CoStar Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CoStar Group Bundle

CoStar Group operates in a dynamic market shaped by intense competition, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating its landscape.

The complete report reveals the real forces shaping CoStar Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CoStar Group benefits from a largely fragmented supplier base for its essential inputs, including data providers, software vendors, and marketing agencies. This wide availability of alternatives means no single supplier can exert substantial influence over CoStar. For instance, the commercial real estate data market, a core input for CoStar, features numerous data aggregators and specialized providers, preventing any one from dominating pricing or terms.

When inputs are not highly differentiated, suppliers have less power. For CoStar Group, this means that the raw data or services it sources are generally available from multiple providers, preventing any single supplier from dictating terms. In 2023, CoStar reported significant investments in data acquisition and technology, indicating a broad sourcing strategy rather than reliance on a few exclusive providers.

Suppliers to CoStar Group face significant barriers to integrating forward into CoStar's comprehensive data and marketplace offerings. CoStar's extensive data collection infrastructure, proprietary analytics, and established online platforms are difficult and costly for suppliers to replicate. This limits their ability to become direct competitors, thus lessening the threat they pose to CoStar's market position.

CoStar as a Significant Customer

CoStar Group, while a significant customer for many of its suppliers, typically doesn't represent a critical revenue stream for them. This dynamic means suppliers are motivated to offer favorable terms and pricing to secure CoStar's business, as they aren't overly reliant on any single client. This leverage allows CoStar to negotiate effectively, enhancing its bargaining power.

For instance, CoStar's substantial purchasing volume in areas like data acquisition and technology infrastructure means suppliers compete to maintain this relationship. This is particularly true in the data services sector, where CoStar's demand for real estate information is considerable. In 2023, CoStar reported a revenue of $2.3 billion, indicating the scale of its operations and, by extension, its purchasing power with suppliers.

- CoStar's purchasing volume is substantial, making it an attractive client for many suppliers.

- Suppliers are often not critically dependent on CoStar, giving CoStar negotiation leverage.

- This balance of power generally favors CoStar in its dealings with suppliers.

- CoStar's 2023 revenue of $2.3 billion underscores its significant market presence and purchasing capacity.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for CoStar Group. Many of the raw data and technological components CoStar utilizes are readily available from multiple sources. This broad accessibility prevents any single supplier from dictating terms or dramatically raising prices, as CoStar can easily switch to alternative vendors offering comparable quality.

For instance, in 2023, the global market for data analytics software, a key input for CoStar's operations, saw numerous vendors offering competitive solutions. CoStar's ability to source data feeds, software platforms, and cloud services from a diverse range of providers means suppliers have limited leverage. This competitive landscape ensures CoStar can maintain favorable pricing and terms for its essential operational inputs.

- Widespread Availability: CoStar sources raw data and technology components from a broad market, reducing reliance on any single supplier.

- Limited Supplier Leverage: The presence of numerous alternative vendors prevents suppliers from significantly impacting CoStar's costs or resource availability.

- Competitive Input Market: In 2023, the data analytics sector, crucial for CoStar, featured many providers, fostering a competitive environment for input sourcing.

CoStar Group generally experiences low bargaining power from its suppliers. This is largely due to the fragmented nature of its supplier base, meaning there are many options for essential inputs like data and technology. CoStar's substantial purchasing volume, evidenced by its 2023 revenue of $2.3 billion, further strengthens its negotiating position, as suppliers are keen to secure its business. The limited ability of suppliers to integrate forward into CoStar's established platforms also reduces their leverage.

