Coterra Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

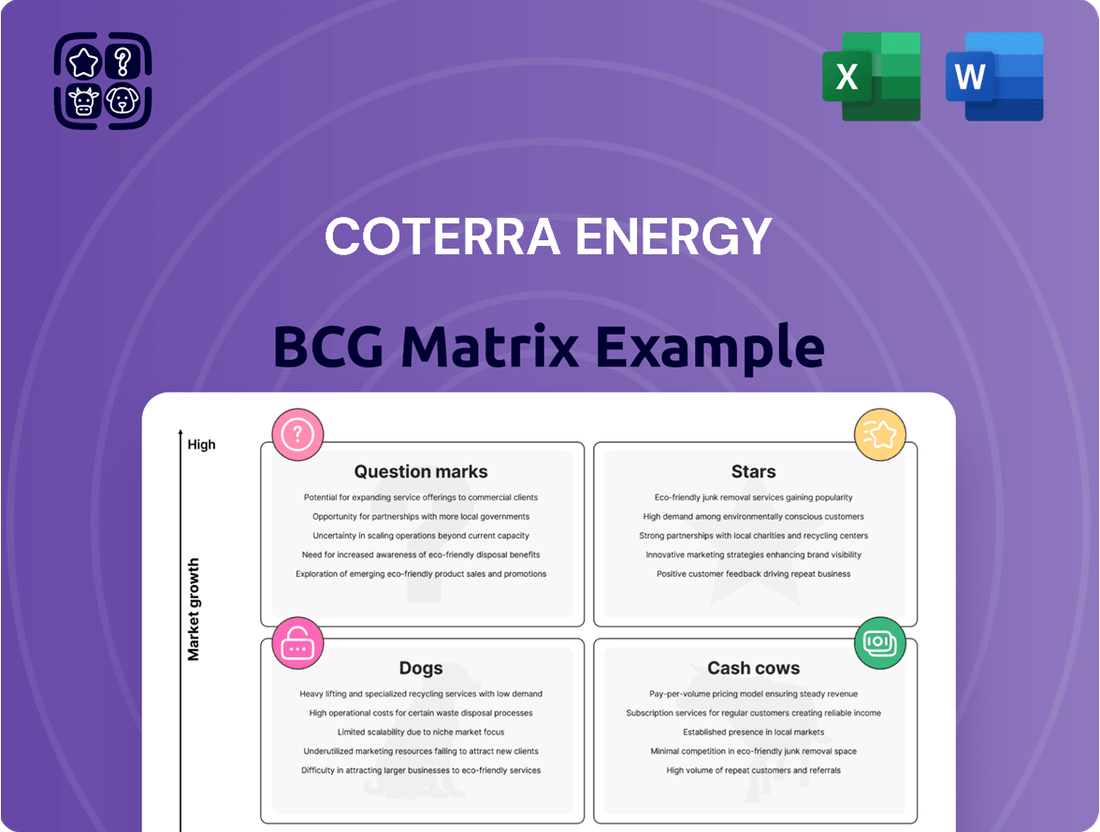

Curious about Coterra Energy's strategic positioning? Our BCG Matrix preview highlights key product categories, but the full report unlocks a deeper understanding of their market share and growth potential.

Don't miss out on the complete picture! Purchase the full Coterra Energy BCG Matrix to gain actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment and strategic decisions.

Elevate your analysis with our comprehensive BCG Matrix. Get the full report for detailed quadrant placements, expert commentary, and a clear roadmap to optimizing Coterra Energy's portfolio.

Stars

Coterra Energy's significant presence in the Permian Basin, bolstered by its approximately $3.2 billion acquisition of assets in the Northern Delaware Basin, firmly establishes oil production as a core growth engine. This strategic move underscores the company's commitment to capitalizing on the region's rich potential.

