CoStar Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CoStar Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CoStar Group's trajectory. Our meticulously researched PESTLE analysis provides the strategic clarity you need to anticipate market shifts and identify opportunities. Don't be left behind; download the full version now for actionable intelligence to inform your decisions.

Political factors

Government policies significantly shape the real estate landscape CoStar Group operates within. Urban development plans, zoning regulations, and housing initiatives directly influence property values and market activity, creating demand for CoStar's data and analytics. For instance, in 2024, many cities are implementing policies to encourage mixed-use development, which requires granular data on retail, office, and residential spaces.

Shifts in government policy can present both opportunities and challenges for CoStar. New legislation promoting energy-efficient buildings or affordable housing, for example, could alter development priorities and necessitate updated data collection and analysis. The U.S. government's continued focus on infrastructure spending, with significant allocations in 2024, is expected to drive commercial real estate development in specific regions, impacting CoStar's market insights.

Central bank monetary policies, especially interest rate decisions, directly impact the cost of borrowing and investment in commercial real estate. Lower rates typically encourage more transactions and development, which benefits CoStar's data and analytics services. Conversely, rising rates can slow down market activity.

For instance, the Federal Reserve's benchmark interest rate remained at 5.25%-5.50% through early 2024, a level that has presented headwinds for real estate. However, projections for 2025 suggest potential rate cuts, with some economists anticipating a reduction of up to 100 basis points by the end of the year. This anticipated easing is expected to improve sentiment and activity within the commercial real estate sector.

Global geopolitical stability and shifting trade policies are significant concerns for commercial real estate. Uncertainty stemming from these issues can dampen investor confidence, disrupt vital supply chains, and ultimately slow economic growth, all of which directly impact real estate demand and valuations. For a company like CoStar Group, with operations spanning multiple countries, keeping a close eye on these geopolitical shifts is crucial for understanding cross-border investment flows and the demand for its international data and marketplace services.

Geopolitical tensions can have a profound effect on the global economy. For instance, the ongoing conflict in Eastern Europe has contributed to energy price volatility and supply chain disruptions, impacting construction costs and tenant demand in affected regions. In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a figure that could be significantly revised based on the resolution or escalation of various geopolitical flashpoints. These global economic conditions directly influence the health of the commercial real estate sector.

Data Privacy Regulations and Cybersecurity Laws

CoStar Group operates within a landscape increasingly shaped by data privacy regulations like GDPR and CCPA, alongside evolving cybersecurity laws. These frameworks directly impact how CoStar collects, stores, and utilizes the vast amounts of real estate data it manages. Failure to comply can result in significant penalties, as seen with various companies facing fines for data breaches or privacy violations in recent years.

The company's business model, which relies heavily on aggregating and analyzing extensive property and client information, makes it particularly sensitive to shifts in these legal environments. For instance, new data localization requirements or stricter consent mandates could necessitate costly adjustments to CoStar's operational infrastructure and data handling protocols. Cybersecurity remains paramount; a significant breach could not only lead to financial losses but also severely damage client trust.

In 2024, the global focus on data protection continues to intensify. Organizations are investing more heavily in cybersecurity measures, with global spending projected to reach over $200 billion by the end of the year. This trend underscores the critical need for companies like CoStar to maintain robust defenses and adapt to evolving legal requirements to safeguard their data assets and client relationships.

- Increased Compliance Burden: Evolving data privacy laws necessitate ongoing investment in legal counsel, compliance officers, and technology to ensure adherence.

- Cybersecurity Investment: Protecting sensitive client and property data requires continuous upgrades to security infrastructure and employee training, with global cybersecurity spending expected to rise.

- Data Handling Adjustments: Regulatory changes can force modifications in data collection, storage, and sharing practices, potentially impacting the scope and accessibility of CoStar's analytics.

- Reputational Risk: Non-compliance or data breaches pose a significant threat to CoStar's reputation and client confidence, impacting its market position.

Government Spending and Infrastructure Projects

Government spending on infrastructure and public sector real estate is a significant driver for commercial property markets. For instance, the US Bipartisan Infrastructure Law, enacted in 2021 with over $1 trillion allocated, continues to fund projects across the nation. These investments can spur demand for industrial spaces as companies relocate or expand due to improved logistics, and boost office and retail sectors in areas experiencing renewed development and population growth. This creates a direct need for CoStar's data to track these evolving market dynamics.