| Factor | CoStar's Position | Impact on Supplier Power |

|---|---|---|

| Supplier Concentration | Fragmented | Low |

| Input Differentiation | Low | Low |

| Switching Costs for CoStar | Low | Low |

| Suppliers' Forward Integration Threat | Low | Low |

| CoStar's Purchasing Volume (2023 Revenue) | High ($2.3 billion) | Low |

What is included in the product

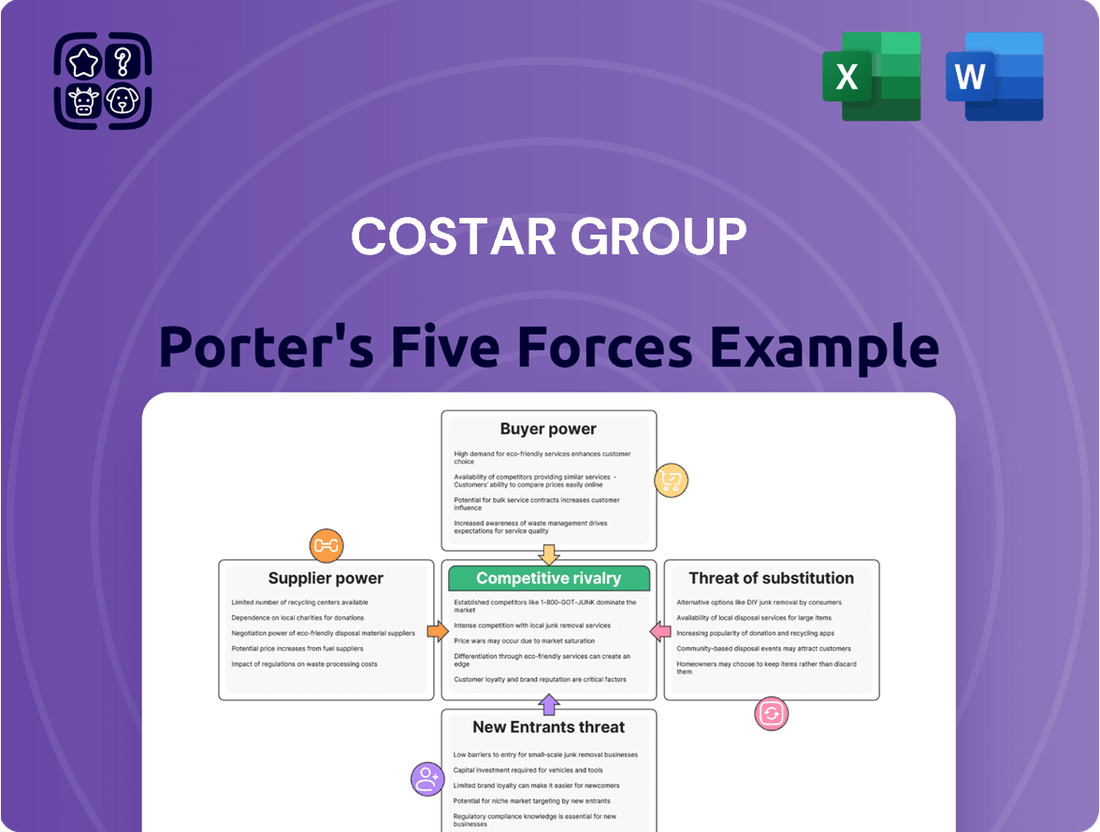

This analysis dissects CoStar Group's competitive environment by examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and quantify competitive threats with a visual breakdown of each force, empowering proactive strategy development.

Customers Bargaining Power

CoStar Group's diverse customer base significantly limits the bargaining power of individual customers. The company serves a broad spectrum of financially-literate professionals, including commercial real estate brokers, investors, appraisers, and lenders, across its various business segments like Information Services, Apartments.com, LoopNet, and STR.

With over 206,000 active subscribers reported as of the fourth quarter of 2023, this wide reach ensures that no single customer or customer group holds substantial sway over CoStar's pricing or service offerings, especially within its foundational commercial information services.

CoStar Group experiences varying customer price sensitivity across its diverse business segments. For instance, in the Apartments.com segment, where customer concentration is lower and numerous alternative advertising platforms exist, clients exhibit greater price sensitivity.

In contrast, the Information Services and STR segments cater to clients who are typically less price-sensitive. These customers are often willing to pay a premium for CoStar's specialized, highly differentiated data and analytical capabilities, which are crucial for their decision-making processes.

CoStar Group benefits from high customer switching costs, a significant factor in its bargaining power. The company reported an impressive customer retention rate of 92% as of 2023, underscoring the difficulty clients face in moving away.

CoStar's extensive databases and sophisticated analytical tools become deeply integrated into a client's daily operations. Replicating this level of functionality and data access with a competitor is both time-consuming and expensive, effectively locking customers into the CoStar ecosystem.

Differentiated and Comprehensive Offerings

CoStar Group's differentiated and comprehensive offerings significantly limit customer bargaining power. The company provides highly specialized information, analytics, and online marketplaces for commercial real estate, offering unique insights into property values and market trends. This extensive data, cultivated through decades of investment, is exceptionally difficult for competitors to replicate, directly reducing customers' ability to negotiate favorable terms.

