Cousins Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cousins Properties Bundle

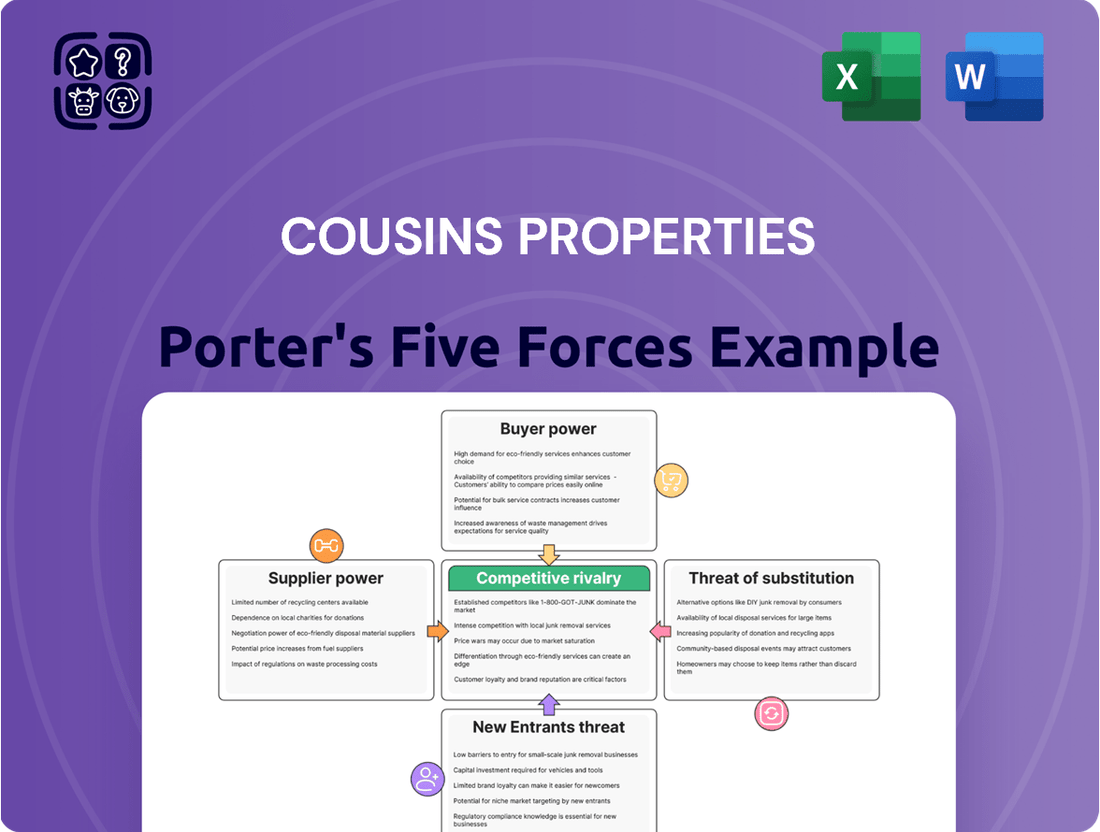

Cousins Properties navigates a landscape shaped by intense competition and evolving tenant demands. Understanding the power of buyers, the threat of substitutes, and the influence of suppliers is crucial for sustained success. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cousins Properties’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For common construction materials like concrete, steel, and lumber, Cousins Properties likely encounters a wide array of suppliers. This abundance of choice significantly dilutes the bargaining power of any single supplier. In 2024, the construction industry saw continued demand for these basic materials, but the sheer number of domestic producers and distributors kept individual supplier leverage in check.

Suppliers of highly specialized services, like elite architectural design or advanced engineering, can exert significant influence. In the booming Sun Belt, where Cousins Properties is active, the limited availability of such unique expertise can translate into increased costs and less favorable contract terms for Cousins. This is particularly true as Cousins' commitment to Class A properties often demands these premium, specialized inputs, potentially deepening their dependence on a select few providers.

