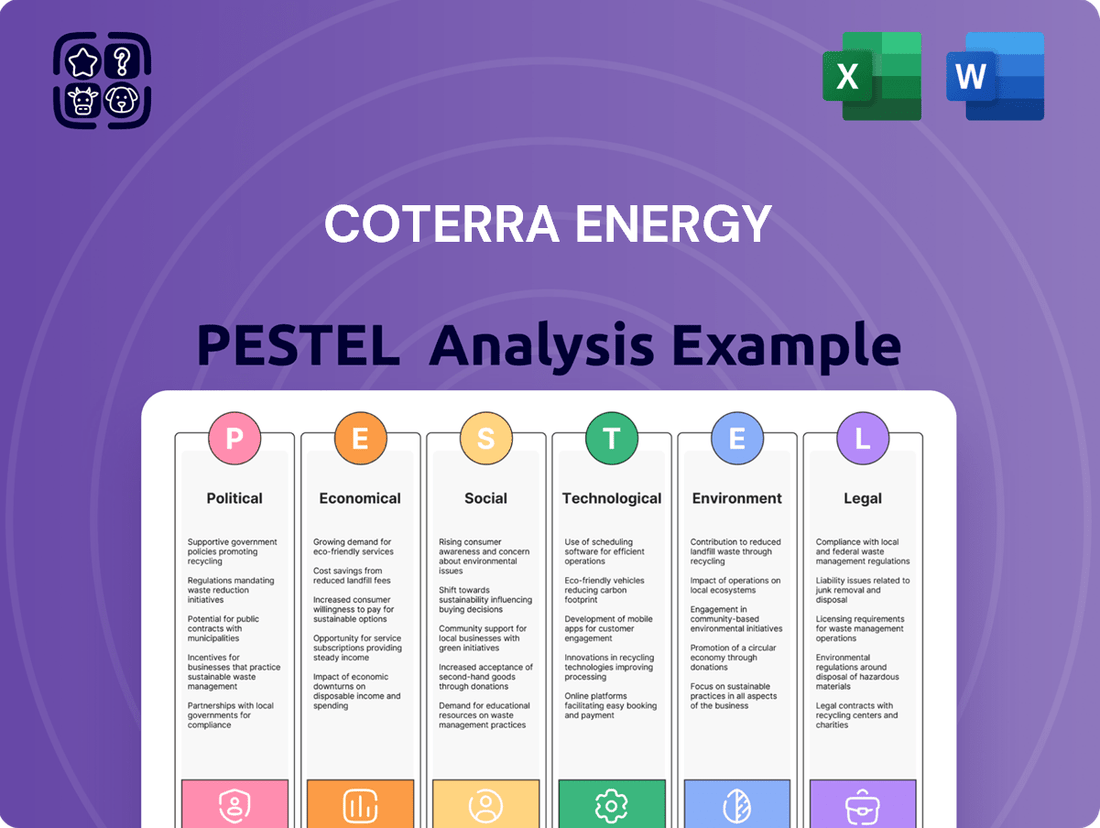

Coterra Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Navigate the complex external landscape impacting Coterra Energy with our comprehensive PESTLE analysis. Understand the political shifts, economic fluctuations, and technological advancements that will shape its future. Gain a crucial competitive advantage by leveraging these expert insights to refine your own strategic planning. Download the full PESTLE analysis now and unlock actionable intelligence.

Political factors

The current US administration is actively promoting domestic oil and gas production, with the goal of achieving greater energy independence. This policy translates into practical measures like streamlining the permitting process for new projects and speeding up the leasing of federal lands, which directly benefits companies like Coterra Energy operating in crucial areas such as the Permian Basin.

These governmental actions are designed to reduce the red tape and potential delays associated with regulatory approvals, which can lead to lower operational costs for energy producers. By fostering a more predictable and supportive regulatory environment, these policies create a more favorable landscape for companies like Coterra Energy to expand their activities and enhance their profitability.

While the drive for domestic energy production remains strong, a significant regulatory push is underway to curb methane emissions from oil and gas operations. The U.S. Environmental Protection Agency (EPA) finalized comprehensive methane regulations in March 2024, imposing requirements for advanced leak detection and repair (LDAR) programs and more stringent reporting protocols for oil and gas facilities.

These evolving regulations, such as the EPA's new methane rules, could lead to increased compliance costs for companies like Coterra Energy. While Coterra has demonstrated a commitment to reducing its methane intensity, achieving a reported 15% reduction in methane intensity from 2019 to 2023, these new mandates will likely necessitate ongoing investment in advanced monitoring technologies and operational modifications to ensure adherence.

