Costain Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

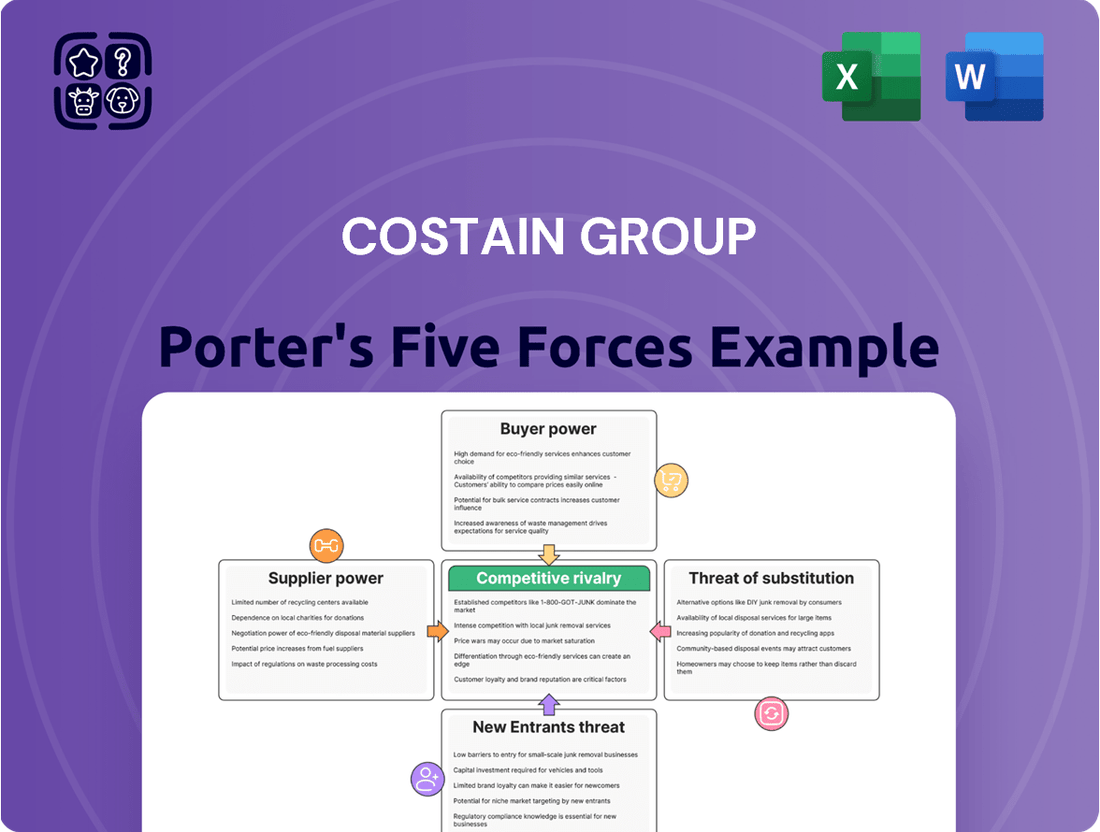

Costain Group operates in a dynamic sector where understanding competitive pressures is paramount. Our Porter's Five Forces analysis reveals significant insights into the bargaining power of buyers and the intensity of rivalry within the infrastructure and engineering landscape. We also examine the threat of new entrants and the availability of substitutes, crucial factors influencing Costain's strategic positioning.

The complete report reveals the real forces shaping Costain Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Costain Group's reliance on specialized suppliers for advanced technologies and skilled labor, particularly in sectors like nuclear and defense, can significantly amplify supplier bargaining power. When few suppliers offer unique components or expertise, Costain faces limited alternatives, potentially driving up costs. For instance, in 2024, the demand for specialized engineering talent in the UK infrastructure sector experienced a notable shortage, with some reports indicating a 15% increase in recruitment costs for highly skilled professionals, directly impacting companies like Costain.

