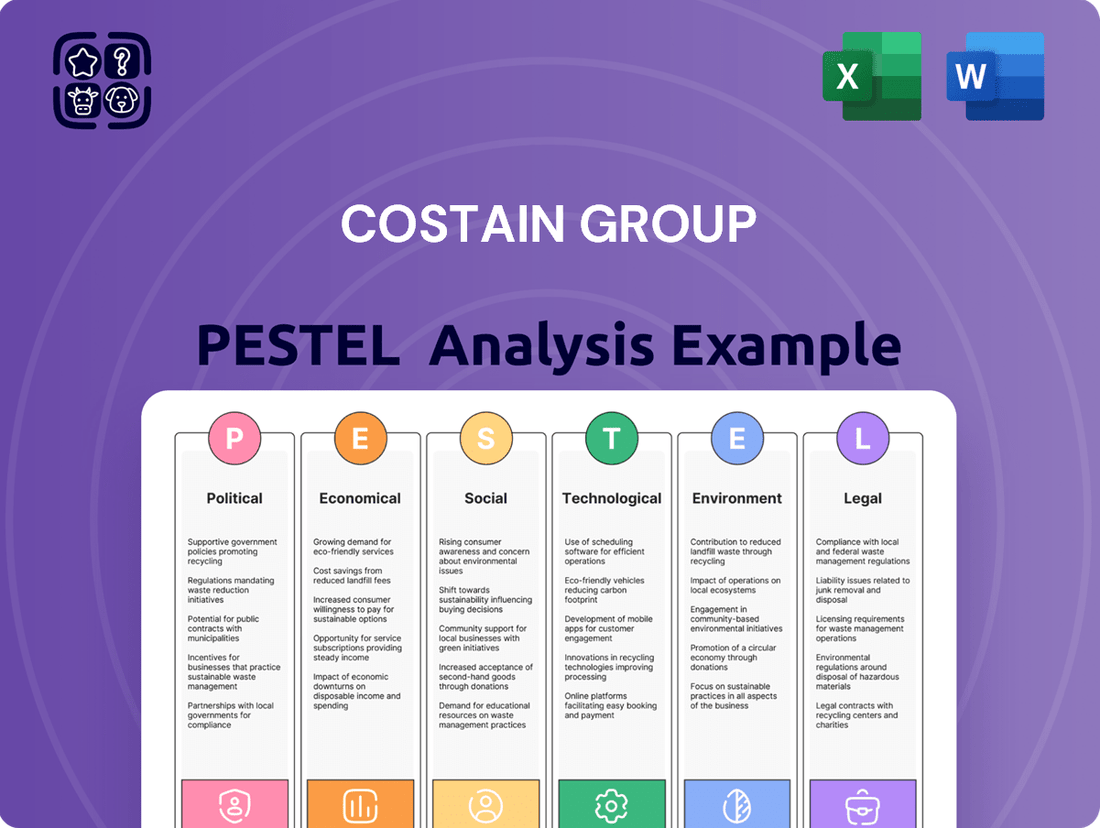

Costain Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Costain Group's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to anticipate challenges and seize opportunities. Don't get left behind in this dynamic industry.

Gain a competitive edge by understanding the intricate PESTLE landscape impacting Costain Group. From evolving government regulations to shifting economic climates and technological advancements, this analysis delivers the strategic insights you need to navigate the future. Download the full version now for immediate access to crucial market intelligence.

Political factors

Costain's performance is intrinsically linked to the UK government's infrastructure spending priorities. The government's continued investment in key sectors like transportation, water, energy, and defense directly translates into opportunities for Costain's services.

The National Infrastructure and Construction Pipeline highlights substantial planned government investment. Specifically, projections indicate significant spending from 2023 through 2025 and a robust outlook for the subsequent decade, ensuring a consistent flow of projects.

This sustained governmental focus on infrastructure development creates a predictable and stable demand landscape. It underpins the long-term revenue potential for companies like Costain, which are equipped to deliver these large-scale projects.

Changes in government regulations, especially concerning construction standards, planning approvals, and the structure of public-private partnerships, have a direct effect on how Costain delivers projects and the associated operational expenses. For instance, evolving environmental regulations can necessitate costly adaptations to building materials and methods.

The government's introduction of the National Infrastructure and Service Transformation Authority (NISTA) is designed to expedite the planning approval process for significant infrastructure undertakings. This initiative, expected to be fully operational by 2025, could potentially shorten project schedules and lessen administrative delays, thereby improving Costain's project execution efficiency.

