Corsair Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

Corsair's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for anyone looking to navigate the gaming and PC hardware market.

The complete Porter's Five Forces Analysis unlocks a deeper understanding of Corsair's strategic positioning, revealing the true pressures and opportunities within its industry. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Corsair's reliance on a concentrated supplier base for essential components like GPUs, CPUs, and memory (DRAM and NAND) significantly amplifies supplier bargaining power. This limited supplier pool, particularly for high-demand, cutting-edge parts, means these suppliers can dictate terms and pricing, potentially squeezing Corsair's profit margins. For instance, in early 2024, the persistent shortage of high-end GPUs continued to give manufacturers like NVIDIA and AMD considerable leverage, impacting component costs for PC builders like Corsair.

Suppliers of cutting-edge technologies, like advanced GPUs with AI capabilities and next-gen CPUs, wield significant power. This is driven by the intense demand for these innovations in the gaming and content creation sectors, crucial for Corsair's product lineup.

Corsair's need to secure access to these high-demand components to maintain its competitive edge directly strengthens the leverage of these technology suppliers. For instance, the global AI chip market, a key area for advanced GPUs, was projected to reach over $100 billion in 2024, highlighting the critical nature of these suppliers.

The memory market, a key component for Corsair's products, faced oversupply and price drops through late 2024 and into early 2025. However, this period also saw increasing geopolitical tensions and potential lead time extensions for critical components in 2025. This dual dynamic directly impacts Corsair's ability to secure necessary parts at predictable costs, thereby influencing supplier bargaining power.

Importance of Supplier Relationships for Innovation

Corsair's ability to innovate and maintain product leadership hinges on its supplier relationships. Strong partnerships with key component providers are vital for securing early access to cutting-edge technologies, such as next-generation memory modules and faster solid-state drives, which are increasingly critical in the evolving PC hardware market. For instance, in 2024, the demand for high-bandwidth components continued to surge, making supplier reliability a significant competitive advantage.

These collaborations also translate into more favorable pricing and supply chain stability, essential for managing costs and ensuring consistent product availability. Corsair's strategic sourcing allows it to navigate market fluctuations effectively. By fostering deep ties, Corsair can influence product roadmaps and co-develop solutions, ensuring its offerings remain at the forefront of performance and features, a necessity as AI integration into consumer electronics gains momentum through 2025.

- Access to New Technologies: Suppliers are key to integrating advancements like DDR5 RAM and PCIe 5.0 SSDs into Corsair's product lines.

- Favorable Pricing and Terms: Strong relationships can lead to cost efficiencies, directly impacting Corsair's profit margins.

- Supply Chain Reliability: Ensuring consistent availability of critical components is paramount, especially during periods of high demand or supply chain disruptions.

- Co-Development Opportunities: Collaborative efforts with suppliers can accelerate innovation and tailor components to Corsair's specific performance targets.

Commoditization of Certain Components

While some standardized PC components, like basic RAM or storage drives, can become commoditized, diminishing supplier leverage, Corsair's strategic focus on high-performance gaming and enthusiast hardware means they often rely on more specialized, less commoditized inputs. This specialization grants suppliers of these unique components greater bargaining power.

For instance, custom-designed PCBs, advanced cooling solutions, or proprietary RGB lighting controllers are not readily available from numerous sources. This limited availability means suppliers of these critical, differentiating components can command higher prices and dictate terms, impacting Corsair's cost structure.

- Specialized Components: Corsair's reliance on custom-designed GPUs, high-speed memory modules, and advanced power supply units means suppliers of these niche products hold significant sway.

- Limited Alternatives: For many of Corsair's premium product lines, there are few, if any, direct substitutes for the specialized components they source.

- Supplier Concentration: In certain segments of high-performance PC hardware, the number of suppliers capable of meeting stringent quality and performance specifications can be quite limited, further enhancing their bargaining power.