For Costain, the costs involved in switching suppliers can significantly bolster supplier bargaining power. These costs often include the expense of re-qualifying new vendors, the technical challenge of integrating novel technologies, and the very real risk of project delays, all of which can add substantial overhead.

In the realm of complex, long-term infrastructure projects, which are Costain's bread and butter, the idea of changing a crucial supplier midway through execution can be financially prohibitive and fraught with operational risk. This dependency naturally strengthens the supplier's hand.

Costain's increasing reliance on digital solutions introduces another layer of switching costs. When the company integrates specific software or hardware from a particular supplier, it can create a deep lock-in effect, making it difficult and costly to transition to an alternative without significant disruption.

The availability of substitutes for inputs significantly influences the bargaining power of suppliers for Costain Group. If Costain relies on readily available, standardized materials or components sourced from numerous vendors, the bargaining power of those suppliers is diminished. However, for Costain's specialized engineering and construction projects, particularly those involving advanced technology or unique project requirements, the pool of suitable suppliers with the necessary expertise and proprietary inputs is often limited. This scarcity of direct substitutes for critical components or specialized services can substantially enhance the bargaining power of those suppliers.

Supplier Importance to Costain's Quality and Innovation

Suppliers providing critical components or services that underpin Costain's high-quality, innovative, and sustainable infrastructure delivery wield considerable bargaining power. This is particularly true for those offering specialized materials or advanced technological solutions integral to Costain's project success.

Costain's strategic emphasis on digital integration and forward-thinking methodologies means partnerships with pioneering technology providers are paramount. These collaborations, often involving bespoke software or advanced digital twin capabilities, can grant suppliers leverage in negotiating terms and pricing, directly impacting Costain's operational costs and project timelines.

- Critical Components: Suppliers of specialized concrete, advanced steel alloys, or unique tunneling equipment essential for large-scale projects like HS2's Northolt Tunnels have significant influence due to limited alternatives.

- Digital Solutions: Providers of bespoke AI-driven project management software or IoT sensor networks crucial for Costain's smart infrastructure initiatives can command higher prices given their unique value proposition.

- Innovation Partnerships: Collaborations with firms developing novel sustainable materials or energy-efficient technologies give these suppliers a stronger hand in shaping contract terms.

- Supply Chain Resilience: In a market where supply chain disruptions can cause significant delays, suppliers who can guarantee consistent quality and timely delivery for critical project elements gain an advantage.

Forward Integration Threat by Suppliers

The threat of suppliers integrating forward into Costain's core business of large-scale infrastructure project delivery is generally low. This is primarily due to the significant capital investment and intricate expertise required to manage and execute such complex projects, which most suppliers are unlikely to possess.

However, there's a nuanced risk from specialized technology providers. These firms could develop integrated digital or advisory solutions that bypass some of Costain's traditional service offerings, potentially impacting revenue streams in those specific digital or consulting areas. For example, a company offering end-to-end digital twin solutions for infrastructure could reduce the need for Costain's traditional project management oversight in certain phases.

Costain's strategic pivot towards higher-value consultancy and digital services is a proactive measure designed to counter this. By moving up the value chain and embedding these advanced capabilities within its project delivery, Costain aims to retain greater control and capture more value, thereby mitigating the impact of potential supplier forward integration in specialized niches.

- Low Threat of Major Supplier Forward Integration: The capital and technical barriers to entry for suppliers wishing to directly compete in Costain's primary infrastructure project delivery market are substantial.

- Niche Threat from Tech Providers: Specialized technology firms offering integrated digital solutions pose a moderate risk, potentially encroaching on Costain's digital and advisory service revenues.

- Strategic Mitigation: Costain's focus on expanding consultancy and digital services is a key strategy to preemptively address this threat by enhancing its own value proposition.

- Revenue Stream Impact: While overall forward integration is limited, specific digital service segments could see revenue pressure if suppliers offer compelling end-to-end digital solutions.