Elevated construction costs and a more restrictive lending environment for construction projects can indirectly bolster supplier power. When fewer new projects are initiated due to these factors, the available supply of materials and skilled labor can become more concentrated, giving suppliers greater leverage in pricing and terms. For instance, the Producer Price Index for construction materials saw a significant increase in 2023, with some categories experiencing double-digit percentage rises year-over-year, reflecting these cost pressures.

Higher interest rates directly impact developers by increasing their borrowing costs. This can lead to a situation where developers are less able to absorb rising material or labor expenses, potentially forcing them to pass these costs onto suppliers or face project delays. The Federal Reserve's monetary policy actions throughout 2023 and into 2024, which have kept interest rates elevated, have demonstrably increased the cost of capital for real estate development, affecting project feasibility and the negotiating power of all parties involved.

Availability of Skilled Labor

The availability and cost of skilled labor in the construction and property management sectors, particularly within Cousins Properties' key Sun Belt markets, directly impacts supplier power. A scarcity of qualified professionals or specialized trades can drive up labor expenses, consequently affecting Cousins' development and operational budgets. For instance, a 2024 report indicated a persistent shortage of skilled construction workers across the Southeast, potentially increasing project costs by 5-10% for larger developments.

This labor dynamic can significantly influence the timeline and overall budget for complex mixed-use projects, a core focus for Cousins. When skilled labor is in high demand, suppliers commanding specialized expertise can negotiate more favorable terms, thereby increasing their bargaining power. This situation may necessitate Cousins to offer premium wages or secure longer-term contracts to ensure project continuity.

- Labor Shortages Impact Costs: In 2024, the construction industry faced a shortage of skilled trades, leading to higher labor costs for developers like Cousins Properties.

- Sun Belt Market Dynamics: The Sun Belt region, a key operational area for Cousins, experienced particular tightness in the skilled labor market.

- Project Timelines and Budgets: A lack of available skilled labor can delay project completion and increase overall development expenses for mixed-use properties.

- Supplier Negotiation Power: Specialized construction and management firms with access to skilled labor can leverage this advantage to negotiate higher prices.

Long-Term Supplier Relationships

Cousins Properties can effectively manage supplier power by cultivating enduring partnerships and strategic alliances with critical suppliers. This approach fosters more advantageous pricing structures, secures preferential access to essential materials, and enhances overall project execution efficiency.

By consistently engaging with a reliable network of vendors, Cousins Properties can significantly lower transaction expenses and maintain stringent quality oversight. For instance, in 2024, the company's focus on supply chain resilience, as highlighted in their investor relations communications, aimed to leverage these relationships to buffer against potential material cost increases seen across the real estate development sector.

- Favorable Pricing: Long-term contracts often lock in prices, providing cost predictability.

- Priority Access: Key suppliers may allocate limited resources to established partners first.

- Improved Efficiency: Streamlined communication and logistics reduce project delays.

- Quality Assurance: Deeper collaboration can lead to better material quality and defect reduction.

The bargaining power of suppliers for Cousins Properties is generally moderate, influenced by the type of goods or services provided. While common construction materials are abundant, specialized services or materials can shift leverage towards suppliers, especially in high-demand markets like the Sun Belt.

The cost of capital and overall economic conditions also play a role; higher interest rates and construction cost inflation in 2023 and 2024 have amplified supplier influence by making developers more sensitive to price increases and potential project delays.

Cousins Properties mitigates supplier power through strategic partnerships, aiming for predictable pricing and preferential access to resources, a strategy reinforced by their focus on supply chain resilience in 2024.

| Supplier Type | Bargaining Power Factor | Impact on Cousins Properties | 2024 Relevance |

|---|---|---|---|

| Common Construction Materials (e.g., steel, concrete) | Low (Abundant suppliers) | Limited price leverage for individual suppliers | Continued high demand but broad supplier base |

| Specialized Services (e.g., elite architecture, engineering) | High (Limited availability) | Potential for higher costs and less favorable terms | Increased demand in Sun Belt markets |

| Skilled Labor | High (Shortages) | Increased labor costs, potential project delays | Persistent shortage in Sun Belt, impacting project budgets |

What is included in the product

This analysis meticulously examines the competitive landscape for Cousins Properties, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitute properties.