The company anticipates a substantial uplift in oil volumes by 2025, a clear indicator of its strategic intent to capture greater market share and boost production capacity within this highly productive, liquids-rich area. This focus highlights the Permian's critical role in Coterra's future revenue streams.

Coterra Energy's commitment to scaling row developments in the Permian Basin positions it as a strong contender in this high-growth oil and gas region. This strategy, focused on drilling and completing multiple wells concurrently across contiguous land parcels, is designed to significantly reduce per-foot drilling costs and boost overall hydrocarbon recovery rates. The company is leveraging this efficient method on its recently expanded acreage, aiming for a substantial increase in both market share and operational efficiency.

Coterra Energy consistently drives enhanced oil production through a sharp focus on operational efficiencies. By reducing drilling cycle times and optimizing well performance, the company effectively boosts output from its prime Permian Basin assets.

These efficiency improvements, including an anticipated reduction in well costs to $960 per foot by 2025, allow Coterra to extract more value from its high-quality resource inventory. This strategic commitment to operational excellence underpins sustained growth and solidifies its competitive standing in the oil industry.

Strategic Capital Allocation Towards Oil Growth

Coterra Energy's strategic capital allocation heavily favors oil growth, with a substantial portion of its 2025 capital expenditure budget earmarked for the Permian Basin. The company plans to invest approximately $1.57 billion in this region, signaling a strong commitment to expanding its oil production capabilities.

This focused investment strategy is designed to capitalize on Coterra's liquids-rich assets and drive significant volume increases. For 2025, Coterra projects a notable 47% year-over-year increase in oil volumes, underscoring its aggressive pursuit of market share and higher returns within the oil sector.

- Permian Basin Investment (2025): Approximately $1.57 billion.

- Projected Oil Volume Growth (2025): 47% year-over-year increase.

- Strategic Focus: Capturing high returns from liquids-rich assets.

High-Return Well Inventory in Permian

Coterra Energy is strategically focusing on its high-return well inventory in the Permian Basin. This approach involves a disciplined development strategy, concentrating on their most productive assets to boost profitability. They are capitalizing on improved service costs and the advantages gained from recent acquisitions to maximize returns from these prime drilling locations.

This strategic prioritization of top-tier Permian assets is designed to reinforce Coterra's position as a market leader. The company anticipates this focus will drive strong and consistent production growth from its key oil-producing areas.

- Permian Basin Focus Coterra is concentrating its development efforts on its most profitable well inventory in the Permian.

- Profitability Enhancement The company is leveraging lower service costs and acquisition synergies to improve the financial performance of its operations.

- Market Leadership By concentrating on these premium drilling sites, Coterra aims to strengthen its standing in the market.

- Production Growth This strategy is expected to deliver robust production increases from Coterra's core oil assets.

Stars in the BCG matrix represent Coterra Energy's most successful and rapidly growing ventures. The company's substantial investments and projected production increases in the Permian Basin, particularly after its $3.2 billion acquisition, firmly place its oil operations in this category. This strategic focus is designed to capture significant market share and drive substantial revenue growth.

Coterra's commitment to scaling row developments and improving operational efficiencies, such as reducing well costs to an anticipated $960 per foot by 2025, further solidifies its oil assets as Stars. These efforts allow for greater value extraction from high-quality resource inventory, ensuring continued expansion and profitability in its core oil-producing regions.

With a significant portion of its 2025 capital expenditure budget, approximately $1.57 billion, allocated to the Permian Basin, Coterra is aggressively pursuing a projected 47% year-over-year increase in oil volumes. This strategic allocation underscores the Permian's role as a key driver of future growth and market leadership for the company.

| Coterra Energy's Permian Basin Operations (BCG Matrix - Stars) | Key Metrics | 2025 Projections/Data |

|---|---|---|

| Strategic Focus | Capital Allocation | Permian Basin Investment: ~$1.57 billion |

| Growth Driver | Oil Volume | Projected Year-over-Year Increase: 47% |

| Operational Efficiency | Well Costs | Anticipated Reduction: ~$960 per foot |

| Acquisition Impact | Asset Base | Northern Delaware Basin Acquisition: ~$3.2 billion |

What is included in the product

Coterra Energy's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Coterra Energy's BCG Matrix offers a clear visual of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Coterra Energy's established Marcellus Shale natural gas production is a prime example of a Cash Cow in their portfolio. These long-standing operations boast a high market share in a mature sector, consistently generating substantial cash flow. In 2023, Coterra reported strong performance from its Marcellus assets, contributing significantly to its overall production volumes and profitability.