The sheer breadth of CoStar's services means customers often rely on a single vendor for their needs. This consolidation reduces the perceived availability of alternatives, thereby diminishing customers' leverage. For instance, in 2023, CoStar reported that 95% of its revenue came from recurring subscriptions, a testament to the sticky nature of its integrated data solutions.

- Data Uniqueness: CoStar's proprietary data collection and analysis methods create information sets that are not easily duplicated by competitors.

- Integrated Solutions: Offering a wide array of services from property listings to valuation tools reduces the need for customers to piece together solutions from multiple providers.

- High Switching Costs: The deep integration of CoStar's platform into clients' workflows and the specialized nature of its data create significant costs and disruptions if a customer were to switch.

- Market Dominance: CoStar's substantial market share, particularly in areas like CRE data and analytics, further concentrates customer reliance and reduces their bargaining power.

Moderate Customer Concentration in Key Segments

CoStar Group's customer base, while broad, shows a moderate concentration among key players in the real estate sector. Major real estate firms, institutional investors, and significant lenders are substantial contributors to the revenue generated by its Information Services segment.

This concentration grants these larger clients a degree of bargaining power, especially during the negotiation of substantial contracts or renewal agreements. They can leverage their significant spending to seek more favorable terms.

However, CoStar's dominant market position and the essential nature of its data often serve to mitigate this potential customer leverage. The company's established reputation and the difficulty for clients to find comparable alternatives strengthen its negotiating stance.

- Key Customer Segments: Large real estate firms, investors, and lenders are significant revenue drivers for CoStar's Information Services.

- Bargaining Leverage: Moderate customer concentration can give these larger clients some power in contract negotiations.

- Mitigating Factors: CoStar's strong market position and the unique value of its data help to offset customer bargaining power.

CoStar Group's extensive customer base and the unique, integrated nature of its data significantly limit the bargaining power of most customers. The company's 2023 retention rate of 92% highlights how difficult and costly it is for clients to switch, effectively locking them into CoStar's ecosystem. While some large clients in the Information Services segment may have moderate leverage due to their spending, CoStar's market dominance and the essential nature of its data generally outweigh this.

| Factor | CoStar's Position | Impact on Customer Bargaining Power |

| Customer Base Size | Over 206,000 active subscribers (Q4 2023) | Lowers individual customer power |

| Switching Costs | High due to data integration and workflow reliance | Significantly reduces customer power |

| Data Differentiation | Proprietary, hard-to-replicate data and analytics | Limits customer power by reducing alternatives |

| Customer Concentration | Moderate among large real estate firms/investors | Grants some leverage to key clients |

| Revenue Model | 95% recurring subscriptions (2023) | Indicates customer stickiness and reduced power |

Full Version Awaits

CoStar Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Porter's Five Forces Analysis of the CoStar Group. You'll gain insight into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within CoStar's industry. This professionally formatted report is ready for your immediate use, providing a detailed strategic overview without any placeholders or surprises.

Rivalry Among Competitors

The commercial real estate data and analytics sector is a battlefield, with CoStar Group navigating a landscape teeming with both seasoned competitors and agile newcomers. These rivals are actively challenging CoStar's dominance, often by deploying advanced technological solutions and employing aggressive pricing models to attract clients.

CoStar's market leadership is constantly tested by firms that are adept at integrating cutting-edge technology and implementing competitive pricing. For instance, in 2023, the overall market for commercial real estate information services saw significant growth, with many smaller, specialized data providers emerging, offering niche solutions at potentially lower price points.

To stay ahead, CoStar must persistently invest in enhancing its product offerings and elevating its customer support. This includes not only refining its existing data sets but also innovating with new analytical tools and platforms. The company's ability to adapt to evolving client needs and technological advancements is crucial for sustaining its competitive edge in this dynamic market.

CoStar Group's competitive rivalry is significantly shaped by its dominant market share in commercial real estate information services. In 2023, the company commanded an impressive estimated 84.5% of the market, a figure that highlights its entrenched position.

This substantial market control, alongside robust revenue growth, solidifies CoStar's competitive standing. The sheer breadth of its comprehensive database and its long-established presence in the industry create substantial hurdles for any new or existing competitors aiming to challenge its dominance.

Competitive rivalry within CoStar Group's diverse segments shows significant variation. The Apartments.com segment experiences the most intense competition, characterized by a fragmented market and lower barriers to entry for new players. This dynamic is reflected in the numerous online listing platforms vying for user attention and advertiser dollars in the residential rental space.

