Cousins Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cousins Properties Bundle

Explore Cousins Properties' strategic positioning through its BCG Matrix, revealing a nuanced view of their real estate portfolio. See which properties are driving growth and which require careful management. Purchase the full report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment strategy.

Stars

Cousins Properties' recent acquisitions, like the $521.8 million Sail Tower in Austin and the $328.5 million Vantage South End in Charlotte, exemplify its strategy of acquiring trophy assets. These Class A properties are situated in rapidly expanding Sun Belt markets, immediately boosting the company's portfolio value and setting the stage for future growth in vibrant city centers.

Cousins Properties' properties with strong cash rent roll-ups are clearly Stars in their BCG Matrix. The company has consistently achieved robust increases on second-generation leases, with an impressive 8.5% jump in 2024 and a further 3.2% in Q1 2025.

This sustained growth in rental income, which has been ongoing for 42 consecutive quarters as of Q3 2024, highlights the strong demand and pricing power associated with Cousins' prime assets. These properties are not just keeping pace; they are leading the market, commanding higher rents in a favorable economic environment.

Cousins Properties' 100% Sun Belt and 100% Class A portfolio is perfectly positioned to benefit from the ongoing migration to these vibrant regions. This demographic and economic trend is fueling demand for premium office spaces, creating a strong and growing tenant base for the company.

The Sun Belt's population and job growth, which saw significant acceleration in 2024, directly translate into robust leasing activity for Cousins Properties. For instance, states like Texas and Florida continued to lead in net migration in early 2024, directly impacting occupancy rates for high-quality office assets.

Properties with Accelerating Leasing Demand

Cousins Properties is experiencing a surge in leasing demand, particularly in its key markets. The company achieved its strongest first-quarter leasing volume since 2019 in Q1 2025, surpassing 500,000 square feet. This upward trend is further underscored by approximately 1.6 million square feet leased in the first nine months of 2024.

The composition of this leasing activity is particularly noteworthy. A substantial 70-73% of these leases were for new spaces or expansions, demonstrating an increasing market share and a healthy appetite for the company's properties in a competitive landscape. This strong performance suggests these assets are in high demand and are poised for continued growth.

- Highest Q1 Leasing Volume Since 2019: Over 500,000 sq ft leased in Q1 2025.

- Significant 2024 Leasing: Approximately 1.6 million sq ft leased in the first nine months of 2024.

- New and Expansion Leases Dominate: 70-73% of leasing activity comprised new and expansion leases.

- Growing Market Influence: Robust leasing momentum indicates high demand and expanding market share.

Recently Developed or Redeveloped Portfolio Assets

Cousins Properties has strategically focused on modernizing its portfolio, with a significant 69% of its assets either recently developed or redeveloped since 2010. This emphasis has resulted in a collection of highly amenitized properties that command premium rents and consistently achieve high occupancy rates.

These contemporary assets are specifically designed to cater to the evolving needs of today's discerning tenants, reinforcing Cousins Properties' market leadership and competitive advantage. The company's commitment to quality ensures its properties remain attractive in a dynamic real estate landscape.

- Modern Portfolio: 69% of Cousins' portfolio developed/redeveloped since 2010.

- Premium Performance: Newer assets attract premium rents and maintain high occupancy.

- Tenant Appeal: Properties designed to meet evolving customer demands.

- Market Advantage: Contemporary design and efficient systems support the 'flight to quality' trend.

Stars, representing Cousins Properties' most successful assets, are characterized by strong market positions and high growth potential. These properties benefit from robust demand, evidenced by consistent rent increases and significant leasing activity. Their modern design and prime Sun Belt locations further solidify their status as Stars, driving superior performance.

| Metric | 2024 (YTD/Full Year Estimate) | Q1 2025 |

|---|---|---|

| Second-Generation Lease Growth | 8.5% | 3.2% |

| Consecutive Quarters of Rent Growth | 42 (as of Q3 2024) | N/A |

| Q1 Leasing Volume | N/A | Over 500,000 sq ft |

| YTD 2024 Leasing Volume | Approx. 1.6 million sq ft (first nine months) | N/A |