While market conditions have historically influenced activity levels, the Marcellus remains a reliable source of natural gas. The company's strategy here focuses on maintaining stable production and leveraging favorable gas price environments, rather than pursuing extensive growth investments. This approach ensures consistent returns from a proven asset base.

Coterra Energy is a prime example of a cash cow, consistently demonstrating impressive free cash flow generation. For 2025, the company is projected to bring in around $2.1 billion in free cash flow.

This substantial cash flow is a key indicator of its maturity and stability. A significant portion of this generated cash is strategically returned to shareholders through dividends and debt reduction efforts, rather than being funneled into high-risk, high-growth ventures.

The predictable and robust nature of this cash flow, which comfortably surpasses the company's reinvestment needs, firmly places Coterra Energy within the cash cow quadrant of the BCG matrix.

Coterra Energy's disciplined approach to capital reinvestment, projected to remain under 50% of its free cash flow, highlights the exceptional efficiency of its core assets. This conservative ratio suggests that its mature, high-market-share operations are generating significant surplus cash beyond what's needed for maintenance and modest expansion.

This strategy directly translates into substantial shareholder returns and a strengthened balance sheet through debt reduction. For instance, in 2023, Coterra returned approximately $1.5 billion to shareholders through dividends and share repurchases, a testament to its cash-generating prowess and disciplined capital allocation.

Stable Base Dividend Program

Coterra Energy's stable base dividend program, set at $0.22 per share quarterly, underscores its position as a cash cow. This consistent payout signifies a mature business generating substantial free cash flow that exceeds operational and reinvestment requirements.

The reliability of this dividend is a direct result of Coterra's established producing assets, which provide a steady stream of earnings. This financial stability allows the company to confidently return capital to shareholders, reinforcing its cash cow status.

- Stable Base Dividend: $0.22 per share quarterly.

- Free Cash Flow Generation: A significant portion of free cash flow is returned to shareholders.

- Asset Stability: Supported by earnings from established producing assets.

- Capital Return: Demonstrates a business with ample cash beyond operational needs.

Optimized Legacy Asset Operations

Coterra Energy's optimized legacy asset operations are a prime example of a Cash Cow in their BCG Matrix. Their unwavering focus on operational excellence and cost optimization across their mature asset base ensures sustained profitability, even when market growth is modest.

By consistently enhancing efficiency and driving down unit operating costs, Coterra effectively maximizes the cash generated from its established wells and infrastructure. This disciplined approach to managing existing assets guarantees stable and robust profit margins, a hallmark of a strong Cash Cow.

- Sustained Profitability: Coterra's mature assets generate consistent cash flow, supporting overall company financial health.

- Cost Optimization: Continuous improvements in operational efficiency reduce per-unit costs, boosting margins.

- High Profit Margins: Disciplined management of legacy assets ensures strong profitability even in less dynamic market segments.

- Cash Generation: These operations are a reliable source of cash, funding investments in other areas of the business.

Coterra Energy's Marcellus Shale operations are a textbook Cash Cow, demonstrating a high market share in a mature segment that reliably churns out significant cash. For 2023, these established assets were instrumental in Coterra's robust financial performance, contributing substantially to both production and profit.

The company's strategy here is all about maintaining steady output and capitalizing on favorable natural gas prices, rather than pursuing aggressive expansion. This focus ensures consistent returns from a proven, stable asset base, reinforcing its Cash Cow status.