Furthermore, shifts in government spending priorities, particularly in areas like rail upgrades and energy transition projects, directly influence the pipeline of opportunities available to Costain. The UK government's commitment to net-zero targets, backed by a £20 billion infrastructure investment plan announced in 2024, presents substantial potential for companies like Costain involved in sustainable development.

Political stability in the UK is paramount for Costain, especially given its focus on long-term infrastructure projects. Shifts in government policy following elections can significantly impact spending priorities. For instance, the UK government's commitment to the National Infrastructure Strategy, announced in November 2021, aims to deliver £600 billion of infrastructure investment over the next five years, but future administrations might alter this trajectory.

The upcoming general election, anticipated in 2024 or early 2025, presents a key political factor. While current government spending plans indicate a robust pipeline, a change in leadership could lead to re-evaluations of major infrastructure commitments, potentially affecting Costain's order book and strategic investments. The Conservative party's current infrastructure agenda contrasts with potential policy shifts under a Labour government, creating a degree of uncertainty for the sector.

Defense and National Security Priorities

Costain's deep involvement in the defense sector means its business is inherently linked to the UK's national security objectives and how defense budgets are allocated. Changes in government spending on defense directly impact the demand for Costain's services and its project pipeline.

Government policy plays a crucial role in shaping Costain's growth, particularly in areas like decarbonization and energy security. For instance, recent contract wins, such as those in nuclear energy with Urenco and Sizewell C, underscore the significance of supportive government strategies for energy infrastructure development.

- UK Defense Spending: In the 2024 Spending Review, the UK government committed to increasing defense spending by 5% above inflation annually, reaching £77 billion by 2027-28, a significant uplift that could benefit defense contractors like Costain.

- Nuclear Energy Investment: The UK government has set ambitious targets for nuclear energy as part of its net-zero strategy, aiming for 24GW of nuclear power by 2050, which provides a strong policy tailwind for companies involved in nuclear infrastructure projects.

- Infrastructure Modernization: National security priorities often translate into significant investment in critical national infrastructure, including energy grids and communication networks, areas where Costain has substantial expertise.

Public-Private Partnership (PPP) Frameworks

The UK government's commitment to Public-Private Partnerships (PPPs) and similar collaborative procurement models directly impacts Costain's project pipeline and operational strategies. As of early 2024, there's a continued emphasis on these frameworks to deliver critical national infrastructure, suggesting a favorable environment for companies like Costain adept at managing such complex arrangements.

Collaborative contracting, a hallmark of modern PPPs, influences how risks and rewards are shared. For Costain, this means a greater potential for stable, long-term revenue streams but also a need for robust risk management capabilities to ensure profitability. The 2024 infrastructure spending plans, with a significant portion allocated to projects utilizing these models, underscore their importance.

- Government Focus on Infrastructure Investment: The UK government's Infrastructure and Projects Authority (IPA) continues to highlight PPPs as a key delivery mechanism for major projects.

- Shifting Contractual Landscape: The trend towards NEC (New Engineering Contract) and other collaborative contracts, which define risk allocation, is well-established in the UK construction sector, impacting Costain's project execution.

- Project Pipeline Visibility: The government's pipeline of planned infrastructure projects, often tendered through PPP or similar structures, provides Costain with forward visibility on potential work.

- Risk Sharing Mechanisms: The effectiveness of risk sharing within PPP frameworks directly influences Costain's profitability and the financial viability of its bids.

Political stability and government infrastructure spending are key drivers for Costain. The UK's National Infrastructure Strategy, aiming for £600 billion investment over five years from November 2021, provides a substantial project pipeline. Government policy on net-zero targets, supported by a £20 billion infrastructure investment plan announced in 2024, specifically benefits Costain's work in sustainable development.

Regulatory changes, particularly in construction standards and planning, directly impact Costain's operations and costs. The planned National Infrastructure and Service Transformation Authority (NISTA), operational by 2025, aims to streamline approvals, potentially boosting efficiency. Defense spending increases, with a 5% above-inflation commitment in the 2024 Spending Review, also present opportunities.

Public-Private Partnerships (PPPs) remain a favored procurement model for major projects as of early 2024, aligning with Costain's expertise. The UK government's focus on collaborative contracting, such as NEC, influences risk sharing and Costain's profitability. The nuclear energy sector, with targets for 24GW by 2050, offers significant policy support for Costain's involvement.

| Political Factor | Impact on Costain | Supporting Data/Initiative (2023-2025 Focus) |

|---|---|---|

| Infrastructure Spending | Directly drives project opportunities and revenue | £600bn National Infrastructure Strategy (5 years from Nov 2021); £20bn Net-Zero investment plan (2024) |

| Regulatory Environment | Affects operational costs and project execution | NISTA streamlining approvals (by 2025); Evolving environmental standards |

| Defense Budget | Influences demand in the defense sector | 5% above inflation annual increase commitment (2024 Spending Review) |

| Procurement Models (PPPs) | Shapes project pipeline and risk management needs | Continued emphasis on PPPs (early 2024); Trend towards NEC contracts |

| Energy Policy (Nuclear) | Creates opportunities in a key growth area | Target of 24GW nuclear power by 2050 |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the Costain Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats shaped by current market and regulatory dynamics.