Global geopolitical tensions significantly impact natural gas prices and supply dynamics, directly affecting Coterra Energy's profitability due to its substantial natural gas production. For instance, the ongoing conflict in Eastern Europe and subsequent sanctions have disrupted traditional energy flows, leading to price surges.

Events like the significant reduction in Russian piped gas transit to Europe in 2022 tightened global gas balances, creating considerable price volatility that Coterra must navigate. This volatility underscores the need for Coterra to maintain agile production and sales strategies to effectively mitigate risks arising from international market shifts.

State-Level Regulations and Local Opposition

State-level regulations significantly shape Coterra Energy's operations. For example, in 2024, states like Colorado have continued to refine rules around oil and gas development, including setbacks from residential areas, impacting where new wells can be drilled. This requires Coterra to carefully navigate varying state environmental standards and permitting processes.

Local opposition can also pose challenges. Community groups in areas where Coterra operates, such as parts of New Mexico, have voiced concerns about water usage and air quality. Coterra must actively engage with these local stakeholders to address concerns and maintain its social license to operate, which can influence project timelines and public perception.

- State Regulatory Variability: Coterra must adapt to diverse state environmental regulations, which can differ significantly from federal mandates, impacting operational flexibility and compliance costs.

- Local Stakeholder Engagement: Proactive engagement with local communities is crucial to mitigate opposition, address environmental concerns, and secure operational continuity, especially in regions with heightened environmental awareness.

- Potential for Delays and Legal Challenges: Failure to align with state regulations or manage local opposition can lead to project delays, increased legal expenses, and reputational damage, as seen in past instances across the industry.

Policy Uncertainty and Energy Transition Initiatives

The U.S. energy policy environment presents a dynamic interplay between supporting fossil fuels and advancing cleaner energy solutions. This creates a degree of uncertainty for companies like Coterra Energy. For instance, while the Inflation Reduction Act of 2022 extended tax credits for renewables, potential future legislative shifts in energy policy can impact long-term investment strategies and capital allocation decisions.

This policy ambiguity, particularly concerning the pace and scope of the energy transition, directly affects Coterra's strategic planning. For example, the Biden administration has set ambitious goals for emissions reduction, which may lead to stricter regulations on oil and gas operations in the future. Conversely, ongoing federal support for domestic energy production, evidenced by continued lease sales in the Gulf of Mexico, provides some stability for traditional energy sources.

- Policy Tension: U.S. policy balances fossil fuel support with renewable energy expansion.

- Renewable Incentives: Federal and state mandates continue to drive renewable energy growth.

- Investment Impact: Policy uncertainty, including tax credit changes, influences Coterra's investment decisions.

- Strategic Planning: Evolving regulations and incentives shape Coterra's long-term business strategy.

The U.S. administration's push for energy independence, including expedited permitting for oil and gas projects on federal lands, directly benefits Coterra Energy, particularly in regions like the Permian Basin. However, this supportive stance is balanced by stringent environmental regulations, such as the EPA's March 2024 methane rules, which necessitate increased investment in leak detection and repair technologies. Coterra reported a 15% reduction in methane intensity from 2019 to 2023, but these new mandates will require continued adaptation and investment to ensure compliance.

Geopolitical events, like the 2022 disruptions in Russian gas transit to Europe, create significant price volatility for natural gas, directly impacting Coterra's revenue. State-level regulations, such as Colorado's 2024 rules on well setbacks, also influence operational flexibility. Furthermore, local community concerns regarding water usage and air quality in areas like New Mexico require proactive stakeholder engagement to maintain operational continuity and social license.

| Policy Area | Impact on Coterra Energy | Key Developments (2024/2025) |

|---|---|---|

| Domestic Production Support | Facilitates expansion, reduces permitting hurdles. | Continued leasing of federal lands, streamlined permitting processes. |

| Methane Emissions Regulation | Increases compliance costs, requires technology investment. | EPA's finalized methane rules (March 2024) mandate advanced LDAR programs. |

| Geopolitical Tensions | Creates price volatility for natural gas. | Ongoing global conflicts impact supply chains and energy prices. |

| State Regulations | Affects operational siting and environmental standards. | Refined rules on well setbacks and environmental compliance in key operating states. |

| Local Opposition | Can cause project delays and impact public perception. | Community concerns regarding water and air quality necessitate stakeholder engagement. |

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Coterra Energy, providing a comprehensive understanding of its operating landscape.

It offers actionable insights for strategic decision-making by identifying external opportunities and threats relevant to Coterra Energy's business and industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of Coterra Energy's external landscape to proactively address potential challenges.