| New/Expansion Leases | 70-73% of YTD 2024 leasing | N/A |

What is included in the product

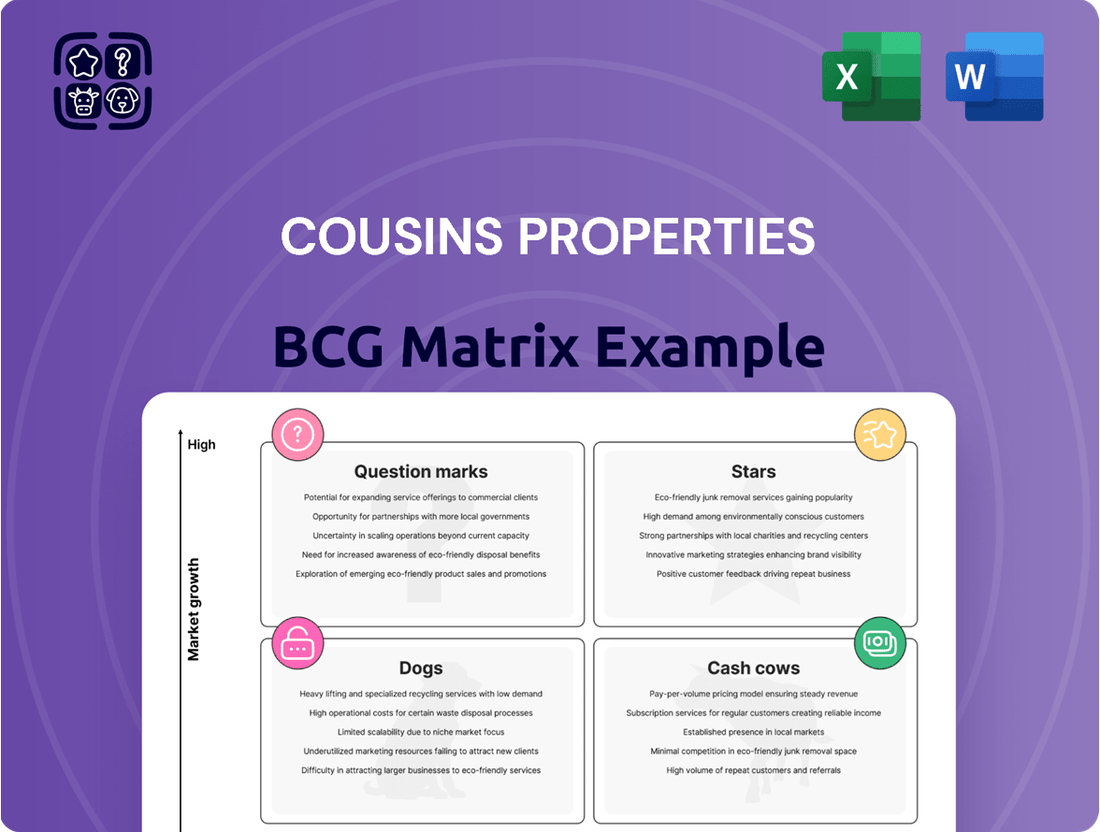

This BCG Matrix overview highlights Cousins Properties' portfolio, categorizing units as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Clear visualization of Cousins Properties' business units, identifying Stars, Cash Cows, Question Marks, and Dogs, to guide strategic resource allocation and alleviate portfolio management headaches.

Cash Cows

Mature, highly-occupied Class A office buildings represent Cousins Properties' Cash Cows. These assets are the bedrock of the company's financial stability, consistently delivering robust and predictable cash flow. In the first quarter of 2025, Cousins' overall portfolio occupancy stood at an impressive 90%, a notable increase from 88.4% in the same period of 2024. This high occupancy rate in established Sun Belt submarkets underscores their strong market position and the enduring demand for premium office space.

Cousins Properties' existing, stable assets are performing exceptionally well, demonstrating consistent same-property net operating income (NOI) growth. In Q1 2025, this growth reached 2.0%, building on a strong 3.4% increase in Q4 2024.

This steady income generation, fueled by higher occupancy and increased rental revenues, clearly marks these properties as the company's cash cows. They form the bedrock of Cousins Properties' financial stability and provide essential capital for future investments.

Properties with Modest Near-Term Lease Expirations, identified as Cash Cows within Cousins Properties' portfolio, demonstrate a robust financial profile due to their stable revenue streams. Only 7.3% of annual contractual rent is set to expire in 2025, with a further 7% in 2026. This limited exposure to near-term lease rollovers is significantly lower than the broader office sector average.