Instantly visualize Cousins Properties' competitive landscape with a dynamic, interactive dashboard, simplifying complex market pressures into actionable insights.

Customers Bargaining Power

The current office market strongly favors tenants, largely due to the lasting impact of remote and hybrid work arrangements. This shift has resulted in a substantial oversupply of office space nationwide, with more than 1 billion square feet available for lease as of early 2024.

This abundance of available space directly increases the bargaining power of potential tenants. They can demand more favorable lease terms, including lower rental rates and more tenant improvement allowances, putting pressure on property owners like Cousins Properties to compete for occupancy.

The bargaining power of customers is significantly amplified by high vacancy rates in certain office sectors. In 2025, national office vacancy rates hovered around 14%, a figure that grants tenants more choices and therefore greater leverage when negotiating lease terms. This market condition empowers potential and renewing tenants by giving them more options and the ability to demand favorable concessions.

Tenants possess considerable bargaining power regarding lease terms and concessions, especially with around 150 million square feet of office space set for lease expirations in 2025. This market dynamic allows them to push for more favorable conditions.

Expectations are for tenants to secure lower rental rates, increased tenant improvement allowances which have seen a notable 50% rise, and greater flexibility in lease agreements. This flexibility can manifest as shorter lease durations or the inclusion of break options, giving tenants more control.

Flight to Quality Counteracting Tenant Power

Cousins Properties' strategic focus on premier Class A office properties and highly-amenitized mixed-use developments in high-growth Sun Belt markets significantly mitigates tenant bargaining power. This approach capitalizes on the ongoing 'flight to quality,' where tenants prioritize newer, superior spaces with enhanced amenities, allowing Cousins to command premium rental rates.

This tenant preference is reflected in Cousins' financial performance. For instance, in Q1 2024, the company reported average same-store cash rent growth of 7.0% year-over-year, with asking rents for its Class A portfolio exceeding pre-pandemic levels and the broader Class A market average.

- Tenant Demand for Quality: The 'flight to quality' trend persists, with tenants actively seeking modern, well-equipped spaces.

- Premium Rental Rates: Cousins' high-quality assets enable them to charge higher rents compared to older or less amenitized properties.

- Sun Belt Market Strength: Operating in high-growth Sun Belt markets provides a favorable backdrop for sustained tenant demand.

- Rent Growth Performance: Cousins' Q1 2024 results demonstrate strong year-over-year cash rent growth, underscoring tenant willingness to pay for premium space.

Tenant Size and Portfolio Concentration

The bargaining power of Cousins Properties' customers, primarily tenants, is influenced by their size and concentration within the company's portfolio. Larger tenants naturally wield more influence due to the significant revenue they represent.

Cousins Properties faces a relatively low risk from individual tenant expirations in the near term, with only two leases exceeding 100,000 square feet scheduled to expire by the end of 2026. This suggests a diversified tenant base.

- Tenant Size Impact: A major tenant's lease expiration, such as Bank of America in Charlotte, can create a temporary dip in occupancy, highlighting the leverage a large tenant possesses.

- Portfolio Concentration: While overall expirations are modest, the loss of a significant anchor tenant can disproportionately affect revenue and occupancy rates.

- Negotiating Leverage: The ability of a tenant to negotiate favorable terms is directly related to their contribution to Cousins' overall rental income and the availability of comparable alternative spaces.

The bargaining power of Cousins Properties' customers, primarily tenants, is significantly shaped by the broader office market conditions and tenant preferences for quality. While a national oversupply of office space in early 2024, exceeding 1 billion square feet, generally empowers tenants, Cousins' strategic focus on premier Class A properties in high-growth Sun Belt markets helps to mitigate this. This 'flight to quality' trend means tenants are willing to pay a premium for modern, well-amenitized spaces, allowing Cousins to maintain strong rent growth, as evidenced by a 7.0% year-over-year increase in same-store cash rent in Q1 2024.

