Costain Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

Costain Group's strategic position is shaped by significant strengths in infrastructure and major projects, coupled with a strong order book. However, potential threats from market volatility and competition necessitate careful navigation.

Delve deeper into Costain's unique advantages and the opportunities it can capitalize on. Our comprehensive SWOT analysis unpacks these elements with actionable insights, providing a clear roadmap for strategic planning.

Understand the critical weaknesses and external threats that could impact Costain's future performance. This detailed analysis is essential for investors and stakeholders seeking a complete understanding of the company's risk profile.

Want the full story behind Costain's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

Costain Group PLC boasts a formidable and expanding forward work position, reaching a record £5.4 billion by the close of FY24. This figure represents over four times its FY24 revenue, underscoring a substantial pipeline of secured projects and a strong outlook for sustained business activity.

This robust order book translates to exceptional revenue visibility, instilling confidence in Costain's ability to achieve its growth targets. The company has already secured approximately 80% of its projected revenue for FY25, highlighting the quality and reliability of its contracted work.

The strength of this pipeline is further bolstered by significant contract wins in critical sectors such as water and rail. These strategic successes provide a stable and predictable foundation for Costain's ongoing operations and future expansion initiatives.

Costain Group's core strength lies in its specialization in critical UK infrastructure, a sector poised for substantial investment. The company's expertise spans transportation, water, energy, and defense, directly addressing national priorities. This focus ensures a steady stream of opportunities, particularly as the UK government commits significant capital to upgrading and expanding these essential services.

For instance, the UK's National Infrastructure Strategy outlines ambitious plans for investment, with the transportation sector alone expected to see considerable development. Costain's involvement in highways, rail, and aviation positions it to capitalize on these multi-billion-pound projects. Their deep understanding of these complex, regulated environments is a significant competitive advantage.

Costain's strategic focus on digital solutions and innovation is a significant strength, driving the delivery of complex infrastructure projects. The company is actively expanding its digital services, demonstrating a commitment to leveraging technology for better outcomes.

This dedication to R&D across its operational sectors aims to create pioneering solutions that fundamentally improve the infrastructure ecosystem. For instance, in 2024, Costain highlighted its increasing work in areas like data analytics and digital twins, which are crucial for optimizing project lifecycle management.

This technological emphasis not only boosts operational efficiency and sustainability but also firmly positions Costain as a leader in industry advancements, ready to tackle the evolving demands of the infrastructure market.

Improved Financial Performance and Strong Cash Position

Costain Group has showcased robust financial performance, with its adjusted operating profit rising by 7.5% in the fiscal year 2024, alongside an enhanced operating margin. This financial strength is further evidenced by a healthy net cash position of £158.5 million recorded at the close of FY24.

The company anticipates this positive trend to continue, projecting its net cash to reach approximately £180 million by the end of FY25. This strong cash generation capability and a disciplined approach to financial management have also allowed Costain to double its full-year dividend, signaling significant confidence in its ongoing growth trajectory and commitment to increasing shareholder value.

- Improved Profitability: Adjusted operating profit up 7.5% in FY24.

- Enhanced Margins: Operating margin shows improvement.

- Strong Cash Reserves: Net cash of £158.5 million at end of FY24, aiming for £180 million by end of FY25.

- Increased Shareholder Returns: Full-year dividend doubled.

Established Long-Term Customer Relationships and Frameworks

Costain Group benefits significantly from its established long-term customer relationships, which are a cornerstone of its business model. These deep-rooted connections provide a predictable revenue base, insulating the company from the volatility often seen in project-based work. For instance, its ongoing involvement in the Anglian Water Strategic Pipeline Alliance exemplifies the value of these sustained partnerships, securing ongoing projects and future opportunities. This strategic advantage translates into reduced risk and consistent engagement with key clients, a critical strength in the infrastructure sector.

The company's reliance on long-term framework contracts further solidifies this strength. These agreements, often spanning multiple years, ensure a steady flow of work and allow Costain to embed itself deeply within client operations. This includes significant engagements within the nuclear energy sector, where such long-term commitments are paramount. This framework approach not only guarantees revenue but also fosters innovation and efficiency through continuous collaboration, enhancing Costain's competitive positioning.