The bargaining power of Costain's suppliers is significant, particularly for specialized components and advanced technologies crucial for its infrastructure projects. Limited availability of unique inputs and high switching costs amplify this power, as seen in the 2024 shortage of specialized engineering talent, which increased recruitment costs by an estimated 15%.

Suppliers offering critical materials like advanced steel alloys or essential equipment for projects such as HS2, alongside providers of bespoke AI project management software, hold considerable sway. Their ability to guarantee consistent quality and timely delivery in a market susceptible to disruptions further bolsters their negotiating position.

While the threat of major supplier forward integration into Costain's core business is low due to high entry barriers, specialized technology firms offering integrated digital solutions present a moderate risk to Costain's digital and advisory service revenues. Costain's strategy to enhance its own value proposition through expanded consultancy and digital services aims to mitigate this.

| Factor | Impact on Costain | Example/Data Point (2024) |

|---|---|---|

| Supplier Specialization | High bargaining power for unique inputs | 15% increase in recruitment costs for specialized engineers |

| Switching Costs | Increases supplier leverage | Costs of re-qualification, technical integration, project delays |

| Availability of Substitutes | Low for specialized services/tech | Limited alternatives for proprietary tunneling equipment |

| Supplier Forward Integration | Low overall, moderate for tech providers | Potential revenue pressure in digital services from integrated solutions |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Costain Group's infrastructure and technology sectors.

Understand the intensity of each competitive force impacting Costain Group, enabling targeted strategies to mitigate threats and leverage opportunities.

Customers Bargaining Power

Costain Group's customers are concentrated among a few large public sector entities and major utility companies. These clients, involved in sectors like transportation, water, energy, and defense, command significant bargaining power due to the sheer scale of the projects they award. For instance, major infrastructure initiatives such as HS2 and Sizewell C represent substantial revenue streams for Costain, enabling these clients to negotiate favorable terms.

Costain's involvement in competitive bidding for large infrastructure projects significantly amplifies customer bargaining power. These processes inherently allow clients to compare numerous bids, creating intense pressure to reduce prices. This price sensitivity is a constant factor, even as Costain seeks to secure higher-margin contracts.

For example, in 2024, many large-scale infrastructure tenders across the UK, where Costain primarily operates, saw an average of 5-7 bidders competing for each project. This high level of competition directly translates to customers having more leverage to negotiate favorable terms and pricing.

While Costain's strategic focus on innovation and offering integrated engineering solutions offers a degree of differentiation, the fundamental nature of the bidding process means customers retain considerable power to push for lower costs. Their ability to play bidders against each other remains a key driver of pricing within this sector.

Customers face substantial switching costs once a complex infrastructure project with Costain Group is underway. This means that after the initial selection process, their leverage diminishes significantly due to the difficulties and expenses involved in changing contractors mid-project.

While customers exert considerable effort in vetting potential contractors initially, the practicalities of project execution create a strong lock-in. This high switching cost effectively reduces their bargaining power throughout the project's lifecycle, although their initial choice remains a powerful negotiation point.

Costain's involvement in long-term frameworks, such as those within the nuclear energy sector, further solidifies customer relationships. These arrangements foster deeper partnerships and necessitate a shared approach to risk management, intrinsically increasing the barriers to switching.

Customer's Ability to Self-Perform (Backward Integration)

Customers in the infrastructure sectors generally do not possess the in-house expertise, capital, or resources to manage and execute complex, large-scale projects independently. This limited ability for customers to self-perform their projects significantly reduces the threat of backward integration, thereby bolstering Costain's bargaining power. For instance, while a client might handle some internal project management, the sheer scale and technical demands of major infrastructure developments typically necessitate outsourcing to specialized firms like Costain.

The capacity for customers to bring critical functions in-house is relatively low across Costain's core markets. This is evident in the substantial upfront investment and specialized knowledge required for areas like tunneling, bridge construction, or large-scale rail networks. Consequently, the risk of clients undertaking such work themselves is minimal, leaving Costain in a favorable negotiating position. For example, major UK infrastructure projects, such as HS2 or the Thames Tideway Tunnel, require highly specific engineering capabilities that are not readily available within client organizations.

