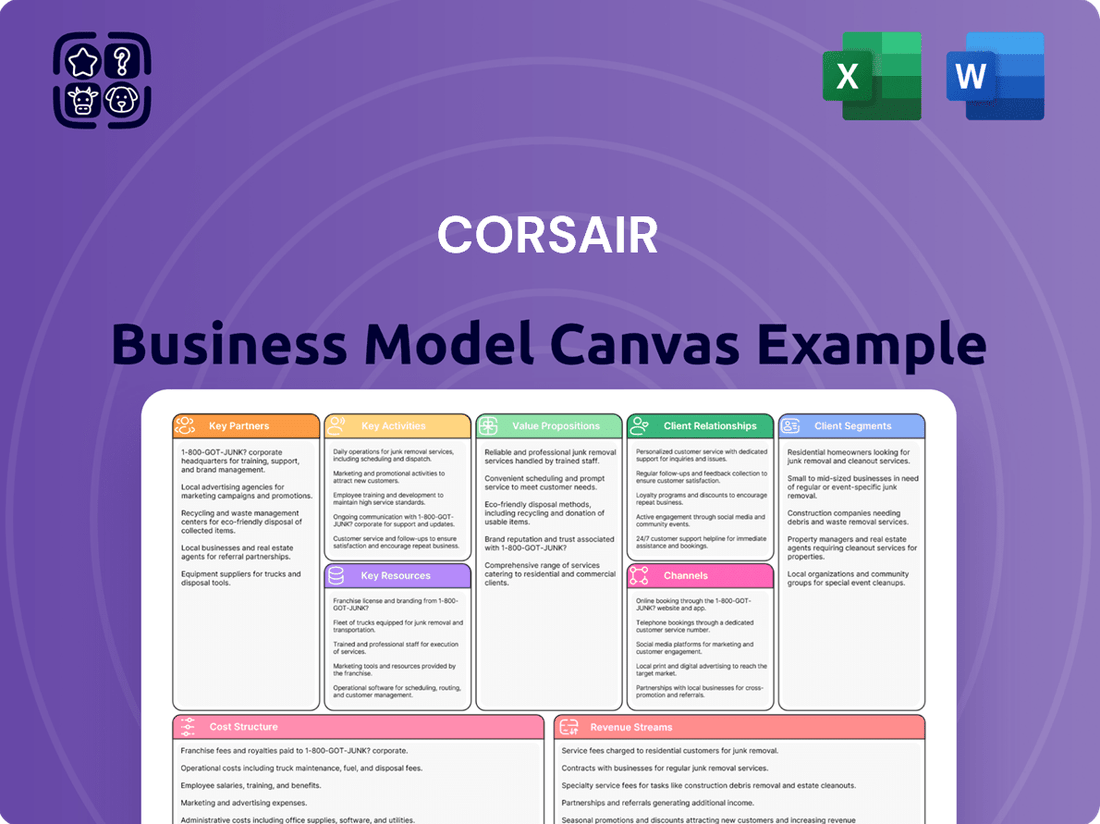

Corsair Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

Discover the strategic engine driving Corsair's dominance in the gaming and PC hardware market. This comprehensive Business Model Canvas unpacks their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Corsair's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Corsair's strategic retail and distributor networks are foundational to its market penetration. In 2024, the company continued to leverage these partnerships to make its gaming peripherals, components, and streaming gear accessible to a global audience. These relationships are vital for managing inventory efficiently and ensuring products are available where consumers shop, from major electronics chains to specialized online marketplaces.

Corsair's strategic alliances with leading game developers and publishers are a cornerstone of its business model. A prime example is its multi-year partnership with Call of Duty, a franchise with millions of active players globally. This collaboration extends across Corsair’s diverse portfolio, including its SCUF gaming controllers, Elgato streaming gear, and ORIGIN PC custom builds.

This integration of Call of Duty branding onto Corsair products not only boosts brand recognition within the massive gaming community but also offers consumers exclusive, themed designs. For instance, the Call of Duty: Modern Warfare III launch saw integrated branding across multiple Corsair product categories, directly tapping into the excitement surrounding a major game release and driving sales through association.

Corsair's engagement with esports teams and content creators is a cornerstone of its marketing strategy, significantly amplifying brand awareness and trust within the gaming and streaming spheres. These partnerships are crucial for reaching a passionate audience that values performance and authenticity.

In 2024, Corsair continued to deepen its relationships with top-tier esports organizations and influential streamers, sponsoring events and providing cutting-edge gear. This strategy directly translates into increased product adoption and brand loyalty, as seen in the growing market share for gaming peripherals.

Technology and Component Suppliers

Corsair's success hinges on strong relationships with technology and component suppliers, particularly for critical elements like memory, power supplies, and especially graphics processing units (GPUs). Key partners such as NVIDIA and AMD are crucial for providing the cutting-edge technology that fuels Corsair's high-performance gaming and PC enthusiast products.

These collaborations grant Corsair access to the latest advancements, which directly impacts their product innovation and market competitiveness. For instance, the anticipated availability of new GPU cards is a significant factor expected to invigorate Corsair's component sales segment.

- NVIDIA and AMD: Essential for supplying the GPUs that power high-end gaming PCs and are a major driver for Corsair's component sales.

- Memory Manufacturers: Provide the RAM modules that are a core part of Corsair's performance-oriented product line.

- Power Supply Component Providers: Ensure the availability of reliable and high-wattage power supply units for demanding systems.

Acquired Brand Integration Partners

Corsair's strategy involves integrating acquired brands like Fanatec to enhance its ecosystem, particularly in the burgeoning sim racing market. This integration aims to leverage existing distribution channels and introduce new product categories. For instance, Fanatec's established presence in specialist retail is a key asset being utilized.

The focus is on harmonizing brand identities and operational efficiencies to unlock synergistic growth. Corsair's increased investment in Elgato's supply chain further supports this integration by bolstering production capabilities. This strategic move is designed to drive revenue growth and expand market reach.

