CoStar Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CoStar Group Bundle

CoStar Group, a leader in commercial real estate information, boasts significant strengths in its data and market dominance, but faces threats from evolving technology and competition. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex industry.

Want the full story behind CoStar's competitive advantages, potential vulnerabilities, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CoStar Group commands a dominant market position in commercial real estate information and analytics, largely due to its vast and proprietary database. This extensive data asset, often referred to as a 'data moat,' has been cultivated over decades through significant investment in research and data collection, creating a formidable barrier to entry for potential competitors.

The company's flagship platforms, CoStar Suite and LoopNet, consistently demonstrate robust market share and resilience. For instance, CoStar reported strong revenue growth in its 2023 fiscal year, reaching $2.4 billion, underscoring the continued demand for its services even when CRE transaction volumes experienced a downturn.

CoStar Group demonstrates exceptional financial strength, highlighted by an impressive streak of 57 consecutive quarters of double-digit revenue growth, extending through Q2 2025. This consistent performance underscores the resilience and effectiveness of its business strategy.

The company's subscription-based model is a significant advantage, with over 95% of its revenue being recurring, supported by high renewal rates. This structure ensures a stable and predictable income stream, a key indicator of financial health and operational efficiency.

Furthermore, CoStar maintains a robust balance sheet, boasting substantial cash reserves. This financial flexibility empowers the company to pursue strategic investments and opportunistic acquisitions, further solidifying its market position and driving future growth.

CoStar Group's strategic acquisitions, like the notable integration of Matterport, significantly bolster its technological capabilities. This move brought advanced 3D digital twin technology and AI-powered insights, directly enhancing user experience and creating a strong market differentiator.

These acquisitions, coupled with consistent investment in R&D, solidify CoStar's technological leadership. This strategy allows them to broaden their market penetration across diverse real estate sectors, ensuring their platforms remain at the forefront of industry innovation.

Expanding Sales Force and Engagement Model

CoStar Group is making significant strides by expanding its sales force, especially for its residential platform, Homes.com. The company aims to substantially grow its sales representatives by the close of 2025, indicating a strong commitment to market penetration.

This strategic expansion, coupled with a high-engagement approach to client interaction, is yielding impressive results. CoStar is experiencing record net new bookings and a notable increase in client touchpoints, showcasing the effectiveness of its sales and client engagement strategies.

- Sales Force Growth: Plans to significantly increase sales representatives by the end of 2025 for the residential segment.

- Enhanced Client Engagement: A high-touch model is fostering deeper client relationships and interactions.

- Record Bookings: The aggressive sales expansion is directly contributing to record net new bookings.

- Increased Client Interactions: The strategy is leading to a higher volume of client engagement, reinforcing market presence.

Diversified Portfolio and International Presence

CoStar's diversified portfolio, featuring strong platforms like Apartments.com, continues to be a major revenue contributor. In the first quarter of 2024, Apartments.com reported record net new bookings, demonstrating sustained growth. This robust domestic performance is complemented by strategic international expansion.

The company's global reach is expanding significantly, with operations established in key markets such as Canada, the UK, Spain, France, and Australia. The pending acquisition of Australia's Domain Group is a notable step, aiming to further diversify revenue streams and reduce dependence on the U.S. market. This international presence helps mitigate risks and opens up new avenues for growth.

- Apartments.com: Achieved record net new bookings in Q1 2024.

- International Expansion: Established presence in Canada, UK, Spain, France.

- Australia: Pending acquisition of Domain Group to enhance global footprint.

- Risk Mitigation: Diversification reduces reliance on the U.S. market.

CoStar's dominant market share in commercial real estate information, built on a vast, proprietary data asset, creates a significant competitive advantage. This data moat, consistently reinforced by investment, makes market entry challenging for rivals.

The company's subscription model, boasting over 95% recurring revenue with high renewal rates, ensures predictable income streams and financial stability. This resilience was evident in its 2023 fiscal year, where revenue reached $2.4 billion despite a downturn in CRE transaction volumes.