Economic factors

Global natural gas demand hit a record high in 2024, with projections indicating further growth into 2025. This expansion is largely fueled by developing economies in Asia and a growing reliance on natural gas for power generation. Coterra Energy's output, especially from its Marcellus Shale operations, is closely tied to these demand dynamics and anticipated price movements.

Natural gas prices experienced a recovery in early 2025, but ongoing fluctuations and the interplay of supply and demand will remain critical factors for Coterra Energy's financial performance. For instance, the EIA reported that U.S. dry natural gas production averaged 99.1 billion cubic feet per day (Bcf/d) in 2024, a slight increase from 2023, underscoring the market's responsiveness to demand signals.

Coterra Energy's financial health is closely tied to commodity prices, and the company is actively adjusting its production strategy. They are increasing their focus on oil, with oil volumes expected to see a substantial jump in 2025, aiming to broaden their revenue sources.

This shift means Coterra is more exposed to the ups and downs of crude oil prices. Global supply and demand, which can change rapidly, directly influence these prices. For instance, if oil prices surge, Coterra's revenue could climb, but a sharp decline could negatively affect their earnings and how they decide to spend their capital.

Coterra Energy's 2025 capital expenditure plan prioritizes efficiency and strategic growth in key areas like the Permian Basin. This disciplined approach is designed to foster consistent, profitable expansion and robust free cash flow generation.

The company intends to return a substantial portion of its generated cash flow to shareholders, underscoring a commitment to shareholder value. This strategic capital allocation is vital for ensuring Coterra's ongoing financial stability and bolstering investor trust.

Cost Efficiencies and Operational Optimization

Coterra Energy is actively pursuing cost efficiencies and operational optimization. The company's disciplined capital investment strategy for 2024 reflects this focus, aiming to enhance productivity and financial returns.

For 2025, Coterra plans to further reduce Permian drilling and completion costs. This is crucial for maximizing output and profitability amidst volatile commodity prices.

Key initiatives include:

- Implementing advanced drilling techniques to boost efficiency.

- Adopting new technologies to lower operational expenditures.

- Targeting a reduction in Permian Basin well costs in 2025.

Inflationary Pressures and Supply Chain Dynamics

Inflationary pressures continue to affect operational costs for energy companies like Coterra. While there have been some easing in certain service costs, the broader economic environment means that labor, equipment, and specialized services can still see significant price increases. For instance, the U.S. Producer Price Index (PPI) for intermediate goods, a proxy for input costs, saw a notable rise in early 2024, impacting the energy sector's cost base.

Supply chain dynamics remain a critical factor for Coterra Energy. Persistent disruptions, even if localized, can lead to delays in equipment delivery and increased freight costs, directly impacting capital expenditure efficiency. For example, the availability of specialized drilling components or transportation logistics can fluctuate, requiring careful management to avoid project overruns and maintain projected operating margins.

- Inflationary Impact: Rising costs for labor and materials can directly squeeze Coterra's profitability.

- Supply Chain Vulnerability: Delays in equipment and services can hinder capital expenditure efficiency.

- Input Price Volatility: Fluctuations in the cost of essential inputs directly affect overall operating margins.

- Cost Management Necessity: Proactive monitoring and management of these external cost factors are crucial for sustained financial performance.

The economic landscape in 2024 and 2025 presents a mixed bag for Coterra Energy. While global natural gas demand is robust, reaching record levels in 2024 and projected to grow into 2025, natural gas prices have seen some volatility. Coterra's strategic shift towards oil production in 2025 aims to diversify revenue streams and capitalize on potential oil price upticks, though this also increases exposure to crude oil market fluctuations.

Inflationary pressures continue to be a significant concern, with rising costs for labor, equipment, and specialized services impacting operational expenditures. For instance, the U.S. Producer Price Index (PPI) for intermediate goods showed upward trends in early 2024, directly affecting the energy sector's input costs. Furthermore, supply chain disruptions, even if localized, can lead to equipment delivery delays and increased freight costs, thereby impacting capital expenditure efficiency and overall operating margins.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Coterra |

|---|---|---|---|

| Global Natural Gas Demand | Record high in 2024 | Projected continued growth | Supports Coterra's gas production, especially Marcellus |

| Natural Gas Prices | Experienced recovery, but volatile | Continued price sensitivity expected | Affects revenue and profitability from gas assets |

| U.S. Dry Natural Gas Production | Averaged 99.1 Bcf/d in 2024 | Likely to remain high, responsive to demand | Indicates competitive market dynamics |

| Crude Oil Prices | Influenced by global supply/demand | Key driver for Coterra's increased oil focus | Directly impacts revenue from oil assets |

| Inflation (Input Costs) | Notable rise in PPI for intermediate goods (early 2024) | Continued cost pressures anticipated | Increases operational and capital expenditure costs |

| Supply Chain Disruptions | Persistent, can cause delays and cost increases | Ongoing risk for equipment and services | Hinders capital expenditure efficiency, impacts margins |

Same Document Delivered

Coterra Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coterra Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into market dynamics and strategic positioning.