Corsair's bargaining power with suppliers is significantly challenged by the specialized nature of its components and the concentration of key manufacturers. This dynamic is particularly evident in high-performance segments like GPUs and advanced memory, where a few dominant suppliers can dictate terms. For example, in 2024, the ongoing demand for AI-accelerated GPUs continued to empower NVIDIA and AMD, influencing component costs for Corsair.

The limited number of suppliers for cutting-edge technologies, such as next-generation CPUs and high-speed DRAM, grants them substantial leverage over Corsair. This is amplified by the critical need for these components to maintain Corsair's product competitiveness in the enthusiast and gaming markets. The global market for advanced semiconductors, a key input for these components, was valued in the hundreds of billions of dollars in 2024, underscoring the suppliers' economic importance.

While the memory market experienced price fluctuations in late 2024 and early 2025, potential supply chain disruptions and geopolitical factors in 2025 could still bolster supplier power by extending lead times and increasing costs for essential parts.

Corsair's dependence on a few key suppliers for specialized components, like custom PCBs and advanced cooling solutions, reduces its ability to negotiate favorable terms. The limited availability of these niche products allows suppliers to command higher prices and impose stricter conditions, directly impacting Corsair's cost structure and profit margins.

| Component Segment | Key Suppliers (Examples) | Impact on Supplier Bargaining Power | 2024 Market Context |

| High-End GPUs | NVIDIA, AMD | High - Limited competition, strong demand | Continued strong demand, supply constraints for top-tier models |

| CPUs | Intel, AMD | Moderate to High - Concentration in advanced nodes | Competitive launches, focus on next-gen architectures |

| DRAM & NAND Flash | Samsung, SK Hynix, Micron | Moderate - Cyclical pricing, but critical for performance | Price volatility, but essential for product differentiation |

| Specialized PCBs/Cooling | Various niche manufacturers | High - Customization, limited alternatives | Growing demand for premium features |