The increasing emphasis on 'onshoring' manufacturing, often bolstered by government incentives and subsidies, is particularly beneficial for the industrial real estate sector. In 2024, we anticipate continued investment in this area, with governments actively promoting domestic production to enhance supply chain resilience. This trend translates into higher demand for warehouse and manufacturing facilities, directly impacting property values and leasing activity that CoStar meticulously tracks.

- Increased Development: Government infrastructure spending often stimulates new commercial and industrial construction projects.

- Property Value Appreciation: Enhanced infrastructure and economic activity can lead to higher property values in affected regions.

- Demand for Analytics: Such investments create a greater need for market intelligence platforms like CoStar to understand and capitalize on emerging opportunities.

- Industrial Sector Growth: 'Onshoring' initiatives supported by government funding directly boost demand for manufacturing and logistics facilities.

Government policies significantly influence CoStar Group's operational environment. Urban planning, zoning laws, and housing initiatives directly impact property values and market activity, driving demand for CoStar's data. For example, many cities in 2024 are promoting mixed-use developments, requiring detailed data on various property types.

Monetary policy, particularly interest rate decisions by central banks, directly affects real estate investment. Lower rates typically boost market transactions, benefiting CoStar's services. The Federal Reserve's benchmark rate remained at 5.25%-5.50% through early 2024, creating headwinds, but potential rate cuts in 2025 could stimulate activity.

Geopolitical stability and trade policies are critical for commercial real estate. Uncertainty can reduce investor confidence and disrupt supply chains, impacting demand and valuations. CoStar's global operations necessitate close monitoring of these shifts to understand cross-border investment flows.

Data privacy regulations like GDPR and CCPA, along with cybersecurity laws, are increasingly important. These impact how CoStar handles its extensive data. Global cybersecurity spending was projected to exceed $200 billion in 2024, highlighting the need for robust data protection.

What is included in the product

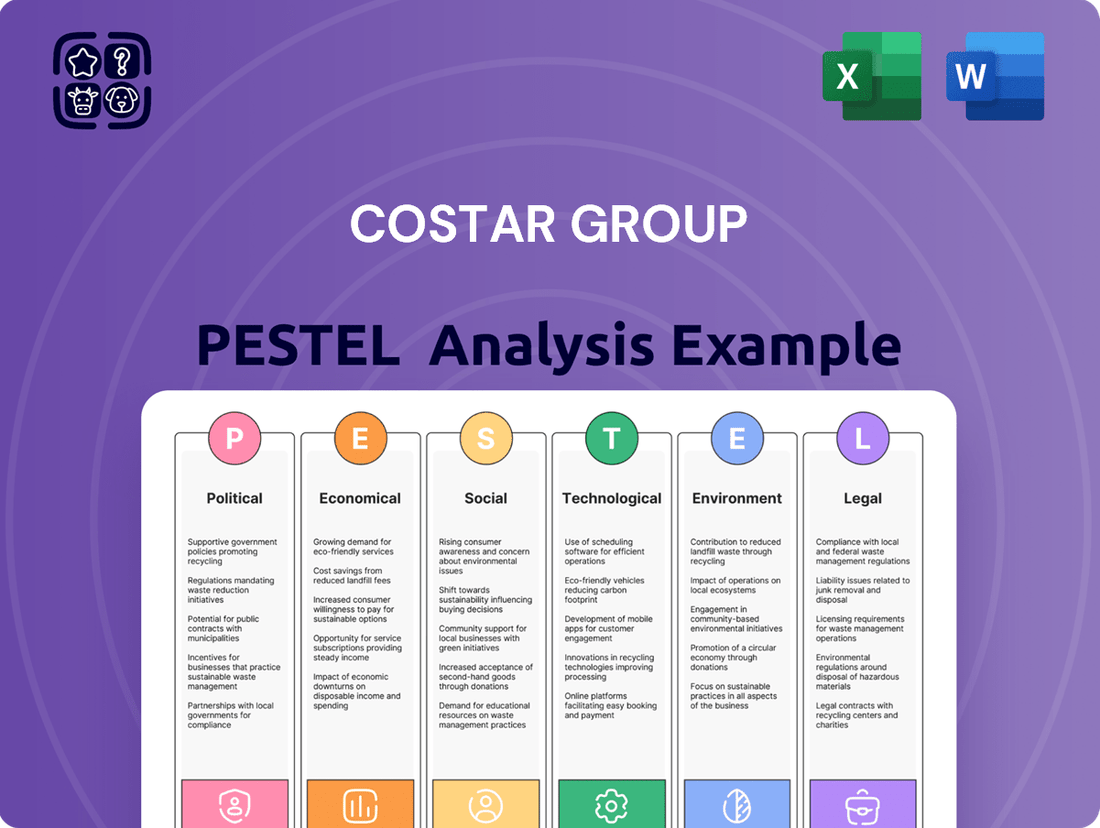

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CoStar Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these critical external forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting the real estate market.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, legal, and environmental influences relevant to CoStar's operations.