Conversely, CoStar's Information Services and STR segments benefit from CoStar's established market dominance and highly differentiated product offerings. These segments, which include commercial real estate data and hospitality analytics, face less direct rivalry. For instance, CoStar's extensive data collection and analytical tools create a significant moat, making it difficult for competitors to replicate their value proposition. In 2023, CoStar's Information Services segment generated approximately $2.1 billion in revenue, underscoring its strong market position.

Strong Competitive Advantages

CoStar Group's competitive rivalry is mitigated by its substantial and unique data assets, which are incredibly difficult for competitors to match. This proprietary information, combined with a deeply entrenched brand, positions CoStar as a go-to resource for real estate professionals seeking detailed analytics and insights.

The company's strategic acquisitions, like the 2024 deal to acquire Matterport for $1.6 billion, significantly enhance its technological capabilities and expand its market presence. This move, in particular, strengthens CoStar's offering in 3D spatial data and digital twin technology, creating a more formidable competitive moat.

- Proprietary Data: CoStar possesses an extensive and exclusive database covering commercial real estate, a key differentiator.

- Brand Recognition: The CoStar brand is synonymous with reliable and comprehensive real estate information among industry professionals.

- Technological Advancement: Acquisitions like Matterport integrate cutting-edge technology, providing advanced analytics and visualization tools.

- Barriers to Entry: The sheer scale of data accumulation and the investment required to build comparable analytical platforms create significant barriers for new entrants.

Aggressive Growth and Innovation

CoStar Group is intensely focused on aggressive growth and innovation to maintain its competitive edge. The company is significantly expanding its sales force and channeling substantial investments into cutting-edge technologies such as artificial intelligence and digital twin capabilities. This dual approach aims to reinforce CoStar's dominant market position and outmaneuver rivals.

These strategic growth initiatives are designed to broaden CoStar's service portfolio and capitalize on emerging market opportunities. A key focus area is the expansion into residential markets and international territories, where the company seeks to replicate its commercial real estate success. By continuously enhancing its offerings, CoStar aims to capture a larger share of the market and stay ahead of the competition.

- Sales Force Expansion: CoStar is actively growing its sales team to increase market penetration and customer reach.

- Innovation Investment: Significant capital is being allocated to AI and digital twin technologies to enhance product offerings and operational efficiency.

- Market Leadership: These investments are crucial for solidifying CoStar's position as a leader in the commercial real estate information and analytics sector.

- Strategic Growth: Expansion into residential and international markets represents a key strategy to diversify revenue streams and capture new growth opportunities.

CoStar's competitive rivalry is intense, particularly in segments like Apartments.com, which faces numerous online listing platforms. However, CoStar's dominant market share, estimated at 84.5% in commercial real estate information services as of 2023, and its highly differentiated offerings in segments like STR, create significant competitive moats.

The company's substantial proprietary data assets and strong brand recognition act as formidable barriers to entry for competitors. Strategic acquisitions, such as the $1.6 billion deal for Matterport in 2024, further bolster its technological capabilities and market position, creating a more defensible competitive landscape.

CoStar's aggressive growth strategy, including expanding its sales force and investing in AI and digital twin technologies, aims to solidify its leadership. These initiatives are critical for outmaneuvering rivals and capturing new opportunities in residential and international markets.

| Segment | Competitive Intensity | Key Factors |

|---|---|---|

| Commercial Real Estate Information Services | Moderate to High | Dominant market share (84.5% in 2023), proprietary data, brand recognition |

| Apartments.com | Very High | Fragmented market, lower barriers to entry, numerous online platforms |

| STR (Hospitality Analytics) | Low to Moderate | Highly differentiated product, established market presence, significant data integration |

SSubstitutes Threaten

Large real estate firms and investors with substantial internal resources can leverage in-house data collection or readily available public sources, such as government databases, as alternatives to CoStar's services. While these methods may not offer the same depth or efficiency, they can provide sufficient market insights for sophisticated users.

The threat of substitutes for CoStar Group's services is significant, particularly from alternative data providers. Companies like Reonomy, Real Capital Analytics, and CoreLogic offer specialized or regional real estate information, directly competing with CoStar's comprehensive data. For instance, Reonomy focuses on granular property-level data and ownership information, which can be a viable substitute for clients needing specific insights rather than CoStar's broad market coverage.

These alternative providers often cater to niche client needs or specific geographic markets, presenting a more tailored and potentially more affordable solution. CoreLogic, for example, provides extensive property data and analytics, including mortgage and foreclosure information, which can substitute for certain CoStar data sets for specific financial institutions or investors. The competitive pricing strategies of these substitutes can also draw clients away from CoStar's premium offerings.