This strategic advantage translates into a predictable and consistent income from existing, established tenants. The limited lease expirations minimize the capital required for property upgrades and tenant improvements, thereby preserving profitability and enhancing cash flow generation.

Reliable Dividend-Paying Assets

Cousins Properties' reliable dividend-paying assets, often categorized as cash cows within a BCG Matrix framework, demonstrate remarkable financial stability. The company's consistent declaration of a quarterly cash dividend of $0.32 per common share for Q2 2025, underpinned by an impressive 45 consecutive years of dividend payments, highlights robust and predictable earnings generation.

These core assets, primarily mature and well-established real estate holdings, reliably produce the substantial cash flow required to sustain and grow shareholder distributions. This consistent return on investment makes them indispensable cash cows for investors seeking dependable income streams.

- Consistent Dividend Payout: $0.32 per common share quarterly for Q2 2025.

- Dividend History: 45 consecutive years of dividend payments.

- Asset Stability: Mature real estate holdings generating predictable earnings.

- Investor Appeal: Vital for investors seeking reliable income.

Established Class A Assets in Key Sun Belt Hubs

Cousins Properties' established Class A assets in key Sun Belt hubs are undeniably their Cash Cows. These properties, located in prime markets like Atlanta, Austin, Charlotte, and Dallas, are the bedrock of the company's focused strategy. They command strong market positions and generate consistent, substantial cash flow with minimal need for aggressive marketing. For instance, in Q1 2024, Cousins reported a 7.4% same-store net operating income growth, largely driven by these mature assets.

- Dominant Market Presence: These Class A assets are strategically located in high-growth Sun Belt cities, ensuring strong occupancy and rental rates.

- Consistent Cash Flow Generation: Their established nature means predictable revenue streams, contributing significantly to Cousins' overall financial stability.

- Low Promotional Investment: Due to their premium branding and location, these properties require less capital for leasing and tenant acquisition compared to newer or less established assets.

- Portfolio Backbone: They represent the core of Cousins' portfolio, underpinning their financial performance and providing a stable base for growth initiatives.

Cousins Properties' Cash Cows are its mature, high-occupancy Class A office buildings in prime Sun Belt locations. These assets consistently generate robust and predictable cash flow, forming the financial bedrock of the company. Their stability is further evidenced by a strong same-property net operating income (NOI) growth of 2.0% in Q1 2025.

The limited near-term lease expirations, with only 7.3% of annual contractual rent expiring in 2025, reinforce their status as cash cows. This minimal rollover risk ensures a steady income stream and reduces the need for capital-intensive property upgrades, thereby preserving profitability.

Furthermore, Cousins Properties' commitment to shareholder returns is highlighted by its consistent quarterly dividend of $0.32 per common share for Q2 2025, a payout maintained for 45 consecutive years. This reliability underscores the strong and predictable earnings generated by these core assets.

| Metric | Q1 2025 | Q1 2024 |

| Portfolio Occupancy | 90.0% | 88.4% |

| Same-Property NOI Growth | 2.0% | 7.4% |

| Annual Contractual Rent Expiring 2025 | 7.3% | |

| Quarterly Dividend | $0.32 | $0.32 |

| Consecutive Dividend Years | 45 | 44 |

Delivered as Shown

Cousins Properties BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive immediately after purchase. This comprehensive report, meticulously crafted for strategic insight into Cousins Properties' portfolio, contains no watermarks or sample data, ensuring you get a fully functional and professional analysis tool.

Dogs

Older vintage assets with limited amenities in Cousins Properties' portfolio are likely positioned as Dogs in the BCG Matrix. These properties, especially those in single-use office districts and lacking modern features, struggle to attract tenants in today's competitive market. Their low growth prospects and limited market share make them misaligned with Cousins' strategic focus on premium lifestyle office assets.

Cousins Properties strategically divested approximately $1.2 billion in older assets during the COVID-19 pandemic. This move aligns with shedding underperforming properties, often categorized as Dogs in a BCG Matrix analysis, to streamline their portfolio.

These divested properties likely represented assets with low market share and limited growth prospects. By recycling capital from these Dogs, Cousins aimed to optimize their real estate holdings and reallocate resources to more promising, higher-growth opportunities within their portfolio.

Properties with inherent, unfixable flaws like low ceilings or small windows, making redevelopment economically unviable, are considered Dogs in Cousins Properties' BCG Matrix. These assets struggle to attract contemporary tenants demanding modern, high-quality workspaces.