A clear, actionable PESTLE analysis for Costain Group that highlights key external drivers, transforming potential threats into strategic opportunities for enhanced market positioning.

Economic factors

Inflationary pressures on materials and wages have been a key concern for Costain. While the UK's Consumer Price Index (CPI) saw a notable decrease, reaching 2.3% in the year to May 2024, and interest rates were maintained at 5.25% by the Bank of England in June 2024, the lingering effects of prior inflation continue to impact project economics. Future interest rate adjustments in late 2024 and early 2025, with expectations of some cuts, will be crucial for Costain's financing costs and the attractiveness of new large-scale infrastructure bids.

The UK's economic trajectory significantly influences Costain's performance, with construction output serving as a key indicator. Modest growth is anticipated for the UK economy in 2025, projecting a GDP increase of around 1.5%, according to the Office for Budget Responsibility (OBR) in their November 2024 forecast. This overall economic health directly impacts demand for Costain's services.

Specifically, the construction sector's outlook is crucial. Forecasts suggest construction output will experience a modest uplift in 2025, potentially around 2%. This growth is anticipated to be particularly strong in infrastructure projects, a core area of Costain's expertise, driven by government investment in transport and energy networks.

The UK construction industry grapples with a persistent shortage of skilled labor, driving up wages and potentially delaying projects. This scarcity impacts companies like Costain, affecting project timelines and operational costs.

In response, Costain is strategically bolstering its early careers programs, which include graduates and apprentices. This initiative is a direct investment in cultivating future talent and mitigating the ongoing skilled labor deficit.

The Construction Industry Training Board (CITB) projected a need for 217,000 new workers by 2025 in the UK, highlighting the scale of the challenge. Costain's focus on internal development aims to secure a stable pipeline of qualified personnel.

By prioritizing apprenticeships and graduate schemes, Costain not only addresses immediate labor needs but also builds a foundation for long-term workforce stability and expertise, crucial for its complex infrastructure projects.

Supply Chain Resilience and Material Costs

Costain, like many in the infrastructure sector, continues to navigate the complexities of global and domestic supply chain disruptions. These issues directly impact project timelines and the overall cost of materials, a persistent challenge for the company.

While the extreme material price inflation seen in earlier periods has somewhat eased, the industry's susceptibility to fluctuations in global economic health and geopolitical tensions remains a significant factor. For instance, in early 2024, construction material prices, including steel and concrete, showed signs of stabilization compared to the peaks of 2022, but remained elevated compared to pre-pandemic levels. This volatility necessitates advanced supply chain management strategies to mitigate risks.

- Supply Chain Vulnerabilities: Ongoing geopolitical events and trade policy shifts can still trigger sudden disruptions.

- Material Cost Volatility: Despite moderation, key commodity prices like copper and cement can experience sharp swings. For example, copper prices reached multi-year highs in early 2024, impacting infrastructure projects reliant on electrical components.

- Resilience Investments: Companies like Costain are investing in diversified sourcing and enhanced inventory management to buffer against future shocks.

- Inflationary Pressures: While overall inflation has cooled, specific material costs can still be subject to localized or sector-specific inflationary pressures.

Investment Cycles in Key Sectors

Costain Group's financial health is closely linked to the investment ebb and flow within its core sectors. These include transportation, water, energy, and defense. Understanding these cycles is crucial for assessing the company's prospects.

Recent indicators point to robust investment activity. The water sector's AMP8 (Asset Management Period 8) programmes are a key driver. Furthermore, significant contract awards in nuclear energy anticipated in 2025 are expected to bolster Costain's order book. These developments signal a positive outlook for the company's forward work pipeline.

- Transportation: Continued government spending on infrastructure projects provides a stable demand base.

- Water: AMP8 programmes, representing billions in planned investment, are a major growth area.

- Energy: Growth in nuclear and offshore wind projects offers substantial opportunities.

- Defense: Increased defense spending globally supports long-term contract potential.