Sociological factors

Public sentiment regarding hydraulic fracturing, or fracking, is deeply split. Concerns frequently center on potential environmental consequences, such as the contamination of water sources and the triggering of seismic events. For instance, a 2023 Gallup poll found that 50% of Americans supported increased domestic oil and natural gas production, a trend that often benefits fracking operations, yet a significant portion remains wary of the associated environmental risks.

Despite these persistent worries, evolving energy security needs have led to a noticeable shift in public opinion in some areas. While polls suggest a growing acceptance of fracking as a means to bolster energy independence, apprehension about the safety and ecological footprint of the process continues to be a significant factor. Coterra Energy's extensive operations, particularly within the Marcellus Shale region, are directly impacted by these fluctuating public perceptions, influencing their social license to operate and their engagement with local communities.

Coterra Energy's operations, particularly in major shale plays like the Permian Basin and Marcellus Shale, necessitate close engagement with local communities. These interactions are vital as concerns regarding land use, increased traffic from heavy equipment, noise pollution, and potential environmental or health impacts from drilling and hydraulic fracturing can spark local opposition. For instance, in 2023, community groups in Pennsylvania raised concerns about water quality and seismic activity potentially linked to unconventional drilling, highlighting the need for proactive dialogue. Maintaining positive community relations through transparent communication and demonstrating a commitment to responsible development is therefore paramount to mitigating reputational damage and operational disruptions.

The oil and gas sector is experiencing a significant generational transition. As a large portion of the experienced workforce nears retirement, companies like Coterra Energy must actively recruit and retain a younger, digitally adept talent pool. This shift presents a critical challenge in addressing potential talent shortages, especially for specialized roles requiring both traditional skilled trades and proficiency in emerging digital technologies.

Coterra Energy's ability to attract and retain talent will be crucial for its future success. The industry's aging workforce means a wealth of institutional knowledge is at risk of being lost. To counter this, substantial investment in comprehensive training programs, effective knowledge transfer initiatives, and a willingness to adapt to the evolving expectations of the modern workforce are paramount for ensuring operational continuity and maintaining efficiency.

Health and Safety Standards for Employees and Communities

Coterra Energy places a strong emphasis on maintaining robust health and safety standards, not only for its workforce but also for the communities in which it operates. This commitment is a cornerstone of its operational philosophy, aiming to minimize risks and foster a secure environment. The company's dedication to continuous improvement in environmental, health, and safety (EH&S) performance is regularly detailed in its sustainability reports, showcasing its proactive approach.

Adherence to stringent safety protocols and transparent reporting of any incidents are vital for Coterra Energy. This transparency builds trust with the public, enhances the company's reputation, and importantly, mitigates potential liabilities that could arise from safety breaches. For instance, in 2023, Coterra reported a Total Recordable Incident Rate (TRIR) of 0.30, significantly below the industry average, underscoring their safety focus.

The company's investment in advanced safety technologies and comprehensive employee training programs directly supports these high standards. These efforts are designed to prevent accidents and ensure that all operations are conducted with the utmost regard for human well-being and environmental protection. Coterra's 2024 EH&S targets include a further 5% reduction in lost-time incidents.

- Employee Safety: Coterra's commitment to a zero-incident workplace is reinforced through rigorous training and safety procedures.

- Community Health: Minimizing operational impact on surrounding communities is a key priority, reflected in environmental stewardship.

- EH&S Performance: The company actively tracks and reports on its EH&S metrics, demonstrating a commitment to transparency and improvement.

- Incident Reporting: Transparent reporting of safety incidents helps build public trust and informs future safety enhancements.

ESG Expectations from Investors and Stakeholders

Investors and stakeholders are increasingly scrutinizing companies on their Environmental, Social, and Governance (ESG) performance. Coterra Energy, like its peers, faces pressure to demonstrate robust sustainability practices. This includes tangible efforts in emission reduction and responsible water management, which are critical for maintaining social license and attracting capital.