CoStar's strategic acquisitions, such as Matterport, enhance its technological capabilities, integrating advanced 3D digital twin technology and AI insights to differentiate its offerings. This commitment to innovation, coupled with a growing sales force for its residential platform, Homes.com, is driving record net new bookings and increased client engagement.

| Metric | Value | Period |

|---|---|---|

| Total Revenue | $2.4 billion | FY 2023 |

| Recurring Revenue Percentage | >95% | Ongoing |

| Consecutive Quarters of Double-Digit Revenue Growth | 57 | Through Q2 2025 |

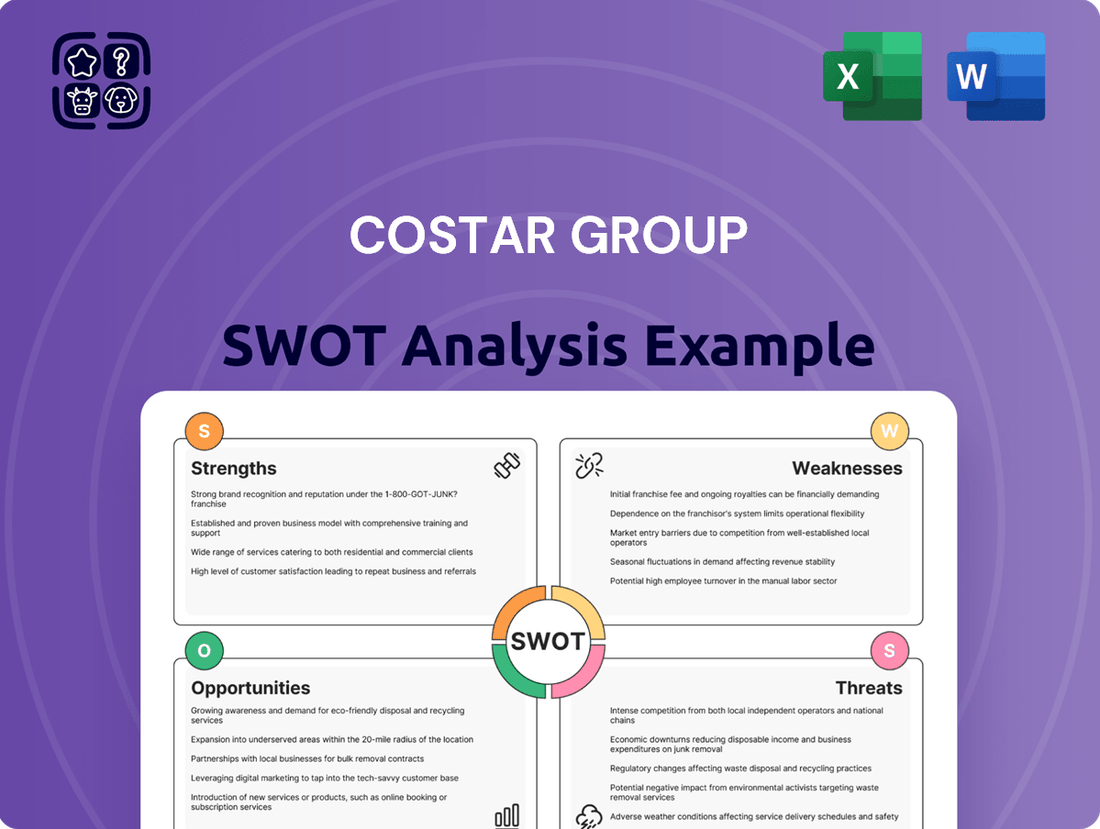

What is included in the product

Delivers a strategic overview of CoStar Group’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear, actionable framework to identify and address CoStar Group's competitive challenges and internal weaknesses.

Weaknesses

CoStar Group has faced a notable challenge in recent periods, reporting net losses in the first quarter and the first half of 2025. This is a departure from the net incomes seen in the previous year, indicating a shift in financial performance.

These losses are largely a consequence of significant escalations in operating expenses. The company has made substantial investments in key areas like selling and marketing, alongside considerable outlays for software development, which have directly impacted its overall profitability.

CoStar's stock has been trading at a premium, with some analysts pointing to a high earnings multiple. For instance, as of early 2024, CoStar's P/E ratio has often been significantly higher than many of its industry peers, reflecting high growth expectations.

This elevated valuation means that CoStar faces intense investor scrutiny. Any perceived misstep or slowdown in growth could lead to a sharp correction, as the market demands continued strong performance to justify the current share price.

For new investors, this high valuation presents a risk. They are essentially betting on CoStar's ability to not only meet but exceed already ambitious growth targets to see a positive return.