Coterra Energy is projected to generate approximately $2.1 billion in free cash flow for 2025, a testament to its mature and stable operations. This substantial cash flow, which comfortably exceeds the company's reinvestment needs, is a key indicator of its Cash Cow position.

A significant portion of this generated cash is strategically returned to shareholders through dividends and debt reduction. In 2023 alone, Coterra returned around $1.5 billion to shareholders via dividends and share repurchases, highlighting its strong cash-generating capabilities and disciplined capital allocation.

| Metric | 2023 (Actual) | 2025 (Projected) |

|---|---|---|

| Free Cash Flow | ~$1.7 billion | ~$2.1 billion |

| Shareholder Returns | ~$1.5 billion | N/A (Ongoing) |

| Capital Reinvestment | <50% of FCF | <50% of FCF |

Delivered as Shown

Coterra Energy BCG Matrix

The Coterra Energy BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no alterations – just the complete, analysis-ready report for your strategic planning needs.

What you see here is the exact Coterra Energy BCG Matrix report that will be delivered to you upon completing your purchase. It's a professionally crafted document, ready for immediate download and use, ensuring you get precisely what you need for informed decision-making.

Rest assured, the preview of the Coterra Energy BCG Matrix you're viewing is the actual file you'll obtain once you buy. This ensures transparency and guarantees that you'll receive a polished, actionable report without any hidden surprises or missing elements.

Dogs

Coterra Energy's Anadarko Basin operations exhibit flexible activity, with rig counts dynamically adjusted to prevailing natural gas market conditions. This strategic approach allows for responsiveness, though it signifies a lower capital allocation priority compared to the company's Permian and Marcellus assets.

Activity in the Anadarko Basin was notably paused in late 2024 due to depressed natural gas prices, underscoring its role as a lower-priority growth area. The basin is expected to at best break even or generate minimal returns, aligning with the characteristics of a 'dog' in a BCG matrix analysis.

Coterra Energy, like many energy companies prioritizing capital discipline, would likely divest assets that are not core to its strategy or are consistently underperforming. These could include smaller, niche fields or those in low-growth basins that don't offer significant returns.

Such divestitures free up capital and management attention for more promising ventures. For instance, if Coterra were to sell off a minor oil asset in a region with declining production, the proceeds could be reinvested into its Permian Basin operations, which have shown robust growth and profitability.

While specific 2024 divestment figures for Coterra are not publicly detailed in this context, the company's stated commitment to returning capital to shareholders through buybacks and dividends implies a focus on optimizing its asset portfolio for maximum cash flow generation. This strategy inherently involves shedding less productive or non-strategic assets.

Within Coterra Energy's extensive portfolio, older wells often exhibit declining production and elevated operating costs relative to their output. These legacy assets, if not actively managed or decommissioned, can be categorized as 'dogs' in a BCG matrix framework.

Such wells represent a drain on resources, offering minimal returns and little to no growth potential. For example, while specific 2024 data for Coterra's individual well performance is proprietary, the industry trend shows that wells drilled before 2015 in many shale plays typically see significant production declines and a rise in lifting costs as they age.

Exploration Projects with Limited Economic Viability

Coterra Energy's exploration projects with limited economic viability represent ventures where initial geological assessments or evolving market conditions have rendered them unlikely to yield profitable returns. These are the areas where past or current exploratory drilling has not uncovered commercially viable reserves, or where the projected costs of extraction far outweigh the potential revenue. Such projects, if not carefully managed, can become significant drains on capital.

For instance, in the broader oil and gas industry, exploration wells that fail to find commercial quantities of hydrocarbons are common. In 2023, the success rate for exploration wells globally hovered around 30-40%, meaning a substantial portion of exploration capital is spent on projects that ultimately do not lead to production. These unsuccessful ventures tie up funds that could otherwise be invested in more promising areas or returned to shareholders.