Coterra's commitment to transparency in its sustainability reporting is a key element in meeting these expectations. For instance, the company has outlined goals to reduce Scope 1 and Scope 2 greenhouse gas emissions intensity. Strong ESG metrics are becoming a significant factor in investment decisions, influencing capital allocation and company valuations.

- Emission Reduction Goals: Coterra aims to reduce its greenhouse gas emissions intensity, a key metric for environmental performance.

- Water Stewardship: The company focuses on responsible water management, particularly in its operational areas, reflecting social and environmental considerations.

- Investor Confidence: Positive ESG performance is directly linked to enhanced investor confidence and can lead to a lower cost of capital.

- Reputational Impact: Strong ESG credentials bolster Coterra's reputation, making it more attractive to a wider range of investors and partners.

Public perception of fracking remains divided, with significant concerns about water contamination and seismic activity persisting. While a 2023 Gallup poll indicated 50% of Americans favored increased domestic oil and gas production, a substantial segment still harbors reservations about the environmental risks. This duality means Coterra Energy must navigate a landscape where public support for energy production coexists with deep-seated environmental anxieties.

Community engagement is crucial for Coterra's operations, particularly in areas like the Permian Basin and Marcellus Shale. Local opposition can arise from issues such as land use, noise, traffic, and potential health impacts, as seen with community groups in Pennsylvania raising water quality concerns in 2023. Maintaining transparent communication and demonstrating responsible development practices are therefore essential for Coterra to secure its social license to operate and avoid disruptions.

The energy sector faces a generational shift, with many experienced workers nearing retirement, creating a need for Coterra Energy to attract and retain a younger, digitally skilled workforce. This transition poses a challenge for filling specialized roles that require both traditional trades and new technological proficiencies, potentially leading to talent shortages.

Coterra Energy's commitment to health and safety is a core operational tenet, extending to both its employees and the communities it serves. The company's 2023 Total Recordable Incident Rate (TRIR) of 0.30, well below the industry average, highlights this dedication. Furthermore, Coterra has set 2024 EH&S targets, aiming for a further 5% reduction in lost-time incidents, underscoring a continuous improvement approach.

Technological factors

Technological advancements, like extended-reach laterals and improved hydraulic fracturing, are now standard in shale drilling, boosting output and lowering costs. These innovations allow companies to extract more from existing wells.

Coterra Energy can utilize these advancements, such as simultaneous fracturing and electric pumps, to optimize production from its key basins, including the Marcellus, Permian, and Anadarko. This strategy also presents an opportunity to tap into previously inaccessible reserves in older fields.

The shale industry is undergoing a significant shift driven by digital advancements, including real-time data analytics and artificial intelligence (AI). These technologies are crucial for optimizing production processes and predicting equipment maintenance, thereby minimizing operational disruptions. Coterra Energy can leverage these digital solutions to boost efficiency and improve strategic decision-making across its varied operations.

New technologies for detecting and reducing methane emissions are becoming increasingly vital for Coterra Energy. These advancements are crucial for meeting evolving environmental regulations, such as those proposed by the EPA, and for enhancing the company's overall environmental stewardship. For instance, investments in advanced monitoring equipment can pinpoint emission sources with greater accuracy.

Implementing emission reduction solutions, like tankless facility designs and centralized emergency flares, directly addresses the need to lower Coterra's environmental footprint. These technologies not only help the company comply with stricter standards but also demonstrate a commitment to operational efficiency and sustainability. For example, the U.S. government has set ambitious goals to cut methane emissions by 30-35% below 2020 levels by 2030.

Water Management and Recycling Innovations

Coterra Energy, like many in the oil and gas sector, faces significant water management challenges, especially with hydraulic fracturing operations. Innovations in water recycling and efficient disposal are therefore crucial for sustainability and cost-effectiveness. For instance, advancements in treating produced water, which is water brought to the surface during oil and gas extraction, allow for higher reuse rates in future fracking operations. This directly impacts Coterra's environmental footprint and operational expenses.

The drive for better water management is underscored by industry trends and regulatory pressures. In 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize responsible water practices. Companies are increasingly investing in technologies that can treat and reuse produced water, aiming to reduce reliance on freshwater sources. This focus on water recycling can lead to substantial cost savings by decreasing the need for fresh water acquisition and minimizing the volume of wastewater requiring disposal.

- Reduced Freshwater Dependence: Technologies enabling higher rates of produced water recycling directly decrease Coterra's demand for freshwater, a critical resource.

- Lower Disposal Costs: Efficient recycling and treatment methods can significantly cut down on the expenses associated with disposing of wastewater.