- Brand Harmonization: Streamlining brand messaging and customer experience across acquired entities.

- Operational Efficiencies: Optimizing supply chains and manufacturing processes for cost savings and improved output.

- Product Category Expansion: Entering new markets, such as sim racing, through integrated offerings.

- Channel Expansion: Leveraging existing retail partnerships of acquired companies, like Fanatec's specialist retailer network.

Corsair's key partnerships extend to technology and component suppliers, with NVIDIA and AMD being paramount for GPUs, a critical driver for their high-performance PC components. In 2024, the company's access to these cutting-edge components directly impacted its product innovation and sales performance, particularly with anticipation surrounding new GPU releases. These relationships ensure Corsair can equip its customer base with the latest advancements in PC hardware.

| Partner Type | Key Partners | Impact on Corsair | 2024 Relevance |

| GPU Suppliers | NVIDIA, AMD | Enables high-performance gaming PCs and component sales | Crucial for providing latest GPU technology to market |

| Memory Suppliers | Various | Core to performance-oriented RAM modules | Ensures consistent supply of high-speed memory |

| Esports & Creators | Top-tier teams, influencers | Brand awareness, product adoption, trust | Continued sponsorship and gear provision driving market share |

| Game Developers | Activision Blizzard (Call of Duty) | Brand integration, exclusive designs, sales | Themed product launches tied to major game releases |

What is included in the product

A detailed Corsair Business Model Canvas that maps out key customer segments, value propositions, and channels, reflecting their strategy in gaming peripherals and PC components.

This canvas offers a structured overview of Corsair's revenue streams, cost structure, and key resources, providing insights for strategic planning and competitive analysis.

Simplifies complex business strategies into a visual, actionable framework, alleviating the pain of unclear direction.

Provides a clear, shared understanding of Corsair's value proposition and customer segments, reducing confusion and alignment issues.

Activities

Corsair's commitment to Research, Development, and Innovation is paramount, driving its ability to lead in the dynamic gaming and PC enthusiast sectors. This focus ensures they remain responsive to emerging technology trends and evolving consumer desires.

This vital activity underpins the creation of cutting-edge, high-performance products, encompassing everything from essential PC components to advanced gaming peripherals and sophisticated streaming gear. Their ongoing R&D efforts are key to maintaining a competitive edge.

Recent advancements highlight this dedication, with Corsair introducing AI-enhanced tools and launching innovative products such as the VIRTUOSO MAX headset and the iCUE LINK RX MAX Fan Series. These releases demonstrate their proactive approach to product development.

Corsair's core activities revolve around the meticulous manufacturing and assembly of its diverse product portfolio. This spans everything from high-performance PC components like memory modules and power supplies to fully assembled gaming PCs and a wide array of peripherals such as keyboards and mice.

A critical aspect of their manufacturing is robust supply chain management. Corsair actively works to ensure the efficient sourcing of components and the timely assembly of finished goods to meet escalating global demand. For instance, in 2023, Corsair reported revenue of $1.4 billion, underscoring the scale of their production and distribution efforts.

The company demonstrates agility in its production strategy, capable of adapting to global disruptions and strategically shifting manufacturing locations when necessary. This proactive approach allows them to maintain production continuity and responsiveness to market dynamics, a crucial factor in the fast-paced tech industry.

Corsair invests heavily in marketing and brand building to solidify its premium image in the gaming and enthusiast PC markets. This includes a robust digital marketing strategy, sponsoring esports teams and events, and engaging directly with its community through social media and forums.

In 2024, Corsair continued its focus on influencer marketing and content creation partnerships, leveraging popular streamers and tech reviewers to showcase its products. This approach is crucial for reaching its core demographic and maintaining brand relevance in a fast-evolving tech landscape.

Corsair's brand strength is a key differentiator, allowing it to command premium pricing and foster strong customer loyalty. Their consistent messaging around performance, quality, and innovation resonates deeply with PC builders and competitive gamers.

Global Sales and Distribution

Corsair manages a vast global sales and distribution network, ensuring its gaming peripherals, components, and systems are accessible to enthusiasts worldwide. This involves fostering strong relationships with a diverse range of retailers, from major electronics chains to specialized gaming stores, as well as managing key distributors in various regions. In 2023, Corsair’s net revenue reached $1.43 billion, underscoring the scale of its global reach and sales operations.

The company also actively cultivates its direct-to-consumer (DTC) channels, including its own e-commerce website. This DTC strategy allows for greater control over customer experience and provides valuable direct feedback. Efficient logistics and robust channel management are paramount for timely product availability, which directly impacts market penetration and customer satisfaction.

- Retail Partnerships: Corsair collaborates with major retailers globally, including Best Buy, Amazon, and Micro Center, to ensure broad product availability.

- Distribution Network: The company utilizes a network of regional distributors to reach markets where direct retail presence is less established.

- Direct-to-Consumer (DTC) Sales: Corsair's own website serves as a significant sales channel, offering a comprehensive product catalog and exclusive deals.

- Logistics and Supply Chain: Efficient management of warehousing, shipping, and inventory across its global operations is crucial for meeting demand.

Customer Support and Community Engagement

Corsair's commitment to exceptional customer support is a cornerstone of its business. This involves providing timely technical assistance, efficiently managing product warranties, and actively engaging with its user base across various digital channels. In 2023, Corsair reported a significant focus on improving customer satisfaction metrics, with a stated goal of reducing average response times for support inquiries by 15%.

Fostering a vibrant community is equally crucial. Corsair actively cultivates this through dedicated forums, social media platforms, and user-generated content initiatives. This engagement not only enhances brand loyalty but also provides invaluable feedback for product development. For instance, their online community forums saw over 5 million active users in 2023, contributing to discussions and troubleshooting.

- Customer Support: Offering technical assistance and warranty management to ensure a positive post-purchase experience.

- Community Engagement: Building and nurturing a loyal customer base through forums, social media, and user interaction.