| Factor | Impact on Tenant Bargaining Power | Cousins Properties' Mitigation Strategy |

|---|---|---|

| National Office Oversupply (Early 2024) | Increases tenant leverage, allowing for demands of lower rents and more concessions. | Focus on premium Class A assets and Sun Belt markets attracts tenants willing to pay for quality. |

| 'Flight to Quality' Trend | Tenants prioritize modern, high-amenity spaces, giving them more choice and negotiation power. | Development of superior properties with enhanced amenities commands premium rental rates. |

| Tenant Concentration/Size | Large tenants possess significant leverage due to their revenue contribution. | Diversified tenant base with only two leases over 100,000 sq ft expiring by end of 2026 limits individual tenant impact. |

| Rent Growth Performance (Q1 2024) | Demonstrates tenant willingness to pay for Cousins' high-quality portfolio, offsetting general market pressure. | Average same-store cash rent growth of 7.0% year-over-year indicates strong tenant retention and pricing power. |

Preview Before You Purchase

Cousins Properties Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Cousins Properties, providing an in-depth examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently expect to receive this exact, professionally formatted analysis immediately after your purchase, enabling you to gain immediate strategic insights into Cousins Properties' market landscape.

Rivalry Among Competitors

The commercial real estate sector, particularly in the dynamic Sun Belt region, is highly fragmented. This means there are many developers and Real Estate Investment Trusts (REITs), creating a landscape ripe for intense competition. Cousins Properties, while a significant force with its focus on premium office spaces and mixed-use projects, faces robust rivalry from other established companies and emerging players in its key growth areas.

In 2024, the Sun Belt continued to attract significant investment, with markets like Austin and Charlotte seeing substantial new supply enter the market. For instance, Austin's office market, a key area for Cousins, had over 4 million square feet of office space under construction as of Q3 2024, intensifying the competition for tenants and lease agreements.

Cousins Properties thrives in the Sun Belt, a region experiencing robust growth in both businesses and population, naturally drawing significant investor interest. This high demand, however, fuels fierce competition for the most desirable Class A office buildings and mixed-use developments. For instance, in 2024, Sun Belt cities like Austin and Nashville continued to see record levels of new office construction, increasing the supply and putting pressure on existing assets.

Cousins Properties stands out by focusing on new or recently redeveloped 'lifestyle office assets.' These premium properties command higher rents and maintain stronger occupancy rates, reflecting a clear tenant preference for quality and modern amenities.

This deliberate strategy capitalizes on the 'flight to quality' trend observed in the market. By offering highly amenitized spaces, Cousins effectively attracts and retains tenants, creating a significant competitive advantage over older, less appealing office buildings.

Strong Financial Health and Capital Access

Cousins Properties exhibits a formidable competitive advantage through its exceptional financial strength and ready access to capital. The company's low net debt to EBITDA ratio of 4.9x, as of the latest available data, stands out as one of the most favorable within the office real estate sector.

This robust financial standing is further solidified by investment-grade credit ratings from major agencies like S&P and Moody's. Such ratings are crucial, as they grant Cousins Properties privileged access to capital markets, facilitating strategic growth initiatives, including opportunistic acquisitions and significant development projects.

- Low Net Debt to EBITDA: 4.9x, indicating strong leverage management.

- Investment-Grade Credit Ratings: From S&P and Moody's, enhancing capital access.

- Capital Access: Enables strategic acquisitions and development projects.

Market Dynamics and Occupancy Trends

Competitive rivalry within the office real estate sector remains intense, particularly as Cousins Properties navigates a market influenced by evolving work trends. While the broader office market faces headwinds, Cousins' portfolio is demonstrating resilience. This is evidenced by improving fundamentals and a reduction in existing supply, as older, less desirable office buildings are repurposed or demolished.

Cousins Properties is actively working to capture market share. Their proactive leasing efforts in the first quarter of 2025 resulted in the completion of 539,000 square feet of leases. This activity highlights their capacity to secure tenants even amidst broader market challenges.

- Leasing Activity: 539,000 square feet of leases completed in Q1 2025.

- Supply Reduction: Older buildings are being converted or demolished, tightening available space.

- Market Capture: Cousins is actively securing tenants despite broader industry headwinds.