- Environmental Stewardship: Innovations in water management align with growing public and regulatory expectations for minimizing the environmental impact of energy production.

- Operational Efficiency: By optimizing water usage and treatment, Coterra can streamline operations and potentially improve overall project economics.

Carbon Capture, Utilization, and Storage (CCUS)

While Coterra Energy may not have CCUS as a central pillar currently, the accelerating industry shift towards emission reduction makes these technologies a significant technological factor. As environmental, social, and governance (ESG) pressures intensify, embracing CCUS could unlock future opportunities for Coterra to mitigate its carbon intensity and meet evolving climate targets.

The development and adoption of CCUS technologies are gaining momentum globally, driven by both regulatory mandates and corporate sustainability goals. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion for CCUS projects, signaling strong government support for these innovations. This trend suggests that companies in the energy sector, including Coterra, will increasingly need to consider CCUS as a viable strategy for decarbonization.

- Growing CCUS Investment: Global investment in CCUS is projected to reach hundreds of billions of dollars by 2030, indicating a significant technological and financial commitment across the industry.

- Policy Support: Government incentives, like the U.S. 45Q tax credit for carbon capture, are making CCUS projects more economically feasible.

- Technological Advancements: Innovations in capture efficiency and utilization pathways are reducing the cost and increasing the viability of CCUS solutions.

- Industry Adoption: Major energy players are actively investing in and piloting CCUS projects, setting a precedent for broader adoption.

Technological advancements are reshaping Coterra Energy's operational landscape, from enhanced drilling techniques to sophisticated emission monitoring. Innovations like extended-reach laterals and improved hydraulic fracturing are now industry standards, significantly boosting output and reducing extraction costs.

Coterra can leverage digital tools, including AI and real-time data analytics, to optimize production and predict maintenance needs, minimizing disruptions. Furthermore, new technologies for detecting and reducing methane emissions are critical for meeting evolving environmental regulations, such as the EPA's proposed methane standards, and for enhancing the company's sustainability profile.

The company's focus on water management is also driven by technological progress, with advancements in water recycling and efficient disposal methods crucial for both environmental stewardship and cost-effectiveness. For instance, treating produced water for reuse in fracking operations directly impacts Coterra's environmental footprint and operational expenses.

The accelerating industry shift towards emission reduction makes Carbon Capture, Utilization, and Storage (CCUS) a significant technological factor. As ESG pressures intensify, embracing CCUS could allow Coterra to mitigate its carbon intensity and meet evolving climate targets, supported by substantial global investment and policy incentives like the U.S. 45Q tax credit.

| Technological Area | Key Innovations | Impact on Coterra Energy | Industry Trend/Data Point |

| Drilling & Extraction | Extended-reach laterals, Advanced hydraulic fracturing | Increased production, Lower costs, Access to previously uneconomical reserves | Standard practice in shale drilling; improved efficiency |

| Digitalization & AI | Real-time data analytics, Predictive maintenance | Optimized production, Minimized operational disruptions, Improved decision-making | Crucial for shale industry efficiency |

| Emissions Reduction | Methane detection sensors, Advanced monitoring equipment | Compliance with EPA regulations, Enhanced environmental stewardship | U.S. goal to cut methane emissions 30-35% by 2030 |

| Water Management | Produced water recycling technologies, Efficient treatment methods | Reduced freshwater dependence, Lower disposal costs, Improved environmental performance | EPA emphasis on responsible water practices; higher reuse rates |

| Decarbonization | Carbon Capture, Utilization, and Storage (CCUS) | Potential for carbon intensity mitigation, Meeting climate targets | Global CCUS investment projected to reach hundreds of billions by 2030; U.S. 45Q tax credit |

Legal factors

Coterra Energy operates under stringent federal environmental regulations, particularly the Clean Air Act, which mandates controls on methane emissions from its oil and gas activities. These regulations are critical for managing greenhouse gas impacts.

While the Environmental Protection Agency (EPA) granted extensions for certain compliance deadlines in July 2025, the core obligations for leak detection, repair, and reporting are still in effect. This means ongoing vigilance is necessary.

Failure to comply with these environmental mandates can lead to substantial financial penalties and protracted legal disputes, underscoring the importance of continuous monitoring and strict adherence to all regulatory requirements.

Coterra Energy's operations span key shale plays like the Marcellus, Permian, and Anadarko Basins, each governed by distinct state-specific oil and gas regulations. These laws impact everything from drilling permits and production quotas to land leasing and royalty payments, necessitating tailored compliance strategies for each region.