- Brand Advocacy: Leveraging a strong community to drive word-of-mouth marketing and product evangelism.

- Feedback Loop: Utilizing community interactions to gather insights for product improvement and innovation.

Corsair's global sales and distribution network is a critical activity, ensuring its products reach enthusiasts worldwide. This involves managing relationships with major retailers like Amazon and Micro Center, alongside a robust distributor network. In 2023, Corsair’s net revenue reached $1.43 billion, highlighting the scale of its sales operations.

The company also prioritizes its direct-to-consumer (DTC) channels, particularly its e-commerce website, for enhanced customer experience and direct feedback. Efficient logistics and channel management are key to meeting demand and maximizing market penetration.

Corsair's customer support and community engagement are vital for fostering brand loyalty and gathering product insights. In 2023, they aimed to improve customer satisfaction by reducing support response times by 15%, while their online community saw over 5 million active users.

| Key Sales & Distribution Activities | Description | 2023 Data/Impact |

| Retail Partnerships | Collaborating with major global retailers | Ensures broad product availability |

| Distribution Network | Utilizing regional distributors | Reaches markets with less direct retail presence |

| Direct-to-Consumer (DTC) | Operating own e-commerce website | Enhances customer experience and feedback loop |

| Net Revenue | Total sales generated | $1.43 billion |

Full Version Awaits

Business Model Canvas

The Corsair Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is processed, you'll gain full access to this professional, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing.

Resources

Corsair's intellectual property, including patents and proprietary software like iCUE, is a cornerstone of its competitive edge. This IP allows for unique product functionalities and an enhanced user experience, setting Corsair apart in the gaming and tech accessory market.

The company actively integrates AI into its software ecosystem, exemplified by Elgato's AI Prompter and AiCoustic. This focus on AI-driven innovation, a trend likely to accelerate through 2025, further strengthens Corsair's ability to offer advanced features and differentiate its offerings.

Corsair's brand is a powerhouse in the gaming and PC component world, recognized for delivering high-quality, high-performance, and innovative products. This strong reputation translates directly into customer loyalty, meaning people trust Corsair and come back for more, which naturally lowers their advertising expenses and boosts sales.

The company's brand strength is evident in its market performance. For instance, in 2024, many of Corsair's product categories held the number one market share position within the United States. This dominance isn't accidental; it's a direct result of consistent quality and genuine connection with its core audience.

Corsair's skilled workforce, encompassing engineers, designers, marketing specialists, and customer support, represents a critical resource. Their collective expertise fuels product innovation, streamlines manufacturing, and ensures effective customer interaction, directly impacting the company's value proposition.

In 2024, Corsair continued to emphasize attracting and retaining top talent. A highly skilled workforce is fundamental to maintaining their competitive edge in the fast-paced gaming and tech industry, directly influencing their capacity for future growth and market leadership.

Global Distribution and Supply Chain Infrastructure

Corsair's global distribution and supply chain infrastructure is a cornerstone of its business model, facilitating efficient product delivery to a worldwide customer base. This network encompasses strategically located warehouses and strong partnerships with logistics providers, ensuring timely and cost-effective shipping. In 2023, Corsair reported significant investments in optimizing its supply chain to enhance resilience and product availability, a critical factor given the dynamic nature of global trade.

The company leverages a multi-modal approach to logistics, integrating air, sea, and land transport to meet diverse market demands. This robust infrastructure is designed to mitigate risks associated with supply chain disruptions, a lesson learned from recent global events. Corsair's ability to maintain product flow is vital for meeting customer expectations and supporting its broad product portfolio.

- Global Warehouse Network: Corsair operates numerous distribution centers across North America, Europe, and Asia, enabling faster order fulfillment and reduced shipping times.

- Logistics Partnerships: The company collaborates with major shipping carriers and third-party logistics providers to manage its complex global transportation needs.

- Supply Chain Resilience: Corsair actively diversifies its supplier base and manufacturing locations to minimize the impact of geopolitical or economic disruptions.

- Inventory Management: Advanced inventory management systems are employed to ensure optimal stock levels across its distribution channels, preventing stockouts and excess inventory.

Acquired Brands and Product Portfolios

Corsair's strategic acquisitions have dramatically broadened its offerings. Brands like Elgato, SCUF Gaming, ORIGIN PC, Drop, and the recent addition of Fanatec have significantly expanded Corsair's product portfolio and market presence. This expansion allows Corsair to provide a more complete ecosystem for gamers and content creators.

- Elgato: Strengthened Corsair's position in the content creation and streaming hardware market.

- SCUF Gaming: Enhanced Corsair's presence in high-performance gaming peripherals, particularly controllers.

- ORIGIN PC: Bolstered Corsair's custom PC building capabilities and premium desktop offerings.

- Drop: Expanded Corsair's reach into enthusiast keyboards and accessories.

- Fanatec: Accelerated Corsair's entry into the lucrative sim racing market, a key growth area.

These acquisitions bring specialized products and expertise, enabling Corsair to offer a more integrated and comprehensive solution set. For example, the integration of Fanatec is a direct play to capture a larger share of the burgeoning sim racing segment, a market that saw significant growth in 2024 with increased interest in esports and realistic simulation experiences.

Corsair's key resources include its strong brand reputation, a vast portfolio of intellectual property like iCUE software, and a highly skilled workforce. The company's global supply chain and distribution network are also critical for efficient product delivery. Strategic acquisitions, such as Fanatec in 2024, have significantly broadened its market reach and product ecosystem.

Value Propositions

Corsair's value proposition centers on delivering high-performance and quality products, meticulously engineered for demanding users like gamers and content creators. This focus on peak performance and durability ensures reliability, fostering trust and loyalty. For example, in 2024, Corsair continued to innovate in areas like DDR5 memory, with speeds exceeding 8000 MT/s becoming more common, directly impacting gaming frame rates and content creation rendering times.