Economic factors

The commercial real estate market's health is a direct driver for CoStar Group. In 2024, property valuations continued their downward trend, a key indicator of market sentiment. However, the rate of these declines is showing signs of moderation.

Looking ahead to 2025, the outlook for commercial real estate is cautiously optimistic. Experts anticipate a potential recovery with improving conditions across various property types, which could translate to increased transaction volumes and a stabilization of vacancy rates.

Interest rates directly influence the cost of borrowing for commercial real estate investors, impacting their ability to acquire and develop properties. Lower rates generally make capital more accessible and cheaper, which is a positive for CoStar's business as it encourages more property transactions and data utilization.

For 2025, market expectations lean towards potential interest rate reductions, which could significantly boost capital availability. This anticipated easing of financial conditions is projected to enhance refinancing options for existing properties and stimulate new investment, directly benefiting CoStar's marketplace and data analytics services by increasing demand.

Inflation and economic growth are key drivers for commercial real estate. High inflation can erode purchasing power and increase operating costs for businesses, potentially dampening demand for rental space. Conversely, robust economic growth typically fuels business expansion and job creation, leading to increased demand for office, retail, and industrial properties, which in turn supports rental growth and property values.

For 2025, the outlook suggests a more positive environment with inflation expected to moderate. For instance, the US Consumer Price Index (CPI) saw a notable slowdown in its year-over-year increase through early 2025, falling below 3%. This easing inflation, coupled with the avoidance of a widespread recession, bodes well for the commercial real estate sector by stabilizing operating expenses and bolstering tenant confidence.

However, it's important to note that while recession fears have receded, economic growth is still projected to be more subdued than in previous boom cycles. For example, projected GDP growth for major economies in 2025 might hover around 2-2.5%, a healthy but not explosive rate. This slower GDP expansion means that while demand for real estate will likely remain steady, the rapid rental growth seen in peak economic periods might be tempered.

Consumer Spending and Retail Sector Performance

Consumer spending is a critical driver for the retail real estate sector, directly influencing property performance and leasing activity. Despite some dips in consumer sentiment, retail trade sales have demonstrated notable increases, showcasing the sector's underlying resilience. This resilience is vital for CoStar Group, as it underpins the demand for their data and insights concerning retail properties and leasing markets.

For instance, U.S. retail sales excluding motor vehicles and parts saw a 3.0% increase year-over-year through April 2024, according to the U.S. Census Bureau. This sustained growth suggests that consumers continue to spend, even if their confidence fluctuates, which bodes well for retailers and, by extension, the commercial real estate that houses them.

- Retail Sales Resilience: U.S. retail sales (excluding autos) grew 3.0% year-over-year as of April 2024.

- Impact on CRE: Stronger retail sales translate to higher demand for retail space, benefiting landlords and CoStar's data.

- Consumer Sentiment vs. Spending: A divergence between consumer sentiment and actual spending indicates underlying strength in the retail economy.

Supply and Demand Dynamics Across Property Types

The interplay of supply and demand is a critical driver for commercial real estate performance. For instance, in the multifamily sector, strong demand continues to support occupancy and rental rate growth, with new supply expected to moderate in 2025, potentially tightening markets further.

Conversely, the office sector grapples with elevated vacancy rates, a direct result of shifting work patterns and a surplus of available space. This imbalance is projected to see a decline in new office construction starts through 2025 as developers respond to market conditions.

The industrial sector remains a bright spot, benefiting from robust e-commerce growth and supply chain adjustments. However, even here, a slowdown in new development is anticipated for 2025 due to rising construction costs and land availability challenges, which could further fuel rental growth for existing, in-demand assets.

Key supply and demand indicators for 2024/2025 include:

- Multifamily: Vacancy rates are expected to remain low, with average rents projected to increase by 3-5% nationally in 2025.

- Industrial: Vacancy rates are anticipated to stay below 5%, with rental growth potentially exceeding 6% in key logistics hubs through 2025.

- Office: Vacancy rates could hover around 18-20% nationally, with new supply completions significantly reduced compared to previous years.

- Retail: Performance varies by subsector, but well-located, necessity-based retail is likely to see stable demand and modest rental increases.