What is included in the product

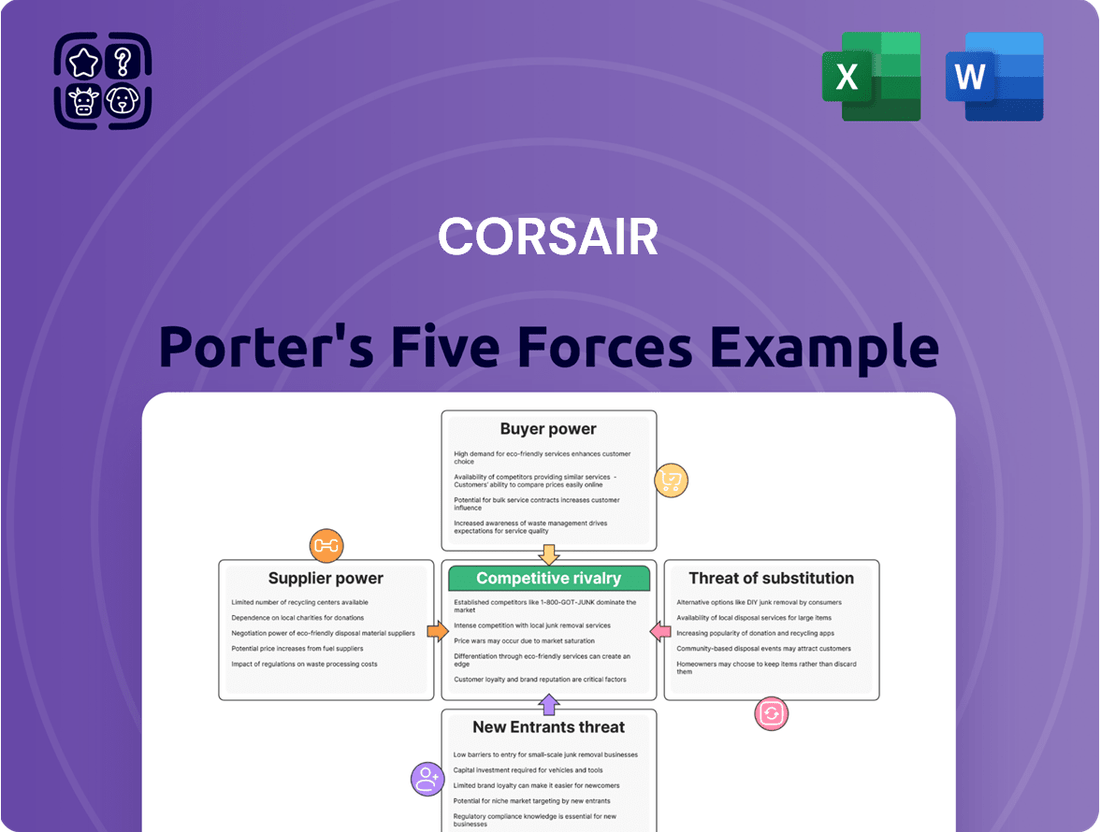

Corsair's Five Forces analysis dissects the competitive intensity within the PC components and peripherals market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Easily identify and quantify competitive threats with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Casual gamers, a substantial segment of the market, often exhibit high price sensitivity. The increasing availability of cost-effective alternatives, such as cloud gaming platforms that bypass the need for high-end PCs or consoles, intensifies this pressure. For instance, services like Xbox Cloud Gaming and GeForce NOW offer access to a wide game library for a monthly subscription, significantly lowering the entry barrier and making dedicated gaming hardware less essential for many.

Customers have a vast array of choices for gaming hardware, from other manufacturers' pre-built systems to individual components that allow for custom builds. This abundance of options significantly strengthens their bargaining power, as they can easily switch to a competitor if Corsair's pricing or offerings are not to their liking. For instance, the global PC gaming hardware market is projected to reach $120 billion by 2027, indicating intense competition.

Beyond traditional PCs, consumers can also opt for alternative gaming platforms such as PlayStation, Xbox, or even mobile gaming devices. These readily available substitutes further dilute Corsair's pricing power, as customers can allocate their entertainment budgets to different gaming ecosystems. The console gaming market alone is expected to generate over $100 billion in revenue in 2024.

The influence of online reviews and communities significantly amplifies customer bargaining power for companies like Corsair. The gaming community, in particular, is highly active in sharing detailed product experiences and benchmarks on platforms like Reddit and YouTube. For instance, a 2024 report indicated that over 70% of consumers consider online reviews before making a purchase in the tech sector, directly impacting product perception and pricing expectations.

Demand for Customization and Performance

PC enthusiasts and professional gamers, a core demographic for Corsair, actively seek products that offer superior performance, extensive customization options, and unwavering reliability. This discerning customer base, while often less sensitive to price fluctuations, possesses significant leverage due to their stringent demands regarding product features and overall quality.

This demand for tailored experiences translates into considerable bargaining power for customers. They can influence product development by favoring brands that meet their specific needs for speed, aesthetics, and durability. For instance, in 2024, the gaming peripheral market saw continued growth, with reports indicating that over 70% of PC gamers consider customization options like RGB lighting and programmable macros as important factors in their purchasing decisions.

- High Expectations Drive Product Innovation: Customers’ desire for cutting-edge performance and personalization pushes Corsair to continuously innovate, giving them a direct say in product roadmaps.

- Brand Loyalty Tied to Customization: While price is a factor, the ability to fine-tune components for optimal gaming or creative workflows often outweighs minor cost differences, fostering loyalty to brands that excel in this area.

- Influence on Feature Sets: The vocal and informed nature of this customer segment means their feedback on desired features, such as specific cooling technologies or connectivity standards, directly impacts what Corsair prioritizes in new product releases.

Direct-to-Consumer Sales Channel

Corsair's direct-to-consumer (DTC) sales channel significantly boosts customer engagement and fosters loyalty through direct interaction. However, this channel also amplifies customer feedback and demands, necessitating highly efficient customer service and robust support systems to manage these heightened expectations.