Corsair offers a complete ecosystem of products designed to work together flawlessly, enabling gamers and creators to assemble entire setups from one trusted brand. This integrated approach, covering everything from essential PC components and high-performance peripherals to advanced streaming gear and ready-to-go prebuilt PCs, delivers unparalleled convenience and ensures optimal compatibility. The synergy across their product lines significantly elevates the user experience, making it easier to achieve peak performance and seamless operation.

Corsair's commitment to innovation is evident in its continuous integration of cutting-edge technology, including advancements like AI in its software and hardware. This dedication ensures users benefit from the most advanced features and superior performance available. For instance, in 2024, Corsair continued to invest heavily in research and development, a strategy that has historically allowed them to anticipate market shifts and launch novel products.

Customization and Personalization Options

Corsair offers deep customization through its Corsair Custom Labs platform, letting users tailor gaming peripherals to their individual style. This isn't just about aesthetics; it's about building a personalized gaming environment. For instance, collaborations with major franchises like Call of Duty and Starfield allow for unique themed designs, enhancing the immersive experience for fans.

This focus on personalization translates into a powerful value proposition. Customers can create truly bespoke setups, making their gear stand out. This approach resonates with a market segment that values individuality and expression in their gaming experience. In 2024, Corsair continued to leverage these partnerships, with specific product lines seeing significant engagement from users eager to showcase their fandom.

- Corsair Custom Labs: Direct platform for user personalization.

- Franchise Collaborations: Partnerships with Call of Duty and Starfield for themed products.

- Bespoke Experience: Enabling customers to create unique, personalized gaming setups.

- Market Appeal: Catering to consumers who prioritize individuality and brand affinity.

Enhanced Immersion and Competitive Advantage

Corsair's value proposition centers on delivering enhanced immersion and a tangible competitive advantage to its core customer base of gamers and content creators. Their meticulously engineered products are crafted to push performance boundaries, offering users a distinct edge in demanding digital environments. This dedication to superior functionality directly translates into a more engaging and effective user experience.

Key product features are designed to amplify immersion and performance. This includes crystal-clear, detailed audio that pulls users into virtual worlds, ultra-responsive mechanical keyboard switches for lightning-fast in-game actions, and precision-engineered mice for pinpoint accuracy. These elements collectively contribute to a more captivating and productive workflow, whether in the heat of a competition or the meticulous process of content creation.

Corsair's focus on optimizing user performance is a cornerstone of their offering. By providing tools that reduce latency, improve input precision, and deliver rich sensory feedback, they empower individuals to achieve their peak potential. For gamers, this means faster reaction times and greater control; for content creators, it translates to smoother editing workflows and more impactful output. For instance, Corsair's gaming peripherals consistently receive high marks in reviews for their responsiveness, a critical factor in esports where milliseconds matter.

- Performance Optimization: Products designed to maximize speed and responsiveness.

- Immersive Experience: High-fidelity audio and tactile feedback for deeper engagement.

- Competitive Edge: Features that provide a distinct advantage in gaming and content creation.

- User Empowerment: Tools enabling users to reach their highest levels of skill and productivity.

Corsair's value proposition is built on delivering a comprehensive, high-performance ecosystem that caters specifically to the needs of gamers and content creators. This integrated approach ensures seamless compatibility and optimal functionality across all their products, from core PC components to peripherals and streaming equipment. By offering a complete suite of solutions, Corsair simplifies the setup process and guarantees a superior user experience, allowing enthusiasts to focus on their passion.

The company's commitment to innovation is a key differentiator, with continuous integration of cutting-edge technology to enhance performance and user experience. This forward-thinking strategy ensures that customers always have access to the latest advancements, providing a tangible competitive edge. Corsair's investment in R&D, exemplified by their work on advanced memory technologies and AI integration in software, keeps them at the forefront of the industry.

Corsair also emphasizes deep personalization, allowing users to tailor their gear to their unique style and preferences through platforms like Corsair Custom Labs and strategic franchise collaborations. This focus on individuality resonates strongly with a market segment that values self-expression, enabling customers to build truly bespoke gaming and creative environments. This commitment to customization fosters a strong sense of brand loyalty and personal connection.

Corsair's value proposition is further strengthened by its focus on delivering enhanced immersion and a tangible competitive advantage. Their products are meticulously engineered to push performance boundaries, offering users a distinct edge in demanding digital environments. This dedication to superior functionality translates directly into a more captivating and productive user experience, whether in competitive gaming or content creation workflows.

| Value Proposition Area | Key Features | Customer Benefit | 2024 Data/Examples |

|---|---|---|---|

| High-Performance Ecosystem | Integrated components, peripherals, and software | Seamless compatibility, optimal functionality, simplified setup | Continued innovation in DDR5 memory speeds exceeding 8000 MT/s |

| Cutting-Edge Innovation | AI integration, advanced hardware/software development | Access to the latest technology, competitive edge | Significant R&D investment anticipating market shifts and launching novel products |

| Deep Personalization | Corsair Custom Labs, franchise collaborations | Unique, tailored setups, self-expression, brand affinity | Themed product lines with franchises like Call of Duty and Starfield |

| Enhanced Immersion & Performance | High-fidelity audio, responsive peripherals, precision engineering | Tangible competitive advantage, deeper engagement, peak user potential | High review marks for peripheral responsiveness, critical in esports |

Customer Relationships

Corsair cultivates a vibrant community by actively engaging customers on forums, social media, and dedicated online spaces. This direct interaction is crucial for gathering valuable feedback and nurturing a loyal user base. For instance, in 2024, Corsair's official forums saw millions of active users discussing products and sharing builds, a testament to the strong community bond.

Responsive customer support is a cornerstone of Corsair's relationship strategy. Providing efficient technical assistance and reliable warranty services ensures customer satisfaction and builds trust. This commitment to support is reflected in their consistently high customer satisfaction scores, averaging over 90% for support interactions throughout 2024.

Corsair actively cultivates relationships with content creators and esports professionals through strategic sponsorships and product seeding initiatives. This approach not only secures powerful endorsements but also provides invaluable insights into the demands of their core user base.