CoStar Group's aggressive acquisition strategy, exemplified by the recent Matterport deal and the pending acquisition of Domain, inherently carries integration risks. Successfully merging these diverse operations into CoStar's existing framework is crucial, and any significant delays or operational hurdles could indeed strain financial resources and complicate growth projections.

Challenges in integrating acquired companies can lead to a dilution of the company's growth narrative, as operational disruptions and unforeseen costs may overshadow the intended strategic benefits. This can create what is often referred to as operational noise, making it harder for investors to assess the true performance of the core business.

Residential Segment Challenges and Investment Intensity

While Homes.com is a strategic growth area for CoStar, it demands significant capital outlay and faces considerable headwinds. The aggressive marketing initiatives and the necessary expansion of its sales team have directly translated into higher operating expenses, consequently affecting the company's short-term profitability metrics.

For instance, CoStar Group's investment in Homes.com has been substantial. During the first quarter of 2024, the company reported that its sales and marketing expenses increased by 30% year-over-year, largely driven by the Homes.com platform. This intensified spending, while aimed at capturing market share, did create pressure on earnings per share in the immediate term.

- Increased Operating Expenses: Significant marketing and sales force expansion for Homes.com are driving up operational costs.

- Short-Term Profitability Impact: Higher expenses related to the residential segment have negatively affected CoStar's near-term profit margins.

- Competitive Landscape: The residential real estate market is highly competitive, requiring continuous investment to gain and maintain traction.

Sensitivity to Economic Cycles in Real Estate

CoStar Group's reliance on the real estate market makes it vulnerable to economic downturns. A slowdown in commercial property transactions, a key driver for CoStar's data and listing services, directly impacts revenue. For instance, during periods of economic uncertainty, like potential recessions in late 2024 or 2025, companies might scale back on new office leases or property acquisitions, reducing the need for detailed market intelligence.

This sensitivity means CoStar's financial performance can fluctuate significantly with the broader economic cycle. A contraction in the real estate sector, which has seen volatility in recent years, could lead to decreased demand for CoStar's core offerings. This was evident in periods of market cooling, where transaction volumes dropped, affecting the company's marketplace revenue streams.

- Economic Sensitivity: CoStar's revenue is closely tied to the health and activity levels within the commercial real estate market.

- Market Downturn Impact: Reduced transaction volumes and leasing activity during economic slowdowns directly decrease demand for CoStar's data and listing services.

- Cyclical Revenue: The company's financial results are subject to the inherent cyclicality of the real estate industry, potentially leading to revenue volatility.

CoStar's significant investments in growth initiatives, particularly Homes.com, have led to increased operating expenses, impacting short-term profitability. For instance, in Q1 2024, sales and marketing expenses rose 30% year-over-year, largely due to Homes.com. This aggressive spending in a competitive residential market requires continuous investment to gain traction.

The company's high stock valuation, often trading at a premium P/E ratio compared to peers as of early 2024, subjects CoStar to intense investor scrutiny. Any perceived slowdown could trigger a sharp stock correction, making it challenging for new investors to achieve positive returns without exceeding ambitious growth targets.

CoStar's reliance on the commercial real estate market makes it susceptible to economic downturns. Reduced transaction volumes and leasing activity during economic slowdowns, such as potential recessions in late 2024 or 2025, directly decrease demand for its core data and listing services, leading to revenue volatility.

The company's aggressive acquisition strategy, including the Matterport and Domain deals, introduces integration risks. Operational disruptions or unforeseen costs from merging these diverse entities could strain financial resources and dilute the growth narrative, making it harder to assess core business performance.

Preview the Actual Deliverable

CoStar Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of CoStar Group's strategic positioning.

This is a real excerpt from the complete document, showcasing the professional quality and structure you can expect. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The commercial real estate landscape is shifting, opening doors for CoStar into specialized areas like data centers, healthcare properties, and agricultural land. These sectors are experiencing significant growth, driven by technological advancements and demographic changes.

CoStar's extensive data and analytical prowess are perfectly suited to dissect and capitalize on these emerging markets. By applying its existing strengths, CoStar can effectively expand its service portfolio, moving beyond conventional office or retail spaces to offer deeper insights into these high-potential segments.

For instance, the global data center market was valued at approximately $276 billion in 2023 and is projected to reach over $500 billion by 2029, showcasing a substantial opportunity. Similarly, the healthcare real estate sector continues to expand, with demand for medical office buildings and specialized facilities remaining robust.