Economic factors significantly shape the commercial real estate landscape, directly impacting CoStar Group's data and analytics business. Moderating inflation and steady, albeit slower, economic growth are key themes for 2025. While recession fears have largely subsided, the pace of recovery will influence property demand and valuations.

Consumer spending remains a crucial determinant, particularly for retail properties. Despite fluctuations in sentiment, actual retail sales have shown resilience, supporting leasing activity and property performance. This underlying strength is vital for CoStar's insights into the retail sector.

Interest rate movements are critical for investor appetite and transaction volumes. Anticipated rate reductions in 2025 could lower borrowing costs, stimulating new investment and refinancing, which in turn boosts demand for CoStar's services.

The balance of supply and demand across different property types presents varied opportunities and challenges. While multifamily and industrial sectors show strong fundamentals, the office sector continues to navigate elevated vacancies, influencing development pipelines and market dynamics.

| Economic Factor | 2024 Trend/Observation | 2025 Outlook |

| Inflation | Moderating year-over-year increases, falling below 3% in early 2025 (US CPI). | Expected to remain at lower levels, stabilizing operating costs. |

| Economic Growth (GDP) | Subdued but positive growth. | Projected 2-2.5% for major economies, supporting steady demand. |

| Consumer Spending | Resilient, with U.S. retail sales (ex-autos) up 3.0% YoY as of April 2024. | Expected to continue supporting retail real estate demand. |

| Interest Rates | Influencing borrowing costs and transaction activity. | Potential reductions anticipated, boosting capital availability and investment. |

Same Document Delivered

CoStar Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This CoStar Group PESTLE analysis provides a comprehensive overview of the external factors impacting the company's operations and strategic decisions. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape relevant to CoStar Group.

Sociological factors

Hybrid work models are fundamentally altering office space demand. CoStar Group data from late 2024 indicates that while some markets see increased vacancy, there's a strong preference for premium, amenity-rich buildings, driving a flight to quality.

This shift means companies are re-evaluating their real estate footprints, often downsizing or consolidating into more collaborative and engaging environments. CoStar's analytics provide essential insights into these evolving occupancy trends, helping businesses and investors navigate the changing landscape.

For instance, by mid-2025, CoStar's analysis projects that office vacancy rates in major metropolitan areas could remain elevated, necessitating strategic adjustments in leasing and property management to align with new work patterns.

Demographic shifts are profoundly impacting real estate demand. For instance, the U.S. population is projected to reach over 370 million by 2030, with migration patterns heavily influencing where this growth concentrates, particularly in Sun Belt states. This influx directly fuels demand for multifamily and single-family housing, with CoStar's platforms like Apartments.com and Homes.com serving as critical tools for understanding these evolving market dynamics.

Housing affordability remains a significant societal challenge, acting as a primary driver for migration. In 2024, median home prices in many major U.S. metropolitan areas continued to outpace wage growth, forcing many to seek more affordable locations. This trend is closely monitored by CoStar, as it directly affects occupancy rates and rental demand across different property sectors.

Consumer shopping habits are in constant flux, with a significant acceleration in e-commerce adoption. This trend, amplified in recent years, continues to reshape how people buy goods, directly impacting the demand for physical retail spaces. CoStar Group data shows a sustained growth in online retail sales, which influences leasing decisions for brick-and-mortar locations.

Beyond online shopping, consumers increasingly seek experiences rather than just products. This translates to a demand for retail environments that offer entertainment, dining, and unique engagement opportunities. Properties that successfully integrate these experiential elements are seeing stronger tenant interest and occupancy rates, according to CoStar's market analyses.

The preference for prime retail locations remains strong, but the definition of "prime" is evolving. It now encompasses accessibility, visibility, and the ability to offer a compelling customer journey. CoStar Group's insights help clients identify these evolving prime markets and understand the underlying demand drivers for high-performing retail assets.

Demand for Smart Buildings and Tenant Experience

Societal expectations are increasingly shaping the real estate market, with a pronounced demand for smart buildings that integrate advanced technology to improve occupant well-being and operational efficiency. This trend is directly fueling the need for sophisticated data and analytics, particularly in areas like building management systems, energy consumption optimization, and personalized tenant engagement. CoStar Group is well-positioned to capitalize on this, as its data-centric approach aligns perfectly with the proptech revolution. For instance, by 2024, the global smart building market was projected to reach over $80 billion, highlighting the significant economic driver behind these sociological shifts.