- Enhanced Customer Engagement: DTC allows Corsair to build direct relationships, collect valuable feedback, and offer personalized experiences, strengthening brand loyalty.

- Increased Support Demands: Direct interaction means customers expect immediate and effective solutions, putting pressure on customer service infrastructure.

- Data-Driven Insights: Sales data from DTC channels provide granular insights into customer preferences, informing product development and marketing strategies.

- Potential for Higher Margins: Bypassing intermediaries can lead to improved profit margins, though this is offset by the costs of managing a DTC operation.

Customers wield significant bargaining power due to the wide availability of gaming hardware alternatives and a growing demand for customization. This allows them to easily switch brands if Corsair's offerings don't meet their expectations, particularly concerning performance and aesthetics. The gaming community’s active online presence and reliance on reviews further amplify this influence, pushing Corsair to maintain competitive pricing and high product standards.

| Customer Segment | Bargaining Power Drivers | Impact on Corsair |

|---|---|---|

| Casual Gamers | Price sensitivity, availability of cloud gaming | Pressure on pricing, need for value-oriented products |

| PC Enthusiasts/Pro Gamers | Demand for high performance, customization, reliability | Drives innovation, influences product features |

| All Customers | Abundance of choices, online reviews, alternative platforms | Limits pricing power, necessitates strong customer service |

Same Document Delivered

Corsair Porter's Five Forces Analysis

This preview showcases the complete Corsair Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You can confidently download and utilize this comprehensive report for your strategic planning needs.

Rivalry Among Competitors

The PC gaming hardware market is a crowded space, with many well-known brands vying for consumer attention. Companies like Logitech, Razer, and SteelSeries offer a wide array of gaming peripherals, directly competing with Corsair's offerings. In 2024, the global PC gaming hardware market was estimated to be worth over $60 billion, highlighting the significant number of players and the intense battle for market share.

The PC components and gaming peripherals industry is a hotbed of technological change. Companies like Corsair must constantly innovate as advancements in GPUs, CPUs, and memory emerge at a breakneck speed. This rapid evolution shortens product life cycles, demanding continuous investment in research and development to maintain a competitive edge.

Intense competition within the PC components and peripherals market, where numerous brands offer similar products, forces Corsair to engage in aggressive pricing. This price competition directly impacts profit margins, particularly in more standardized product categories like memory modules and power supplies, where differentiation is less pronounced.

For instance, in the first quarter of 2024, the gaming peripherals market, a key segment for Corsair, saw continued price sensitivity among consumers, especially with the economic outlook remaining uncertain. This environment necessitates careful cost management and strategic pricing to maintain market share without excessively eroding profitability.

Expansion of Product Portfolios by Competitors

Competitors are aggressively broadening their product portfolios, introducing innovative items like AI-accelerated graphics cards and advanced liquid cooling solutions. This expansion directly targets Corsair's established presence across gaming, streaming, and enthusiast PC components, intensifying the competitive landscape.

For instance, in 2024, several key rivals launched new lines of high-performance peripherals and custom PC building components, often incorporating AI features or superior cooling technologies. This strategic move forces Corsair to continually innovate and differentiate its own offerings to maintain market share.

- AI-Enhanced Graphics: Competitors are releasing GPUs with dedicated AI processing units, impacting the high-end graphics card market.

- Advanced Liquid Cooling: New all-in-one (AIO) coolers and custom loop components are entering the market with improved thermal performance.

- Versatile Peripherals: Key rivals are introducing modular keyboards, mice with advanced sensor technology, and high-fidelity headsets, directly competing with Corsair's popular lines.

Influence of Esports and Content Creation Markets

The burgeoning esports and content creation markets are significantly intensifying competitive rivalry for hardware manufacturers. These rapidly expanding sectors create a powerful demand for high-performance gaming peripherals and components, forcing brands into aggressive competition to win over this valuable customer base.