- Limited Customer Self-Performance: Most clients in infrastructure lack the necessary expertise, capital, and resources for large-scale project execution.

- Reduced Backward Integration Threat: This inability of customers to self-perform strengthens Costain's competitive position.

- Potential for Partial Internalization: Some clients may retain project management or design functions, slightly moderating Costain's scope.

- Costain's Specialized Capabilities: The group's expertise in complex engineering and construction remains a key differentiator against customer self-performance.

Importance of Project Quality and Timeliness

For critical national infrastructure projects in transportation, water, energy, and defense, customers place immense importance on quality, safety, and timely delivery. Costain's proven track record in successfully executing complex projects and integrating advanced digital solutions significantly strengthens its appeal. This emphasis on high-stakes, high-impact projects allows Costain to shift the customer's primary focus away from just cost, as project success is directly linked to vital national strategic objectives.

- Critical Infrastructure Focus: Costain operates in sectors like transportation, water, and energy where project failure has significant societal and economic consequences.

- Reputation for Delivery: The company's ability to deliver complex projects on time and to high-quality standards is a key differentiator. For instance, in 2024, Costain continued to be a significant player in the UK's infrastructure development, including ongoing work on major road and rail networks.

- Digital Integration Value: Costain's investment in and application of digital technologies, such as building information modeling (BIM) and data analytics, enhance project predictability and efficiency, offering greater value beyond mere cost.

- Reduced Price Sensitivity: The strategic importance and high stakes of national infrastructure projects mean that customers are often less sensitive to price alone, prioritizing reliability and assured outcomes.

While Costain's clients, particularly in the public sector, are large and can negotiate effectively, their ability to bring Costain's core services in-house is limited. The specialized nature and capital intensity of major infrastructure projects mean clients rarely possess the in-house capabilities to self-perform. This significantly curtails the threat of backward integration, bolstering Costain's negotiating position.

For example, in 2024, major UK infrastructure projects like HS2 continued to demand highly specialized engineering and construction expertise, which clients typically outsource. While clients manage project oversight, the execution of complex tasks such as tunneling or advanced rail systems remains firmly within Costain's domain, reducing client leverage on these fronts.

This dynamic means that despite the initial competitive bidding, once Costain is engaged on a project, the high switching costs for clients effectively reduce their bargaining power throughout the project's duration. The need for continuity and specialized skills creates a form of customer lock-in.

Clients prioritize quality, safety, and timely delivery for critical national infrastructure. Costain's proven track record and integration of digital solutions, as seen in ongoing 2024 projects, enhance its value proposition, shifting focus from pure cost to assured outcomes. This reduces price sensitivity for strategically vital projects.

| Customer Bargaining Power Factor | Assessment for Costain Group | Impact on Costain | Supporting Evidence (2024 Context) |

|---|---|---|---|

| Customer Concentration | Moderate to High (Few large public sector and utility clients) | Significant leverage for major contracts | Clients like National Highways or major water companies award substantial project values. |

| Switching Costs | High (Once project is underway) | Reduces power post-selection | Complex, long-term infrastructure projects are difficult and costly to change contractors mid-stream. |

| Threat of Backward Integration | Low | Strengthens Costain's position | Clients lack specialized expertise and capital for large-scale self-performance. |

| Price Sensitivity | Moderate to Low (for critical infrastructure) | Allows for value-based pricing | Emphasis on quality, safety, and national strategic importance in projects like energy or defense. |

Preview Before You Purchase

Costain Group Porter's Five Forces Analysis

This preview showcases the full Costain Group Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape. You're viewing the exact document you'll receive immediately after purchase, ensuring no surprises or placeholder content. The analysis details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report is ready for your immediate use, offering valuable strategic insights into Costain's operational environment.