Economic factors present a mixed outlook for Costain. While inflationary pressures have moderated, with UK CPI at 2.3% in May 2024, lingering effects and potential future interest rate adjustments by the Bank of England (currently at 5.25%) will influence financing costs and bid competitiveness. The UK economy is projected to grow modestly, around 1.5% in 2025, with construction output expected to see a 2% uplift, particularly in infrastructure, a core Costain strength.

| Economic Factor | 2024/2025 Data/Forecast | Impact on Costain |

|---|---|---|

| UK Inflation (CPI) | 2.3% (May 2024) | Moderating cost pressures, but lingering effects on project economics. |

| Bank of England Interest Rate | 5.25% (June 2024) | Influences financing costs and investment attractiveness of new projects. |

| UK GDP Growth Forecast | ~1.5% (2025) | Indicates overall economic health impacting demand for Costain's services. |

| UK Construction Output Forecast | ~2% (2025) | Positive outlook, especially for infrastructure, a core Costain sector. |

Preview the Actual Deliverable

Costain Group PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Costain Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It provides a robust framework for understanding the external landscape and strategic challenges faced by Costain. You'll gain actionable insights into market dynamics and potential opportunities.

Sociological factors

The UK construction sector faces a significant challenge with an aging workforce, with many experienced professionals nearing retirement, creating a pressing need for new talent. This demographic trend is exacerbated by a persistent skills gap, meaning there aren't enough workers with the necessary expertise to meet project demands. Costain is actively tackling this by boosting its graduate and apprentice intake for 2025, aiming to cultivate a future talent pool and ensure a skilled workforce for years to come.

Public and regulatory expectations for robust health, safety, and wellbeing standards on construction sites are consistently increasing. This heightened scrutiny impacts operational costs and requires ongoing investment in training and safety protocols.

Costain's unwavering commitment to safety is not just a regulatory necessity but a core pillar of its business, directly influencing its reputation and ability to secure contracts. For instance, in 2023, Costain reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.21, demonstrating their focus on maintaining a safe working environment.

Adherence to stringent safety measures is crucial for operational efficiency, minimizing disruptions, and reducing potential financial liabilities. It also plays a vital role in attracting and retaining skilled personnel who prioritize working for organizations with a strong safety culture.

Community engagement is becoming a cornerstone of major infrastructure projects, with an increasing demand for construction firms to actively contribute to the social fabric of the areas they operate in. This focus on social value, beyond just the physical build, is crucial for gaining and maintaining public acceptance, as well as for future business opportunities.

Costain's approach, exemplified by its work on projects like Sizewell C, actively seeks to embed positive social impacts. This includes creating local employment, skills development, and supporting community initiatives. For example, in 2023, Costain reported creating over 1,500 apprenticeships and training opportunities across its projects, directly contributing to community development.

By prioritizing social value, Costain not only fulfills ethical obligations but also builds trust and goodwill with local stakeholders. This proactive engagement is vital for securing the necessary social license to operate and for fostering long-term relationships that can lead to future contract awards in a competitive market.

Diversity and Inclusion Initiatives

Societal expectations and evolving legal landscapes increasingly mandate greater diversity and inclusion within organizations. Costain Group's commitment to Equality, Diversity, and Inclusion (EDI) is therefore not just a matter of social responsibility but a strategic imperative. This focus helps cultivate a more innovative workplace and broadens the appeal to a wider range of potential employees, a crucial factor in the competitive engineering and construction sector.

Costain has actively pursued initiatives to embed EDI principles. For instance, by mid-2024, the company reported that women held approximately 30% of its leadership positions, a figure they aim to increase further. Their ongoing efforts include unconscious bias training for all employees and targeted recruitment programs aimed at underrepresented groups.

- Talent Attraction: A diverse and inclusive culture is a significant draw for top talent, especially among younger generations entering the workforce who prioritize these values.

- Innovation: Diverse teams bring a wider range of perspectives, leading to more creative problem-solving and innovative solutions, vital for complex engineering projects.

- Reputation: Strong EDI performance enhances Costain's reputation with clients, investors, and the public, contributing to its social license to operate.

- Employee Engagement: An inclusive environment fosters higher employee morale, retention, and productivity, as individuals feel valued and respected.

Public Perception of Infrastructure Projects

Public sentiment significantly influences the feasibility and timeline of major infrastructure developments. Costain, a key player in this sector, must actively cultivate positive public perception to secure its social license to operate.

For instance, public opposition, often fueled by concerns over environmental impact or local disruption, can lead to project delays and increased costs. In the UK, recent infrastructure projects have faced scrutiny, with surveys indicating public support often hinges on clear communication about long-term benefits and mitigation of immediate impacts. Costain's engagement strategies, therefore, need to be robust, highlighting job creation and economic upliftment in local communities.

- Community Engagement: Proactive dialogue with local residents and stakeholders to address concerns and build trust.