Such properties typically yield low returns and consume resources without significant potential for improvement. For instance, a 2024 market analysis might reveal that office buildings with original 1970s ceiling heights (often below 8 feet) require extensive structural work for even basic upgrades, pushing redevelopment costs far beyond achievable rental premiums.

Specific WeWork Leases Under Negotiation

Cousins Properties is actively engaged in negotiations with WeWork regarding specific lease agreements. These discussions aim to potentially reduce the amount of space WeWork occupies or even terminate leases at three distinct locations. This situation highlights a segment of Cousins Properties' portfolio that carries both significant risk and potentially low returns.

- WeWork Lease Modifications: Cousins Properties is in talks with WeWork to adjust lease terms, which could involve downsizing space or exiting certain agreements.

- Portfolio Risk Assessment: The instability associated with a struggling co-working tenant like WeWork positions these specific leases as a high-risk, low-return component within Cousins Properties' broader real estate holdings.

- Potential Vacancy Impact: The possibility of reduced occupancy or outright vacancies stemming from these negotiations introduces uncertainty and potential financial strain for Cousins Properties.

Non-Core Assets from Pre-Sun Belt Strategy

Non-core assets from Cousins Properties' pre-Sun Belt strategy, if any remained, would likely fall into the Dogs quadrant of the BCG Matrix. These would be properties outside their current focus on Sun Belt markets or those not classified as Class A. For instance, if Cousins had retained any office buildings in declining secondary markets or older, less amenitized properties, these would represent a strategic departure.

These types of assets typically exhibit low market share within their respective submarkets and possess limited growth potential due to market saturation or obsolescence. Their contribution to Cousins' overall portfolio would be minimal, potentially even a drain on resources. As of the latest available data, Cousins Properties has significantly streamlined its portfolio, divesting non-core assets to sharpen its focus on high-growth Sun Belt markets, underscoring the strategic shift away from such Dog-like holdings.

- Low Market Share: Properties in non-strategic geographic areas or of lower quality would struggle to capture significant tenant demand.

- Limited Growth Potential: These assets would face headwinds in appreciation and rental income growth compared to prime Sun Belt locations.

- Resource Drain: Maintaining and managing these properties could divert capital and management attention from core, high-performing assets.

- Strategic Misalignment: Holding such assets would contradict Cousins' stated objective of being 100% focused on Sun Belt, Class A office properties.

Dogs in Cousins Properties' portfolio represent older, less desirable assets with minimal growth prospects. These properties, often lacking modern amenities and located in less competitive submarkets, struggle to attract and retain tenants. Cousins' strategy has involved divesting these underperforming assets to focus on higher-quality, growth-oriented properties, as seen in their significant asset sales in recent years.

The company's strategic pivot away from older, non-core assets is a clear indicator of identifying and managing its Dogs. For example, by early 2024, Cousins had largely completed its divestiture of assets outside its core Sun Belt, Class A office focus. This proactive approach aims to improve overall portfolio performance and resource allocation.

Properties with inherent physical limitations, such as outdated building systems or designs that cannot be economically updated to meet current tenant demands, are prime candidates for the Dog classification. These assets typically offer low rental yields and limited potential for capital appreciation, making them a drag on overall portfolio returns.

| Asset Type | BCG Quadrant | Cousins' Strategy | Example Characteristics | 2024 Market Insight |

|---|---|---|---|---|

| Older Vintage Office Buildings | Dogs | Divestiture/Strategic Exit | Limited amenities, outdated infrastructure, low ceiling heights | Struggle to command premium rents; require significant capital for modernization |

| Non-Core Geographic Holdings | Dogs | Divestiture/Strategic Exit | Outside Sun Belt, secondary markets, lower quality | Lower tenant demand and slower rent growth compared to core markets |

| Properties with Unfixable Flaws | Dogs | Divestiture/Strategic Exit | Economically unviable redevelopment potential | Low tenant appeal; may incur ongoing maintenance costs without significant return |

Question Marks

Cousins Properties' undeveloped land bank, poised for 5.1 million square feet of future development, represents a classic question mark in the BCG Matrix. These assets hold immense growth potential, particularly in high-demand Sun Belt markets, but currently contribute zero revenue and possess no market share.

The significant capital investment required to develop these parcels, coupled with execution risk, places them firmly in the question mark category. Success in transforming these undeveloped lands into revenue-generating properties could propel them into the Star quadrant, driving future growth for Cousins Properties.