These enduring relationships and contractual frameworks are not merely transactional; they represent a strategic commitment to mutual growth and reliability. They enable Costain to plan resources effectively, invest in specialized capabilities, and deliver consistent value, leading to high rates of repeat business and contract extensions. This stability is crucial for navigating the complex and often lengthy project cycles typical in its operating markets, such as major infrastructure upgrades and energy projects.

Costain’s success in securing and retaining these long-term frameworks, such as those with major water utilities and in the nuclear sector, underscores its reputation for dependability and technical expertise. This proven track record fosters client confidence, making Costain the preferred partner for critical national infrastructure projects. The company's ability to deliver on these extended contracts is a testament to its operational excellence and its understanding of client needs, ensuring sustained market presence.

Costain Group's substantial and growing order book, reaching a record £5.4 billion by the end of FY24, provides exceptional revenue visibility. This strong pipeline, with approximately 80% of FY25 revenue already secured, is underpinned by key contract wins in vital sectors like water and rail, offering a stable foundation for future growth.

The company's specialization in critical UK infrastructure, encompassing transportation, water, and energy, aligns perfectly with national investment priorities. This strategic focus, coupled with a commitment to digital solutions and innovation, positions Costain as a leader in delivering complex projects efficiently and sustainably, as seen in its 2024 work with data analytics and digital twins.

Costain demonstrates robust financial health, with a 7.5% increase in adjusted operating profit in FY24 and a net cash position of £158.5 million at year-end, projected to reach £180 million by end of FY25. This financial strength is further reflected in the doubling of its full-year dividend, indicating confidence in sustained growth and shareholder value.

Established long-term customer relationships and framework contracts, particularly in sectors like water utilities and nuclear energy, provide Costain with a predictable revenue stream and reduced business risk. This deep client integration and proven reliability foster repeat business and contract extensions, solidifying its competitive advantage.

| Metric | FY24 (End) | FY25 (Projected) | Significance |

|---|---|---|---|

| Forward Work Position | £5.4 billion | - | Record order book, >4x FY24 Revenue |

| FY25 Revenue Secured | ~80% | - | High revenue visibility |

| Net Cash | £158.5 million | ~£180 million | Strong financial health and liquidity |