- Benefit Communication: Clearly articulating the positive outcomes of projects, such as improved transport links or enhanced digital connectivity.

- Environmental Stewardship: Demonstrating a commitment to sustainable practices and minimizing the ecological footprint of construction.

- Economic Impact: Showcasing the creation of local jobs and supply chain opportunities associated with project delivery.

Societal expectations are increasingly shaping the construction industry, pushing for greater diversity and inclusion within companies like Costain. This focus is vital for attracting top talent, fostering innovation through varied perspectives, and enhancing overall corporate reputation. By mid-2024, Costain reported approximately 30% of its leadership positions were held by women, a figure they are actively working to increase.

Technological factors

Costain Group's strategic emphasis on digital transformation is a significant technological factor. The company is actively integrating advanced digital solutions to enhance its project delivery capabilities.

The construction industry is seeing a rapid uptake of Building Information Modeling (BIM), which allows for detailed 3D design and lifecycle management. In 2024, it's estimated that BIM adoption in major infrastructure projects in the UK has surpassed 70%, significantly improving collaboration and reducing design clashes.

Artificial Intelligence (AI) is playing a crucial role in optimizing project scheduling, predicting potential delays, and managing risks more effectively. For instance, AI-powered analytics can process vast amounts of data to identify patterns and recommend adjustments, leading to more predictable project timelines and cost savings.

Furthermore, the Internet of Things (IoT) is revolutionizing site management through real-time data collection from sensors on equipment and materials. This enables enhanced monitoring of progress, asset utilization, and safety compliance, contributing to improved operational efficiency and quality control throughout the project lifecycle.

The construction industry, including companies like Costain, is increasingly embracing automation and robotics to combat persistent labor shortages. In the UK, for instance, the construction sector faced a shortage of around 225,000 workers in 2023, highlighting the critical need for technological solutions. These advancements allow for tasks such as autonomous surveying using drones and self-operating machinery to be executed more efficiently, boosting productivity. This technological integration not only streamlines operations but also presents an opportunity to attract a new generation of tech-savvy workers to the industry.

Costain Group's focus on sustainable construction technologies is paramount, with innovations like low-carbon concrete and timber construction gaining traction. The UK government's commitment to net-zero by 2050, reinforced by initiatives like the Construction Leadership Council's Net Zero Carbon Roadmap, directly influences demand for these methods.

The adoption of off-site and modular construction, which can reduce waste by up to 90% and construction time by 50%, offers Costain a significant edge. For instance, projects utilizing pre-manufactured components are increasingly favored for their efficiency and reduced environmental impact, a trend that is expected to accelerate as regulatory pressures and client expectations evolve through 2024 and 2025.

Energy-efficient designs, incorporating advanced insulation and smart building systems, are becoming standard. The UK Green Building Council reported that operational carbon emissions from buildings account for 40% of the UK's total carbon footprint, underscoring the market's drive towards retrofitting and new builds with lower energy demands, a key area for Costain's technological investment.

Cybersecurity and Data Management

Costain's increasing reliance on digital platforms for project management and execution amplifies cybersecurity and data management concerns. The company handles substantial volumes of sensitive project data, client information, and intellectual property, making robust protection a critical operational imperative. A breach could compromise project continuity, lead to significant financial losses, and damage Costain's reputation, impacting client trust. In 2023, the UK government reported a 14% increase in cyberattacks against critical infrastructure, a sector Costain actively serves.

Effective data management ensures that project information is secure, accessible, and compliant with regulations, which is vital for Costain's operational efficiency and strategic decision-making. Maintaining client confidence in data security is paramount, especially given the sensitive nature of infrastructure projects. Costain's commitment to cybersecurity is demonstrated through its investments in advanced security protocols and employee training. For instance, in 2024, Costain continued to enhance its data governance frameworks to align with evolving data protection standards.

- Cybersecurity Investment: Costain allocates significant resources to protect its digital infrastructure and project data from escalating cyber threats.

- Data Governance: Implementing stringent data management policies ensures compliance and maintains the integrity of project-related information.

- Client Trust: Robust cybersecurity measures are essential for safeguarding client data and upholding Costain's reputation for reliability and security.

- Operational Resilience: Effective data management and cybersecurity practices contribute directly to the continuity and resilience of Costain's project operations.

Innovation in Smart Infrastructure

Costain's focus on smart infrastructure solutions hinges on ongoing innovation. This includes advancements in smart cities, intelligent transport, and digital twins, which are vital for staying competitive. These technologies are key to improving how we manage and maintain essential services.