Cousins Properties boasts an impressive development pipeline of 916,000 square feet. These projects are strategically located in markets experiencing robust growth and are being developed as Class A properties, signifying a commitment to high-quality assets.

However, these developments are currently in their nascent stages. This means they require substantial capital outlay without yet having secured significant market share or demonstrated substantial returns, placing them firmly in the question mark category.

The success of these projects remains uncertain, necessitating ongoing investment and careful management to navigate the early-stage risks and capitalize on their high-growth market potential.

Cousins Properties' strategic move into mezzanine loan investments, specifically acquiring newly created loans in Nashville and Charlotte in July 2024 with a total commitment of $37.0 million, positions these as potential question marks within their BCG Matrix. This opportunistic approach aims for attractive risk-adjusted returns, reflecting a diversification beyond direct property ownership.

Exploration of Emerging Sun Belt Submarkets

Emerging Sun Belt submarkets, where Cousins Properties might make initial investments, would fall under the 'Question Marks' category in the BCG Matrix. These areas represent high growth potential but are in the early stages of development, requiring substantial capital and strategic focus to gain traction.

- High Growth Potential: These submarkets are characterized by rapid population influx and economic expansion, mirroring broader Sun Belt trends. For instance, areas like Boise, Idaho, or parts of the Carolinas are experiencing significant job growth and migration, indicating nascent opportunities.

- Low Market Share: Cousins, like other investors, would be entering these markets with a relatively small presence, needing to build brand recognition and secure prime locations. This initial stage inherently means a low market share despite the promising growth trajectory.

- Capital Intensive: Establishing a foothold in these emerging markets demands significant investment in land acquisition, development, and marketing to compete effectively. The cost of entry can be substantial, reflecting the risk and potential reward.

- Strategic Importance: Identifying and investing in these submarkets early allows Cousins to shape their development and potentially capture market leadership as they mature. This proactive approach is crucial for long-term portfolio diversification and growth.

Opportunistic Structured Transactions and Joint Ventures

Cousins Properties actively seeks opportunistic structured transactions and joint ventures as a key part of its growth strategy. These ventures go beyond straightforward property purchases, aiming for higher returns through innovative deal structures and partnerships. The company's commitment to exploring these less traditional avenues reflects a dynamic approach to market engagement.

While these opportunistic deals hold the promise of significant upside, their novel structures and partnerships mean their long-term success and market share impact are still being established. This uncertainty places them in a category where potential is high, but proven performance is still developing. For instance, in the first quarter of 2024, Cousins reported progress on several development projects, some of which likely involve JV structures, contributing to their overall portfolio expansion.

- Opportunistic Deal Focus: Cousins Properties engages in structured transactions and joint ventures, moving beyond conventional acquisitions.

- High-Return Potential: These less conventional deals are pursued for their potential to yield significant returns.

- Developing Track Record: The success and market share capture of these new structures and partnerships are still in the process of being proven.

- Strategic Diversification: This approach allows Cousins to diversify its investment portfolio and explore new avenues for growth beyond traditional methods.

Cousins Properties' strategic investments in mezzanine loans, such as the $37.0 million commitment in July 2024 for loans in Nashville and Charlotte, represent question marks. These ventures offer potential for attractive risk-adjusted returns but are in early stages with unproven market share. The company's expansion into emerging Sun Belt submarkets also falls into this category, requiring significant capital and strategic focus to establish a presence.

These emerging markets offer high growth potential due to population and economic expansion, but Cousins, like other investors, starts with low market share. The capital required for land acquisition and development is substantial, making these ventures capital-intensive. However, early investment allows Cousins to shape market development and potentially achieve leadership as these areas mature.

| Asset Type | Potential | Current Status | Market Share | Capital Needs |

|---|---|---|---|---|

| Undeveloped Land Bank | 5.1M sq ft | Zero Revenue | N/A | High |

| Development Pipeline | 916k sq ft | Nascent Stages | Low | Substantial |

| Mezzanine Loans | Attractive Returns | New Investments | Developing | Significant |

| Emerging Submarkets | High Growth | Early Development | Low | High |

| Opportunistic Ventures | Significant Upside | Novel Structures | Developing | Variable |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from Cousins Properties' annual reports, investor presentations, and segment-specific financial disclosures to accurately assess market share and growth.