Collaborating on content creation allows Corsair to showcase its products in authentic, high-stakes environments. For instance, in 2024, Corsair continued to support numerous esports teams and prominent streamers, leveraging their platforms to reach millions of engaged gamers.

Corsair's direct-to-consumer (DTC) strategy allows for immediate customer engagement, fostering personalized experiences and crucial feedback loops. This direct channel is vital for understanding evolving market demands and preferences, directly influencing their product roadmap.

In 2024, Corsair continued to emphasize its DTC channels, which contributed significantly to its brand loyalty and market responsiveness. This approach enables rapid iteration on product design and customer service, as evidenced by their agile development cycles.

Brand Loyalty Programs and Affinity Building

Corsair fosters deep brand loyalty by consistently providing top-tier gaming peripherals and components, creating a strong sense of community among its users. This commitment to quality and innovation naturally builds affinity, driving repeat business and organic customer advocacy.

While Corsair doesn't heavily emphasize formal loyalty programs, its brand authenticity and reputation for cutting-edge technology are key drivers of customer retention. This approach encourages users to remain invested in the Corsair ecosystem.

- Brand Authenticity: Corsair's genuine connection with the gaming and PC building community is a cornerstone of its customer relationships.

- Product Excellence: A consistent track record of high-performance, reliable products fuels customer trust and repeat purchases.

- Community Engagement: Active participation in forums, social media, and events helps build a strong sense of belonging among users.

- Innovation Focus: Corsair's commitment to pushing technological boundaries keeps customers engaged and eager for new offerings.

Educational Content and Resources

Corsair offers a wealth of educational content, including detailed guides and tutorials designed to help users build and optimize their PC systems. This commitment to education empowers customers, fostering a deeper engagement with Corsair's product ecosystem.

Their website serves as a central hub for this information, featuring troubleshooting guides, comprehensive product specifications, and step-by-step build tutorials. This accessibility ensures users can confidently maximize their hardware's potential.

- Extensive Tutorials: Corsair provides video and written guides covering everything from basic PC assembly to advanced overclocking techniques.

- Troubleshooting Resources: A dedicated section on their website offers solutions to common PC issues, reducing customer frustration.

- Product Deep Dives: Detailed specifications and feature explanations help users understand and leverage the full capabilities of their purchased components.

- Community Engagement: Forums and social media channels allow users to share knowledge and receive peer support, further enhancing the educational experience.

Corsair's customer relationships are built on a foundation of community, support, and product excellence. They actively engage users through forums and social media, fostering a sense of belonging. In 2024, their commitment to responsive customer support, averaging over 90% satisfaction for interactions, and strategic partnerships with content creators further solidified these bonds.

Their direct-to-consumer approach in 2024 allowed for personalized engagement and rapid feedback loops, directly influencing product development. This, combined with their focus on brand authenticity and delivering high-performance products, cultivates strong customer loyalty and drives repeat business.

Corsair also empowers its customers through extensive educational content, including detailed guides and troubleshooting resources, ensuring users can maximize their hardware. This commitment to user success reinforces their brand as a trusted partner in the PC building and gaming ecosystem.

| Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Community Engagement | Active participation in forums, social media, and events. | Millions of active users on official forums discussing products. |

| Customer Support | Responsive technical assistance and reliable warranty services. | Average customer satisfaction scores over 90% for support interactions. |

| Content Creator Partnerships | Sponsorships and product seeding with esports pros and streamers. | Leveraged platforms of numerous supported teams and streamers to reach millions. |

| Direct-to-Consumer (DTC) | Immediate customer engagement and personalized experiences. | DTC channels contributed significantly to brand loyalty and market responsiveness. |

Channels

Corsair leverages its direct-to-consumer (DTC) sales channel through its own e-commerce website, providing customers with access to its full product range and direct support. This approach enables Corsair to meticulously manage the customer journey, collect invaluable direct feedback, and potentially enhance profit margins by bypassing intermediaries. In 2023, Corsair’s revenue from its direct channels, including its website and retail partners, was a significant contributor to its overall financial performance, demonstrating the channel's importance.

Corsair strategically utilizes prominent e-commerce marketplaces like Amazon and Newegg to extend its global product distribution. These platforms offer unparalleled access to a vast consumer audience and benefit from their robust, pre-existing logistics and secure payment systems, streamlining transactions for customers worldwide.

By listing its diverse product catalog on these widely recognized online retail giants, Corsair significantly enhances product accessibility, catering to the preferences of a broad segment of consumers who trust and frequently shop through these familiar digital storefronts.

In 2024, Amazon alone facilitated over $600 billion in sales, highlighting the immense customer traffic and sales potential that marketplaces like it represent for brands like Corsair, which aims to reach a global customer base efficiently.

Corsair leverages traditional retailers like Best Buy and Micro Center, providing a crucial touchpoint for customers to experience high-performance PC components and gaming peripherals firsthand. This physical presence is vital for capturing consumers who value tangible product interaction, contributing to an estimated 30% of Corsair's revenue from its component segment in 2024.

Wholesale and Distributors

Corsair leverages wholesale and distribution channels to ensure its high-performance PC components and peripherals reach a broad customer base. These partners are essential for managing the complexities of global logistics and inventory, allowing Corsair to efficiently supply a vast network of retailers, from large electronics chains to smaller, specialized shops.

By working with distributors, Corsair effectively extends its market reach, particularly into regions or segments where direct engagement would be less efficient. This strategy is vital for handling the high volume of products Corsair manufactures, ensuring timely availability and reducing the burden of direct sales management for a multitude of smaller accounts.

- Global Reach: Distributors enable Corsair to access markets worldwide, reaching consumers who might otherwise be difficult to serve directly.

- Supply Chain Efficiency: These partnerships streamline inventory management and logistics, ensuring products are available where and when demand exists.