| Adjusted Operating Profit Growth | 7.5% | - | Improved profitability |

What is included in the product

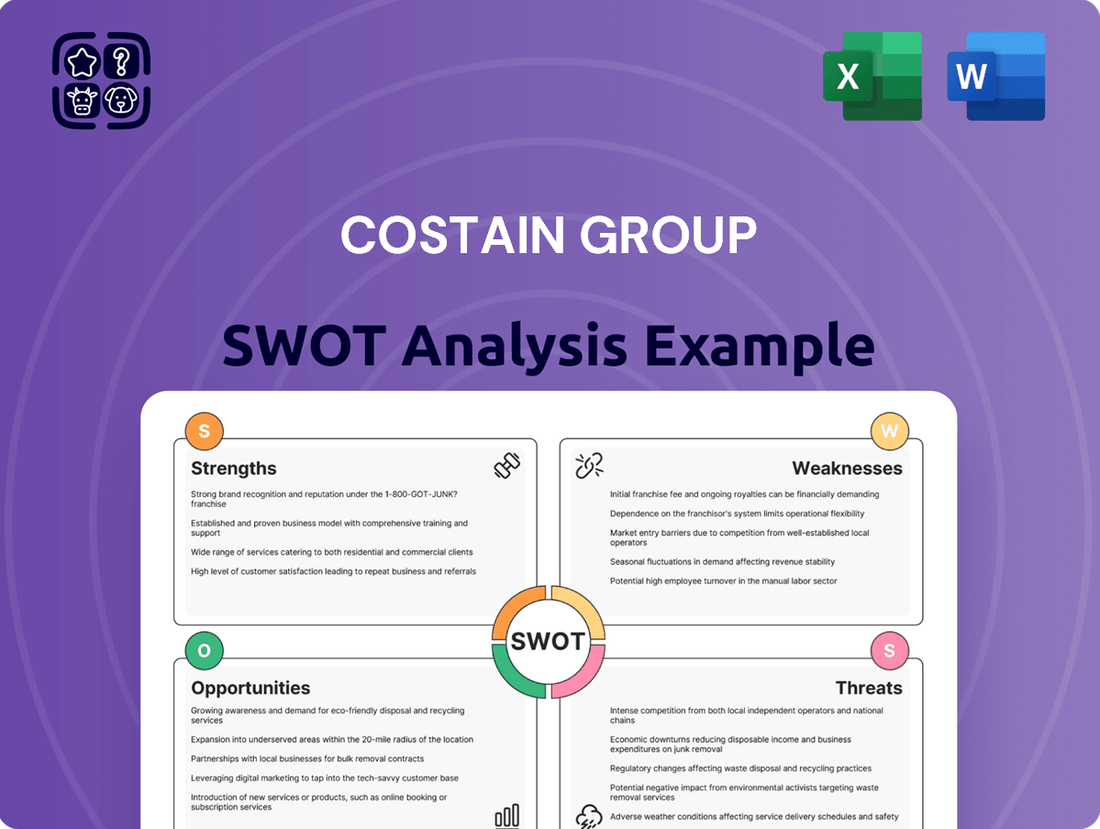

Analyzes Costain Group’s competitive position through key internal and external factors, highlighting its strengths in infrastructure and opportunities in energy transition, while acknowledging weaknesses in project delivery and threats from market competition.

Offers a clear, actionable framework to identify and leverage Costain's strengths, mitigate weaknesses, capitalize on opportunities, and counter threats for improved strategic planning.

Weaknesses

Costain Group faced a 6.1% revenue contraction in FY24, a notable weakness despite otherwise strong financial results. This dip was largely due to the natural ebb and flow of contract timings within their crucial Transportation division, where project starts and completions can shift.

While adjusted operating profit saw an increase, the decline in revenue highlights a challenge in ensuring consistent top-line expansion across all business segments. This revenue inconsistency can pose a risk to investor confidence, potentially affecting how they view the company's growth trajectory.

Analysts are forecasting a 2.5% decrease in Costain's revenue for 2025. This is a significant shift from the 6.0% annual growth the company experienced over the past five years. This projected decline is also considerably lower than the 5.1% growth anticipated for its industry peers.

This downward revenue projection for 2025 suggests Costain may be facing headwinds that hinder its ability to seize market opportunities as effectively as its competitors. The company will need to implement its strategic plans with precision to counter this negative trend.

Costain's sheer size and involvement in numerous large-scale projects and joint ventures present significant challenges. Ensuring uniform data accuracy and consistent risk management across such a diverse portfolio is a constant hurdle. For instance, managing the interplay of multiple complex contracts in a major infrastructure project can strain internal oversight.

Maintaining high operational standards across all these ventures requires robust systems. While Costain's SHE Assurance platform is a notable effort, the inherent complexity means that any lapse in oversight could lead to inefficiencies or even reputational damage. This was underscored by the company's prior experience with project delays, which can be exacerbated by poor coordination across multiple workstreams.

Exposure to Project Execution Risks and Liabilities

Costain’s deep involvement in massive, intricate infrastructure projects means they are inherently exposed to substantial risks and potential liabilities tied to project execution. For instance, delays or unexpected technical hurdles on major schemes can easily lead to budget blowouts, directly impacting the company's bottom line and overall financial health. In 2023, Costain reported that its rail division faced challenges, contributing to a £30 million operating loss for that segment, highlighting the financial impact of execution difficulties.

These execution challenges can manifest in various ways, including:

- Unforeseen Site Conditions: Discovering unexpected ground conditions or existing infrastructure can necessitate costly redesigns and delays.

- Supply Chain Disruptions: Volatility in material availability and pricing, as seen with rising steel costs in late 2024, can significantly inflate project expenses.

- Labor Shortages: A lack of skilled labor, a persistent issue in the construction sector, can slow progress and increase labor costs.

- Contractual Disputes: Disagreements over scope, timelines, or payment with clients or subcontractors can lead to lengthy and expensive legal battles.

Effectively managing these risks through robust planning, strong contractual frameworks, and diligent oversight is absolutely crucial for Costain to ensure successful project delivery and safeguard its financial performance against these inherent vulnerabilities.

Potential Recruitment and Retention Challenges

The construction and engineering sector is intensely competitive, and Costain faces headwinds in attracting and keeping skilled individuals. This is particularly true for the specialized expertise needed for intricate infrastructure projects.

Despite efforts to boost early careers programs, a sustained difficulty in drawing in and holding onto qualified professionals poses a risk. This could hinder Costain's ability to deliver projects on time and impede its expansion plans. In 2023, Costain noted a need to strengthen its talent pipeline, especially in areas like digital engineering and offshore wind.