These innovations directly translate into tangible benefits. Predictive maintenance, for instance, can significantly reduce downtime and operational costs. In 2024, the global smart cities market was valued at an estimated $1.5 trillion, showcasing the immense growth potential and the importance of technological leadership in this sector.

Costain's commitment to digital twins, a core aspect of smart infrastructure, is particularly noteworthy. These virtual replicas of physical assets enable better planning, simulation, and management of infrastructure projects. The UK government's own investment in digital infrastructure and smart city initiatives, projected to reach tens of billions by 2030, underscores the strategic importance of these capabilities.

- Smart Cities Growth: The global smart cities market is projected to reach over $2.5 trillion by 2026, indicating a strong demand for innovative solutions.

- Digital Twin Adoption: Around 75% of large organizations are expected to adopt digital twins for at least one business process by 2027, highlighting a growing trend.

- AI in Infrastructure: Investments in AI for infrastructure management are escalating, with AI expected to contribute significantly to operational efficiency and predictive maintenance in the coming years.

Costain's technological strategy heavily leverages digital transformation, integrating advanced solutions like Building Information Modeling (BIM) which saw over 70% adoption in UK infrastructure projects in 2024. Artificial intelligence is crucial for optimizing project timelines and managing risks, while the Internet of Things (IoT) enhances site management through real-time data collection.

The company is also addressing labor shortages by adopting automation and robotics, a necessity given the UK construction sector's deficit of approximately 225,000 workers in 2023. Sustainable technologies, such as low-carbon concrete, are a priority, aligning with the UK's net-zero targets. Off-site and modular construction methods are also being employed, offering significant waste and time reductions.

Costain's commitment to smart infrastructure, including digital twins and smart city solutions, is supported by a growing global market valued at $1.5 trillion in 2024, with significant government investment in these areas. However, this digital reliance necessitates robust cybersecurity measures, especially considering the 14% increase in cyberattacks against UK critical infrastructure reported in 2023.

Legal factors

Costain operates under stringent health and safety regulations, such as the Construction (Design and Management) Regulations (CDM), which are crucial for overseeing construction projects in the UK. These laws dictate how projects are planned, managed, and monitored to ensure the health and safety of everyone involved, from start to finish.

Failure to comply can result in significant penalties, including fines and project delays, directly impacting Costain's profitability and reputation. For instance, in 2023, the Health and Safety Executive (HSE) reported that construction sector fatalities remained a concern, underscoring the ongoing importance of rigorous safety protocols for companies like Costain.

Adherence to these health and safety standards influences every aspect of Costain's business, from site management and risk assessment to employee training and the selection of subcontractors. The company's commitment to safety is a core operational principle, directly affecting project timelines and the allocation of resources, with continuous investment in safety training and equipment being a necessity.

Environmental regulations, such as the UK's Environmental Protection Act 1990 and the Water Resources Act 1991, directly shape how Costain designs and executes its infrastructure projects, focusing on pollution control and waste management. These laws necessitate rigorous environmental impact assessments, which are legal prerequisites for securing project approvals and are critical for ensuring compliance.

Costain's commitment to sustainability means navigating a complex web of permitting processes for activities like construction near protected habitats or discharging treated water, as mandated by the Habitat Regulations and relevant environmental agency guidelines.

For 2024 and into 2025, ongoing scrutiny of construction's environmental footprint, particularly concerning carbon emissions and biodiversity net gain, means stricter enforcement and potentially longer lead times for obtaining environmental permits, impacting project timelines and costs.

Failure to comply with these environmental statutes can result in significant fines, project delays, and reputational damage, underscoring the legal imperative for Costain to maintain robust environmental management systems across all its operations.

Costain's operations are heavily influenced by contract law and public procurement regulations, particularly when engaging in government-backed infrastructure projects. Navigating these complex legal frameworks is crucial for successful bidding, contract negotiation, and effective dispute resolution.

The UK's Public Contracts Regulations 2015, for example, dictate transparency and fairness in awarding public service contracts, impacting how companies like Costain must approach tenders. Failure to comply can lead to disqualification or legal challenges, as seen in various procurement disputes across the infrastructure sector.

Costain's reliance on long-term, high-value contracts means understanding liability, performance bonds, and termination clauses within contract law is paramount. A significant portion of their revenue, often billions annually, is tied to these contractual agreements.

Data Protection and Privacy Legislation

Costain's reliance on digital solutions and smart infrastructure necessitates strict adherence to data protection and privacy laws, such as the UK's Data Protection Act 2018 which incorporates GDPR principles. Failure to comply can lead to significant financial penalties; for instance, the Information Commissioner's Office (ICO) can impose fines up to £17.5 million or 4% of global annual turnover for serious data breaches.