- Deprioritized Ventures: Projects shelved due to unfavorable geological data or unpromising economic forecasts.

- Capital Consumption: These initiatives consume financial resources without contributing to future revenue streams or market expansion.

- Cash Trap Potential: If not divested or written off, they can become persistent drains on the company's liquidity.

- Risk Mitigation: Strategic divestment or write-downs are crucial to prevent these projects from becoming long-term financial burdens.

Outdated or Inefficient Ancillary Infrastructure

Aging or inefficient ancillary infrastructure supporting marginal production volumes can be a 'dog' in Coterra Energy's business. These assets often demand maintenance capital without generating substantial growth or significant cash flow, effectively becoming a drain on resources. For instance, older gathering systems or processing facilities that are not optimized for current production levels might fall into this category.

Coterra's strategic emphasis on integrating new infrastructure with its recent acquisitions, such as the Permian Basin assets acquired in 2022 for $1.1 billion, suggests a deliberate move to modernize its operational backbone. This integration implies that less efficient legacy systems are likely to be phased out or minimized in favor of more capable and cost-effective solutions. By focusing on these upgrades, Coterra aims to improve overall operational efficiency and reduce the burden of outdated infrastructure.

- Aging Infrastructure Burden: Legacy pipelines or processing units that require ongoing repairs and upgrades but contribute minimally to overall output can be classified as 'dogs'.

- Maintenance vs. Growth: These assets consume capital for upkeep without offering significant potential for expansion or increased cash generation.

- Strategic Integration: Coterra's acquisition strategy, including the 2022 Permian deal, prioritizes the integration of modern infrastructure, signaling a potential divestment or decommissioning of less efficient older systems.

- Efficiency Improvements: By replacing or upgrading outdated ancillary components, Coterra can enhance operational performance and reduce costs associated with inefficient legacy systems.

Coterra Energy's Anadarko Basin operations, characterized by fluctuating rig counts and lower capital allocation, fit the 'dog' quadrant of the BCG matrix. These assets are expected to generate minimal returns, with activity paused in late 2024 due to depressed natural gas prices.

Older wells with declining production and high operating costs also represent 'dogs'. Industry trends indicate significant production drops and increased lifting costs for wells drilled before 2015.

Unsuccessful exploration projects with limited economic viability are another example of 'dogs'. Globally, exploration well success rates were around 30-40% in 2023, meaning a substantial portion of capital is invested in non-productive ventures.

Aging or inefficient ancillary infrastructure supporting marginal production also falls into the 'dog' category, requiring maintenance without significant growth or cash flow. Coterra's strategic integration of new infrastructure, like that from the $1.1 billion Permian acquisition in 2022, suggests a move away from such legacy systems.

Question Marks

Coterra Energy's decision to restart Marcellus development in April 2025, bringing back two gas-directed rigs, positions the company for potential growth in a historically productive basin. This re-engagement signals a belief in strengthening natural gas markets and the opportunity to capture increased market share.

The full impact of this reinvestment remains a question mark, contingent on the sustained strength of natural gas prices and Coterra's ability to execute efficiently. While the company has a track record in the region, the competitive landscape and evolving market dynamics mean the ultimate return on this renewed activity is yet to be fully determined.

Coterra Energy's recent Permian acquisitions, particularly the 49,000 net acres in Lea County, New Mexico, present a significant growth opportunity, with plans for up to 550 new drilling locations. This acreage, while broadly categorized as a Star in the BCG Matrix due to its high growth potential, carries inherent uncertainties in its early development phase.

The substantial upfront capital investment required for these new locations, coupled with the need for successful operational execution, introduces a question mark regarding their immediate impact on market share and profitability. While the long-term outlook is promising, the near-term success of these early-stage developments remains a key factor to monitor.