- Market Penetration: Wholesalers and distributors facilitate Corsair's presence in diverse retail environments, expanding its brand visibility and sales opportunities.

- Reduced Operational Burden: By outsourcing certain sales and distribution functions, Corsair can focus its resources on product development and core business operations.

Specialized for Acquired Brands

Corsair is actively expanding distribution for recently acquired brands, such as Fanatec, by targeting specialized retailers. This approach is particularly relevant for sim racing products, a niche segment where enthusiast communities thrive. By partnering with these specialist retailers, Corsair can ensure its products reach the most engaged customer base.

This strategic channel expansion allows Corsair to effectively capture niche market segments by leveraging existing specialist distribution networks. These networks are already established with customers who have a keen interest in high-performance sim racing equipment. This focused distribution ensures that the unique value proposition of acquired brands like Fanatec is communicated directly to the right audience.

- Targeted Reach: Accessing niche markets through specialized retailers ensures products are seen by highly relevant consumers.

- Leveraging Expertise: Specialist retailers often possess deep product knowledge, enhancing the customer buying experience for complex sim racing gear.

- Brand Synergy: For brands like Fanatec, this strategy aligns with their existing customer base and brand perception within the sim racing community.

Corsair's channel strategy is a multi-faceted approach designed to maximize product availability and customer engagement. This includes a strong direct-to-consumer (DTC) presence via its website, strategic partnerships with major e-commerce marketplaces like Amazon, and relationships with brick-and-mortar retailers such as Best Buy.

The company also relies on wholesale and distribution networks to ensure broad market penetration and efficient supply chain management, particularly for its extensive product catalog. Furthermore, Corsair is actively expanding into niche markets by partnering with specialist retailers, a strategy exemplified by its efforts to distribute recently acquired brands like Fanatec to the sim racing community.

This diverse channel mix allows Corsair to cater to different consumer preferences, from online convenience to in-person product interaction, while also optimizing its global reach and operational efficiency. In 2024, Corsair's retail partnerships contributed significantly to its sales, with estimates suggesting around 30% of its component segment revenue stemmed from these channels.

| Channel Type | Key Platforms/Partners | Strategic Importance | 2024 Data/Insight |

|---|---|---|---|

| Direct-to-Consumer (DTC) | Corsair.com | Customer journey control, direct feedback, margin enhancement | Significant revenue contributor; direct support offered. |

| E-commerce Marketplaces | Amazon, Newegg | Global reach, access to vast consumer base, logistics/payment benefits | Amazon facilitated over $600 billion in sales in 2024, showcasing platform potential. |

| Traditional Retail | Best Buy, Micro Center | Tangible product interaction, brand visibility | Estimated 30% of component segment revenue in 2024. |

| Wholesale & Distribution | Various global partners | Market penetration, supply chain efficiency, reduced operational burden | Essential for managing high product volumes and global availability. |

| Niche Specialist Retail | Specialized sim racing stores | Targeted reach for niche products (e.g., Fanatec), leveraging expert knowledge | Key for integrating acquired brands into relevant enthusiast communities. |

Customer Segments

Dedicated gamers, encompassing everyone from casual enthusiasts to elite esports athletes, form a core customer segment for Corsair. These individuals are driven by a need for hardware that elevates their gameplay, focusing on critical attributes like responsiveness, deep immersion, and robust durability in their gaming peripherals and PC components. In 2024, the global gaming market was valued at over $200 billion, with a significant portion attributed to hardware sales, indicating a substantial opportunity for companies like Corsair.

Content creators and streamers, including YouTubers and live streamers, form a crucial customer segment. These individuals rely heavily on high-quality equipment to produce professional-grade content. Corsair's Elgato brand directly addresses this need, offering specialized gear like capture cards, microphones, and lighting.

In 2024, the creator economy continued its robust expansion, with platforms like YouTube and Twitch seeing significant growth in active creators and viewership. Elgato's product suite, designed for seamless integration and superior performance, positions Corsair to capture a substantial share of this market by providing essential tools for this expanding demographic.

PC Enthusiasts and System Builders are a core customer group for Corsair. These individuals are passionate about crafting high-performance, personalized computers, actively seeking out top-tier components like RAM, power supplies, cases, and cooling systems. They prioritize not just raw performance but also reliability and visual appeal for their custom builds.

Corsair caters to this segment by offering a broad and deep product portfolio designed for customization and peak performance. For instance, in 2024, the demand for high-speed DDR5 memory, crucial for enthusiast builds, continued to grow, with Corsair's VENGEANCE series being a popular choice. Their commitment to quality ensures these components meet the rigorous standards of builders who push their systems to the limit.

Sim Racing Enthusiasts

Following its acquisition of Fanatec, Corsair is now directly engaging with sim racing enthusiasts. This group is actively seeking realistic and immersive simulation hardware to elevate their virtual racing experiences. The market for high-fidelity sim racing gear, including steering wheels, pedals, and full cockpits, is a key focus for Corsair's expanded strategy.

This strategic move allows Corsair to tap into a passionate and growing community. The sim racing market, while niche, demonstrates significant growth and a high willingness to invest in premium equipment. For instance, the global sim racing market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially in the coming years, with a compound annual growth rate (CAGR) of over 10% expected through 2030.

- Target Audience: Dedicated sim racers looking for authentic, high-performance equipment.

- Product Focus: Advanced steering wheels, pedals, shifters, and cockpit accessories.

- Market Opportunity: Access to a dedicated and growing enthusiast base with high disposable income for specialized gaming hardware.

- Strategic Value: Diversifies Corsair's revenue streams and strengthens its position in the lucrative gaming peripheral market.

Performance-Oriented Professionals

Corsair's high-performance computing solutions extend beyond the traditional gaming and content creation markets, catering to professionals like engineers, designers, and developers who demand robust power for intensive workloads. These users require reliable systems capable of handling complex simulations, 3D rendering, and large datasets.