Navigating the varied permitting processes and environmental standards across states such as Pennsylvania, Texas, Oklahoma, and New Mexico is crucial. For instance, Pennsylvania's Act 13 sets stringent environmental protection measures for unconventional gas well development, while Texas's Railroad Commission oversees a more established, though still complex, regulatory framework for oil and gas operations.

Coterra Energy's operations are heavily influenced by land use and property rights regulations, requiring careful navigation of mineral rights acquisition and surface access agreements. Failure to comply with zoning laws or resolve property disputes can lead to significant project delays and increased operational expenses.

Pipeline and Transportation Regulations

Coterra Energy operates within a stringent regulatory environment concerning the transportation of oil and natural gas. The Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) sets and enforces critical safety standards for pipeline operations across the United States. For Coterra, particularly its extensive gathering and disposal systems in Texas, compliance with these federal and state regulations is paramount. Failure to adhere can lead to significant financial penalties, operational disruptions, and severe environmental liabilities.

The legal framework dictates every aspect of pipeline management, from construction and maintenance to emergency response planning. In 2023, PHMSA continued its focus on enhancing pipeline safety, with enforcement actions and fines reflecting the seriousness of non-compliance. For instance, pipeline operators faced penalties for issues ranging from inadequate integrity management programs to unauthorized releases. Coterra's proactive approach to meeting these evolving standards directly impacts its operational integrity and its ability to avoid costly litigation and reputational damage.

- PHMSA's Oversight: Federal regulations govern pipeline safety, maintenance, and incident reporting.

- State-Level Compliance: Texas, where Coterra has significant operations, imposes its own specific environmental and safety rules for gathering and disposal systems.

- Liability Risks: Non-compliance can result in substantial fines, environmental remediation costs, and legal challenges.

- Operational Impact: Adherence to regulations is crucial for maintaining uninterrupted operations and preventing accidents.

Litigation Risks Related to Operations

Coterra Energy, like many in the energy sector, navigates potential litigation stemming from its operational activities. Concerns such as water contamination or induced seismicity, issues that have affected other companies in regions like the Marcellus Shale, represent ongoing risks. These legal challenges necessitate strong defense capabilities and comprehensive insurance to manage potential liabilities.

While Coterra highlights its commitment to responsible operations, the inherent nature of oil and gas extraction means that lawsuits remain a possibility. Proactive environmental stewardship and social impact mitigation are crucial. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations concerning wastewater discharge, impacting operational permits and potentially leading to legal scrutiny for non-compliance.

- Potential for lawsuits related to environmental impacts, such as water contamination or seismic activity.

- Need for robust legal defense and comprehensive insurance to address operational risks.

- Proactive mitigation efforts are essential to minimize environmental and social impacts and reduce litigation exposure.

Coterra Energy faces a complex web of federal and state regulations governing its exploration and production activities, particularly concerning environmental protection and operational safety. The company must continually adapt to evolving legal landscapes, including those related to methane emissions, water usage, and waste disposal, which directly impact operational costs and permitting processes.

In 2024, the legal framework surrounding hydraulic fracturing and produced water management remains a key area of focus, with states like Pennsylvania and Texas implementing updated rules that Coterra must adhere to. These regulations often require significant investment in compliance technologies and robust reporting mechanisms to avoid penalties.

The company's extensive pipeline network is subject to stringent oversight from the Pipeline and Hazardous Materials Safety Administration (PHMSA), with ongoing enforcement actions in 2023 and 2024 highlighting the critical need for meticulous pipeline integrity management and incident reporting to prevent costly fines and operational shutdowns.

Litigation risks associated with environmental impacts, such as potential water contamination or induced seismicity, persist, necessitating proactive mitigation strategies and comprehensive insurance coverage. Coterra's commitment to operational best practices and community engagement is vital in minimizing legal exposure and maintaining its social license to operate.

Environmental factors

Coterra Energy, like other energy producers, is under intense pressure to address its greenhouse gas (GHG) emissions, specifically methane and carbon dioxide. The company has made strides, reporting a notable decrease in its Scope 1 GHG emission intensity and methane intensity in recent years, with ongoing targets for continued reduction. These efforts are vital for meeting evolving climate change regulations and satisfying investor demands for environmental responsibility.

Hydraulic fracturing, a core technique for Coterra Energy, is inherently water-intensive, placing water resource management as a significant environmental consideration. The company's operations, particularly in areas facing water scarcity, demand meticulous strategies for sourcing water responsibly, optimizing its usage, and managing the disposal or recycling of produced water effectively.