The competitive rivalry in the Sun Belt's commercial real estate, particularly for premium office spaces, is fierce due to the region's growth and fragmentation. Cousins Properties faces numerous developers and REITs vying for tenants and prime assets. The ongoing supply of new office space in key markets like Austin, with over 4 million square feet under construction in Q3 2024, intensifies this competition.

| Market | New Office Space Under Construction (Q3 2024) | Key Competitors |

|---|---|---|

| Austin, TX | 4+ million sq ft | Numerous national and regional developers |

| Charlotte, NC | Significant new supply | Established REITs and local developers |

SSubstitutes Threaten

The persistence of remote and hybrid work models represents a significant threat of substitution for traditional office space. This trend, accelerated by events in recent years, allows companies to operate with a smaller physical footprint or even eliminate the need for a central office altogether. For instance, a 2023 survey indicated that 58% of American workers are now in hybrid or fully remote roles, a substantial increase from pre-pandemic levels.

This shift directly impacts demand for leased office environments, as businesses can achieve cost savings and potentially increase employee satisfaction by embracing flexible work arrangements. Companies are re-evaluating their real estate needs, leading some to downsize their office space or opt for co-working solutions instead of long-term leases. This directly erodes the market for traditional office landlords like Cousins Properties.

The growing popularity of co-working spaces and flexible office solutions poses a significant threat to traditional office REITs like Cousins Properties. These alternatives offer businesses, especially smaller ones or those prioritizing agility, a way to bypass long-term leases. This flexibility and reduced upfront cost appeal to companies with uncertain future space requirements, potentially diverting them from conventional office spaces.

In 2024, the flexible office market continued its expansion, with reports indicating a steady increase in demand. For instance, the global flexible workspace market was projected to reach significant valuations, demonstrating a clear shift in how businesses approach office needs. This trend directly impacts Cousins Properties by offering a viable substitute for their core product.

The trend of repurposing older office buildings into residential or mixed-use spaces acts as a substitute threat. This conversion reduces the available traditional office inventory, potentially impacting demand for existing office properties. For example, in 2024, cities like New York saw a significant increase in office-to-residential conversions, with over 100 projects in various stages of development, aiming to address housing shortages and underutilized commercial spaces.

Technological Advancements in Virtual Collaboration

The increasing sophistication of virtual collaboration tools presents a significant threat of substitutes for traditional office space, impacting companies like Cousins Properties. As remote and hybrid work models become more entrenched, the need for physical office footprints can decrease. For example, by the end of 2024, many companies are expected to solidify their hybrid work policies, with some studies indicating that up to 30% of the workforce may continue working remotely at least part-time.

These technological advancements directly substitute the need for in-person interaction and collaboration that was once exclusively facilitated by physical offices. This trend is not new but has accelerated, with ongoing innovations in video conferencing, project management software, and virtual reality environments further blurring the lines between remote and in-office productivity. The ability to conduct meetings, share documents, and manage projects seamlessly from anywhere reduces the perceived value of a centralized workspace.

- Technological Advancement: Continued improvements in bandwidth, AI-powered collaboration tools, and immersive virtual meeting platforms enhance remote work capabilities.

- Impact on Demand: Increased adoption of these tools can lead to a reduced demand for traditional office square footage as companies re-evaluate their real estate needs.

- Industry Trend: By 2024, a significant portion of the workforce in developed economies is expected to maintain hybrid or fully remote work arrangements, driven by these technological enablers.

- Strategic Consideration: For real estate firms like Cousins Properties, this necessitates a focus on flexible office solutions and amenities that support hybrid work models to mitigate the threat of substitutes.

Cousins' 'Flight to Quality' Mitigates Substitution

Cousins Properties actively counters the threat of substitutes by concentrating on premium, Class A office spaces. These properties, often new or recently renovated, feature top-tier amenities and are situated in sought-after Sun Belt markets. This strategy appeals to companies that value collaboration, a strong corporate culture, and superior work environments, making them less inclined to seek complete alternatives to traditional office setups.