- Talent Scarcity: The demand for specialized engineering skills often outstrips supply in the UK market.

- Competition: Major players and emerging firms actively compete for the same pool of skilled labor.

- Retention Issues: High project demands and the attractiveness of other sectors can lead to employee turnover.

- Skill Gaps: Keeping pace with technological advancements requires continuous upskilling, which can be challenging to implement broadly.

Costain's revenue experienced a 6.1% decrease in FY24, indicating a challenge in maintaining consistent top-line growth, especially with a projected 2.5% revenue decline in 2025, underperforming industry peers who are expected to grow by 5.1%. This inconsistency can affect investor confidence and the perception of the company's growth trajectory.

The company's large-scale projects and joint ventures create complexity in ensuring uniform data accuracy and consistent risk management across its diverse portfolio, potentially leading to inefficiencies or reputational damage if oversight falters.

Costain faces significant execution risks and potential liabilities on major infrastructure projects, as demonstrated by its rail division's £30 million operating loss in 2023 due to execution difficulties, which can lead to budget overruns.

The intense competition within the sector makes it challenging for Costain to attract and retain skilled professionals, particularly those with specialized expertise, which could impede project delivery timelines and expansion plans, as noted by the company's need to strengthen its talent pipeline in 2023.

| Metric | FY24 Value | FY25 Projection | Industry Peer Projection (2025) |

|---|---|---|---|

| Revenue Change | -6.1% | -2.5% | +5.1% |

| Segment Loss (Rail) | N/A (Reported £30M Loss in 2023) | N/A | N/A |

| Talent Pipeline Strength | Needs Strengthening (as per 2023) | N/A | N/A |

Full Version Awaits

Costain Group SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for the Costain Group. This comprehensive report details their Strengths, Weaknesses, Opportunities, and Threats. The complete version, offering in-depth insights and actionable strategies, becomes available immediately after your purchase. What you see here is exactly what you'll get, ensuring transparency and quality for your strategic planning needs.

Opportunities

The UK government's commitment to national infrastructure development, with an estimated £700 billion planned over the next decade and a £600 billion National Infrastructure Strategy, creates a robust long-term opportunity. Costain is well-positioned to capitalize on this, particularly in sectors like water, rail, nuclear energy, and defense.

The ongoing Asset Management Period 8 (AMP8) for water infrastructure, expected to be a significant driver of investment through 2030, offers substantial contract potential for Costain. Similarly, advancements in rail projects and the development of new nuclear power stations, such as the ongoing work at Sizewell C, further bolster these opportunities.

Costain's existing strong market positions and recent contract wins in these critical infrastructure areas demonstrate its capability to secure and deliver on these large-scale projects. This pipeline translates into sustained revenue streams and growth potential for the group.

The UK's commitment to net-zero targets and the broader energy transition presents a significant opportunity for Costain. The company is well-positioned to capitalize on the growing demand for decarbonisation solutions, particularly in emerging sectors like hydrogen generation and carbon capture technologies.

Costain's involvement in key projects underscores this potential. For instance, its role in the East Coast Cluster, a major carbon capture, utilization, and storage (CCUS) initiative, highlights its strategic alignment with national decarbonisation goals. This project alone aims to capture and store millions of tonnes of CO2 annually.

Furthermore, Costain's established presence in the nuclear sector, including work with Urenco and its bid for Sizewell C, offers another avenue for growth. As the UK seeks to bolster its low-carbon energy mix, Costain's expertise in complex infrastructure development for nuclear power plants becomes increasingly valuable, with Sizewell C projected to cost upwards of £20 billion.

Costain is actively growing its higher-margin consultancy offerings, such as delivery partner, engineering, and design services, alongside advisory and digital solutions. This strategic shift is designed to boost profitability by focusing on areas that historically command better margins.

The company's focus on digital transformation, data analytics, and intelligent automation presents a clear avenue for enhanced profitability and market differentiation. By embracing these advanced technologies, Costain is better positioned to meet the evolving digital demands of its client base.

For the year ended December 31, 2023, Costain reported a significant increase in its order book, reaching £5.7 billion, indicating strong demand for its integrated services, including consultancy.

Potential for Strategic Mergers and Acquisitions

Costain Group has signaled a clear strategic intent to pursue mergers and acquisitions (M&A), opening avenues for inorganic growth. This focus could lead to the diversification of its service offerings or expansion into new geographical regions and adjacent markets. For instance, the company's strong cash position, reported at £313 million as of the end of 2023, provides a solid financial footing to execute strategic deals.

