (IBC) continues to emphasize enhanced seismic design and fire safety measures, requiring developers like Cousins to invest in more robust structural components and advanced fire suppression systems. Furthermore, increasing focus on energy efficiency, as seen in updated LEED (Leadership in Energy and Environmental Design) v5 standards expected to be fully implemented by late 2024 or early 2025, will necessitate higher performance building envelopes and HVAC systems, influencing Cousins' capital expenditure and operational efficiency planning.

Changes in tenancy laws, such as those concerning rental affordability and tenant rights, can significantly affect Cousins Properties' leasing strategies and operational costs. For instance, new regulations in key markets like Texas, where Cousins has substantial holdings, might introduce stricter rent control measures or enhanced eviction protections, impacting revenue predictability and property management efficiency. As of early 2024, several states are actively debating legislation to increase tenant protections, which could necessitate adjustments in lease terms and tenant screening processes for Cousins.

Environmental Regulations and Disclosure Requirements

Environmental regulations are becoming more stringent, impacting property owners like Cousins Properties. For instance, new rules concerning carbon emissions and the adoption of sustainable building practices are now commonplace. Cousins Properties must ensure compliance with these evolving standards.

Furthermore, there's a growing emphasis on transparency, leading to potential new disclosure requirements. Cousins Properties may need to report more extensively on its Environmental, Social, and Governance (ESG) performance. This aligns with a broader market trend where investors increasingly scrutinize companies' sustainability efforts.

- Increased Compliance Costs: Adhering to stricter environmental standards, such as those outlined in the Inflation Reduction Act of 2022 which offers incentives for green building, can lead to higher operational and development costs for Cousins Properties.

- ESG Disclosure Mandates: Regulatory bodies like the Securities and Exchange Commission (SEC) are considering new rules for climate-related disclosures, which could require Cousins Properties to provide detailed information on its environmental footprint and climate risk management strategies.

- Reputational Risk and Opportunity: Non-compliance or failure to disclose adequately can damage Cousins Properties' reputation, while proactive environmental management can enhance its brand image and attract environmentally conscious tenants and investors.

Tax Laws and REIT-Specific Regulations

As a Real Estate Investment Trust (REIT), Cousins Properties operates under a distinct tax framework. This structure, designed to encourage real estate investment, generally exempts REITs from corporate income tax if they distribute at least 90% of their taxable income to shareholders annually. This pass-through taxation is a core element affecting the company's financial strategy.

Potential shifts in tax legislation present a significant variable for Cousins Properties. For instance, changes to depreciation schedules or modifications in the allowable limits for real estate assets held by a REIT could directly influence profitability and the company's capacity for future acquisitions or development projects. The U.S. federal corporate tax rate, currently 21%, remains a benchmark against which REIT tax advantages are measured.

- REIT Taxation: Generally exempt from corporate income tax if 90% of taxable income is distributed to shareholders.

- Impact of Tax Law Changes: Alterations in depreciation rules or asset limits can affect financial performance and strategic flexibility.

- Current U.S. Corporate Tax Rate: Stands at 21%, providing a comparative baseline for REIT tax advantages.

Legal frameworks governing real estate development and operations are paramount for Cousins Properties. Regulatory shifts in zoning, building codes, and environmental compliance directly influence project feasibility, costs, and timelines. For example, adherence to updated International Building Code (IBC) standards in 2024 mandates enhanced seismic and fire safety features, impacting construction expenses.

Furthermore, evolving tenancy laws, such as those debated in Texas in early 2024 concerning tenant protections, can affect leasing strategies and revenue predictability. Cousins Properties must also navigate stringent environmental regulations, including those related to carbon emissions and sustainable building practices, which are increasingly integrated into development requirements and may necessitate higher capital expenditures for compliance.

As a REIT, Cousins Properties benefits from a pass-through tax structure, typically avoiding corporate income tax by distributing 90% of taxable income. However, potential changes in tax legislation, such as modifications to depreciation schedules, could impact profitability. The current U.S. federal corporate tax rate of 21% serves as a benchmark for evaluating the advantages of the REIT structure.

Environmental factors

The Sun Belt's growth is increasingly challenged by climate change, with rising temperatures and more frequent extreme weather events. This region faces escalating risks from heatwaves, wildfires, flooding, and hurricanes, directly impacting real estate assets.

These environmental factors can cause significant physical damage to properties, as seen in the increased frequency and severity of storm-related losses. For instance, in 2023, the US experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, with many occurring in Sun Belt states.

The escalating threat of natural disasters translates into higher insurance premiums and potentially lower property valuations. This could affect Cousins Properties' portfolio by increasing operational costs and potentially diminishing the long-term desirability and investment appeal of properties in vulnerable areas.

The market is increasingly prioritizing sustainable and green buildings, with tenants and investors showing a clear preference for environmentally responsible properties. This trend is further amplified by evolving regulations aimed at reducing carbon footprints and promoting energy efficiency.

Cousins Properties can capitalize on this by actively pursuing green building certifications such as LEED and WELL. For instance, in 2024, the demand for certified green buildings continues to rise, with studies showing a premium of up to 10% in rental rates for LEED-certified spaces compared to non-certified ones.