CoStar Group's strategic acquisition of Matterport in late 2023 for $1.6 billion, coupled with substantial ongoing investments in R&D, positions the company to deeply embed AI, computer vision, and machine learning across its offerings. This technological integration is expected to unlock more sophisticated property analytics, streamline internal operations, and accelerate the adoption of digital twin technology, thereby creating a significant competitive edge in the market.

CoStar Group's strategic expansion into key international markets, including Canada, the UK, Spain, and France, presents a substantial opportunity for continued growth. This global reach is further bolstered by the acquisition of Domain Holdings in Australia, a move that significantly broadens their footprint in a high-potential region.

By actively tapping into these new geographies, CoStar can effectively diversify its revenue streams, reducing reliance on any single market. This international penetration allows the company to capture valuable market share in regions experiencing robust economic activity and increasing demand for commercial real estate data and analytics.

Monetization of Growing User Engagement and Data

CoStar Group's platforms, including Homes.com and Apartments.com, are experiencing significant growth in user traffic. Homes.com, for instance, saw a substantial increase in unique visitors throughout 2024, indicating a robust and expanding audience. This escalating engagement presents a prime opportunity for enhanced monetization.

The company can leverage this growing user base by developing and implementing new advertising solutions tailored to these platforms. Furthermore, introducing premium features or subscription tiers for enhanced access or analytics can tap into the value generated by this engaged audience. The rich data collected from these interactions can also be packaged into valuable insights for industry professionals.

- Increased Visitor Traffic: Homes.com reported a significant surge in unique visitors in early 2024, demonstrating strong audience growth.

- Enhanced Advertising Products: Opportunity exists to create more sophisticated and targeted advertising options for real estate professionals on these platforms.

- Premium Features: Monetization can be achieved through premium listing enhancements, advanced search filters, or data analytics tools for users.

- Data Monetization: Aggregated and anonymized user data can be leveraged to provide market trend reports and insights for a fee.

Strategic Partnerships and Collaborations

CoStar Group has a significant opportunity to forge strategic partnerships with other technology providers, real estate service firms, and financial institutions. These collaborations could broaden CoStar's market penetration and allow for the seamless integration of its extensive data with complementary services, thereby enhancing its existing offerings.

By teaming up with other players in the real estate ecosystem, CoStar can develop innovative, integrated solutions that offer new value propositions to a wider client base. For instance, a partnership with a proptech firm specializing in IoT solutions could enable CoStar to offer real-time building performance data alongside its market analytics. As of early 2024, the proptech market is experiencing robust growth, with significant investment flowing into companies that enhance building efficiency and tenant experience, presenting a fertile ground for such alliances.

- Expand Reach: Partnering with established real estate service companies can provide immediate access to their existing client networks and market presence.

- Data Integration: Collaborations with financial institutions could lead to the integration of CoStar's property data with lending platforms, streamlining the mortgage and financing processes.

- New Value Propositions: Joint ventures with technology firms can create unique service bundles, such as AI-powered property valuation tools or blockchain-based transaction management systems, appealing to a broader spectrum of industry professionals.

CoStar is well-positioned to expand into specialized real estate sectors like data centers and healthcare properties, which are experiencing substantial growth. The company's robust data capabilities and recent acquisitions, such as Matterport for $1.6 billion in late 2023, enhance its ability to leverage AI and advanced analytics in these emerging markets.

The company's strategic international expansion into markets like the UK, Spain, and France, alongside the acquisition of Domain Holdings in Australia, offers significant diversification and market share capture opportunities. Furthermore, the increasing user traffic on platforms like Homes.com and Apartments.com presents a clear path for enhanced monetization through new advertising products and premium features.

CoStar can also capitalize on opportunities by forming strategic partnerships with proptech firms and financial institutions, as evidenced by the robust growth in the proptech market in early 2024. These collaborations can lead to integrated solutions and new value propositions, further solidifying CoStar's market leadership.

Threats

CoStar Group faces a growing competitive landscape in both commercial and residential real estate. Established rivals and agile newcomers are increasingly challenging CoStar's dominance, particularly in the multifamily sector where players like Zillow are deploying advanced technology and aggressive pricing. This intensified competition could pressure CoStar's market share and overall profitability as the market evolves.