Rivalry Among Competitors

The UK construction and engineering sector is a crowded space with many significant companies vying for projects. Major players like Kier Group, Galliford Try, BAM Nuttall, and Balfour Beatty operate alongside Costain, creating a highly competitive environment. This maturity means there are established firms with deep resources and long track records.

This density of capable competitors, including both UK-based and international firms, fuels intense rivalry. For instance, in 2023, Balfour Beatty reported revenue of £8.2 billion, Kier Group £5.1 billion, and Galliford Try £3.2 billion, demonstrating the substantial scale of Costain’s rivals.

The UK construction sector's growth is varied, but the infrastructure segment, especially in energy transition, water, and defense, boasts a robust, long-term investment pipeline. This projected growth, fueled by decarbonization goals and national infrastructure needs, certainly attracts more players. For Costain Group, this means increased competition for major project bids. For instance, the government's commitment to Net Zero by 2050 directly translates into substantial opportunities in areas like renewable energy infrastructure and grid upgrades, intensifying the rivalry among established and emerging construction firms.

Costain Group distinguishes itself through its emphasis on 'smart infrastructure solutions,' embedding digital technologies and novel methodologies throughout the entire asset lifecycle. This strategic specialization serves to mitigate direct price-based competition, particularly in projects demanding high complexity or advanced technological integration. For instance, Costain's involvement in the £300 million A465 Section 2 upgrade project highlights their application of digital twin technology for improved project delivery and asset management.

While Costain pioneers in this niche, the competitive landscape is dynamic. Rivals are also channeling investments into digital and sustainable offerings, compelling Costain to engage in perpetual innovation to preserve its competitive advantage. In 2023, the UK construction sector saw significant investment in digital transformation, with companies reporting an average of 15% of their capital expenditure allocated to technology, a figure expected to grow as the industry embraces Industry 4.0 principles.

High Exit Barriers

High exit barriers are a defining characteristic of the infrastructure sector, significantly influencing competitive rivalry for companies like Costain Group. These barriers stem from the immense capital investment required for specialized equipment and the long-term nature of infrastructure projects. Consequently, firms often find it difficult and costly to divest assets or exit the market, even when facing challenging economic conditions.

This immobility means that even during industry downturns, companies are compelled to remain active, leading to sustained, high levels of competitive pressure. Costain, with its extensive project portfolio and substantial asset base, is particularly subject to these exit barriers. For instance, Costain's significant ongoing projects, like the Highways England A5036 Port of Liverpool scheme, represent long-term commitments that solidify their presence in the market.

The implications for competitive rivalry are clear:

- Companies are locked into the industry due to sunk costs in specialized plant and machinery, making exit prohibitively expensive.

- The long lead times and contractual obligations of infrastructure projects further entrench firms, preventing easy withdrawal.

- Costain's reported revenue for 2023 was approximately £1.1 billion, underscoring the scale of assets and commitments that contribute to high exit barriers.

- This persistence of players, regardless of profitability, intensifies competition as firms vie for remaining opportunities.

Competitive Bidding and Margins

The large-scale nature of infrastructure projects inherently leads to intense competitive bidding. This often compresses profit margins for companies like Costain. While Costain has seen an improvement in its adjusted operating margin, reaching 3.2% in 2023, the sector remains vulnerable to rising tender prices and escalating costs.

The pursuit of high-value contracts demands a strategic approach to pricing and cost management. Failure to navigate these competitive pressures effectively can significantly impact overall profitability for Costain and its peers.

- Competitive bidding: A common feature in large infrastructure projects, driving down potential profit margins.

- Margin Pressure: The industry is sensitive to tender price inflation and ongoing cost increases.

- Strategic Management: Fierce competition for major contracts necessitates careful pricing and cost control to maintain profitability.

- Costain's 2023 Performance: The company reported an adjusted operating margin of 3.2% in 2023, indicating some recovery, but the underlying industry dynamics persist.