This dynamic is evident in the substantial growth of these industries. For instance, the global esports market was projected to generate over $1.5 billion in revenue in 2023, with projections indicating continued strong growth through 2025. Similarly, content creation, particularly on platforms like Twitch and YouTube, fuels consistent demand for powerful PCs, streaming equipment, and accessories.

- Market Growth: Esports revenue is expected to reach $1.86 billion by 2025, showcasing the immense opportunity.

- Demand Drivers: Content creators and esports professionals require top-tier, reliable, and often visually appealing hardware.

- Brand Competition: Companies like Corsair, Logitech, Razer, and SteelSeries are locked in a fierce battle for market share, investing heavily in product innovation, marketing, and sponsorships to attract and retain these consumers.

- Product Differentiation: Intense competition necessitates continuous product development and feature enhancements to stand out, from customizable RGB lighting to advanced sensor technology.

The PC gaming hardware market is incredibly competitive, with numerous established brands like Logitech, Razer, and SteelSeries directly challenging Corsair. This intense rivalry means companies must constantly innovate and differentiate their products to capture market share. In 2024, the global PC gaming hardware market, valued at over $60 billion, reflects the crowded nature of this industry and the fierce battle for consumer preference.

SSubstitutes Threaten

Cloud gaming services like NVIDIA GeForce Now and Xbox Cloud Gaming present a significant threat by enabling players to stream demanding titles without requiring costly local hardware. This directly substitutes the need for high-performance gaming PCs and their associated components, such as graphics cards and processors, which are core to Corsair's business.

The accessibility and lower upfront cost of cloud gaming can attract a broad user base, potentially diverting consumers from purchasing traditional gaming hardware. For instance, by mid-2024, services like Xbox Cloud Gaming were expanding their reach, making AAA titles playable on a wider array of devices, from smartphones to older laptops.

Dedicated gaming consoles like PlayStation, Xbox, and Nintendo Switch present a significant threat of substitution for PC gaming. These consoles often require a lower upfront cost than a high-end gaming PC, making them an attractive alternative for many consumers. For instance, the PlayStation 5 launched at $499 USD, while building a comparable gaming PC could easily exceed $1,000 in 2024.

The market for these consoles is robust, with the Nintendo Switch alone selling over 141 million units by March 2024, demonstrating their widespread appeal. The upcoming release of the Nintendo Switch 2 in 2025 is expected to further intensify this competitive pressure, offering new features and potentially attracting a significant portion of the gaming market away from PC-centric experiences.

The proliferation of smartphones and the increasing sophistication of mobile game development, particularly with 5G integration, present a significant threat of substitutes for traditional PC gaming hardware. These mobile platforms offer a readily available and often free entry point, diverting consumer attention and spending away from dedicated gaming PCs and components.

In 2024, the global mobile gaming market is projected to reach over $110 billion, demonstrating its massive appeal and reach. This accessibility means many consumers who might have previously invested in PC gaming hardware are now satisfied with the gaming experiences available on their phones.

General-Purpose Computing Devices

For tasks not requiring extreme graphical power, high-performance general-purpose laptops and desktops increasingly act as substitutes for specialized gaming PCs. This is particularly true as their integrated graphics and processors become more capable, blurring the lines for less demanding gaming or content creation needs.

The improving performance of integrated graphics, for instance, means that many users can now enjoy a wider range of games without needing a dedicated, high-end graphics card. This trend is supported by advancements in processor technology, with many CPUs now featuring graphics processing units (GPUs) that are powerful enough for casual gaming and everyday productivity.

- Increasing Capability: General-purpose devices are becoming more powerful, offering better integrated graphics and processors.

- Cost-Effectiveness: For many users, these devices present a more budget-friendly alternative to dedicated gaming hardware.

- Market Trend: The market for powerful, versatile computing devices continues to grow, impacting the demand for niche gaming hardware.