Such acquisitions could significantly bolster Costain's existing capabilities, enlarge its market share, and fortify its competitive stance within the infrastructure sector.

- Inorganic Growth: M&A provides a faster route to expanding revenue and market presence compared to organic growth alone.

- Diversification: Acquiring companies with complementary services can broaden Costain's service portfolio and reduce reliance on specific sectors.

- Geographic Expansion: Strategic acquisitions can facilitate entry into new territories, accessing new customer bases and project pipelines.

- Enhanced Capabilities: Integrating new technologies or expertise through acquisitions can strengthen Costain's overall service delivery and innovation potential.

Enhanced Shareholder Returns Through Capital Allocation

Costain Group's strategic capital allocation, including a £10 million share buyback program announced in early 2024, demonstrates a commitment to rewarding shareholders. This initiative, coupled with a decision to double the dividend payout, signals financial robustness and a focus on boosting earnings per share. Such actions are designed to make Costain a more appealing investment within the competitive infrastructure sector.

These capital return initiatives are expected to enhance shareholder value by directly increasing the return on investment for existing shareholders. Furthermore, a strong dividend policy can attract new investors seeking reliable income streams, broadening the company's investor base.

- Share Buyback: £10 million program initiated in early 2024.

- Dividend Increase: Doubling of dividend payout to enhance shareholder returns.

- Investor Attraction: Signalling financial strength and commitment to shareholder value.

- Earnings Per Share: Focus on improving EPS through capital management.

The sustained UK government investment in national infrastructure, projected at £700 billion over the next decade, offers a significant growth runway for Costain, especially in water, rail, and nuclear energy sectors. The ongoing AMP8 water program and large-scale rail projects are expected to drive substantial contract opportunities through 2030.

Costain's strategic pivot towards higher-margin consultancy services, including digital and advisory solutions, presents an opportunity to enhance profitability. The company's order book of £5.7 billion as of December 31, 2023, reflects strong demand for these integrated offerings.

The UK's net-zero targets and the energy transition create fertile ground for Costain's expertise in decarbonisation technologies like hydrogen and carbon capture, exemplified by its involvement in the East Coast Cluster initiative.

Strategic mergers and acquisitions, supported by a robust cash position of £313 million at the end of 2023, provide a pathway for inorganic growth and market expansion.

Threats

The construction and infrastructure sectors are highly susceptible to shifts in the broader economic climate. For Costain, adverse macro-economic conditions, such as persistent inflation and rising interest rates, pose a significant threat. These factors can directly inflate project costs for materials, labor, and financing, putting pressure on already tight margins. For instance, the UK experienced an average inflation rate of 7.9% in 2023, impacting input costs across various industries.

Furthermore, economic downturns can lead to a reduction in client spending and a slowdown in new project commencements. This directly affects Costain’s revenue streams and the pipeline of future work. The Bank of England's Monetary Policy Committee has been actively adjusting interest rates to combat inflation, with rates reaching 5.25% by August 2023, increasing the cost of borrowing for both Costain and its clients.

To navigate these challenges, Costain must maintain robust cost management strategies and focus on securing projects with adequate pricing mechanisms to offset inflationary pressures. Effectively managing the impact of these economic headwinds on both revenue generation and operational expenses is crucial for sustaining profitability throughout 2024 and into 2025.

The UK's construction and engineering landscape is a battlefield, teeming with established giants all chasing the same lucrative infrastructure contracts. This fierce competition directly impacts Costain. For instance, in 2024, the infrastructure sector saw significant bidding activity, with major players like Balfour Beatty and Kier Group also actively pursuing large-scale projects, intensifying price pressures.

This constant jostling for position inevitably squeezes profit margins. When multiple firms bid on the same project, the lowest price often wins, forcing companies like Costain to operate on thinner margins. This makes securing new work a challenging endeavor, necessitating a sharp focus on efficiency and value proposition.

To combat this, Costain must consistently find ways to stand out from the crowd. This means not just offering competitive pricing, but also demonstrating unique expertise, innovative solutions, and a proven track record of successful project delivery to differentiate its services and maintain its edge in securing future contracts.