Corsair's existing lineup of prebuilt gaming PCs and premium components are well-suited to meet these demanding professional needs, offering the necessary speed and stability. For instance, the CORSAIR ONE PRO series, known for its compact design and powerful internals, can be a strong contender for professionals seeking a high-performance workstation.

The recent launch of the CORSAIR AI WORKSTATION 300 specifically targets AI developers and engineers, signaling a direct push into this specialized professional segment. This move acknowledges the growing demand for tailored hardware solutions that accelerate AI model training and deployment.

- Targeting Professionals: Engineers, designers, and developers with demanding computational needs represent a key customer segment beyond gamers.

- Product Fit: Corsair's high-end gaming PCs and components offer the performance and reliability required for intensive professional applications.

- Strategic Expansion: The introduction of the CORSAIR AI WORKSTATION 300 highlights a focused effort to capture the burgeoning AI development market.

Corsair's customer base is diverse, extending beyond core gamers to include content creators and PC enthusiasts. The company also strategically targets emerging markets like sim racing and professional users requiring high-performance computing.

This broad appeal is supported by a robust product ecosystem, from customizable PC components to specialized peripherals. Corsair's ability to cater to distinct needs within these segments underscores its market adaptability.

The company's expansion into areas like AI workstations in 2024 demonstrates a forward-looking approach to capturing growth opportunities in specialized professional sectors.

| Customer Segment | Key Needs | Corsair's Offering | 2024 Market Insight |

|---|---|---|---|

| Dedicated Gamers | Performance, responsiveness, durability | High-end peripherals, PC components | Global gaming market > $200 billion |

| Content Creators | High-quality audio/video capture, streaming | Elgato capture cards, microphones, lighting | Continued creator economy expansion |

| PC Enthusiasts | Customization, performance, reliability | RAM, PSUs, cases, cooling systems | Growth in DDR5 memory demand |

| Sim Racers | Realistic immersion, high-fidelity hardware | Steering wheels, pedals (via Fanatec) | Sim racing market projected CAGR > 10% |

| Professionals (AI, Design) | Power, stability for intensive workloads | High-performance PCs, AI Workstations | Growing demand for specialized workstation solutions |

Cost Structure

Corsair's manufacturing and supply chain costs are substantial, driven by the production of a wide array of gaming peripherals and components. These expenses encompass the procurement of raw materials, the sourcing of various electronic components, and the direct labor involved in assembly. For instance, in 2023, Corsair reported cost of revenues totaling $1.39 billion, a significant portion of which is directly tied to these manufacturing activities.

Managing a complex global supply chain adds another layer of cost, including expenses for international logistics, maintaining warehousing facilities, and navigating potential tariffs. Corsair has strategically focused on mitigating tariff impacts and diversifying its supplier base to enhance resilience and manage these costs effectively. This proactive approach is crucial for maintaining competitive pricing in the dynamic tech market.

Corsair's commitment to continuous innovation is evident in its significant investment in Research and Development (R&D). These expenditures are vital for maintaining a competitive edge in the fast-paced gaming and enthusiast hardware market.

In 2024, Corsair's R&D costs encompass salaries for their dedicated engineering and design teams, the creation of prototypes for new products, and rigorous testing of emerging technologies. This focus ensures they remain at the forefront of high-performance gear development.

Corsair's marketing, sales, and distribution expenses are significant investments. These costs encompass everything from large-scale advertising campaigns and sponsorships to the salaries of their dedicated sales force. For instance, in 2023, Corsair reported $1.3 billion in selling, general, and administrative expenses, a substantial portion of which is allocated to these critical functions.

Distribution is another major cost area, covering the logistics of getting their products to customers worldwide. This includes warehousing their extensive inventory, managing shipping costs, and paying fees to various channel partners, such as retailers and online marketplaces. These operational necessities are fundamental to ensuring their gaming peripherals and components reach a global audience efficiently.

These expenditures are not merely overhead; they are vital drivers of Corsair's business. High visibility through marketing and effective sales channels are crucial for penetrating competitive markets and ultimately driving product sales. Without these investments, reaching and engaging their target demographic of gamers and PC enthusiasts would be significantly more challenging.

Employee Salaries and Operational Overheads

Corsair's cost structure heavily relies on employee salaries and operational overheads to manage its global presence. This includes competitive compensation packages for its workforce across various departments, from engineering and marketing to logistics and customer support. For instance, in 2024, the company continued to invest in talent, reflecting the industry's demand for skilled professionals in the gaming and tech sectors.

Beyond personnel costs, significant expenses are incurred for maintaining office spaces, data centers, and the IT infrastructure necessary to support its online operations and product development. Utilities, software licenses, and hardware maintenance are ongoing costs that contribute to the overall operational overhead. Corsair's commitment to innovation necessitates ongoing investment in research and development, further impacting this cost category.

Efficiently managing these operational overheads is crucial for maintaining profitability. Corsair's strategic approach involves optimizing resource allocation and leveraging technology to streamline processes.

- Employee Compensation: Includes salaries, bonuses, and benefits for a global workforce.

- Office and Facilities: Costs associated with physical office spaces, warehouses, and retail locations.

- IT Infrastructure: Expenses for servers, software, cloud services, and network maintenance.

- General & Administrative: Includes legal, accounting, marketing support, and other corporate functions.

Acquisition and Integration Costs

Corsair's acquisition strategy, while aimed at long-term growth, significantly impacts its cost structure. For instance, the strategic acquisition of Fanatec, a leading brand in simulation racing peripherals, involved substantial upfront costs. These expenses typically encompass thorough due diligence, legal fees, and the initial capital required to secure the deal. These are crucial investments, but they represent a considerable outlay in the short to medium term.

Furthermore, integrating acquired companies and enhancing existing operations, such as the increased investment in Elgato's supply chain, adds to these costs. The process of merging systems, aligning operational procedures, and potentially restructuring to achieve synergies requires dedicated resources. These integration efforts, while vital for realizing the full value of acquisitions, contribute directly to Corsair's overall expenditure.