The emphasis on tenant experience is no longer a niche concern but a mainstream driver of leasing decisions and property valuations. This translates into a demand for real-time insights into building performance and tenant satisfaction. CoStar’s comprehensive data sets and analytical tools are crucial for property owners and managers looking to meet these evolving expectations. The increasing adoption of IoT devices within commercial spaces, expected to grow significantly through 2025, directly supports the data requirements for enhanced tenant experiences.

- Growing Tenant Expectations: Occupants now expect seamless technology integration, personalized amenities, and responsive building management.

- Data-Driven Operations: Demand for analytics on energy usage, space utilization, and predictive maintenance is rising to optimize building performance.

- Proptech Integration: Smart building technologies, including AI-powered systems and IoT sensors, are becoming standard, requiring robust data platforms.

- Market Value Impact: Properties offering superior tenant experiences and smart functionalities are commanding higher rents and valuations, as evidenced by increasing investment in proptech solutions.

Workforce Dynamics and Talent Attraction

The ability to attract and retain skilled employees is a critical driver for corporate real estate decisions. Companies are increasingly prioritizing locations and office environments that resonate with their workforce, impacting demand for specific property types and amenities. CoStar's extensive data on market demographics, including labor pool characteristics and amenity preferences, empowers businesses to align their real estate strategies with talent acquisition and retention goals.

CoStar Group itself recognizes the importance of its own workforce, actively investing in employee expansion and retention initiatives. For instance, CoStar reported a significant increase in its global workforce in recent years, reflecting its growth and commitment to talent. This internal focus on workforce dynamics likely informs its understanding of broader market trends, allowing it to provide more relevant insights to its clients.

- Talent-Driven Real Estate: Companies are choosing locations based on their ability to attract and retain talent, influencing office leasing and development.

- CoStar's Data Advantage: CoStar's market analytics provide crucial insights into demographics and amenities, supporting informed real estate decisions for talent strategies.

- Internal Workforce Focus: CoStar's own investment in workforce expansion and retention demonstrates an understanding of the critical link between talent and business success.

- 2024/2025 Trends: Expect continued emphasis on flexible work arrangements, wellness amenities, and accessible locations as key factors in attracting and retaining employees in the current market.

Societal expectations are increasingly shaping the real estate market, with a pronounced demand for smart buildings that integrate advanced technology to improve occupant well-being and operational efficiency. This trend is directly fueling the need for sophisticated data and analytics, particularly in areas like building management systems and energy consumption optimization. By 2024, the global smart building market was projected to reach over $80 billion, highlighting the significant economic driver behind these sociological shifts.

The emphasis on tenant experience is no longer a niche concern but a mainstream driver of leasing decisions and property valuations. This translates into a demand for real-time insights into building performance and tenant satisfaction. CoStar’s comprehensive data sets and analytical tools are crucial for property owners and managers looking to meet these evolving expectations, with the adoption of IoT devices within commercial spaces expected to grow significantly through 2025.

The ability to attract and retain skilled employees is a critical driver for corporate real estate decisions, with companies prioritizing locations and office environments that resonate with their workforce. CoStar's extensive data on market demographics, including labor pool characteristics and amenity preferences, empowers businesses to align their real estate strategies with talent acquisition and retention goals. Expect continued emphasis on flexible work arrangements, wellness amenities, and accessible locations as key factors in attracting and retaining employees in the 2024/2025 market.

Technological factors

Advancements in AI and machine learning are fundamentally reshaping the real estate sector. These technologies are now enabling significantly more precise property valuations and sophisticated predictive analytics for identifying market trends. Furthermore, AI is streamlining operational tasks, such as the critical process of tenant screening, making it faster and more efficient.

CoStar Group is well-positioned to harness these powerful AI and machine learning capabilities. By integrating these advancements, CoStar can elevate its data analysis, leading to more robust forecasting models and the creation of innovative client tools. For instance, the development of dynamic pricing engines, powered by AI, could offer clients real-time adjustments based on market fluctuations.

The proptech sector is booming, with a strong push towards digitizing everything in real estate, from how properties are managed to how deals are done. This digital shift is making the industry more efficient and accessible.

CoStar Group is a major player here, leading the charge with its online platforms like Apartments.com and LoopNet, which are essential tools for many in the real estate world. Their acquisition of Matterport in 2023 for $1.6 billion also highlights their commitment to digital twin technology, offering immersive 3D models of properties.

This digital transformation is not just about convenience; it's fundamentally changing how real estate is bought, sold, and managed, with CoStar providing the digital infrastructure and data to support these advancements.