CoStar Group faces significant regulatory and legal headwinds, including ongoing litigation alleging anti-competitive practices. These challenges, while not expected to halt the company's progress, introduce considerable uncertainty and could divert crucial resources. Potential outcomes range from operational restrictions to financial penalties, impacting future growth and profitability.

CoStar's reliance on the real estate market makes it vulnerable to economic downturns. A slowdown in property transactions, a key driver for CoStar's data and analytics, directly impacts revenue. For instance, during periods of economic contraction, commercial real estate transaction volumes can significantly decrease, as seen in the broader market trends observed throughout 2023 and early 2024, which have shown reduced deal activity compared to previous years.

Real estate market volatility, characterized by fluctuating property values and rental rates, also poses a threat. Sharp declines in property valuations can reduce the perceived value of market data, potentially impacting CoStar's subscription renewal rates and new customer acquisition. The ongoing adjustments in commercial real estate, particularly in sectors like office space, highlight this inherent market risk that CoStar must navigate.

Data Security and Privacy Concerns

CoStar Group's vast repository of sensitive real estate data presents a significant threat from potential data security breaches and privacy violations. A major security incident could severely damage its brand, incur substantial regulatory penalties, and undermine the trust of its subscriber base, directly impacting its recurring revenue streams. For instance, the increasing sophistication of cyberattacks in 2024 means that companies like CoStar must continually invest in advanced cybersecurity measures to safeguard their proprietary information and client data. The potential fallout from a breach could include loss of competitive advantage and significant financial remediation costs.

The financial implications of a data breach for a company like CoStar can be substantial. Regulatory bodies globally are imposing stricter data protection laws, such as GDPR and CCPA, with penalties for non-compliance reaching millions of dollars. In 2024, the average cost of a data breach for organizations globally was reported to be around $4.45 million, according to IBM's Cost of a Data Breach Report. This figure highlights the considerable financial risk CoStar faces. Furthermore, reputational damage can lead to customer churn, directly affecting its subscription revenue, which forms the backbone of its business model.

- Reputational Damage: A data breach can erode customer trust, leading to significant loss of business and market share.

- Regulatory Fines: Non-compliance with data privacy laws can result in hefty penalties, impacting profitability. For example, GDPR fines can be up to 4% of annual global revenue.

- Operational Disruption: Recovering from a breach can lead to significant downtime and operational challenges, affecting service delivery.

- Loss of Competitive Advantage: Theft of proprietary data could compromise CoStar's unique market insights and analytical capabilities.

Technological Disruption and Rapid Innovation

The real estate technology sector is a hotbed of innovation, with new solutions constantly emerging. CoStar Group faces a significant threat if it cannot keep pace with these advancements. For instance, the integration of advanced AI for property valuation and predictive analytics, or the adoption of novel data sourcing techniques, could quickly render existing CoStar offerings less competitive. In 2024, the PropTech market saw significant investment, with venture capital funding reaching billions, highlighting the rapid pace of development that CoStar must navigate.

Failure to adapt could lead to obsolescence. Imagine competitors leveraging sophisticated machine learning algorithms to provide more accurate market forecasts or utilizing drone technology for more efficient property inspections. CoStar's market position relies heavily on the perceived value and currency of its data and analytics. If newer, more agile platforms offer superior insights or user experiences powered by cutting-edge tech, CoStar could see a decline in its market share. This is particularly true as the global PropTech market is projected to reach over $50 billion by 2025, indicating a strong demand for technological evolution.

- AI-Driven Analytics: Competitors are increasingly using AI for predictive leasing, tenant screening, and investment risk assessment.

- Data Aggregation Methods: New technologies for real-time data collection from diverse sources, including IoT devices, pose a challenge to traditional data aggregation.

- User Experience (UX) Innovation: Platforms offering more intuitive interfaces and personalized insights powered by advanced technology could attract users away from established players.

The intensifying competition from both established players and nimble startups, particularly in the residential sector, presents a significant threat to CoStar's market share and profitability. Moreover, ongoing litigation alleging anti-competitive practices introduces substantial legal and financial uncertainty, potentially diverting resources and impacting future growth strategies.

SWOT Analysis Data Sources

This CoStar Group SWOT analysis is built upon a robust foundation of data, including their official financial filings, comprehensive market intelligence reports, and expert industry commentary. These sources provide a reliable basis for understanding the company's strategic position.