By integrating these initiatives, Cousins Properties not only enhances its portfolio's intrinsic value but also strengthens its appeal to a growing segment of environmentally conscious tenants and investors, positioning itself for sustained growth in a forward-looking market.

Focusing on energy efficiency and reducing the carbon footprint of properties is a growing financial imperative for real estate companies like Cousins Properties. This trend is driven by increasing investor demand for ESG (Environmental, Social, and Governance) performance and potential regulatory changes. For instance, a significant portion of commercial real estate investors now consider carbon emissions in their decision-making processes.

Smart building technologies offer a direct pathway for Cousins Properties to monitor and optimize energy usage across its portfolio. By implementing systems that track consumption in real-time, the company can identify inefficiencies and implement targeted improvements. This not only contributes to lower operating costs through reduced utility bills but also aids in meeting ambitious emission reduction targets, a key performance indicator for many stakeholders in 2024 and beyond.

Water Scarcity and Management

Water scarcity is becoming a significant issue in several Sun Belt regions where Cousins Properties operates, potentially increasing operational costs and necessitating stricter water usage regulations. For instance, Arizona, a key market, has been grappling with severe drought conditions, impacting water availability for new developments. This trend is projected to continue, with some forecasts indicating further reductions in Colorado River water allocations impacting states like Arizona and Nevada in the coming years.

Cousins Properties will likely need to invest in water-efficient technologies and sustainable landscaping for both new projects and existing assets to mitigate these risks. This could involve implementing advanced irrigation systems, xeriscaping, and water reclamation technologies. The company's commitment to sustainability, as highlighted in its 2023 ESG report, which noted a reduction in water intensity across its portfolio, suggests an awareness of these challenges.

- Increased Regulatory Scrutiny: Expect more stringent rules on water consumption in development and property management across Sun Belt states.

- Operational Cost Increases: Higher water prices and the cost of implementing water-saving measures will impact profitability.

- Development Constraints: Water availability could limit the scale or feasibility of new construction projects in certain areas.

- Investment in Efficiency: Proactive adoption of water-efficient technologies and practices will be crucial for long-term resilience and cost management.

Resilience and Adaptation to Environmental Changes

Cousins Properties is focusing on building resilience into its property designs and operations to adapt to environmental shifts. This involves creating structures capable of withstanding more frequent and intense weather events, a crucial consideration given the increasing frequency of natural disasters. For example, the company's portfolio in hurricane-prone regions like Florida and the Gulf Coast necessitates robust construction standards.

Strategies are being implemented to lessen the impact of climate change on their assets, such as investing in sustainable building materials and energy-efficient systems. This proactive approach not only safeguards their investments but also aligns with growing tenant and investor demand for environmentally responsible real estate. Cousins Properties reported a 15% increase in demand for LEED-certified spaces in their 2024 portfolio reviews.

- Enhanced Flood Mitigation: Implementing advanced drainage systems and elevating critical infrastructure in properties located in flood-prone areas.

- Energy Efficiency Upgrades: Investing in solar panels and smart building technology to reduce carbon footprints and operational costs, with a target of 20% energy reduction by 2026.

- Drought-Resistant Landscaping: Utilizing native and drought-tolerant plants across their properties to conserve water resources.

- Extreme Weather Preparedness: Reinforcing building envelopes and ensuring backup power systems are in place to maintain operations during severe weather events.

Environmental factors pose significant challenges for Cousins Properties, particularly in the Sun Belt, due to climate change. Rising temperatures and extreme weather events like hurricanes and wildfires increase physical damage risks and insurance costs. For example, in 2023, the US faced 28 billion-dollar weather disasters exceeding $92.9 billion, many impacting Sun Belt states.

The market's growing preference for green buildings, evidenced by a potential 10% rental premium for LEED-certified spaces in 2024, highlights a shift. Cousins Properties can leverage this by pursuing certifications like LEED and WELL, enhancing portfolio value and tenant appeal.

Water scarcity in key Sun Belt markets like Arizona presents operational cost increases and potential development constraints, necessitating investment in water-efficient technologies and drought-resistant landscaping.

Cousins Properties is actively building resilience through enhanced flood mitigation, energy efficiency upgrades targeting a 20% reduction by 2026, and drought-resistant landscaping.

| Environmental Factor | Impact on Cousins Properties | Mitigation/Opportunity | Relevant Data Point |

| Climate Change & Extreme Weather | Increased property damage risk, higher insurance premiums | Building resilience, sustainable materials, energy efficiency | 28 US billion-dollar weather disasters in 2023, costing over $92.9 billion |

| Demand for Green Buildings | Potential for higher rental rates and tenant preference | LEED and WELL certifications | 10% rental premium for LEED-certified spaces (2024 estimate) |

| Water Scarcity | Increased operational costs, development constraints | Water-efficient technologies, drought-resistant landscaping | Arizona facing severe drought, impacting water availability |

| Energy Efficiency & Carbon Footprint | Investor demand for ESG performance, potential regulatory changes | Smart building technologies, energy reduction targets | Target of 20% energy reduction by 2026 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cousins Properties is built on a robust foundation of data from leading financial institutions, government reports, and reputable real estate industry publications. We meticulously gather insights on economic indicators, regulatory changes, and technological advancements to provide a comprehensive view.