The growing use of 3D digital twin, VR, and AR is transforming how properties are seen, with virtual tours and space planning becoming more sophisticated. CoStar's strategic acquisition of Matterport in late 2023, a deal valued at approximately $1.6 billion, directly bolsters its position in this evolving technological landscape. This move significantly enhances CoStar's ability to offer deeply immersive and data-rich visualizations of commercial real estate assets.

Big Data Analytics and Predictive Insights

Big Data analytics is fundamental to CoStar Group's operations, enabling the collection, processing, and analysis of extensive real estate information. This capability is essential for generating actionable insights and accurately forecasting market trends. For instance, CoStar's platforms process billions of data points on property listings, transactions, and market comparables, providing users with unparalleled market intelligence.

Continuous innovation in data analytics and predictive modeling is paramount for CoStar to maintain its competitive advantage in the real estate information sector. The company's investment in AI and machine learning is designed to enhance the precision of its forecasts and the depth of its insights. In 2023, CoStar reported significant investments in technology and data infrastructure, underscoring their commitment to this area.

- Data Volume: CoStar's platforms aggregate and analyze petabytes of real estate data, covering millions of properties globally.

- Predictive Accuracy: Advancements in AI are enhancing the accuracy of CoStar's market trend predictions, aiding client decision-making.

- Investment in Innovation: The company consistently allocates substantial resources to R&D for data analytics and software development, aiming to stay ahead of technological shifts.

Cybersecurity and Data Infrastructure Resilience

CoStar Group's reliance on digital platforms and sensitive client data makes robust cybersecurity and resilient data infrastructure absolutely critical. Protecting against evolving cyber threats and ensuring the integrity and continuous availability of this data are paramount for maintaining client trust and uninterrupted operations. Many real estate technology firms, including CoStar, are significantly investing in their core technology infrastructure to meet these demands.

The increasing sophistication of cyberattacks necessitates ongoing investment in advanced security measures. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk associated with vulnerabilities. CoStar's commitment to protecting its vast datasets, which include property information and client transaction histories, is therefore a key technological imperative.

- Cybersecurity Investment: CoStar Group likely allocates significant resources to cybersecurity, focusing on threat detection, prevention, and incident response to safeguard its digital assets.

- Data Infrastructure Resilience: Ensuring the uptime and integrity of its data centers and cloud infrastructure is vital for providing reliable services to its clients.

- Client Data Protection: Maintaining the confidentiality and security of client data is a cornerstone of CoStar's business model, directly impacting client retention and reputation.

- Technological Advancements: Continuous upgrades to hardware, software, and network security protocols are necessary to stay ahead of emerging threats and maintain a competitive edge in data management.

Technological advancements, particularly in AI and data analytics, are central to CoStar Group's strategy. The company is leveraging these tools to enhance property valuations, predict market trends with greater accuracy, and streamline operations like tenant screening. CoStar's 2023 acquisition of Matterport for $1.6 billion underscores its commitment to digital twin technology, offering immersive 3D property visualizations.

The proptech sector's growth, driven by digitalization, is fundamentally changing real estate transactions and management. CoStar, through platforms like Apartments.com and LoopNet, is a key enabler of this shift, providing the digital infrastructure for the industry. The firm's ongoing investment in R&D for data analytics and software development, evidenced by significant technology infrastructure investments in 2023, aims to maintain its competitive edge.

CoStar's operational scale involves processing petabytes of real estate data, with AI enhancing predictive accuracy for market trends. The company's robust cybersecurity measures are critical, given the projected $10.5 trillion global cost of cybercrime by 2025, to protect sensitive client data and maintain operational resilience.

Legal factors

CoStar Group navigates a complex web of global data privacy regulations, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws are crucial for how CoStar handles sensitive real estate and client information, demanding strong data governance. Failure to comply can lead to significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

CoStar Group's dominant position in the commercial real estate data sector naturally draws attention from antitrust regulators. As of early 2025, the company's ongoing acquisition strategy, including its substantial $7 billion acquisition of Ten-X in 2021 and its pending $1.7 billion acquisition of Homes.com, means its market practices and their impact on competition are under continuous review.

These regulatory bodies closely examine whether CoStar's actions, including potential mergers or exclusive agreements, stifle innovation or limit choices for consumers and businesses in the commercial real estate information and transaction markets. Any adverse findings could lead to significant penalties or restrictions on future business activities, directly influencing CoStar's growth trajectory and ability to maintain its market share.

Changes in real estate transaction laws, such as updated disclosure requirements for commercial leases or new regulations on property ownership transfers, directly influence the data CoStar Group must gather. For instance, shifts in zoning laws or environmental regulations can alter property valuations and transaction complexities, impacting the accuracy of CoStar's market intelligence. In 2024, many jurisdictions are reviewing and updating their commercial real estate disclosure laws to enhance transparency, which could lead to more granular data requirements for CoStar.