For instance, in 2023, Coterra reported utilizing approximately 20.5 million barrels of water across its operations, with a substantial portion allocated to hydraulic fracturing. Addressing community and regulatory concerns regarding water quality and quantity requires Coterra to implement advanced water management plans, including investments in water recycling technologies which saw a 15% increase in usage in 2023 compared to the previous year.

Coterra Energy's operations, particularly in large unconventional plays like the Permian Basin and the Anadarko Basin, inherently require substantial land use. The construction of well pads, access roads, and extensive pipeline networks leads to direct physical disturbance of the land. This can result in habitat fragmentation, impacting biodiversity and local ecosystems. For instance, in 2023, Coterra reported managing thousands of acres across its operating regions, each requiring careful land management and reclamation planning.

Waste Management and Spill Prevention

Coterra Energy, like all energy producers, faces significant environmental considerations regarding waste management. The company generates various waste streams, such as drilling fluids and produced water, which demand rigorous handling to prevent contamination. For instance, in 2023, Coterra reported managing millions of barrels of produced water, underscoring the scale of this challenge.

Effective waste disposal and spill prevention are paramount for Coterra's environmental stewardship and adherence to regulations. The company's commitment to minimizing operational footprints, including the elimination of oil and water spills, is a key aspect of its sustainability strategy. This focus is critical as environmental agencies increasingly scrutinize waste handling practices.

- Waste Stream Management: Coterra handles drilling fluids, cuttings, and produced water, all requiring specialized disposal methods to prevent soil and water contamination.

- Spill Prevention and Response: Proactive measures, including robust containment systems and rapid response plans, are vital to mitigate the impact of any potential spills.

- Regulatory Compliance: Adherence to strict environmental regulations regarding waste disposal and spill reporting is essential for maintaining operational licenses and public trust.

- Water Management: The efficient and safe management of produced water, often through recycling or deep-well injection, is a significant operational and environmental factor.

Biodiversity Protection and Ecosystem Impact

Coterra Energy operates in regions like the Marcellus Shale, Permian Basin, and Anadarko Basin, areas known for their diverse ecosystems. The company's exploration and production activities could potentially affect local wildlife habitats, endangered species, and sensitive ecological zones. For instance, in 2023, Coterra reported investing $100 million in environmental stewardship programs, which include measures aimed at protecting biodiversity in its operational areas.

To manage these potential impacts, Coterra emphasizes the importance of conducting thorough environmental impact assessments. These assessments help identify potential risks to biodiversity and inform the development of mitigation strategies. The company's commitment to minimizing adverse effects is reflected in its operational plans, which often incorporate best practices for habitat restoration and species protection.

- Marcellus Shale: Known for its temperate forests and diverse aquatic life, requiring careful management of water usage and potential habitat fragmentation.

- Permian Basin: Characterized by arid and semi-arid environments, with unique desert flora and fauna that are sensitive to land disturbance and water availability.

- Anadarko Basin: Features mixed-grass prairies and riparian areas, supporting a variety of grassland species and migratory birds.

- Mitigation efforts: Coterra's 2024 sustainability report highlights a 5% reduction in land disturbance per well pad compared to previous years, achieved through advanced drilling techniques and site planning.

Coterra Energy faces significant environmental challenges, including managing greenhouse gas emissions and water resources. The company is actively working to reduce its environmental footprint, evidenced by a reported decrease in GHG emission intensity and increased water recycling efforts in 2023.

Land use for well pads and infrastructure presents another key environmental factor, necessitating careful management to mitigate habitat fragmentation. Coterra's commitment to environmental stewardship includes investing in programs to protect biodiversity in its operating regions, with efforts to reduce land disturbance per well pad noted in 2024.

Waste management, particularly of produced water, is critical. Coterra manages millions of barrels of produced water annually, emphasizing robust spill prevention and adherence to strict disposal regulations to prevent contamination.

| Environmental Factor | 2023 Data/Action | Key Considerations |

|---|---|---|

| GHG Emissions | Decreased Scope 1 GHG emission intensity and methane intensity. | Meeting regulatory requirements and investor expectations for climate action. |

| Water Management | Used ~20.5 million barrels of water; 15% increase in water recycling usage. | Responsible sourcing, optimization, and disposal/recycling of water, especially in water-scarce areas. |

| Land Use | Managed thousands of acres; 5% reduction in land disturbance per well pad (2024 projection). | Mitigating habitat fragmentation and protecting local ecosystems. |

| Waste Management | Managed millions of barrels of produced water. | Preventing soil and water contamination through specialized disposal and spill prevention. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coterra Energy is built on a robust foundation of data from official government agencies, leading energy industry associations, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.