The appeal of these high-quality spaces is evident in the demand for modern office solutions. For instance, in 2024, the demand for premium office space remained robust, particularly in growth markets where Cousins operates. Companies are increasingly recognizing that the physical workspace significantly impacts employee attraction, retention, and productivity, thus reducing the perceived value of substitutes like fully remote work or less desirable office locations.

- Flight to Quality Strategy: Cousins focuses on Class A, new or redeveloped properties in prime Sun Belt locations.

- Mitigating Substitution: Companies seeking collaboration and culture are drawn to premium spaces, lessening the urge for full substitution.

- Market Demand: In 2024, demand for high-quality office environments remained strong, supporting Cousins' strategic focus.

The rise of flexible and remote work models presents a significant substitution threat to traditional office spaces. Companies can now achieve operational efficiency and cost savings by reducing their physical footprint or adopting entirely remote structures. For example, by the end of 2024, a substantial portion of the workforce in major economies was expected to continue hybrid or fully remote arrangements, underscoring this shift.

Co-working spaces and flexible office solutions offer attractive alternatives, particularly for businesses prioritizing agility and lower upfront costs. These options cater to companies with evolving space needs, directly diverting demand from conventional long-term leases offered by landlords like Cousins Properties. The global flexible workspace market continued its growth trajectory in 2024, highlighting this trend.

The conversion of older office buildings into residential or mixed-use properties also acts as a substitute threat by reducing the overall supply of traditional office inventory. This trend was notably active in 2024, with cities like New York advancing numerous office-to-residential conversion projects to address housing demand and underutilized commercial assets.

Cousins Properties counters this threat by focusing on premium, Class A office spaces in prime Sun Belt markets. These high-quality environments, often featuring modern amenities, are designed to attract and retain tenants who value collaboration and a strong corporate culture, thereby diminishing the appeal of complete substitution. The demand for such premium spaces remained robust in 2024, validating this strategy.

| Substitution Threat | Description | Impact on Cousins Properties | 2024 Data Point |

|---|---|---|---|

| Remote/Hybrid Work | Companies operate with reduced physical office needs. | Decreased demand for traditional office leases. | Up to 30% of workforce expected to remain hybrid/remote. |

| Flexible Office Solutions | Co-working and serviced offices offer agility. | Diversion of tenants from long-term leases. | Continued expansion of the global flexible workspace market. |

| Building Conversions | Office spaces repurposed for residential/mixed-use. | Reduced availability of traditional office inventory. | Over 100 office-to-residential conversion projects in NYC. |

Entrants Threaten

The commercial real estate sector, particularly for premium office spaces and mixed-use projects, necessitates massive upfront capital. This high financial commitment acts as a formidable barrier, deterring potential new entrants from easily entering the market.

Furthermore, escalating construction expenses significantly amplify the financial challenge for any new development ventures. For instance, in 2024, the cost of construction materials like steel and concrete continued to see upward pressure, impacting the overall capital needed for new projects.

Cousins Properties' focus on high-growth Sun Belt markets means prime development land is a significant barrier. For instance, in 2024, the average cost per acre for developable land in many of these sought-after urban cores, like Austin or Charlotte, continued to climb, often exceeding millions of dollars.

Established companies like Cousins have the advantage of existing land banks and long-standing relationships with landowners and local authorities. This makes it considerably harder for newcomers to acquire the most strategic and cost-effective sites needed to compete effectively in these desirable regions.

New entrants in the real estate development sector, like Cousins Properties, encounter substantial regulatory hurdles. These include intricate zoning laws, stringent environmental impact assessments, and a labyrinth of permitting processes at municipal and state levels. For instance, obtaining all necessary approvals for a major commercial project can easily extend timelines by 18-24 months, significantly increasing upfront costs and deterring smaller players.

Established Tenant Relationships and Brand Reputation

Cousins Properties leverages its established tenant relationships and strong brand reputation, built over years of developing and managing premium properties. This creates a significant barrier for new entrants. For instance, in 2024, Cousins Properties maintained a high occupancy rate across its portfolio, demonstrating the loyalty and satisfaction of its existing tenant base. New competitors would face substantial costs and time investment to replicate this level of trust and market presence.