Intellectual Property Rights and Data Licensing

CoStar Group's business heavily relies on safeguarding its vast proprietary data and technology through robust intellectual property rights. This protection is crucial for maintaining its competitive edge in the market.

Data licensing agreements are fundamental to CoStar's operations, enabling them to legally access and utilize third-party data, which is then integrated into their offerings. Ensuring the legality and integrity of these data sources is paramount for the accuracy and reliability of their services.

- Intellectual Property Protection: CoStar Group actively protects its extensive databases, software, and analytical tools through patents, copyrights, and trademarks, preventing unauthorized use and ensuring the exclusivity of its data assets.

- Data Licensing Agreements: The company engages in numerous licensing agreements with data providers, ensuring legal access to critical market information. These agreements are vital for the continuous expansion and enhancement of their data offerings.

- Compliance and Data Integrity: CoStar adheres to strict legal frameworks governing data acquisition and usage, particularly concerning privacy regulations. Maintaining data integrity is a cornerstone of their service, ensuring clients receive accurate and reliable market intelligence.

Zoning, Land Use, and Building Codes

Zoning, land use, and building codes are critical legal factors shaping the commercial real estate landscape, a core area for CoStar Group. These regulations, enacted at both local and national levels, define permissible construction types, site allocations, and detailed building specifications. For instance, in 2024, cities across the US continued to grapple with updating outdated zoning ordinances to encourage denser, mixed-use developments, directly impacting the feasibility and design of new commercial properties.

CoStar's business thrives on providing comprehensive data on these very property characteristics and development trends. The company's platforms meticulously track how zoning changes, new land use policies, and evolving building codes influence property values, construction costs, and investment opportunities, offering clients crucial insights into market dynamics.

- Zoning Laws: Local ordinances that dictate property usage (e.g., commercial, residential, industrial) and density, impacting CoStar's data on permitted development.

- Land Use Regulations: Broader policies governing how land can be utilized, influencing CoStar's tracking of urban planning and development patterns.

- Building Codes: Technical standards for construction, safety, and accessibility that affect property design and renovation costs, all of which CoStar analyzes.

- Impact on Development: These legal frameworks directly influence the type, scale, and location of commercial real estate projects CoStar's clients invest in and develop.

CoStar Group operates under stringent data privacy laws like GDPR and CCPA, necessitating robust data protection measures for sensitive real estate information. Non-compliance can result in substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue.

Environmental factors

The growing intensity and frequency of climate change-driven hazards, such as severe storms and rising sea levels, directly affect commercial property values and increase insurance premiums. These shifts necessitate careful consideration in real estate investment strategies.

CoStar Group's extensive data analytics empower clients to evaluate and quantify these climate-related risks. This information is crucial for developing more resilient real estate portfolios and investment approaches, particularly as we look towards 2024 and 2025.

For instance, in 2024, regions experiencing more frequent extreme weather events saw an average increase of 15% in property insurance costs compared to the previous year, impacting net operating income for commercial properties.

The increasing focus on environmental sustainability is significantly shaping the real estate sector. This trend is driving the adoption of green building standards, influencing how properties are developed, managed, and even what tenants are looking for. For instance, a growing number of companies are setting ambitious net-zero targets, which directly impacts their real estate decisions, favoring energy-efficient buildings.

CoStar Group is well-positioned to capitalize on this by offering data and analytics related to energy efficiency, LEED certifications, and other crucial sustainability metrics. As of early 2024, the demand for certified green buildings continues to rise, with investors and occupiers increasingly scrutinizing these environmental credentials. For example, buildings with LEED Platinum certification can command higher rents and occupancy rates compared to their less sustainable counterparts.

The real estate sector faces increasing pressure to improve energy efficiency and decarbonize, driven by ambitious government targets and growing investor interest in sustainable assets. This trend directly affects building operations, necessitating upgrades and retrofits to meet evolving environmental standards.

CoStar's comprehensive data solutions are instrumental in helping clients navigate these changes. For instance, by analyzing property-level energy consumption data, CoStar can pinpoint opportunities for significant energy savings. Furthermore, its insights into regulatory compliance can guide clients in identifying buildings that meet or require upgrades to comply with new environmental mandates, such as those aiming for net-zero emissions by 2050.