Costain Group faces threats from project-specific risks and contractual disputes, particularly on large infrastructure projects. These can include unexpected ground conditions, technical hurdles, or shifts in regulations, all of which can derail timelines and inflate costs. For instance, in 2023, the UK's construction sector experienced significant challenges with material price volatility and labor shortages, impacting project profitability across the board.

Disagreements with clients or subcontractors are also a considerable risk. Such disputes can lead to prolonged legal battles, substantial financial penalties, and damage to Costain's reputation. The industry average for disputes in major infrastructure projects can range from 5-10% of project value, highlighting the potential financial strain these issues can impose.

Reputational Damage from Corruption or Ethical Lapses

The infrastructure sector, where Costain Group PLC operates, faces inherent risks of bribery and corruption. Discussions at industry events in 2024 highlighted this ongoing concern. Any association, even indirect, with unethical practices can inflict severe reputational damage.

Such damage can translate into tangible financial and operational consequences. These include the potential loss of valuable contracts and the imposition of significant regulatory fines. For instance, Transparency International's 2023 Corruption Perception Index noted persistent challenges in procurement processes within the construction and infrastructure industries globally, underscoring the sector's vulnerability.

- Erosion of Trust: Ethical breaches severely undermine stakeholder confidence, affecting investor relations and public perception.

- Contractual Risks: Companies implicated in corruption may face contract cancellations and debarment from future bidding opportunities.

- Regulatory Penalties: Fines and sanctions from regulatory bodies can be substantial, impacting profitability and cash flow.

- Brand Value Decline: A tarnished reputation directly impacts brand equity, making it harder to attract talent and secure new business.

Changes in Government Policy or Funding Priorities

Costain's reliance on UK government infrastructure spending makes it susceptible to political shifts. For instance, a change in government leadership or a re-evaluation of national priorities could directly impact the pipeline of projects. The Autumn Statement 2023, while outlining significant investment, also signaled a focus on specific areas, potentially deprioritizing others where Costain operates.

Changes in funding levels for key sectors like transport or energy pose a significant threat. Reductions or delays in the disbursement of allocated funds can lead to project deferrals or even cancellations, directly affecting Costain's order book and revenue projections. The government's commitment to net-zero targets, while creating opportunities, also means funding priorities can shift rapidly based on evolving environmental policies.

Delays in the implementation of crucial policies, such as the National Infrastructure Strategy, can create uncertainty. If approved projects face prolonged bureaucratic hurdles or a lack of timely policy backing, it directly hampers Costain's ability to secure and commence new work. This uncertainty can make long-term planning and resource allocation challenging.

- Policy Uncertainty: Evolving government infrastructure plans create a risk of project cancellations or delays.

- Funding Fluctuations: Changes in public spending on infrastructure can directly impact Costain's revenue streams.

- Regulatory Shifts: New environmental or planning regulations could increase project costs or timelines.

- Political Instability: General elections or changes in government can lead to reviews of existing infrastructure commitments.

Costain's reliance on UK government infrastructure spending makes it susceptible to political shifts and changes in funding priorities. For instance, the Autumn Statement 2023 detailed infrastructure investment, but evolving environmental policies and net-zero targets could rapidly alter funding allocations. Delays in implementing key policies, like the National Infrastructure Strategy, also create uncertainty and hinder Costain's project pipeline and long-term planning.

Intense competition within the UK construction and engineering sector, with major players like Balfour Beatty and Kier Group actively bidding on large infrastructure projects, inevitably squeezes Costain's profit margins. This pressure necessitates a strong focus on efficiency and demonstrating unique expertise to secure new work and maintain a competitive edge through 2024 and into 2025.

Project-specific risks, such as unexpected ground conditions or material price volatility, alongside contractual disputes, pose significant threats. In 2023, the UK construction sector faced labor shortages and price fluctuations, impacting profitability, and industry data suggests disputes can account for 5-10% of project value, highlighting potential financial strain.

The infrastructure sector also faces ongoing risks of bribery and corruption, as highlighted in industry discussions in 2024. Association with unethical practices can lead to severe reputational damage, contract cancellations, and substantial regulatory fines, as indicated by Transparency International's 2023 Corruption Perception Index regarding procurement challenges.

SWOT Analysis Data Sources

The Costain Group SWOT analysis is built upon a foundation of credible data, including the company's official financial statements, comprehensive market intelligence reports, and insights from industry experts. This multi-faceted approach ensures a robust and accurate assessment of their strategic position.