Technological Advancements in Other Platforms

Technological advancements in console and mobile gaming are increasingly making them viable substitutes for PC gaming. For instance, the PlayStation 5 and Xbox Series X, released in late 2020, offer significantly improved graphics and processing power, rivaling many PC configurations. Mobile gaming, boosted by powerful smartphone chipsets like Apple's A-series and Qualcomm's Snapdragon, now supports complex games with sophisticated visuals, attracting a massive player base.

These platforms are not just catching up; they are innovating with features like advanced haptic feedback and spatial audio, creating more immersive experiences. This continuous enhancement directly challenges the traditional dominance of PC gaming, especially for casual and even some core gamers who prioritize convenience and accessibility. The global mobile gaming market alone was projected to reach over $272 billion in 2024, demonstrating its substantial and growing appeal.

- Console Gaming Advancements: New console generations offer higher frame rates, ray tracing, and faster loading times, directly competing with mid-to-high-end PCs.

- Mobile Gaming Sophistication: Powerful mobile processors and advanced touch controls enable complex gameplay, expanding the reach of gaming beyond traditional platforms.

- Immersive Technologies: Features like advanced haptics and 3D audio on consoles and some mobile devices enhance player engagement, presenting a strong alternative to PC peripherals.

- Market Growth: The substantial growth in mobile gaming revenue, exceeding $270 billion in 2024, highlights its significant threat as a substitute.

The threat of substitutes for Corsair is substantial, stemming from cloud gaming, dedicated consoles, and increasingly capable mobile devices. These alternatives offer lower entry costs and greater convenience, diverting consumers who might otherwise purchase high-performance PC gaming hardware.

Cloud gaming services, for example, allow players to stream games without needing powerful hardware, directly impacting the demand for GPUs and CPUs. Similarly, consoles like the PlayStation 5 and Nintendo Switch, with their widespread adoption, present a compelling alternative, especially given their often lower upfront costs compared to a custom-built gaming PC.

The mobile gaming sector, projected to exceed $270 billion in 2024, further amplifies this threat. Advancements in smartphone technology mean these devices can handle increasingly sophisticated games, capturing a significant portion of the gaming market and reducing the necessity for dedicated gaming PCs.

| Substitute Category | Key Features | Impact on Corsair | 2024 Market Data/Projections |

|---|---|---|---|

| Cloud Gaming | Streaming games, no high-end hardware needed | Reduces demand for GPUs, CPUs, and gaming PCs | Growing adoption, accessibility increasing |

| Gaming Consoles | Lower upfront cost, ease of use, exclusive titles | Direct competition for gaming entertainment spending | PS5 and Xbox Series X/S sales strong; Nintendo Switch sales over 141 million by March 2024 |

| Mobile Gaming | Ubiquitous access, free-to-play models, growing sophistication | Captures casual and some core gamers, reduces PC hardware investment | Global market projected to exceed $270 billion in 2024 |

Entrants Threaten

Entering the high-performance gaming hardware sector demands immense capital for cutting-edge research and development, sophisticated manufacturing facilities, and robust supply chain infrastructure. For instance, developing a new graphics processing unit (GPU) can cost hundreds of millions, if not billions, of dollars, a figure that deters most newcomers.

These substantial upfront costs, coupled with the need for continuous innovation to stay competitive, erect a formidable barrier. Companies like NVIDIA and AMD, which dominate the GPU market, invest billions annually in R&D, ensuring that emerging players face an uphill battle to match their technological advancements and scale.

Established brand loyalty, particularly for companies like Corsair, presents a significant barrier to new entrants. Years of delivering quality and performance have cultivated deep trust among consumers, making it challenging for newcomers to capture market share. For instance, Corsair's consistent presence and positive reviews in the PC component market, especially for memory and power supplies, have solidified its reputation, requiring substantial effort and investment for any new brand to even begin to compete for customer attention and loyalty.