Coterra Energy's deployment of advanced drilling and completion technologies, such as Halliburton's Octiv® Auto Frac in the Permian Basin, is a strategic move to boost efficiency and hydrocarbon recovery. This focus on innovation is critical in a dynamic energy landscape. For instance, in the first quarter of 2024, Coterra reported a 15% increase in drilled and completed wells year-over-year, partially attributed to technological advancements.

While these technologies show promise for optimizing existing operations and potentially improving well economics, their broader impact on Coterra's overall market position and competitive standing remains to be fully realized. The significant capital investment required for widespread adoption and the time needed to demonstrate sustained market share gains or the creation of entirely new competitive advantages across Coterra's diverse asset base means these initiatives are currently categorized as question marks within the BCG framework.

Strategic Flexibility to Pursue Emerging Opportunities

Coterra Energy highlights its strategic flexibility, allowing for swift capital reallocation towards high-margin natural gas opportunities when market conditions are favorable. This agility is crucial for capitalizing on emerging ventures that may start with a small market presence but possess substantial growth potential.

This adaptability positions Coterra to effectively pursue 'question mark' opportunities, which are characterized by their high potential but uncertain future success. The company’s ability to pivot resources ensures it can invest in these ventures as they mature and demonstrate profitability.

- Capital Reallocation: Coterra can shift investment towards profitable gas plays based on market signals.

- Emerging Opportunities: The company is poised to invest in ventures with high growth potential but currently low market share.

- Strategic Agility: This flexibility allows Coterra to adapt to changing commodity markets and pursue new ventures.

- Uncertainty: The ultimate success of these opportunistic investments remains a key factor for future evaluation.

Optimizing Anadarko Basin in Response to Gas Prices

Coterra Energy has strategically ramped up rig operations in the Anadarko Basin in early 2025, a direct response to the encouraging rebound in natural gas prices. This cautious recommitment of capital follows a period of reduced activity, signaling a clear intent to leverage more favorable market dynamics. The company's objective is to optimize this basin's potential, transforming it from a previously lower-tier asset into a more substantial driver of growth and market presence.

The key uncertainty, or the 'question mark,' revolves around the ultimate success of this renewed focus. Specifically, it remains to be seen how effectively Coterra can translate this increased investment into a significant expansion of its market share and overall contribution from the Anadarko Basin. This strategic pivot is closely watched for its ability to reshape the basin's importance within Coterra's portfolio.

- Increased Rig Activity: Coterra resumed drilling operations in the Anadarko Basin in early 2025, a shift from its previous pause.

- Market Condition Response: This decision is directly linked to the observed recovery and improvement in natural gas prices.

- Growth Potential Uncertainty: The primary question is whether this re-investment will elevate the Anadarko Basin's status from a secondary asset to a major growth engine for Coterra.

- Market Share Ambition: A key metric for success will be Coterra's ability to capture a larger share of the Anadarko Basin market as a result of these efforts.

Coterra's strategic flexibility allows for capital reallocation towards high-margin natural gas opportunities, enabling investment in ventures with high growth potential but currently uncertain futures. This adaptability is key to pursuing and developing these 'question mark' opportunities as they mature.

The success of Coterra's renewed Marcellus development and Permian acreage expansion, along with the impact of new technologies, are currently question marks. While promising, the ultimate market share gains and profitability from these initiatives are yet to be fully realized, making them areas of close observation for future performance.

Coterra's increased rig activity in the Anadarko Basin in early 2025, driven by improved natural gas prices, represents a significant question mark. The company aims to transform this basin into a growth driver, but its ability to translate this investment into expanded market share and substantial contributions remains to be seen.

The ultimate success of Coterra's strategic initiatives, particularly those involving new ventures and basin development, hinges on market conditions and operational execution. These factors introduce an element of uncertainty, classifying them as question marks within the BCG framework, requiring ongoing monitoring for their future impact.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Coterra Energy's financial filings, industry-specific market research, and internal operational performance metrics to accurately assess each business unit's position.