The UK construction and engineering sector is highly competitive, with major players like Kier Group and Balfour Beatty alongside Costain. This density of capable firms, including both domestic and international entities, fuels intense rivalry, as evidenced by Balfour Beatty's £8.2 billion revenue in 2023 compared to Costain's £1.1 billion. Costain focuses on smart infrastructure solutions to differentiate itself, especially in complex projects. However, rivals are also investing in digital and sustainable offerings, necessitating continuous innovation from Costain to maintain its edge, with the sector allocating an average of 15% of capital expenditure to technology in 2023.

| Competitor | 2023 Revenue (approx.) | Specialization Example |

|---|---|---|

| Balfour Beatty | £8.2 billion | Infrastructure, construction, energy, and government services |

| Kier Group | £5.1 billion | Infrastructure services, construction, and property |

| Galliford Try | £3.2 billion | Construction, housebuilding, and partnerships |

| Costain Group | £1.1 billion | Smart infrastructure solutions, digital technology integration |

SSubstitutes Threaten

While direct substitutes for massive physical infrastructure projects are scarce, alternative ways of getting these projects done can indeed present a challenge. Think about how a client might choose to build a new rail line, for example.

Instead of a traditional contracting model, a client might opt for a public-private partnership (PPP). In a PPP, the private sector, like Costain, often takes on more risk and responsibility, potentially including financing and long-term maintenance. This can be attractive for governments looking to spread costs and leverage private sector expertise.

Another alternative is for clients, especially large government bodies or major corporations, to bring more of the work in-house. This means they might develop their own engineering or construction capabilities for certain parts of a project, reducing the need to hire external contractors. This trend was visible in 2024 as some large infrastructure clients sought greater control over project delivery and cost management.

The rise of innovative financing and delivery mechanisms, such as build-operate-transfer (BOT) schemes, also offers alternatives. These models shift long-term operational risk to the private sector, which can be appealing for clients wanting to secure predictable revenue streams and offload operational complexities.

The threat of substitutes is significant as digital solutions and advisory services can bypass traditional engineering lifecycles. Companies offering specialized digital twins, AI asset management, or smart city planning tools could emerge as direct competitors, potentially reducing demand for Costain's comprehensive engineering services. For instance, the global market for AI in infrastructure management was projected to reach billions by 2024, indicating substantial growth in these substitute areas.

Costain's strategic pivot to bolster its own digital offerings, including digital twin technology and data analytics, directly addresses this threat by integrating these capabilities into its core business. This proactive approach aims to capture value from the digital transformation trend rather than being displaced by it. By enhancing its digital advisory capacity, Costain can offer integrated solutions that are harder for standalone digital providers to replicate.

Significant shifts in government policy, such as a move from large-scale new builds to maintenance or localized projects, could impact Costain's traditional business model. For instance, a hypothetical pivot from high-speed rail development to enhanced regional connectivity might require different skill sets and project types. This could present a threat if Costain cannot adapt its service offerings quickly enough to meet these new demands.

New Technologies Reducing Need for Traditional Construction

Emerging technologies pose a significant threat of substitution for traditional construction methods. Advancements in modular construction, 3D printing, and automation are beginning to offer alternatives that could reduce reliance on conventional on-site labor and specialized skills. For instance, the global 3D printing construction market was valued at approximately USD 1.6 billion in 2023 and is projected to grow substantially, indicating a shift in how buildings can be assembled.

Costain is proactively addressing this threat by investing in and adopting innovative technologies. Their focus on areas like AI-driven robotics and digital twins aims to enhance efficiency and adapt to evolving industry standards. In 2024, Costain reported a strong focus on digital transformation, with investments in areas that support these new construction paradigms, positioning them to capitalize on rather than be displaced by these technological shifts.

- Modular Construction: Offers faster project completion and reduced waste compared to traditional methods.