Traditional brokerage and direct networking remain viable substitutes for online platforms like LoopNet and Apartments.com. While these digital marketplaces offer broad reach and efficiency, many deals still originate through established broker relationships and personal connections within the industry. In 2024, a significant portion of commercial real estate transactions still rely on these more personal, albeit potentially slower, methods.

Impact of Remote Work Trends

The widespread adoption of remote work presents a significant threat of substitutes for CoStar Group. As more companies embrace flexible or fully remote models, the demand for traditional physical office spaces diminishes. This directly impacts the need for the detailed property data and analytics that CoStar provides, as fewer physical locations require constant tracking and valuation.

This macro-level substitution effect means that even if CoStar's core services remain valuable, the overall market size for those services shrinks. For instance, data from the U.S. Bureau of Labor Statistics in early 2024 indicated that a substantial percentage of the workforce continued to work remotely at least part of the time, a trend that solidified post-pandemic.

This shift can be viewed as a substitute for the very need for extensive commercial real estate data. If businesses require less physical space, the market for leasing, selling, and managing that space contracts, consequently reducing the demand for the data that underpins these transactions.

- Reduced Demand for Office Space: The ongoing trend of remote and hybrid work significantly lowers the need for traditional office buildings, a core segment for CoStar's data.

- Shift in Real Estate Needs: Companies are re-evaluating their physical footprints, opting for smaller, more flexible spaces or entirely virtual operations, thereby reducing reliance on comprehensive property data for large office portfolios.

- Impact on Data Services: As the underlying market for physical commercial real estate transactions and leasing activity potentially contracts due to remote work, the demand for CoStar's data and analytics services in these areas faces pressure.

- Market Size Contraction: In 2023, office vacancy rates remained elevated in major U.S. cities, a clear indicator of reduced demand for physical office space, which directly translates to a smaller market for related data.

Emerging Technologies for Property Insights

New technologies, particularly advanced AI and machine learning, present a significant threat of substitutes for traditional property data providers like CoStar. These innovations offer alternative ways to gather and analyze real estate information, potentially bypassing established players. For instance, companies leveraging proprietary algorithms could offer niche insights or broader market trends more efficiently.

While CoStar is actively investing in AI and machine learning, the emergence of independent, tech-driven solutions is a real concern. These new entrants might provide comparable or even superior insights at a lower price point or with unique functionalities. This could include platforms that aggregate publicly available data and apply sophisticated analytics, offering a compelling alternative for certain user segments.

The disruption potential is substantial. Consider the rapid advancements in natural language processing that can extract valuable information from unstructured data sources, such as news articles or social media, to gauge market sentiment or identify emerging development trends. By 2024, the market for AI in real estate analytics was already seeing significant growth, with projections indicating continued expansion as these technologies mature and become more accessible.

- AI-powered property valuation tools can offer alternative appraisal methods.

- Blockchain technology could enable more transparent and efficient property data management, reducing reliance on centralized providers.

- Crowdsourced data platforms might emerge, aggregating insights from a wider network of users.

The threat of substitutes for CoStar's comprehensive real estate data is multifaceted, encompassing alternative data providers, traditional methods, and evolving market dynamics. Companies offering specialized or regional data, like Reonomy and CoreLogic, present direct competition by catering to niche needs or specific geographic markets, often at competitive price points.

Furthermore, the fundamental shift towards remote and hybrid work models reduces the overall demand for physical office spaces, a core area for CoStar's data services. This macro-trend, evident in 2024 with persistently high office vacancy rates in major U.S. cities, directly impacts the market size for commercial real estate data.

Emerging technologies, particularly AI and machine learning, also pose a significant threat by enabling new ways to gather and analyze property information, potentially bypassing established data providers. These advancements can offer comparable or superior insights, sometimes at lower costs.

| Substitute Type | Examples | Impact on CoStar |

| Alternative Data Providers | Reonomy, CoreLogic, Real Capital Analytics | Direct competition for specific data needs, potentially lower cost |

| Traditional Methods | Brokerage, Direct Networking | Still prevalent for deal origination, though less efficient |

| Market Dynamics | Remote Work Trends | Reduced demand for office space data, shrinking market size |

| Emerging Technologies | AI/ML Analytics, Blockchain | Potential for new, efficient data aggregation and analysis |

Entrants Threaten

The sheer cost of building and maintaining a commercial real estate database comparable to CoStar's presents a formidable barrier. We're talking about massive investments in data acquisition, advanced technology, and continuous research efforts. For instance, in 2024, companies looking to replicate CoStar's depth would need to allocate hundreds of millions, if not billions, of dollars to even begin competing on scale and data comprehensiveness.