The financial implications of these strategic moves are evident. While specific figures for the Fanatec acquisition are not publicly disclosed in detail, such deals often run into tens or even hundreds of millions of dollars, depending on the size and profitability of the target company. For example, in 2023, Corsair reported total operating expenses of $1.56 billion, a portion of which would have been allocated to such strategic investments and integration activities.

- Strategic Acquisitions: Costs include due diligence, legal fees, and the purchase price for companies like Fanatec.

- Integration Expenses: Resources are allocated to merging operations, IT systems, and personnel post-acquisition.

- Supply Chain Investment: Enhancements to existing supply chains, like Elgato's, also represent significant capital outlays.

- Short-to-Medium Term Impact: These acquisition and integration costs are a notable component of Corsair's expenditure, impacting profitability before full synergies are realized.

Corsair's cost structure is primarily driven by its extensive manufacturing and supply chain operations, significant investments in research and development, and substantial marketing and distribution efforts. Employee compensation and general administrative overheads also form a core part of their expenditure, alongside costs associated with strategic acquisitions and their subsequent integration.

In 2023, Corsair reported a cost of revenues of $1.39 billion, reflecting the substantial expenses tied to producing its gaming peripherals and components. The company's selling, general, and administrative expenses for the same year stood at $1.3 billion, underscoring the significant outlay in marketing, sales, and distribution to reach its global customer base. These figures highlight the capital-intensive nature of Corsair's business model, requiring continuous investment across its value chain to maintain market leadership and drive innovation.

| Cost Category | 2023 (USD Billions) | Key Components |

|---|---|---|

| Cost of Revenues | 1.39 | Raw materials, component sourcing, direct labor, manufacturing overhead |

| Selling, General & Administrative | 1.30 | Marketing, sales force, distribution logistics, corporate functions |

| Research & Development | Not Separately Disclosed | Engineering talent, prototyping, technology testing |

| Acquisition & Integration Costs | Part of Operating Expenses | Due diligence, legal fees, integration of acquired entities (e.g., Fanatec) |

Revenue Streams

Corsair's business model heavily relies on the sale of PC components, a core revenue driver. This includes essential parts like memory modules, power supply units (PSUs), and computer cases, appealing directly to PC builders and enthusiasts.

In 2024, this crucial segment brought in $843.7 million. However, sales in this area saw a slight dip as customers held off purchases in anticipation of new graphics processing unit (GPU) releases.

Corsair's revenue is substantially boosted by its gaming peripherals, a category that includes popular items like keyboards, mice, and headsets. This segment has demonstrated robust expansion, achieving net revenue of $472.7 million in 2024 and maintaining positive momentum into the first quarter of 2025.

The strong performance in gaming peripherals is attributed to successful new product introductions and strategic acquisitions, such as that of Fanatec, which has not only driven sales but also enhanced profit margins for Corsair.

Corsair, primarily through its Elgato brand, brings in money by selling specialized gear and add-ons for people who create content online. Think of popular items like the Stream Deck, which helps manage broadcasts, and various capture devices that get video into computers. These products are a big hit with streamers and content creators looking to improve their setups.

This part of Corsair's business is a significant engine for growth, riding the wave of the ever-expanding digital content creation industry. For instance, in 2023, Elgato’s revenue saw a substantial boost, reflecting the increasing demand for high-quality streaming tools as more individuals and businesses embraced online broadcasting and content production.

Sales of Prebuilt Gaming PCs and Systems

Corsair's revenue from prebuilt gaming PCs and systems, largely driven by its ORIGIN PC brand, offers a convenient, high-performance solution for gamers who prefer ready-made setups. This segment directly addresses consumers seeking immediate access to powerful gaming hardware without the complexities of self-assembly. In the first quarter of 2025, the Gaming Components and Systems division, which encompasses these prebuilt systems, generated a significant $257.8 million in revenue.

- Prebuilt Systems: Corsair provides complete, high-performance gaming PCs through brands like ORIGIN PC.

- Target Audience: Caters to gamers who value convenience and ready-to-use solutions.

- Q1 2025 Performance: The Gaming Components and Systems segment, including prebuilt PCs, reported $257.8 million in revenue.

Subscription Services and Software

Corsair is increasingly leveraging subscription services and software to diversify its revenue. Platforms like iCUE, which optimize hardware performance, and the Stream Deck marketplace offer recurring revenue opportunities. This strategic shift complements their traditional hardware sales, fostering a more robust and predictable income stream.

- Software Subscriptions: Revenue generated from premium features or expanded capabilities within software like iCUE.

- Marketplace Fees: Income derived from transactions within the Stream Deck marketplace, potentially through developer fees or a percentage of sales.

- Ecosystem Value: Subscription services enhance the overall value proposition of Corsair's hardware, encouraging customer loyalty and repeat purchases.

- Recurring Revenue: This model provides a stable and predictable revenue base, reducing reliance on cyclical hardware sales.

Corsair's revenue streams are diverse, encompassing PC components, gaming peripherals, content creation gear, prebuilt systems, and increasingly, software and subscriptions. This multi-faceted approach allows Corsair to capture value across different segments of the gaming and tech enthusiast markets.

| Revenue Stream | 2024 Revenue (Millions USD) | Notes |

|---|---|---|

| PC Components | 843.7 | Slight dip due to anticipation of new GPU releases. |

| Gaming Peripherals | 472.7 | Robust expansion driven by new products and acquisitions. |

| Content Creation Gear (Elgato) | N/A | Significant growth driver; substantial boost in 2023. |

| Prebuilt PCs & Systems (Q1 2025) | 257.8 | Part of the Gaming Components and Systems division. |

| Software & Subscriptions | N/A | Growing recurring revenue through platforms like iCUE. |

Business Model Canvas Data Sources

The Corsair Business Model Canvas is built upon a foundation of detailed financial reports, extensive market research on the gaming and PC hardware sectors, and internal strategic analysis. These sources ensure each component of the canvas is informed by accurate, actionable data.