- 3D Printing: Enables complex designs and potentially lower material costs, with significant market growth projected.

- Automation & Robotics: Can increase safety and precision in construction tasks, reducing the need for manual labor in certain areas.

- Digital Twins: Provide virtual replicas of physical assets, improving design, construction, and operational efficiency, a key area of Costain's investment.

Focus on Repair and Maintenance vs. New Build

A societal or governmental pivot towards prioritizing repair and maintenance over new large-scale infrastructure projects presents a significant threat of substitutes for Costain Group. This shift could directly impact Costain's project pipeline, as new builds typically involve larger, more complex, and higher-value contracts compared to maintenance work. For instance, in 2024, many governments are emphasizing the upgrade and longevity of existing assets to meet sustainability goals and manage public finances more conservatively, potentially reducing the volume of entirely new construction tenders.

However, Costain is well-positioned to mitigate this threat through its existing capabilities in asset optimization and support services. These services span the entire asset lifecycle, meaning Costain can effectively capture value from the increasing demand for maintenance, refurbishment, and operational support. This strategy allows the company to adapt to changing market priorities while leveraging its expertise in managing complex infrastructure assets.

- Shift in Infrastructure Spending: Growing emphasis on extending the life of existing assets could divert investment away from new build projects, impacting traditional revenue streams.

- Costain's Diversification: Costain’s focus on asset optimization and lifecycle support services provides a counter-strategy to capture value in the maintenance and upgrade segments.

- Market Adaptability: The company’s ability to service both new builds and existing asset needs demonstrates resilience against substitution threats in the infrastructure sector.

- 2024 Market Trends: Increased government spending on infrastructure renewal and maintenance, rather than solely on new construction, is a notable trend in 2024.

While direct substitutes for large-scale physical infrastructure are limited, alternative delivery and financing models represent a significant threat. Public-private partnerships (PPPs) and clients bringing work in-house are gaining traction, offering clients more control and risk-sharing options. For instance, in 2024, many governmental clients prioritized greater project oversight, leading to increased interest in these alternative structures.

Entrants Threaten

The infrastructure and large-scale engineering sector demands immense capital for specialized equipment, advanced technology, and skilled labor. Newcomers face a steep challenge in replicating the significant upfront investments required to compete effectively against established firms like Costain.

Established companies benefit from substantial economies of scale, which translate into lower per-unit costs. This cost advantage is difficult for new entrants to overcome, creating a significant barrier to entry in the market.

For instance, major infrastructure projects often require billions of pounds in upfront capital, a level of investment that deters many potential new competitors. Costain's long history and extensive asset base allow it to spread these costs, enhancing its competitive position.

The defense, nuclear, water, and transportation sectors, where Costain Group operates, are characterized by extensive and complex regulatory frameworks. New entrants must secure numerous certifications and licenses, a process that is both time-consuming and costly. For instance, in the UK's nuclear sector, obtaining the necessary approvals involves rigorous safety assessments and site-specific licensing, often taking years and significant investment.

Adherence to stringent safety and environmental standards further elevates the barrier to entry. Companies must demonstrate robust compliance mechanisms, which require substantial upfront investment in technology, training, and procedural development. Failure to meet these exacting standards can result in significant penalties or outright denial of entry, making the regulatory landscape a formidable challenge.

The financial burden associated with navigating these regulations is substantial. Obtaining and maintaining necessary certifications, coupled with ongoing compliance audits, adds significant operational costs. For example, companies seeking to work on major infrastructure projects in the UK water sector, such as those managed by the Environment Agency, face detailed application processes and regular performance reviews, impacting their initial capital outlay and ongoing expenses.

Costain Group's strength in complex infrastructure projects creates a significant barrier to entry. Their deep engineering expertise and proven project management skills, honed over decades, are not easily replicated by newcomers. For instance, securing a role on a major national infrastructure project often requires a substantial pre-qualification process, demonstrating a history of successful delivery, which new entrants simply lack. This established reputation and the sheer difficulty of acquiring comparable talent and experience mean that new companies find it exceedingly hard to challenge established players for these high-value contracts.