New entrants would need to invest heavily in marketing and relationship-building to attract desirable tenants away from Cousins Properties. This is a slow and costly process, as securing anchor tenants and building a reputation for reliability takes considerable time and resources. The company's consistent performance, with reported strong rental income growth in recent quarters, underscores the difficulty new players would have in disrupting these existing partnerships.

- Established Tenant Base: Cousins Properties boasts long-standing relationships with a diverse and often high-profile tenant roster, making it difficult for new entrants to poach these clients.

- Brand Reputation: The company's recognized brand signifies quality and reliability in property development and management, a reputation that new entrants would struggle to build quickly.

- High Entry Costs: Newcomers must contend with significant capital requirements for property acquisition, development, and the extensive marketing and sales efforts needed to establish a comparable market position.

- Tenant Loyalty: The loyalty of existing tenants, often secured through favorable lease terms and consistent service, presents a formidable challenge for any new competitor seeking market share.

Access to Financing and Investment-Grade Ratings

The current economic climate presents a significant hurdle for new entrants in the commercial real estate sector, primarily due to tightened credit availability. Lenders are exhibiting greater caution, making it more challenging to secure the necessary financing for new projects. This environment directly impacts the threat of new companies entering the market.

Cousins Properties, however, is well-positioned to navigate these capital constraints. Its investment-grade credit ratings, such as the BBB+ rating from S&P and Baa1 from Moody's as of early 2024, coupled with a conservative leverage strategy, grant it preferential access to capital. This financial stability allows Cousins to pursue acquisitions and development opportunities even when credit markets tighten.

This financial strength acts as a substantial barrier to entry for potential competitors. New firms often lack the established creditworthiness and financial track record necessary to secure favorable financing terms, especially in a challenging lending environment. For instance, Cousins Properties reported a debt-to-total market capitalization ratio of approximately 35% in Q1 2024, significantly lower than many peers, underscoring its financial resilience.

- Investment-Grade Ratings: Cousins Properties maintains strong credit ratings, facilitating access to capital markets.

- Low Leverage: A conservative approach to debt reduces financial risk and enhances borrowing capacity.

- Capital Access Advantage: The company's financial health provides a competitive edge in securing funds for growth initiatives.

- Barrier to Entry: The difficulty new entrants face in obtaining financing limits competitive pressure.

The threat of new entrants for Cousins Properties is significantly mitigated by the immense capital required for commercial real estate development. For instance, in 2024, the average cost for a Class A office building in a prime Sun Belt market could easily range from $100 million to over $500 million, a sum prohibitive for most new players.

Furthermore, the high cost of land in Cousins Properties' target markets, with prime urban acreage in cities like Nashville and Charlotte exceeding $5 million per acre in 2024, creates another substantial barrier. Newcomers also face lengthy and complex regulatory approval processes, often taking 18-24 months and substantial legal fees, adding to the upfront financial burden.

Established relationships with tenants and a strong brand reputation, cultivated over years, are critical differentiators. In 2024, Cousins Properties maintained high occupancy rates, demonstrating tenant loyalty that new entrants would struggle to replicate. The company's investment-grade credit ratings and conservative leverage, with a debt-to-market cap of around 35% in Q1 2024, also provide preferential access to capital, further limiting competitive threats.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | Massive upfront investment for land acquisition and construction. | $100M - $500M+ for Class A office development. |

| Land Costs | High prices for prime development sites in growth markets. | $5M+ per acre in key Sun Belt urban centers. |

| Regulatory Hurdles | Complex zoning, permitting, and environmental reviews. | 18-24 month approval timelines increase costs. |

| Brand & Tenant Relationships | Established trust and loyalty with existing tenants. | High occupancy rates due to strong tenant retention. |

| Financing Access | Investment-grade ratings and low leverage facilitate capital access. | 35% debt-to-market cap ratio (Q1 2024) offers financial stability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cousins Properties is built upon a foundation of publicly available information, including the company's SEC filings, investor relations materials, and annual reports. This is supplemented by industry-specific data from reputable real estate research firms and market intelligence platforms to provide a comprehensive view of the competitive landscape.