Maintaining robust data security and privacy is paramount for safeguarding client trust and avoiding legal repercussions. In 2023, the UK government continued to refine its data protection framework, with ongoing discussions around the Data Protection and Digital Information Bill, which aims to streamline regulations while maintaining high privacy standards. Costain's proactive approach to data governance directly impacts its reputation and operational continuity.

- GDPR/UK Data Protection Act 2018 Compliance: Essential for handling client and project data securely.

- ICO Enforcement: Potential fines for breaches can be substantial, impacting financial performance.

- Client Trust: Demonstrating strong data protection practices is key to winning and retaining contracts.

- Reputational Risk: Data privacy incidents can severely damage Costain's brand image and market standing.

Competition Law and Anti-Trust

As a significant entity in the UK's construction and engineering landscape, Costain is bound by stringent competition laws and anti-trust regulations. These legal frameworks are designed to foster a level playing field by prohibiting practices that stifle fair market competition and collusion among businesses. This means Costain must ensure its bidding strategies and dealings with other firms in the sector are transparent and do not involve any form of anti-competitive behavior.

Adherence to these regulations directly impacts Costain's approach to tendering for major infrastructure projects. For instance, the UK's Competition and Markets Authority (CMA) actively investigates and penalizes companies found guilty of bid rigging or price fixing. In 2023, the CMA continued its focus on construction sector procurement, issuing fines for anti-competitive practices. Costain's commitment to operating within these legal boundaries is crucial for maintaining its reputation and securing future contracts.

- Regulatory Scrutiny: Costain operates under the watchful eye of bodies like the UK's Competition and Markets Authority (CMA), which enforces competition law.

- Fair Bidding Practices: The company must ensure its bidding processes for projects are demonstrably fair and free from collusion with competitors.

- Market Conduct Influence: Competition law shapes how Costain engages with rivals, impacting pricing strategies and partnership opportunities.

- Risk of Penalties: Non-compliance can lead to substantial fines and reputational damage, as seen in past CMA investigations within the construction industry.

Costain's legal obligations extend to ensuring robust data protection, adhering to the UK's Data Protection Act 2018, which aligns with GDPR principles. Failure to comply, as evidenced by potential fines from the Information Commissioner's Office (ICO) up to 4% of global annual turnover, underscores the importance of diligent data governance. Ongoing legislative developments, such as the Data Protection and Digital Information Bill in 2023-2024, necessitate continuous adaptation to maintain compliance and client trust, directly impacting project continuity.

The company is also subject to competition laws, governed by bodies like the UK's Competition and Markets Authority (CMA). These laws mandate fair bidding practices and prohibit anti-competitive behavior such as bid rigging, with the CMA actively penalizing non-compliance. Costain's commitment to ethical market conduct is therefore vital for maintaining its reputation and securing future contracts, especially given the CMA's continued focus on the construction sector's procurement practices.

Contract law and public procurement regulations, such as the Public Contracts Regulations 2015, are fundamental to Costain's business, particularly for government projects. These regulations ensure transparency and fairness in contract awards, and non-compliance can lead to disqualification or legal challenges, impacting revenue streams that often exceed billions annually.

| Legal Area | Key Legislation/Body | Implication for Costain | Potential Consequence of Non-compliance |

|---|---|---|---|

| Data Protection | UK Data Protection Act 2018 (GDPR) / ICO | Secure handling of client and project data, maintaining trust. | Fines up to 4% of global annual turnover, reputational damage. |

| Competition Law | Competition and Markets Authority (CMA) | Fair bidding, no anti-competitive practices. | Substantial fines, loss of contracts, reputational harm. |

| Procurement | Public Contracts Regulations 2015 | Transparency and fairness in public tenders. | Disqualification from tenders, legal challenges, project delays. |

Environmental factors

The UK's commitment to achieving net-zero carbon emissions by 2050 is a significant driver for the construction sector, necessitating a shift towards sustainable and environmentally friendly methodologies. This regulatory landscape directly influences how companies like Costain operate and plan for the future.

Costain has proactively embraced these environmental challenges, establishing ambitious targets for reducing its own carbon footprint. The company aims for substantial reductions in Scope 1, 2, and 3 emissions by key dates: 2025, 2030, and 2050. This aligns with the stringent guidelines set by the Science Based Targets initiative (SBTi), demonstrating a commitment to verifiable climate action.

Increasing global awareness of resource scarcity is significantly reshaping the construction sector, pushing companies like Costain towards more sustainable practices. Stringent waste management regulations are a key driver here, encouraging the adoption of circular economy principles. This means a greater emphasis on minimizing waste generated on-site and maximizing the reuse of materials.