New companies often struggle to gain access to established distribution channels. For instance, in the highly competitive consumer electronics market, securing shelf space with major retailers like Best Buy or Amazon requires significant investment and existing brand recognition, which new entrants typically lack. Corsair, a leader in gaming peripherals, has built strong relationships with these key distributors over years, making it difficult for newcomers to replicate their reach.

Intellectual Property and Patents

The threat of new entrants in industries heavily reliant on intellectual property and patents is substantial. Without proprietary technology or exclusive licenses, newcomers face significant hurdles in developing competitive products. This often necessitates costly R&D investments or expensive licensing agreements, effectively raising the barrier to entry.

For instance, in the semiconductor industry, where patents are crucial, companies like TSMC invest billions annually in R&D to maintain their technological edge. In 2023, TSMC’s R&D expenditure reached approximately $5.4 billion, underscoring the financial commitment required to stay ahead and deter potential competitors who lack similar patent portfolios.

- High R&D Investment: New entrants must commit significant capital to research and development to innovate and potentially circumvent existing patents.

- Licensing Costs: Acquiring licenses for patented technologies can be prohibitively expensive, impacting profitability from the outset.

- Patent Protection: Strong patent portfolios act as a significant deterrent, making it difficult for new players to legally operate or offer comparable products.

- Innovation Pace: Industries with rapid technological advancement, like AI or advanced materials, require continuous innovation to remain competitive, further increasing the challenge for new entrants.

Rapidly Evolving Technology and Market Trends

The gaming industry is a prime example of how rapidly evolving technology acts as a significant barrier to entry. New companies struggle to keep pace with the constant advancements in graphics, processing power, and virtual reality integration. For instance, the global gaming market was projected to reach $229 billion in 2023, with significant investments pouring into next-generation hardware and software development, making it an expensive arena for newcomers to break into.

Shifting consumer preferences also pose a threat. What's popular today might be obsolete tomorrow, demanding continuous adaptation. New entrants often lack the established research and development infrastructure and the deep market insights that established players possess to anticipate and respond to these changes effectively. This requires substantial upfront investment in R&D and market analysis, which can be prohibitive for startups.

- Constant Innovation Demands: The rapid pace of technological change in gaming, from AI-driven gameplay to cloud streaming, requires continuous, substantial R&D investment.

- High R&D Costs: Companies like NVIDIA, a key supplier of GPUs for gaming, invested billions in R&D in 2023 to maintain their technological edge, a cost difficult for new entrants to match.

- Market Trend Volatility: Player preferences shift quickly, influenced by new game releases and emerging genres, making it hard for new entrants to build a stable market position.

- Established Player Advantage: Incumbents leverage existing brand loyalty and economies of scale in R&D and marketing, creating a challenging environment for new companies to gain traction.

The threat of new entrants in the gaming hardware sector is moderate due to substantial capital requirements for R&D and manufacturing. For instance, developing advanced components like GPUs necessitates billions in investment, a barrier that deters many potential competitors. Established brands also benefit from strong customer loyalty and extensive distribution networks, making it difficult for newcomers to gain traction.

| Barrier Type | Description | Example Data (2023/2024) |

| Capital Requirements | High investment needed for R&D, manufacturing, and marketing. | NVIDIA's R&D spending was approximately $5.4 billion in 2023. |

| Brand Loyalty | Established brands have built trust and recognition over time. | Corsair has a long-standing reputation for quality in PC components. |

| Distribution Channels | Securing access to major retailers requires established relationships and brand presence. | Corsair's strong ties with retailers like Best Buy and Amazon are difficult to replicate. |

| Intellectual Property | Patents protect proprietary technology, increasing entry costs for new players. | Semiconductor firms invest heavily in patents to maintain competitive advantage. |

| Technological Pace | Rapid innovation in gaming hardware demands continuous R&D investment. | The global gaming market was projected to reach $229 billion in 2023, fueling innovation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Corsair leverages data from company annual reports, investor presentations, and industry-specific market research from firms like Statista and Newzoo. We also incorporate insights from financial news outlets and competitor websites to capture current market dynamics and strategic positioning.