Resource Scarcity and Supply Chain Disruptions

Resource scarcity, especially for construction materials like lumber and steel, along with ongoing global supply chain disruptions, directly impacts development costs and project timelines within the commercial real estate sector. For instance, the Producer Price Index for construction materials saw significant increases throughout 2023 and into early 2024, adding pressure to new builds.

While CoStar Group's core business revolves around digital data and analytics, these environmental factors indirectly influence its operations. Changes in development activity, driven by cost and supply chain issues, can affect the volume and nature of new properties entering the market, which CoStar meticulously tracks and analyzes.

- Rising Material Costs: Lumber prices, for example, experienced volatility, with futures trading at elevated levels in late 2023 compared to pre-pandemic averages, impacting construction budgets.

- Shipping Delays: Global shipping costs and transit times remained a concern through 2024, affecting the timely delivery of essential building components.

- Impact on New Supply: Delays or cancellations in construction projects due to these pressures can lead to a tighter supply of new commercial properties, influencing market dynamics that CoStar reports on.

Corporate Social Responsibility (CSR) and ESG Investing

The increasing focus on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) investing is significantly shaping the real estate sector. Investors are increasingly prioritizing companies that demonstrate strong ESG performance, impacting capital allocation and operational strategies for firms like CoStar. For instance, a 2024 report indicated that over 60% of institutional investors consider ESG factors in their investment decisions, a trend expected to continue its upward trajectory through 2025.

CoStar is well-positioned to assist its clients in navigating this evolving landscape. By providing comprehensive data and analytical tools, CoStar can empower real estate companies to track their ESG metrics, identify areas for improvement, and report on their sustainability efforts effectively. This support is crucial for meeting growing regulatory demands and investor expectations for transparency in environmental and social impact. The demand for ESG-compliant real estate assets is projected to grow by 15-20% annually through 2025, highlighting the market opportunity.

CoStar's role extends to facilitating compliance with emerging ESG standards and showcasing a firm's commitment to sustainable practices. This includes offering insights into energy efficiency, social impact within communities, and robust corporate governance. For example, CoStar's platform can help clients analyze building energy performance data, a key component of environmental assessments, and benchmark against industry best practices. By 2025, it's estimated that over 80% of global real estate investment firms will have integrated ESG criteria into their due diligence processes.

- Growing Investor Demand: Over 60% of institutional investors incorporated ESG factors into their decision-making in 2024, with this trend accelerating towards 2025.

- Market Growth: ESG-compliant real estate assets are anticipated to see annual growth rates between 15% and 20% through 2025.

- Compliance and Transparency: By 2025, an estimated 80% of global real estate investment firms will mandate ESG criteria in their due diligence.

- Data-Driven ESG: CoStar's data solutions are essential for real estate firms to measure, manage, and report on their ESG performance.

Environmental factors are increasingly influencing real estate investments and operations. Climate change, with its heightened risks of severe weather, directly impacts property values and insurance costs, a trend observed to increase by an average of 15% in affected regions during 2024.

Sustainability is a major driver, pushing for green building standards and favoring energy-efficient properties as companies pursue net-zero goals. CoStar's data helps clients assess these risks and opportunities, with certified green buildings showing higher rents and occupancy rates.

Resource scarcity and supply chain issues also affect development costs, as seen with the volatility in construction material prices through early 2024. Furthermore, the rise of ESG investing means over 60% of institutional investors consider these factors, with ESG-compliant real estate assets projected for 15-20% annual growth through 2025.

| Environmental Factor | Impact on Real Estate | CoStar's Role | Relevant Data (2024-2025) |

|---|---|---|---|

| Climate Change & Extreme Weather | Increased insurance premiums, reduced property values in vulnerable areas. | Quantifying climate risk, identifying resilient locations. | 15% average increase in property insurance costs in high-risk zones (2024). |

| Sustainability & Green Buildings | Higher demand for energy-efficient properties, tenant preference for certified buildings. | Providing data on energy efficiency, LEED certifications, and ESG metrics. | LEED Platinum buildings command higher rents and occupancy rates. |

| Resource Scarcity & Supply Chain | Increased construction costs, project delays. | Tracking development activity and market supply dynamics. | Elevated lumber futures prices (late 2023), ongoing shipping delays impacting component delivery. |

| ESG Investing | Shift in capital allocation towards sustainable assets, demand for transparency. | Enabling clients to track, manage, and report ESG performance. | Over 60% of institutional investors consider ESG (2024); 80% of firms to integrate ESG in due diligence by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis is powered by a blend of public and proprietary data, drawing from official government publications, reputable market research firms, and economic forecasting agencies. This comprehensive approach ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.