Costain's operations are directly impacted by these environmental pressures. There's a growing need to reduce the amount of waste sent to landfill, which in 2023, the UK construction industry generated approximately 127 million tonnes of waste. The company is therefore influenced by the push for deconstruction over traditional demolition methods, allowing for the recovery and reuse of building components. Furthermore, increasing the use of recycled materials in new projects is becoming a crucial aspect of their environmental strategy to meet regulatory demands and client expectations.

Costain's infrastructure projects inherently interact with ecosystems, necessitating a strong focus on biodiversity. For instance, major transport developments, a core area for Costain, can disrupt natural habitats and impact species. In 2023, the UK government continued to emphasize net gain for biodiversity, requiring new developments to leave biodiversity at least 10% higher than it was before the project. This regulatory pressure means Costain must integrate robust ecological surveys and mitigation plans into project design and execution, such as creating new habitats or wildlife corridors.

Water Management and Scarcity

Costain’s extensive involvement in the UK water industry makes water management and scarcity a paramount environmental consideration. The company's operations are directly impacted by the increasing need for sustainable water solutions, driven by regulatory pressures and public expectations for improved water quality and resource efficiency. For example, in 2023, the UK faced significant drought conditions in various regions, highlighting the critical nature of effective water management for infrastructure providers like Costain.

The company’s work in water infrastructure, from wastewater treatment to supply network upgrades, is intrinsically linked to environmental regulations concerning water quality and abstraction. These regulations, such as those set by the Environment Agency, necessitate substantial investment in technology and operational practices to minimize environmental impact and ensure compliance. Costain's £1.2 billion AMP7 (Asset Management Period 7) framework with Welsh Water, which began in 2020 and runs until 2025, specifically targets improvements in water quality and resilience, demonstrating this direct link.

- Regulatory Focus: Stricter environmental permits and water quality standards are increasing operational costs and project design complexity for water infrastructure projects.

- Water Scarcity Impact: Climate change-induced water scarcity necessitates new infrastructure for water recycling, desalination, and improved leak detection, creating both challenges and opportunities for Costain.

- Investment in Sustainability: The water sector is seeing significant investment in sustainable solutions, with companies like Costain playing a key role in developing and implementing these technologies.

- Customer Demand: Growing public awareness of water conservation and pollution is driving demand for more efficient and environmentally sound water management practices.

Adaptation to Extreme Weather Events

The escalating frequency and intensity of extreme weather events, driven by climate change, present significant hurdles for infrastructure resilience. Costain's commitment to adapting its solutions means incorporating advanced designs and resilient materials capable of withstanding evolving climatic conditions, thereby safeguarding the long-term integrity of vital assets.

For instance, the UK experienced its hottest year on record in 2022, with temperatures reaching 40.3°C. This highlights the urgent need for infrastructure to cope with such extremes. Costain's focus on sustainable engineering and climate adaptation strategies, including enhanced flood defenses and heat-resistant road surfacing, directly addresses these environmental pressures.

- Increased Investment in Climate-Resilient Infrastructure: Global spending on climate adaptation infrastructure is projected to reach $1.7 trillion annually by 2025, presenting a significant market opportunity for companies like Costain.

- Focus on Nature-Based Solutions: By 2024, the UK government aims to invest £100 million in nature-based solutions for flood management, areas where Costain is actively developing expertise.

- Material Innovation for Extreme Conditions: Research and development into materials that can withstand prolonged heat, intense rainfall, and high winds are critical for the longevity of infrastructure projects.

- Supply Chain Resilience: Ensuring the robustness of supply chains to deliver necessary materials and components during or after extreme weather events is paramount for project continuity.

The UK's drive towards net-zero emissions by 2050 significantly influences Costain, demanding sustainable construction practices and a reduction in carbon footprints. Costain has set ambitious emission reduction targets aligned with the Science Based Targets initiative (SBTi), aiming for substantial cuts by 2025, 2030, and 2050.

Resource scarcity and waste management regulations are pushing Costain towards circular economy principles, emphasizing waste minimization and material reuse. The construction sector's substantial waste generation, around 127 million tonnes in the UK in 2023, underscores the need for deconstruction and recycled material integration.

Costain's infrastructure projects must now prioritize biodiversity, with new developments needing to achieve at least a 10% net gain in biodiversity by 2023, requiring robust ecological planning.

The company's water infrastructure work is heavily impacted by water scarcity and quality regulations, necessitating investments in efficient technologies. Costain's £1.2 billion AMP7 framework with Welsh Water, running until 2025, reflects this focus on water quality and resilience.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Costain Group is built upon a robust foundation of data, including official government publications, reports from reputable financial institutions, and insights from leading industry analysts. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.