Established Client Relationships and Frameworks

Costain Group leverages deeply entrenched relationships with major public and private sector clients, often securing multi-year framework agreements. These established connections and preferred supplier statuses act as a formidable barrier to entry for newcomers who haven't built the necessary trust and demonstrable track record for vital national infrastructure projects.

New entrants face the challenge of replicating Costain's history of successful project delivery, which is crucial for winning bids on large-scale, complex infrastructure. This proven performance builds confidence, making it difficult for less experienced companies to compete for these significant contracts.

- Established Client Base: Costain's long-standing partnerships provide a stable revenue stream and reduce the need for constant new business acquisition.

- Framework Agreements: These multi-year contracts offer predictability and reduce the uncertainty typically faced by new market entrants.

- Trust and Proven Delivery: The company's history of successful project execution builds significant client confidence, a hard-to-replicate asset.

Access to Supply Chains and Technology Integration

New entrants into the infrastructure sector, like those looking to compete with Costain Group, would grapple with the significant hurdle of establishing reliable supply chains for specialized materials and components. Costain's established relationships with key suppliers, built over years, provide a distinct advantage in securing necessary resources, a feat that would take considerable time and investment for a newcomer to achieve. For instance, Costain's 2023 annual report highlighted its ongoing investment in digital solutions and technology integration across its projects, a complex undertaking requiring deep expertise and established partnerships that new entities would struggle to replicate swiftly.

Furthermore, the integration of cutting-edge digital solutions, such as advanced data analytics and Building Information Modeling (BIM), presents another formidable barrier. Costain has been a leader in adopting these technologies to enhance efficiency and project delivery. A new entrant would face substantial upfront costs and a steep learning curve to match Costain's current level of technological sophistication and its embedded operational processes. This technological integration is not merely about acquiring software but about seamlessly embedding it into workflows and workforce capabilities, a process that is inherently difficult and time-consuming to replicate.

- Supply Chain Dependence: New entrants would need to build relationships with specialized material providers, a process that could take years.

- Technology Integration Costs: Replicating Costain's advanced digital solutions would require significant capital investment and expertise.

- Operational Expertise Gap: New companies would lack the proven track record and embedded processes that Costain possesses in technology deployment.

- Market Trust and Reputation: Costain's established reputation in the industry facilitates easier access to critical supply chain partners.

The significant capital requirements for specialized equipment, technology, and skilled labor present a major hurdle for new entrants. Costain's established economies of scale further solidify its cost advantage, making it difficult for newcomers to compete on price. Major infrastructure projects, often costing billions, demand upfront investment that deters many potential new competitors.

The complex regulatory environment across sectors like defense, nuclear, water, and transportation requires extensive certifications and licenses, a time-consuming and costly process. Stringent safety and environmental standards add to these barriers, necessitating substantial investment in compliance. For instance, navigating the UK's nuclear sector approvals can take years and significant financial commitment.

Costain’s deep engineering expertise and proven project management skills are difficult to replicate, especially for securing high-value national infrastructure contracts. Long-standing client relationships and framework agreements provide a stable revenue base and preferred supplier status, which new entrants lack. For example, Costain's 2023 financial performance underscored its ability to secure and deliver on large-scale projects, demonstrating a track record that builds essential client confidence.

New entrants also face challenges in establishing reliable supply chains for specialized materials and integrating advanced digital solutions like BIM. Costain's established supplier relationships and expertise in technology deployment offer a distinct advantage. The company's investment in digital transformation, as noted in its 2023 reports, highlights the complexity and cost involved in matching its technological sophistication.

Porter's Five Forces Analysis Data Sources

Our Costain Group Porter's Five Forces analysis is built upon a foundation of publicly available data, including Costain's annual reports and investor presentations, as well as industry-specific market research reports and competitor analyses.