Economies of scale are a significant barrier for new entrants in the commercial real estate information sector. CoStar Group, for instance, leverages its vast data aggregation and sophisticated analytics capabilities, developed over decades, to offer unparalleled comprehensiveness and cost-efficiency. This extensive infrastructure makes it incredibly challenging for newcomers to match CoStar's value proposition or achieve similar operational economics, creating a substantial competitive hurdle.

CoStar Group's formidable network of established distribution channels and deep-seated relationships with industry participants presents a significant barrier to new entrants. These entrenched connections, cultivated over years, provide CoStar with unparalleled market access and a trusted position within the commercial real estate ecosystem.

Newcomers would face immense difficulty in replicating CoStar's widespread adoption among brokers, investors, and other real estate professionals. Building the necessary trust and seamlessly integrating into existing workflows would demand substantial time and financial resources, making market entry a daunting prospect.

Proprietary Data and Expertise

CoStar Group's significant barrier to new entrants lies in its proprietary data and deep expertise. While patents might not be the main hurdle, the sheer volume of meticulously gathered, verified, and analyzed real estate data, accumulated over decades, is incredibly difficult and costly for newcomers to replicate. This creates a substantial intellectual moat.

New competitors would face immense challenges and require substantial upfront investment to build comparable data collection infrastructure and analytical capabilities. For instance, CoStar's investment in data acquisition and technology is a continuous, multi-million dollar effort. In 2023, CoStar reported total revenue of $2.4 billion, demonstrating the scale of its operations and the resources dedicated to maintaining its data advantage.

- Proprietary Data Accumulation: CoStar has invested billions of dollars over decades to build its comprehensive database, covering millions of commercial properties globally.

- Data Verification and Analytics: The company employs thousands of researchers and data analysts to ensure data accuracy and develop sophisticated analytical tools, a costly and time-intensive process.

- High Entry Costs: Replicating CoStar's data assets and analytical prowess would necessitate a massive financial commitment, likely hundreds of millions, if not billions, of dollars, deterring most potential entrants.

- Network Effects: As more users utilize CoStar's platform, the data becomes richer and more valuable, further strengthening its competitive position and making it harder for new players to gain traction.

Market Growth and Niche Opportunities

Despite substantial barriers to entry, the commercial real estate technology sector is anticipated to experience significant growth. This expansion is likely to draw in both well-capitalized startups and established technology giants looking to capitalize on emerging opportunities.

New entrants may initially focus on specialized market segments or deploy innovative technologies, such as blockchain for managing property records or sophisticated geospatial analytics, to establish a presence. These strategic approaches could allow them to build a foundation before potentially challenging incumbent players like CoStar.

The projected market growth, estimated to reach over $20 billion globally by 2025, presents a compelling incentive for new competition to emerge and vie for market share.

- Market Growth: Commercial real estate technology market projected to exceed $20 billion globally by 2025.

- Niche Targeting: New entrants may focus on specific segments like proptech or data analytics.

- Disruptive Technologies: Blockchain and advanced geospatial analytics are potential entry points for competitors.

- Incumbent Challenge: Growth potential incentivizes new players to challenge established firms like CoStar.

The threat of new entrants for CoStar Group is generally low due to significant barriers. Replicating CoStar's extensive, decades-old proprietary database, which required billions in investment, is a monumental task. Furthermore, the company's strong network effects and established customer relationships create a formidable moat, making it difficult for newcomers to gain market traction and trust. While market growth may attract some, the sheer scale and cost of entry remain substantial deterrents.

| Barrier Type | Description | Estimated Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a comparable data infrastructure and research team would require hundreds of millions to billions of dollars. | Very High |

| Proprietary Data & Expertise | CoStar's vast, verified, and analyzed data accumulated over decades is difficult and costly to replicate. | Very High |

| Network Effects | More users enhance data value, creating a self-reinforcing cycle that new entrants struggle to break. | High |

| Distribution Channels & Relationships | CoStar's entrenched relationships with industry professionals provide unparalleled market access. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages proprietary CoStar Group data, including extensive property transaction records, lease agreements, and market leasing data. This is supplemented by industry-specific reports, economic indicators, and regulatory filings to provide a comprehensive view of competitive dynamics.